Current Report Filing (8-k)

28 April 2023 - 7:18AM

Edgar (US Regulatory)

00-0000000 Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant 0001868573 false 0001868573 2023-04-27 2023-04-27 0001868573 us-gaap:CapitalUnitsMember 2023-04-27 2023-04-27 0001868573 us-gaap:CommonClassAMember 2023-04-27 2023-04-27 0001868573 us-gaap:WarrantMember 2023-04-27 2023-04-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 27, 2023

APX ACQUISITION CORP. I

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Cayman Islands |

|

001-41125 |

|

N/A |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

Juan Salvador Agraz 65 Contadero, Cuajimalpa de Morelos Mexico City, Mexico |

|

05370 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: +52 (55) 4744 1100

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one Class A ordinary share, par value $0.0001, and one-half of one redeemable warrant |

|

APXIU |

|

The NASDAQ Stock Market LLC |

| Class A ordinary shares, par value $0.0001 per share |

|

APXI |

|

The NASDAQ Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of Class A ordinary share for $11.50 per share |

|

APXIW |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

APx Acquisition Corp. I (“APXI”) is providing an update to the beneficial ownership table previously provided in Item 12 of its Annual Report on Form 10-K for the year ended December 31, 2022 (the “2022 Form 10-K”) to reflect each person known by APXI as of March 31, 2023 to be a beneficial owner of more than 5% of its issued and outstanding ordinary shares after taking into account the redemption by APXI of 10,693,417 of its public shares on February 27, 2023 (the “Redemption”). The below table is based on Schedule 13G or 13G/A reporting and discussions between APXI and shareholders previously disclosed in the beneficial ownership table provided in Item 12 of the 2022 Form 10-K. As a result, the below table may not reflect actual holding of the shares beneficially owned by a shareholder after giving effect to the Redemption. The below table excludes the beneficial ownership of our ordinary shares by our executive officers and directors as there has been no change to the information previously provided in our 2022 Form 10-K with respect to such holders.

The following table is based on 10,869,083 ordinary shares outstanding at March 31, 2023, of which 6,556,583 were Class A ordinary shares and 4,312,500 were Class B ordinary shares. Unless otherwise indicated, it is believed that all persons named in the table below have sole voting and investment power with respect to all ordinary shares beneficially owned by them.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Class A ordinary shares |

|

|

Class B ordinary shares |

|

|

|

|

| Name and Address of Beneficial Owner (1) |

|

Number of

Shares

Beneficially

Owned |

|

|

Approximate

Percentage

of Class |

|

|

Number of

Shares

Beneficially

Owned |

|

|

Approximate

Percentage of

Class |

|

|

Percentage of

Outstanding

ordinary

shares |

|

| APx Cap Sponsor Group I, LLC (2) |

|

|

|

|

|

|

|

|

|

|

4,272,500 |

|

|

|

99.07 |

% |

|

|

39.31 |

% |

| Glazer Capital, LLC (3) |

|

|

740,743 |

|

|

|

11.30 |

% |

|

|

|

|

|

|

|

|

|

|

6.82 |

% |

| (1) |

Unless otherwise noted, the business address of each of the following is Juan Salvador Agraz 65, Contadero, Cuajimalpa de Morelos, 05370, Mexico City, Mexico. |

| (2) |

The shares reported above are held in the name of our sponsor. APx Cap Sponsor Group I, LLC is controlled by its managing member, APx Cap Holdings I, LLC. APx Cap Holdings I, LLC’s board of directors consists of three members. Each director of APx Cap Holdings I, LLC has one vote, and the approval of the members of the board of directors is required to approve an action of APx Cap Holdings I, LLC. Under the so-called “rule of three,” if voting and dispositive decisions regarding an entity’s securities are made by two or more individuals, and a voting and dispositive decision requires the approval of a majority of those individuals, then none of the individuals is deemed a beneficial owner of the entity’s securities. This is the situation with regard to APx Cap Holdings I, LLC. Based upon the foregoing analysis, no individual manager of APx Cap Holdings I, LLC exercises voting or dispositive control over any of the securities held by APx Cap Holdings I, LLC even those in which he directly holds a pecuniary interest. Accordingly, none of them will be deemed to have or share beneficial ownership of such shares and, for the avoidance of doubt, each expressly disclaims any such beneficial interest to the extent of any pecuniary interest he may have therein, directly or indirectly. |

| (3) |

Shares beneficially owned are based on Schedule 13G/A filed with the SEC on March 10, 2023, by Glazer Capital, LLC (“Glazer”) and discussions between APXI and Glazer. The address of the shareholder, as reported in the Schedule 13G/A is 250 West 55th Street, Suite 30A, New York, New York 10019. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: April 27, 2023

|

|

|

| APX ACQUISITION CORP. I |

|

|

| By: |

|

/s/ Xavier Martinez |

| Name: |

|

Xavier Martinez |

| Title: |

|

Chief Financial Officer |

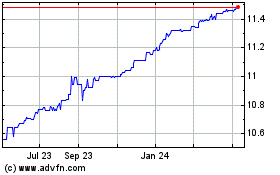

APx Acquisition Corporat... (NASDAQ:APXI)

Historical Stock Chart

From Feb 2025 to Mar 2025

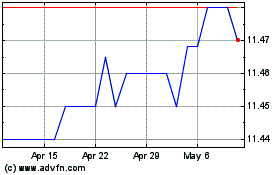

APx Acquisition Corporat... (NASDAQ:APXI)

Historical Stock Chart

From Mar 2024 to Mar 2025