000109714912/312024Q2falsexbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureiso4217:EURiso4217:GBPiso4217:CADiso4217:PLNiso4217:CNYiso4217:JPYiso4217:ILSiso4217:BRLiso4217:MXNiso4217:CHFiso4217:AUDiso4217:TWDiso4217:NZDiso4217:KRWiso4217:CZKalgn:claimalgn:segment00010971492024-01-012024-06-3000010971492024-07-2600010971492024-04-012024-06-3000010971492023-04-012023-06-3000010971492023-01-012023-06-3000010971492024-06-3000010971492023-12-310001097149us-gaap:CommonStockMember2024-03-310001097149us-gaap:AdditionalPaidInCapitalMember2024-03-310001097149us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001097149us-gaap:RetainedEarningsMember2024-03-3100010971492024-03-310001097149us-gaap:RetainedEarningsMember2024-04-012024-06-300001097149us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001097149us-gaap:CommonStockMember2024-04-012024-06-300001097149us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001097149us-gaap:CommonStockMember2024-06-300001097149us-gaap:AdditionalPaidInCapitalMember2024-06-300001097149us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001097149us-gaap:RetainedEarningsMember2024-06-300001097149us-gaap:CommonStockMember2023-12-310001097149us-gaap:AdditionalPaidInCapitalMember2023-12-310001097149us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001097149us-gaap:RetainedEarningsMember2023-12-310001097149us-gaap:RetainedEarningsMember2024-01-012024-06-300001097149us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300001097149us-gaap:CommonStockMember2024-01-012024-06-300001097149us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300001097149us-gaap:CommonStockMember2023-03-310001097149us-gaap:AdditionalPaidInCapitalMember2023-03-310001097149us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001097149us-gaap:RetainedEarningsMember2023-03-3100010971492023-03-310001097149us-gaap:RetainedEarningsMember2023-04-012023-06-300001097149us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001097149us-gaap:CommonStockMember2023-04-012023-06-300001097149us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001097149us-gaap:CommonStockMember2023-06-300001097149us-gaap:AdditionalPaidInCapitalMember2023-06-300001097149us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001097149us-gaap:RetainedEarningsMember2023-06-3000010971492023-06-300001097149us-gaap:CommonStockMember2022-12-310001097149us-gaap:AdditionalPaidInCapitalMember2022-12-310001097149us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001097149us-gaap:RetainedEarningsMember2022-12-3100010971492022-12-310001097149us-gaap:RetainedEarningsMember2023-01-012023-06-300001097149us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001097149us-gaap:CommonStockMember2023-01-012023-06-300001097149us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001097149us-gaap:CashMember2024-06-300001097149us-gaap:CashMemberus-gaap:CashAndCashEquivalentsMember2024-06-300001097149us-gaap:MoneyMarketFundsMember2024-06-300001097149us-gaap:MoneyMarketFundsMemberus-gaap:CashAndCashEquivalentsMember2024-06-300001097149us-gaap:CorporateBondSecuritiesMember2024-06-300001097149us-gaap:CorporateBondSecuritiesMemberalgn:MarketableSecuritiesShortTermMember2024-06-300001097149algn:MarketableSecuritiesLongTermMemberus-gaap:CorporateBondSecuritiesMember2024-06-300001097149us-gaap:AssetBackedSecuritiesMember2024-06-300001097149algn:MarketableSecuritiesShortTermMemberus-gaap:AssetBackedSecuritiesMember2024-06-300001097149algn:MarketableSecuritiesLongTermMemberus-gaap:AssetBackedSecuritiesMember2024-06-300001097149us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2024-06-300001097149us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberalgn:MarketableSecuritiesShortTermMember2024-06-300001097149algn:MarketableSecuritiesLongTermMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2024-06-300001097149us-gaap:CashAndCashEquivalentsMember2024-06-300001097149algn:MarketableSecuritiesShortTermMember2024-06-300001097149algn:MarketableSecuritiesLongTermMember2024-06-300001097149us-gaap:CashMember2023-12-310001097149us-gaap:CashMemberus-gaap:CashAndCashEquivalentsMember2023-12-310001097149us-gaap:MoneyMarketFundsMember2023-12-310001097149us-gaap:MoneyMarketFundsMemberus-gaap:CashAndCashEquivalentsMember2023-12-310001097149us-gaap:CorporateBondSecuritiesMember2023-12-310001097149us-gaap:CorporateBondSecuritiesMemberalgn:MarketableSecuritiesShortTermMember2023-12-310001097149algn:MarketableSecuritiesLongTermMemberus-gaap:CorporateBondSecuritiesMember2023-12-310001097149us-gaap:USTreasuryBondSecuritiesMember2023-12-310001097149algn:MarketableSecuritiesShortTermMemberus-gaap:USTreasuryBondSecuritiesMember2023-12-310001097149algn:MarketableSecuritiesLongTermMemberus-gaap:USTreasuryBondSecuritiesMember2023-12-310001097149us-gaap:AssetBackedSecuritiesMember2023-12-310001097149algn:MarketableSecuritiesShortTermMemberus-gaap:AssetBackedSecuritiesMember2023-12-310001097149algn:MarketableSecuritiesLongTermMemberus-gaap:AssetBackedSecuritiesMember2023-12-310001097149us-gaap:MunicipalBondsMember2023-12-310001097149us-gaap:MunicipalBondsMemberalgn:MarketableSecuritiesShortTermMember2023-12-310001097149algn:MarketableSecuritiesLongTermMemberus-gaap:MunicipalBondsMember2023-12-310001097149us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2023-12-310001097149us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberalgn:MarketableSecuritiesShortTermMember2023-12-310001097149algn:MarketableSecuritiesLongTermMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2023-12-310001097149us-gaap:CashAndCashEquivalentsMember2023-12-310001097149algn:MarketableSecuritiesShortTermMember2023-12-310001097149algn:MarketableSecuritiesLongTermMember2023-12-310001097149us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001097149us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001097149us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001097149us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AgencySecuritiesMember2024-06-300001097149us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AgencySecuritiesMember2024-06-300001097149us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AgencySecuritiesMember2024-06-300001097149us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001097149us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001097149us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001097149us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2024-06-300001097149us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2024-06-300001097149us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2024-06-300001097149us-gaap:FairValueInputsLevel1Member2024-06-300001097149us-gaap:FairValueInputsLevel2Member2024-06-300001097149us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001097149us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001097149us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001097149us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001097149us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001097149us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001097149us-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001097149us-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001097149us-gaap:FairValueInputsLevel2Memberus-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001097149us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AgencySecuritiesMember2023-12-310001097149us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AgencySecuritiesMember2023-12-310001097149us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AgencySecuritiesMember2023-12-310001097149us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-12-310001097149us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-12-310001097149us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-12-310001097149us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryBondSecuritiesMember2023-12-310001097149us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryBondSecuritiesMember2023-12-310001097149us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryBondSecuritiesMember2023-12-310001097149us-gaap:FairValueInputsLevel1Member2023-12-310001097149us-gaap:FairValueInputsLevel2Member2023-12-310001097149algn:HeartlandMember2024-04-220001097149algn:HeartlandMember2023-04-242024-04-220001097149us-gaap:ForeignExchangeForwardMember2024-04-012024-06-300001097149us-gaap:ForeignExchangeForwardMember2023-04-012023-06-300001097149us-gaap:ForeignExchangeForwardMember2024-01-012024-06-300001097149us-gaap:ForeignExchangeForwardMember2023-01-012023-06-300001097149us-gaap:ForeignExchangeForwardMember2024-06-300001097149us-gaap:ForeignExchangeForwardMember2023-12-310001097149currency:EURus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMember2024-06-300001097149currency:GBPus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMember2024-06-300001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:CAD2024-06-300001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:PLN2024-06-300001097149us-gaap:FairValueInputsLevel2Membercurrency:CNYus-gaap:ForeignExchangeForwardMember2024-06-300001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:JPY2024-