The First of Long Island Corporation (Nasdaq: FLIC, the “Company”

or the “Corporation”), the parent of The First National Bank of

Long Island (the “Bank”), reported earnings for the three

and six months ended June 30, 2024.

President and Chief Executive Officer Chris

Becker commented on the Company's results: "We are encouraged by a

quarter of increase in many financial metrics, including both

deposit and loan growth during the quarter. At the end of the

first quarter of this year, I commented that we believe our margin

should be at the bottom. A one basis point increase in the

margin during the second quarter is reflective of that

guidance. Our noninterest income and noninterest expense beat

our guidance for the second straight quarter. Finally, our

credit quality results remained strong."

Analysis of Earnings - Six Months Ended

June 30, 2024

Net income and earnings per share for the six

months ended June 30, 2024, were $9.2 million and $0.41,

respectively, compared to $13.4 million and $0.59, respectively,

for the comparable period in 2023. The principal drivers of the

change in earnings were a decline in net interest income of $8.9

million, or 19.5%, and an increase in the provision for credit

losses of $1.6 million, partially offset by a loss on sales of

securities of $3.5 million in the first quarter of 2023 and

decreases in noninterest expense of $1.0 million and income tax

expense of $1.4 million. The six months ended 2024 produced a

return on average assets of 0.44%, return on average equity of

4.93%, net interest margin of 1.80%, and an efficiency ratio of

75.00%.

Net interest income declined when comparing the

six months of 2024 and 2023 due to an increase in interest expense

of $18.8 million that was only partially offset by a $9.9 million

increase in interest income. The cost of interest-bearing

liabilities increased 128 basis points while the yield on

interest-earning assets increased 45 basis points when comparing

the six-month periods. The Bank's balance sheet remains liability

sensitive but the pace of repricing of average interest earning

assets is beginning to match the pace of repricing of average

interest-bearing liabilities, which stabilized the net interest

margin over the first half of 2024.

The Bank recorded a provision for credit losses

of $570,000 for the six months ended 2024, compared to a provision

reversal of $1.1 million in the same period of 2023. The decline in

the reserve was driven largely by declines in historical loss rates

and specific reserves, partially offset by a deterioration in

current and forecasted economic conditions, including adjustments

for rent stabilization status of multifamily properties. The

reserve coverage ratio remained stable at 0.88% of total loans at

June 30, 2024 as compared to 0.88% at March 31, 2024 and 0.89% at

December 31, 2023. Past due loans and nonaccrual loans were at

$942,000 and $2.4 million, respectively, on June 30, 2024. Overall

credit quality of the loan and investment portfolios remain

strong.

Noninterest income, excluding the loss on sales

of securities in the 2023 period, increased $454,000, or 8.8%, when

comparing the first six months of 2024 and 2023. Recurring

components of noninterest income including bank-owned life

insurance (“BOLI”) and service charges on deposit accounts had

increases of 7.8% and 10.5%, respectively. Other noninterest income

increased 8.2% and included increases of $287,000 in merchant card

services and $121,000 in pension income, which were partially

offset by a gain on disposition of premises and fixed assets of

$240,000 in 2023.

Noninterest expense declined $1.0 million, or

3.1%, for the six months of 2024, as compared to the same period in

2023. Reductions in occupancy and equipment expense of $397,000,

telecommunication expense of $285,000, professional fees of

$268,000 and salaries and employee benefits of $145,000 drove the

decline. The decrease in occupancy and equipment expense was

largely due to the ongoing branch optimization strategy, which

resulted in the closing of various locations. Telecom expense

decreased mainly due to efficiencies associated with system

upgrades. Salaries and employee benefits declined largely due to a

decrease in incentives compensation expense.

