0001045742DEF 14Afalseiso4217:USD00010457422022-10-012023-09-3000010457422021-10-012022-09-3000010457422020-10-012021-09-300001045742live:ReductionForAmountsPaidForLifeInsurancePremiumsMemberecd:PeoMember2022-10-012023-09-300001045742ecd:EqtyAwrdsAdjsMemberecd:PeoMember2022-10-012023-09-300001045742live:ReductionForAmountsPaidForLifeInsurancePremiumsMemberecd:PeoMember2021-10-012022-09-300001045742live:ReductionForAmountsPaidForLifeInsurancePremiumsMemberecd:PeoMember2020-10-012021-09-300001045742ecd:EqtyAwrdsAdjsMemberecd:PeoMember2020-10-012021-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material Pursuant to §240.14a-12 |

Live Ventures Incorporated

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| x | No fee required |

| |

| o | Fee paid previously with preliminary materials |

| |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

LIVE VENTURES INCORPORATED

325 E. Warm Springs Road, Suite 102

Las Vegas, Nevada 89119

(702) 997-5968

NOTICE OF 2024 ANNUAL MEETING

OF STOCKHOLDERS

_______________________

Las Vegas, Nevada

May 23, 2024

Dear Stockholder,

The 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Live Ventures Incorporated (the “Company”), a Nevada corporation, will be held on Thursday, June 27, 2024, at 10:00 a.m., Pacific Daylight Time, at our principal executive offices located at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119 for the following purposes:

1.To elect five directors to our Board of Directors.

2.To ratify the appointment of Frazier & Deeter, LLC as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2024.

3.To transact such other business as may properly come before the meeting and any adjournments thereof.

The Company's Board of Directors has fixed the close of business on May 10, 2024 as the record date for the Annual Meeting. Only the holders of record of the Company’s common stock as of the close of business on the record date are entitled to receive notice of, and to vote at, the Annual Meeting and any adjournment thereof. We have also enclosed with this notice (i) our Annual Report on Form 10-K for the fiscal year ended September 30, 2023 and (ii) a Proxy Statement.

Whether you own a few shares or many, and whether or not you plan to attend the Annual Meeting in person, it is important that your shares be represented and voted. You may vote your shares on the Internet, by telephone, by completing, signing, and promptly returning a proxy card, or by voting in person at the Annual Meeting. Voting online, by telephone, or by returning your proxy card does not deprive you of your right to attend the Annual Meeting.

| | | | | |

| By Order of the Board of Directors, |

| |

| |

| Jon Isaac |

| President and Chief Executive Officer |

The Proxy Statement is dated May 23, 2024 and is first being made available to stockholders on or about May 23, 2024.

All stockholders are cordially invited to attend the Annual Meeting. Even if you have given your proxy, you may still attend the Annual Meeting and elect to revoke your proxy.

PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK, OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE ANNUAL MEETING, YOU WILL NOT BE PERMITTED TO VOTE IN PERSON AT THE ANNUAL MEETING UNLESS YOU FIRST OBTAIN A PROXY ISSUED IN YOUR NAME FROM THE RECORD HOLDER.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on June 27, 2024. This Notice of 2024 Annual Meeting of Stockholders and Proxy Statement and the 2023 Annual Report on Form 10-K are available on our website at https://ir.liveventures.com/all-sec-filings. Except as stated otherwise, information on our website is not considered part of this Proxy Statement.

LIVE VENTURES INCORPORATED

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 27, 2024

PROXY STATEMENT

_______________________

This Proxy Statement relates to the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Live Ventures Incorporated (“Live Ventures” or the “Company”). The Annual Meeting will be held on Thursday, June 27, 2024 at 10:00 a.m. Pacific Daylight Time, at our corporate offices located at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119, or at such other time and place to which the Annual Meeting may be adjourned or postponed. The enclosed proxy is solicited by Live Ventures’ Board of Directors (the “Board”). The proxy materials relating to the Annual Meeting are first being mailed to stockholders entitled to vote at the Annual Meeting on or about May 30, 2024.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Q:What is the purpose of the Annual Meeting?

A:At the Annual Meeting, holders of shares of the Company’s common stock will act upon the matters outlined in the accompanying Notice of 2024 Annual Meeting of Stockholders and this Proxy Statement, including (i) the election of five directors to the Board; and (ii) the ratification of the Audit Committee’s appointment of Frazier & Deeter, LLC (“Frazier & Deeter”) as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2024.

Q:What are the Board’s recommendations?

A:The Board recommends a vote:

•FOR the election of the nominated slate of directors; and

•FOR the ratification of the Audit Committee’s appointment of Frazier & Deeter as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2024.

With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

Q:Who is entitled to attend and vote at the Annual Meeting?

A:Only holders of shares of the Company’s common stock at the close of business on the record date, May 10, 2024, or their duly appointed proxies, are entitled to receive notice of the Annual Meeting, attend the Annual Meeting, and vote the shares that they held on that date at the Annual Meeting or any postponement or adjournment of the Annual Meeting. At the close of business on May 10, 2024, the record date, there were issued, outstanding, and entitled to vote 3,144,028 shares of the Company’s common stock, par value $0.001 per share, each of which is entitled to one vote.

Q:How do I vote my shares if they are registered directly in my name?

A:We offer four methods for you to vote your shares at the Annual Meeting. While we offer four methods (including in-person voting), we encourage you to vote through the Internet or by telephone, as they are the most cost-effective methods for the Company. We also recommend that you vote as soon as possible, even if you are planning to attend the Annual Meeting, so that the vote count will not be delayed. Both the Internet and the telephone provide convenient, cost-effective alternatives to returning your proxy card by mail. There is no charge to vote your shares via the Internet, though you may incur costs associated with electronic access, such as usage charges from Internet access providers. If you choose to vote your shares through the Internet or by telephone, there is no need for you to mail your proxy card. You may (i) vote in person at the Annual Meeting; or (ii) authorize the persons named as proxies on the enclosed proxy card, Jon Isaac and David Verret, to vote your shares by returning the enclosed proxy card by mail or authorizing such persons through the Internet or by telephone.

•To vote by proxy on the Internet, go to www.proxyvote.com to complete an electronic proxy card.

•To vote by proxy by telephone, dial the toll-free number listed on your proxy card using a touch-tone telephone and follow the recorded instructions.

•To vote by proxy using a mailing card (if you received a printed copy of these proxy materials by mail), complete, sign, and date the enclosed proxy card and return it promptly in the envelope provided.

Q:How do I vote my shares if they are held in the name of my broker (street name)?

A:If your shares of the Company’s common stock are held by your broker, bank, or other nominee, or its agent (“Broker”) in “street name,” you will receive a voting instruction form from your Broker asking you how your shares should be voted. You should contact your Broker with questions about how to provide or revoke your instructions. If you hold your shares in “street name” and do not provide specific voting instructions to your Broker, a “broker non-vote” will result with respect to Proposal No. 1. Therefore, it is very important to respond to your Broker’s request for voting instructions on a timely basis if you want your shares held in “street name” to be represented and voted at the Annual Meeting. Please see below for additional information if you hold your shares in “street name” and desire to attend the Annual Meeting and vote your shares in person.

Q:What if I vote and then change my mind?

A:If you are a stockholder of record, you may revoke your proxy at any time before it is exercised by either (i) filing with our Corporate Secretary a notice of revocation, (ii) sending in another duly executed proxy bearing a later date, or (iii) attending the Annual Meeting and casting your vote in person. Your last vote will be the vote that is counted. If you hold your shares in “street name,” refer to the voting instruction form provided by your Broker for more information about what to do if you submit voting instructions and then change your mind and need to revoke your vote in advance of the Annual Meeting.

Q:How can I get more information about attending the Annual Meeting and voting in person?

