Two Europe Firms Halve Libyan Oil Output As Unrest Persists

25 February 2011 - 8:02AM

Dow Jones News

European oil producers Eni SpA (E) and Repsol YFP SA (REP)

Thursday said they've halved their output in Libya due to

continuing unrest, as oil companies operating there have sent crude

prices surging by shutting in production and removing workers.

Estimates differ on just how much of Libya's oil production has

been removed from world oil markets. The International Energy

Agency Thursday said it estimates the Libyan crisis has removed

less than 1% of global production from the market, or between

500,000 and 750,000 barrels per day of crude oil. Yet Paolo

Scaroni, chief executive of Eni--the international energy company

with the biggest operations in the hydrocarbon-rich North African

country--estimated Libya's oil output has dropped as much as

75%.

They agree, however, that oil producers and consumers can deal

with the lost supply if the disruption doesn't spread to other key

oil-exporting nations in the crucial Middle East and North Africa

region.

"There are 1.2 million barrels of oil less [in the markets per

day], which isn't really a lot," said Scaroni at a conference in

Rome. "There's a degree of general uncertainty, and this acts as a

trigger for speculation."

Libya's total daily oil output was about 1.6 million barrels

before a revolt led to widespread chaos and violence, prompting

foreign oil companies to withdraw workers from the country.

The violent clashes and concerns about disrupted Libyan oil

production Thursday lifted international benchmark Brent crude

prices to their highest levels in more than two years. Brent

futures soared to an intraday high of nearly $120 a barrel in

volatile trading. They recently traded around $111.50 a barrel,

after the IEA reassured the market about its ability to deal with a

shortfall.

Uncertainty over precisely how much output is affected by the

upheaval fueled speculation that there might not be adequate spare

production capacity to meet possible further supply disruptions in

the region.

The IEA, however, said it could adequately compensate for a

potential shortfall of oil supplies. It's prepared to release its

emergency oil stockpiles, which can cover up to 145 days of IEA

members' imports. The IEA's industrialized nations have 1.6 billion

barrels of emergency oil stocks available, said the agency.

Spain's Repsol YPF Thursday said it is managing to maintain

production at its Libyan oilfields at around 50% of capacity,

despite the clashes.

Oil companies such as France's Total SA (TOT) and Germany's

Wintershall have shut down operations and begun flying staff to

safety, after violent clashes between forces loyal to Col. Moammar

Gadhafi and protesters led to hundreds of deaths.

Gadhafi's forces maintain control over most of western Libya,

while his opponents hold the eastern side.

"It's difficult to talk to Libya these days," Repsol's Chairman

Antonio Brufau said. "There is confusion, no question about

it."

Eni isn't in contact with the Libyan government, and its only

link with Gadhafi's representatives is with Tripoli's ambassador in

Rome, Scaroni said.

Eni has been present in Libya since 1959, or a decade before

Gadhafi seized power in a military coup. Output from Libya

represents about 14% of Eni's total hydrocarbon production.

The upheaval in Libya has led Eni to shut in more than 50% of

its output from the country, said Scaroni. Eni's current Libyan

production is 120,000 out of the usual 280,000 barrels of oil

equivalent a day, he said.

Tuesday, Eni shut down the Greenstream natural gas pipeline from

Libya that supplies Italy with more than 10% of its needs.

Prolonged political unrest or a more hostile environment to

foreign investment in the Middle East and North Africa could

negatively affect the credit ratings of several European oil

companies, Fitch Ratings said Thursday.

Refiners have brushed aside concerns about potential supply

trouble, as long as the unrest doesn't spread to other producing

countries.

If the output drop remains "limited to Libya, there are plenty

of [supply] alternatives," said Chief Executive Alessandro Garrone

of ERG SpA (ERG.MI), Italy's biggest independent refiner by

capacity, Thursday in Rome.

Top oil exporter Saudi Arabia is in active talks with European

refiners to replace any shortage of Libyan oil supplies, a senior

Saudi oil official said Thursday, in an attempt to reassure markets

that the world's biggest oil exporter can offset lost crude.

Exporting Libyan oil is also becoming a challenge as some ports

are closed due to the clashes and as storage space fills up in

those ports where ships can't funnel the fuel.

In the meantime, Eni's CEO said he hopes to have a "clearer

picture of the overall political situation" when the company

presents its new strategy plan on March 10.

Eni website: http://www.eni.it

-By Liam Moloney, Dow Jones Newswires; +39 06 6976 6924;

liam.moloney@dowjones.com

(Carlo Renda and Daria of MF-DJ, Summer Said in Dubai and David

Roman in Madrid contributed to this article.)

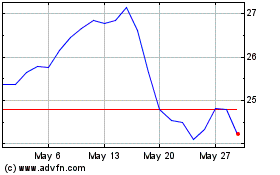

ERG (BIT:ERG)

Historical Stock Chart

From Jan 2025 to Feb 2025

ERG (BIT:ERG)

Historical Stock Chart

From Feb 2024 to Feb 2025