false

0001854583

0001854583

2024-02-02

2024-02-02

0001854583

CAUD:CommonStockParValue0.0001PerShareMember

2024-02-02

2024-02-02

0001854583

CAUD:WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember

2024-02-02

2024-02-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 8-K

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

February

2, 2024

Date

of Report (Date of earliest event reported)

COLLECTIVE

AUDIENCE, INC.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-40723 |

|

86-2861807 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

85

Broad Street 16-079

New

York, NY 10004

(Address

of Principal Executive Offices and Zip Code)

Registrant’s

telephone number, including area code:

(808) 829-1057

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| ☐ |

|

Written communications pursuant to Rule 425 under the Securities Act |

| ☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| |

|

|

|

|

| Common Stock, par value $0.0001 per share |

|

CAUD |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Warrants, each exercisable for one share of Common Stock for $11.50 per share |

|

CAUDW |

|

The Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.02

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers.

Board of Director Changes

On February 2, 2024, Joseph Zawadzki was appointed to the Board

of Directors (the “Board”) of Collective Audience, Inc., a Delaware corporation (the “Company”), as Chairman of

the Board.

Mr. Zawadzki, 49, is an

experienced entrepreneur, private company CEO, and investor in the online marketing industry. From January 2022 until present, Mr.

Zawadzki has been serving as General Partner at Aperiam Ventures. Additionally, from May 2022 until present, Mr. Zawadzki has been

serving as Executive Chairman for FxM, a FinTech for Media Company. Previously, Mr. Zawadzki founded and served as Chief Executive

Officer and Chairman at MediaMath from 2007 until 2022. He is a respected pioneer in the online marketing industry, known especially

for establishing the demand-side platform sector. He holds several patents in the area of online methods for dynamic segmentation

and content presentation. Mr. Zawadzki holds a Bachelor’s degree in English from Harvard University. Mr. Zawadzki will

participate in the Company’s non-employee director compensation arrangements generally applicable to all of the

Company’s non-employee directors.

Mr. Zawadzki is not related

to any of the Company’s executive officers or directors. There are no arrangements or understandings between Mr. Zawadzki

and any other person in the Company pursuant to which Mr. Zawadzki was selected as a director of the Board. Mr. Zawadzki is not a participant

in, nor is he to be a participant in, any related-person transaction or proposed related-person transaction required to be disclosed by

Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

In connection with Mr. Zawadzki’s appointment, the Company

accepted the resignation of Brent Suen as a member of the Board on February 2, 2024.

Officer Changes

Additionally, on February 2, 2024, Robb Billy, the Company’s

current Chief Financial Officer, submitted his resignation to the Board effective immediately. Concurrently therewith, the Company’s

current Chief Operating Officer, Chris Andrews, was appointed as Interim Chief Financial Officer for the Company. Mr. Andrews will retain

his Chief Operating Officer role as well.

Neither Mr. Suen’s nor Mr. Billy’s resignations were

a result of any disagreements with the Company, or its management, on any matter relating to the Company’s operations, policies

or practices.

Item 7.01

Regulation FD Disclosure

On February 8, 2024, the Company issued a press release announcing

Mr. Zawadzki’s appointment as Chairman of the Board. A copy of that press release is furnished as Exhibit 99.1 hereto and incorporated

herein by reference.

Exhibit 99.1 contains forward-looking statements. These forward-looking

statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Forward-looking

statements are based upon assumptions as to future events that may not prove to be accurate. Actual outcomes and results may differ materially

from what is expressed in these forward-looking statements.

The information set forth under Item 7.01 of this Current Report,

including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18

of the Exchange Act, or otherwise subject to the liabilities of such section. The information in Item 7.01 of this Current Report, including

Exhibit 99.1, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act,

regardless of any incorporation by reference language in any such filing, except as expressly set forth by specific reference in such

a filing. This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is

required to be disclosed solely by Regulation FD.

Item 9.01. Financial Statements and Exhibits.