Income tax expense decreased $1.4 million, and

the effective tax rate declined to 3.9% for the six months ended

2024 as compared to 11.6% for the same period in prior year. The

decline in the effective tax rate is mainly due to an increase in

the percentage of pre-tax income derived from the Bank’s real

estate investment trust and BOLI. The decrease in income tax

expense reflects the lower effective tax rate and a decline in

pre-tax income.

Analysis of Earnings –

Second Quarter 2024 Versus Second Quarter

2023

Net income for the second quarter of 2024

decreased $2.1 million as compared to the second quarter of last

year. The decrease is mainly attributable to a $3.4 million

decline in net interest income for substantially the same reasons

discussed above with respect to the six-month periods along with a

$570,000 increase in the provision for credit losses.

Partially offsetting the decrease in net interest income was

reductions in salaries and employee benefits and occupancy and

equipment expense of $354,000 and $286,000, respectively, for

substantially the same reasons previously discussed. The

quarter produced a return on average assets of 0.45%, return on

average equity of 5.15%, net interest margin of 1.80%, and an

efficiency ratio of 73.55%.

Analysis of Earnings –

Second Quarter 2024 Versus First Quarter 2024

Net income for the second quarter of 2024

increased $363,000 compared to the first quarter of 2024. The

increase was partially due to an increase in net interest income of

$270,000, primarily due to an increase in interest income on loans

and taxable investment securities along with decreases in

borrowings outweighing the increase in interest expense on savings,

NOW and money market deposits. Also contributing to the

favorable earnings over the linked quarter is a decrease in

salaries and employee benefits of $474,000 partially offset by an

increase in the provision for credit losses of $570,000. Salaries

and employee benefit expenses were lower in the second quarter of

2024 due to a decline in incentive compensation and payroll related

expenses.

The increase in the net interest margin to 1.80%

in the second quarter of 2024 from 1.79% in the first quarter of

2024 was largely due to the stabilization of our wholesale

funding cost that is essentially repriced to current market

rates. Additionally, average interest-bearing deposits increased

$73.1 million and average higher cost borrowings

decreased $52 million.

Liquidity

Total average deposits declined by $81.0

million, or 2.4%, when comparing the first halves of 2024 to 2023,

reflecting industry trends. On June 30, 2024, overnight advances

and other borrowings were down by $70.0 million and $42.5 million,

respectively, from year-end 2023. The Bank had $1.1 billion in

collateralized borrowing lines with the Federal Home Loan Bank of

New York and the Federal Reserve Bank, as well as a $20 million

unsecured line of credit with a correspondent bank. We also had

$282.5 million in unencumbered cash and securities. In total, we

had approximately $1.4 billion of available liquidity on June 30,

2024.

Capital

The Corporation’s capital position remains

strong with a leverage ratio of approximately 9.91% on June 30,

2024. Book value per share was $16.71 on June 30, 2024, versus

$16.22 on June 30, 2023. The accumulated other comprehensive loss

component of stockholders’ equity is mainly comprised of a net

unrealized loss in the available-for-sale securities portfolio due

to higher market interest rates. The Company declared its quarterly

cash dividend of $0.21 per share during the quarter. There were no

share repurchases during the quarter. The Board and management

continue to evaluate both capital management tools to provide the

best opportunity to maximize shareholder value.

Forward Looking Information

This earnings release contains various

“forward-looking statements” within the meaning of that term as set

forth in Rule 175 of the Securities Act of 1933 and Rule 3b-6 of

the Securities Exchange Act of 1934. Such statements are generally

contained in sentences including the words “may” or “expect” or

“could” or “should” or “would” or “believe” or “anticipate”. The

Corporation cautions that these forward-looking statements are

subject to numerous assumptions, risks and uncertainties that could

cause actual results to differ materially from those contemplated

by the forward-looking statements. Factors that could cause future

results to vary from current management expectations include, but

are not limited to, changing economic conditions; legislative and

regulatory changes; monetary and fiscal policies of the federal

government; changes in interest rates; deposit flows and the cost

of funds; demand for loan products; competition; changes in

management’s business strategies; changes in accounting principles,

policies or guidelines; changes in real estate values; and other

factors discussed in the “risk factors” section of the

Corporation’s filings with the Securities and Exchange Commission

(“SEC”). The forward-looking statements are made as of the date of

this press release, and the Corporation assumes no obligation to

update the forward-looking statements or to update the reasons why

actual results could differ from those projected in the

forward-looking statements.