06-300001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:ILS2024-06-300001097149us-gaap:FairValueInputsLevel2Membercurrency:BRLus-gaap:ForeignExchangeForwardMember2024-06-300001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:MXN2024-06-300001097149currency:CHFus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMember2024-06-300001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:AUD2024-06-300001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:TWD2024-06-300001097149currency:NZDus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMember2024-06-300001097149currency:KRWus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMember2024-06-300001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:CZK2024-06-300001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMember2024-06-300001097149currency:EURus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMember2023-12-310001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:CAD2023-12-310001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:PLN2023-12-310001097149currency:GBPus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMember2023-12-310001097149us-gaap:FairValueInputsLevel2Membercurrency:CNYus-gaap:ForeignExchangeForwardMember2023-12-310001097149currency:CHFus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMember2023-12-310001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:JPY2023-12-310001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:ILS2023-12-310001097149us-gaap:FairValueInputsLevel2Membercurrency:BRLus-gaap:ForeignExchangeForwardMember2023-12-310001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:MXN2023-12-310001097149currency:NZDus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMember2023-12-310001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:AUD2023-12-310001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:TWD2023-12-310001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMembercurrency:CZK2023-12-310001097149currency:KRWus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMember2023-12-310001097149us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMember2023-12-3100010971492024-07-012024-06-3000010971492024-07-01srt:MinimumMember2024-06-300001097149srt:MaximumMember2025-01-012024-06-300001097149algn:CubicureGmbHMember2024-01-020001097149algn:CubicureGmbHMember2024-01-022024-01-020001097149algn:ExistingTechnologyMemberalgn:CubicureGmbHMember2024-01-020001097149algn:ExistingTechnologyMemberalgn:CubicureGmbHMember2024-01-022024-01-020001097149algn:ClearAlignerMember2023-12-310001097149algn:ImagingSystemsAndCADCAMServicesMember2023-12-310001097149algn:ClearAlignerMember2024-01-012024-06-300001097149algn:ImagingSystemsAndCADCAMServicesMember2024-01-012024-06-300001097149algn:ClearAlignerMember2024-06-300001097149algn:ImagingSystemsAndCADCAMServicesMember2024-06-300001097149algn:ExistingTechnologyMember2024-01-012024-06-300001097149algn:ExistingTechnologyMember2024-06-300001097149us-gaap:CustomerRelationshipsMember2024-01-012024-06-300001097149us-gaap:CustomerRelationshipsMember2024-06-300001097149us-gaap:TrademarksAndTradeNamesMember2024-01-012024-06-300001097149us-gaap:TrademarksAndTradeNamesMember2024-06-300001097149us-gaap:PatentsMember2024-01-012024-06-300001097149us-gaap:PatentsMember2024-06-300001097149algn:ExistingTechnologyMember2023-01-012023-12-310001097149algn:ExistingTechnologyMember2023-12-310001097149us-gaap:CustomerRelationshipsMember2023-01-012023-12-310001097149us-gaap:CustomerRelationshipsMember2023-12-310001097149us-gaap:TrademarksAndTradeNamesMember2023-01-012023-12-310001097149us-gaap:TrademarksAndTradeNamesMember2023-12-310001097149us-gaap:PatentsMember2023-01-012023-12-310001097149us-gaap:PatentsMember2023-12-310001097149algn:CreditFacility2022Memberus-gaap:RevolvingCreditFacilityMember2024-06-300001097149us-gaap:LetterOfCreditMemberalgn:CreditFacility2022Member2024-06-300001097149algn:CreditFacility2022Member2024-06-300001097149algn:ShareholderDerivativeLawsuitMember2019-01-012019-01-310001097149algn:ShareholderDerivativeLawsuitMember2024-03-310001097149algn:AntitrustClassActionsMember2024-04-012024-06-300001097149us-gaap:HerMajestysRevenueAndCustomsHMRCMember2024-03-310001097149us-gaap:HerMajestysRevenueAndCustomsHMRCMember2024-06-302024-06-300001097149algn:StockIncentivePlan2005Member2024-06-300001097149us-gaap:CostOfSalesMember2024-04-012024-06-300001097149us-gaap:CostOfSalesMember2023-04-012023-06-300001097149us-gaap:CostOfSalesMember2024-01-012024-06-300001097149us-gaap:CostOfSalesMember2023-01-012023-06-300001097149us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-04-012024-06-300001097149us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-04-012023-06-300001097149us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-06-300001097149us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-06-300001097149us-gaap:ResearchAndDevelopmentExpenseMember2024-04-012024-06-300001097149us-gaap:ResearchAndDevelopmentExpenseMember2023-04-012023-06-300001097149us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-06-300001097149us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-06-300001097149us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300001097149us-gaap:RestrictedStockUnitsRSUMember2023-12-310001097149us-gaap:RestrictedStockUnitsRSUMember2024-06-300001097149algn:MarketPerformanceBasedRestrictedStockUnitsMember2024-01-012024-06-300001097149algn:MarketPerformanceBasedRestrictedStockUnitsMember2023-12-310001097149algn:MarketPerformanceBasedRestrictedStockUnitsMember2024-06-300001097149us-gaap:PerformanceSharesMember2022-10-012022-12-310001097149algn:EmployeeStockPurchasePlanMember2024-06-300001097149us-gaap:EmployeeStockMember2024-01-012024-06-300001097149us-gaap:EmployeeStockMember2023-01-012023-06-300001097149us-gaap:EmployeeStockMember2024-06-300001097149algn:May2021RepurchaseProgramMember2021-05-310001097149algn:January2023RepurchaseProgramMember2023-01-310001097149algn:May2021RepurchaseProgramMemberalgn:FourthQuarter2022Member2023-01-012023-03-310001097149algn:May2021RepurchaseProgramMemberalgn:FirstQuarter2023Member2023-01-012023-03-310001097149algn:January2023RepurchaseProgramMemberalgn:FourthQuarter2023Member2024-01-012024-03-310001097149algn:January2023RepurchaseProgramMember2024-06-262024-06-260001097149algn:January2023RepurchaseProgramMember2023-01-012023-12-310001097149algn:January2023RepurchaseProgramMember2023-01-012023-06-300001097149algn:January2023RepurchaseProgramMember2024-06-300001097149us-gaap:RestrictedStockUnitsRSUMember2024-04-012024-06-300001097149us-gaap:EmployeeStockMember2024-04-012024-06-300001097149us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300001097149us-gaap:EmployeeStockMember2024-01-012024-06-300001097149algn:ClearAlignerMember2024-04-012024-06-300001097149algn:ClearAlignerMember2023-04-012023-06-300001097149algn:ClearAlignerMember2023-01-012023-06-300001097149algn:ImagingSystemsAndCADCAMServicesMember2024-04-012024-06-300001097149algn:ImagingSystemsAndCADCAMServicesMember2023-04-012023-06-300001097149algn:ImagingSystemsAndCADCAMServicesMember2023-01-012023-06-300001097149algn:ClearAlignerMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300001097149algn:ClearAlignerMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001097149algn:ClearAlignerMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001097149algn:ClearAlignerMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001097149us-gaap:OperatingSegmentsMemberalgn:ImagingSystemsAndCADCAMServicesMember2024-04-012024-06-300001097149us-gaap:OperatingSegmentsMemberalgn:ImagingSystemsAndCADCAMServicesMember2023-04-012023-06-300001097149us-gaap:OperatingSegmentsMemberalgn:ImagingSystemsAndCADCAMServicesMember2024-01-012024-06-300001097149us-gaap:OperatingSegmentsMemberalgn:ImagingSystemsAndCADCAMServicesMember2023-01-012023-06-300001097149us-gaap:CorporateNonSegmentMember2024-04-012024-06-300001097149us-gaap:CorporateNonSegmentMember2023-04-012023-06-300001097149us-gaap:CorporateNonSegmentMember2024-01-012024-06-300001097149us-gaap:CorporateNonSegmentMember2023-01-012023-06-300001097149us-gaap:OperatingSegmentsMember2024-04-012024-06-300001097149us-gaap:OperatingSegmentsMember2023-04-012023-06-300001097149us-gaap:OperatingSegmentsMember2024-01-012024-06-300001097149us-gaap:OperatingSegmentsMember2023-01-012023-06-300001097149country:US2024-04-012024-06-300001097149country:US2023-04-012023-06-300001097149country:US2024-01-012024-06-300001097149country:US2023-01-012023-06-300001097149country:CH2024-04-012024-06-300001097149country:CH2023-04-012023-06-300001097149country:CH2024-01-012024-06-300001097149country:CH2023-01-012023-06-300001097149algn:OtherInternationalMember2024-04-012024-06-300001097149algn:OtherInternationalMember2023-04-012023-06-300001097149algn:OtherInternationalMember2024-01-012024-06-300001097149algn:OtherInternationalMember2023-01-012023-06-300001097149country:CH2024-06-300001097149country:CH2023-12-310001097149country:US2024-06-300001097149country:US2023-12-310001097149algn:OtherInternationalMember2024-06-300001097149algn:OtherInternationalMember2023-12-3100010971492023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 10-Q

