UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of August 2024

Commission file number: 001-41523

BEAMR IMAGING LTD.

(Translation of registrant’s name into English)

10 HaManofim Street

Herzeliya, 4672561, Israel

(Address of principal executive offices)

Indicate by check mark

whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Exhibits 99.2 and Exhibit 99.3 of this Form 6-K

are hereby incorporated by reference into the registrant’s Registration Statement on Form S-8 (File No. 333-272779) and Form F-3 (File No. 333-277787), to be a part thereof from the date on which this report is submitted, to the extent not superseded by

documents or reports subsequently filed or furnished.

On August 6, 2024, Beamr

Imaging Ltd. (the “Company”) issued a press release entitled “Beamr Issues Q2-2024 CEO Letter to Shareholders and Announces

First Half 2024 Financial Results”. In addition, on the same day, the Company issued condensed consolidated interim financial statements

(unaudited) as of June 30, 2024 together with the Company’s Operating and Financial Review and Prospects for the same period.

Attached hereto and incorporated by reference

herein are the following exhibits:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Beamr Imaging Ltd. |

| |

|

| Date: August 6, 2024 |

By: |

/s/ Sharon Carmel |

| |

Name: |

Sharon Carmel |

| |

Title: |

Chief Executive Officer |

2

Exhibit 99.1

Beamr in Q2-2024: Enhancements to Beamr Cloud and Collaborations

with Industry Giants

Beamr Issues Q2-2024 CEO Letter to Shareholders and Announces its

First Half 2024 Financial Results

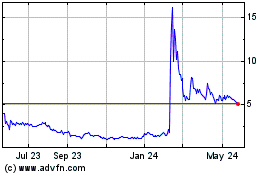

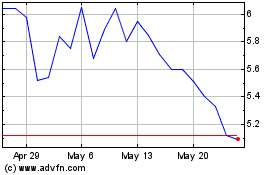

Herzliya, Israel, Aug. 06, 2024 (GLOBE NEWSWIRE) -- Beamr Imaging Ltd.

(NASDAQ: BMR), a leader in video optimization technology and solutions, today issued a Letter to Shareholders from Sharon Carmel, Chief

Executive Officer, including its financial results for the six months ended June 30, 2024.

Dear Shareholders:

I am pleased to update you on our Q2-2024 activities and

progress, which include significant developments in Beamr Cloud video services, Beamr product enhancements and

collaborations with industry giants.

These developments span the integration of artificial intelligence

(AI) features into Beamr Cloud, an improved pricing model for our products and demonstrations at industry

premier events, including optimization of real-time video streaming and videos rendered from 3D models.

To support our future growth, we have appointed two new senior

management roles, a Chief Operations Officer and a Head of Human Resources.

We believe that Beamr Cloud’s new AI services are only the

tip of the iceberg – as the video world undergoes a revolution, video processes are no longer focused mainly on storage

and streaming challenges, but also video that itself transforms into AI video.

AI video allows, for example, searching inside the video

just like in text. It could also include enhancement of quality, appearance and acceleration of delivery to customers.

Later this year, we plan to release additional video AI enhancement features into Beamr Cloud.

While we continuously maintain our progress, in this letter I will

highlight our achievements in Q2-2024 and the first half of 2024, along with recent developments and plans for the coming months.

Significant Developments in Beamr Cloud Video Services

Beamr Cloud was launched in February 2024, designed to provide

an automatic, easy-to-use and scalable video processing in the cloud. Beamr Cloud was first launched on Amazon Web Service (AWS) and is

now available via Oracle Cloud Infrastructure (OCI) as well (see “Collaborations with Industry Giants” below).

Along with high-performance video processes, based on GPU accelerated

computing, Beamr Cloud aims to support modernization of video repositories and libraries to advance formats such as AV1 (AOMedia

Video 1) - a high-quality, future-proofed and royalty free video format backed by tech giants.

Thanks to Beamr’s technological ability to significantly reduce

video files size without compromising quality, Beamr Cloud is poised to accelerate machine learning training. Case studies published

by Beamr showed that optimizing videos, leveraging them with smaller, faster capabilities, had no negative impact on video AI processes.

Product Enhancements

Successfully achieving our Q2-2024 plan, the first AI video capabilities

were integrated into Beamr Cloud. The AI video enhancements allow automatic caption and transcription generation for

videos in multiple languages.

Incorporating these AI features is a first step in augmenting Beamr Cloud with

cutting-edge services. We consider AI video to be at the forefront of the video industry in the coming years, shifting

and improving current video processes, hence we plan to provide our customers with such workflows.

Since launching Beamr Cloud in February 2024,

we have been in constant contact with dozens of prospective customers from enterprises to medium-sized and small businesses. This

has resulted in improving the pricing model of our products to a “flexible pricing model”, including three

tiers:

| (1) | Special plans for enterprises, including secured

virtual private cloud (VPC) as well as other capabilities tailored to their needs. |

| (2) | Subscription plans for long-term contracts, with

flexible pricing according to usage growth. |

| (3) | Prepaid packages for users with specific video needs,

such as video archives. |

These flexible pricing model plans are available for customers of the

cloud platforms, AWS and OCI, allowing them immediate and automated onboarding to Beamr Cloud’s optimization, modernization and

AI services.

Collaboration with Industry Giants

ACM Mile-High-Video 2024

In February 2024, we presented research on automated video modernization

to the advanced format, AV1, at ACM Mile-High-Video 2024, a flagship video formats and streaming event.

GTC – GPU Technology Conference

In March 2024, we presented at GTC, a global conference about

the future of AI and accelerated computing, in which we spotlighted plans for integrating AI workflows into Beamr Cloud.

NAB Show 2024

In April 2024, Beamr demonstrated how our perceptual optimization

technology (CABR), accelerated by GPUs, is poised to overcome 5G bandwidth bottlenecks that are due to internet providers’ difficulty

to support the always-growing demand for real-time video streaming required for live event transmission and other use cases.

Oracle Inc.

Beamr Cloud was launched on OCI in June 2024. OCI

is the second cloud service that provides to its customers Beamr’s GPU-based video optimization services, following AWS.

When we announced this collaboration with Oracle, David Hicks, Oracle’s

group vice president, Worldwide ISV Cloud Business Development said in a joint press release : “Beamr’s commitment

to innovation with the Oracle Cloud and quality execution helps our mutual customers receive cloud-enabled, automated, and scalable video

processing solutions ready to meet critical business needs.”.

The collaboration

with OCI has opened access to customers of both companies to the newest generation of GPUs, and preliminary testing showed the

potential for increased video processing speed by up to 30%. Alongside the enhanced service on a second cloud platform,

Beamr has achieved “Powered by Oracle Cloud” expertise and was chosen as one of OCI’s AI innovators .

SIGGRAPH 2024

In July 2024, Beamr participated in SIGGRAPH 2024, the

premier conference on computer graphics and interactive tech. Beamr demonstrated the optimization process of a massive high-quality, high-resolution

video rendered from 3D design - reducing it to one-fourth of its original size while securing the same quality. The demonstration

was on Oracle Cloud Infrastructure, using GPU-accelerated computing.

