false

0001708176

0001708176

2024-05-20

2024-05-20

0001708176

HOFV:CommonStock0.0001ParValuePerShareMember

2024-05-20

2024-05-20

0001708176

HOFV:WarrantsToPurchase0.064578SharesOfCommonStockMember

2024-05-20

2024-05-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

May 20, 2024

HALL OF FAME RESORT & ENTERTAINMENT COMPANY

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38363 |

|

84-3235695 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

2014 Champions Gateway

Canton, OH 44708

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (330) 458-9176

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

HOFV |

|

Nasdaq Capital Market |

| Warrants to purchase 0.064578 shares of Common Stock |

|

HOFVW |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive

Agreement.

Amendment to Business Loan Agreement with

Stark County Port Authority

On May 20, 2024, the Hall of Fame Resort &

Entertainment Company (the “Company” or “Borrower”), a Delaware corporation, entered into an Amendment to Business

Loan Agreement (“Amendment”) with the Stark County Port Authority (“Lender”), a body corporate and politic and

a port authority duly organized and validly existing under the law of the State of Ohio.

Pursuant to the Amendment, which modifies the

original instrument dated August 31, 2022, the parties agreed: (i) to modify the original maturity date from August 30, 2029 to June 30,

2044; (ii) Lender will provide additional funds to Borrower totaling $520,383.33; (iii) the original principal balance will be increased

from $5,000,000 to $5,520,383.33; and (iv) Borrower shall repay as follows (a) interest will be capitalized and compounded annually for

two years, from May 20, 2024 through May 20, 2026, (b) quarterly interest only payments for five years, from June 30, 2026 through June

30, 2031, with subsequent interest payments due the last day of each March, June, September and December, (c) quarterly principal and

interest payments until the maturity date when all other amounts due and owing to Lender are due. In addition, in the event of a substantial

change in ownership, defined as more than 50% of the outstanding ownership and control of the Borrower, the Lender may, at its option,

declare an Event of Default and declare all sums owed to Lender immediately due and payable.

The Amendment contains customary affirmative and

negative covenants for this type of loan, including without limitation, affirmative covenants, negative covenants and default provisions.

Borrower agreed to reimburse Lender for all costs and expenses including, without limitation, legal fees and expenses of counsel.

The foregoing description of the Amendment does

not purport to be complete and is qualified in its entirety by the full text of the Amendment which is attached hereto as Exhibit 10.1

to this Current Report on Form 8-K and incorporated herein by reference.

Item 2.03 –

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information set forth

under Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference into this Item 2.03.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

HALL OF FAME RESORT & ENTERTAINMENT COMPANY |

| |

|

|

| |

By: |

/s/ Michael Crawford |

| |

|

Name: |

Michael Crawford |

| |

|

Title: |

President and Chief Executive Officer |

| |

|

|

| Dated: May 24, 2024 |

|

|

3

Exhibit

10.1

AMENDMENT

TO

BUSINESS LOAN AGREEMENT

($5,520,383.33

Term Loan)

| Borrower: |

HALL

OF FAME RESORT &

ENTERTAINMENT

COMPANY

2626

Fulton Drive NW

Canton, OH 44718 |

|

Lender: |

STARK

COUNTY PORT AUTHORITY

400

3rd Street SE, Suite 310

Canton,

Ohio 44702 |

Effective

Date of Business Loan Agreement: August 31, 2022

Effective

Date of Amendment to Business Loan Agreement: May 20, 2024

THIS

AMENDMENT TO BUSINESS LOAN AGREEMENT, dated as of May 20, 2024 (sometimes herein referred to as the “Amendment”),

is made and executed between HALL OF FAME RESORT & ENTERTAINMENT COMPANY, a Delaware corporation (“Borrower”),

and the STARK COUNTY PORT AUTHORITY (“Lender”) in order to amend and partially restate the Business Loan Agreement,

dated August 31, 2022 (referred to as the “Business Loan Agreement” and, together with this Amendment, as the same

may be further amended or supplemented, the “Loan Agreement”).

