SBM Offshore completes US$1.5 billion financing of Jaguar

22 November 2024 - 4:01AM

UK Regulatory

SBM Offshore completes US$1.5 billion financing of Jaguar

Amsterdam, November 21, 2024

SBM Offshore announces it has completed the

project financing of FPSO Jaguar for a total of US$1.5

billion.

The project financing was fully secured by a

consortium of 16 international financial institutions. The Company

expects to draw the loan phased over the construction period of the

FPSO. The project loan is in line with the duration of the

construction phase.

The FPSO Jaguar’s design is

based on SBM Offshore’s industry leading Fast4Ward®

program that incorporates the Company’s seventh new build,

multi-purpose floater hull combined with several standardized

topsides modules. The FPSO is designed to produce 250,000 barrels

of oil per day, will have associated gas treatment capacity of 540

million cubic feet per day and water injection capacity of 300,000

barrels per day. The FPSO will be spread moored in water depth of

about 1,630 meters and will be able to store around 2 million

barrels of crude oil.

The project is part of the Whiptail development,

which is the sixth development within the Stabroek block, circa 200

kilometers offshore Guyana. ExxonMobil Guyana Ltd, an affiliate of

ExxonMobil Corporation, is the operator and holds a 45 percent

interest in the Stabroek block, Hess Guyana Exploration Ltd. holds

a 30 percent interest and CNOOC Petroleum Guyana Limited, holds a

25 percent interest.

Douglas Wood, CFO of SBM Offshore,

commented:

“I am proud of our teams which have successfully secured the

project financing of FPSO Jaguar, the Company’s first

project under the sale and operate model. We are demonstrating once

again the value of our unique lifecycle offering not only from an

execution and operation standpoint but also in our ability to

continue to provide material financing solutions for our clients.

We appreciate the continued support from the 16 financial

institutions.”

Corporate Profile

SBM Offshore is the world’s deepwater

ocean-infrastructure expert. Through the design, construction,

installation, and operation of offshore floating facilities, we

play a pivotal role in a just transition. By advancing our core, we

deliver cleaner, more efficient energy production. By pioneering

more, we unlock new markets within the blue economy.

More than 7,400 SBMers collaborate worldwide to

deliver innovative solutions as a responsible partner towards a

sustainable future, balancing ocean protection with progress.

For further information, please visit our

website at www.sbmoffshore.com.

|

Financial Calendar |

|

Date |

Year |

| Full Year 2024

Earnings |

|

February 20 |

2025 |

| Annual General

Meeting |

|

April 9 |

2025 |

| First Quarter

2025 Trading Update |

|

May 15 |

2025 |

| Half Year 2025

Earnings |

|

August 7 |

2025 |

| Third Quarter

2025 Trading Update |

|

November 13 |

2025 |

For further information, please contact:

Investor Relations

Wouter Holties

Corporate Finance & Investor Relations Manager

|

Phone: |

+31 (0)20 236 32 36 |

|

E-mail: |

wouter.holties@sbmoffshore.com |

|

Website: |

www.sbmoffshore.com |

Media Relations

Giampaolo Arghittu

Head of External Relations

|

Phone: |

+31 (0)6 212 62 333 / +39 33 494 79 584 |

|

E-mail: |

giampaolo.arghittu@sbmoffshore.com |

|

Website: |

www.sbmoffshore.com |

Market Abuse Regulation

This press release may contain inside information within the

meaning of Article 7(1) of the EU Market Abuse Regulation.

Disclaimer

Some of the statements contained in this release that are not

historical facts are statements of future expectations and other

forward-looking statements based on management’s current views and

assumptions and involve known and unknown risks and uncertainties

that could cause actual results, performance, or events to differ

materially from those in such statements. These statements may be

identified by words such as ‘expect’, ‘should’, ‘could’, ‘shall’

and similar expressions. Such forward-looking statements are

subject to various risks and uncertainties. The principal risks

which could affect the future operations of SBM Offshore N.V. are

described in the ‘Impact, Risk and Opportunity Management’ section

of the 2023 Annual Report.

Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results and performance of the Company’s business

may vary materially and adversely from the forward-looking

statements described in this release. SBM Offshore does not intend

and does not assume any obligation to update any industry

information or forward-looking statements set forth in this release

to reflect new information, subsequent events or otherwise.

This release contains certain alternative

performance measures (APMs) as defined by the ESMA guidelines which

are not defined under IFRS. Further information on these APMs is

included in the Half-Year Management Report accompanying the Half

Year Earnings 2024 report, available on our website

https://www.sbmoffshore.com/investors/financial-disclosures.

Nothing in this release shall be deemed an offer

to sell, or a solicitation of an offer to buy, any securities. The

companies in which SBM Offshore N.V. directly and indirectly owns

investments are separate legal entities. In this release “SBM

Offshore” and “SBM” are sometimes used for convenience where

references are made to SBM Offshore N.V. and its subsidiaries in

general. These expressions are also used where no useful purpose is

served by identifying the particular company or companies.

"SBM Offshore®", the SBM logomark,

“Fast4Ward®”, “emissionZERO®” and

“F4W®” are proprietary marks owned by SBM Offshore.

- SBM Offshore completes US$1.5 billion financing of Jaguar

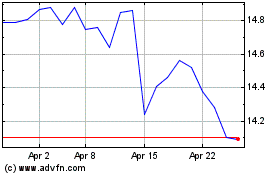

SBM Offshore NV (EU:SBMO)

Historical Stock Chart

From Nov 2024 to Dec 2024

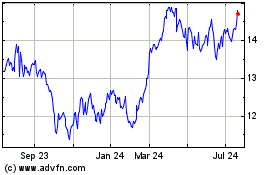

SBM Offshore NV (EU:SBMO)

Historical Stock Chart

From Dec 2023 to Dec 2024