____________________________

(Mark One) | | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

or | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-32259

____________________________

ALIGN TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

____________________________ | | | | | |

| Delaware | 94-3267295 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer

Identification No.) |

410 North Scottsdale Road, Suite 1300

Tempe, Arizona 85288

(Address of principal executive offices, including zip code)

(602) 742-2000

(Registrant’s telephone number, including area code)

____________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

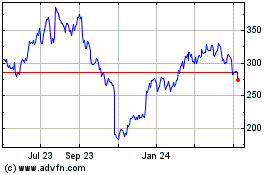

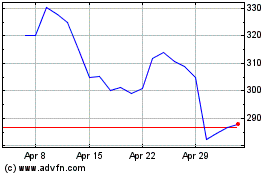

| Common Stock, $0.0001 par value | ALGN | The NASDAQ Stock Market LLC |

| | (NASDAQ Global Select Market) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of the registrant’s Common Stock, $0.0001 par value, as of July 26, 2024 was 74,697,065.

ALIGN TECHNOLOGY, INC.

TABLE OF CONTENTS

| | | | | | | | |

| | |

| PART I | | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| PART II | | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

| |

Invisalign, Align, the Invisalign logo, ClinCheck, Invisalign Assist, Invisalign Teen, Invisalign First, Invisalign Go, the Invisalign sonic logo, Vivera, SmartForce, SmartTrack, SmartStage, SmileView, iTero, iTero Element, iTero Lumina, Orthocad, exocad, Align Digital Platform, Invisalign Smile Architect, iTero exocad Connector and exocad Dental CAD, among others, are trademarks and/or service marks of Align Technology, Inc. or one of its subsidiaries or affiliated companies and may be registered in the United States and/or other countries.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

ALIGN TECHNOLOGY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Net revenues | | $ | 1,028,490 | | | $ | 1,002,173 | | | $ | 2,025,921 | | | $ | 1,945,320 | |

| Cost of net revenues | | 305,862 | | | 288,564 | | | 605,477 | | | 571,057 | |

| Gross profit | | 722,628 | | | 713,609 | | | 1,420,444 | | | 1,374,263 | |

| Operating expenses: | | | | | | | | |

| Selling, general and administrative | | 452,262 | | | 453,193 | | | 904,084 | | | 892,884 | |

| Research and development | | 92,193 | | | 88,485 | | | 184,052 | | | 175,932 | |

Legal settlement loss | | 31,127 | | | — | | | 31,127 | | | — | |

| | | | | | | | |

| Total operating expenses | | 575,582 | | | 541,678 | | | 1,119,263 | | | 1,068,816 | |

| Income from operations | | 147,046 | | | 171,931 | | | 301,181 | | | 305,447 | |

| Interest income and other income (expense), net: | | | | | | | | |

| Interest income | | 3,301 | | | 4,421 | | | 7,693 | | | 6,758 | |

| Other income (expense), net | | (6,481) | | | (4,763) | | | (6,622) | | | (5,992) | |

| Total interest income and other income (expense), net | | (3,180) | | | (342) | | | 1,071 | | | 766 | |

| Net income before provision for income taxes | | 143,866 | | | 171,589 | | | 302,252 | | | 306,213 | |

| Provision for income taxes | | 47,302 | | | 59,775 | | | 100,660 | | | 106,601 | |

| Net income | | $ | 96,564 | | | $ | 111,814 | | | $ | 201,592 | | | $ | 199,612 | |

| | | | | | | | |

| Net income per share: | | | | | | | | |

Basic | | $ | 1.28 | | | $ | 1.46 | | | $ | 2.68 | | | $ | 2.60 | |

Diluted | | $ | 1.28 | | | $ | 1.46 | | | $ | 2.68 | | | $ | 2.60 | |

| Shares used in computing net income per share: | | | | | | | | |

Basic | | 75,184 | | | 76,524 | | | 75,180 | | | 76,722 | |

Diluted | | 75,223 | | | 76,689 | | | 75,315 | | | 76,897 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ALIGN TECHNOLOGY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | | $ | 96,564 | | | $ | 111,814 | | | $ | 201,592 | | | $ | 199,612 | |

Other comprehensive income: | | | | | | | | |

| Change in foreign currency translation adjustment, net of tax | | 6,359 | | | 9,158 | | | 3,427 | | | 19,632 | |

| Change in unrealized gains (losses) on investments, net of tax | | 243 | | | 350 | | | 446 | | | 1,995 | |

| | | | | | | | |

Other comprehensive income | | 6,602 | | | 9,508 | | | 3,873 | | | 21,627 | |

| Comprehensive income | | $ | 103,166 | | | $ | 121,322 | | | $ | 205,465 | | | $ | 221,239 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ALIGN TECHNOLOGY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | |

| | June 30,

2024 | | December 31,

2023 |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 761,429 | | | $ | 937,438 | |

| Marketable securities, short-term | | 20,682 | | | 35,304 | |

Accounts receivable, net of allowance for doubtful accounts of $17,355 and $14,893, respectively | | 1,020,135 | | | 903,424 | |

| Inventories | | 259,492 | | | 296,902 | |

| Prepaid expenses and other current assets | | 350,634 | | | 273,550 | |

| Total current assets | | 2,412,372 | | | 2,446,618 | |

| Marketable securities, long-term | | — | | | 8,022 | |

| Property, plant and equipment, net | | 1,277,826 | | | 1,290,863 | |

| Operating lease right-of-use assets, net | | 122,174 | | | 117,999 | |

| Goodwill | | 454,493 | | | 419,530 | |

| Intangible assets, net | | 115,705 | | | 82,118 | |

| Deferred tax assets | | 1,577,856 | | | 1,590,045 | |

| Other assets | | 197,898 | | | 128,682 | |

| Total assets | | $ | 6,158,324 | | | $ | 6,083,877 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 105,792 | | | $ | 113,125 | |

| Accrued liabilities | | 555,458 | | | 525,780 | |

| Deferred revenues | | 1,378,867 | | | 1,427,706 | |

| Total current liabilities | | 2,040,117 | | | 2,066,611 | |

| Income tax payable | | 103,783 | | | 116,744 | |

| Operating lease liabilities | | 98,301 | | | 96,968 | |

| Other long-term liabilities | | 158,215 | | | 173,065 | |

| Total liabilities | | 2,400,416 | | | 2,453,388 | |

Commitments and contingencies (Note 7 and Note 8) | | | | |

| Stockholders’ equity: | | | | |

Preferred stock, $0.0001 par value (5,000 shares authorized; none issued) | | — | | | — | |

Common stock, $0.0001 par value (200,000 shares authorized; 74,696 and 75,075 issued and outstanding, respectively) | | 7 | | | 7 | |

| Additional paid-in capital | | 1,276,298 | | | 1,162,140 | |

| Accumulated other comprehensive income (loss), net | | 25,041 | | | 21,168 | |

| Retained earnings | | 2,456,562 | | | 2,447,174 | |

| Total stockholders’ equity | | 3,757,908 | | | 3,630,489 | |

| Total liabilities and stockholders’ equity | | $ | 6,158,324 | | | $ | 6,083,877 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ALIGN TECHNOLOGY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income (Loss), Net | | Retained Earnings | | Total |

