false000184271800018427182025-02-282025-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2025

___________________________________

INTEGRAL AD SCIENCE HOLDING CORP.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-40557 (Commission File Number) | 83-0731995 (I.R.S. Employer Identification Number) |

| | |

12 E 49th Street, 20th Floor New York, NY | | 10017 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

646 278-4871 |

(Registrant's telephone number, including area code) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.001 | IAS | The Nasdaq Stock Market LLC |

| | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 28, 2025, Integral Ad Science Holding Corp. (the “Company”) issued a press release announcing its financial results for the year ended December 31, 2024. A copy of the press release is furnished herewith as Exhibit 99.1.

The information contained in this Item 2.02 and in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| 99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 28, 2025

| | | | | |

| INTEGRAL AD SCIENCE HOLDING CORP. |

| |

By: | /s/Jill Putman |

Name: | Jill Putman |

Title: | Interim Chief Financial Officer and Director

(Principal Financial Officer) |

IAS Reports Fourth Quarter and Full Year 2024 Financial Results

Fourth quarter revenue increased 14% to $153 million

Fourth quarter net income of $15.3 million at a 10% margin; fourth quarter adjusted EBITDA increased 29% to $61.4 million at a 40% margin

NEW YORK – February 28, 2025 – Integral Ad Science (Nasdaq: IAS), a leading global media measurement and optimization platform, today announced financial results for the fourth quarter and full year ended December 31, 2024.

"We achieved 14% revenue growth in the fourth quarter with double-digit gains across our optimization, measurement, and publisher businesses,” said Lisa Utzschneider, CEO of IAS. “Throughout the year, we launched several first-to-market solutions to increase advertiser returns across the digital ecosystem. We look forward to driving value for our customers in 2025 based on our AI-powered, differentiated products, expanded platform partnerships, and global market leadership.”

Fourth Quarter 2024 Financial Highlights

•Total revenue was $153.0 million, a 14% increase compared to $134.3 million in the prior-year period.

•Optimization revenue was $70.6 million, an 11% increase compared to $63.6 million in the prior-year period.

•Measurement revenue was $59.1 million, a 12% increase compared to $52.6 million in the prior-year period.

•Publisher revenue was $23.4 million, a 30% increase compared to $18.1 million in the prior-year period.

•International revenue, excluding the Americas, was $49.0 million, a 13% increase compared to $43.3 million in the prior-year period, or 32% of total revenue for the fourth quarter of 2024.

•Gross profit was $119.7 million, a 13% increase compared to $106.0 million in the prior-year period. Gross profit margin was 78% for the fourth quarter of 2024.

•Net income was $15.3 million, or $0.09 per basic and diluted share, compared to $10.2 million, or $0.06 per basic and diluted share, in the prior-year-period. Net income margin was 10% for the fourth quarter of 2024.

•Adjusted EBITDA* was $61.4 million, a 29% increase compared to $47.5 million in the prior-year period. Adjusted EBITDA* margin was 40% for the fourth quarter of 2024.

Full Year 2024 Financial Highlights

•Total revenue was $530.1 million, a 12% increase compared to $474.4 million in the prior year.

•Optimization revenue was $242.6 million, an 8% increase compared to $224.5 million in the prior year.

•Measurement revenue was $211.0 million, a 13% increase compared to $186.0 million in the prior year.

•Publisher revenue was $76.5 million, a 20% increase compared to $63.8 million in the prior year.

•International revenue, excluding the Americas, was $166.0 million, a 13% increase compared to $146.8 million in the prior year, or 31% of total revenue for the full year 2024.

•Gross profit was $416.1 million, an 11% increase compared to $375.0 million in the prior year. Gross profit margin was 79% for the full year 2024.

•Net income was $37.8 million, or $0.23 per basic and diluted share, compared to $7.2 million, or $0.04 per diluted share, in the prior year. Net income margin was 7% for the full year 2024.

•Adjusted EBITDA* was $191.3 million, a 20% increase compared to $159.5 million in the prior year. Adjusted EBITDA* margin was 36% for the full year 2024.