The Way Forward - Accelerated Growth

In Q2-2024 and continuing into Q3-2024, we strengthened and expanded

our activities, mainly due to raising gross proceeds of approximately $13.8 million in an underwritten offering (prior to deducting underwriting

discounts and other offering expenses) that we closed in February 2024.

To further accelerate Beamr’s growth, we have recently appointed

a Chief Operations Officer, Mr. Haggai Barel. In his new role, Mr. Barel will be responsible for advancing Beamr’s significant growth

in research & development, product and marketing, and will be an essential contributor in building and promoting Beamr Cloud.

Furthermore, we have appointed Ms. Yael Carter as Head of Human Resources.

Ms. Carter will contribute significantly to scaling Beamr’s workforce in order to drive the growth of our company and cloud services.

In the coming months, our enhanced management, together with our

marketing, sales and research and development teams, will focus on the rapid addition of unique cloud capabilities that will

further differentiate Beamr Cloud from other services, alongside seeking out new opportunities for further collaborations

and partnerships, distribution agreements and contracts with new customers.

First Half 2024 Financial Results

| ● | Revenues increased by $0.05 million, or 5% to $1 million for the six months

ended June 30, 2024, from $0.955 million for the six months ended June 30, 2023. The increase was primarily due to signing new license

agreements offset by certain license agreements that were terminated. |

| ● | Cost of revenues increased by $0.035 million, or 71% to $0.085 million

for the six months ended June 30, 2024, from $0.05 million for the six months ended June 30, 2023. The increase was primarily due to amortization

of capitalized internal-use software costs related to our Beamr Cloud SaaS solution. |

| ● | Research and development expenses increased by $0.09 million, or 10% to $1

million for the six months ended June 30, 2024, from $0.912 million for the six months ended June 30, 2023. The increase was mainly due

to an increase in subcontractors’ professional fees. |

| ● | Selling and marketing expenses increased by $0.113 million, or 57% to $0.3

million for the six months ended June 30, 2024, from $0.197 million for the six months ended June 30, 2023. The increase was primarily

due to costs related to the hiring of a new sales executive, as well as conference expenses. |

| ● | General and administrative expenses increased by $0.35 million, or 44% to

$1.15 million for of six months ended June 30, 2024, from $0.8 million for of six months ended June 30, 2023. The increase was primarily

due to service providers expenses related to the company being a public entity (legal, insurance, accounting, NASDAQ fees, Sarbanes Oxley

and investor relations). |

| ● | Financing income decreased by $0.62 million, or 273% to $(0.4) million for

the six months ended June 30, 2024, from $0.23 million for the six months ended June 30, 2023. The decrease was primarily due to changes

in the fair value of derivative warrants liability related to certain warrants granted to a commercial bank offset by income from interest

on bank deposits. |

| ● | Net loss for the six months ended June 30, 2024 was $1.96 million or $0.13

basic net loss per ordinary share, compared to a net loss of $0.78 million, or $0.08 basic net loss per ordinary share, in the six months

ended June 30, 2023. The increase in the net loss is attributed mainly to above change in the operating expenses. |

| ● | Beamr ended the second quarter of 2024 with $14.1 million in cash and cash

equivalents, compared to $6.2 million as of the second quarter ended 2023. In addition, Beamr has $3.5 million in short-term bank deposits

as of the second quarter ended 2024. |

We look forward to informing you in Q3 of our exciting developments

and achievements.

Respectfully,

Sharon Carmel

Chief Executive Officer, Beamr Imaging Ltd.

About Beamr

Beamr (Nasdaq: BMR) is a world leader in content adaptive video solutions.

Backed by 53 granted patents, and winner of the 2021 Technology and Engineering Emmy® award and the 2021 Seagate Lyve Innovator of

the Year award, Beamr’s perceptual optimization technology enables up to a 50% reduction in bitrate with guaranteed quality. www.beamr.com

Forward-Looking Statements

This press release contains “forward-looking statements”

that are subject to substantial risks and uncertainties. Forward-looking statements in this communication may include, among other things,

statements about Beamr’s strategic and business plans, technology, relationships, objectives and expectations for its business,

the impact of trends on and interest in its business, intellectual property or product and its future results, operations and financial

performance and condition. All statements, other than statements of historical fact, contained in this press release are forward-looking

statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,”

“believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,”

“seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,”

“target,” “aim,” “should,” “will” “would,” or the negative of these words

or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on

the Company’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict.

Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. For a more

detailed description of the risks and uncertainties affecting the Company, reference is made to the Company’s reports filed from

time to time with the Securities and Exchange Commission (“SEC”), including, but not limited to, the risks detailed in the

Company’s annual report filed with the SEC on March 4, 2024 and in subsequent filings with the SEC. Forward-looking statements contained

in this announcement are made as of the date hereof and the Company undertakes no duty to update such information except as required under

applicable law.

Investor Contact:

investorrelations@beamr.com

5

Exhibit 99.2

BEAMR IMAGING LTD.

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2024

BEAMR IMAGING LTD.

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2024

INDEX TO CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS

BEAMR IMAGING LTD.

CONDENSED CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands except share and per

share amounts)

| |

|

As of

June 30, |

|

|

As of

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

Unaudited |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

14,159 |

|

|

$ |

6,116 |

|

| Short-term bank deposit |

|

|

3,500 |

|

|

|

- |

|

| Trade receivables |

|

|

134 |

|

|

|

597 |

|

| Other current assets |

|

|

369 |

|

|

|

132 |

|

| Total current assets |

|

|

18,162 |

|

|

|

6,845 |

|

| |

|

|

|

|

|

|

|

|

| Non-current assets: |

|

|

|

|

|

|

|

|

| Property and equipment, net |

|

|

33 |

|

|

|

19 |

|

| Intangible assets, net |

|

|

599 |

|

|

|

280 |

|

| Goodwill |

|

|

4,379 |

|

|

|

4,379 |

|

| Total non-current assets |

|

|

5,011 |

|

|

|

4,678 |

|

| |

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

23,173 |

|

|

$ |

11,523 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Current maturities of loans, net |

|

$ |

369 |

|

|

$ |

330 |

|

| Account payables |

|

|

6 |

|

|

|

7 |

|

| Deferred revenues |

|

|

18 |

|

|

|

27 |

|

| Liability to controlling shareholder, net |

|

|

50 |

|

|

|

199 |

|

| Other current liabilities |

|

|

501 |

|

|

|

458 |

|

| Total current liabilities |

|

|

944 |

|

|

|

1,021 |

|

| |

|

|

|

|

|

|

|

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

| Loans, net of current maturities |

|

|

32 |

|

|

|

170 |

|

| Derivative warrant liability |

|

|

50 |

|

|

|

72 |

|

| Total non-current liabilities |

|

|

82 |

|

|

|

242 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and contingent liabilities |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

|

| Ordinary Shares of NIS 0.05 par value each: |

|

|

|

|

|

|

|

|

| Authorized: 222,000,000 shares at June 30, 2024 and December 31, 2023; Issued and outstanding: 15,511,414 and 13,051,343 shares at June 30, 2024 and December 31, 2023, respectively |

|

|

212 |

|

|

|

179 |

|

| Additional paid-in capital |

|

|

55,571 |

|

|

|

41,752 |

|

| Accumulated deficit |

|

|

(33,636 |

) |

|

|

(31,671 |

) |

| Total shareholders’ equity |

|

|

22,147 |

|

|

|

10,260 |

|

| |

|

|

|

|

|

|

|

|

| Total liabilities and shareholders’ equity |

|

$ |

23,173 |

|

|

$ |

11,523 |

|

The

accompanying notes are an integral part of these condensed consolidated financial statements.