A:The Annual Meeting will be held on Thursday, June 27, 2024 at 10:00 a.m. Pacific Daylight Time, at our principal executive offices located at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119, or at such other time and place to which the Annual Meeting may be adjourned or postponed. For additional details about the Annual Meeting, including directions to the Annual Meeting and information about how you may vote in person if you so desire, please contact Live Ventures at (702) 997-5968. If you hold your shares in “street name,” please bring an account statement or letter from the applicable Broker, indicating that you are the beneficial owner of the shares as of the record date if you would like to gain admission to the Annual Meeting. In addition, if you hold your shares in “street name” and desire to vote your shares in person at the Annual Meeting, you must obtain a valid proxy from your Broker. For more information about obtaining such a proxy, contact your Broker.

Q:What constitutes a quorum?

A:The presence at the Annual Meeting, in person or by proxy, of the holders of not less than a majority of the shares entitled to vote at the Annual Meeting (as of the record date), will constitute a quorum, permitting us to conduct our business at the Annual Meeting. Proxies received but marked as abstentions will be included in the calculation of the number of shares considered to be present at the Annual Meeting for purposes of determining whether a quorum is present. Broker non-votes will also be counted for purposes of determining whether a quorum is present.

Q:What vote is required to approve each item?

A:Election of Directors. Election of a director requires the affirmative vote of the holders of a plurality of the shares for which votes are cast at a meeting at which a quorum is present. The five persons receiving the greatest number of votes will be elected as directors. Stockholders may not cumulate votes in the election of directors.

Ratification of Auditors. The ratification of the Audit Committee’s appointment of Frazier & Deeter as our independent registered public accounting firm for the fiscal year ending September 30, 2024 will be approved if the proposal receives the affirmative vote of the holders of a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote, in favor of the proposal.

Q:Are abstentions and broker non-votes counted in the vote totals?

A:A broker non-vote occurs when shares held by a Broker are not voted with respect to a particular proposal because the Broker does not have discretionary authority to vote on the matter and has not received voting instructions from its clients. If your Broker holds your shares in its name and you do not instruct your Broker how to vote, your Broker will only have discretion to vote your shares on “routine” matters. Where a proposal is not “routine,” a Broker who has not received any instructions from its clients does not have discretion to vote its clients’ uninstructed shares on that proposal. At our Annual Meeting, only Proposal No. 2 (ratifying the appointment of our independent registered public accounting firm) is considered a "routine matter." Your Broker will therefore not have discretion to vote on Proposal No. 1 (the election of directors) as this proposal is a “non-routine” matter. Broker non-votes and abstentions by stockholders from voting (including Brokers holding their clients’ shares of record who cause abstentions to be

recorded) will be counted towards determining whether or not a quorum is present. However, because the five director nominees receiving the affirmative vote of the holders of a plurality of the shares for which votes are cast will be elected, abstentions and broker non-votes will not affect the outcome of the election of directors. With regard to Proposal No. 2, this is considered to be a routine matter so there will be no broker non-votes, but abstentions will have the effect of a vote against Proposal No. 2.

Q:Can I dissent or exercise rights of appraisal?

A:Under Nevada law, holders of the Company’s common stock are not entitled to dissenters’ rights in connection with any of the proposals to be presented at the Annual Meeting or to demand appraisal of their shares as a result of the approval of any of the proposals.

Q:Who pays for this proxy solicitation?

A:The Company will bear the entire cost of this proxy solicitation, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy card, and any additional solicitation materials furnished to the stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others so that they may forward the solicitation material to such beneficial owners.

Q:Where can I access this Proxy Statement and the related materials online?

A:The Proxy Statement and our Annual Report on Form 10-K are both available at www.proxyvote.com.

CORPORATE GOVERNANCE

In accordance with the Nevada Revised Statutes, the Company’s Articles of Incorporation (the “Articles”) and Bylaws, the Company’s business, property, and affairs are managed under the direction of the Board. Although the Company’s non-employee directors are not involved in day-to-day operations, they are kept informed of the Company’s business through written financial and operations reports and other documents provided to them from time to time by management, as well as by operating, financial, and other reports presented by management in preparation for, and at meetings of, the Board and the three standing committees of the Board.

We have adopted a Code of Business Conduct and Ethics that applies to all directors, officers, and employees of our Company, including the Chief Executive Officer and other principal financial and operating officers of the Company. The Code of Business Conduct and Ethics is posted on our website at ir.liveventures.com/governance-docs. Please note that information on our website is not incorporated by reference into this Proxy Statement and should not be considered part of this document. If we make any amendment to, or grant any waivers of, a provision of the Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer, or controller where such amendment or waiver is required to be disclosed under applicable Securities and Exchange Commission (the “SEC”) rules, we intend to disclose such amendment or waiver and the reasons therefore on Form 8-K or on our website. We have also adopted a Policy on Hedging that applies to all directors, officers, and employees of our Company, which prohibits the purchase of any financial instruments or engaging in transactions designed to mitigate, off-set, or avoid the risks associated with a decrease in the market value of the Company’s securities granted or awarded to directors, officers, and employees as compensation.

Independence.

The Company is required by Nasdaq listing standards to have a majority of independent directors. Each year, the Board reviews the relationships that each director has with the Company and with other parties to determine whether each director qualifies as an “independent director” under Nasdaq listing standards and applicable rules of the SEC. Only those directors who do not have any of the categorical relationships that preclude them from being independent within the meaning of applicable Nasdaq Listing Rules and whom the Board affirmatively determines have no relationships that would interfere with the exercise of independent judgment in fulfilling the responsibilities of a director are considered to be independent directors. The Board reviewed a number of factors to evaluate the independence of each of its members. These factors include its members’ current and historic relationships with the Company and its competitors, suppliers, and customers; their relationships with management and other directors; the relationships their current and former employers have with the Company; and the relationships between the Company and other companies of which a member of the Company’s Board of Directors is a director or executive officer.

The Board determined that for the fiscal year ended September 30, 2023, a majority of its members, namely Messrs. Butler, Gao, and Sickmeyer, did not have any relationships that would interfere with the exercise of independent judgment in carrying out their responsibilities as directors and that each such director was an independent director of the Company within the meaning of Nasdaq Listing Rule 5605(a)(2) and the related rules of the SEC. On November 8, 2022, the Company commenced its compensation to Fidelitas Development, of which Mr. Sickmeyer is the sole owner and Chief Executive Officer, for certain marketing consulting services that it provided to the Company. On February 22, 2023, Fidelitas Development received its final compensation for those services for an aggregate amount of approximately $22,000. While the services provided by Fidelitas Development did not impact Mr. Sickmeyer’s status as an independent director with in the meaning of Nasdaq Listing Rule 5605(a)(2), the Board determined that Mr. Sickmeyer was not considered independent solely for purposes of his service on the Audit Committee within the definitions of Nasdaq Listing Rule 5605(c)(2)(A)(ii) and Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) during the approximate three and one-half-month compensation period. During that period, the Audit Committee took unanimous action and the Board believes that Mr. Sickmeyer’s service on the Audit Committee was in the best interests of the Company and its stockholders.

Meetings of the Board of Directors.

The Board met three times during the fiscal year ended September 30, 2023. None of our directors attended fewer than 75% of the meetings of the Board or of any committee on which the director served during the completed fiscal year and held during the director’s service on the Board. The Board does not have a formal policy regarding director attendance at the Company’s annual meeting of stockholders, but all directors are encouraged to attend. A majority of the director nominees who were standing for re-election at our 2023 Annual Meeting attended that meeting, either in person or via teleconference.

Risk Oversight.