Three Months Ended June 30, 2024 | | Shares | | Amount | |

Balance as of March 31, 2024 | | 75,281 | | | $ | 7 | | | $ | 1,238,739 | | | $ | 18,439 | | | $ | 2,502,675 | | | $ | 3,759,860 | |

| Net income | | — | | | — | | | — | | | — | | | 96,564 | | | 96,564 | |

| Net change in unrealized gains (losses) from investments | | — | | | — | | | — | | | 243 | | | — | | | 243 | |

| Net change in foreign currency translation adjustment | | — | | | — | | | — | | | 6,359 | | | — | | | 6,359 | |

| Issuance of common stock relating to employee equity compensation plans | | 17 | | | — | | | — | | | — | | | — | | | — | |

| Tax withholdings related to net share settlements of equity awards | | (4) | | | — | | | (1,547) | | | — | | | — | | | (1,547) | |

| Common stock repurchased and retired | | (598) | | | — | | | (7,922) | | | — | | | (142,677) | | | (150,599) | |

| Equity forward contract related to accelerated stock repurchase | | | | — | | | — | | | — | | | — | | | — | |

| Stock-based compensation | | — | | | — | | | 47,028 | | | | | — | | | 47,028 | |

Balance as of June 30, 2024 | | 74,696 | | | $ | 7 | | | $ | 1,276,298 | | | $ | 25,041 | | | $ | 2,456,562 | | | $ | 3,757,908 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income (Loss), Net | | Retained Earnings | | Total |

Six Months Ended June 30, 2024 | | Shares | | Amount | |

Balance as of December 31, 2023 | | 75,075 | | | $ | 7 | | | $ | 1,162,140 | | | $ | 21,168 | | | $ | 2,447,174 | | | $ | 3,630,489 | |

| Net income | | — | | | — | | | — | | | — | | | 201,592 | | | 201,592 | |

| Net change in unrealized gains (losses) from investments | | — | | | — | | | — | | | 446 | | | — | | | 446 | |

| Net change in foreign currency translation adjustment | | — | | | — | | | — | | | 3,427 | | | — | | | 3,427 | |

| Issuance of common stock relating to employee equity compensation plans | | 345 | | | — | | | 14,339 | | | — | | | — | | | 14,339 | |

| Tax withholdings related to net share settlements of equity awards | | (90) | | | — | | | (27,602) | | | — | | | — | | | (27,602) | |

| Common stock repurchased and retired | | (634) | | | — | | | (7,922) | | | — | | | (142,677) | | | (150,599) | |

| Equity forward contract related to accelerated stock repurchase | | — | | | — | | | 49,527 | | | — | | | (49,527) | | | — | |

| Stock-based compensation | | — | | | — | | | 85,816 | | | — | | | — | | | 85,816 | |

Balance as of June 30, 2024 | | 74,696 | | | $ | 7 | | | $ | 1,276,298 | | | $ | 25,041 | | | $ | 2,456,562 | | | $ | 3,757,908 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income (Loss), Net | | Retained Earnings | | Total |

Three Months Ended June 30, 2023 | | Shares | | Amount | |

Balance as of March 31, 2023 | | 76,516 | | | $ | 8 | | | $ | 1,104,693 | | | $ | 1,835 | | | $ | 2,373,513 | | | $ | 3,480,049 | |

| Net income | | — | | | — | | | — | | | — | | | 111,814 | | | 111,814 | |

| Net change in unrealized gains (losses) from investments | | — | | | — | | | — | | | 350 | | | — | | | 350 | |

| Net change in foreign currency translation adjustment | | — | | | — | | | — | | | 9,158 | | | — | | | 9,158 | |

Issuance of common stock relating to employee equity compensation plans1 | | 16 | | | — | | | — | | | — | | | — | | | — | |

| Tax withholdings related to net share settlements of equity awards | | — | | | — | | | (930) | | | — | | | — | | | (930) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Stock-based compensation | | — | | | — | | | 37,860 | | | | | — | | | 37,860 | |

Balance as of June 30, 2023 | | 76,532 | | | $ | 8 | | | $ | 1,141,623 | | | $ | 11,343 | | | $ | 2,485,327 | | | $ | 3,638,301 | |

1 Includes tax withholding shares related to net share settlements of equity awards. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income (Loss), Net | | Retained Earnings | | Total |

Six Months Ended June 30, 2023 | | Shares | | Amount | |

Balance as of December 31, 2022 | | 77,267 | | | $ | 8 | | | $ | 1,044,946 | | | $ | (10,284) | | | $ | 2,566,688 | | | $ | 3,601,358 | |

| Net income | | — | | | — | | | — | | | — | | | 199,612 | | | 199,612 | |

| Net change in unrealized gains (losses) from investments | | — | | | — | | | — | | | 1,995 | | | — | | | 1,995 | |

| Net change in foreign currency translation adjustment | | — | | | — | | | — | | | 19,632 | | | — | | | 19,632 | |

Issuance of common stock relating to employee equity compensation plans1 | | 207 | | | — | | | 14,256 | | | — | | | — | | | 14,256 | |

| Tax withholdings related to net share settlements of equity awards | | — | | | — | | | (21,787) | | | — | | | — | | | (21,787) | |

| Common stock repurchased and retired | | (942) | | | — | | | (11,387) | | | — | | | (280,973) | | | (292,360) | |

| Equity forward contract related to accelerated stock repurchase | | — | | | — | | | 40,000 | | | — | | | — | | | 40,000 | |

| Stock-based compensation | | — | | | — | | | 75,595 | | | — | | | — | | | 75,595 | |

Balance as of June 30, 2023 | | 76,532 | | | $ | 8 | | | $ | 1,141,623 | | | $ | 11,343 | | | $ | 2,485,327 | | | $ | 3,638,301 | |

1 Includes tax withholding shares related to net share settlements of equity awards. |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ALIGN TECHNOLOGY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | | | | | | | | | | | | | |

| | | Six Months Ended

June 30, |

| | | 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

| Net income | | $ | 201,592 | | | $ | 199,612 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Deferred taxes | | 9,506 | | | (36,688) | |

| Depreciation and amortization | | 69,112 | | | 71,639 | |

| Stock-based compensation | | 85,816 | | | 75,595 | |

| Non-cash operating lease cost | | 19,040 | | | 15,531 | |

| | | | |

| | | | |

| Other non-cash operating activities | | 2,377 | | | 21,860 | |

| Changes in assets and liabilities, net of effects of acquisitions: | | | | |

| Accounts receivable | | (146,932) | | | (73,680) | |

| Inventories | | 31,396 | | | 19,064 | |

| Prepaid expenses and other assets | | (80,904) | | | (16,799) | |

| Accounts payable | | (6,398) | | | (10,351) | |

| Accrued and other long-term liabilities | | 44,779 | | | 140,284 | |

| Long-term income tax payable | | (12,961) | | | (11,113) | |

| Deferred revenues | | (27,932) | | | 56,718 | |

Net cash provided by operating activities | | 188,491 | | | 451,672 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | |

| Acquisitions, net of cash acquired | | (77,075) | | | — | |

| Purchase of property, plant and equipment | | (62,819) | | | (122,664) | |

| Purchase of marketable securities | | — | | | (2,373) | |

| Proceeds from maturities of marketable securities | | 15,560 | | | 17,601 | |

| Proceeds from sales of marketable securities | | 7,518 | | | 4,048 | |

| Purchase of equity investments | | (75,390) | | | (75,000) | |

| | | | |

| | | | |

| Other investing activities | | 129 | | | 74 | |

| Net cash used in investing activities | | (192,077) | | | (178,314) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Proceeds from issuance of common stock | | 14,339 | | | 14,256 | |

| Common stock repurchases | | (150,012) | | | (292,360) | |

| Activity for equity forward contracts related to accelerated stock repurchase agreements, net | | — | | | 40,000 | |

| Payroll taxes paid upon the vesting of equity awards | | (27,602) | | | (21,788) | |

| Net cash used in financing activities | | (163,275) | | | (259,892) | |

| Effect of foreign exchange rate changes on cash, cash equivalents, and restricted cash | | (9,196) | | | (3,523) | |

| Net (decrease) increase in cash, cash equivalents, and restricted cash | | (176,057) | | | 9,943 | |

| Cash, cash equivalents, and restricted cash at beginning of the period | | 938,519 | | | 942,355 | |

| Cash, cash equivalents, and restricted cash at end of the period | | $ | 762,462 | | | $ | 952,298 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ALIGN TECHNOLOGY, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Note 1. Summary of Significant Accounting Policies

Basis of Presentation and Preparation

The accompanying unaudited Condensed Consolidated Financial Statements have been prepared by Align Technology, Inc. (“we”, “our”, the "Company", or “Align”) on a consistent basis with the audited Consolidated Financial Statements for the year ended December 31, 2023, and contain all adjustments, including normal recurring adjustments, necessary to fairly state the information set forth herein. These unaudited Condensed Consolidated Financial Statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”), and, therefore, omit certain information and footnote disclosures necessary to present the unaudited Condensed Consolidated Financial Statements in accordance with accounting principles generally accepted in the United States of America (“U.S.”).