BEAMR IMAGING LTD.

CONDENSED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS

(U.S. dollars in thousands except share and per

share amounts)

| |

|

Six-month period ended

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

Unaudited |

|

| |

|

|

|

| Revenues |

|

$ |

1,001 |

|

|

$ |

955 |

|

| Cost of revenues |

|

|

(85 |

) |

|

|

(50 |

) |

| Gross profit |

|

|

916 |

|

|

|

905 |

|

| |

|

|

|

|

|

|

|

|

| Research and development expenses |

|

|

(1,002 |

) |

|

|

(912 |

) |

| Sales and marketing expenses |

|

|

(310 |

) |

|

|

(197 |

) |

| General and administrative expenses |

|

|

(1,152 |

) |

|

|

(800 |

) |

| |

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(1,548 |

) |

|

|

(1,004 |

) |

| |

|

|

|

|

|

|

|

|

| Financing income (expense), net |

|

|

(396 |

) |

|

|

229 |

|

| |

|

|

|

|

|

|

|

|

| Loss before taxes on income |

|

|

(1,944 |

) |

|

|

(775 |

) |

| |

|

|

|

|

|

|

|

|

| Taxes on income |

|

|

(21 |

) |

|

|

(7 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss and comprehensive loss for the period |

|

$ |

(1,965 |

) |

|

$ |

(782 |

) |

| |

|

|

|

|

|

|

|

|

| Basic net loss per share |

|

$ |

(0.13 |

) |

|

$ |

(0.08 |

) |

| Weighted average number of Ordinary Shares outstanding used in computing basic net loss per share |

|

|

14,815,174 |

|

|

|

9,411,251 |

|

| Diluted net loss per share |

|

$ |

(0.13 |

) |

|

$ |

(0.11 |

) |

| Weighted average number of Ordinary Shares outstanding used in computing diluted net loss per share |

|

|

14,815,174 |

|

|

|

9,879,633 |

|

The accompanying notes

are an integral part of these condensed consolidated financial statements.

BEAMR IMAGING LTD.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES

IN SHAREHOLDERS’ EQUITY (DEFICIT)

(U.S. dollars in thousands except share and per

share amounts)

| | |

Ordinary shares | | |

Convertible

Ordinary 1 and 2 shares | | |

Convertible

Preferred shares | | |

Additional

paid-in | | |

Accumulated | | |

Total

shareholders’

Equity | |

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

Number | | |

Amount | | |

capital | | |

deficit | | |

(deficit) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance as of December 31, 2022 | |

| 2,578,760 | | |

$ | 51 | | |

| 1,496,880 | | |

$ | 5 | | |

| 5,714,400 | | |

$ | 78 | | |

$ | 30,375 | | |

$ | (30,970 | ) | |

$ | (461 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of Ordinary Shares upon completion of an initial public offering, net of offering expenses | |

| 1,950,000 | | |

| 27 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 6,355 | | |

| - | | |

| 6,382 | |

| Voluntary conversion of all shares with preferences over Ordinary Shares into Ordinary Shares | |

| 7,211,280 | | |

| 83 | | |

| (1,496,880 | ) | |

| (5 | ) | |

| (5,714,400 | ) | |

| (78 | ) | |

| - | | |

| - | | |

| - | |

| Automatic conversion of all convertible advanced investments into Ordinary Shares | |

| 1,142,856 | | |

| 16 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,555 | | |

| - | | |

| 4,571 | |

| Deemed dividend resulted from trigger of down round protection feature of certain warrants granted | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 7 | | |

| (7 | ) | |

| - | |

| Share-based compensation (Note 4) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 176 | | |

| - | | |

| 176 | |

| Exercise of options into ordinary shares to be issued (Note 4) | |

| 18,448 | | |

| (*)- | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 28 | | |

| - | | |

| 28 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (782 | ) | |

| (782 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of June 30, 2023 (unaudited) | |

| 12,901,344 | | |

$ | 177 | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

$ | 41,496 | | |

$ | (31,759 | ) | |

$ | 9,914 | |

The accompanying notes are an integral part

of these condensed consolidated financial statements.

BEAMR IMAGING LTD.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY (DEFICIT)

(U.S. dollars in thousands except share and per

share amounts)

| | |

Ordinary shares | | |

Additional

paid-in | | |

Accumulated | | |

Total

shareholders’ | |

| | |

Number | | |

Amount | | |

capital | | |

Deficit | | |

Equity | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance as of December 31, 2023 | |

| 13,051,343 | | |

$ | 179 | | |

$ | 41,752 | | |

$ | (31,671 | ) | |

$ | 10,260 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of Ordinary Shares upon completion of an initial public offering (including exercise of over-allotment option), net of offering expenses (Note 3A) | |

| 1,971,300 | | |

| 27 | | |

| 12,259 | | |

| - | | |

| 12,286 | |

| Issuance of Ordinary Shares upon cashless exercise of Warrants (Note 3B) | |

| 95,120 | | |

| 1 | | |

| (1 | ) | |

| - | | |

| - | |

| Amount classified to equity upon determination of the exercise price (Note 3B) | |

| | | |

| | | |

| 599 | | |

| | | |

| 599 | |

| Share-based compensation (Note 4) | |

| - | | |

| - | | |

| 185 | | |

| - | | |

| 185 | |

| Exercise of options into ordinary shares to be issued (Note 4) | |

| 393,651 | | |

| 5 | | |

| 777 | | |

| - | | |

| 782 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (1,965 | ) | |

| (1,965 | ) |

| Balance as of June 30, 2024 (unaudited) | |

| 15,511,414 | | |

$ | 212 | | |

$ | 55,571 | | |

$ | (33,636 | ) | |

$ | 22,147 | |

The accompanying notes are an integral part

of these condensed consolidated financial statements.

