Continued strong third quarter performance with 11% topline growth to €191 million

12 October 2023 - 4:00PM

Continued strong third quarter performance with 11% topline growth

to €191 million

Regulated information - inside informationNazareth

(Belgium)/Rotterdam (The Netherlands), 12 October 2023 – 7:00 AM

CET

Continued strong third quarter performance with 11%

topline growth to €191 million

Fagron, the leading global player in pharmaceutical compounding

today publishes its quarterly results for the period ending 30

September 2023.

Key Highlights

- Solid revenue growth continues

with 10.6% reported growth (13.9% at CER) and 10.2% organic growth

(13.4% at CER) to €191.4 million

- Sustained strong performance in

North America and solid recovery of Latin America; EMEA reflects

completion of pricing pass through

- Roll out of global operational

excellence initiatives continues

- Signing of Parma Produkt

acquisition provides entry into attractive Hungarian compounding

market

- Science Based Targets

initiative (SBTi) has approved our near-term science-based emission

reduction target

- FY 2023 revenue between

€750-€770 million; improvement in profitability YoY

Rafael Padilla, CEO of Fagron:

“Our performance through the third quarter reflects the solidity of

our diversified and defensive business model in a macro-economic

environment that remains dynamic. Our results were driven by

further enhancements to our commercial approach, reaping benefits

of operational excellence initiatives, as well as excellent

execution across our businesses. Organic revenue growth picked up

pace this quarter, supported by all our regions, with North America

delivering the highest organic growth in its history. This was

driven by outstanding performances at both FSS and Anazao, as

underlying demand for outsourcing compounding services remains

strong. In EMEA, we saw revenue growth softening for the quarter

following the completion of the pricing pass-through exercise in

the first half of the year. Latin America continued its upward

trajectory, supported by our focus on driving operational

efficiencies and innovation.

We are also pleased to announce the signing of the Parma Produkt

acquisition, which enables access to the attractive Hungarian

market in line with our strategic plan to further diversify our

EMEA footprint. We remain committed to consolidating the market and

are assessing market opportunities across all our regions in line

with our disciplined acquisition strategy.

Overall, we remain confident about our prospects and reiterate

our midterm guidance. For FY 2023 we expect revenue between €750

million and €770 million and reiterate the expected profitability

increase YoY.”

Please open the link below for the full press release:

- Continued strong third quarter performance with 11% topline

growth to €191 million

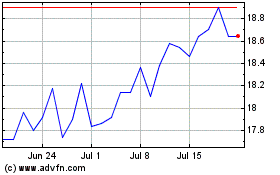

Fagron NV (EU:FAGR)

Historical Stock Chart

From Oct 2024 to Nov 2024

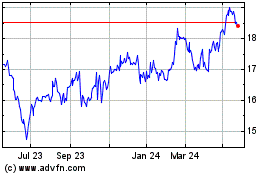

Fagron NV (EU:FAGR)

Historical Stock Chart

From Nov 2023 to Nov 2024