Smart Share Global Limited Receives Approval to Transfer to Nasdaq Capital Market and Extension of Minimum Bid Price Compliance Period

21 December 2023 - 10:00PM

Smart Share Global Limited (“Energy Monster” or the “Company”), a

consumer tech company providing mobile device charging service,

today announced that on December 20, 2023, the Listing

Qualifications department of the Nasdaq Stock Market LLC (“Nasdaq”)

approved the Company’s request to transfer the listing of the

Company’s American depositary shares, each representing two Class A

ordinary shares of the Company (the “ADSs”), from the Nasdaq Global

Select Market to the Nasdaq Capital Market. The transfer is

expected to take effect at the opening of business on December 22,

2023. The transfer of the Company’s listing to the Nasdaq Capital

Market is not expected to have any impact on trading in the

Company’s ADSs. The Company’s ADSs will continue to trade

uninterruptedly under the symbol “EM.” The Nasdaq Capital Market

operates in substantially the same manner as the Nasdaq Global

Select Market, and companies on the Nasdaq Capital Market must meet

certain financial and corporate governance requirements to qualify

for continued listing.

As previously disclosed, on June 22, 2023, the

Company received a letter from Nasdaq indicating that the Company

was not in compliance with Nasdaq Listing Rule 5450(a)(1), as the

closing bid price of the ADSs had been below US$1.00 per ADS for

the previous 30 consecutive business days. The Company was given a

period of 180 calendar days, or until December 19, 2023, to regain

compliance with the minimum bid price requirement. In response, the

Company submitted an application to transfer the listing of its

ADSs from the Nasdaq Global Select Market to the Nasdaq Capital

Market.

In connection with the transfer to the Nasdaq

Capital Market, Nasdaq granted the Company a second period of 180

calendar days, or until June 17, 2024, to regain compliance with

the minimum bid price requirement for continued listing. To regain

compliance, the closing bid price of the Company’s ADSs must meet

or exceed US$1.00 per ADS for a minimum of 10 consecutive business

days on or prior to June 17, 2024. Nasdaq’s determination to grant

the additional 180-day compliance period was in part based on the

Company meeting the continued listing requirements of the Nasdaq

Capital Market with the exception of the bid price requirement, and

the Company having provided written notice of its intention to cure

the deficiency during the additional compliance period, including

effecting a reverse stock split or a change of the ratio of its

ADSs to its Class A ordinary shares if necessary.

The Company intends to continue to actively

monitor the bid price of its ADSs and, as appropriate, will

consider available options to regain compliance with the minimum

bid price requirement.

About Smart Share Global

Limited

Smart Share Global Limited (Nasdaq: EM), or

Energy Monster, is a consumer tech company with the mission to

energize everyday life. The Company is the largest provider of

mobile device charging service in China with the number one market

share. The Company provides mobile device charging service through

its power banks, which are placed in POIs such as entertainment

venues, restaurants, shopping centers, hotels, transportation hubs

and public spaces. Users may access the service by scanning the QR

codes on Energy Monster’s cabinets to release the power banks. As

of September 30, 2023, the Company had 8.7 million power banks in

1,189,000 POIs across more than 2,000 counties and county-level

districts in China.

Contact Us

Investor RelationsHansen Shiir@enmonster.com

Safe Harbor Statement

This press release contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. In some cases, forward-looking statements can be identified

by words or phrases such as “may,” “will,” “expect,” “anticipate,”

“target,” “aim,” “estimate,” “intend,” “plan,” “believe,”

“potential,” “continue,” “is/are likely to,” or other similar

expressions. The Company may also make written or oral

forward-looking statements in its reports filed with, or furnished

to, the U.S. Securities and Exchange Commission (“SEC”), in its

annual reports to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical

facts, including statements about the Company’s beliefs and

expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties, and a number

of factors could cause actual results to differ materially from

those contained in any forward-looking statement, including but not

limited to the following: Energy Monster’s strategies; its future

business development, financial condition and results of

operations; the impact of technological advancements on the pricing

of and demand for its services; competition in the mobile device

charging service industry; Chinese governmental policies and

regulations affecting the mobile device charging service industry;

changes in its revenues, costs or expenditures; the risk that

COVID-19 or other health risks in China or globally could adversely

affect its operations or financial results; general economic and

business conditions globally and in China and assumptions

underlying or related to any of the foregoing. Further information

regarding these and other risks, uncertainties or factors is

included in the Company’s filings with the SEC. All information

provided in this press release is as of the date of this press

release, and the Company does not undertake any duty to update such

information, except as required under applicable law.

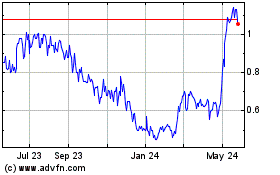

Smart Share Global (NASDAQ:EM)

Historical Stock Chart

From Nov 2024 to Dec 2024

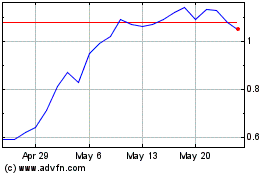

Smart Share Global (NASDAQ:EM)

Historical Stock Chart

From Dec 2023 to Dec 2024