The following exhibits are filed herewith:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

COLLECTIVE AUDIENCE, INC. |

| Dated: February 8, 2024 |

|

| |

|

| |

By: |

/s/ Peter Bordes |

| |

|

|

| |

Name: |

Peter Bordes |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

Collective Audience Appoints AdTech Executive,

Inventor and Venture Investor, Joe Zawadzki, as Chairman

New York, NY, February 8, 2024 – Collective Audience, Inc. (Nasdaq: CAUD), a leading innovator of audience-based performance

advertising and media, has appointed industry veteran, Joe Zawadzki, as chairman of its board of directors.

Joe Zawadzki joins Collective Audience Board of Directors as Chairman |

Zawadzki is a highly accomplished entrepreneur,

operator, and venture investor with more than 25 years of leadership experience across digital advertising and media, technology, corporate

governance, M&A and finance.

“Joe is recognized as a founding father and pioneer across many

facets of the digital advertising industry,” stated Collective Audience CEO, Peter Bordes. “He has played a crucial role in

shaping the evolution of the industry, inventing the demand-side platform category with MediaMath, and now spearheading the reinvention

of the media supply chain ‘financial backbone’ with FxM.”

|

Zawadzki commented: “It is an incredible time of opportunity

for the advertising industry. With every company a marketer, and increasingly media companies themselves, advertising has become the underlying

engine of the global economy. The opportunities of tomorrow are bigger than any single company can tackle on its own. Our belief is that

Collective Audience can simplify a complicated ecosystem and scale needed innovation across it. Through strategic acquisitions and corporate

partnerships plus an extended network of talent, the collective can be greater than the sum of the parts. I am excited to be part of this,

and excited to bring others to the cause.”

Bordes added: “As a newly traded Nasdaq company, Joe’s

appointment as chairman demonstrates our commitment to infusing our senior management and governance teams with the best and brightest

leadership the industry has to offer. Joe strengthens the foundation of our board, helping us foster a culture of transparency, accountability,

and strategic decision-making for the benefit of our collective stakeholders.”

Since the company’s recently completed merger and rebranding

as Collective Audience, it has turned its focus on the rapidly expanding global AdTech market that, according to a report by Allied Market

Research, is projected to grow at a CAGR of 14.7% reaching $2.9 trillion by 2031.

Joe Zawadzki Bio

Joe Zawadzki currently serves as general partner at Aperiam, a venture

capital and advisory firm focused on the digital transformation of marketing and media. Aperiam’s investment approach spans the

full lifecycle, from incubation to growth, with portfolio companies including ID5, TVision Insights, tvScientific, Kevel, Rembrand, and

Transmit.live.

He also serves as chairman of FxM, a fintech startup that is revolutionizing

how media companies drive financial efficiency through their digital media supply chain, accelerating payment to suppliers, and addressing

the hidden estimated 20% “ad financing tax” that drives up costs across the media ecosystem.

Zawadzki other board memberships include serving on the board of directors

of MINT, the global leader in Advertising Resource Management (ARM), and on the boards of the MMA and Interactive Advertising Bureau (IAB).

He previously served on the board of the Digital & Marketing Association now a part of the Association of National Advertisers (ANA).

Zawadzki founded and served as chairman and CEO of MediaMath, the first

demand-side platform that launched the programmatic/addressable era of digital marketing. Prior to MediaMath, he founded and served as

chairman and president of [x+1] / Poindexter Systems, where he helped pioneer its digital marketing technology + data science platform

supporting Fortune 2000 brands and agencies.

As an angel investor, Zawadzki has invested in more than 70 companies,

including MOAT, IAS, Appnexus, Accordant, Beeswax, Credit Karma, Dataminr and mParticle, with a cumulative exit value of more than $10

billion.

He holds an A.B. in English from Harvard University, and served as

a teaching fellow at Harvard in cosmology, set theory and the history of science.

About Collective Audience

Collective

Audience provides an innovative audience-based performance advertising and media platform for brands, agencies and publishers. The company

has introduced a new open, interconnected, data driven, digital advertising and media ecosystem that will uniquely eliminate many inefficiencies

in the digital ad buyer and seller process for brands, agencies and publishers. It will deliver long sought-after visibility, complementary

technology, and unique audience data that drives focus on performance, brand reach, traffic and transactions.

For the AdTech providers and media buyers

who come onto Collective Audience’s platform, they will be able to leverage audience data as a new asset class, powered by AI as

an intelligence layer to guide decision making.

To learn more, visit collectiveaudience.co.

