UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14a INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934 (Amendment No.)

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for use of the Commission Only (as permitted by Rule 14a-6(e) (2) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

MANHATTAN

BRIDGE CAPITAL, INC.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

MANHATTAN

BRIDGE CAPITAL, INC.

60

Cutter Mill Road

Great

Neck, NY 11021

Notice

of Annual Meeting of Shareholders

To

be held on Thursday, June 20, 2024

To

Our Shareholders:

You

are invited to attend the 2024 Annual Meeting of Shareholders of Manhattan Bridge Capital, Inc. at 9:00 a.m. local time, on Thursday,

June 20, 2024, at the office of Sullivan & Worcester LLP, 1251 Avenue of the Americas, New York, NY 10020.

The

Notice of Meeting and Proxy Statement on the following pages describe the matters to be presented at the meeting.

It

is important that your shares be represented at this meeting to ensure the presence of a quorum. Whether or not you plan to attend the

meeting, we hope that you will have your shares represented by signing, dating and returning your proxy in the enclosed envelope, which

requires no postage if mailed in the United States, as soon as possible. Your shares will be voted in accordance with the instructions

you have given in your proxy.

Thank

you for your continued support.

| |

Sincerely, |

| |

|

| |

Assaf

Ran |

| |

President

and Chief Executive Officer |

MANHATTAN

BRIDGE CAPITAL, INC.

60

Cutter Mill Road

Great

Neck, NY 11021

Notice

of Annual Meeting of Shareholders

To

be held on Thursday, June 20, 2024

The

Annual Meeting of Shareholders of Manhattan Bridge Capital, Inc. (the “Company”) will be held at the offices of Sullivan

& Worcester LLP, 1251 Avenue of the Americas, New York, NY 10020, on Thursday, June 20, 2024 at 9:00 a.m., local time, for the purpose

of considering and acting upon the following:

| |

1. |

Election

of six (6) directors to serve until the next Annual Meeting of Shareholders and until their respective successors have been duly

elected and qualified. |

| |

|

|

| |

2. |

Advisory

approval of the appointment of Hoberman & Lesser CPA’s, LLP as the Company’s independent auditors for the fiscal

year ending December 31, 2024. |

| |

|

|

| |

3. |

Transaction

of such other business as may properly come before the meeting and any adjournment or adjournments thereof. |

The

Company’s Board of Directors has set the close of business on April 26, 2024 as the record date for the determination of shareholders

entitled to notice of and to vote at the meeting, or any adjournment or adjournments thereof. A complete list of such shareholders will

be available for examination by any shareholder at the meeting. The meeting may be adjourned from time to time without notice other than

by announcement at the meeting.

| |

By |

order

of the Board of Directors |

| |

|

|

| |

|

Vanessa

Kao |

| |

|

Secretary |

Great

Neck, New York

May

9, 2024

| IMPORTANT: |

IT

IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING REGARDLESS OF THE NUMBER OF SHARES YOU HOLD. WHETHER OR NOT YOU PLAN

TO ATTEND THE MEETING IN PERSON, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND MAIL IT PROMPTLY IN THE ENCLOSED RETURN

ENVELOPE. THE PROMPT RETURN OF PROXIES WILL ENSURE A QUORUM AND SAVE THE COMPANY THE EXPENSE OF FURTHER SOLICITATION. EACH PROXY

GRANTED MAY BE REVOKED BY THE SHAREHOLDER APPOINTING SUCH PROXY AT ANY TIME BEFORE IT IS VOTED. IF YOU RECEIVE MORE THAN ONE PROXY

CARD BECAUSE YOUR SHARES ARE REGISTERED IN DIFFERENT NAMES OR ADDRESSES, EACH SUCH PROXY CARD SHOULD BE SIGNED AND RETURNED TO ENSURE

THAT ALL OF YOUR SHARES WILL BE VOTED. |

We

appreciate your giving this matter your prompt attention.

IMPORTANT

NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS

FOR

THE SHAREHOLDER MEETING TO BE HELD ON THURSDAY, JUNE 20, 2024

The

proxy materials for the Annual Meeting, including the Annual Report and the Proxy Statement are also

available at www.proxyvote.com

MANHATTAN

BRIDGE CAPITAL, INC.