The Board has oversight responsibility for the processes established to report and monitor material risks applicable to the Company. The Board also oversees the appropriate allocation of responsibility for risk oversight among the committees of the Board. The Audit Committee plays a central role in overseeing the integrity of the Company’s financial statements and reviewing and approving the performance of the Company’s internal audit function and independent accountants. The Governance and Nominating Committee is responsible for oversight of risks related to the corporate governance policies of the Company, and Board independence, composition, and succession planning. The Compensation Committee monitors the design and administration of the Company’s compensation programs to ensure that they incentivize strong individual and group performance and include appropriate safeguards to avoid unintended or excessive risk taking by Company officers and employees.

Committees of the Board of Directors.

The three standing committees of the Board are:

•Audit

•Compensation

•Governance and Nominating

Committee membership shown below is as of May 23, 2024.

| | | | | | | | | | | |

| Audit Committee | Compensation Committee | Governance and

Nominating Committee |

| Richard D. Butler, Jr. | | | |

| Dennis (De) Gao | | | |

| Tyler Sickmeyer | | | |

| | | | | | | | | | | | | | |

| Member | | Chair | | Financial Expert |

| | | | |

Audit Committee. The purpose of our Audit Committee is to assist the Board in overseeing (i) the integrity of our Company’s accounting and financial reporting processes, the audits of our financial statements, as well as our systems of internal controls regarding finance, accounting, and legal compliance, (ii) our Company’s compliance with legal and regulatory requirements, (iii) the qualifications, independence, and performance of our independent public accountants, and (iv) our Company’s financial risk. In carrying out this purpose, the Audit Committee maintains and facilitates free and open communication between the Board, the independent public accountants, and our management. During the fiscal year ended September 30, 2023, Messrs. Gao (Chair), Butler, and Sickmeyer served on our Audit Committee. During the fiscal year ended September 30, 2023, each member of the committee satisfied the independence standards specified in Rule 5605(a)(2) of the Nasdaq Listing Rules, however, as discussed in greater detail under the section titled "Independence," the Board determined that Mr. Sickmeyer was not considered independent solely for purposes of his service on the Audit Committee within the definitions of Nasdaq Listing Rule 5605(c)(2)(A)(ii) and Exchange Act Rule 10A-3(b)(1) during an approximate three and one-half-month period in fiscal year 2023. During the fiscal year ended September 30, 2023, each member of the committee was determined by the Board to be “financially literate” with accounting or related financial management experience. The Board has also determined that Mr. Gao is an “audit committee financial expert” as defined under SEC rules and regulations and qualifies as a financially sophisticated audit committee member as required under Rule 5605(c)(2)(A) of the Nasdaq Listing Rules. The Board has adopted a charter for the Audit Committee, a copy of which is posted on our website at ir.liveventures.com/governance-docs. The Audit Committee met five times during the fiscal year ended September 30, 2023.

Compensation Committee. The purpose of the Compensation Committee is to (i) discharge the Board’s responsibilities relating to compensation of the Company’s directors and executives, (ii) produce an annual report on executive compensation for inclusion in the Company’s proxy statement, if necessary, and (iii) oversee and advise the Board on the adoption of policies that govern the Company’s compensation programs, including stock and benefit plans. During the fiscal year ended September 30, 2023, Messrs. Butler (Chair), Gao, and Sickmeyer served on the Compensation Committee. During the fiscal year ended September 30, 2023, each member of the committee satisfied the independence

standards specified in Rule 5605(a)(2) of the Nasdaq Listing Rules and the related rules of the SEC. In addition, each of the current members of the Compensation Committee is a “non-employee director” as such term is defined under Rule 16b-3 of the Exchange Act and an “outside director” for as such term is defined for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). The Board has adopted a charter for the Compensation Committee, a copy of which is posted on our website at ir.liveventures.com/governance-docs. The Compensation Committee met twice during the fiscal year ended September 30, 2023.

Governance and Nominating Committee. The purpose of the Governance and Nominating Committee is to (i) identify individuals who are qualified to become members of the Board, consistent with criteria approved by the Board, and to select, or to recommend that the Board select, the director nominees for the next annual meeting of stockholders or to fill vacancies on the Board, (ii) develop and recommend to the Board a set of corporate governance principles applicable to our Company, and (iii) oversee the evaluation of the Board. During the fiscal year ended September 30, 2023, Messrs. Butler (Chair), Gao, and Sickmeyer served on the Governance and Nominating Committee. During the fiscal year ended September 30, 2023, each member of the committee satisfied the independence standards specified in Rule 5605(a)(2) of the Nasdaq Listing Rules and the related rules of the SEC. The Board has adopted a charter for the Governance and Nominating Committee, a copy of which is posted on our website at ir.liveventures.com/governance-docs. The Governance and Nominating Committee met twice during the fiscal year ended September 30, 2023.

The Governance and Nominating Committee is charged with establishing and periodically reviewing the criteria and qualifications for Board membership and the selection of candidates to serve as directors of our Company. In determining whether to nominate a candidate for director, the Governance and Nominating Committee considers the following criteria, among others:

•the candidate’s integrity and ethical character;

•the candidate’s expertise, business and industry experience, judgement, diversity, age, and length of service;

•whether the candidate is “independent” under applicable SEC rules and regulations;

•whether the candidate has any conflicts of interest that would materially impair his or her ability to exercise independent judgment as a member of the Board or otherwise discharge the fiduciary duties owed by a director to Live Ventures and our stockholders; and

•the candidate’s ability to represent all of our stockholders without favoring any particular stockholder group or other constituency of Live Ventures.

The Governance and Nominating Committee has the authority to retain a search firm to identify director candidates and to approve any fees and retention terms of the search firm’s engagement, although it has not recently engaged such a firm.

Although the Governance and Nominating committee has not specified any minimum criteria or qualifications that each director must meet, it conducts its nominating process in a manner designed to ensure that the Board continues to meet applicable requirements under SEC and Nasdaq rules (including, without limitation, as they relate to the composition of the Audit Committee).

The Governance and Nominating Committee will consider director candidates recommended by our stockholders under criteria similar to those used to evaluate candidates nominated by the committee (including those listed above). In considering the potential candidacy of persons recommended by stockholders, however, the committee may also consider the size, duration, and pecuniary interest of the recommending stockholder (or group of stockholders) in our common stock.

The Board believes that the continuing service of qualified incumbent directors promotes stability and continuity in the boardroom, giving our Company the benefit of the familiarity and insight into our Company’s affairs that its directors have accumulated during their tenure, while contributing to the Board’s ability to work as a collective body. Accordingly, the process of the Governance and Nominating Committee for identifying nominees reflects the practice of re-nominating incumbent directors who continue to satisfy the committee’s criteria for membership on the Board, who it believes will continue to make important contributions to the Board, and who consent to continue their service on the Board.

Board Leadership Structure.

Jon Isaac, our President and Chief Executive Officer, also serves as Chairman of the Board. Currently, the Board does not have a Lead Independent Director. Although the Board assesses the appropriate leadership structure from time to time in light of internal and external events or developments and reserves the right to make changes in the future, it believes that the current structure, as described in this Proxy Statement, is appropriate at this time given the size and experience of the

Board, as well as the background and experience of management. The Board does not believe that having the President and Chief Executive Office serve as Chairman of the Board materially impacts its process for risk oversight because Board committees (comprised entirely of independent directors during the fiscal year ended September 30, 2023, subject to the additional disclosure included under the section "Independence") play the central role in risk oversight.

RELATED PARTY TRANSACTIONS

Transactions with Isaac Capital Group, LLC

As of May 10, 2024, Isaac Capital Group, LLC (“ICG”) beneficially owned 49.1% of the Company’s issued and outstanding capital stock. Jon Isaac, the Company’s President and Chief Executive Officer, is the President and sole member of ICG, and, accordingly, has sole voting and dispositive power with respect to these shares. Mr. Isaac also personally owns 219,177 shares of common stock and holds options to purchase up to 25,000 shares of common stock at an exercise price of $10.00 per share, all of which are currently exercisable. Mr. Isaac's options expire on January 15, 2025.

