Capital Southwest Corporation Announces Offering of Notes

07 June 2023 - 10:43PM

Capital Southwest Corporation (“Capital Southwest”) (Nasdaq: CSWC)

(rated Baa3, Stable Outlook by Moody’s) announced the commencement

of a registered public offering of unsecured notes due 2028 (the

“Notes”). The Notes are expected to be listed on the Nasdaq Global

Select Market under the trading symbol “CSWCZ” within 30 days of

issuance.

Capital Southwest intends to use the net

proceeds from this offering to repay a portion of the outstanding

indebtedness under its senior secured revolving credit

facility.

Oppenheimer & Co. Inc., B. Riley Securities,

Inc., Janney Montgomery Scott LLC and Ladenburg Thalmann & Co.,

Inc. are serving as joint book-running managers for this offering.

InspereX LLC, William Blair & Company L.L.C. and ING Financial

Markets LLC are acting as co-managers for this offering.

Investors should carefully consider,

among other things, Capital

Southwest’s investment objective and strategies

and the risks related to Capital

Southwest and the offering before

investing. The preliminary prospectus supplement,

dated June 7, 2023, and the accompanying prospectus, dated October

29, 2021, included therein, which have been filed with the

Securities and Exchange Commission (the “SEC”), contain this and

other information about Capital Southwest

and should be read carefully before investing.

To obtain a copy of the preliminary

prospectus supplement for this offering and the accompanying

prospectus, please contact: Oppenheimer & Co. Inc.,

Attention: Syndicate Prospectus Department, 85 Broad Street, 26th

Floor, New York, NY 10004, by telephone at

(212) 667-8055, or by email

at FixedIncomeProspectus@opco.com.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy, nor will there be

any sale of, the Notes referred to in this press release in any

state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to the registration or qualification under

the securities laws of such state or jurisdiction. The offering is

being conducted as a public offering under Capital Southwest’s

effective shelf registration filed with the SEC (File

No. 333-259455).

About Capital Southwest

Capital Southwest Corporation (Nasdaq: CSWC) is

a Dallas, Texas-based, internally managed business development

company with approximately $1.2 billion in investments at fair

value as of March 31, 2023. Capital Southwest is a middle market

lending firm focused on supporting the acquisition and growth of

middle market businesses with $5 million to $35

million investments across the capital structure, including

first lien, second lien and non-control equity co-investments. As a

public company with a permanent capital base, Capital

Southwest has the flexibility to be creative in its financing

solutions and to invest to support the growth of its portfolio

companies over long periods of time.

Forward-Looking Statements

This press release may contain certain

forward-looking statements within the meaning of the federal

securities laws, including statements with regard to Capital

Southwest’s notes offering, the expected net proceeds from the

offering, the anticipated use of the net proceeds of the offering,

and the expected impact of this offering on Capital Southwest’s

financial results. Forward-looking statements are statements that

are not historical statements and can often be identified by words

such as “will,” “believe,” “expect” and similar expressions and

variations or negatives of these words. These statements are based

on management's current expectations, assumptions and beliefs. They

are not guarantees of future results and are subject to numerous

risks, uncertainties and assumptions that could cause actual

results to differ materially from those expressed in any

forward-looking statement. These risks include risks related to:

changes in the markets in which Capital Southwest invests; changes

in the financial, capital, and lending markets; changes in the

interest rate environment and its impact on Capital Southwest’s

business and its portfolio companies; regulatory changes; tax

treatment; Capital Southwest’s ability to operate its wholly owned

subsidiary, Capital Southwest SBIC I, LP, as a small business

investment company; an economic downturn and its impact

on the ability of Capital Southwest’s portfolio companies to

operate and the investment opportunities available to it; the

impact of supply chain constraints and labor shortages on Capital

Southwest’s portfolio companies; and the elevated levels of

inflation and its impact on Capital Southwest’s portfolio companies

and the industries in which it invests. Readers should not

place undue reliance on any forward-looking statements and are

encouraged to review the preliminary prospectus supplement, the

accompanying prospectus and Capital Southwest’s other SEC filings

for a more complete discussion of the risks and other factors that

could affect any forward-looking statements. Except as required by

the federal securities laws, Capital Southwest does not undertake

any obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events,

changing circumstances or any other reason after the date of this

press release.

Investor Relations Contact:

Michael S. Sarner, Chief Financial Officer214-884-3829

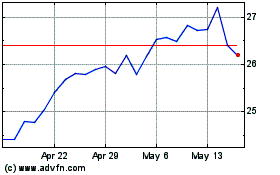

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Nov 2024 to Dec 2024

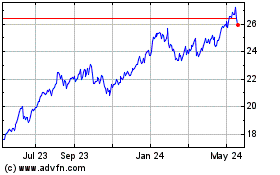

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Dec 2023 to Dec 2024