BEAMR IMAGING LTD.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S. dollars in thousands)

| | |

Six-month period ended

June 30, | |

| | |

2024 | | |

2023 | |

| | |

Unaudited | |

| Cash flows from operating activities: | |

| | |

| |

| Net loss | |

$ | (1,965 | ) | |

$ | (782 | ) |

| Adjustments required to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 53 | | |

| 13 | |

| Share-based compensation (Note 4) | |

| 112 | | |

| 176 | |

| Change in the fair value of convertible advanced investments | |

| - | | |

| (269 | ) |

| Amortization of discount on straight loan received from commercial bank | |

| 12 | | |

| 13 | |

| Exchange rate differences on straight loan received from commercial bank | |

| (10 | ) | |

| (30 | ) |

| Change in the fair value of derivative warrant liability (Note 5) | |

| 577 | | |

| (36 | ) |

| Change in estimation of maturity date of liability to controlling shareholder (Note 6) | |

| - | | |

| 12 | |

| Amortization of discount and accrued interest on straight loan from controlling shareholder (Note 6) | |

| 10 | | |

| 28 | |

| Exchange rate differences on straight loan from controlling shareholder (Note 6) | |

| (5 | ) | |

| (21 | ) |

| Decrease (increase) in trade receivables | |

| 463 | | |

| 170 | |

| Increase in other current assets | |

| (237 | ) | |

| (178 | ) |

| Decrease in accounts payable | |

| (1 | ) | |

| (15 | ) |

| Decrease in deferred revenues | |

| (9 | ) | |

| (12 | ) |

| Increase in other current liabilities | |

| 43 | | |

| (84 | ) |

| Net cash used in operating activities | |

| (957 | ) | |

| (1,015 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of property and equipment | |

| (18 | ) | |

| (4 | ) |

| Capitalization of internal-use software | |

| (295 | ) | |

| - | |

| Investment is short-term bank deposit | |

| (3,500 | ) | |

| - | |

| Net cash used in investing activities | |

| (3,813 | ) | |

| (4 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Repayment of principal relating to straight loan received from commercial bank | |

| (101 | ) | |

| (94 | ) |

| Net proceeds received upon completion of initial public offering transaction | |

| - | | |

| 6,695 | |

| Net proceeds received upon completion of public offering transaction (Note 3A) | |

| 12,286 | | |

| - | |

| Proceeds from loan received from controlling shareholder (Note 6) | |

| - | | |

| 25 | |

| Repayment of principal relating to straight loan received from controlling shareholder (Note 6) | |

| (154 | ) | |

| (104 | ) |

| Proceeds received from exercise of options into shares to be issued (Note 4) | |

| 782 | | |

| 28 | |

| Net cash provided by financing activities | |

| 12,813 | | |

| 6,550 | |

| | |

| | | |

| | |

| Change in cash, cash equivalents | |

| 8,043 | | |

| 5,531 | |

| Cash, cash equivalents at beginning of period | |

| 6,116 | | |

| 693 | |

| Cash, cash equivalents at end of period | |

$ | 14,159 | | |

$ | 6,224 | |

| | |

| | | |

| | |

| Non-cash financing activities: | |

| | | |

| | |

| Amount classified to equity upon determination of the exercise price (Note 3) | |

$ | 599 | | |

$ | | |

| Share-based compensation capitalized in internal-use software | |

$ | 73 | | |

$ | - | |

| Automatic conversion of convertible advanced investments into shares | |

$ | - | | |

$ | 4,571 | |

| Deemed dividend upon trigger of down round protection | |

$ | - | | |

$ | (7 | ) |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Interest paid | |

$ | 38 | | |

$ | 20 | |

| Interest received | |

$ | 168 | | |

$ | - | |

| Taxes paid | |

$ | 30 | | |

$ | 7 | |

The accompanying notes are an integral part

of these condensed consolidated financial statements.

BEAMR IMAGING LTD.

NOTES TO CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS

(U.S. dollars in thousands)

NOTE 1 -

GENERAL

Beamr Imaging Ltd. (the “Company”

or “Beamr”) was incorporated on October 1, 2009 under the laws of the State of Israel and it engages mainly development of

optimization technologies for video and photo compression.

On February 20,

2024, the Company launched its next generation product, a cloud-based software-as-a-Service (“SaaS”) solution that aims to

simplify video processing and make it accessible and affordable to everyone. On June 11, 2024, the Company announced that its SaaS solution

is available on Oracle Cloud Infrastructure cloud.

In 2012, the Company incorporated a

wholly-owned U.S. subsidiary, Beamr Inc. (“Beamr Inc.”), for the purpose of reselling the Company’s software and products

in the U.S. market.

In 2016, the Company incorporated a

wholly-owned limited Russian partnership, Beamr Imaging RU LLC (“Beamr Imaging RU”), for the purpose of conducting research

and development services to the Company.

The Company and its subsidiaries,

Beamr Inc. and Beamr Imaging RU, are collectively referred to as the “Group”.

| C. | Liquidity and capital resources |

The Company has devoted substantially

all of its efforts to research and development, the commercialization of its software and products and raising capital for such purposes.

The development and further commercialization of the Company’s software and products are expected to require substantial further expenditures.

To date, the Company has not yet generated sufficient revenues from operations to support its activities, and therefore it is dependent

upon external sources for financing its operations. During the six month period ended June 30, 2024, the Company had net losses of $1,965.

As of June 30, 2024, the Company had an accumulated deficit of $33,636 The Company plans to finance its operations through the sales of

its equity securities (including, but not limited to, (i) proceeds received from (A) the Company’s underwritten initial public offering

(“IPO”) on the Nasdaq Capital Market (the “Nasdaq”) of its ordinary shares, par value NIS 0.05 per share, of the

Company (the “Ordinary Shares”) that closed in March 2023, and (B) the Company’s underwritten public offering on the

Nasdaq of its Ordinary Shares that closed in February 2024, and (ii) one or more offerings that the Company may enter into pursuant to

its Company’s outstanding Shelf Registration Statement (as defined below)) and to the extent available, revenues from sales of its software,

products and related services. In addition, the Company is collaborating with a strategic partner in development of the Company’s next

generation, cloud-based SaaS solution that is based the Company’s video optimization technology and which is expected to allow the

Company to potentially access new customers and new markets with relatively low sales investment.

During the year ended December 31,

2023, the Company raised net proceeds of $6,382 and $49 through completion of the aforesaid IPO and exercises of options into Ordinary

Shares, respectively. During the six month period ended June 30, 2024, the Company raised net proceeds of $12,286 and $782 through completion

of the underwritten public offering and exercises of options into Ordinary Shares, respectively (see also Note 3A and Note 4, respectively).

In addition, on

March 8, 2024, the Company’s filed a shelf registration statement on Form F-3 (the “Shelf Registration Statement”), which

was declared effective by the Securities and Exchange Commission (the “SEC”) on March 19, 2024, which permits the Company

to register up to $250,000 of certain equity and debt securities of the Company in one or more offerings. In addition, as of June

30, 2024, the Company has positive working capital of $17,218.

Management has considered the significance

of such conditions in relation to the Company’s ability to meet its current obligations and to achieve its business targets and determined

that it has sufficient cash to fund its planned operations for at least the next 12 months.

BEAMR IMAGING LTD.

NOTES TO CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS (Cont.)