ICG Term Loan

During 2015, Marquis Industries, Inc. ("Marquis") entered into a mezzanine loan in the amount of up to $7.0 million (the “ICF Loan”) with Isaac Capital Fund I, LLC (“ICF”), a private lender whose managing member is Jon Isaac. On July 10, 2020, (i) ICF released and discharged Marquis from all obligations under the loan, (ii) ICF assigned all of its rights and obligations under the instruments, documents, and agreements with respect to the ICF Loan to ICG, of which Jon Isaac, the Company’s President and Chief Executive Officer, is the sole member, and (iii) Live Ventures borrowed $2.0 million (the “ICG Loan”) from ICG. The ICG Loan bears interest at 12.5% and matures in May 2025. As of March 31, 2024 and September 30, 2023, the outstanding balance on this note was $2.0 million

ICG Revolving Promissory Note

On April 9, 2020, the Company, as borrower, entered into an unsecured revolving line of credit promissory note whereby ICG agreed to provide the Company with a $1.0 million revolving credit facility (the “ICG Revolver”). On June 23, 2022, as approved by unanimous consent of the Board, the amount of available revolving credit under the facility was increased to $6.0 million. No other terms of the note were changed. On April 1, 2023, the Company entered into the Second Amendment of the ICG Revolver that extended the maturity date to April 8, 2024, increased the interest rate from 10% to 12% per annum, and decreased the amount of available revolving credit under the facility to $1.0 million. On January 11, 2024, the Company entered into the Third Amendment of the ICG Revolver that extended the maturity date to April 8, 2025 and increased the amount of available revolving credit under the facility to $5.0 million. As of March 31, 2024 and September 30, 2023, the outstanding balance on the ICG Revolver was $2.0 million and 1.0 million, respectively.

ICG Flooring Liquidators Note

On January 18, 2023, in connection with the acquisition of Flooring Liquidators, Inc. ("Flooring Liquidators"), Flooring Affiliated Holdings, LLC ("Flooring Affiliated Holdings"), a wholly owned subsidiary of the Company, as borrower, entered into a promissory note for the benefit of ICG in the amount of $5.0 million (the “ICG Flooring Liquidators Loan”). The ICG Flooring Liquidators Loan matures on January 18, 2028, and bears interest at 12%. Interest is payable in arrears on the last day of each calendar month. The note is fully guaranteed by the Company. As of March 31, 2024 and September 30, 2023, the outstanding balance on this loan was $5.0 million.

Transactions with Tony Isaac and JanOne Inc.

Tony Isaac, a member of the Board, and father of the Company's Chief Executive Officer, Jon Isaac, is the Chief Executive Officer and a director of JanOne Inc. (“JanOne”). Richard Butler, a member of the Company's board of directors, is a director of JanOne.

Consulting Fee

In December 2023, subsequent to the fiscal year ended September 30, 2023, the Board approved the grant of a consulting fee to Tony Isaac in the amount of $100,000, for services rendered to the Company throughout 2023. This consulting fee is in addition to the compensation that he receives as a member of the Board.

Lease Agreement

Customer Connexx LLC, formerly a subsidiary of JanOne, previously rented approximately 9,900 square feet of office space from the Company at its Las Vegas office, which totals 16,500 square feet. JanOne paid the Company $39,000 and $112,000 in rent and other reimbursed expenses for three months ended March 31, 2024 and 2023, respectively, and $75,000 and $256,000 for the six months ended March 31, 2024 and 2023, respectively.

Purchasing Agreement with ARCA Recycling

On April 5, 2022, the Company entered into a Purchasing Agreement with ARCA Recycling ("ARCA"), which was a wholly owned subsidiary of JanOne until March 2023. Pursuant to the agreement, the Company agreed to purchase inventory from time to time for ARCA as set forth in submitted purchase orders. The inventory is owned by the Company until ARCA installs it in customer's homes, and payment by ARCA to the Company is due upon ARCA's receipt of payment from the customer. All purchases made by the Company shall be paid back by ARCA in full plus an additional five percent surcharge or broker-type fee. As of March 31, 2024, the Company had a full allowance of approximately $690,000 recorded in the reserve for doubtful accounts for the amount due.

On February 7, 2024, the Company converted outstanding receivables from JanOne and amounts due under the Purchase Agreement with ARCA into a promissory note with JanOne. On March 6, 2024, the Company entered into a Note Sale Agreement (the “NSA”) with an unaffiliated third party under which the third party acquired the promissory note for approximately $700,000. The NSA requires payment of 50% of the amount due upon execution, and the balance due no later than three days following 60 days after the date of execution. On March 11, 2024, the Company received payment of approximately $350,000, which was recorded as other income. Additionally, the Company has accrued a receivable for the balance due, which was also recorded as other income. In connection with the execution of the NSA, the Company recognized a gain of approximately $0.6 million in the second quarter. On April 29, 2024, the Company received the balance due.

Transactions with Vintage Stock CEO

Rodney Spriggs, the President and Chief Executive Officer of Vintage Stock, Inc., a wholly owned subsidiary of the Company, is the sole member of Spriggs Investments, LLC (“Spriggs Investments”).

Spriggs Promissory Note I

On July 10, 2020, the Company executed a promissory note (the “Spriggs Promissory Note I”) in favor of Spriggs Investments that memorializes a loan by Spriggs Investments to the Company in the initial principal amount of $2.0 million (the “Spriggs Loan I”). The Spriggs Loan I originally matured on July 10, 2022; however, the maturity date was extended to July 10, 2023, pursuant to a unanimous written consent of the Board. The Spriggs Promissory Note I bears simple interest at a rate of 10.0% per annum. On January 19, 2023, the Company entered into a modification agreement of the Spriggs Loan I. Under the modification agreement, the Spriggs Promissory Note I will bear interest at a rate of 12% per annum, and the maturity date was extended to July 31, 2024. On February 29, 2024, the Company entered into a loan modification agreement of the Spriggs Loan I. Under the loan modification agreement, the Company was required to make a principal payment of $600,000 to Spriggs Investments within five business days following the effective date of the loan modification agreement, and make principal payments of not less than $300,000 each 90-day period thereafter, beginning on April 1, 2024, until the Spriggs Promissory Note I is fully repaid. Further, under the loan modification agreement, the maturity date of the Spriggs Promissory Note I was extended to July 31, 2025. All monthly payments under the original Spriggs Promissory Note I remain in effect through the maturity date as amended. As of March 31, 2024 and September 30, 2023, the principal amount owed was $1.4 million and $2.0 million, respectively.

Spriggs Promissory Note II

On January 19, 2023, in connection with the acquisition of Flooring Liquidators, the Company executed a promissory note in favor of Spriggs Investments in the initial principal amount of $1.0 million (the “Spriggs Loan II”). The Spriggs Loan II matures on July 31, 2024, and bears interest at a rate of 12% per annum. On February 29, 2024, the Company entered into a loan modification agreement of the Spriggs Loan II. Under the loan modification agreement, upon full principal repayment of the Spriggs Promissory Note I (see above), the Company will make principal payments of not less than $300,000, per each 90-day period, until the Spriggs Loan II is fully repaid. Further, under the loan modification agreement, the maturity date of the Spriggs Loan II was extended to July 31, 2025. All monthly payments under the original Spriggs Loan II remain in effect through the maturity date as amended. As of March 31, 2024 and September 30, 2023, the principal amount owed was $1.0 million.

Transactions with Spyglass Estate Planning, LLC

Jon Isaac, the Company's President and Chief Executive Officer, is the sole member of Spyglass Estate Planning, LLC (“Spyglass”).