60

Cutter Mill Road

Great

Neck, NY 11021

PROXY

STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

To

be held on Thursday, June 20, 2024

Proxies

in the form enclosed with this Proxy Statement are solicited by the Board of Directors (the “Board”) of Manhattan Bridge

Capital, Inc. (the “Company,” “we,” “us,” “our,” or any derivative thereof) to be used

at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held at the offices of Sullivan & Worcester LLP, 1251

Avenue of the Americas, New York, NY 10020 on Thursday, June 20, 2024 at 9:00 a.m., local time, for the purposes set forth in the Notice

of Meeting and this Proxy Statement. The Company’s principal executive offices are located at 60 Cutter Mill Road, Suite 205, Great

Neck, NY 11021. The approximate date on which this Proxy Statement, the accompanying Proxy and Annual Report for the year ended December

31, 2023 will be mailed to shareholders is May 9, 2024.

IMPORTANT

NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS

FOR

THE SHAREHOLDER MEETING TO BE HELD ON THURSDAY, JUNE 20, 2024

The

proxy materials for the Annual Meeting, including the Annual Report and the Proxy Statement are

also available at www.proxyvote.com

THE

VOTING AND VOTE REQUIRED

Record

Date and Quorum

Only

shareholders of record at the close of business on April 26, 2024 (the “Record Date”), are entitled to notice of and vote

at the Annual Meeting. On the Record Date, there were 11,438,651 outstanding shares of our common stock, par value $0.001 per share (the

“Common Shares”). Each Common Share is entitled to one vote. Common Shares represented by each properly executed, unrevoked

proxy received in time for the Annual Meeting will be voted as specified. Common Shares were our only voting securities outstanding on

the Record Date. A quorum will be present at the Annual Meeting of shareholders when such shareholders owning a majority of the Common

Shares outstanding on the Record Date are present at the meeting in person or by proxy.

Voting

of Proxies

The

persons acting as proxies (the “Proxyholders”) pursuant to the enclosed Proxy will vote the shares represented as directed

in the signed proxy. Unless otherwise directed in the proxy, the Proxyholders will vote the shares represented by the proxy: (i) for

the election of the director nominees named in this Proxy Statement; (ii) for the advisory approval of the appointment of Hoberman &

Lesser CPA’s, LLP (“H&L”) as the Company’s independent auditors for the fiscal year ending December 31, 2024;

and (iii) in their discretion, on any other business that may come before the Annual Meeting and any adjournments of the Annual Meeting.

All

votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative

votes, abstentions and broker non-votes. All shares represented by valid proxies will be voted in accordance with the instructions contained

therein. In the absence of instructions, proxies will be voted FOR all of the director nominees in Proposal No. 1 and FOR Proposal No.

2. A proxy may be revoked by the shareholder giving the proxy at any time before it is voted at the Annual Meeting, by written notice

addressed to and received by the Secretary of the Company or Secretary of the Annual Meeting, and a prior proxy is automatically revoked

by a shareholder giving a subsequent proxy or attending and voting in person at the Annual Meeting. Attendance at the Annual Meeting,

however, in and of itself, does not revoke a prior proxy. In the case of the election of directors, shares represented by a proxy which

are marked “WITHHOLD AUTHORITY” to vote for all director nominees will not be counted in determining whether a plurality

vote has been received for the election of directors. Shares represented by proxies that are marked “ABSTAIN” on any other

proposal will not be counted in determining whether the requisite vote has been received for such proposal. In instances where brokers

are prohibited from exercising discretionary authority for beneficial owners who have not returned proxies (“broker non-votes”),

including with respect to Proposal No. 1, those shares will not be counted as entitled to be voted (other than for the purpose of establishing

a quorum) and, therefore, will have no effect on the outcome of the vote.

Voting

Requirements

Election

of Directors. The election of the six director nominees will require a plurality of the votes cast at the Annual Meeting. Votes may

be cast in favor of or withheld with respect to each nominee. Votes that are withheld will be excluded entirely from the vote and will

have no effect on the outcome of the vote.

