UPDATE: New Hope Corp 1st Half Net Profit A$407.4 Million, Lifted By Arrow Energy Sale

22 March 2011 - 10:24AM

Dow Jones News

New Hope Corp. (NHC.AU) said Tuesday first-half net profit more

than tripled to A$407.4 million from A$111.6 million a year before,

buoyed by the coal miner selling its 16.7% stake in Arrow Energy

Ltd. to Royal Dutch Shell PLC (RDSB.LN) and PetroChina Co.

(PTR).

The miner, which operates two mines in southeast Queensland,

said the sale added a one-off A$326.3 million to net profit.

Excluding this benefit, net profit in the six months to the end of

January fell 27% to A$81.1 million from A$111.6 million, with the

company blaming a strong Australian dollar, increased transport

costs, and the impact of wet weather in Queensland.

Australia is the world's largest coal exporter, but heavy rains

along its eastern coast since last November have severely hit the

industry. The country's Bureau of Meteorology earlier Tuesday

warned that an area of the country including New Hope's New

Oakleigh and New Acland mines west of Brisbane would have a 70%

chance of higher-than-median rainfall during the three months to

the end of June.

New Hope said it had been particularly hit by problems with QR

National Ltd.'s (QRN.AU) Western Rail System, which carries coal

from its two mines to the port of Brisbane. The rail system "was

severely damaged" from flooding around the time of January's

Brisbane floods. Movements of coal from New Acland would be

curtailed for around 2.5 months and were expected to resume in late

March, but the full impact of the rail outage couldn't yet be

accurately determined, New Hope said.

Clean coal production fell 2% on year to 2.8 million metric tons

as a result of the rain, particularly in January, New Hope said,

predicting full year output of 4.8 million tons-5.2 million

tons.

New Hope last year mined 5.9 million tons of coal, making it the

fifth-biggest coal miner listed on the Australian Securities

Exchange.

In the first half of the year, revenues fell 8.6% to A$336.2

million from A$367.9 million, while the interim dividend was raised

5% to 5.25 cents per share from 5.00 cents.

In an outlook statement, the miner said expectations for thermal

coal prices were firm heading into negotiations on annual benchmark

coal prices expected to begin in coming weeks.

Negotiations over the annual benchmark price for thermal coal

are expected to begin between Xstrata PLC (XTA.LN), the world's

largest producer of the export commodity, and representatives of

Japanese power generators in coming weeks.

Progress toward the talks has been interrupted by Japan's

earthquake, which analysts expect to crimp coal demand in the near

term but to increase it over the longer term as coal generators

take up the slack from the country's stricken nuclear industry.

Thermal coal at Newcastle port in Australia's New South Wales,

the world's biggest thermal coal port, rose to US$122.60 a ton for

April deliveries Monday. The price fell sharply Friday after

hovering close to US$130 since late February.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

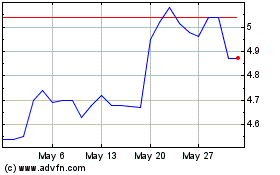

New Hope (ASX:NHC)

Historical Stock Chart

From Jan 2025 to Feb 2025

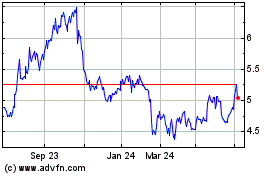

New Hope (ASX:NHC)

Historical Stock Chart

From Feb 2024 to Feb 2025