•Cash and cash equivalents were $84.5 million at December 31, 2024.

Recent Business Highlights

•Meta Optimization Expansion – In February 2025, IAS announced new features and increased global availability for its first-to-market Content Block List optimization solution on Meta across Facebook and Instagram Feed and Reels. IAS now supports 9 additional content categories for a total of 45 and 6 additional languages for a total of 34.

•Brand Safety and Suitability on Reddit – In January 2025, Reddit announced that IAS is integrated into Reddit’s Limited inventory safety tier, and can now provide advertisers with IAS’s industry-leading, AI-driven Multimedia Technology. Reddit also announced an integration with IAS to measure the brand safety and brand suitability of advertisers’ campaigns on Reddit.

•Quality Sync Pre-Bid Integrations – In February 2025, IAS announced the integration of Quality Sync pre-bid with Display and Video 360. In December 2024, IAS launched Quality Sync pre-bid in Amazon DSP. Quality Sync seamlessly syncs advertisers’ settings to streamline their efforts and drive superior results.

•Quality Attention Expansion – In December 2024, IAS announced the release of its new Quality Attention Optimization product and its first-to-market partnership with Lumen Research to offer Social Attention. IAS now provides advertisers complete coverage for attention metrics across post-bid, pre-bid, and social media.

•China Expansion – In December 2024, IAS announced plans to expand into China to provide global advertisers with invalid traffic, fraud, and brand safety and suitability measurement, aligned to international and local standards. IAS will also offer local support to Chinese advertisers looking to grow their reach beyond China's borders.

•Kwai International Brand Safety Expansion – In December 2024, IAS announced exclusive first-to-market content-level brand safety and suitability measurement for advertisers on Kwai for Business as well as the launch of its Total Media Quality for Kwai product suite.

•ISO Certification – In December 2024, IAS announced it has received an accredited ISO/IEC 42001 certification, making it the first measurement provider to receive ISO certification for its use of AI, and one of the first companies certified in the world.

Financial Outlook

Utzschneider commented, “In addition to 14% revenue growth in the fourth quarter, we realized a 40% adjusted EBITDA margin for the period. In 2025, we expect to deliver profitable, double-digit revenue growth while maintaining a strong balance sheet and healthy cash flows to fuel investment in the business.”

IAS is introducing the following financial outlook for the first quarter and full year 2025:

First Quarter Ending March 31, 2025:

•Total revenue of $128 million to $131 million

•Adjusted EBITDA* of $38 million to $40 million

Year Ending December 31, 2025:

•Total revenue of $588 million to $600 million

•Adjusted EBITDA* of $202 million to $210 million

* See “Supplemental Disclosure Regarding Non-GAAP Financial Information” section herein for an explanation of Non-GAAP measures. IAS is unable to provide a reconciliation for forward-looking guidance of adjusted EBITDA to net income (loss), the most closely comparable GAAP measure, because certain material reconciling items, such as depreciation and amortization, interest expense, income tax expense (benefit), restructuring and severance costs, and acquisition and integration costs, cannot be estimated due to factors outside of IAS's control and could have a material impact on the reported results. However, IAS estimates stock-based compensation expense for the first quarter of 2025 in the range of $15 million to $17 million and for the full year 2025 in the range of $77 million to $81 million. A reconciliation is not available without unreasonable effort.

INTEGRAL AD SCIENCE HOLDING CORP.