Advisory

Approval of the Appointment of Independent Auditors. The affirmative vote of a majority of the votes cast on the matter by stockholders

entitled to vote at the Annual Meeting is required to approve the appointment of H&L as the Company’s independent auditors

for the fiscal year ending December 31, 2024. An abstention from voting on approval of auditors will be treated as “present”

for quorum purposes. However, since an abstention is not treated as a “vote” for or against the matter, it will have no effect

on the outcome of the vote on either matter.

Proposal

No. 1

ELECTION

OF DIRECTORS

The

current members of our Board are Lyron Bentovim, Eran Goldshmit, Michael J. Jackson, Vanessa Kao, Phillip Michals and Assaf Ran. All

six directors are to be elected at the Annual Meeting. All directors hold office until the next annual meeting of shareholders and until

their successors are duly elected and qualified.

It

is intended that votes pursuant to the enclosed proxy will be cast for the election of the six nominees named below. In the event that

any such nominee should become unable or unwilling to serve as a director, the Proxy will vote for the election of an alternate candidate,

if any, as shall be designated by the Board. Our Board has no reason to believe these nominees will be unable to serve if elected. Each

nominee has consented to be named in this Proxy Statement and to serve if elected. All six nominees are currently members of our Board.

There are no family relationships among any of the executive officers or directors of the Company.

Our

director nominees and their respective ages as of the Record Date are as follows:

| Name |

|

Age |

|

Position |

| Assaf

Ran |

|

58 |

|

Founder,

Chairman of the Board, Chief Executive Officer and President |

| Lyron

Bentovim (1) |

|

54 |

|

Director |

| Eran

Goldshmit (1)(2)(3) |

|

57 |

|

Director |

| Michael

J. Jackson (1)(2)(3) |

|

59 |

|

Director |

| Vanessa

Kao |

|

46 |

|

Chief

Financial Officer, Vice President, Treasurer, Secretary and Director |

| Phillip

Michals (1)(2)(3) |

|

54 |

|

Director |

| |

(1) |

Member

of the Audit Committee. |

| |

(2) |

Member

of the Compensation Committee. |

| |

(3) |

Member

of the Corporate Governance and Nominating Committee. |

Set

forth below is a brief description of the background and business experience of our director nominees:

Assaf

Ran, our founder, has been our Chief Executive Officer, President and Chairman of the Board since our inception in 1989. Mr. Ran

has 35 years of senior management experience leading public and private businesses. Mr. Ran started several yellow page and other businesses

from the ground up and managed to make each one of them successful. Mr. Ran’s professional experience and background with us, as

our director since March 1999, have given him the expertise needed to serve as one of our directors.

Lyron

Bentovim has been a member of the Board since December 2008. Mr. Bentovim currently serves as the president and chief executive officer

of The Glimpse Group, Inc. (Nasdaq: VRAR), a virtual reality and augmented reality company based in New York, NY. Mr. Bentovim also serves

as a managing partner at Darklight Partners, a strategic advisor to small and mid-size public and private companies. Prior to that, from

July 2014 to August 2015, Mr. Bentovim served as chief operating officer and chief financial officer of Top Image Systems Ltd. (formerly

listed on Nasdaq: TISA), and from March 2013 to July 2014, Mr. Bentovim served as chief operating officer and chief financial officer

of NIT Health Inc. and as chief operating officer and chief financial officer and managing director at Cabrillo Advisors LLC. From August

2009 until July 2012, Mr. Bentovim has served as chief operating officer and chief financial officer of Sunrise Telecom, Inc. Prior to

joining Sunrise Telecom, Inc., from January 2002 until August 2009, Mr. Bentovim served as a portfolio manager for Skiritai Capital LLC,

an investment advisor based in San Francisco. Mr. Bentovim has over 25 years of management experience, including his experience as a

member of the board of directors at RTW Inc., Ault, Inc., Top Image Systems Ltd., Three-Five Systems Inc., Sunrise Telecom Inc., Blue

Sphere Corporation, and Argonaut Technologies Inc. Prior to his position in Skiritai Capital LLC, Mr. Bentovim served as president, chief

operating officer and co-founder of WebBrix, Inc. Additionally, Mr. Bentovim spent time as a senior engagement manager with strategy

consultancies including USWeb/CKS, the Mitchell Madison Group LLC and McKinsey & Company Inc. Mr. Bentovim has an MBA from Yale School

of Management and a law degree from the Hebrew University, Jerusalem, Israel. Mr. Bentovim’s professional experience and background

with other companies and with us have given him the expertise needed to serve as one of our directors.