RECITALS:

WHEREAS,

Lender established a revolving loan fund program (the “Revolving Loan Fund”), under which amounts deposited, together

with principal of and interest on loans made and repaid from time to time, may be loaned by Lender to eligible persons; and

WHEREAS,

in order to fund the Revolving Loan Fund, Lender entered into that certain Funding Agreement with the Board of County Commissioners of

Stark County, Ohio (the “Board”), and established a special fund (the “RLF Fund”) for the deposit

of funds appropriated and provided by Lender and funds appropriated and provided by the Board all in order to make loans to eligible

persons from the RLF Fund; and

WHEREAS,

Borrower made a loan application with Lender requesting an unsecured loan (“Original Term Loan”) in the amount of

$5,000,000 for purposes of the financing of or reimbursing Borrower for amounts advanced for infrastructure improvements necessary for

and related to the development of Phase II of the Hall of Fame Village complex (“Phase II”)on those parcels of real

property described in Exhibit A to the Business Loan Agreement (“Phase II Parcels”) and submitted for review by Lender

due diligence materials and documentation supporting its request for the HOFRECO Loan, all of which will create or preserve jobs and

employment opportunities within the territorial jurisdiction of the Board and the Lender; and

WHEREAS,

Borrower has represented to Lender that the final costs of the infrastructure improvements necessary for and related to the development

of the Phase II Parcels, as completed in and prior to 2023 (“Infrastructure Improvements”) include those costs set

forth in Application and Certificate for Payment No. 19 for the period ending March 6, 2023 and relating to the Turner/AECOM Hunt (a

Joint Venture) contract for a portion of the Infrastructure Improvements, a copy of which is on file with Lender and Borrower (“Final

Turner- Hunt PayApp”), and Lender and Borrower have now determined that it is necessary and desirable to allocate the proceeds

of the Original Term Loan to specific costs of the Infrastructure Improvements not otherwise financed or to be financed by Lender; and

WHEREAS,

pursuant to Resolution 2022-13 adopted on August 15, 2022 by the Legislative Authority of Lender, Lender made the HOFRECO Loan to Borrower

which is evidenced by the Business Loan Agreement as well as that certain promissory note dated as of August 31, 2022 (“Original

Term Loan Note”) and other Loan Documents; and

WHEREAS,

Borrower has requested a new or additional loan from the RLF Fund and, in connection therewith, certain amendments to the terms of the

Original Term Loan, including but not limited to, an extension of the term thereof, certain revisions to the payment obligations relating

to interest thereon, and an additional loan of $520,383.33 (“Additional Term Loan” and, together with the Original

Term Loan, the “HOFRECO Loan” or “Term Loan”) to pay or reimburse additional costs of the Infrastructure

Improvements; and

WHEREAS,

costs of the Infrastructure Improvements include not less than $6,204,597.52 of direct costs, plus an allocable portion of other related

contract costs related to “Site Electrical-Teledata Ductbanks” on the Phase II Parcels, as shown in the Final Turner-Hunt

Pay/App, no portion of which has otherwise been financed by Lender, and Lender and Borrower have determined to allocate 100% of the proceeds

of the HOFRECO Loan to pay or reimburse costs of the Site Electrical-Teledata Ductbanks included in the Infrastructure Improvements (the

“Project”); and

WHEREAS,

Lender has agreed to extend the Additional Term Loan to the Borrower and to amend the terms of the Original Term Loan to the extent set

forth herein and Borrower has agreed to the terms and conditions set forth herein and in that certain promissory note executed by Borrower

in favor of Lender of even date herewith (“the “Note” or Term Loan Note”), as provided for in this

Amendment; and, in consideration of the execution and delivery of this Amendment and the Term Loan Note, Lender has agreed to cancel

the Original Term Loan Note and deliver the same to Borrower.

AGREEMENT:

NOW

THEREFORE, in consideration of the foregoing, and for other good and valuable consideration, the receipt and sufficiency of which is

hereby acknowledged, Lender and Borrower agree as follows:

| 1. | INCORPORATION

OF RECITALS. The foregoing recitals shall be deemed incorporated into this Amendment as if fully rewritten herein. |

| 2. | NO

NOVATION. Borrower understands and agrees that: (A) in granting, renewing, or extending any loan, Lender is relying upon the representations,

warranties, and agreements as set forth in this Amendment and in the Business Loan Agreement, and the Loan Documents; (B) the granting,

renewing, or extending of the HOFRECO Loan, or any loan, by Lender at all times shall be subject to Lender’s sole judgment and discretion;