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

| December 31, |

| (IN THOUSANDS, EXCEPT SHARE DATA) | 2024 | | 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 84,469 | | | $ | 124,759 | |

| Restricted cash | 506 | | | 54 | |

| Accounts receivable, net of allowance for credit losses of $7,454 and $8,645 as of December 31, 2024 and December 31, 2023, respectively | 79,427 | | | 74,609 | |

| Unbilled receivables | 53,388 | | | 46,548 | |

| Prepaid expenses and other current assets | 36,639 | | | 18,959 | |

| Due from related party | 28 | | | — | |

| Total current assets | 254,457 | | | 264,929 | |

| Property and equipment, net | 4,004 | | | 3,769 | |

| Internal use software, net | 53,636 | | | 40,301 | |

| Intangible assets, net | 140,943 | | | 178,908 | |

| Goodwill | 673,025 | | | 675,282 | |

| Operating lease right-of-use assets, net | 17,888 | | | 21,668 | |

| Deferred tax asset, net | 1,675 | | | 2,465 | |

| Other long-term assets | 5,943 | | | 4,402 | |

| Total assets | $ | 1,151,571 | | | $ | 1,191,724 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable and accrued expenses | $ | 72,910 | | | $ | 72,232 | |

| Operating lease liabilities, current | 10,184 | | | 9,435 | |

| Due to related party | 11 | | | 121 | |

| Deferred revenue | 1,061 | | | 682 | |

| Total current liabilities | 84,166 | | | 82,470 | |

| Deferred tax liability, net | 3,118 | | | 20,367 | |

| Long-term debt, net | 34,189 | | | 153,725 | |

| Operating lease liabilities, non-current | 13,374 | | | 19,523 | |

| Other long-term liabilities | 8,713 | | | 6,183 | |

| Total liabilities | 143,560 | | | 282,268 | |

| Commitments and Contingencies (Note 15) | | | |

| Stockholders’ Equity | | | |

Preferred Stock, $0.001 par value, 50,000,000 shares authorized at December 31, 2024; 0 shares issued and outstanding at December 31, 2024 and 2023 | — | | | — | |

Common Stock, $0.001 par value, 500,000,000 shares authorized at December 31, 2024, 162,871,266 and 158,757,620 shares issued and outstanding at December 31, 2024 and 2023, respectively | 163 | | | 159 | |

| Additional paid-in-capital | 964,765 | | | 901,259 | |

| Accumulated other comprehensive loss | (3,666) | | | (916) | |

| Retained earnings | 46,749 | | | 8,954 | |

| Total stockholders’ equity | 1,008,011 | | | 909,456 | |

| Total liabilities and stockholders’ equity | $ | 1,151,571 | | | $ | 1,191,724 | |

INTEGRAL AD SCIENCE HOLDING CORP.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended December 31, | | Year ended

December 31, |

| (IN THOUSANDS, EXCEPT SHARE AND PER SHARE DATA) | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | | $ | 153,038 | | | $ | 134,295 | | | $ | 530,101 | | | $ | 474,369 | |

| Operating expenses: | | | | | | | | |

| Cost of revenue (excluding depreciation and amortization shown below) | | 33,332 | | | 28,252 | | | 113,960 | | | 99,352 | |

| Sales and marketing | | 30,753 | | | 30,423 | | | 122,294 | | | 117,989 | |

| Technology and development | | 17,546 | | | 19,056 | | | 69,851 | | | 72,906 | |

| General and administrative | | 24,310 | | | 25,961 | | | 95,717 | | | 111,634 | |

| Depreciation and amortization | | 16,934 | | | 14,593 | | | 63,966 | | | 54,966 | |

| Foreign exchange loss (gain), net | | 4,650 | | | (501) | | | 3,927 | | | 430 | |

| Total operating expenses | | 127,525 | | | 117,784 | | | 469,715 | | | 457,277 | |

| Operating income | | 25,513 | | | 16,511 | | | 60,386 | | | 17,092 | |

| Interest expense, net | | (571) | | | (2,489) | | | (5,358) | | | (12,236) | |

| Net income before income taxes | | 24,942 | | | 14,022 | | | 55,028 | | | 4,856 | |

| (Provision) benefit for income taxes | | (9,671) | | | (3,858) | | | (17,233) | | | 2,382 | |

| Net income | | $ | 15,271 | | | $ | 10,164 | | | $ | 37,795 | | | $ | 7,238 | |