Eran

Goldshmit has been a member of the Board since March 1999. Since August 2001, he has been the president of the New York Diamond Center,

New York, NY. From December 1998 until July 2001, Mr. Goldshmit was the general manager of the Carmiel Shopping Center in Carmiel, Israel.

Mr. Goldshmit received certification as a financial consultant in February 1993 from the School for Investment Consultants, Tel Aviv,

Israel, and a BA in business administration from the University of Humberside, England, in December 1998. Mr. Goldshmit’s professional

experience and background with other companies and with us have given him the expertise needed to serve as one of our directors.

Michael

J. Jackson has been a member of the Board since July 2000. Since May 2017, Mr. Jackson has been the chief financial officer of Radius

Global Market Research. From March 2016 through April 2017, Mr. Jackson served as chief financial officer and executive vice president

of both Ethology, Inc., a digital marketing agency, and Tallwave, LLC, a business design and innovation agency. From April 2007 through

February 2016, he was the chief financial officer and the executive vice president of iCrossing, Inc., a digital marketing agency. From

October 1999 to April 2007, he served as executive vice president and chief financial officer of AGENCY.COM, a global Internet professional

services company. He also served as the chief accounting officer of AGENCY.com from May 2000 and as its corporate controller from August

1999 until September 2001. From October 1994 until August 1999, Mr. Jackson was a senior manager at Arthur Andersen, LLP and manager

at Ernst & Young LLP. Mr. Jackson also served on the New York State Society Auditing Standards and Procedures Committee from 1998

to 1999 and served on the New York State Society’s Securities and Exchange Commission Committee from 1999 to 2001. Mr. Jackson

holds an MBA in Finance from Hofstra University and is a certified public accountant. Mr. Jackson is a current member of the board of

directors of AvenueZ, Inc a privately held digital marketing technology company. For the five years ended May 2008, Mr. Jackson was a

member of the board of directors of Adstar, Inc. (OTC PINK: ADST). Mr. Jackson’s professional experience and background with other

companies and with us have given him the expertise needed to serve as one of our directors.

Vanessa

Kao has been our Chief Financial Officer, vice president, treasurer and secretary since rejoining us in June 2011. Ms. Kao joined

our Board in November 2023. From January 2014 through April 2016, she was also the Chief Financial Officer of Jewish Marketing Solutions

LLC. Since April 2016, she has been serving as a consultant to Jewish Marketing Solutions LLC. From July 2004 through April 2006, she

served as our assistant Chief Financial Officer. From April 2006 through December 2013, she was the Chief Financial Officer of DAG Jewish

Directories, Inc. Ms. Kao holds a M.B.A. in Finance and MIS/E-Commerce from the University of Missouri and a bachelor’s degree

of Business Administration in Finance from the National Taipei University in Taiwan.

Phillip

Michals has been a member of the Board since rejoining our Board in June 2019. Mr. Michals is the chief executive officer and executive

chairman of A.G.P./Alliance Global Partners, a full-service investment banking and wealth management firm since 2018. Mr. Michals is

also a Co-Founder and Chairman of the Board and Director of A.G.P. Canada, where he assists the team with developing and executing business

goals in Canada. Mr. Michals has also been a partner in RG Michals since 1999 and affiliated with an independent firm from 2010 to 2018.

His responsibilities were primarily in business development. He was also a partner for over 10 years at MSCI, an advisory/consulting

firm that consulted for member firms of NYSE and FINRA. Mr. Michals currently has his Series 7, 63, 24, 99, and 65 licenses and received

his Bachelor of Science from the University of Delaware. Mr. Michal’s professional experience and background with other companies

and with us have given him the expertise needed to serve as one of our directors.

The

Board recommends a vote FOR the election of each of the director nominees

and

proxies that are signed and returned will be so voted

unless

otherwise instructed.

*

* * * *

Proposal

No. 2

ADVISORY

APPROVAL OF THE APPOINTMENT OF INDEPENDENT AUDITORS

H&L

has been our independent registered public accounting firm since November 2014 when Hoberman, Goldstein & Lesser, CPA’s, P.C.

