Launch of an any and all cash tender offer to repurchase its bonds

due May 2025 and potential issuance of new sustainability-linked

bonds

Paris, 21 May 2024, 8:50 a.m.

PRESS RELEASE

Eramet: Launch of an any and all cash

tender offer to repurchase its bonds due May 2025 and potential

issuance of new sustainability-linked bonds

Eramet (the “Company”)

announces today:

(i) the

launch of a tender offer to repurchase for cash any and all of its

€300 million bonds due May 2025 issued on 21 November 2019

(ISIN: FR0013461274), of which € 293,600,000 are

currently outstanding, and which are admitted to trading on the

regulated market of Euronext Paris (the “Existing

Bonds”) (the “Tender Offer”); and

(ii) its

intention, subject to market conditions, to issue new

sustainability-linked bonds denominated in euros concomitantly with

the Tender Offer (the “New Bonds”).

The Tender Offer is made under the terms and

conditions set out in the Tender Offer Memorandum dated 21 May

2024. This Tender Offer is, in particular, conditional upon the

successful completion (in the sole and absolute determination of

the Company) of the issue of the New Bonds. An application for

admission to trading of the New Bonds on the regulated market of

Euronext in Paris should be made. The net proceeds of the New Bonds

would be used for general corporate purposes of the Company,

including to refinance part of the Existing Bonds to be purchased

in the context of the Tender Offer.

A mechanism of priority allocation in the New

Bonds may be applied at the sole and absolute discretion of the

Company for holders of the Existing Bonds who participate in the

Tender Offer and who wish to subscribe to the New Bonds.

The purpose of this Tender Offer and the

contemplated issue of the New Bonds is, amongst other things, to

proactively manage the Company’s debt profile and to extend its

average maturity.

Final results of the Tender Offer will be

announced as soon as practicable after the pricing of the Tender

Offer which is expected on 30 May 2024 (subject to any extension,

withdrawal, termination or amendment of this Tender Offer).

DISCLAIMER

This press release does not constitute an offer

to subscribe to the New Bonds nor an invitation to participate in

the Tender Offer in or from any country or jurisdiction to whom or

in which such offer would be unlawful under the applicable laws and

regulations.

This press release is not a prospectus for the

purposes of the Regulation (EU) 2017/1129 (as amended, the

“Prospectus Regulation”). This press release does

not constitute and shall not, in any circumstances, constitute a

public offering nor an invitation to the public in connection with

any offer within the meaning of the Prospectus Regulation or

otherwise There is no assurance that the Tender Offer will be

completed or, if completed, as to the terms on which it is

completed.

The issue of the New Bonds is not being subject

to a public offering in any country or jurisdiction, including in

France, to any person other than qualified investors (as defined in

article 2(e) of the Prospectus Regulation). Tenders of Existing

Bonds for purchase pursuant to the Tender Offer from qualifying

holders shall not be accepted in any circumstances where such offer

or solicitation would be unlawful. Eramet does not make any

recommendation as to whether or not qualifying holders should

participate in the Tender Offer.

The distribution of this press release may be

restricted by law in certain jurisdictions. Persons into whose

possession this press release comes should inform themselves about

and observe any applicable legal and regulatory restrictions.

The New Bonds will only be offered outside the

United States pursuant to “Regulation S” under the U.S. Securities

Act of 1933, as amended (the “Securities

Act”), subject to prevailing market and other conditions.

The New Bonds have not been registered under the Securities Act or

the securities laws of any other jurisdiction and may not be

offered or sold in the United States or to, or for the account or

benefit of, U.S. persons (as defined in “Regulation

S” under the Securities Act) (the “U.S.

Persons”) absent registration or unless pursuant to an

applicable exemption from the registration requirements of the

Securities Act and any other applicable securities laws. This press

release does not constitute an offer to sell or the solicitation of

an offer relating to the New Bonds, nor shall it constitute an

offer, solicitation or sale in any jurisdiction in which such

offer, solicitation or sale would be unlawful.

The Tender Offer is not being made or offered

and will not be made or offered directly or indirectly in or into,

or by use of the mails of, or by any means or instrumentality

(including, without limitation, facsimile transmission, telex,

telephone, email and other forms of electronic transmission) of

interstate or foreign commerce of, or any facility of a national

securities exchange of, or to owners of Existing Bonds who are

located in the United States (as defined in Regulation S), or to,

or for the account or benefit of, any U.S. persons and the Existing

Bonds may not be tendered in the Tender Offer by any such use,

means, instrumentality or facility from or within the United

States, by persons located or resident in the United States or by

U.S. persons.