For more detailed financial information please

see the Corporation’s quarterly report on Form 10-Q for the quarter

ended June 30, 2024. The Form 10-Q will be available through

the Bank’s website at www.fnbli.com on or about August 1, 2024,

when it is anticipated to be electronically filed with the SEC. Our

SEC filings are also available on the SEC’s website at

www.sec.gov.

| |

|

CONSOLIDATED BALANCE

SHEETS(Unaudited) |

| |

| |

|

6/30/2024 |

|

|

12/31/2023 |

|

| |

|

(dollars in thousands) |

|

|

Assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

67,289 |

|

|

$ |

60,887 |

|

|

Investment securities available-for-sale, at fair value |

|

|

657,989 |

|

|

|

695,877 |

|

| |

|

|

|

|

|

|

|

|

|

Loans: |

|

|

|

|

|

|

|

|

|

Commercial and industrial |

|

|

150,587 |

|

|

|

116,163 |

|

|

Secured by real estate: |

|

|

|

|

|

|

|

|

|

Commercial mortgages |

|

|

1,936,691 |

|

|

|

1,919,714 |

|

|

Residential mortgages |

|

|

1,122,866 |

|

|

|

1,166,887 |

|

|

Home equity lines |

|

|

39,665 |

|

|

|

44,070 |

|

|

Consumer and other |

|

|

1,330 |

|

|

|

1,230 |

|

| |

|

|

3,251,139 |

|

|

|

3,248,064 |

|

|

Allowance for credit losses |

|

|

(28,484 |

) |

|

|

(28,992 |

) |

| |

|

|

3,222,655 |

|

|

|

3,219,072 |

|

| |

|

|

|

|

|

|

|

|

|

Restricted stock, at cost |

|

|

27,530 |

|

|

|

32,659 |

|

|

Bank premises and equipment, net |

|

|

30,687 |

|

|

|

31,414 |

|

|

Right-of-use asset - operating leases |

|

|

21,270 |

|

|

|

22,588 |

|

|

Bank-owned life insurance |

|

|

115,317 |

|

|

|

114,045 |

|

|

Pension plan assets, net |

|

|

10,527 |

|

|

|

10,740 |

|

|

Deferred income tax benefit |

|

|

31,628 |

|

|

|

28,996 |

|

|

Other assets |

|

|

24,432 |

|

|

|

19,622 |

|

| |

|

$ |

4,209,324 |

|

|

$ |

4,235,900 |

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

Checking |

|

$ |

1,123,244 |

|

|

$ |

1,133,184 |

|

|

Savings, NOW and money market |

|

|

1,628,078 |

|

|

|

1,546,369 |

|

|

Time |

|

|

612,119 |

|

|

|

591,433 |

|

| |

|

|

3,363,441 |

|

|

|

3,270,986 |

|

| |

|

|

|

|

|

|

|

|

|

Overnight advances |

|

|

— |

|

|

|

70,000 |

|

|

Other borrowings |

|

|

430,000 |

|

|

|

472,500 |

|

|

Operating lease liability |

|

|

23,553 |

|

|

|

24,940 |

|

|

Accrued expenses and other liabilities |

|

|

16,134 |

|

|

|

17,328 |

|

| |

|

|

3,833,128 |

|

|

|

3,855,754 |

|

| Stockholders'