(U.S. dollars in thousands)

NOTE 1 -

GENERAL (Cont.)

| D. | The impact of the Russian Invasion of Ukraine |

On February 24, 2022, Russia invaded

Ukraine. The Company has an operation in Russia through its wholly-owned subsidiary, Beamr Imaging RU. The Company undertakes some of

its software development and design, quality assurance and support in Russia using personnel located there. While most of the Company’s

developers are located in Russia, its research and development leadership are all located in Israel. The Company has no manufacturing

operations in Russia, and the Company does not sell any products in Russia. The Company constantly evaluates its activities in Russia

and currently believes there was no significant impact on its activities. As of June 30, 2024, two employees have relocated from Russia

to Serbia and are employes as subcontractors of the Company.

| E. | The impact of Iron Sword War (Israel-Hamas war) |

On October 7, 2023, the State of Israel

was attacked by the Hamas terrorist organization, and as a result, the State of Israel declared a state of war and a large-scale mobilization

of reserves (the “War”) which is an exceptional event with security and economic implications, the scope and outcome of which

cannot be predicted. Following the outbreak of the War, the State of Israel took and is continuing to take significant steps to maintain

the security of Israeli residents, which has had and continues to have a significant impact on economic and business activity in the country.

The management regularly monitors developments and acts in accordance with the guidelines of the various authorities. Since this is an

event beyond the Company’s control and characterized by uncertainty, inter alia as to when the War will end, as of the approval date of

these unaudited condensed interim consolidated financial statements, the Company is unable to predict the intensity of the impact of the

War on the Company’s financial condition and the results of its operations.

NOTE 2 -

SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited condensed

interim consolidated financial statements and related notes should be read in conjunction with the Company’s consolidated financial statements

and related notes included in the Company’s annual report on Form 20-F for the fiscal year ended December 31, 2023, which was filed

with the SEC on March 4, 2024. The unaudited condensed interim consolidated financial statements have been prepared in accordance with

the rules and regulations of the SEC related to interim financial statements. As permitted under those rules, certain information and

footnote disclosures normally required or included in financial statements prepared in accordance with U.S. GAAP have been condensed or

omitted. The financial information contained herein is unaudited; however, management believes all adjustments have been made that are

considered necessary to present fairly the results of the Company’s financial position and operating results for the interim periods.

All such adjustments are of a normal recurring nature.

The results for the six month period

ended June 30, 2024 are not necessarily indicative of the results to be expected for the year ending December 31, 2024 or for any other

interim period or for any future period.

| B. | Use of estimates in the preparation of financial statements |

The preparation of the financial statements

in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities

and the disclosure of contingent assets and liabilities at the dates of the financial statements, and the reported amounts of expenses

during the reporting periods. Actual results could differ from those estimates. As applicable to these interim financial statements, the

most significant estimates and assumptions include (i) revenues recognition; (ii) recoverability of the Company’s goodwill upon

subsequent periods and (iii) measurement of fair value of equity awards.

| C. | Principles of Consolidation |

The consolidated financial statements

include the accounts of the Group. Intercompany transactions and balances have been eliminated upon consolidation.

| D. | Cash and cash equivalents |

Cash equivalents are short-term highly

liquid investments which include short term bank deposits (up to three months from date of deposit), that are not restricted as to withdrawals

or use that are readily convertible to cash with maturities of three months or less as of the date acquired.

BEAMR IMAGING LTD.

NOTES TO CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS (Cont.)

(U.S. dollars in thousands)

NOTE 2 -

SIGNIFICANT ACCOUNTING POLICIES (Cont.)

| E. | Short-term bank deposit |

Short-term bank deposit in banking

institution for a period in excess of three months but less than one year following the date of deposit. The deposit is presented in accordance

with the deposit terms.

| F. | Basic and diluted net loss per ordinary share |

Until the completion

of the IPO in March 2023, the Company applied the two-class method as required by ASC 260-10, “Earnings Per Share” (“ASC 260-10”),

which requires the income or loss per share for each class of shares (ordinary and all other shares with preferences over ordinary shares)

to be calculated assuming 100% of the Company’s earnings are distributed as dividends to each class of shares based on their contractual

rights. No dividends were declared or paid during the reported periods. According to the provisions of ASC 260-10, the Company’s

formerly outstanding Convertible Preferred Shares (including series Convertible Ordinary 1 and 2 Shares) did not have a contractual obligation

to share losses of the Company and therefore they were not included in the computation of net loss per share. Upon the completion of the

IPO in March 2023, all such convertible preferred shares were voluntarily converted to Ordinary Shares.

Basic net loss per

ordinary share is computed by dividing the net loss for the period applicable to ordinary shareholders, by the weighted average number

of ordinary shares outstanding during the period. Diluted loss per share gives effect to all potentially dilutive common shares outstanding

during the period using the treasury stock method with respect to stock options and certain stock warrants and using the if-converted

method with respect to convertible advanced investments and certain stock warrants accounted for as derivative financial liability. In

computing diluted loss per share, the average share price for the period is used in determining the number of shares assumed to be purchased

from the exercise of stock options or warrants.

During the six month

periods ended June 30, 2024 and 2023, the total weighted average number of Ordinary Shares related to then outstanding shares with preferences

over Ordinary Shares (Convertible Ordinary 1 and 2 shares and Convertible Preferred Shares), share options and share warrants that were

excluded from the calculation of the diluted loss per share was 1,152,190 and 4,564,665, respectively.

The net loss from

operations and the weighted average number of Ordinary Shares used in computing basic and diluted net loss per share for the six month

periods ended June 30, 2024 and 2023, is as follows:

| | |

Six-month period ended

June 30, | |

| | |

2024 | | |

2023 | |

| | |

Unaudited | |

| Numerator: | |

| | |

| |

| Net loss | |

$ | (1,965 | ) | |

$ | (782 | ) |

| Deemed dividend related to trigger of down round protection feature resulting from completion of an IPO | |

| - | | |

| (7 | ) |

| Net basic loss | |

$ | (1,965 | ) | |

$ | (789 | ) |

| Change in fair value of derivative warrant liability | |

| - | | |

| (36 | ) |

| Change in fair value of convertible advanced investment | |

| - | | |

| (269 | ) |

| Net diluted loss | |

$ | (1,965 | ) | |

$ | (1,094 | ) |

| | |

| | | |

| | |

| Denominator: | |

| | | |

| | |

| Ordinary shares used in computing basic net loss per share | |

| 14,815,174 | | |

| 9,411,251 | |

| Incremental ordinary shares to be issued upon exercise of derivative warrant liability | |

| - | | |

| 6,623 | |

| Incremental ordinary shares to be issued upon conversion of convertible advanced investments | |

| - | | |

| 461,759 | |

| Ordinary shares used in computing diluted net loss per share | |

| 14,815,174 | | |

| 9,879,633 | |

| | |

| | | |

| | |

| Basic net loss per ordinary share | |

$ | (0.13 | ) | |

$ | (0.08 | ) |

| Diluted net loss per ordinary share | |

$ | (0.13 | ) | |

$ | (0.11 | ) |

BEAMR IMAGING LTD.

NOTES TO CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS (Cont.)

(U.S. dollars in thousands)

NOTE 3 - SIGNIFICANT

TRANSACTIONS

| A. | Completion of underwritten U.S. public offering |

On February 12, 2024, the Company

announced the pricing of an underwritten U.S. public offering under which 1,714,200 Ordinary Shares were issued at a public offering price

of $7.00 per share, for aggregate gross proceeds of $12,000, prior to deducting underwriting discounts and other offering expenses. In

addition, the Company granted to the underwriters (i) 98,565 warrants, which are exercisable into Ordinary Shares of the Company at an

exercise price of $8.75 per Ordinary Share over a period of 5-years commencing August 10, 2024 and (ii) a 45-day option to purchase up

to an additional 257,100 Ordinary Shares to cover over-allotments at the public offering price to cover over-allotments.