| Net income per share: | | | | | | | | |

| Basic | | $ | 0.09 | | | $ | 0.06 | | | $ | 0.23 | | | $ | 0.05 | |

| Diluted | | $ | 0.09 | | | $ | 0.06 | | | $ | 0.23 | | | $ | 0.04 | |

| Weighted average shares outstanding: | | | | | | | | |

| Basic | | 162,643,523 | | | 158,243,619 | | | 161,060,227 | | | 156,272,335 | |

| Diluted | | 166,541,025 | | | 163,060,805 | | | 165,465,836 | | | 161,723,131 | |

| Other comprehensive income: | | | | | | | | |

| Foreign currency translation adjustments | | (2,390) | | | 2,772 | | | (2,750) | | | 1,983 | |

| Total comprehensive income | | $ | 12,881 | | | $ | 12,936 | | | $ | 35,045 | | | $ | 9,221 | |

INTEGRAL AD SCIENCE HOLDING CORP.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common Stock | | | | | | | | |

| (IN THOUSANDS, EXCEPT SHARES DATA) | | Shares | | Amount | | Additional

paid-in

capital | | Accumulated other comprehensive loss | | Retained earnings (accumulated deficit) | | Total stockholders' equity |

| Balance at December 31, 2021 | | 154,398,495 | | | $ | 154 | | | $ | 781,951 | | | $ | (315) | | | $ | (14,600) | | | $ | 767,190 | |

| RSUs vested | | 1,084,966 | | | 1 | | | — | | | — | | | — | | | 1 | |

| Option exercises | | 1,586,728 | | | 2 | | | 7,153 | | | — | | | — | | | 7,155 | |

| Stock-based compensation | | — | | | — | | | 44,733 | | | — | | | — | | | 44,733 | |

| Foreign currency translation adjustment | | — | | | — | | | — | | | (2,584) | | | — | | | (2,584) | |

| Repurchase of common stock | | (3,080,061) | | | (3) | | | (23,652) | | | — | | | — | | | (23,655) | |

| Net income | | — | | | — | | | — | | | — | | | 15,373 | | | 15,373 | |

| Balance at December 31, 2022 | | 153,990,128 | | | $ | 154 | | | $ | 810,186 | | | $ | (2,899) | | | $ | 775 | | | $ | 808,216 | |

| RSUs and MSUs vested | | 3,492,130 | | | 4 | | | — | | | — | | | — | | | 4 | |

| Option exercises | | 1,001,793 | | | 1 | | | 7,988 | | | — | | | — | | | 7,989 | |

| ESPP purchase | | 273,569 | | | — | | | 2,306 | | | — | | | — | | | 2,306 | |

| Stock-based compensation | | — | | | — | | | 80,779 | | | — | | | — | | | 80,779 | |

| Foreign currency translation adjustment | | — | | | — | | | — | | | 1,983 | | | — | | | 1,983 | |

| Adoption of ASC 326, net of tax | | — | | | — | | | — | | | — | | | 941 | | | 941 | |

| Net income | | — | | | — | | | — | | | — | | | 7,238 | | | 7,238 | |

| Balance at December 31, 2023 | | 158,757,620 | | | $ | 159 | | | $ | 901,259 | | | $ | (916) | | | $ | 8,954 | | | $ | 909,456 | |

| RSUs and MSUs vested | | 3,723,743 | | | 4 | | | — | | | — | | | — | | | 4 | |

| Option exercises | | 64,049 | | | — | | | 409 | | | — | | | — | | | 409 | |

| ESPP purchase | | 325,854 | | | — | | | 3,373 | | | — | | | — | | | 3,373 | |

| Stock-based compensation | | — | | | — | | | 59,724 | | | — | | | — | | | 59,724 | |

| Foreign currency translation adjustment | | — | | | — | | | — | | | (2,750) | | | — | | | (2,750) | |

| Net income | | — | | | — | | | — | | | — | | | 37,795 | | | 37,795 | |

| Balance at December 31, 2024 | | 162,871,266 | | | $ | 163 | | | $ | 964,765 | | | $ | (3,666) | | | $ | 46,749 | | | $ | 1,008,011 | |