Equity: |

|

|

|

|

|

|

|

|

|

Common stock, par value $0.10 per share: |

|

|

|

|

|

|

|

|

|

Authorized, 80,000,000 shares; |

|

|

|

|

|

|

|

|

|

Issued and outstanding, 22,517,881 and 22,590,942 shares |

|

|

2,252 |

|

|

|

2,259 |

|

|

Surplus |

|

|

78,537 |

|

|

|

79,728 |

|

|

Retained earnings |

|

|

355,674 |

|

|

|

355,887 |

|

| |

|

|

436,463 |

|

|

|

437,874 |

|

|

Accumulated other comprehensive loss, net of tax |

|

|

(60,267 |

) |

|

|

(57,728 |

) |

| |

|

|

376,196 |

|

|

|

380,146 |

|

| |

|

$ |

4,209,324 |

|

|

$ |

4,235,900 |

|

| |

|

CONSOLIDATED STATEMENTS OF

INCOME(Unaudited) |

| |

| |

|

Six Months Ended |

|

|

Three Months Ended |

|

| |

|

6/30/2024 |

|

|

6/30/2023 |

|

|

6/30/2024 |

|

|

6/30/2023 |

|

| |

|

(dollars in thousands) |

|

|

Interest and dividend income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

$ |

67,653 |

|

|

$ |

61,888 |

|

|

$ |

34,110 |

|

|

$ |

31,483 |

|

|

Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

14,472 |

|

|

|

9,283 |

|

|

|

7,479 |

|

|

|

5,614 |

|

|

Nontaxable |

|

|

1,917 |

|

|

|

2,972 |

|

|

|

957 |

|

|

|

1,027 |

|

| |

|

|

84,042 |

|

|

|

74,143 |

|

|

|

42,546 |

|

|

|

38,124 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings, NOW and money market deposits |

|

|

21,520 |

|

|

|

13,386 |

|

|

|

11,437 |

|

|

|

7,611 |

|

|

Time deposits |

|

|

14,036 |

|

|

|

7,301 |

|

|

|

7,059 |

|

|

|

4,232 |

|

|

Overnight advances |

|

|

267 |

|

|

|

546 |

|

|

|

4 |

|

|

|

438 |

|

|

Other borrowings |

|

|

11,627 |

|

|

|

7,435 |

|

|

|

5,615 |

|

|

|

4,002 |

|

| |

|

|

47,450 |

|

|

|

28,668 |

|

|

|

24,115 |

|

|

|

16,283 |

|

|

Net interest income |

|

|

36,592 |

|

|

|

45,475 |

|

|

|

18,431 |

|

|

|

21,841 |

|

| Provision (credit) for credit

losses |

|

|

570 |

|

|

|

(1,056 |

) |

|

|

570 |

|

|

|

— |

|

|

Net interest income after provision (credit) for credit losses |

|

|

36,022 |

|

|

|

46,531 |

|

|

|

17,861 |

|

|

|

21,841 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank-owned life insurance |