Building Leases

On July 1, 2022, in connection with its acquisition of certain assets and intellectual property of Better Backers, Inc., Marquis a wholly owned subsidiary of the Company, entered into two building leases with Spyglass. The provisions of the lease agreements include an initial 24-month month-to-month rental period, during which the lessee may cancel with 90-day notice, followed by a 20-year lease term with two five-year renewal options. The initial monthly rent for each of the leases is $31,737 and $73,328, respectively, and each lease increases by 2.5% annually on each anniversary date of the effective date.

Transactions with Flooring Liquidators CEO

Stephen Kellogg is the Chief Executive Officer of Flooring Liquidators, a wholly owned subsidiary of the Company.

Flooring Liquidators leases five properties from K2L Property Management, and one from Railroad Investments, each of which Mr. Kellogg is a member. Additionally, Flooring Liquidators leases two properties from Stephen Kellogg and Kimberly Hendrick as a couple, and properties from each of The Stephen Kellogg and Kimberly Hendrick Trust, The Stephen Kellogg Trust, and Mr. Kellogg personally. Ms. Hendrick is Mr. Kellogg's spouse.

Sellers Notes

Note Payable to the Sellers of Kinetic

In connection with the purchase of The Kinetic Co., Inc. (“Kinetic”), on June 28, 2022, Precision Industries, Inc., a wholly owned subsidiary of the Company, entered into a seller financed loan in the amount of $3.0 million with the previous owners of Kinetic. The related note bears interest at 7.0% per annum, with interest payable quarterly in arrears and has a maturity date of September 27, 2027. As of March 31, 2024 and September 30, 2023, the remaining principal balance was $3.0 million.

Note Payable to the Seller of Flooring Liquidators

In connection with the purchase of Flooring Liquidators on January 18, 2023, Flooring Affiliated Holdings, a wholly owned subsidiary of the Company, entered into a seller financed mezzanine loan in the amount of $34.0 million with the previous owners of Flooring Liquidators. The Seller Subordinated Acquisition Note (“Sellers Note”) bears interest at 8.24% per annum, with interest payable monthly in arrears beginning on January 18, 2024. The Sellers Note has a maturity date of January 18, 2028. The fair value assigned to the Sellers Note, as calculated by an independent third-party firm, was $31.7 million, or a discount of $2.3 million from the aggregate principal amount of the Sellers Note. The $2.3 million discount is being accreted to interest expense, using the effective interest rate method, as required by accounting principles generally accepted in the United States of America, over the term of the Sellers Note. As of May 31, 2024 and September 30, 2023, the carrying value of the Sellers Note was approximately $34.9 million and $33.5 million, respectively.

Note Payable to the Seller of PMW

In connection with the purchase of Precision Metal Works, Inc. ("PMW"), on July 20, 2023, the Company entered into a consulting agreement with the previous owner of PMW to serve as part-time President and Chief Executive Officer. The consulting agreement commenced on the Effective Date and shall terminate upon the later of (i) Sellers’ receipt of earn-out payments in an aggregate amount equal to $3.0 million; and (ii) the full satisfaction and payment of all amounts due and to that are to become due under the seller note, unless earlier terminated in accordance with the terms set forth in the consulting agreement. Additionally, PMW entered into two seller financed loans, in the aggregate amount of $2.5 million, which are fully guaranteed by the Company. The seller financed loans bear interest at 8.0% per annum, with interest payable quarterly in arrears. The seller financed loans have a maturity date of July 18, 2028. As of March 31, 2024 and September 30, 2023, the carrying value of the seller financed loans was approximately $2.5 million.

Procedures for Approval of Related Party Transactions

In accordance with its charter, the Audit Committee reviews and determines whether to approve all related party transactions (as such term is defined for purposes of Item 404 of Regulation S-K). The Audit Committee participated in the review, approval, or ratification of the transactions described above.

Stockholder Communications with the Board.

Stockholders and others interested in communicating with the Board may do so by writing to Board of Directors, Live Ventures Incorporated, 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119.

EXECUTIVE OFFICERS

Set forth below is certain information regarding each of our current executive officers as of May 23, 2024, other than Jon Isaac, whose biographical information is presented under the “Nominees for Directors” section of this Proxy Statement.

| | | | | |

Weston Godfrey, Jr. 45 | Mr. Godfrey, beginning on June 1, 2023, has served as the Co-Chief Executive officer of Marquis Industries, Inc. (“Marquis”), and is responsible for managing its manufacturing operation, business operations, and overseeing all administrative functions. He previously served as its Chief Executive Officer, beginning on July 1, 2018 after re-joining the company as Executive Vice president on January 22, 2018. Mr. Godfrey served as sales Operations Manager and Senior Sales Manager for Samsung Electronics America, Inc. for three years prior to re-joining the company, where he was responsible for financial operations, forecasting, and sales in the home appliance business. Prior to joining Samsung Electronics America, Inc., Mr. Godfrey spent five years serving as Vice President of Operations for Marquis, reporting directly to the Chief Executive Officer and responsible for credit, claims, customer service, sales operations, supply chain, and purchasing. Early in his career, Mr. Godfrey worked for Dupont’s nylon fibers business, where he was certified as a six sigma black belt. Mr. Godfrey’s experience includes process improvement, supply chain optimization, demand planning, forecasting, business operations, strategic selling, and strategic purchasing. Mr. Godfrey holds a Bachelor of Business Administration in marketing from the University of Georgia. |

Stephen Kellogg, 53 | Mr. Kellogg is President and Chief Executive officer of Flooring Liquidators, Inc. ("Flooring Liquidators"). Mr. Kellogg founded Flooring Liquidators in 1997 and has served as its President and Chief Executive Officer since its founding. In addition to corporate oversight, Mr. Kellogg is responsible for new market openings, the specialty retail site selection, lease negotiation, product sourcing, and display development. Mr. Kellogg has also been a partner and advisor in a software company focused on the management of samples in the home improvement industry. He received a Bachelor’s degree in Journalism and a Minor in Philosophy from California State University, Fresno. |

Thomas Sedlak, 53 | Effective with the Company's acquisition of Precision Industries, Inc. ("Precision") on July 14, 2020, Mr. Sedlak has served as its Chief Executive Officer. Prior to his appointment as Chief Executive Officer, he served as Senior Vice President, beginning in November 2017 and as Manager of Operations beginning in October 2008. Prior to joining Precision, he held financial management and controllership positions with PPG Industries and DQE Services. Mr. Sedlak holds a Bachelor of Science in Business Administration from Robert Morris University and a Master of Business Administration from the University of Pittsburgh - Joseph M. Katz Graduate School of Business. |

Rodney Spriggs, 57 | Mr. Spriggs is President and Chief Executive officer of Vintage Stock, Inc. (“Vintage Stock”). Mr. Spriggs joined Vintage Stock as General Manager in January 1990 and has served as President since 2002 and Chief Executive Officer since 1991. In addition to corporate oversight, Mr. Spriggs is responsible for new market openings, the specialty retail site selection, lease negotiation and product acquisitions. He has also served as President of Moving Trading Company since 2006 and has also been a partner and advisor in a commercial led lighting and commercial and resident solar company. He received a Bachelor’s degree in Business Administration and a minor in Marketing from Missouri Southern State University. |

David Verret, 50 | Mr. Verret became Chief Accounting Officer of the Company on September 29, 2021 and was appointed as Chief Financial Officer on March 1, 2022. For the decade prior to joining the Company, he was the Chief Accounting Officer at Brinks Home Security™, where he also had held other accounting positions. In the preceding 13 years, he was employed by KPMG LLP in its audit practice. During David’s tenure at KPMG, he worked as a member of its audit staff (1998 to 2003) and then as a Manager and Senior Manager (2003 to 2011) in Dallas, Texas. Mr. Verret holds a Bachelor of Business Administration in Accounting, as well as a Master of Science, both from Texas Tech University. |

SUBMISSION OF STOCKHOLDER PROPOSALS

Stockholders interested in submitting a proposal for inclusion in our proxy materials relating to our 2024 Annual Meeting may do so by following the procedures set forth in Rule 14a-8 under the Exchange Act. Rule 14a-8 addresses when we must include a stockholder proposal in our proxy materials, including eligibility and procedural requirements that apply to the proponent. To be eligible for inclusion in our proxy materials, stockholder proposals must be received at our principal executive offices by January 30, 2025, which is 120 calendar days prior to the first anniversary of the mailing date of the Company’s 2024 Proxy Statement. All stockholder proposals must be in compliance with applicable laws and regulations, including the provisions of Rule 14a-8 of the Exchange Act, in order to be considered for possible inclusion in the proxy statement and form of proxy for the 2025 Annual Meeting.

