Australia Stocks Led Lower by Miners

24 February 2017 - 6:04PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--A further decline by Australian shares

Friday amid broad selling dragged the market lower for the week,

snapping two weeks of gains.

Weakness in base metals and a lackluster cue from Wall Street

weighed on sentiment, with the materials sector proving a big drag

for the day and the week.

Falling for a fifth session in the last six, the S&P/ASX 200

dropped 45.7 points, or 0.8%, to 5739.0--the sharpest drop since

the end of January.

Copper prices fell for three days straight before stabilizing in

Asian trade Friday, amid concerns about demand and high inventories

in China. Iron-ore prices have also been under pressure this week

after rebounding in recent months, with Chinese futures down

sharply on Friday.

"Caution about the prospects of near-term stimulus has softened

the outlook for demand growth in base metals. This change of

attitude coincided with remarks from Chinese authorities on plans

to develop a property tax, which could also soften demand growth

for metals," said Ric Spooner, chief market analyst at CMC Markets

in Sydney.

For the day, diversified miners BHP Billiton and Rio Tinto were

3% and 4.2% lower, respectively, while iron-ore producer Fortescue

Metals Group was 3.4% weaker.

The materials subindex lost 2.1% on Friday and 4.1% for the

week.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

February 24, 2017 01:49 ET (06:49 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

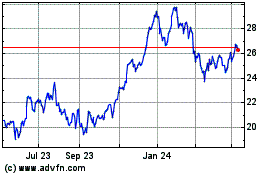

Fortescue (ASX:FMG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Fortescue (ASX:FMG)

Historical Stock Chart

From Feb 2024 to Feb 2025