If Dogecoin Falls Below This Level, A Freefall To $0.06 Is Possible: Analyst

26 February 2025 - 7:30AM

NEWSBTC

In a post on X on Tuesday, crypto analyst Ali Martinez

(@ali_charts) shared a long‐term Dogecoin (DOGE) price chart

highlighting a critical support level that, if lost, could open the

door for a steep correction. Martinez pinpointed $0.19 as the line

in the sand. Should the meme‐inspired token dip below this

threshold, he argues, “the probability of a deeper correction

toward $0.06 significantly increases.” Dogecoin Crash To $0.06

Incoming? The weekly chart—which spans back to early 2014—depicts

Dogecoin trading within a broad ascending channel. Solid black

trend lines enclose most of the price action from DOGE’s earliest

sub‐penny valuations to the all‐time high of roughly $0.73 in 2021.

Dashed lines running parallel to these trend lines appear to act as

mid‐channel guides, capturing smaller swings within Dogecoin’s

larger market cycles. Notably, DOGE has spent prolonged periods

moving laterally within the lower range of this channel, only to

break out sharply when it has tested the upper boundaries. When

Martinez posted the chart, Dogecoin was seen hovering around

$0.225, just above a key horizontal support region in the chart.

Related Reading: Dogecoin Warning: One Level Could Trigger A Surge,

Says Analyst Overlaid on the channel are extensive Fibonacci levels

derived from Dogecoin’s long‐term price history. The 0.786 Fib

retracement—commonly viewed as a make‐or‐break support in deeper

corrections—seems to align near $0.1978, very close to the $0.19

level Martinez highlighted. Below $0.19, the chart shows few

immediate technical cushions until roughly $0.13, which is aligning

with the lower part of the multi‐year ascending channel. Beneath

that, the $0.06 price point emerges as the most prominent downside

target, potentially matching a key historical congestion area and

aligning with the lower part of the multi‐year ascending channel.

Among the other Fibonacci levels visible on the chart are the 0.618

Fib near $0.05, 0.5 Fib near $0.03, 0.382 Fib near $0.015 and 0.236

Fib near $0.0059. While these lower Fib lines may not all come into

play, they help map out DOGE’s historical support/resistance zones

in the event of an extended sell‐off. Related Reading: Dogecoin

Price Confirming Final Retest, Here Are The Levels To Watch For A

Bullish Breakout The chart also shows higher Fib extension levels

such as 1.272 (around $4.10), 1.414 (around $10.04), and 1.618

(around $36.32). Though these may appear far‐fetched given current

market conditions, such extensions on a long‐term chart can serve

as reference points if Dogecoin were to regain strong bullish

momentum and climb toward new heights in future market cycles. For

now, all eyes are on $0.19 as Dogecoin’s crucial inflection point.

If DOGE holds above this level, it may preserve its place in the

mid‐range of the ascending channel. However, as Ali Martinez warns,

a breach of $0.19 could intensify downward pressure and potentially

set Dogecoin on a path toward $0.06. At press time, DOGE traded at

$0.206. Featured image created with DALL.E, chart from

TradingView.com

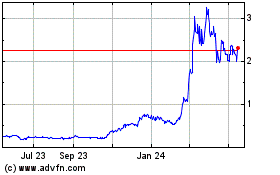

Fetch (COIN:FETUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

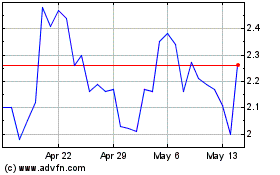

Fetch (COIN:FETUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025