Diamondback Stockholders,

This letter is meant to be a supplement to our

earnings release and is being furnished to the Securities and

Exchange Commission (SEC) and released to our stockholders

simultaneously with our earnings release. Please see the

information regarding forward-looking statements and non-GAAP

financial information included at the end of this letter.

The first quarter of 2024 was a great start of

the year for Diamondback. The Company continues to execute with

production and capital expenditures meeting expectations.

Additionally, we generated $1.3 billion of net cash provided

by operating activities and nearly $800 million in Free Cash Flow

with 50% of that Cash Flow returned to our stockholders through a

combination of our base dividend, variable dividend and share

buybacks.

Last week, our stockholders voted to approve our

transformational combination with Endeavor Energy Resources, L.P.

(“Endeavor”), creating the “must-own” North American independent

oil company. As a reminder, the combined business will have an

unmatched depth of high-quality inventory in the core of the

Midland Basin, which, when combined with Diamondback’s cost

structure, is set to generate significant long-term Free Cash Flow

accretion to our stockholders.

On April 29, 2024, we received a second request

for information and documents from the Federal Trade Commission.

This second request was factored into our previously announced

closing timeline. We still expect the Endeavor transaction to close

in the fourth quarter of this year and will provide more

information when possible.

Production:First quarter oil

production of 273.3 MBO/d was at the high end of our quarterly

guidance range of 270 - 274 MBO/d. Looking ahead to the second

quarter, we expect our oil production to stay relatively flat, with

guidance of 271 – 275 MBO/d. We continue to target a capital

program designed to maintain fourth quarter 2023 oil production

levels. By focusing on capital efficiency and increasing our Free

Cash Flow, we feel we are executing a plan that creates the most

value for our stockholders in the current macro environment.

On the pricing side, oil realizations stayed

relatively flat quarter over quarter at 98% of West Texas

Intermediate ("WTI") pricing. We expect to realize at least 95% of

WTI when WTI is at least $65 per barrel, with most quarters (like

the first quarter) above that number.

NGL realizations increased quarter over quarter,

while natural gas realizations decreased quarter over quarter due

to lower pricing, particularly as WAHA basis pricing declined

significantly. We have the majority of our basis exposure hedged

protecting this very small portion of our cash flow stream. More

importantly, we have not experienced any gas takeaway issues and

are confident that our product will continue to move to market.

About a third of our gas production exits the basin on our pipeline

space, and we will continue to find ways to increase this

percentage as our contracts allow. We will also do our part to try

and help new gas pipeline projects reach FID as more takeaway is

needed out of the basin.

Capital Expenditures:Cash capex

for the first quarter was $609 million and near the high end of our

quarterly guidance range, but down 6% quarter over quarter. In the

first quarter we drilled 69 wells in the Midland Basin with an

average lateral length of over 13,000 feet per well drilled, an 11%

increase quarter over quarter and our longest quarterly average to

date. This contributed to improved capital efficiency on the

drilling side, where our costs were down approximately 10% per

foot. In addition to the benefits we are seeing by drilling longer

laterals, we are also seeing price reductions, with our average rig

fleet rates now down nearly 20% since the peak in the first quarter

of 2023.

We are currently utilizing four simulfrac crews,

consisting of two diesel powered fleets and two e-fleets. Our

completions team continues to push the limits of efficiency and we

are now averaging over 3,200 completed lateral feet per day. We are

seeing cost savings of approximately $10 per foot when comparing an

e-fleet to a diesel fleet and are currently powering both e-fleets

with residue gas (vs. CNG), which reduces costs further.

As we move into the second quarter, we expect

capital costs to remain flat and within a guidance range of $580 -

$620 million. We remain comfortable with our full year 2024 capex

guidance of $2.30 - $2.55 billion. As a reminder, the midpoint of

this capital guidance range is down 10% year over year due to a

combination of lower well costs and lower activity needed to

maintain fourth quarter 2023 oil production.

Operating Costs:Total cash

operating costs increased by $0.69 per BOE quarter over quarter

primarily because of an increase to production and ad valorem taxes

as well as cash G&A. Production and ad valorem taxes per BOE

were up 16% quarter over quarter but still under our full year

guidance range of ~7% of revenue. Cash G&A per BOE was up 29%

quarter over quarter primarily due to various one-time items. We

expect cash G&A to decrease throughout the year and are

comfortable maintaining our guidance range of $0.55 - $0.65 per

BOE.