The information included in this Quarterly Report on Form 10-Q should be read in conjunction with the Consolidated Financial Statements and notes thereto included in Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2023 as filed with the SEC. The results of operations for the three and six months ended June 30, 2024 are not necessarily indicative of the results that may be expected for the year ending December 31, 2024 or any other future period, and we make no representations related thereto.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles (“GAAP”) in the U.S. requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ materially from those estimates. On an ongoing basis, we evaluate our estimates, including those related to revenue recognition, useful lives of intangible assets and property and equipment, long-lived assets and goodwill, income taxes, contingent liabilities, the fair values of financial instruments, stock-based compensation and the valuation of investments in privately held companies, among others. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable, the results of which form the basis for making judgments about the carrying values of assets and liabilities.

Certain Risks and Uncertainties

We are subject to risks including, but not limited to, global and regional economic market conditions, inflation, fluctuations in foreign currency exchange rates, changes in consumer confidence and demand, increased competition, dependence on key personnel, protection and litigation of proprietary technology, shifts in taxable income between tax jurisdictions and compliance with regulations of the U.S. Food and Drug Administration (“FDA”) and similar international agencies.

Our cash and investments are held primarily by five financial institutions. Financial instruments which potentially expose us to concentrations of credit risk consist primarily of cash equivalents and marketable securities. We invest excess cash primarily in money market funds, corporate bonds, asset-backed securities, municipal and U.S. government agency bonds and treasury bonds. We periodically evaluate our investments for credit losses. Such credit losses have not been material to our financial statements.

We purchase certain inventory from sole suppliers. Additionally, we rely on a limited number of hardware manufacturers. The inability of any supplier or manufacturer to fulfill our supply requirements could materially and adversely impact our future operating results.

Recent Accounting Pronouncements

Recent Accounting Pronouncements Not Yet Effective

On November 27, 2023, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2023-07, “Improvements to Reportable Segment Disclosures.” The amendments in this update improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. For public business entities, the provisions of ASU 2023-07 are effective for fiscal years beginning after December 15, 2023 and interim periods within fiscal years beginning after December 15, 2024. Early adoption is permitted. Companies must apply the

guidance retrospectively to all prior periods presented in the financial statements. The Company expects this pronouncement may result in changes to the nature of our reportable segment disclosures.

On December 14, 2023, the FASB issued ASU 2023-09, “Improvements to Income Tax Disclosures.” The amendments in this ASU require a public entity to disclose in tabular format, using both percentages and reporting currency amounts, specific categories in the rate reconciliation and to provide additional information for reconciling items that meet a quantitative threshold. The amendments in this ASU also require taxes paid (net of refunds received) to be disaggregated by federal, state, and foreign taxes and further disaggregated for specific jurisdictions to the extent the related amounts exceed a quantitative threshold. For public business entities, the provisions of ASU 2023-09 are effective for fiscal years beginning after December 15, 2024. Early adoption is permitted. The Company is evaluating the effect of this pronouncement on its annual consolidated financial statements.

Note 2. Financial Instruments

Cash, Cash Equivalents and Marketable Securities

The following tables summarize our cash and cash equivalents, and marketable securities on our Condensed Consolidated Balance Sheets as of June 30, 2024 and December 31, 2023 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Reported as: |

| June 30, 2024 | | Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | Fair Value | | Cash and Cash Equivalents | | Marketable securities, short-term | | Marketable securities, long-term |

| Cash | | $ | 759,803 | | | $ | — | | | $ | — | | | $ | 759,803 | | | $ | 759,803 | | | $ | — | | | $ | — | |

| Money market funds | | 1,626 | | | — | | | — | | | 1,626 | | | 1,626 | | | — | | | — | |

| Corporate bonds | | 19,560 | | | — | | | (208) | | | 19,352 | | | — | | | 19,352 | | | — | |

| | | | | | | | | | | | | | |

| Asset-backed securities | | 324 | | | — | | | — | | | 324 | | | — | | | 324 | | | |

| | | | | | | | | | | | | | |

| U.S. government agency bonds | | 1,009 | | | — | | | (3) | | | 1,006 | | | — | | | 1,006 | | | — | |

| | | | | | | | | | | | | | |

| Total | | $ | 782,322 | | | $ | — | | | $ | (211) | | | $ | 782,111 | | | $ | 761,429 | | | $ | 20,682 | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Reported as: |

| December 31, 2023 | | Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | Fair Value | | Cash and Cash Equivalents | | Marketable securities, short-term | | Marketable securities, long-term |

| Cash | | $ | 887,682 | | | $ | — | | | $ | — | | | $ | 887,682 | | | $ | 887,682 | | | $ | — | | | $ | — | |

| Money market funds | | 49,756 | | | — | | | — | | | 49,756 | | | 49,756 | | | — | | | — | |

| Corporate bonds | | 31,943 | | | 5 | | | (676) | | | 31,272 | | | — | | | 28,704 | | | 2,568 | |

U.S. government treasury bonds

| | 4,855 | | | — | | | (99) | | | 4,756 | | | — | | | — | | | 4,756 | |

| Asset-backed securities | | 1,416 | | | 2 | | | (1) | | | 1,417 | | | — | | | 719 | | | 698 | |

| Municipal bonds | | 702 | | | — | | | (2) | | | 700 | | | — | | | 700 | | | — | |

| U.S. government agency bonds | | 5,215 | | | — | | | (34) | | | 5,181 | | | — | | | 5,181 | | | — | |

| | | | | | | | | | | | | | |

| Total | | $ | 981,569 | | | $ | 7 | | | $ | (812) | | | $ | 980,764 | | | $ | 937,438 | | | $ | 35,304 | | | $ | 8,022 | |

The following table summarizes the fair value of our available-for-sale marketable securities classified by contractual maturity as of June 30, 2024 and December 31, 2023 (in thousands):

| | | | | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 |

| Due in 1 year or less | | $ | 20,358 | | | $ | 34,617 | |

| Due in 1 year through 5 years | | 324 | | | 8,709 | |

| Total | | $ | 20,682 | | | $ | 43,326 | |

The securities that we invest in are generally deemed to be low risk based on their credit ratings from the major rating agencies. The longer the duration of these securities, the more susceptible they are to changes in market interest rates and bond yields. As interest rates increase, those securities purchased at a lower yield show a mark-to-market unrealized loss. Our unrealized losses as of June 30, 2024 and December 31, 2023 are primarily due to changes in interest rates and credit spreads.

The following tables summarize the fair value and gross unrealized losses as of June 30, 2024 and December 31, 2023, aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of June 30, 2024 |

| | Less than 12 months | | 12 Months of Greater | | Total |

| June 30, 2024 | | Fair Value | | Unrealized Loss | | Fair Value | | Unrealized Loss | | | Fair Value | | Unrealized Loss |

| Corporate bonds | | $ | 2,013 | | | $ | — | | | $ | 17,339 | | | $ | (208) | | | | $ | 19,352 | | | $ | (208) | |

| | | | | | | | | | | | | |

| Asset-backed securities | | — | | | — | | | 324 | | | — | | | | 324 | | | — | |

| | | | | | | | | | | | | |

| U.S. government agency bonds | | — | | | — | | | 1,006 | | | (3) | | | | 1,006 | | | (3) | |

| | | | | | | | | | | | | |

| Total | | $ | 2,013 | | | $ | — | | | $ | 18,669 | | | $ | (211) | | | | $ | 20,682 | | | $ | (211) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 31, 2023 |

| | Less than 12 months | | 12 Months of Greater | | Total |

| December 31, 2023 | | Fair Value | | Unrealized Loss | | Fair Value | | Unrealized Loss | | | Fair Value | | Unrealized Loss |

| Corporate bonds | | $ | — | | | $ | — | | | $ | 27,939 | | | $ | (676) | | | | $ | 27,939 | | | $ | (676) | |

U.S. government treasury bonds

| | 2,044 | | | (11) | | | 2,712 | | | (88) | | | | 4,756 | | | (99) | |

| Asset-backed securities | | 1,018 | | | (1) | | | 83 | | | — | | | | 1,101 | | | (1) | |

| Municipal bonds | | — | | | — | | | 700 | | | (2) | | | | 700 | | | (2) | |

| U.S. government agency bonds | | 4,003 | | | (11) | | | 1,178 | | | (23) | | | | 5,181 | | | (34) | |

| | | | | | | | | | | | | |

| Total | | $ | 7,065 | | | $ | (23) | | | $ | 32,612 | | | $ | (789) | | | | $ | 39,677 | | | $ | (812) | |

Fair Value Measurements

Fair value is an exit price, representing the amount that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. We use the GAAP fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. This hierarchy requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The three levels of inputs that may be used to measure fair value:

Level 1 — Quoted (unadjusted) prices in active markets for identical assets or liabilities.

