Trending: Enel Aims to Slash Debt Through Asset Disposals

23 November 2022 - 6:44PM

Dow Jones News

Italy's biggest utility Enel is among the most mentioned

companies across global news over the past 12 hours, according to

Factiva data, after the company unveiled a plan to sell assets in

order to cut debt and adopt a leaner structure going forward. The

Rome-based energy player's balance sheet has been a core area of

focus for investors over the past months. Enel now seeks to raise

around EUR21 billion through disposals, reducing net debt toward a

range of EUR51billion-EUR52 billion by the end of next year from an

estimated EUR58 billion-EUR62 billion in 2022. "The new plan should

come as a strong positive," analysts at UBS said in a research

note. "We expect investors to appreciate the disposal and

simplification plan, reduction of net debt, continuation of

renewable deployment without any downside to last year's plan on

earnings or dividend." Dow Jones & Co. owns Factiva.

(giulia.petroni@wsj.com)

(END) Dow Jones Newswires

November 22, 2022 06:36 ET (11:36 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

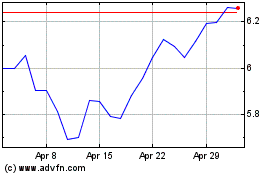

Enel (BIT:ENEL)

Historical Stock Chart

From Mar 2025 to Apr 2025

Enel (BIT:ENEL)

Historical Stock Chart

From Apr 2024 to Apr 2025