|

|

1,697 |

|

|

|

1,574 |

|

|

|

857 |

|

|

|

794 |

|

|

Service charges on deposit accounts |

|

|

1,701 |

|

|

|

1,540 |

|

|

|

821 |

|

|

|

753 |

|

|

Net loss on sales of securities |

|

|

— |

|

|

|

(3,489 |

) |

|

|

— |

|

|

|

— |

|

|

Other |

|

|

2,240 |

|

|

|

2,070 |

|

|

|

1,186 |

|

|

|

1,135 |

|

| |

|

|

5,638 |

|

|

|

1,695 |

|

|

|

2,864 |

|

|

|

2,682 |

|

| Noninterest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

19,474 |

|

|

|

19,619 |

|

|

|

9,500 |

|

|

|

9,854 |

|

|

Occupancy and equipment |

|

|

6,324 |

|

|

|

6,721 |

|

|

|

3,110 |

|

|

|

3,396 |

|

|

Other |

|

|

6,257 |

|

|

|

6,748 |

|

|

|

3,239 |

|

|

|

3,267 |

|

| |

|

|

32,055 |

|

|

|

33,088 |

|

|

|

15,849 |

|

|

|

16,517 |

|

|

Income before income taxes |

|

|

9,605 |

|

|

|

15,138 |

|

|

|

4,876 |

|

|

|

8,006 |

|

| Income tax expense |

|

|

372 |

|

|

|

1,758 |

|

|

|

78 |

|

|

|

1,107 |

|

|

Net income |

|

$ |

9,233 |

|

|

$ |

13,380 |

|

|

$ |

4,798 |

|

|

$ |

6,899 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share and Per Share Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares |

