PEPE Faces Key Support Test At $0.00000589 – Will Bulls Hold The Line?

08 September 2024 - 4:30AM

NEWSBTC

PEPE is facing intense bearish pressure, with its price trending

downward toward a critical support level at $0.00000589. Recent

market actions have shown that the bears are firmly in control,

pushing the token closer to this key threshold. As sellers continue

to dominate, the question is whether the bulls can step in to

defend this level or if PEPE is set for further declines.

This article will analyze PEPE’s recent price action as it nears

the critical support level at $0.00000589 by examining key

technical indicators and market dynamics. It will explore whether

the bulls can mount a defense to prevent further losses or if the

bears will drive the token lower, aiming to provide a potential

future outlook for the cryptocurrency. With a market capitalization

exceeding $2.8 billion and a trading volume surpassing $602

million, PEPE was trading at approximately $0.000006683, reflecting

a 6.47% decrease at the time of writing. In the past 24 hours, its

market cap has dropped by 6,47%, while trading volume has increased

by 74.80%. Current Market Sentiment: Bearish Signals Dominate On

the 4-hour chart, although PEPE is attempting to move upward, it

has maintained its downward trajectory after successfully breaking

below the $0.00000766 level, continuing to trade below the 100-day

Simple Moving Average (SMA). The asset is moving closer to the

$0.00000589 support level, with negative market sentiment

persisting. Also, the Relative Strength Index (RSI) on the 4-hour

chart is currently at 31%, indicating that PEPE is in the oversold

zone. This level suggests that selling pressure has been strong,

potentially hinting at a short-term rebound or consolidation if the

bears do not maintain dominance. On the daily chart, PEPE has shown

significant bearish momentum since breaking below the $0.00000766

level and trading under the 100-day SMA. While the cryptocurrency

is currently attempting an upward move, this rebound could be

short-lived due to the prevailing bearish sentiment, which

continues to exert pressure on the price. Finally, the RSI signal

line on the 1-day chart is currently sitting at 36% as it continues

to trend below the 50% threshold, suggesting that PEPE remains

under bearish pressure, with the potential for bears to regain

control and push the price lower. What’s Next For PEPE: Outlook For

The Coming Days The current bearish trend, marked by negative

momentum indicators, suggests that the bears could drive the price

of PEPE to the $0.00000589 support level. If this support is

broken, it could trigger further bearish action, potentially

pushing the asset down to the $0.00000398 support level and

possibly lower. However, if PEPE bounces back at the $0.00000589

support, it could retrace towards the resistance level at

$0.00000766. Should the crypto asset break above this level, it

could signal a further upward movement, possibly targeting the

$0.00001152 resistance range and other higher levels. Featured

image from iStock, chart from Tradingview.com

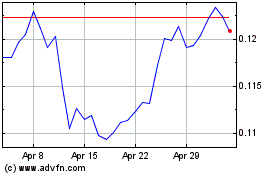

TRON (COIN:TRXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024