Level 2 — Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the asset or liability. We obtain fair values for our Level 2 investments. Our custody bank and asset managers independently use professional pricing services to gather pricing data which may include quoted market prices for identical or comparable financial instruments, or inputs other than quoted prices that are observable either directly or indirectly, and we are ultimately responsible for these underlying estimates.

Level 3 — Unobservable inputs to the valuation methodology that are supported by little or no market activity and that are significant to the measurement of the fair value of the assets or liabilities. Level 3 assets and liabilities include those whose fair value measurements are determined using pricing models, discounted cash flow methodologies or similar valuation techniques, as well as significant management judgment or estimation.

The following tables summarize our financial assets measured at fair value as of June 30, 2024 and December 31, 2023 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | |

| Description | | Balance as of June 30, 2024 | | Level 1 | |

Level 2 | | |

| Cash equivalents: | | | | | | | | |

| Money market funds | | $ | 1,626 | | | $ | 1,626 | | | $ | — | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Short-term investments: | | | | | | | | |

| | | | | | | | |

| U.S. government agency bonds | | 1,006 | | | — | | | 1,006 | | | |

| | | | | | | | |

| Corporate bonds | | 19,352 | | | — | | | 19,352 | | | |

| | | | | | | | |

| Asset-backed securities | | 324 | | | — | | | 324 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | $ | 22,308 | | | $ | 1,626 | | | $ | 20,682 | | | |

| | | | | | | | | | | | | | | | | | | | |

| Description | | Balance as of December 31, 2023 | | Level 1 | | Level 2 |

| Cash equivalents: | | | | | | |

| Money market funds | | $ | 49,756 | | | $ | 49,756 | | | $ | — | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Short-term investments: | | | | | | |

| Corporate bonds | | 28,704 | | | — | | | 28,704 | |

| Municipal bonds | | 700 | | | — | | | 700 | |

U.S. government agency bonds | | 5,181 | | | — | | | 5,181 | |

| Asset-backed securities | | 719 | | | — | | | 719 | |

| | | | | | |

| | | | | | |

| | | | | | |

| Long-term investments: | | | | | | |

U.S. government treasury bonds | | 4,756 | | | — | | | 4,756 | |

| Corporate bonds | | 2,568 | | | — | | | 2,568 | |

| | | | | | |

| | | | | | |

Asset-backed securities | | 698 | | | — | | | 698 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | $ | 93,082 | | | $ | 49,756 | | | $ | 43,326 | |

| | | | | | |

Accounts Receivable Factoring

We enter into factoring transactions on a non-recourse basis with financial institutions to sell certain of our non-U.S. accounts receivable. We account for these transactions as sales of financial assets and include the cash proceeds as a part of our cash flows from operations in the Condensed Consolidated Statements of Cash Flows. Total accounts receivable sold under the factoring arrangements was $11.3 million and $8.2 million during the three months ended June 30, 2024 and 2023, respectively, and $25.9 million and $16.2 million during the six months ended June 30, 2024 and 2023, respectively. Factoring fees on the sales of receivables were recorded in other income (expense), net in our Condensed Consolidated Statement of Operations and were not material.

Investments in Privately Held Companies

Our investments in privately held companies in which we cannot exercise significant influence and do not own a majority equity interest or otherwise control are accounted for as an investment in equity securities. We have elected to account for all investments in equity securities in accordance with the measurement alternative. Under the measurement alternative, we record the value of our investments in equity securities at cost, minus impairment, if any. Additionally, we adjust the carrying value of our investments in equity securities to fair value for observable transactions for identical or similar investments of the same issuer.

On April 24, 2023 and April 22, 2024, we entered into Subscription Agreements (the “Subscription Agreements”) with Heartland Dental Holding Corporation (“Heartland”). Pursuant to the Subscription Agreements we acquired less than a 5% equity interest through the purchase of Class A Common Stock for $150 million in total. We are accounting for our investment in Heartland as an investment in equity securities. Based on a review of the relevant facts and circumstances, primarily observable transactions for Heartland's Class A Common Stock, we determined that no adjustment to the carrying value of our investment was necessary for the three or six months ended June 30, 2024.

Our investments in privately held companies in which we can exercise significant influence are accounted for as equity method investments. We have elected to account for our equity method investments under the fair value option.

The carrying value of our investments in equity securities and equity method investments are reported on our Condensed Consolidated Balance Sheets as Other assets and any fair value adjustments or impairment, if any, are recorded in other income (expense), net on our Condensed Consolidated Statement of Operations.

Derivatives Not Designated as Hedging Instruments

We enter into foreign currency forward contracts to minimize the short-term impact of foreign currency exchange rate fluctuations on certain assets and liabilities. These forward contracts are classified within Level 2 of the fair value hierarchy. As a result of the settlement of foreign currency forward contracts, we recognized a net gain of $7.5 million and $1.1 million, respectively, during the three months ended June 30, 2024 and 2023, and a net gain of $27.2 million and a net loss of $5.3 million, respectively, during the six months ended June 30, 2024 and 2023. Recognized gains and losses from the settlement of foreign currency forward contracts are recorded to Other income (expense), net in our Condensed Consolidated Statements of Operations. As of June 30, 2024 and December 31, 2023, the fair value of foreign exchange forward contracts outstanding were not material.

The following tables present the gross notional value of all our foreign exchange forward contracts outstanding as of June 30, 2024 and December 31, 2023 (in thousands):

| | | | | | | | | | | |

| June 30, 2024 |

| Local Currency Amount | | Notional Contract Amount (USD) |

| Euro | €224,400 | | $ | 240,601 | |

| British Pound | £114,500 | | 144,867 | |

| Canadian Dollar | $102,400 | | 74,790 | |

| Polish Zloty | PLN291,700 | | 72,401 | |

| Chinese Yuan | ¥336,300 | | 46,207 | |

| Japanese Yen | ¥4,700,000 | | 29,419 | |

| Israeli Shekel | ILS69,600 | | | 18,554 | |

| Brazilian Real | R$91,600 | | 16,390 | |

| Mexican Peso | M$288,500 | | 15,750 | |

| Swiss Franc | CHF4,700 | | 5,246 | |

| Australian Dollar | A$6,200 | | 4,137 | |

| New Taiwan Dollar | NT$111,000 | | 3,418 | |

| New Zealand Dollar | NZ$5,200 | | 3,168 | |

| Korean Won | ₩3,100,000 | | 2,244 | |

| Czech Koruna | Kč28,000 | | 1,197 | |

| | | $ | 678,389 | |

| | | | | | | | | | | |

| December 31, 2023 |

| Local Currency Amount | | Notional Contract Amount (USD) |

| Euro | €337,780 | | $ | 373,705 | |

| Canadian Dollar | $108,900 | | 82,166 | |

| Polish Zloty | PLN276,900 | | 70,393 | |

| British Pound | £45,590 | | 58,005 | |

| Chinese Yuan | ¥244,500.00 | | 34,361 | |

| Swiss Franc | CHF28,600 | | 34,132 | |

| Japanese Yen | ¥3,577,000 | | 25,347 | |

| Israeli Shekel | ILS78,700 | | 21,800 | |

| Brazilian Real | R$80,500 | | 16,563 | |

| Mexican Peso | M$230,000 | | | 13,593 | |

| New Zealand Dollar | NZ$6,600 | | 4,161 | |

| Australian Dollar | A$4,300 | | 2,921 | |

| New Taiwan Dollar | NT$89,000 | | 2,919 | |

| Czech Koruna | Kč60,200 | | 2,687 | |

| Korean Won | ₩2,200,000 | | 1,709 | |

| | | $ | 744,462 | |

Note 3. Balance Sheet Components

Inventories consist of the following (in thousands):