Pursuant to Section 2.7 of the Company’s Bylaws, any notice of a stockholder nomination or other proposal submitted outside of the process prescribed by Rule 14a-8 of the Exchange Act (i.e., proposals that are not to be included in the Company’s proxy statement and form of proxy) received after January 30, 2025 will be considered untimely. To be in proper written form, a stockholder’s notice must set forth, as to each matter such stockholder proposes to bring before the annual meeting (i) a brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting, (ii) the name and record address of such stockholder, (iii) the class or series and number of shares of capital stock of the Company that are owned beneficially or of record by such stockholder, (iv) a description of all arrangements or understandings between such stockholder and any other person or persons (including their names) in connection with the proposal of such business by such stockholder and any material interest of such stockholder in such business, and (v) a representation that such stockholder intends to appear in person or by proxy at the annual meeting to bring such business before the meeting.

In addition to satisfying the requirements under our Bylaws with respect to advance notice of any director nomination, any stockholder who intends to solicit proxies in support of director nominees other than the Company’s nominees in accordance with Rule 14a-19 under the Exchange Act must provide the required notice of intent to solicit proxies at our principal executive offices no later than April 28, 2025 for the 2025 Annual Meeting, which is 60 calendar days prior to the first anniversary of the date of the 2024 Annual Meeting.

Under Rule 14a-4(c) of the Exchange Act, our Board may exercise discretionary voting authority under proxies solicited by it with respect to any matter properly presented by a stockholder at the 2025 Annual Meeting that the stockholder does not seek to have included in our proxy statement if (except as described in the following sentence) the proxy statement discloses the nature of the matter and how our Board intends to exercise its discretion to vote on the matter, unless we are notified of the proposal on or before April 15, 2025, and the stockholder satisfies the other requirements of Rule 14a-4(c)(2). If we first receive notice of the matter after April 15, 2025, and the matter nonetheless is permitted to be presented at the 2025 Annual Meeting, our Board may exercise discretionary voting authority with respect to the matter without including any discussion of the matter in the proxy statement for the meeting. We reserve the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with the requirements described above and other applicable requirements.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Live Ventures’ Bylaws provide that the Board shall consist of not less than three nor more than nine directors (with the precise number of directors to be established by resolution of the Board), each of whom is elected annually. Currently, there are five members of the Board. The Board has set the size of the Board at five directors, each of whom will be elected at the Annual Meeting, and has nominated each of the five incumbent directors for re-election. Each director is to be elected to hold office until the next annual meeting of stockholders or until his successor is elected and qualified. If a director resigns or otherwise is unable to complete his term of office, the Board may elect another director for the remainder of the departing director’s term.

The Board has no reason to believe that the nominees will not serve if elected, but if they should become unavailable to serve as a director, and if the Board designates a substitute nominee, the persons named as proxies will vote for the substitute nominee designated by the Board.

Nominees for Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Position with Company | | Residence | | Director Since |

| Jon Isaac | | 40 | | President, CEO, and Director | | Las Vegas, Nevada | | 2011 |

| Tony Isaac | | 69 | | Director | | Las Vegas, Nevada | | 2011 |

| Richard D. Butler, Jr. | | 75 | | Independent Director | | Stockton, California | | 2006 |

| Dennis (De) Gao | | 44 | | Independent Director | | Las Vegas, Nevada | | 2012 |

| Tyler Sickmeyer | | 37 | | Independent Director | | Santee, California | | 2014 |

Jon Isaac has served as a director of our Company since December 2011 and has served as our President and Chief Executive Officer since January 2012. Mr. Isaac also previously served as our Chief Financial Officer from 2013 until January 2017. He is the founder of Isaac Capital Group, LLC ("ICG") a privately held investment company. At ICG, Mr. Isaac has closed a variety of multi-faceted real estate deals and has experience in aiding public companies to implement turnarounds and in raising capital. Mr. Isaac studied Economics and Finance at the University of Ottawa, Canada.

The Board concluded that Mr. Isaac is qualified to serve as a director because of his extensive knowledge of and experience in capital markets, mergers, acquisitions, and strategic planning gained through his professional experiences, as well as his relevant educational background.

Tony Isaac has served as a director of our Company since December 2011 and in July 2012 began leading the Company’s efforts regarding financial planning and strategy. He has also served as a director of JanOne Inc. (NasdaqCM: JAN) since May 2015 and as its Chief Executive Officer since May 2016. Mr. Isaac’s specialty is negotiation and problem-solving of complex real estate and business transactions. Mr. Isaac graduated from Ottawa University, where he majored in Commerce and Business Administration and Economics.

The Board concluded that Mr. Isaac is qualified to serve as a director because of his relevant educational background and extensive experience in negotiation and problem-solving of complex real estate and business transactions.

Richard D. Butler, Jr. has served as director of our Company since August 2006. Mr. Butler has also served on the board of JanOne Inc. (NasdaqCM: JAN) since May 2015. He is a veteran savings, loan, and mortgage banking executive, co-founder and major shareholder of Aspen Healthcare, Inc. and Ref-Razzer Corporation, and formerly served as: Chief Executive Officer of Mt. Whitney Savings Bank, Chief Executive Officer of First Federal Mortgage Bank, Chief Executive Officer of Trafalgar Mortgage, and Executive Officer & Member of the President’s Advisory Committee at State Savings & Loan Association and American Savings & Loan Association. Mr. Butler attended Bowling Green University, San Joaquin Delta College, and Southern Oregon State College.

The Board concluded that Mr. Butler is qualified to serve as a director because of his extensive senior management experience, experience as a public company director, deep knowledge of corporate strategy, operations and finance, and experience in mergers, acquisitions, business development, sales, and marketing.

Dennis (De) Gao has served as a director of our Company since January 2012. In July 2010, Mr. Gao co-founded Oxstones Capital Management, a privately held company and a social and philanthropic enterprise, serving as an idea exchange for the global community. Prior to establishing Oxstones Capital Management, from June 2008 until July 2010, Mr. Gao was a product owner at Procter and Gamble for its consolidation system and was responsible for Procter and

Gamble’s financial report consolidation process. From May 2007 to May 2008, Mr. Gao was a financial analyst at the Internal Revenue Service’s CFO division. Mr. Gao has a dual major Bachelor of Science degree in Computer Science and Economics from University of Maryland, and a Masters of Business Administration specializing in finance and accounting from Georgetown University’s McDonough School of Business.

The Board concluded that Mr. Gao is qualified to serve as a director because of his extensive financial reporting experience, entrepreneurial experience, and advanced education in finance and accounting.

Tyler Sickmeyer has served as a director of our Company since August 2014. In August 2008, he founded, and since that time has served, as the Chief Executive Officer of Fidelitas Development, a full-service marketing firm that focuses on producing an improved return on investment rate for its clients. In 2022, Mr. Sickmeyer co-founded, and currently oversees operations for, the San Diego Sharks, a minor league basketball team. Mr. Sickmeyer, an eCommerce thought expert who has presented to audiences across the globe, has provided consulting services to a variety of companies, large and small alike, and specializes in creating efficiencies for developing brands. Mr. Sickmeyer studied business at Robert Morris University and Lincoln Christian University.