INTEGRAL AD SCIENCE HOLDING CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | | | | | | |

| | Year ended December 31, |

| (IN THOUSANDS) | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 37,795 | | | $ | 7,238 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 63,966 | | | 54,966 | |

| Stock-based compensation | 59,762 | | | 81,103 | |

| Foreign currency loss (gain), net | 2,898 | | | (484) | |

| Deferred tax benefit | (16,417) | | | (21,531) | |

| Amortization of debt issuance costs | 464 | | | 463 | |

| Allowance for credit losses | 21 | | | 3,816 | |

| Impairment of assets | 170 | | | 33 | |

| Changes in operating assets and liabilities: | | | |

| Increase in accounts receivable | (6,223) | | | (8,148) | |

| Increase in unbilled receivables | (7,369) | | | (4,685) | |

| (Increase) decrease in prepaid expenses and other current assets | (18,722) | | | 6,418 | |

| Increase in operating leases, net | (1,561) | | | (29) | |

| (Increase) decrease in other long-term assets | (1,785) | | | 375 | |

| Increase in accounts payable and accrued expenses and other long-term liabilities | 4,654 | | | 11,478 | |

| Increase in deferred revenue | 383 | | | 582 | |

| (Decrease) increase in due to/from related party | (138) | | | 28 | |

| Net cash provided by operating activities | 117,898 | | | 131,623 | |

| Cash flows from investing activities: | | | |

| Payment for acquisitions, net of acquired cash | — | | | (966) | |

| Purchase of property and equipment | (1,784) | | | (1,975) | |

| Acquisition and development of internal use software and other | (38,760) | | | (31,777) | |

| Net cash used in investing activities | (40,544) | | | (34,718) | |

| Cash flows from financing activities: | | | |

| Repayment of long-term debt | (120,000) | | | (145,000) | |

| Proceeds from the Revolver | — | | | 75,000 | |

| Proceeds from exercise of stock options | 409 | | | 7,989 | |

| Cash received from Employee Stock Purchase Program (ESPP) | 3,213 | | | 3,160 | |

| Net cash used in financing activities | (116,378) | | | (58,851) | |

| Net (decrease) increase in cash, cash equivalents, and restricted cash | (39,024) | | | 38,054 | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (931) | | | (435) | |

| Cash, cash equivalents, and restricted cash, at beginning of year | 127,290 | | | 89,671 | |

| Cash, cash equivalents, and restricted cash, at end of year | $ | 87,335 | | | $ | 127,290 | |

| Supplemental Disclosures: | | | |

| Net cash paid during the year for: | | | |

| Interest | $ | 4,901 | | | $ | 11,229 | |

| Taxes | $ | 34,800 | | | $ | 10,985 | |

| Non-cash investing and financing activities: | | | |

| Property and equipment acquired included in accounts payable | $ | 324 | | | $ | 431 | |

| Internal use software acquired included in accounts payable | $ | 816 | | | $ | 1,444 | |

| Lease liabilities arising from right-of-use assets | $ | 6,030 | | | $ | 6,282 | |

Supplemental Disclosure Regarding Non-GAAP Financial Information

We use supplemental measures of our performance, which are derived from our consolidated financial information, but which are not presented in our consolidated financial statements prepared in accordance with GAAP. Adjusted EBITDA is the primary financial performance measure used by management to evaluate our business and monitor ongoing results of operations. Adjusted EBITDA is defined as income/loss before depreciation and amortization, stock-based compensation, interest expense, income taxes, restructuring and severance costs, acquisition and integration costs, foreign exchange gains and losses, and other one-time, non-recurring costs. Adjusted EBITDA margin represents the adjusted EBITDA for the applicable period divided by the revenue for that period presented in accordance with GAAP.