Earlier this month, we successfully priced a

multi-tranche senior notes offering totaling $5.5 billion at an

average coupon rate of approximately 5.5%. The proceeds from this

offering will be used to partially fund the cash portion of the

Endeavor merger. As a result of this offering, we have increased

our full-year net interest expense guidance range to $1.65 - $1.85

per BOE.

Return of Capital:We generated

$1.3 billion of Net Cash Provided by Operating Activities

($1.4 billion after adjusting for working capital changes) and $791

million of Free Cash Flow in the first quarter. As conveyed

previously in our Endeavor merger announcement, we have reduced our

go-forward return of capital commitment to at least 50% of Free

Cash Flow from at least 75% previously. This gives us the

flexibility to allocate more Free Cash Flow to quickly pay down

debt. Therefore, we will distribute $396 million to shareholders

this quarter, including $162 million ($0.90 per share) in the form

of our base dividend.

We repurchased 279,266 shares in the first quarter

for a cost of approximately $42 million ($149.50 per share

average). Because we did not return 50% of first quarter Free Cash

Flow through the combination of our base dividend and executed

buybacks, we are paying a variable cash dividend of $192 million

($1.07 per share) to keep our stockholders whole on our return of

capital commitment. We have not repurchased any shares so far in

the second quarter.

Balance Sheet:Total debt and

net debt ended the quarter at $6.8 billion and $5.9 billion,

respectively. Net debt decreased by over $330 million quarter over

quarter due to Free Cash Flow generation and Diamondback’s

previously announced sale of Viper common stock. Pro forma for our

$5.5 billion Senior Notes offering completed earlier this month,

our total consolidated debt is approximately $12.3 billion. Our

near-term goal will be to get pro forma net debt below $10 billion,

which will be done through Free Cash Flow generation and

potentially supplemented with non-core asset sales. Our long-term

priority is to maintain a leverage ratio of approximately 0.5x at

mid-cycle oil pricing, or approximately $6 to $8 billion in net

debt. We feel we can achieve this goal within the next couple of

years solely by dedicating 50% of Free Cash Flow to debt

paydown.

Other Business:We continue to

focus on operational excellence, maintaining our industry leading

cost-structure and differentiated operational execution. We look

forward to closing the Endeavor merger, which we believe will make

us not only bigger, but better. The sound industrial logic and

accretive nature of the transaction has resonated with our

stockholder base and validates our acquire and exploit

strategy.

We are confident that the best is yet to come.

Thank you for your interest in Diamondback Energy.

Travis D. SticeChairman of the Board and Chief

Executive Officer

Investor Contact:Adam Lawlis+1

432.221.7467alawlis@diamondbackenergy.com

Forward-Looking Statements:

This letter contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Exchange Act of 1934,

as amended, which involve risks, uncertainties, and assumptions.

All statements, other than statements of historical fact, including

statements regarding the proposed business combination transaction

between Diamondback and Endeavor; future performance; business

strategy; future operations (including drilling plans and capital

plans); estimates and projections of revenues, losses, costs,

expenses, returns, cash flow, and financial position; reserve

estimates and its ability to replace or increase reserves;

anticipated benefits of strategic transactions (including

acquisitions and divestitures), including the proposed transaction;

the expected amount and timing of synergies from the proposed

transaction; the anticipated timing of the proposed transaction;

and plans and objectives of management (including plans for future

cash flow from operations and for executing environmental

strategies) are forward-looking statements. When used in this

letter, the words “aim,” “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “forecast,” “future,” “guidance,”

“intend,” “may,” “model,” “outlook,” “plan,” “positioned,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” “would,” and similar expressions (including the negative of

such terms) are intended to identify forward-looking statements,

although not all forward-looking statements contain such

identifying words. Although Diamondback believes that the

expectations and assumptions reflected in its forward-looking

statements are reasonable as and when made, they involve risks and

uncertainties that are difficult to predict and, in many cases,

beyond Diamondback’s control. Accordingly, forward-looking

statements are not guarantees of future performance and actual

outcomes could differ materially from what Diamondback has

expressed in its forward-looking statements.