The Board concluded that Mr. Sickmeyer is qualified to serve as a director because of his extensive background in marketing and brand development efficiencies, as well as entrepreneurial experience.

Certain Family Relationships

Jon Isaac, who is a director and serves as our President and Chief Executive Officer, is the son of Tony Isaac, who is also a director and leads the Company’s efforts regarding financial planning and strategy. The compensation paid to Tony Isaac is described in the section “Director Compensation."

The Board unanimously recommends a vote “FOR” each of the listed nominees.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

Our Board, upon the recommendation of the Audit Committee, has ratified the appointment of Frazier & Deeter to serve as our independent registered public accounting firm for the fiscal year ending September 30, 2024. The Audit Committee of our Board of Directors is solely responsible for selecting our independent public accountants. Although stockholder approval is not required to appoint Frazier & Deeter as our independent public accounting firm, we believe that submitting the appointment of Frazier & Deeter to our stockholders for ratification is a matter of good corporate governance. If our stockholders do not ratify the appointment, then the appointment may be reconsidered by the Audit Committee. Even if the appointment is ratified, the Audit Committee may engage a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interest of our Company and our stockholders.

We expect that one or more representatives of Frazier & Deeter will be present at the Annual Meeting and will be available to answer stockholders’ questions or make a statement if they desire to do so.

The shares represented by your proxy will be voted for the ratification of the selection of Frazier & Deeter unless you specify otherwise.

The ratification of the Audit Committee’s appointment of Frazier & Deeter as our independent registered public accounting firm for the fiscal year ending September 30, 2024 will be approved if the proposal receives the affirmative vote of the holders of a majority of the shares present in person or by proxy at the Annual Meeting entitled to vote, in favor of the proposal. Since Proposal No. 2 is a routine matter, there will be no broker non-votes, but abstentions will have the effect of a vote against Proposal No. 2.

Audit and Other Fees

Each year, the Audit Committee approves the annual audit engagement in advance. The Audit Committee has also established procedures to pre-approve all non-audit services provided by the Company’s independent registered public accounting firm. All 2023 and 2022 fiscal year services listed below were pre-approved.

Audit Fees: Audit fees include fees for the audit of the Company’s consolidated financial statements and interim reviews of the Company’s quarterly financial statements, comfort letters, consents, and other services related to SEC matters.

Audit-Related Fees: Audit-related fees primarily include fees for certain audits of subsidiaries not required for purposes of Frazier & Deeter’s audit of the Company’s consolidated financial statements or for any other statutory or regulatory requirements, fees for acquisition related services, and consultations on various other accounting and reporting matters.

Tax Fees: This category consists of professional services rendered by our independent auditors for tax compliance.

All Other Fees: This category consists of fees for services other than the services described above.

The following fees were billed to us for the fiscal years ended September 30, 2023 and 2022, respectively.

| | | | | | | | | | | |

| 2023 | | 2022 |

| Audit Fees | $ | 1,143,271 | | | $ | 531,200 | |

| Audit-Related Fees | 440,000 | | | 250,000 | |

| Tax Fees | — | | | — | |

| All Other Fees | 19,000 | | | — | |

| Total | $ | 1,602,271 | | | $ | 781,200 | |

The Board unanimously recommends a vote “FOR” ratification of the appointment of Frazier & Deeter as the Company’s independent registered public accounting firm.

AUDIT COMMITTEE REPORT

The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” or incorporated by reference by any general statement incorporating this Proxy Statement into any future filings with the SEC or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that the Company specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

The Audit Committee has reviewed and discussed the Company’s audited financial statements with management. The Audit Committee has also discussed with Frazier & Deeter, the Company’s independent registered public accountant for fiscal year 2023, the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC.

The Audit Committee has received written disclosures and the letter from Frazier & Deeter required by the applicable requirements of the PCAOB relating to the independent registered public accountant’s communications with the Audit Committee concerning independence from the Company and its related entities and has discussed with Frazier & Deeter the registered public accountant’s independence from the Company. The Audit Committee has considered whether the provision of services by the registered public accountant, other than audit services and review of Forms 10-Q, is compatible with maintaining the registered public accountant’s independence.

Based on the review of the Company’s audited financial statements and discussion with management and the independent registered public accountant described above, the Audit Committee, in a meeting in which all directors were present, approved the inclusion of the Company’s audited financial statements in the Company’s Annual Report on Form 10-K for the year ended September 30, 2023.

In addition, the Audit Committee, in consultation with executive management, has selected Frazier & Deeter as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2024. The Board has recommended to the stockholders that they ratify and approve the selection of Frazier & Deeter as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2024.

While the Audit Committee has provided oversight, advice, and direction regarding the Company’s financial reporting process, management is responsible for establishing and maintaining the Company’s internal controls, the preparation, presentation, and integrity of financial statements, and for the appropriateness of the accounting principles and reporting policies used by the Company. It is the responsibility of the independent registered public accountant, not the Audit Committee, to conduct the audit and opine on the conformity of the financial statements with accounting principles generally accepted in the United States, and to review the Company’s unaudited interim financial statements. The Audit Committee’s responsibility is to monitor and review these processes. It is not the Audit Committee’s duty or responsibility to conduct auditing or accounting reviews.

This report is respectfully submitted by the Audit Committee of the Board:

| | | | | |

| AUDIT COMMITTEE |

| Dennis (De) Gao, Chair |

| Richard D. Butler, Jr. |

| Tyler Sickmeyer |

COMPENSATION DISCUSSION AND ANALYSIS

The purpose of this Compensation Discussion and Analysis (“CD&A”) is to provide material information about the Company’s compensation philosophy, objectives, and other relevant policies and to explain and put into context the material elements of the disclosure that follows in this Proxy Statement with respect to the compensation of our named executive officers (in this CD&A, referred to as the “NEOs”). For the fiscal year ended September 30, 2023, our NEOs were:

•Jon Isaac, President and Chief Executive Officer

•Thomas Sedlak, Chief Executive Officer of Precision Industries, Inc.

•Eric Althofer, Former Chief Operating Officer

Biographical information regarding: Mr. Isaac is presented under the “Nominees for Directors” section of this Proxy Statement; Mr. Sedlak is presented under the “Executive Officers” section of this Proxy Statement; and Mr. Althofer is provided below.

Eric Althofer (age 41). Mr. Althofer previously served as the Chief Operating Officer of the Company from April 2021 to May 2024. Mr. Althofer will remain with the Company in his capacity as Managing Director (Finance) and will serve a strategic advisor to the Company. Prior to joining Live Ventures, Mr. Althofer served as a director of Capitala Investment Advisors (“Capitala”), joining the firm in 2014. Mr. Althofer’s primary responsibilities included transaction screening, structuring, and due diligence execution. Prior to joining Capitala, Mr. Althofer spent more than three years in investment banking with Jefferies LLC, working on over 25 M&A, debt and equity transactions for consumer and retail companies. Before joining Jefferies, Mr. Althofer worked as a strategy and operations consultant for four years with Deloitte Consulting, where he worked primarily in the healthcare and financial services industries. Mr. Althofer graduated cum laude from Washington University in St. Louis with a degree in Economics and received his Master of Business Administration, with distinction, from the University of Michigan Ross School of Business with emphases in Finance and Accounting.

The Compensation Committee

The Compensation Committee reviews the performance and compensation of our President and Chief Executive Officer and the Company’s other executive officers. Additionally, the Compensation Committee reviews compensation of outside directors for service on the Board and for service on committees of the Board and administers the Company’s stock plans.