|

|

22,515,464 |

|

|

|

22,522,663 |

|

|

|

22,510,359 |

|

|

|

22,551,568 |

|

|

Dilutive restricted stock units |

|

|

62,161 |

|

|

|

59,910 |

|

|

|

50,494 |

|

|

|

33,309 |

|

| |

|

|

22,577,625 |

|

|

|

22,582,573 |

|

|

|

22,560,853 |

|

|

|

22,584,877 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic EPS |

|

$ |

0.41 |

|

|

$ |

0.59 |

|

|

$ |

0.21 |

|

|

$ |

0.31 |

|

| Diluted EPS |

|

|

0.41 |

|

|

|

0.59 |

|

|

|

0.21 |

|

|

|

0.31 |

|

|

Cash Dividends Declared per share |

|

|

0.42 |

|

|

|

0.42 |

|

|

|

0.21 |

|

|

|

0.21 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCIAL RATIOS |

|

|

(Unaudited) |

|

| ROA |

|

|

0.44 |

% |

|

|

0.64 |

% |

|

|

0.45 |

% |

|

|

0.66 |

% |

| ROE |

|

|

4.93 |

|

|

|

7.27 |

|

|

|

5.15 |

|

|

|

7.44 |

|

| Net Interest Margin |

|

|

1.80 |

|

|

|

2.25 |

|

|

|

1.80 |

|

|

|

2.17 |

|

| Dividend Payout Ratio |

|

|

102.44 |

|

|

|

71.19 |

|

|

|

100.00 |

|

|

|

67.74 |

|

| Efficiency Ratio |

|

|

75.00 |

|

|

|

64.31 |

|

|

|

73.55 |

|

|

|

66.61 |

|

| |

|

PROBLEM AND POTENTIAL PROBLEM LOANS AND

ASSETS(Unaudited) |

| |

| |

|

6/30/2024 |

|

|

12/31/2023 |

|

| |

|

(dollars in thousands) |

|

|

Loans including modifications to borrowers experiencing financial

difficulty: |

|

|

|

|

|

|

|

|

|

Modified and performing according to their modified terms |

|

$ |

426 |

|

|

$ |

431 |

|

|

Past due 30 through 89 days |

|

|

942 |

|

|

|

3,086 |

|

|

Past due 90 days or more and still accruing |

|

|

— |

|

|

|

— |

|

|

Nonaccrual |

|

|

2,370 |

|

|

|

1,053 |

|

| |

|

|

3,738 |

|

|

|

4,570 |

|

| Other real estate owned |

|

|

— |

|

|

|

— |

|

| |

|

$ |

3,738 |

|

|

$ |

4,570 |

|

| |

|

|

|

|

|

|

|

|

| Allowance for credit

losses |

|

$ |

28,484 |

|

|

$ |

28,992 |

|

| Allowance for credit losses as

a percentage of total loans |

|

|

0.88 |

% |

|

|

0.89 |

% |

| Allowance for credit losses as

a multiple of nonaccrual loans |

|

|

12.0 |

x |

|

|

27.5 |

x |

| |

|

|

AVERAGE BALANCE SHEET, INTEREST RATES AND INTEREST

DIFFERENTIAL(Unaudited) |

| |

|

| |

|

Six Months Ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

Average |

|

|

Interest/ |

|

|

Average |

|

|

Average |

|

|

Interest/ |

|

|

Average |

|

|

(dollars in thousands) |

|

Balance |

|

|

Dividends |

|

|

Rate |

|

|

Balance |

|

|

Dividends |

|

|

Rate |

|

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning bank

balances |

|

$ |

83,341 |

|

|

$ |

2,271 |

|

|

|

5.48 |

% |

|

$ |

44,889 |

|

|

$ |

1,067 |

|

|

|

4.79 |

% |

| Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable (1) |

|

|

629,958 |

|

|

|

12,201 |

|

|

|

3.87 |

|

|

|

533,866 |

|

|

|

8,216 |

|

|

|

3.08 |

|

|

Nontaxable (1) (2) |

|

|

153,001 |

|

|

|

2,427 |

|

|

|

3.17 |

|

|

|

234,036 |

|

|

|

3,762 |

|

|

|

3.21 |

|

| Loans (1) (2) |

|

|

3,236,620 |

|

|

|

67,653 |

|

|

|

4.18 |

|

|

|

3,270,722 |

|

|

|

61,890 |

|

|

|

3.78 |

|

| Total interest-earning

assets |