Important Cautions Regarding Forward-Looking Statements

This press release includes certain statements that are not historical

facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation

Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,”

“estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,”

“would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,”

“outlook” and similar expressions that predict or indicate future events or trends or that are not statements of historical

matters. All statements, other than statements of present or historical fact included in this press release, regarding the company’s

future financial performance, as well as the company’s strategy, future operations, estimated financial position, estimated revenues

and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. These statements are based

on various assumptions, whether or not identified in this press release, and on the current expectations of the management of Collective

Audience and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and

are not intended to serve as, and must not be relied on as, a guarantee, an assurance, a prediction or a definitive statement of fact

or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events

and circumstances are beyond the control of Collective Audience. Potential risks and uncertainties that could cause the actual results

to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, changes in domestic

and foreign business, market, financial, political and legal conditions; unanticipated conditions that could adversely affect the company;

the overall level of consumer demand for Collective Audience’s products/services; general economic conditions and other factors

affecting consumer confidence, preferences, and behavior; disruption and volatility in the global currency, capital, and credit markets;

the financial strength of Collective Audience’s customers; Collective Audience’s ability to implement its business strategy;

changes in governmental regulation, Collective Audience’s exposure to litigation claims and other loss contingencies; disruptions

and other impacts to Collective Audience’s business, as a result of the COVID-19 pandemic and government actions and restrictive

measures implemented in response; stability of Collective Audience’s suppliers, as well as consumer demand for its products, in

light of disease epidemics and health-related concerns such as the COVID-19 pandemic; the impact that global climate change trends may

have on Collective Audience and its suppliers and customers; Collective Audience’s ability to protect patents, trademarks and other

intellectual property rights; any breaches of, or interruptions in, Collective Audience’s information systems; changes in tax laws

and liabilities, legal, regulatory, political and economic risks. More information on potential factors that could affect Collective Audience’s

financial results is included from time to time in Collective Audience’s public reports filed with the SEC. If any of these risks

materialize or Collective Audience’s assumptions prove incorrect, actual results could differ materially from the results implied

by these forward-looking statements. There may be additional risks that Collective Audience presently knows, or that Collective Audience

currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements.

In addition, forward-looking statements reflect Collective Audience’s expectations, plans or forecasts of future events and views

as of the date of this press release. Nothing in this press release should be regarded as a representation by any person that the forward-looking

statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved.

Collective Audience anticipates that subsequent events and developments will cause their assessments to change. However, while Collective

Audience may elect to update these forward-looking statements at some point in the future, Collective Audience specifically disclaims

any obligation to do so, except as required by law. These forward-looking statements should not be relied upon as representing Collective

Audience’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed

upon the forward-looking statements.

Company Contact:

Peter Bordes, CEO

Collective Audience, Inc.

Email contact

Investor Contact:

Ron Both or Grant Stude

CMA Investor Relations

Tel (949) 432-7566

Email contact

Media Contact:

Tim Randall

CMA Media Relations

Tel (949) 432-7572

Email contact

3

v3.24.0.1

Cover

|

Feb. 02, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 02, 2024

|

| Entity File Number |

001-40723

|

| Entity Registrant Name |

COLLECTIVE

AUDIENCE, INC.

|

| Entity Central Index Key |

0001854583

|

| Entity Tax Identification Number |

86-2861807

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

85

Broad Street 16-079

|

| Entity Address, City or Town |

New

York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10004

|

| City Area Code |

808

|

| Local Phone Number |

829-1057

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

CAUD

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for one share of Common Stock for $11.50 per share |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of Common Stock for $11.50 per share

|

| Trading Symbol |

CAUDW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CAUD_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CAUD_WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

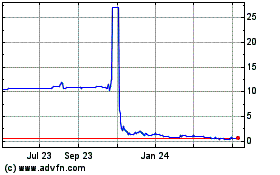

Collective Audience (NASDAQ:CAUD)

Historical Stock Chart

From Nov 2024 to Dec 2024

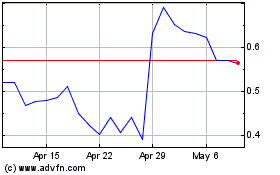

Collective Audience (NASDAQ:CAUD)

Historical Stock Chart

From Dec 2023 to Dec 2024