| | | | | | | | | | | | | | |

| | June 30,

2024 | | December 31,

2023 |

| Raw materials | | $ | 125,034 | | | $ | 145,492 | |

| Work in process | | 87,034 | | | 91,259 | |

| Finished goods | | 47,424 | | | 60,151 | |

| Total inventories | | $ | 259,492 | | | $ | 296,902 | |

Prepaid expenses and other current assets consist of the following (in thousands):

| | | | | | | | | | | | | | |

| | June 30,

2024 | | December 31,

2023 |

| Value added tax receivables | | $ | 188,847 | | | $ | 143,728 | |

| Prepaid expenses | | 91,262 | | | 52,487 | |

| Other current assets | | 70,525 | | | 77,335 | |

| Total prepaid expenses and other current assets | | $ | 350,634 | | | $ | 273,550 | |

Accrued liabilities consist of the following (in thousands):

| | | | | | | | | | | | | | |

| | June 30,

2024 | | December 31,

2023 |

| Accrued payroll and benefits | | $ | 232,052 | | | $ | 220,862 | |

| Accrued expenses | | 64,476 | | | 71,109 | |

| Accrued sales and marketing expenses | | 48,287 | | | 34,035 | |

| Accrued income taxes | | 36,082 | | | 38,103 | |

| Current operating lease liabilities | | 30,790 | | | 29,651 | |

| Accrued property, plant and equipment | | 10,985 | | | 23,618 | |

| | | | |

| Other accrued liabilities | | 132,786 | | | 108,402 | |

| Total accrued liabilities | | $ | 555,458 | | | $ | 525,780 | |

Accrued warranty, which is included in the "Other accrued liabilities" category of the accrued liabilities table above, consists of the following activity (in thousands):

| | | | | | | | | | | | | | |

| | Six Months Ended

June 30, |

| | | 2024 | | 2023 |

| Balance at beginning of period | | $ | 22,426 | | | $ | 17,873 | |

| Charged to cost of net revenues | | 10,959 | | | 9,421 | |

| Actual warranty expenditures | | (6,523) | | | (6,797) | |

| Balance at end of period | | $ | 26,862 | | | $ | 20,497 | |

Deferred revenues consist of the following (in thousands):

| | | | | | | | | | | | | | |

| | June 30,

2024 | | December 31,

2023 |

| Deferred revenues - current | | $ | 1,378,867 | | | $ | 1,427,706 | |

Deferred revenues - long-term 1 | | $ | 117,582 | | | $ | 138,000 | |

1 Included in Other long-term liabilities within our Condensed Consolidated Balance Sheets.

During the three months ended June 30, 2024 and 2023, we recognized $1,028.5 million and $1,002.2 million of net revenues, respectively, of which $222.4 million and $199.0 million was included in the deferred revenues balance at December 31, 2023 and 2022, respectively.

During the six months ended June 30, 2024 and 2023, we recognized $2,025.9 million and $1,945.3 million of net revenues, respectively, of which $459.2 million and $404.7 million was included in the deferred revenues balance at December 31, 2023 and 2022, respectively.

Our unfulfilled performance obligations, including deferred revenues and backlog, as of June 30, 2024 were $1,505.0 million. These performance obligations are expected to be fulfilled over the next six months to five years.

Note 4. Business Combination

On January 2, 2024 (the “Cubicure Acquisition Date”), we completed the acquisition of privately-held Cubicure GmbH (“Cubicure”) (the "Cubicure Acquisition"). Cubicure is an Austrian company and specializes in direct 3D printing solutions for polymer additive manufacturing that develops, produces, and distributes innovative materials, equipment, and processes for 3D printing solutions. The Cubicure Acquisition is intended to support and scale our strategic innovation roadmap and strengthen the Align Digital Platform. In fiscal year 2021, we acquired an 9.04% equity interest in Cubicure. Subsequently, on the Cubicure Acquisition Date, we acquired the remaining equity of Cubicure. Prior to the acquisition, we also had technology license and joint development agreements with Cubicure.

The fair value of consideration transferred in the acquisition is shown in the table below (in thousands):

| | | | | | | | |

| Cash paid to Cubicure stockholders | | $ | 80,142 | |

| Fair value of pre-existing equity interest ownership | | 7,968 | |

| Settlement of pre-existing relationship - accounts payable | | (2,316) | |

| Total purchase consideration paid | | $ | 85,794 | |

The Cubicure Acquisition was accounted for as a business combination under ASC Topic 805, Business Combinations (“ASC 805”) that was achieved in stages. As a result of the Cubicure Acquisition, we remeasured our pre-existing equity interest in Cubicure at fair value prior to the Cubicure Acquisition. Based on the fair value of this equity interest, derived from the purchase price, we estimated the fair value of our 9.04% pre-existing investment in Cubicure to be approximately $8.0 million. The remeasurement resulted in the recognition of a pre-tax gain of $4.1 million, which was reflected as a component of Other income (expense), net within our Condensed Consolidated Statement of Operations.

In 2021, we initiated Joint development (“JDA”) and Technology license agreements (“TLA”) to provide us with access to Cubicure's technology. The settlement of the JDA and TLA were concluded to be at market terms on the Cubicure Acquisition Date; therefore, no gain or loss was recorded related to the settlement of these contracts. We also had accounts payable from the pre-existing arrangements with Cubicure of $2.3 million, which were effectively settled and reduced from the purchase consideration of the Cubicure Acquisition.

The preliminary allocation of purchase price to assets acquired and liabilities assumed which is subject to change within the measurement period is as follows (in thousands):

| | | | | | | | |

| Working capital | | $ | 1,039 | |

| Property & equipment | | 975 | |

| Developed technology | | 47,000 | |

| Other non-current asset | | 1,386 | |

| Other liabilities | | (12,279) | |

| Goodwill | | 47,673 | |

| Total | | $ | 85,794 | |

Goodwill represents the excess of the purchase price over the fair value of the underlying net tangible and identifiable intangible assets, and represents the value associated future technology, future customer relationships, and the knowledge and experience of the workforce in place. None of this goodwill is deductible for tax purposes. We allocated all goodwill to our Clear Aligner reporting unit.

As part of the Cubicure Acquisition we acquired a developed technology intangible asset. The acquired developed technology had an estimated fair value of $47.0 million as of the Cubicure Acquisition Date and will be amortized over a useful life of thirteen years.

The fair value of developed technology was estimated under the Multi-Period Excess Earnings Method and the fair value estimates for developed technology include significant assumptions in the prospective financial information which include, but are not limited, to the projected future cash flows associated with the technology, asset's life cycle and the present value factor.

Acquisition related costs are recognized separately from the business combination and are expensed as incurred. Acquisition related costs were not material.

Our consolidated financial statements include the operating results of Cubicure from the Cubicure Acquisition Date. Separate post-acquisition operating results and pro forma results of operations for this acquisition have not been presented as the effect is not material to our consolidated financial results.