|

|

4,102,920 |

|

|

|

84,552 |

|

|

|

4.12 |

|

|

|

4,083,513 |

|

|

|

74,935 |

|

|

|

3.67 |

|

| Allowance for credit

losses |

|

|

(28,639 |

) |

|

|

|

|

|

|

|

|

|

|

(30,811 |

) |

|

|

|

|

|

|

|

|

| Net interest-earning

assets |

|

|

4,074,281 |

|

|

|

|

|

|

|

|

|

|

|

4,052,702 |

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

|

32,751 |

|

|

|

|

|

|

|

|

|

|

|

30,388 |

|

|

|

|

|

|

|

|

|

| Premises and equipment,

net |

|

|

31,093 |

|

|

|

|

|

|

|

|

|

|

|

32,024 |

|

|

|

|

|

|

|

|

|

| Other assets |

|

|

120,772 |

|

|

|

|

|

|

|

|

|

|

|

116,229 |

|

|

|

|

|

|

|

|

|

| |

|

$ |

4,258,897 |

|

|

|

|

|

|

|

|

|

|

$ |

4,231,343 |

|

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Savings, NOW & money

market deposits |

|

$ |

1,576,447 |

|

|

|

21,520 |

|

|

|

2.75 |

|

|

$ |

1,675,355 |

|

|

|

13,386 |

|

|

|

1.61 |

|

| Time deposits |

|

|

638,028 |

|

|

|

14,036 |

|

|

|

4.42 |

|

|

|

510,461 |

|

|

|

7,301 |

|

|

|

2.88 |

|

| Total interest-bearing

deposits |

|

|

2,214,475 |

|

|

|

35,556 |

|

|

|

3.23 |

|

|

|

2,185,816 |

|

|

|

20,687 |

|

|

|

1.91 |

|

| Overnight advances |

|

|

9,560 |

|

|

|

267 |

|

|

|

5.62 |

|

|

|

20,845 |

|

|

|

546 |

|

|

|

5.28 |

|

| Other borrowings |

|

|

487,541 |

|

|

|

11,627 |

|

|

|

4.80 |

|

|

|

374,285 |

|

|

|

7,435 |

|

|

|

4.01 |

|

| Total interest-bearing

liabilities |

|

|

2,711,576 |

|

|

|

47,450 |

|

|

|

3.52 |

|

|

|

2,580,946 |

|

|

|

28,668 |

|

|

|

2.24 |

|

| Checking deposits |

|

|

1,131,917 |

|

|

|

|

|

|

|

|

|

|

|

1,241,566 |

|

|

|

|

|

|

|

|

|

| Other liabilities |

|

|

39,137 |

|

|

|

|

|

|

|

|

|

|

|

37,541 |

|

|

|

|

|

|

|

|

|

| |

|

|

3,882,630 |

|

|

|

|

|

|

|

|

|

|

|

3,860,053 |

|

|

|

|

|

|

|

|

|

| Stockholders' equity |

|

|

376,267 |

|

|

|

|

|

|

|

|

|

|

|

371,290 |

|

|

|

|

|

|

|

|

|

| |

|

$ |

4,258,897 |

|

|

|

|

|

|

|

|

|

|

$ |

4,231,343 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income (2) |

|

|

|

|

|

$ |

37,102 |

|

|

|

|

|

|

|

|

|

|

$ |

46,267 |

|

|

|

|

|

| Net interest spread (2) |

|

|

|

|

|

|

|

|

|

|

0.60 |

% |

|

|

|

|

|

|

|

|

|

|

1.43 |

% |

| Net interest margin (2) |

|

|

|

|

|

|

|

|

|

|

1.80 |

% |

|

|

|

|

|

|

|

|

|

|

2.25 |

% |

(1) The average balances of loans include

nonaccrual loans. The average balances of investment securities

exclude unrealized gains and losses on available-for-sale

securities.

(2) Tax-equivalent basis. Interest income on a

tax-equivalent basis includes the additional amount of interest

income that would have been earned if the Corporation's investment

in tax-exempt loans and investment securities had been made in

loans and investment securities subject to federal income taxes

yielding the same after-tax income. The tax-equivalent amount of

$1.00 of nontaxable income was $1.27 for each period presented

using the statutory federal income tax rate of 21%.

