Big Bitcoin Exchange Ends Bid to Lure High-Speed Traders

24 April 2019 - 5:55AM

Dow Jones News

By Alexander Osipovich

Cryptocurrency exchange Coinbase Inc. is ending an ambitious

effort to win over high-frequency traders, the latest sign that

bitcoin companies are having trouble attracting mainstream

financial players.

As part of the move, Coinbase laid off about 30 people in its

Chicago office who had been working to improve the company's

technology to cater to speedy traders, Coinbase President and Chief

Operating Officer Asiff Hirji said in an interview. The employees

had been hired from local firms like futures exchange giant CME

Group Inc. and high-speed trader Jump Trading LLC, he said.

High-frequency trading, or HFT, firms play a huge -- if

controversial -- role in U.S. stock and futures markets. By some

estimates, they account for around half the daily volume in U.S.

equities. But they are often regarded with suspicion by more

traditional investors, who fear that HFT firms eat into their

profits by zipping in and out of stocks while slower-moving players

execute trades.

Last year, Coinbase unveiled an effort to draw ultrafast traders

by carrying out tech upgrades, including speeding up its matching

engine, the system that brings together buy and sell orders.

Greater HFT activity at Coinbase would have boosted trading

volumes and revenues at the San Francisco-based company, which runs

one of the biggest U.S. crypto exchanges and offers a popular

"wallet" service that lets individual investors hold bitcoin.

Mr. Hirji said Coinbase is focused on a growing business with

financial institutions like hedge funds, endowments and family

offices, rather than serving high-speed traders.

He added that a San Francisco-based team at Coinbase has sped up

the firm's matching engine by a factor of 20 compared with late

2017, when an influx of investor interest in bitcoin caused

slowdowns and glitches at many crypto exchanges.

Mr. Hirji said Coinbase still plans to eventually offer

co-location, a practice in which trading firms place their servers

directly in the data center of an exchange.

Coinbase had more than 600 employees as of late 2018, and it

continues to expand head count despite the Chicago layoffs,

according to a spokesman.

Bitcoin was trading at about $5,590 on Tuesday afternoon, down

from its peak of nearly $20,000 in December 2017.

Write to Alexander Osipovich at

alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

April 23, 2019 15:40 ET (19:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

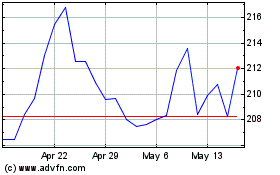

CME (NASDAQ:CME)

Historical Stock Chart

From Aug 2024 to Sep 2024

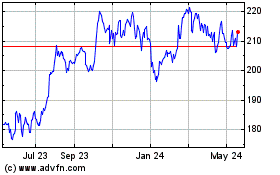

CME (NASDAQ:CME)

Historical Stock Chart

From Sep 2023 to Sep 2024