(“HG&L”), our independent registered public accounting firm at the time, effectively resigned when the ownership interest

in HG&L changed and formed H&L as a new successor entity to HG&L. As a result, H&L was engaged as our new independent

registered public accounting firm. One or more representatives of H&L is expected to be at the Annual Meeting and will have an opportunity

to make a statement if he or she desires to do so and will be available to respond to appropriate questions from our shareholders.

Selection

of the independent accountants is not required to be submitted to a vote of our shareholders for ratification. In addition, Nasdaq Stock

Market rules require the Audit Committee to be directly responsible for the appointment, compensation and oversight of the audit work

of the independent auditors. The Audit Committee expects to appoint H&L to serve as independent auditors to conduct an audit of our

accounts for the 2024 fiscal year. However, the Board is submitting this matter to our shareholders as a matter of good corporate practice.

If the shareholders fail to vote on an advisory basis in favor of the selection, the Audit Committee will take that into consideration

when deciding whether to retain H&L and may retain that firm or another without re-submitting the matter to the shareholders. Even

if shareholders vote on an advisory basis in favor of the appointment, the Audit Committee may, in its discretion, direct the appointment

of different independent auditors at any time during the year if it determines that such a change would be in our and our shareholders’

best interests.

The

Board recommends a vote FOR this proposal

and

proxies that are signed and returned will be so voted

unless

otherwise instructed.

*

* * * *

EXECUTIVE

OFFICERS

The

following table identifies our executive officers as of the Record Date:

| Name |

|

Age |

|

Position |

|

In

Current Position Since |

| Assaf

Ran (1) |

|

58 |

|

President

and Chief Executive Officer |

|

1989 |

| |

|

|

|

|

|

|

| Vanessa

Kao (2) |

|

46 |

|

Chief

Financial Officer, Vice President, Treasurer, Secretary and Director |

|

2011

(as Chief Financial Officer, Vice President, Treasurer, Secretary)

2023

(as Director) |

| |

(1) |

Mr.

Ran’s biographical information is provided above. |

| |

(2) |

Ms.

Kao’s biographical information is provided above. |

CORPORATE

GOVERNANCE

Code

of Ethics

We

have adopted a Code of Ethics that applies to our principal executive officer, principal financial officer and other persons performing

similar functions. Our current Code of Ethics is posted on our website at www.manhattanbridgecapital.com. The information on our website

is not incorporated by reference into this Proxy Statement. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K

regarding amendment to, or waiver from, a provision of our Code of Ethics by posting such information on the website address specified

above.

Director

Independence

The

Board has determined, in accordance with Nasdaq’s Stock Market Rules, that: (i) Messrs. Jackson, Goldshmit, Bentovim and Michals

(the “Independent Directors”) are independent and represent a majority of its members; (ii) Messrs. Jackson, Goldshmit, Bentovim

and Michals, as the members of the Audit Committee, are independent for such purposes; and (iii) Messrs. Jackson, Goldshmit and Michals,

as the members of the Compensation Committee, are independent for such purposes. In determining director independence, the Board applies

the independence standards set by the Nasdaq. In its application of such standards the Board takes into consideration all transactions

with Independent Directors and the impact of such transactions, if any, on any of the Independent Directors’ ability to continue

to serve on the Board.

Board

and Committees

During

fiscal year 2023, the Board held two meetings, our Audit Committee held four meetings and our Compensation Committee did not meet. Our

Corporate Governance and Nominating Committee did not meet. All directors attended or participated by telephone in all meetings of the

Board and of the Board’s committees on which each applicable director served. It is the Company’s policy that directors are

invited and encouraged to attend the Annual Meeting. All of our then current directors attended our annual meeting held in 2023.

We

have three standing committees: an Audit Committee, a Compensation Committee and a Corporate Governance and Nominating Committee. Each

committee is made up entirely of independent directors as defined under the Nasdaq Stock Market Rules. The members of the Audit Committee

are Michael Jackson, who serves as chairman, Eran Goldshmit, Lyron Bentovim and Phillip Michals. The members of the Compensation Committee

and the Corporate Governance and Nominating Committee are Michael Jackson, Eran Goldshmit and Phillip Michals. Current copies of each

committee’s charter are available on our website at www.manhattanbridgecapital.com.