and (C) the HOFRECO Loan shall be and remain subject to the terms and conditions of this Amendment and the Business Loan Agreement. All

terms not otherwise defined in this Amendment will have the meaning set forth in the Business Loan Agreement. In the event of a term

being defined herein that conflicts with a term defined in the Business Loan Agreement, the term as defined herein shall control. The

parties intend that the terms and conditions set forth in this Amendment will supersede and replace those terms and conditions set forth

in the Business Loan Agreement and the Loan Documents (in each case if and to the extent inconsistent with the terms and conditions set

forth in this Amendment. All provisions in the Business Loan Agreement (including all amendments thereto) not superseded or modified

by this Amendment shall remain in full force and effect. |

| 3. | LOAN

FACILITIES. The Loan Agreement shall apply to a term loan in the original principal amount of $5,520,383.33 (the “Term Loan”)

as evidenced by the Term Loan Note. |

| 4. | TERM

OF TERM LOAN. In the absence of an Event of Default, the Term Loan shall mature and shall be due and payable in full on June 30,

2044 (the “Maturity Date”). |

| 5. | REPAYMENT

OBLIGATIONS. The following repayment obligations shall apply to the Term Loan: |

| (A) | TERM

LOAN: Borrower will pay the entire outstanding principal balance to Lender on the Maturity Date. Commencing May 20, 2024 and continuing

until May 20, 2026, interest shall be deemed capitalized interest and shall accrue and be compounded annually during such period as shown

on the amortization schedule attached to the Term Loan Note and added to the principal amount of the Term Loan. If and to the extent

required by law, each additional dollar of principal of the Term Loan is hereby deemed an additional advance to Borrower to reimburse

additional costs of the Project. After the initial no payment period, commencing May 20, 2026, Borrower shall pay regular quarterly payments

of all accrued unpaid interest due as of each payment date in the amounts as set forth on the amortization schedule attached to the Term

Loan Note, beginning June 30, 2026 through June 30, 2031, with all subsequent interest payments to be due on the last day of each March,

June, September and December of each year thereafter. Commencing on June 30, 2031 and through the remainder of the term, being June 30,

2044, quarterly payments of principal and accrued interest shall be made in the amounts set forth on the amortization schedule attached

to the Term Loan Note with each payment to be due on the last day of each March, June, September and December of each year. Borrower’s

final payment is due on the Maturity Date, which payment will be for all principal and all accrued interest not yet paid and all other

amounts that may be due and owing to Lender under the Business Loan Agreement, this Note and the Loan Documents. |

| 6. | LOAN

FACILITIES. Borrower agrees that this Amendment is executed in order to reflect the terms, covenants, conditions, and obligations

in connection with the Term Loan Note, together with all renewals of, extensions of, modifications of, refinancings of, replacements

of, consolidations of, and substitutions for such Term Loan Note. |

| 7. | The

following provision shall be added as an Event of Default under the section of the Business Loan Agreement entitled “DEFAULT”: |

SUBSTANTIAL

CHANGE IN OWNERSHIP. In the event of a substantial change in ownership of Borrower, Lender may, at Lender’s option, declare

immediately due and payable all sums owed by Borrower to Lender pursuant to this Business Loan Agreement, Term Loan Note and other Loan

Documents. A “substantial change in ownership” shall be defined as: (a) any change in ownership of more than 50% of the outstanding

stock of the Borrower, (b) a new owner of more than 50% of the outstanding stock of Borrower, or (c) a merger, consolidation, or other

reorganization of Borrower resulting in a change of more than 50% of the outstanding ownership and control of Borrower.

| 8. | The

following provision shall replace in its entirety the current section of the Business Loan Agreement entitled “Completion Default”: |

COMPLETION

DEFAULT. Borrower fails to complete all required infrastructure improvements necessary for Phase II on or before December 31, 2025.

| 9. | The

following provision shall be added to the Business Loan Agreement: |

COSTS

AND EXPENSES. The Borrower affirms and acknowledges that it shall reimburse Lender for all of Lender’s costs and expenses in

connection with the negotiation and documentation of this Amendment including, without limitation, legal fees and expenses of counsel,

including general and special counsel) to Lender in connection with this Amendment.