Note 5. Goodwill and Intangible Assets

Goodwill

The change in the carrying value of goodwill for the six months ended June 30, 2024, categorized by reportable segments, is as follows (in thousands):

| | | | | | | | | | | | | | | | | |

| Clear Aligner | | Systems and Services | | Total |

Balance as of December 31, 2023 | $ | 111,086 | | | $ | 308,444 | | | $ | 419,530 | |

| Additions from acquisition | 47,673 | | | — | | | 47,673 | |

Foreign currency translation adjustments | (3,091) | | | (9,619) | | | (12,710) | |

Balance as of June 30, 2024 | $ | 155,668 | | | $ | 298,825 | | | $ | 454,493 | |

Finite-Lived Intangible Assets

Acquired finite-lived intangible assets were as follows, excluding intangibles that were fully amortized, is as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted Average Amortization Period

(in years) | | Gross Carrying Amount as of June 30, 2024 | | Accumulated

Amortization | | Accumulated

Impairment Loss | | Net Carrying Value as of June 30, 2024 |

| Existing technology | 11 | | $ | 146,651 | | | $ | (44,869) | | | $ | — | | | $ | 101,782 | |

| Customer relationships | 10 | | 21,500 | | | (9,138) | | | — | | | 12,362 | |

| Trademarks and tradenames | 10 | | 16,600 | | | (8,374) | | | (4,122) | | | 4,104 | |

| Patents | 12 | | 480 | | | (260) | | | — | | | 220 | |

| | | $ | 185,231 | | | $ | (62,641) | | | $ | (4,122) | | | 118,468 | |

| Foreign currency translation adjustments | | | | | | | | | (2,763) | |

Total intangible assets, net 1 | | | | | | | | | $ | 115,705 | |

1 Includes $46.7 million of fully amortized intangible assets.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted Average Amortization Period

(in years) | | Gross Carrying Amount as of December 31, 2023 | | Accumulated Amortization | | Accumulated Impairment Loss | | Net Carrying Value as of December 31, 2023 |

| Existing technology | 10 | | $ | 112,051 | | | $ | (45,331) | | | $ | (4,328) | | | $ | 62,392 | |

| Customer relationships | 10 | | 21,500 | | | (8,063) | | | — | | | 13,437 | |

| Trademarks and tradenames | 10 | | 16,600 | | | (7,605) | | | (4,122) | | | 4,873 | |

| Patents | 8 | | 6,511 | | | (6,082) | | | — | | | 429 | |

| | | $ | 156,662 | | | $ | (67,081) | | | $ | (8,450) | | | 81,131 | |

| Foreign currency translation adjustments | | | | | | | | | 987 | |

Total intangible assets, net 1 | | | | | | | | | $ | 82,118 | |

1 Includes $34.3 million of fully amortized intangible assets.

Of the $146.7 million recorded as existing technology intangible assets as of June 30, 2024, $47.0 million was acquired during the first quarter of 2024 as part of the Cubicure Acquisition. The existing technology acquired in the Cubicure Acquisition had an estimated useful life of 13 years, which had the effect of increasing the weighted average amortization period from approximately 10 years as of December 31, 2023 to approximately 11 years as of June 30, 2024. Refer to Note 4. Business Combination.

The total estimated annual future amortization expense for these acquired intangible assets as of June 30, 2024, is as follows (in thousands):

| | | | | | | | |

| Fiscal Year Ending December 31, | | Amortization |

Remainder of 2024 | | $ | 9,287 | |

| 2025 | | 18,574 | |

| 2026 | | 17,969 | |

| 2027 | | 15,607 | |

| 2028 | | 14,505 | |

| Thereafter | | 42,526 | |

| Total | | $ | 118,468 | |

Amortization expense for the three months ended June 30, 2024 and 2023 was $4.7 million and $4.1 million, respectively, and amortization expense for the six months ended June 30, 2024 and 2023 was $9.6 million and $8.2 million, respectively.

Note 6. Credit Facility

We have a credit facility that provides for a $300.0 million unsecured revolving line of credit, along with a $50.0 million letter of credit. On December 23, 2022, we amended certain provisions in our credit facility which included extending the maturity date on the facility to December 23, 2027 and replacing the interest rate from the existing LIBOR with SOFR (“2022 Credit Facility”). The 2022 Credit Facility requires us to comply with specific financial conditions and performance requirements. Loans under the 2022 Credit Facility bear interest, at our option, at either a rate based on the SOFR for the applicable interest period or a base rate, in each case plus a margin. As of June 30, 2024, we had no outstanding borrowings under the 2022 Credit Facility and were in compliance with the conditions and performance requirements in all material respects.

Note 7. Legal Proceedings

2019 Shareholder Derivative Lawsuit

In January 2019, three derivative lawsuits were filed in the U.S. District Court for the Northern District of California which were later consolidated, purportedly on our behalf, naming as defendants the then current members of our Board of Directors along with certain of our executive officers. The complaints assert various state law causes of action, including for breaches of fiduciary duty, insider trading, and unjust enrichment. The complaints seek unspecified monetary damages on our

behalf, which is named solely as a nominal defendant against whom no recovery is sought, as well as disgorgement and the costs and expenses associated with the litigation, including attorneys’ fees. The consolidated action is currently stayed. Defendants have not yet responded to the complaints.

On April 12, 2019, a derivative lawsuit was also filed in California Superior Court for Santa Clara County, purportedly on our behalf, naming as defendants the members of our Board of Directors along with certain of our executive officers. The allegations in the complaint are similar to those in the derivative suits described above. The matter is currently stayed. Defendants have not yet responded to the complaint.

In the first quarter of 2024, the parties to these actions entered into a settlement agreement whereby, subject to court approval, plaintiffs will dismiss the lawsuits and release their claims. In the settlement agreement, Align and the defendants deny any wrongdoing and are not making any monetary payments, other than a potential award of $575,000 in attorney’s fees to plaintiffs’ counsel, covered by insurance. On July 3, 2024, the U.S. District Court for the Northern District of California denied preliminary approval of the settlement without prejudice. The court held a case management conference on August 1, 2024 and indicated a revised order would issue in the near future.

Antitrust Class Actions

On June 5, 2020, a dental practice named Simon and Simon, PC doing business as City Smiles brought an antitrust action in the U.S. District Court for the Northern District of California on behalf of itself and a putative class of similarly situated practices seeking treble monetary damages, interest, costs, attorneys’ fees, and injunctive relief relating to our alleged market activities in alleged clear aligner and intraoral scanner markets. Plaintiff filed an amended complaint and added VIP Dental Spas as a plaintiff on August 14, 2020. On December 18, 2023, the court certified a class of persons or entities that purchased Invisalign directly from Align between January 1, 2019 and March 31, 2022. The court denied Plaintiffs’ motion to certify a class of purchasers of scanners. On February 21, 2024, the court granted Align’s motion for summary judgment on all claims brought by the plaintiffs. The court entered judgment on March 22, 2024. Plaintiffs have appealed the district court’s summary judgment ruling to the United States Court of Appeals for the Ninth Circuit. Plaintiff-Appellants' opening brief was filed July 15, 2024. Align’s response brief is due September 27, 2024 and Plaintiff-Appellants' reply brief is due October 18, 2024.

On May 3, 2021, an individual named Misty Snow brought an antitrust action in the U.S. District Court for the Northern District of California on behalf of herself and a putative class of similarly situated individuals seeking treble monetary damages, interest, costs, attorneys’ fees, and injunctive relief relating to our alleged market activities in alleged clear aligner and intraoral scanner markets based on Section 2 of the Sherman Act. Plaintiffs have filed several amended complaints adding new plaintiffs, various state law claims, and allegations based on Section 1 of the Sherman Act. On November 29, 2023, the court certified a class of indirect purchasers of Invisalign between July 1, 2018 and December 31, 2023 and a class of indirect purchasers of Invisalign seeking injunctive relief. On February 21, 2024, the court granted Align’s motion for summary judgment on the claims related to Section 2 allegations. The court entered judgment for the Section 2 and related state law claims on March 22, 2024. Plaintiffs have appealed the district court’s summary judgment ruling to the United States Court of Appeals for the Ninth Circuit. Plaintiff-Appellants' opening brief was filed July 15, 2024. Align’s response brief is due September 27, 2024 and Plaintiff-Appellants' reply brief is due October 18, 2024.

We are currently unable to predict the outcome of these lawsuits and therefore we cannot determine the likelihood of loss, if any, nor estimate a range of possible loss.

In June 2024, Align and the Section 1 plaintiffs reached a settlement in principle that would resolve all remaining claims in the Section 1 lawsuit. The settlement terms remain confidential and subject to court approval. While we continue to believe that plaintiffs’ Section 1 claims are without merit and despite vigorously defending ourselves against those claims, we decided to settle the lawsuit to avoid the distraction and uncertainty of litigation.

During the three months ended June 30, 2024 we accrued a loss of $31.1 million for legal settlements for multiple legal matters, but primarily related to the settlement of the Section 1 claims described above.

Straumann Litigation