Audit

Committee. The Audit Committee oversees our accounting and financial reporting processes, internal systems of accounting and financial

controls, relationships with auditors and audits of financial statements. Specifically, the Audit Committee’s responsibilities

include the following:

| ● | selecting,

hiring and terminating our independent auditors; |

| ● | evaluating

the qualifications, independence and performance of our independent auditors; |

| ● | approving

the audit and non-audit services to be performed by the independent auditors; |

| ● | reviewing

the design, implementation and adequacy and effectiveness of our internal controls and critical

policies; |

| ● | overseeing

and monitoring the integrity of our consolidated financial statements and our compliance

with legal and regulatory requirements as they relate to our financial statements and other

accounting matters; |

| ● | with

management and our independent auditors, reviewing any earnings announcements and other public

announcements regarding our results of operations; and |

| ● | preparing

the report that the Securities and Exchange Commission requires in our annual proxy statement. |

The

Board has determined that Michael Jackson is qualified as an Audit Committee Financial Expert pursuant to Item 407(d)(5) of Regulation

S-K. Each Audit Committee member is independent, as that term is defined in Section 10A(m)(3) of the Exchange Act of 1934, as amended

(the “Exchange Act”) and their relevant experience is more fully described above.

Compensation

Committee. The Compensation Committee assists the Board in determining the compensation of our officers and directors. Specific responsibilities

include the following:

| ● | approving

the compensation and benefits of our executive officers; |

| ● | administering

our clawback policy; |

| ● | reviewing

the performance objectives and actual performance of our officers; and |

| ● | administering

our stock option and other equity and incentive compensation plans. |

The

Compensation Committee is comprised entirely of directors who satisfy the standards of independence applicable to compensation committee

members under Section 16(b) of the Exchange Act. During the fiscal year ended December 31, 2023, the Compensation Committee did not utilize

the services of a compensation consultant.

Corporate

Governance and Nominating Committee. The Corporate Governance and Nominating Committee assists the Board by identifying and recommending

individuals qualified to become members of the Board. Specific responsibilities include the following:

| ● | evaluating

the composition, size and governance of the Board and its committees and making recommendations

regarding future planning and the appointment of directors to our committees; |

| ● | establishing

a policy for considering shareholder nominees to the Board; |

| ● | reviewing

our corporate governance principles and making recommendations to the Board regarding possible

changes; and |

| ● | reviewing

and monitoring compliance with our code of ethics and insider trading policy. |

Board

Leadership Structure

Mr.

Ran has served as Chairman of the Board, Chief Executive Officer and President since our inception in 1989. Our By-Laws give the Board

the flexibility to determine whether the roles of Chairman and Chief Executive Officer should be held by the same person or by two separate

individuals. Each year, the Board evaluates our leadership structure and determines the most appropriate structure for the coming year

based upon its assessment of our position, strategy, and our long term plans. The Board also considers the specific circumstances we

face and the characteristics and membership of the Board. At this time, the Board has determined that having Mr. Ran serve as both the

Chairman and Chief Executive Officer is in the best interest of our shareholders. We believe this structure makes the best use of the

Chief Executive Officer’s extensive knowledge of our business and personnel, our strategic initiatives and our industry, and also

fosters real-time communication between management and the Board.

The

Board’s Oversight of Risk Management

The

Board recognizes that companies face a variety of risks, including credit risk, liquidity risk, strategic risk, and operational risk.

The Board believes an effective risk management system will (1) timely identify the material risks that we face, (2) communicate necessary

information with respect to material risks to senior executives and, as appropriate, to the Board or relevant Board committee, (3) implement

appropriate and responsive risk management strategies consistent with our risk profile, and (4) integrate risk management into our decision-making.

The Board encourages and management promotes a corporate culture that incorporates risk management into our corporate strategy and day-to-day

business operations. The Board also continually works, with the input of our management and executive officers, to assess and analyze

the most likely areas of future risk for us.

Anti-Hedging

Policy

Under

our insider trading policy, our directors, officers, employees, consultants, and contractors are prohibited from engaging in short sales

of our securities, purchases of our securities on margin, hedging or monetization transactions through the use of financial instruments,

and options and derivatives trading on any of the stock exchanges or futures exchanges, without prior written pre-clearance.