On February 13, 2024, the over-allotment

option was fully exercised by the underwriter for additional gross proceeds of approximately $1,800, before deducting underwriting discounts.

Direct and incremental costs incurred

related to the IPO amounted to $1,514.

Upon satisfaction of customary closing

conditions, the offering closed on February 15, 2024.

| B. | Partial cashless exercise of warrants |

| 1. | During the six month period ended June 30, 2024, the Company

issued 63,931 Ordinary Shares upon partial exercise of 93,502 warrants on a cashless basis granted to the underwriter in the IPO. |

| 2. | On February 22, 2024, a written notice was received by the

Company from IBI under which the exercise price of the warrant share granted in previous period to IBI to purchase 65,563 Ordinary Shares

was determined at a fixed amount of $3.67 per Ordinary Share. Consequently, the warrant share was classified from derivative warrants

liability to equity in total amount of $599. During the six month period ended June 30, 2024, the Company recorded revaluation expenses

amounted to $577 as result of changes in the fair value of the derivative warrants liability (see Note 5 below). |

In addition, during the six month

period ended June 30, 2024, the Company issued 31,189 Ordinary Shares to IBI upon the partial exercise of such warrant on a cashless basis.

BEAMR IMAGING LTD.

NOTES TO CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS (Cont.)

(U.S. dollars in thousands)

NOTE 4 - SHARE OPTIONS

On January 11, 2015, the Company’s Board

of Directors approved and adopted the 2015 Share Incentive Plan (the “Plan”), pursuant to which the Company’s Board

of Directors may award share options to purchase the Company’s Ordinary Shares as well as restricted shares, RSUs and other share-based

awards to designated participants. Subject to the terms and conditions of the Plan, the Company’s Board of Directors has full authority

in its discretion, from time to time and at any time, to determine (i) the designated participants; (ii) the terms and provisions of the

respective award agreements, including, but not limited to, the number of options to be granted to each optionee, the number of shares

to be covered by each option, provisions concerning the time and the extent to which the options may be exercised and the nature and duration

of restrictions as to the transferability or restrictions constituting substantial risk of forfeiture and to cancel or suspend awards,

as necessary; (iii) determine the fair market value of the shares covered by each award; (iv) make an election as to the type of approved

102 Option under Israeli tax law; (v) designate the type of award; (vi) take any measures, and take actions, as deemed necessary or advisable

for the administration and implementation of the Plan; (vii) interpret the provisions of the Plan and to amend from time to time the terms

of the Plan.

On May 22, 2024, the Company’s Board of Directors

approved to increase the number of Ordinary Shares, reserved out of the Company’s registered share capital, to be issued under the

Plan by additional 1,000,000 Ordinary Shares.

The Plan permits the grant of up to 3,069,280

Ordinary Shares subject to adjustments set in the Plan. As of June 30, 2024, considering the effect of previously exercised share options,

there were 1,345,019 Ordinary Shares available for future issuance under the Plan.

The following table presents the Company’s

share option activity for employees and members of the Board of Directors of the Company under the Plan for the periods of six months

ended June 30, 2024 and 2023:

| | | Number of Share

Options | | | Weighted Average

Exercise

Price | | | Weighted

average

remaining

contractual

life | | | Intrinsic

value | |

| | | | | | $ | | | (years) | | | $ | |

| | | | | | | | | | | | | |

| Outstanding as of December 31, 2023 | | | 1,295,367 | | | | 2.09 | | | | 6.04 | | | | 84 | |

| Granted | | | 48,600 | | | | 4.32 | | | | - | | | | - | |

| Exercised | | | (393,651 | ) | | | 1.99 | | | | - | | | | - | |

| Cancelled | | | (7,500 | ) | | | 3.20 | | | | - | | | | - | |

| Outstanding as of June 30, 2024 (unaudited) | | | 942,816 | | | | 2.24 | | | | 6.71 | | | | 2,811 | |

| Exercisable as of June 30, 2024 (unaudited) | | | 563,204 | | | | 2.15 | | | | 5.42 | | | | 1,730 | |

| | | Number of Share

Options | | | Weighted Average

Exercise

Price | | | Weighted

average

remaining

contractual

life | | | Intrinsic

value | |

| | | | | | $ | | | (years) | | | $ | |

| | | | | | | | | | | | | |

| Outstanding as of December 31, 2022 | | | 1,570,991 | | | | 1.78 | | | | 4.97 | | | | 2,435 | |

| Granted | | | 88,800 | | | | 3.67 | | | | 9.70 | | | | - | |

| Exercised | | | (18,448 | ) | | | 1.50 | | | | - | | | | - | |

| Forfeited or expired | | | (72,357 | ) | | | 1.96 | | | | - | | | | - | |

| Outstanding as of June 30, 2023 (unaudited) | | | 1,568,986 | | | | 1.88 | | | | 4.85 | | | | 1,475 | |

| Exercisable as of June 30, 2023 (unaudited) | | | 1,096,887 | | | | 1.75 | | | | 3.09 | | | | 1,174 | |

The aggregate intrinsic value in the table above represents the total intrinsic value (the difference between the estimated fair value

of the Company’s ordinary shares on the last day of the second quarter of each of the applicable reporting periods and the exercise price,

multiplied by the number of in-the-money share options) that would have been received by the share option holders had all option holders

exercised their share options on June 30 of each of the applicable reporting periods. This amount is impacted by the changes in the fair

market value of the Company’s ordinary share.

BEAMR IMAGING LTD.

NOTES TO CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS (Cont.)

(U.S. dollars in thousands)

NOTE 4 - SHARE OPTIONS (Cont.)

The outstanding share options as of June 30,

2024 have been separated into ranges of exercise prices, as follows:

| Exercise price | | Share options

outstanding

as of

June 30,

2024 | | | Weighted

average

remaining

contractual

term | | | Share options

exercisable

as of

June 30,

2024 | | | Weighted

average

remaining

contractual

term | |

| | | Unaudited | |

| | | | | | (years) | | | | | | (years) | |

- | | | 17,680 | | | | 2.7 | | | | 17,680 | | | | 2.7 | |

| 1.14 | | | 84,080 | | | | 2.34 | | | | 84,080 | | | | 2.34 | |

| 1.47 | | | 9,600 | | | | 9.59 | | | | - | | | | - | |

| 1.48 | | | 50,000 | | | | 9.21 | | | | - | | | | - | |

| 1.74 | | | 12,800 | | | | 8.80 | | | | 3,200 | | | | 8.8 | |

| 1.83 | | | 573,454 | | | | 7.03 | | | | 354,325 | | | | 6.31 | |

| 2.79 | | | 6,400 | | | | 9.09 | | | | - | | | | - | |

| 3.20 | | | 5,002 | | | | 7.15 | | | | 3,439 | | | | 7.15 | |

| 4.00 | | | 76,000 | | | | 8.68 | | | | 31,680 | | | | 8.68 | |

| 4.17 | | | 28,800 | | | | 1.53 | | | | 28,800 | | | | 1.53 | |

| 5.02 | | | 39,000 | | | | 9.99 | | | | - | | | | - | |

| 5.12 | | | 40,000 | | | | 5.04 | | | | 40,000 | | | | 5.04 | |

| | | | 942,816 | | | | | | | | 563,204 | | | | | |

The weighted average grant date fair value of

share options granted during the six month periods ended June 30, 2024 and 2023, was $2.45 and $2.07 per share option, respectively. During

the six month periods ended June 30, 2024 and 2023, 393,651 and 18,448 share options were exercised for a total amount of $782 and $28,

respectively.

