Analytics Firm Reveals Why Dogecoin & Apecoin Hit Tops

24 October 2024 - 5:00PM

NEWSBTC

The on-chain analytics firm Santiment has revealed the potential

reason behind the corrections that Dogecoin and Apecoin have faced

recently. Dogecoin & Apecoin Are Among Memecoins That Fell Prey

To FOMO Recently As explained by Santiment in a new post on X, the

Positive Sentiment vs. Negative Sentiment Ratio has seen a spike

for Dogecoin and other memecoins recently. The “Positive Sentiment

vs. Negative Sentiment Ratio” here refers to an indicator that

tells us whether major social media platforms are leaning towards

positive or negative comments right now. Related Reading: Bitcoin

Profitability Index Hits 202%: Is This Enough For A Top? This

indicator makes use of a machine-learning model designed by the

analytics firm to separate between comments pertaining to negative

and positive sentiments. When the value of the metric is greater

than zero, it means the total number of positive

posts/threads/messages is outweighing that of the negative ones. On

the other hand, the indicator being under this threshold suggests

the dominance of bearish sentiment on social media. Now, here is

the chart shared by Santiment that shows the trend in this

indicator for four assets over the past few months: As displayed in

the above graph, Dogecoin and Apecoin both witnessed spikes in the

Positive Sentiment vs. Negative Sentiment Ratio recently, implying

a large amount of positive comments related to these coins were

made on social media. Interestingly, as the analytics firm has

pointed out, these spikes coincided with tops in the DOGE and APE

prices. The other two memecoins listed in the chart, GIGA and GOAT,

also witnessed a similar pattern, although their tops came before

that of the former two. While positive sentiment can suggest belief

in the market, a large amount of it can be an indication of

excessive hype, which is something that has historically led to

tops for not just memecoins but cryptocurrencies in general.

“Prices typically always go the opposite direction of the crowd’s

expectations, and when the crowd gets extreme on either the bullish

or bearish end, it becomes highly predictable to buy or sell,”

explains Santiment. Given the timing of the recent positive spikes

in the indicator, it would appear possible that the Fear Of Missing

Out (FOMO) that developed among the investors was the reason behind

the corrections that Dogecoin and others have faced. Related

Reading: Ethereum Leverage Ratio Reaches Extreme Levels, What It

Means The Positive Sentiment vs. Negative Sentiment Ratio could now

be to watch in the coming days, as any cooldowns in its value could

pave way for bullish momentum to restart for these coins. DOGE

Price Dogecoin had neared the $0.150 level a few days ago, but with

the correction that has followed since then, its price has retraced

back to the $0.136 mark. Featured image from Dall-E, Santiment.net,

chart from TradingView.com

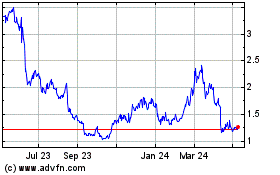

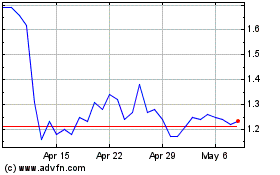

ApeCoin (COIN:APEUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

ApeCoin (COIN:APEUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024