Audit

Committee Report

The

Audit Committee oversees our financial reporting process on behalf of the Board. The Audit Committee consists of four members of the

Board who meet the independence and experience requirements of Nasdaq and the SEC.

The

Audit Committee retains our independent registered public accounting firm and approves in advance all permissible non-audit services

performed by them and other auditing firms. Although management has the primary responsibility for the financial statements and the reporting

process including the systems of internal control, the Audit Committee consults with management and our independent registered public

accounting firm regarding the preparation of financial statements, the adoption and disclosure of our critical accounting estimates and

generally oversees the relationship of the independent registered public accounting firm with our Company.

The

Audit Committee reviewed our audited financial statements for the year ended December 31, 2023, and met with management to discuss such

audited financial statements. The Audit Committee has discussed with H&L, our independent accountants, the matters required to be

discussed pursuant to the applicable requirements of the Public Company Accounting Oversight Board (the “PCOAB”) and the

SEC. The Audit Committee has received the written disclosures and the letter from H&L required by applicable requirements of the

PCOAB regarding the independent accountant’s communications with the Audit Committee concerning independence and has discussed

with H&L its independence from us and our management. Based on its review and discussions, the Audit Committee recommended to the

Board that our audited financial statements for the year ended December 31, 2023 be included in our Annual Report on Form 10-K for the

year then ended for filing with the SEC.

| |

AUDIT

COMMITTEE: |

| |

|

| |

Michael

J. Jackson, Chairman |

| |

Eran

Goldshmit |

| |

Lyron

Bentovim |

| |

Phillip

Michals |

Shareholder

Communications

The

Board has established a process to receive communications from shareholders. Shareholders and other interested parties may contact any

member (or all members) of the Board, or the non-management directors as a group, any Board committee or any chair of any such committee

by mail or electronically. To communicate with the Board, any individual director or any group or committee of directors, correspondence

should be addressed to the Board or any such individual director or group or committee of directors by either name or title. All such

correspondence should be sent c/o Corporate Secretary at 60 Cutter Mill Road, Suite 205, Great Neck, NY 11021.

All

communications received as set forth in the preceding paragraph will be opened by the Secretary for the sole purpose of determining whether

the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or

service, patently offensive material or matters deemed inappropriate for the Board will be forwarded promptly to the addressee. In the

case of communications to the Board or any group or committee of directors, the Secretary will make sufficient copies of the contents

to send to each director who is a member of the group or committee to which the envelope or e-mail is addressed.

Executive

Compensation

The

following Summary Compensation Table sets forth all compensation earned by or paid to, in all capacities, during the years ended December

31, 2023 and 2022 by (i) the Company’s Chief Executive Officer and (ii) the most highly compensated executive officers, other than

the Chief Executive Officer, who were serving as executive officers and whose total compensation exceeded $100,000 (the individuals falling

within categories (i) and (ii) are collectively referred to as the “Named Executive Officers”):

Summary

Compensation Table

| Name and Principal Position | |

Year | |

Salary ($) | | |

Bonus ($) | | |

All Other Compensation ($) (1) | | |

Total ($) | |

| Assaf Ran | |

2023 | |

$ | 350,000 | | |

$ | 130,000 | | |

$ | 48,751 | | |

$ | 528,751 | |

| Chief Executive Officer and President | |

2022 | |

$ | 329,231 | | |

$ | — | | |

$ | 46,190 | | |

$ | 375,421 | |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Vanessa Kao | |

2023 | |

$ | 170,000 | | |

$ | 65,000 | | |

$ | 12,090 | | |

$ | 247,090 | |

| Chief Financial Officer, Vice President, Treasurer and Secretary | |

2022 | |

$ | 160,769 | | |

$ | — | | |

$ | 12,190 | | |

$ | 172,959 | |

| (1) |

Consists of certain expense reimbursements and Company matching

contributions made pursuant to its Simple IRA Plan. |

Employment

Contracts

We

have an employment agreement with Mr. Ran, our President and Chief Executive Officer, pursuant to which: (i) Mr. Ran’s employment

term renews automatically on June 30th of each year for successive one-year periods unless either party gives to the other

written notice at least 180 days prior to June 30th of its intention to terminate the agreement; (ii) Mr. Ran receives a current