The following table presents the assumptions used

to estimate the fair values of the share options granted in the reported periods presented:

| |

|

six-month period ended

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

| Volatility (%) |

|

|

52.7%-73.5% |

|

|

|

61.4% |

|

| Risk-free interest rate (%) |

|

|

4.0%-4.3% |

|

|

|

3.7%-4.3% |

|

| Dividend yield (%) |

|

|

- |

|

|

|

- |

|

| Expected life (years) |

|

|

6.25 |

|

|

|

6.25 |

|

| Exercise price ($) |

|

|

1.47-5.02 |

|

|

|

1.74-4.00 |

|

| Share price ($) |

|

|

1.72-4.96 |

|

|

|

1.74-3.73 |

|

As of June 30, 2024, there was $774 of unrecognized

compensation expense related to unvested share options. The Company recognizes compensation expense over the requisite service periods,

which results in a weighted average period of approximately 1.24 years over which the unrecognized compensation expense is expected to

be recognized.

The total compensation cost related to all of

the Company’s equity-based awards recognized in profit and loss during the periods of six months ended June 30, 2024 and 2023 was comprised

as follows:

| |

|

Six-month period ended

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

Unaudited |

|

| |

|

|

|

|

|

|

| Research and development |

|

$ |

126 |

|

|

$ |

122 |

|

| Sales and marketing |

|

|

11 |

|

|

|

14 |

|

| General and administrative |

|

|

48 |

|

|

|

40 |

|

| |

|

$ |

185 |

|

|

$ |

176 |

|

BEAMR IMAGING LTD.

NOTES TO CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS (Cont.)

(U.S. dollars in thousands)

NOTE 5 - FINANCING

EXPENSES (INCOME), NET

| |

|

Six-month period ended

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

Unaudited |

|

| |

|

|

|

|

|

|

| Change in fair value of convertible advanced investment |

|

$ |

- |

|

|

$ |

(269 |

) |

| Change in fair value of derivative warrant liability |

|

|

577 |

|

|

|

(36 |

) |

| Amortization of discount and accrued interest relating to straight loan received from commercial bank |

|

|

52 |

|

|

|

68 |

|

| Amortization of discount relating to loan received from controlling shareholder |

|

|

10 |

|

|

|

28 |

|

| Change in accounting estimates related to maturity date of loan received from controlling shareholder |

|

|

- |

|

|

|

12 |

|

| Interest on bank deposits |

|

|

(228 |

) |

|

|

(10 |

) |

| Exchange rate differences and other finance expenses |

|

|

(15 |

) |

|

|

(22 |

) |

| |

|

$ |

396 |

|

|

$ |

(229 |

) |

NOTE 6 - RELATED PARTIES

TRANSACTIONS

The liability to controlling shareholder derives

from a service agreement with the Company’s Founder under which the Company receives consulting services on recurring basis from the Founder

as Chief Executive Officer indirectly through an entity controlled by the Founder (the “Service Provider”) for total current

monthly gross amount of NIS 45 thousand. On March 14, 2022, the Company’s shareholders approved, among other matters, to renew the service

agreement with the Founder for a period ending December 31, 2025.

On May 22, 2024, the Company’s Compensation Committee

and Board of Directors approved a certain adjustment of the compensation terms and conditions of the Founder for his duties as Chief Executive

Officer of the Company, so that the salary of the Founder shall be increased by NIS 20 thousand (the “Founder’s Compensation

Adjustment”). However, the Founder’s Compensation Adjustment is subject to reaffirmation of the general meeting of the shareholders

which was achieved on August 5, 2024.

On February 16, 2022, the Company entered into

an addendum to the aforesaid service agreement with the Service Provider under which it was agreed that (i) the term of the service agreement

with the Service Provider was extended to December 31, 2025 and (ii) the then current liability towards the Service Provider as was accrued

for services rendered under the service agreement over a period commencing January 1, 2020 through the date hereof in total nominal amount

of $357 (the “Current Liability”) will be paid in 18 equal monthly installments (without an interest) starting on March 1,

2022 (the “Commencement Date”). However, in the event that the Company shall not have available sufficient funds in any such

payment date from and after the Commencement Date to repay the installments of the Current Liability and/or the on-going fee owed to the

Service Provider or in the event that the Company determines that according to the following 12-months period budget that it shall not

have available sufficient funds to pay such installments and/or the on-going fee, then the Service Provider hereby agrees to postpone

such payments owed to it until the Company will have such sufficient funds. Any unpaid on-going fee payments will be added to the Current

Liability.

Since the liability towards the Founder was considered

as free interest loan, which did not represent the applicable rate of risk for the Company, the aforesaid addendum was accounted for as

a capital contribution from a controlling shareholder. Thus, the liability towards the Founder was measured at fair value based on future

cash payments discounted using an interest rate of 15.45% which represented the applicable rate of risk for the Company, as determined

by management using the assistance of third-party appraiser. As a result, the Company recorded a discount on the balance of liability

towards the Founder in total amount of $112 against additional paid-in capital (including in respect to amounts due for services period

through fiscal year for 2022). Discount expenses are recorded over the economic life of the loan based on the effective interest rate

method.

As of December 31, 2022, management has updated

the repayments schedule of the obligation based on its current projection of the availability of funds. Accordingly, the obligation was

expected to be repaid over the subsequent 24-month period. However, the Commencement Date was determined to be the pricing date of the

IPO (February 27, 2023) under which the liability in nominal amount of NIS 1,710 thousand (approximately $462) will be paid in 18 equal

monthly installments of approximately $26 each.

BEAMR IMAGING LTD.

NOTES TO CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS (Cont.)

(U.S. dollars in thousands)

NOTE 6 - RELATED PARTIES

TRANSACTIONS (Cont.)