Role of Executives in Determining Executive Compensation

Our President and Chief Executive Officer provides input to the Compensation Committee regarding the performance of the other NEOs and offers recommendations regarding their compensation packages in light of such performance, however, the Compensation Committee is ultimately responsible for determining their compensation.

Compensation Philosophy and Objectives

The Compensation Committee and the Board believe that the Company’s compensation programs for its executive officers should reflect the Company’s performance and the value created for its stockholders. In addition, we believe the compensation programs should support the goals and values of the Company and should reward individual contributions to the Company’s success. Specifically, the Company’s executive compensation program is intended to:

•attract and retain the highest caliber executive officers;

•drive achievement of business strategies and goals;

•motivate performance in an entrepreneurial, incentive-driven culture;

•closely align the interests of executive officers with the interests of the Company’s stockholders;

•promote and maintain high ethical standards and business practices; and

•reward results and the creation of stockholder value.

Factors Considered in Determining Compensation; Components of Compensation

The Compensation Committee makes executive compensation decisions on the basis of total compensation, rather than on individual components of compensation. The Compensation Committee attempts to create an integrated total compensation program structured to balance both short and long-term financial and strategic goals. Our compensation

should be competitive enough to attract and retain highly skilled individuals. In this regard, we utilize a combination of two to four of the following types of compensation to compensate our executive officers:

•base salary;

•performance bonuses, which may be earned annually depending on the Company’s achievement of pre-established goals;

•cash bonuses given at the discretion of the Board; and

•equity compensation, consisting of restricted stock and/or stock options.

The Compensation Committee periodically reviews each executive officer’s base salary and makes appropriate recommendations to the Board. Salaries are based on the following factors:

•the Company’s performance for the prior fiscal years and subjective evaluation of each executive’s contribution to that performance;

•the performance of the particular executive in relation to established goals or strategic plans; and

•competitive levels of compensation for executive positions based on information drawn from compensation surveys and other relevant information.

Performance bonuses and equity compensation are awarded based upon the recommendation of the Compensation Committee. Restricted stock is granted under the Company’s stockholder-approved equity incentive plan and is priced at 100% of the closing price of the Company’s common stock on the date of grant. Incentive and/or non-qualified stock options are generally granted under the Company’s stockholder-approved equity incentive plan, as well, with the exercise price of such options set forth in the award agreement for such options. These grants are made with a view to linking executives’ compensation to the long-term financial success of the Company.

Use of Benchmarking and Compensation Peer Groups

The Compensation Committee did not utilize any benchmarking measure in the fiscal year ended September 30, 2023 and traditionally has not tied compensation directly to a specific profitability measurement, market value of the Company’s common stock, or benchmark related to any established peer or industry group. Salary increases are based on the terms of each NEO’s employment agreement, if applicable, and correlated with the Board of Directors’ and the Compensation Committee’s assessment of each NEO’s performance. The Company also generally seeks to increase or decrease compensation, as appropriate, based upon changes in an executive officer’s functional responsibilities within the Company. Historically, the Compensation Committee has not used outside consultants in determining the compensation of the NEOs, and no such consultants were engaged during the fiscal year ended September 30, 2023.

Other Compensation Considerations and Risk Management

The Compensation Committee has reviewed the Company’s compensation policies and practices and has determined that, such policies and practices do not create risks that are likely to have a material adverse effect on the Company.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary | | Bonus | | Stock Awards | | Option Awards (1) | | All Other Compensation (2) | | Total |

Jon Isaac (3) | | 2023 | | $ | 350,000 | | | $ | — | | | $ | — | | | $ | 69,177 | | | $ | 10,226 | | | $ | 429,403 | |

President and Chief

Executive Officer | | 2022 | | $ | 363,462 | | | $ | — | | | $ | — | | | $ | — | | | $ | 10,226 | | | $ | 373,688 | |

| Thomas Sedlak | | 2023 | | $ | 446,749 | | | $ | 681,832 | | | $ | — | | | $ | — | | | $ | 90,044 | | | $ | 1,218,625 | |

Chief Executive Officer of

Precision Industries, Inc. | | 2022 | | $ | 319,707 | | | $ | 737,934 | | | $ | — | | | $ | — | | | $ | 64,221 | | | $ | 1,121,862 | |

Eric Althofer (4) | | 2023 | | $ | 330,000 | | | $ | 330,000 | | | $ | — | | | $ | 237,206 | | | $ | — | | | $ | 897,206 | |

| Former Chief Operating Officer | | 2022 | | $ | 326,077 | | | $ | 75,000 | | | $ | — | | | $ | 37,619 | | | $ | — | | | $ | 438,696 | |

____________________

(1)The amounts reflect the dollar amount recognized for financial statement reporting purposes in accordance with ASC 718. These amounts reflect Live Ventures’ accounting expense for these awards, and do not correspond to the actual value that may be recognized by the NEOs. Please refer to Note 14, Stock-Based Compensation, in our consolidated financial statements included in our Form 10-K for the fiscal year ended September 30, 2023 for a discussion of the assumptions related to the calculation of such value.

(2)“All Other Compensation” includes amounts accrued or incurred by us for perquisites and benefits per each NEO’s employment agreement. The 2022 and 2023 amounts for Mr. Isaac include the amount of life insurance premiums paid. The amount for Mr. Sedlak is related to a car allowance of $16,800 and $21,800 for 2022 and 2023, respectively, deferred compensation of $63,704 and $42,881 for 2022 and 2023, respectively, and life insurance premiums of $4,540 for both 2022 and 2023 in accordance with his employment agreement.

(3)On January 13, 2023, the Compensation Committee of the Board of Directors approved an extension of the expiration date of Mr. Isaac's existing 25,000 stock options to purchase the Company’s common stock from January 15, 2023 to January 15, 2025. The option awards for Mr. Isaac for 2023 represents the incremental expense associated with extending those option awards.

(4)Mr. Althofer resigned as the Chief Operating Officer of the Company effective as of May 3, 2024.

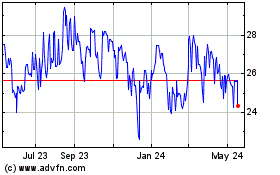

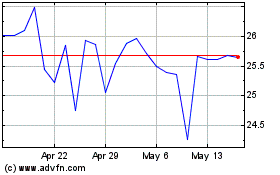

Pay vs Performance.

In August 2022, the SEC adopted amendments to its rules to require companies to disclose information reflecting the relationship between executive compensation actually paid by a company and the company’s financial performance. In accordance with the new SEC rules, the table below specifies executive compensation paid to Jon Isaac, the Company’s Principal Executive Officer (“PEO”), and the other NEOs for the Company’s three most recently completed fiscal years, and financial performance measures for the Company’s three most recently completed fiscal years. The methodology for calculating amounts presented in the columns “Compensation Actually Paid to PEO” [column (4)] and “Average Compensation Actually Paid to Non-PEO NEOs” [column (6)], including details regarding the amounts that were deducted from, and added to, the Summary Compensation Table totals to arrive at the values presented for Compensation Actually Paid, are provided in the footnotes to the table. With respect to the measures of performance, the table includes the Company’s cumulative total shareholder return (“TSR”) and net income as noted in the Company’s audited financial statements. Also, below is a description of the relationship between the executive compensation actually paid and the Company’s cumulative TSR and Net Income for the periods noted in the Pay vs Performance Table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year | | PEO | | Summary

Compensation

Table Total

for PEO | | Compensation

Actually

Paid to PEO | | | Average

Summary

Compensation

Table

Total for

Non-PEO

NEO’s | | Average

Compensation

Actually

Paid to

Non-PEO

NEO’s | | | Value of

Initial $100

Investment

Based on Total

Stockholder

Return | | | Net Income (in $000's) |

| (1) | | (2) | | (3) | | (4) | | | (5) | | (6) | | | (7) | | | (8) |