| 10. | TERM

OF AMENDMENT. This Amendment shall be effective as of May 20, 2024, and shall continue in full force and effect until such time as

the Term Loan Note has been paid in full, including principal, interest, costs, expenses, attorneys’ fees, and other fees and charges,

or until such time as the parties may agree in writing to terminate this Amendment. Unless an Event of Default has occurred prior thereto,

all principal, accrued interest, and other amounts due and owing in connection with the Term Loan Note are due and payable on June 30,

2044 (the “Term”). |

| 11. | CONDITIONS

TO LOAN. The consummation of the Loan contemplated by this Amendment shall be contingent upon: (a) receipt of written approval from

the Stark County Commissioners as evidenced by a duly adopted resolution; (b) execution of the Term Loan Note, this Amendment and all

other documents as Lender may reasonably require, all in form and substance satisfactory to Lender and Lender’s counsel; (c) documentation,

satisfactory to Lender, affirming and certifying the items contained in the Borrower Secretary’s Certificate as previously provided

by Borrower; and (d) acceptable certification to Lender of Project costs. |

| 12. | REPRESENTATIONS

AND WARRANTIES. By executing this Amendment, Borrower hereby reaffirms that (a) (i) all representations and warranties set forth

in the Business Loan Agreement remain true, accurate, and complete as the date of this Amendment and will remain true, accurate, and

complete as of the date of each advance of loan proceeds, as of the date of any renewal, extension, amendment, or modification of any

Loan, and at all times any Indebtedness exists; (ii) all representations and warranties set forth in the Business Loan Agreement are

ratified and confirmed without condition as if made anew, (iii) all representations and warranties set forth in the Business Loan Agreement

are incorporated into this Amendment by reference, and (iv) Borrower has obtained and provided Lender with all consents necessary for

executing and delivering this Amendment and the Term Loan Note, (b) no Event of Default or event which, with the passage of time or the

giving of notice or both, would constitute an Event of Default, exists under any Loan Document which will not be cured by the execution

and effectiveness of this Amendment, (c) no consent, approval, order or authorization of, or registration or filing with, any third party

is required in connection with the execution, delivery and carrying out of this Amendment or, if required, has been obtained, and (d)

this Amendment has been duly authorized, executed and delivered so that it constitutes the legal, valid and binding obligation of the

Borrower, enforceable in accordance with its terms. The Borrower confirms that the Original Term Loan remains outstanding without defense,

set off, counterclaim, discount or charge of any kind as of the date of this Amendment. |

CONFESSION

OF JUDGMENT. Borrower hereby irrevocably authorizes and empowers any attorney-at-law, including an attorney hired by Lender, to appear

in any court of record and to confess judgment against Borrower for the unpaid amount due and owing in connection with the Loan Agreement,

the Note, and/or other Loan Documents, as evidenced by an affidavit signed by an officer of Lender setting forth the amount then due,

attorneys’ fees plus costs of suit, and to release all errors, and waive all rights of appeal. If a copy of this Amendment, the Note,

or other Loan Document, as may be applicable, verified by an affidavit, shall have been filed in the proceeding, it will not be necessary

to file the original as a warrant of attorney. Borrower hereby waives the right to any injunction which would prevent Lender from taking

judgment under the Loan Agreement, the Note and/or other Loan Documents by confession, and any stay of execution and the benefit of all

exemption laws now or hereafter in effect. No single exercise of the foregoing warrant and power to confess judgment will be deemed to

exhaust the power, whether or not any such exercise shall be held by any court to be invalid, voidable, or void; but the power will continue

undiminished and may be exercised from time to time as Lender may elect until all amounts owing on the Loan Agreement, the Note and/or

other Loan Documents have been paid in full. Borrower waives any conflict of interest that an attorney hired by Lender may have in acting

on behalf of Borrower in confessing judgment against Borrower while such attorney is retained by Lender. Borrower expressly consents

to such attorney acting for Borrower in confessing judgment.

BORROWER

ACKNOWLEDGES THAT IS HAS CAREFULLY READ ALL THE PROVISIONS OF THIS AMENDMENT TO BUSINESS LOAN AGREEMENT AND BORROWER AGREES TO ITS TERMS.