Factors that could cause the outcomes to differ

materially include (but are not limited to) the following: the

completion of the proposed Endeavor transaction on anticipated

terms and timing or at all, including obtaining regulatory approval

and satisfying other conditions to the completion of the

transaction; uncertainties as to whether the proposed transaction,

if consummated, will achieve its anticipated benefits and projected

synergies within the expected time period or at all; Diamondback’s

ability to integrate Endeavor’s operations in a successful manner

and in the expected time period; the occurrence of any event,

change, or other circumstance that could give rise to the

termination of the proposed transaction; risks that the anticipated

tax treatment of the proposed transaction is not obtained;

unforeseen or unknown liabilities; unexpected future capital

expenditures; litigation relating to the proposed transaction; the

possibility that the proposed transaction may be more expensive to

complete than anticipated, including as a result of unexpected

factors or events; the effect of the pendency, or completion of the

proposed transaction on the parties’ business relationships and

business generally; risks that the proposed transaction disrupts

current plans and operations of Diamondback or Endeavor and their

respective management teams and potential difficulties in retaining

employees as a result of the proposed transaction; the risks

related to Diamondback’s financing of the proposed transaction;

potential negative effects of the pendency or completion of the

proposed transaction on the market price of Diamondback’s common

stock and/or operating results; rating agency actions and

Diamondback’s ability to access short- and long-term debt markets

on a timely and affordable basis; changes in supply and demand

levels for oil, natural gas, and natural gas liquids, and the

resulting impact on the price for those commodities; the impact of

public health crises, including epidemic or pandemic diseases and

any related company or government policies or actions; actions

taken by the members of OPEC and Russia affecting the production

and pricing of oil, as well as other domestic and global political,

economic, or diplomatic developments, including any impact of the

ongoing war in Ukraine and the Israel-Hamas war on the global

energy markets and geopolitical stability; instability in the

financial markets; concerns over a potential economic slowdown or

recession; inflationary pressures; rising interest rates and their

impact on the cost of capital; regional supply and demand factors,

including delays, curtailment delays or interruptions of

production, or governmental orders, rules or regulations that

impose production limits; federal and state legislative and

regulatory initiatives relating to hydraulic fracturing, including

the effect of existing and future laws and governmental

regulations; physical and transition risks relating to climate

change; those risks described in Item 1A of Diamondback’s Annual

Report on Form 10-K, filed with the SEC on February 22, 2024, and

those risks disclosed in its subsequent filings on Forms 10-Q and

8-K, which can be obtained free of charge on the SEC’s website at

http://www.sec.gov and Diamondback’s website at

www.diamondbackenergy.com/investors/; and those risks more fully

described in the definitive proxy statement on Schedule 14A filed

with the SEC in connection with the proposed transaction.

In light of these factors, the events

anticipated by Diamondback’s forward-looking statements may not

occur at the time anticipated or at all. Moreover, Diamondback

operates in a very competitive and rapidly changing environment and

new risks emerge from time to time. Diamondback cannot predict all

risks, nor can it assess the impact of all factors on its business

or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those anticipated by

any forward-looking statements it may make. Accordingly, you should

not place undue reliance on any forward-looking statements. All

forward-looking statements speak only as of the date of this letter

or, if earlier, as of the date they were made. Diamondback does not

intend to, and disclaims any obligation to, update or revise any

forward-looking statements unless required by applicable law.

Non-GAAP Financial Measures

This letter includes financial information not

prepared in conformity with generally accepted accounting

principles (GAAP), including free cash flow. The non-GAAP

information should be considered by the reader in addition to, but

not instead of, financial information prepared in accordance with

GAAP. A reconciliation of the differences between these non-GAAP

financial measures and the most directly comparable GAAP financial

measures can be found in Diamondback's quarterly results posted on

Diamondback's website at www.diamondbackenergy.com/investors/.

Furthermore, this letter includes or references certain

forward-looking, non-GAAP financial measures. Because Diamondback

provides these measures on a forward-looking basis, it cannot

reliably or reasonably predict certain of the necessary components

of the most directly comparable forward-looking GAAP financial

measures, such as future impairments and future changes in working

capital. Accordingly, Diamondback is unable to present a

quantitative reconciliation of such forward-looking, non-GAAP

financial measures to the respective most directly comparable

forward-looking GAAP financial measures. Diamondback believes that

these forward-looking, non-GAAP measures may be a useful tool for

the investment community in comparing Diamondback's forecasted

financial performance to the forecasted financial performance of

other companies in the industry.

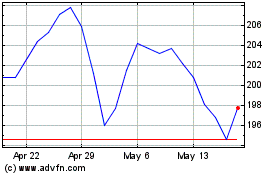

Diamondback Energy (NASDAQ:FANG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Diamondback Energy (NASDAQ:FANG)

Historical Stock Chart

From Feb 2024 to Feb 2025