We use non-GAAP financial measures to supplement financial information presented on a GAAP basis. We believe that excluding certain items from our GAAP results allows management to better understand our consolidated financial performance from period to period and better project our future consolidated financial performance as forecasts are developed at a level of detail different from that used to prepare GAAP-based financial measures. Moreover, we believe these non-GAAP financial measures provide our shareholders with useful information to help them evaluate our operating results by facilitating an enhanced understanding of our operating performance and enabling them to make more meaningful period-to-period comparisons. Although we believe these measures are useful to investors and analysts for the same reasons they are useful to management, these measures are not a substitute for, or superior to, U.S. GAAP financial measures or disclosures. Our non-GAAP financial measures may not be comparable to similarly titled measures of other companies. Other companies, including companies in our industry, may calculate non-GAAP financial measures differently than we do, limiting the usefulness of those measures for comparative purposes.

Reconciliation of historical adjusted EBITDA and corresponding margin to their most directly comparable GAAP financial measures, net income/loss and corresponding margin are presented below. We encourage you to review the reconciliations in conjunction with the presentation of the non-GAAP financial measures for each of the periods presented. In future fiscal periods, we may exclude such items and may incur income and expenses similar to these excluded items.

Reconciliation of Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended

December 31, | | Year ended

December 31, |

| (IN THOUSANDS, EXCEPT PERCENTAGES) | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | | $ | 15,271 | | $ | 10,164 | | $ | 37,795 | | $ | 7,238 |

| Depreciation and amortization | | 16,934 | | 14,593 | | 63,966 | | 54,966 |

| Stock-based compensation | | 12,577 | | 15,462 | | 59,762 | | 81,103 |

| Interest expense, net | | 571 | | 2,489 | | 5,358 | | 12,236 |

| Provision (benefit) for income taxes | | 9,671 | | 3,858 | | 17,233 | | (2,382) |

| Acquisition, restructuring and integration costs | | 1,543 | | 1,054 | | 3,008 | | 4,028 |

| Foreign exchange loss (gain), net | | 4,650 | | (501) | | 3,927 | | 430 |

| Asset impairments and other costs | | 133 | | 396 | | 223 | | 1,913 |

| Adjusted EBITDA | | $ | 61,350 | | $ | 47,515 | | $ | 191,272 | | $ | 159,532 |

| Revenue | | $ | 153,038 | | $ | 134,295 | | $ | 530,101 | | $ | 474,369 |

| Net income margin | | 10% | | 8% | | 7% | | 2% |

| Adjusted EBITDA margin | | 40% | | 35% | | 36% | | 34% |

Stock-Based Compensation

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | Year ended

December 31, |

| (IN THOUSANDS) | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenue | $ | 82 | | | $ | 124 | | | $ | 368 | | | $ | 452 | |

| Sales and marketing | 3,780 | | | 5,512 | | | 17,782 | | | 23,371 | |

| Technology and development | 5,059 | | | 4,104 | | | 19,198 | | | 17,538 | |

| General and administrative | 3,656 | | | 5,722 | | | 22,414 | | | 39,742 | |

| Total stock-based compensation | $ | 12,577 | | | $ | 15,462 | | | $ | 59,762 | | | $ | 81,103 | |

Conference Call and Webcast Information

IAS will host a conference call and live webcast to discuss its fourth quarter and full year 2024 financial results today at 8:30 a.m. ET. To access the live webcast and conference call dial-in, please register under the "News & Events" section of IAS's investor relations website. A replay will be available on IAS’s investor relations website following the live call: https://investors.integralads.com.

About Integral Ad Science

Integral Ad Science (IAS) is a leading global media measurement and optimization platform that delivers the industry's most actionable data to drive superior results for the world's largest advertisers, publishers, and media platforms. IAS's software provides comprehensive and enriched data that ensures ads are seen by real people in safe and suitable environments while improving return on ad spend for advertisers and yield for publishers. Our mission is to be the global benchmark for trust and transparency in digital media quality. For more information, visit integralads.com.

