Coinbase Unveils $25M For Political Donations As Stocks Suffer Worst Day In Over Two Years

01 November 2024 - 2:00PM

NEWSBTC

In a strategic move to increase its influence in the political

landscape, US-based cryptocurrency exchange Coinbase has committed

an additional $25 million to Fairshake, a political action

committee (PAC), as it prepares to support pro-crypto candidates

ahead of the 2026 midterm elections. Coinbase CEO Armstrong Commits

$25M To Fairshake Coinbase CEO Brian Armstrong confirmed the

investment during the company’s third-quarter earnings call,

stating, “We’re not going to slow down post-election. We know we

need to have pro-crypto legislation passed in this country.”

Fairshake, which has garnered backing from major players in the

digital asset sector, including Ripple Labs and Andreessen

Horowitz, aims to ensure that both Republican and Democratic

candidates recognize the importance of cryptocurrency in their

platforms. The committee is poised to spend over $40 million

in the lead-up to the 2024 elections, having already invested $140

million in various congressional races across the nation. Related

Reading: Analyst Claims Ethereum ‘Is Not Dying,’ Bitcoin Surge No

Threat To Ether In the current political climate, Republican

nominee Donald Trump has shifted his stance on cryptocurrency, now

embracing the industry after previously labeling it as a scam, with

promises including firing the Securities and Exchange Commission

(SEC) chair Gary Gensler and Bitcoin as a strategic reserve asset

for the nation. Conversely, Democratic Vice President Kamala

Harris has pledged to support a regulatory framework for digital

assets if elected. Armstrong noted, “We get the US election results

in six days, and no matter how you slice it, it will be the most

pro-crypto Congress ever.” Coinbase’s CEO emphasized the

growing influence of the “crypto voter,” suggesting that their

impact will only continue to expand. Despite these political

developments, Coinbase’s stock faced significant pressure following

the company’s recent earnings report, which fell short of

expectations. Analysts Call Current Crypto Market Dip A

‘Temporary Unwind’ Coinbase shares dropped 14.3% on Thursday,

marking the steepest decline since May 2022. This downturn was

exacerbated by a broader market decline and disappointing earnings

from other crypto-related firms, including Robinhood, which saw its

stock tumble 15% after reporting weak results. However, analysts

are viewing the current market conditions as a temporary setback.

Devin Ryan of JMP Securities described the situation as a

“temporary unwind” in crypto stocks, suggesting that long-term

investors may find opportunities amidst the volatility. The

analyst further pointed out that upcoming events—such as the US

elections and rising crypto prices—could positively impact

Coinbase’s fourth-quarter revenue if trends continue. Related

Reading: Institutional Traders Bet On Bitcoin Exceeding $79,300 By

End Of November Owen Lau, an analyst at Oppenheimer, also noted

that the recent stock decline might be tied to concerns about

subdued trading volumes and the potential impact of lower US

interest rates on Coinbase’s stablecoin revenue. At the time

of writing, COIN shares were trading at $179 after hitting a

three-month high of $223 last Tuesday. Featured image from DALL-E,

chart from TradingView.com

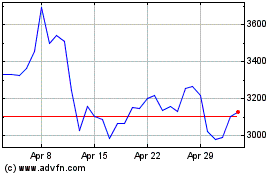

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024