| |

|

AVERAGE BALANCE SHEET, INTEREST RATES AND INTEREST

DIFFERENTIAL(Unaudited) |

| |

| |

|

Three Months Ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

Average |

|

|

Interest/ |

|

|

Average |

|

|

Average |

|

|

Interest/ |

|

|

Average |

|

|

(dollars in thousands) |

|

Balance |

|

|

Dividends |

|

|

Rate |

|

|

Balance |

|

|

Dividends |

|

|

Rate |

|

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning bank

balances |

|

$ |

111,565 |

|

|

$ |

1,520 |

|

|

|

5.48 |

% |

|

$ |

40,668 |

|

|

$ |

520 |

|

|

|

5.13 |

% |

| Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable (1) |

|

|

621,059 |

|

|

|

5,959 |

|

|

|

3.84 |

|

|

|

599,558 |

|

|

|

5,094 |

|

|

|

3.40 |

|

|

Nontaxable (1) (2) |

|

|

152,585 |

|

|

|

1,212 |

|

|

|

3.18 |

|

|

|

165,559 |

|

|

|

1,300 |

|

|

|

3.14 |

|

| Loans (1) |

|

|

3,229,796 |

|

|

|

34,110 |

|

|

|

4.22 |

|

|

|

3,253,952 |

|

|

|

31,483 |

|

|

|

3.87 |

|

| Total interest-earning

assets |

|

|

4,115,005 |

|

|

|

42,801 |

|

|

|

4.16 |

|

|

|

4,059,737 |

|

|

|

38,397 |

|

|

|

3.78 |

|

| Allowance for credit

losses |

|

|

(28,330 |

) |

|

|

|

|

|

|

|

|

|

|

(30,204 |

) |

|

|

|

|

|

|

|

|

| Net interest-earning

assets |

|

|

4,086,675 |

|

|

|

|

|

|

|

|

|

|

|

4,029,533 |

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

|

33,798 |

|

|

|

|

|

|

|

|

|

|

|

29,768 |

|

|

|

|

|

|

|

|

|

| Premises and equipment,

net |

|

|

30,929 |

|

|

|

|

|

|

|

|

|

|

|

32,263 |

|

|

|

|

|

|

|

|

|

| Other assets |

|

|

120,660 |

|

|

|

|

|

|

|

|

|

|

|

117,288 |

|

|

|

|

|

|

|

|

|

| |

|

$ |

4,272,062 |

|

|

|

|

|

|

|

|

|

|

$ |

4,208,852 |

|

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Savings, NOW & money

market deposits |

|

$ |

1,618,812 |

|

|

|

11,437 |

|

|

|

2.84 |

|

|

$ |

1,673,101 |

|

|

|

7,611 |

|

|

|

1.82 |

|

| Time deposits |

|

|

632,201 |

|

|

|

7,059 |

|

|

|

4.49 |

|

|

|

513,414 |

|

|

|

4,232 |

|

|

|

3.31 |

|

| Total interest-bearing

deposits |

|

|

2,251,013 |

|

|

|

18,496 |

|

|

|

3.30 |

|

|

|

2,186,515 |

|

|

|

11,843 |

|

|

|

2.17 |

|

| Overnight advances |

|

|

275 |

|

|

|

4 |

|

|

|

5.85 |

|

|

|

32,747 |

|

|

|

438 |

|

|

|

5.36 |

|

| Other borrowings |

|

|

470,824 |

|

|

|

5,615 |

|

|

|

4.80 |

|

|

|

378,654 |

|

|

|

4,002 |

|

|

|

4.24 |

|

| Total interest-bearing

liabilities |

|

|

2,722,112 |

|

|

|

24,115 |

|

|

|

3.56 |

|

|

|

2,597,916 |

|

|

|

16,283 |

|

|

|

2.51 |

|

| Checking deposits |

|

|

1,137,244 |

|

|

|

|

|

|

|

|

|

|

|

1,201,585 |

|

|

|

|

|

|

|

|

|

| Other liabilities |

|

|

38,259 |

|

|

|

|

|

|

|

|

|

|

|

37,391 |

|

|

|

|

|

|

|

|

|

| |

|

|

3,897,615 |

|

|

|

|

|

|

|

|

|

|

|

3,836,892 |

|

|

|

|

|

|

|

|

|

| Stockholders' equity |

|

|

374,447 |

|

|

|

|

|

|

|

|

|

|

|

371,960 |

|

|

|

|

|

|

|

|

|

| |

|

$ |

4,272,062 |

|

|

|

|

|

|

|

|

|

|

$ |

4,208,852 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income (2) |

|

|

|

|

|

$ |

18,686 |

|

|

|

|

|

|

|

|

|

|

$ |

22,114 |

|

|

|

|

|

| Net interest spread (2) |

|

|

|

|

|

|

|

|

|

|

0.60 |

% |

|

|

|

|

|

|

|

|

|

|

1.27 |

% |

| Net interest margin (2) |

|

|

|

|

|

|

|

|

|

|

1.80 |

% |

|

|

|

|

|

|

|

|

|

|

2.17 |

% |

(1) The average balances of loans include

nonaccrual loans. The average balances of investment securities

exclude unrealized gains and losses on available-for-sale

securities.

(2) Tax-equivalent basis. Interest income on a

tax-equivalent basis includes the additional amount of interest

income that would have been earned if the Corporation's investment

in tax-exempt investment securities had been made in investment

securities subject to federal income taxes yielding the same

after-tax income. The tax-equivalent amount of $1.00 of nontaxable

income was $1.27 for each period presented using the statutory

federal income tax rate of 21%.

|

For More Information Contact: |

|

Janet Verneuille, SEVP and CFO |

|

(516) 671-4900, Ext. 7462 |

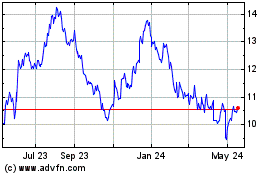

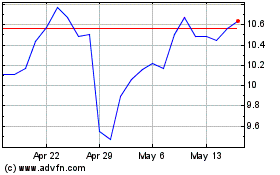

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Oct 2024 to Nov 2024

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Nov 2023 to Nov 2024