The New Bonds are not intended to be offered,

sold or otherwise made available to and should not be offered, sold

or otherwise made available to any retail investor in the European

Economic Area (the “EEA”). For these

purposes, a “retail investor” means a person who

is one (or more) of: (i) a retail client as defined in point (11)

of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID

II”); or (ii) a customer within the meaning of Directive

(EU) 2016/97, as amended, where that customer would not qualify as

a professional client as defined in point (10) of Article 4(1)

of MiFID II; or (iii) a person who is not

a qualified investor within the meaning of Article 2(e)

of the Prospectus Regulation.

The New Bonds are not intended to be offered,

sold or otherwise made available to and should not be offered, sold

or otherwise made available to any retail investor in the United

Kingdom. For these purposes, a “retail

investor” means a person who is one (or more) of the

following: (i) a retail client, as defined in point (8) of Article

2 of Regulation (EU) No. 2017/565 as it forms part of domestic law

by virtue of the European Union (Withdrawal) Act 2018

(the “EUWA”); (ii) a

customer within the meaning of the provisions of the Financial

Services and Markets Act 2000 (as amended, the

“FSMA”) and any rules or regulations made

thereunder to implement Directive (EU) 2016/97, where that customer

would not qualify as a professional client, as defined in point (8)

of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of

domestic law by virtue of the EUWA; or (iii) a person who is not a

qualified investor as defined in Article 2 of Regulation (EU)

2017/1129 as it forms part of domestic law by virtue of the

EUWA.

In the United Kingdom, this press release is

directed only at persons who (i) have professional experience in

matters relating to investments falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005, as amended (the “Financial Promotion

Order”), (ii) are persons falling within Article 43(2) of

the Financial Promotion Order or (iii) are other persons to whom it

may lawfully be communicated (all such persons together being

referred to as “Relevant Persons”). The issue

of the New Bonds is only available to, and any invitation, offer or

agreement to subscribe, purchase or otherwise acquire the New Bonds

will be directed only to Relevant Persons.

MiFID II professionals/ECPs-only/ No PRIIPs KID

– Manufacturer target market (MIFID II product governance) is

eligible counterparties and professional clients only (all

distribution channels). No PRIIPs or UK PRIIPs key information

document (KID) has been prepared as not available to retail

investors in EEA and in the United Kingdom.

Calendar

30.05.2024: Shareholders’ General Meeting

25.07.2024: Publication of 2024 half-year results

24.10.2024: Publication of 2024 Group third-quarter turnover

ABOUT ERAMET

Eramet transforms the Earth’s mineral resources

to provide sustainable and responsible solutions to the growth of

the industry and to the challenges of the energy transition.

Its employees are committed to this through

their civic and contributory approach in all the countries where

the mining and metallurgical group is present.

Manganese, nickel, mineral sands, lithium, and

cobalt: Eramet recovers and develops metals that are essential to

the construction of a more sustainable world.

As a privileged partner of its industrial

clients, the Group contributes to making robust and resistant

infrastructures and constructions, more efficient means of

mobility, safer health tools and more efficient telecommunications

devices.

Fully committed to the era of metals, Eramet’s

ambition is to become a reference for the responsible

transformation of the Earth’s mineral resources for living well

together.

www.eramet.com

| INVESTOR

CONTACT Director of Investor Relations

Sandrine Nourry-Dabi T. +33 1 45 38 37 02

sandrine.nourrydabi@eramet.com |

PRESS

CONTACT Media Relations Manager

Fanny Mounier T. +33 7 65 26 46 83

fanny.mounier@eramet.com |

- 2024 05 21 - Eramet - Tender Offer - CP de lancement - EN

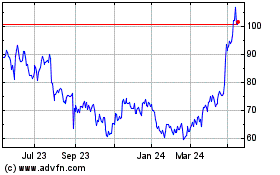

Eramet (EU:ERA)

Historical Stock Chart

From Oct 2024 to Nov 2024

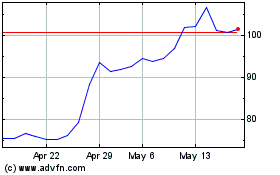

Eramet (EU:ERA)

Historical Stock Chart

From Nov 2023 to Nov 2024