Forward-Looking Statements

This earnings press release contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this press release are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, all statements we make relating to our estimated and projected costs, expenditures, cash flows, growth rates and financial results or our plans and objectives for future operations, growth initiatives, strategies, client wins, or market penetration are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including: (i) factors that affect the amount of advertising spending, such as economic downturns, instability in geopolitical or market conditions, and changes in tax treatment of advertising expenses; (ii) our failure to innovate or make the right investment decisions; (iii) our ability to provide digital or cross-platform analytics; (iv) our ability to sustain our profitability and revenue growth rate, particularly if our revenue growth continues to decline; (v) issues with the development and use of artificial intelligence and machine learning; (vi) our failure to maintain or achieve industry accreditation standards; (vii) our dependence on integrations with advertising platforms, demand side providers (“DSPs”), proprietary platforms, and ad servers that we do not control; (viii) our ability to maintain high impression volumes; (ix) our ability to compete successfully with our current or future competitors in an intensely competitive market; (x) our international expansion; (xi) our ability to expand into new channels; (xii) risks that our customers do not pay or choose to dispute their invoices; (xiii) risks of material changes to revenue share agreements with certain DSPs; (xiv) our dependence on the overall demand for advertising; (xv) our ability to effectively manage our growth; (xvi) the impact that any acquisitions we have completed in the past and may consummate in the future, strategic investments, or alliances may have on our business, financial condition, and results of operations; (xvii) our ability to successfully execute our international plans; (xviii) the risks associated with the seasonality of our market; (xix) the difficulty in evaluating our future prospects given our short operating history; (xx) uncertainty in how the market for buying digital advertising verification solutions will evolve; (xxi) interruption by man-made problems such as terrorism, computer viruses, or social disruptions; (xxii) the risk of failures in the systems and infrastructure supporting our solutions and operations; (xxiii) our ability to avoid operational, technical, and performance issues with our platform; (xxiv) risks associated with any unauthorized access to user, customer, or inventory and third-party provider data; (xxv) our ability to provide the non-proprietary technology, software, products, and services that we use; (xxvi) the risk that we are sued by third parties for alleged infringement, misappropriation, or other violation of their proprietary rights; (xxvii) our ability to obtain, maintain, protect, or enforce intellectual property and proprietary rights that are important to our business; (xxviii) our involvement in lawsuits to protect or enforce our intellectual

property; (xxix) risks that our employees, consultants, or advisors have wrongfully used or disclosed alleged trade secrets of their current or former employers; (xxx) risks that our trademarks and trade names are not adequately protected; (xxxi) the impact of unforeseen changes to privacy and data protection laws and regulation on digital advertising; (xxxii) our ability to maintain our corporate culture; (xxxiii) risks posed by earthquakes, fires, floods, public health crises, and other natural catastrophic events; (xxxiv) the risk that a perceived failure to comply with laws and industry self-regulation may damage our reputation; and (xxxv) other factors disclosed in our filings with the SEC. Given these factors, as well as other variables that may affect our operating results, you should not rely on forward-looking statements, assume that past financial performance will be a reliable indicator of future performance, or use historical trends to anticipate results or trends in future periods.

We derive many of our forward-looking statements from our operating budgets and forecasts, which are based on many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. The forward-looking statements included in this press release are made only as of the date hereof. We undertake no obligation to update or revise any forward- looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Investor Contact:

Jonathan Schaffer

ir@integralads.com

Media Contact:

press@integralads.com

v3.25.0.1

Cover

|

Feb. 28, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 28, 2025

|

| Entity Registrant Name |

INTEGRAL AD SCIENCE HOLDING CORP.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40557

|

| Entity Tax Identification Number |

83-0731995

|

| City Area Code |

646

|

| Local Phone Number |

278-4871

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.001

|

| Trading Symbol |

IAS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Address, Address Line One |

12 E 49th Street,

|

| Entity Address, Address Line Two |

20th Floor

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001842718

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

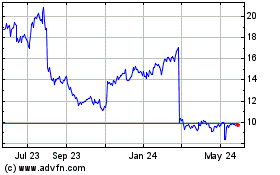

Intergral Ad Science (NASDAQ:IAS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Intergral Ad Science (NASDAQ:IAS)

Historical Stock Chart

From Mar 2024 to Mar 2025