SBM Offshore completes US$1.5 billion financing of Jaguar

22 November 2024 - 4:01AM

Amsterdam, November 21, 2024

SBM Offshore announces it has completed the

project financing of FPSO Jaguar for a total of US$1.5

billion.

The project financing was fully secured by a

consortium of 16 international financial institutions. The Company

expects to draw the loan phased over the construction period of the

FPSO. The project loan is in line with the duration of the

construction phase.

The FPSO Jaguar’s design is based on

SBM Offshore’s industry leading Fast4Ward® program that

incorporates the Company’s seventh new build, multi-purpose

floater hull combined with several standardized topsides modules.

The FPSO is designed to produce 250,000 barrels of oil per day,

will have associated gas treatment capacity of 540 million cubic

feet per day and water injection capacity of 300,000 barrels per

day. The FPSO will be spread moored in water depth of about 1,630

meters and will be able to store around 2 million barrels of crude

oil.

The project is part of the Whiptail development,

which is the sixth development within the Stabroek block, circa 200

kilometers offshore Guyana. ExxonMobil Guyana Ltd, an affiliate of

ExxonMobil Corporation, is the operator and holds a 45 percent

interest in the Stabroek block, Hess Guyana Exploration Ltd. holds

a 30 percent interest and CNOOC Petroleum Guyana Limited, holds a

25 percent interest.

Douglas Wood, CFO of SBM Offshore, commented:“I

am proud of our teams which have successfully secured the project

financing of FPSO Jaguar, the Company’s first project under the

sale and operate model. We are demonstrating once again the value

of our unique lifecycle offering not only from an execution and

operation standpoint but also in our ability to continue to provide

material financing solutions for our clients. We appreciate the

continued support from the 16 financial institutions.”

Corporate Profile

SBM Offshore is the world’s deepwater

ocean-infrastructure expert. Through the design, construction,

installation, and operation of offshore floating facilities, we

play a pivotal role in a just transition. By advancing our core, we

deliver cleaner, more efficient energy production. By pioneering

more, we unlock new markets within the blue economy.

More than 7,400 SBMers collaborate worldwide to

deliver innovative solutions as a responsible partner towards a

sustainable future, balancing ocean protection with progress.

For further information, please visit our

website at www.sbmoffshore.com.

|

Financial Calendar |

|

Date |

Year |

| Full Year 2024

Earnings |

|

February 20 |

2025 |

| Annual General

Meeting |

|

April 9 |

2025 |

| First Quarter

2025 Trading Update |

|

May 15 |

2025 |

| Half Year 2025

Earnings |

|

August 7 |

2025 |

| Third Quarter

2025 Trading Update |

|

November 13 |

2025 |

For further information, please contact:

Investor Relations

Wouter HoltiesCorporate Finance & Investor

Relations Manager

|

Phone: |

+31 (0)20 236 32 36 |

|

E-mail: |

wouter.holties@sbmoffshore.com |

|

Website: |

www.sbmoffshore.com |

Media Relations

Giampaolo ArghittuHead of External Relations

|

Phone: |

+31 (0)6 212 62 333 / +39 33 494 79 584 |

|

E-mail: |

giampaolo.arghittu@sbmoffshore.com |

|

Website: |

www.sbmoffshore.com |

Market Abuse RegulationThis press release may

contain inside information within the meaning of Article 7(1) of

the EU Market Abuse Regulation.

Disclaimer Some of the statements contained

in this release that are not historical facts are statements of

future expectations and other forward-looking statements based on

management’s current views and assumptions and involve known and

unknown risks and uncertainties that could cause actual results,

performance, or events to differ materially from those in such

statements. These statements may be identified by words such as

‘expect’, ‘should’, ‘could’, ‘shall’ and similar expressions. Such

forward-looking statements are subject to various risks and

uncertainties. The principal risks which could affect the future

operations of SBM Offshore N.V. are described in the ‘Impact, Risk

and Opportunity Management’ section of the 2023 Annual Report.

Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results and performance of the Company’s business

may vary materially and adversely from the forward-looking

statements described in this release. SBM Offshore does not intend

and does not assume any obligation to update any industry

information or forward-looking statements set forth in this release

to reflect new information, subsequent events or otherwise.

This release contains certain alternative

performance measures (APMs) as defined by the ESMA guidelines which

are not defined under IFRS. Further information on these APMs is

included in the Half-Year Management Report accompanying the Half

Year Earnings 2024 report, available on our website

https://www.sbmoffshore.com/investors/financial-disclosures.

Nothing in this release shall be deemed an offer

to sell, or a solicitation of an offer to buy, any securities. The

companies in which SBM Offshore N.V. directly and indirectly owns

investments are separate legal entities. In this release “SBM

Offshore” and “SBM” are sometimes used for convenience where

references are made to SBM Offshore N.V. and its subsidiaries in

general. These expressions are also used where no useful purpose is

served by identifying the particular company or companies.

"SBM Offshore®", the SBM logomark, “Fast4Ward®”,

“emissionZERO®” and “F4W®” are proprietary marks owned by SBM

Offshore.

- SBM Offshore completes US$1.5 billion financing of Jaguar

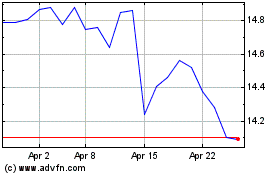

SBM Offshore NV (EU:SBMO)

Historical Stock Chart

From Nov 2024 to Dec 2024

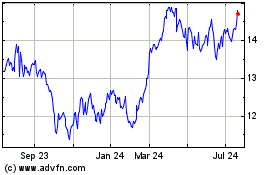

SBM Offshore NV (EU:SBMO)

Historical Stock Chart

From Dec 2023 to Dec 2024