THIS AMENDMENT TO BUSINESS LOAN AGREEMENT IS ENTERED INTO AND DATED AS OF THE EFFECTIVE DATE FIRST ABOVE STATED. EXCEPT AS SUPERSEDED,

AMENDED OR OTHERWISE MODIFIED HEREBY, THE TERMS AND PROVISIONS OF THE LOAN DOCUMENTS REMAIN UNCHANGED, ARE AND SHALL REMAIN IN FULL FORCE

AND EFFECT UNLESS AND UNTIL MODIFIED OR AMENDED IN WRITING IN ACCORDANCE WITH THEIR TERMS, AND ARE HEREBY RATIFIED AND CONFIRMED. EXCEPT

AS EXPRESSLY PROVIDED HEREIN, THIS AMENDMENT SHALL NOT CONSTITUTE AN AMENDMENT, WAIVER, CONSENT OR RELEASE WITH RESPECT TO ANY PROVISION

OF ANY LOAN DOCUMENT, A WAIVER OF ANY DEFAULT OR EVENT OF DEFAULT UNDER ANY LOAN DOCUMENT, OR A WAIVER OR RELEASE OF ANY OF LENDER’S

RIGHTS AND REMEDIES (ALL OF WHICH ARE HEREBY RESERVED).

BORROWER

EXPRESSLY RATIFIES AND CONFIRMS THE CONFESSION OF JUDGMENT AND WAIVER OF JURY TRIAL OR ARBITRATION PROVISIONS CONTAINED IN THE BUSINESS

LOAN AGREEMENT AND OTHER LOAN DOCUMENTS, ALL OF WHICH ARE INCORPORATED HEREIN BY REFERENCE.

[Remainder

of Page Intentionally Left Blank]

| WARNING - BY SIGNING THIS PAPER YOU GIVE UP YOUR RIGHT TO NOTICE AND COURT TRIAL. IF YOU DO NOT PAY ON TIME A COURT JUDGMENT MAY BE TAKEN AGAINST YOU WITHOUT YOUR PRIOR KNOWLEDGE AND THE POWERS OF A COURT CAN BE USED TO COLLECT FROM YOU REGARDLESS OF ANY CLAIMS YOU MAY HAVE AGAINST THE CREDITOR WHETHER FOR RETURNED GOODS, FAULTY GOODS, FAILURE ON HIS PART TO COMPLY WITH THE AGREEMENT, OR ANY OTHER CAUSE. |

BORROWER:

Hall

of Fame Resort & Entertainment Company

| /s/

Michael Crawford |

|

| By: |

Michael Crawford, its President & CEO

Accepted at Canton, Ohio: |

|

| |

|

|

LENDER:

|

|

| Stark

County Port Authority |

|

| |

|

| /s/

Chris Remark |

|

| By: |

Chris Remark, its Board Member and |

|

| |

|

|

| /s/

Ray Hexamer |

|

| By: |

Ray

Hexamer, its Secretary |

|

CERTIFICATE

The

undersigned officers of the Stark County Port Authority (the “Lender” in the above Amendment), hereby certify that

the money, if any, required to meet the obligations of Lender during the year 2024 under the foregoing Agreement have been lawfully appropriated

by the Board of Directors of Lender for such purposes and are in the treasury of Lender or in the process of collection to the credit

of an appropriate fund, free from any previous encumbrances. This Certificate is given in compliance with Sections 5705.41 and 5705.44,

Ohio Revised Code.

| |

/s/

Ray Hexamer |

| |

Ray

Hexamer, Secretary |

| |

Stark

County Port Authority |

| |

|

| |

/s/

Roger Mann |

| |

Roger

Mann, Treasurer |

| |

Stark

County Port Authority |

Date:

May 20, 2024

7

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HOFV_CommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HOFV_WarrantsToPurchase0.064578SharesOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

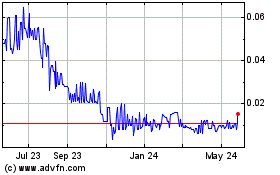

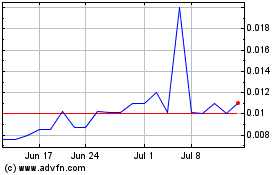

Hall of Fame Resort and ... (NASDAQ:HOFVW)

Historical Stock Chart

From Feb 2025 to Mar 2025

Hall of Fame Resort and ... (NASDAQ:HOFVW)

Historical Stock Chart

From Mar 2024 to Mar 2025