Amundi launches a share repurchase programme as part of performance

share allocation plans

Press Release

Amundi launches a share repurchase

programme as part of performance share allocation

plans

Paris on 7 October 2024

As part of performance share allocation

plans and after having obtained the necessary regulatory

authorisation, Amundi is announcing the launch of a share

repurchase programme, via a mandate agreed with an Investment

Services Provider (Kepler Cheuvreux)

In accordance with the authorisation granted by

the Ordinary General Meeting of 24 May 2024 and delegated by the

Board of Directors to the Chief Executive Officer, the share

repurchase programme will have the following features:

1. Objective

Shares will be acquired for the purpose of

covering the performance share allocation plans that have already

been allocated and those in the future.

To avoid the dilution of existing shareholders,

Amundi has decided not to issue new shares, but to purchase on the

market the shares that will be delivered starting in 2025

(following a vesting period and subject to certain conditions of

performance and presence1).

2. Number of shares and

maximum amount

The total number of shares to be bought back on

the market should not exceed 1 million1, representing

around 0.5% of the share capital. The total amount allocated to

this programme cannot exceed €80 million.

3. Features of the

purchased shares

The Amundi shares in question are those admitted for trading on the

Euronext regulated market in Paris under ISIN code

FR0004125920.

4. Duration of the

share repurchase programme

The authorisation of the Ordinary General

Meeting of 24 May 2024 has been granted for a period of eighteen

months, starting at the date of the AGM.

This programme is part of the share repurchase

programme described in Chapter 1 (pages 42-43) of the 2021

Universal Registration Document filed by Amundi on 18 April 2024

with the French financial markets authority (AMF) under number

D.24-0302, available on the Amundi website:

https://legroupe.amundi.com/regulated-information. Changes to any

of the features of this share repurchase programme during its

implementation period shall be communicated according to the

procedures provided for under Article 241-2 II of the AMF’s General

Regulation.

It is also reminded that as at 30 September

2024, Amundi already holds 958,031 shares under the share

management agreement signed with Kepler Cheuvreux and under

previous share repurchase programmes.

About Amundi

Amundi, the leading European asset manager,

ranking among the top 10 global players2, offers its 100

million clients - retail, institutional and corporate - a complete

range of savings and investment solutions in active and passive

management, in traditional or real assets. This offering is

enhanced with IT tools and services to cover the entire savings

value chain. A subsidiary of the Crédit Agricole group and listed

on the stock exchange, Amundi currently manages more than €2.15

trillion of assets3.

With its six international investment hubs4,

financial and extra-financial research capabilities and

long-standing commitment to responsible investment, Amundi is a key

player in the asset management landscape.

Amundi clients benefit from the expertise and

advice of 5,500 employees in 35 countries.

Amundi, a trusted partner, working

every day in the interest of its clients and

society.

www.amundi.com

Press contacts:

Natacha Andermahr Tel. +33 1 76 37 86

05 natacha.andermahr@amundi.com

Corentin Henry Tel. +33 1 76 36 26 96

corentin.henry@amundi.com

Investor contacts:

Cyril Meilland, CFA Tel.+33 1 76 32 62 67

cyril.meilland@amundi.com

Thomas Lapeyre Tel.+33 1 76 33 70 54

thomas.lapeyre@amundi.com

Annabelle Wiriath Tel. +33 1 76 32 43 92

annabelle.wiriath@amundi.com

DISCLAIMER

This document does not constitute an offer or

invitation to sell or purchase, or any solicitation of any offer to

purchase or subscribe for, any securities of Amundi in the United

States of America. Securities may not be offered, subscribed or

sold in the United States of America absent registration under the

U.S. Securities Act of 1933, as amended (the "U.S. Securities

Act"), except pursuant to an exemption from, or in a transaction

not subject to, the registration requirements thereof. The

securities of Amundi have not been and will not be registered under

the U.S. Securities Act and Amundi does not intend to make a public

offer of its securities in the United States of America. This

document does not constitute an offer or invitation to sell or

purchase, or any solicitation of any offer to purchase or subscribe

for, any securities of Amundi in France and Amundi does not intend

to make a public offer of its securities in France.

This document may contain forward-looking

information concerning Amundi's financial position and results.

These data do not represent "forecasts" within the meaning of

Delegated Regulation (EU) 2019/980.

Such forward-looking information includes

projections and financial estimates that are derived from scenarios

based on a number of economic assumptions in a given competitive

and regulatory environment, considerations relating to projects,

objectives and expectations in connection with events and

operations, transactions (including the proposed transaction

between Amundi and Victory Capital), future products and services

and on assumptions in terms of future performance and synergies. By

their very nature, they are therefore subject to known and unknown

risks and uncertainties, which could lead to the non-fulfillment of

the forward-looking items mentioned, including, with regard to the

proposed transaction between Amundi and Victory Capital, risks that

the conditions to completion will not be satisfied and that the

transaction will not be completed on schedule, or at all; risks

relating to the expected benefits or impact of the proposed

transaction on Victory Capital's and Amundi's respective

businesses, including the ability to realize expected synergies;

and other risks and factors relating to Victory's and Amundi's

respective businesses contained in their respective public filings.

Consequently, no assurance can be given that these projections and

estimates will materialize, and Amundi's financial position and

results could differ materially from those projected or implied in

the forward-looking information contained in this press release.

Amundi does not undertake any obligation to publicly update or

revise any forward-looking statements made as of the date of this

document. More detailed information on the risks that could affect

Amundi's financial position and results can be found in the "Risk

Factors" section of our Registration Document filed with the French

Autorité des marchés financiers under number D.24-0302 on 18 April

2024.

Readers are advised to consider all of these

risks and uncertainties before forming their own

judgement.

The figures presented have been subject to a

limited review from the statutory auditors and have been prepared

in accordance with IFRS as adopted by the European Union and

applicable at that date, and with prudential regulations in force

to date. Unless otherwise stated, the sources of the rankings and

market positions are internal. The information contained in this

document, to the extent that it relates to entities other than

Amundi, or is derived from external sources, has not been reviewed

by any supervisory authority, nor more generally been independently

verified, and no representation or undertaking is given as to, and

no reliance should be placed on, the accuracy, truthfulness or

completeness of any information or opinions contained in this

document. Neither Amundi nor its representatives may be held liable

for any decision taken or negligence or for any loss which may

result from the use of this presentation or its contents or

anything relating to them or to any document or information to

which it may refer.

The sum of the values shown in the tables and

analyses may differ slightly from the reported total due to

rounding.

1 The number of shares

granted will only be final upon delivery.

2 Source:

IPE “Top 500 Asset Managers” published in June

2024, based on assets under management as at

31/12/2023

3 Amundi

data at 30/06/2024

4 Boston,

Dublin, London, Milan, Paris and Tokyo

- Amundi - PR Launch share repurchase programme as part of

performance share allocation plans

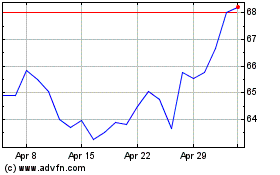

Amundi (EU:AMUN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Amundi (EU:AMUN)

Historical Stock Chart

From Jan 2024 to Jan 2025