The following tabular presentation reflects the

reconciliation of the carrying amount of the Company’s Liability to related party, net during the six month periods ended June 30,

2024 and 2023:

| |

|

Six-month period ended

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

Unaudited |

|

| |

|

|

|

|

|

|

| Opening balance |

|

$ |

199 |

|

|

$ |

388 |

|

| Accrued liability in respect to additional services rendered |

|

|

- |

|

|

|

25 |

|

| Repayment of liability to controlling shareholder |

|

|

(154 |

) |

|

|

(104 |

) |

| Change in estimation of maturity date of liability to controlling shareholder |

|

|

- |

|

|

|

12 |

|

| Amortization of discount relating to liability to controlling shareholder |

|

|

10 |

|

|

|

28 |

|

| Exchange rate differences |

|

|

(5 |

) |

|

|

(21 |

) |

| Closing balance |

|

$ |

50 |

|

|

$ |

328 |

|

Maturity dates:

| | |

As of

June 30, | | |

As of

December 31, | |

| | |

2024 | | |

2023 | |

| | |

Unaudited | | |

| |

| | |

| | |

| |

| First year (current maturities) | |

$ | 50 | | |

$ | 278 | |

| Second year | |

| - | | |

| 50 | |

| Closing balance | |

$ | 50 | | |

$ | 328 | |

The Company

allocated the expenses related to the above service agreement and addendum as follows:

| |

|

Six-month period ended

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

Unaudited |

|

| |

|

|

|

|

|

|

| Research and development |

|

$ |

24 |

|

|

$ |

18 |

|

| Sales and marketing |

|

|

24 |

|

|

|

18 |

|

| General and administrative |

|

|

48 |

|

|

|

38 |

|

| |

|

$ |

96 |

|

|

$ |

74 |

|

The allocation

was done based on the management estimation to reflect the contribution to the related activity.

NOTE 7 - SUBSEQUENT EVENTS

The Company evaluated subsequent

events and transactions that occurred after the balance sheet date up to the date that the condensed interim consolidated financial statements

were available to be issued. Based upon this review, the Company did not identify any other significant subsequent events that would have

required adjustment or disclosure in the financial statements, except as disclosed below.

On July 23, 2024,

the Company’s Board of Directors approved a grant of options to purchase 315,200 Ordinary Shares to one officer and two employees. Each

option is eligible for exercise into one Ordinary Share at an exercise price of $4.96 per share with a vesting schedule of four years.

false

--12-31

Q2

2024-06-30

0001899005

0001899005

2024-01-01

2024-06-30

0001899005

2024-06-30

0001899005

2023-12-31

0001899005

2023-01-01

2023-06-30

0001899005

us-gaap:CommonStockMember

2022-12-31

0001899005

bmr:ConvertibleOrdinary1And2SharesMember

2022-12-31

0001899005

us-gaap:PreferredStockMember

2022-12-31

0001899005

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001899005

us-gaap:RetainedEarningsMember

2022-12-31

0001899005

2022-12-31

0001899005

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001899005

bmr:ConvertibleOrdinary1And2SharesMember

2023-01-01

2023-06-30

0001899005

us-gaap:PreferredStockMember

2023-01-01

2023-06-30

0001899005

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001899005

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001899005

us-gaap:CommonStockMember

2023-06-30

0001899005

bmr:ConvertibleOrdinary1And2SharesMember

2023-06-30

0001899005

us-gaap:PreferredStockMember

2023-06-30

0001899005

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001899005

us-gaap:RetainedEarningsMember

2023-06-30

0001899005

2023-06-30

0001899005

us-gaap:CommonStockMember

2023-12-31

0001899005

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001899005

us-gaap:RetainedEarningsMember

2023-12-31

0001899005

us-gaap:CommonStockMember

2024-01-01

2024-06-30

0001899005

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-06-30

0001899005

us-gaap:RetainedEarningsMember

2024-01-01

2024-06-30

0001899005

us-gaap:CommonStockMember

2024-06-30

0001899005

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001899005

us-gaap:RetainedEarningsMember

2024-06-30

0001899005

2023-01-01

2023-12-31

0001899005

2024-03-19

0001899005

us-gaap:StockOptionMember

2024-01-01

2024-06-30

0001899005

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001899005

us-gaap:IPOMember

2024-02-12

2024-02-12

0001899005

us-gaap:IPOMember

2024-02-12

0001899005

us-gaap:WarrantMember

2024-02-12

0001899005

2024-02-12

0001899005

2024-02-12

2024-02-12

0001899005

2024-02-13

2024-02-13

0001899005

us-gaap:IPOMember

2024-01-01

2024-06-30

0001899005

us-gaap:IPOMember

2024-06-30

0001899005

bmr:IBIMember

2024-02-22

2024-02-22

0001899005

bmr:IBIMember

2024-02-22

0001899005

bmr:IBIMember

2024-01-01

2024-06-30

0001899005

bmr:OrdinarySharesMember

2024-05-22

0001899005

srt:BoardOfDirectorsChairmanMember

2023-12-31

0001899005

srt:BoardOfDirectorsChairmanMember

2024-01-01

2024-06-30

0001899005

srt:BoardOfDirectorsChairmanMember

2024-06-30

0001899005

srt:BoardOfDirectorsChairmanMember

2022-12-31

0001899005

srt:BoardOfDirectorsChairmanMember

2023-01-01

2023-06-30

0001899005

srt:BoardOfDirectorsChairmanMember

2023-06-30

0001899005

bmr:ExercisePrice0000Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice0000Member

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice0000Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice0000Member

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice0000Member

2024-01-01

2024-06-30

0001899005

bmr:ExercisePrice114Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice114Member

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice114Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice114Member

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice114Member

2024-01-01

2024-06-30

0001899005

bmr:ExercisePrice147Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice147Member

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice147Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice147Member

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice147Member

2024-01-01

2024-06-30

0001899005

bmr:ExercisePrice148Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice148Member

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice148Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice148Member

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice148Member

2024-01-01

2024-06-30

0001899005

bmr:ExercisePrice174Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice174Member

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice174Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice174Member

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice174Member

2024-01-01

2024-06-30

0001899005

bmr:ExercisePrice183Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice183Member

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice183Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice183Member

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice183Member

2024-01-01

2024-06-30

0001899005

bmr:ExercisePrice279Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice279Member

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice279Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice279Member

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice279Member

2024-01-01

2024-06-30

0001899005

bmr:ExercisePrice320Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice320Member

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice320Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice320Member

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice320Member

2024-01-01

2024-06-30

0001899005

bmr:ExercisePrice400Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice400Member

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice400Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice400Member

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice400Member

2024-01-01

2024-06-30

0001899005

bmr:ExercisePrice417Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice417Member

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice417Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice417Member

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice417Member

2024-01-01

2024-06-30

0001899005

bmr:ExercisePrice502Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice502Member

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice502Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice502Member

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice502Member

2024-01-01

2024-06-30

0001899005

bmr:ExercisePrice512Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice512Member

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

bmr:ExercisePrice512Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice512Member

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

bmr:ExercisePrice512Member

2024-01-01

2024-06-30

0001899005

bmr:ShareOptionsOutstandingMember

2024-06-30

0001899005

bmr:ShareOptionsExercisableMember

2024-06-30

0001899005

srt:MinimumMember

2024-01-01

2024-06-30

0001899005

srt:MaximumMember

2024-01-01

2024-06-30

0001899005

srt:MinimumMember

2023-01-01

2023-06-30

0001899005

srt:MaximumMember

2023-01-01

2023-06-30

0001899005

srt:MinimumMember

2024-06-30

0001899005

srt:MaximumMember

2024-06-30

0001899005

srt:MinimumMember

2023-06-30

0001899005

srt:MaximumMember