annual base salary of $350,000 and annual bonuses as determined by the Compensation Committee of the Board, in its sole and absolute

discretion, and is eligible to participate in all executive benefit plans established and maintained by us; and (iii) Mr. Ran agreed

to a one-year non-competition period following the termination of his employment. If the employment agreement is terminated by Mr. Ran

for “good reason” (as defined in the employment agreement) he shall be paid (1) his base compensation up to the effective

date of such termination; (2) his full share of any incentive compensation payable to him for the year in which the termination occurs;

and (3) a lump sum payment equal to 100% of the average cash compensation paid to, or accrued for, him in the two calendar years immediately

preceding the calendar year in which the termination occurs.

In

June 2022, the Compensation Committee approved an increase of Mr. Ran’s annual base salary from $305,000 to $350,000.

Restricted

Stock Grant

In

September 2011, upon shareholders’ approval at the 2011 annual meeting of shareholders, we granted 1,000,000 restricted common

shares (the “Restricted Shares”) to Mr. Ran, our Chief Executive Officer. Under the terms of the restricted shares agreement,

among other things, Mr. Ran may not sell, convey, transfer, pledge, encumber or otherwise dispose of the Restricted Shares until the

earliest to occur of the following: (i) September 9, 2026, with respect to 1/3 of the Restricted Shares, September 9, 2027 with respect

to an additional 1/3 of the Restricted Shares and September 9, 2028 with respect to the final 1/3 of the Restricted Shares; (ii) the

date on which Mr. Ran’s employment is terminated by us for any reason other than for “Cause” (i.e., misconduct that

is materially injurious to us monetarily or otherwise, including engaging in any conduct that constitutes a felony under federal, state

or local law); or (iii) the date on which Mr. Ran’s employment is terminated on account of (A) his death; or (B) his disability,

which, in the opinion of his personal physician and a physician selected by us prevents him from being employed with us on a full-time

basis (each such date being referred to as a “Risk Termination Date”). If at any time prior to a Risk Termination Date Mr.

Ran’s employment is terminated by us for Cause, or by Mr. Ran voluntarily for any reason other than death or disability, Mr. Ran

will forfeit that portion of the Restricted Shares which has not previously vested. Mr. Ran has the power to vote the Restricted Shares

and will be entitled to all dividends payable with respect to the Restricted Shares.

In

connection with the Compensation Committee’s approval of the foregoing grant of Restricted Shares, the Compensation Committee consulted

with and obtained the concurrence of independent compensation experts and informed Mr. Ran that it had no present intention of continuing

its prior practice of annually awarding stock options to Mr. Ran as Chief Executive Officer. Also, Mr. Ran, advised the Compensation

Committee that he would not seek future stock option grants.

Termination

and Change of Control Arrangement

In

the event of termination, Mr. Ran will not be entitled to receive any severance and any non-vested options will be automatically forfeited.

If at any time prior to a Risk Termination Date Mr. Ran’s employment is terminated by us for cause or by Mr. Ran voluntarily for

any reason other than death or disability, Mr. Ran will forfeit that portion of the Restricted Shares which have not previously vested.

If Mr. Ran is terminated for any reason other than for cause, the Restricted Shares become immediately transferable.

Compensation

of Directors

During

2023, the annual cash compensation paid to each independent member of the Board was $16,000, plus an additional $300 for each committee

meeting attended.

The

table below summarizes the compensation paid to our independent directors for the year ended December 31, 2023. Mr. Ran’s compensation

is described below under “Executive Compensation.”

Director

Compensation

| Name | |

Fees Earned or Paid in Cash ($) | |

| Michael Jackson | |

$ | 17,500 | |

| Eran Goldshmit | |

$ | 17,200 | |

| Lyron Bentovim | |

$ | 17,500 | |

| Phillip Michals | |

$ | 17,200 | |

Outstanding

Equity Awards at Fiscal Year-End

The

following table sets forth information concerning outstanding equity awards to the Named Executive Officers as of December 31, 2023.

| Name | |

Stock Awards Number of Shares or Units of Stock That Have Not Vested (#) | | |

Market Value of Shares or Units of Stock That Have Not Vested ($) | |

| Assaf Ran | |

| | | |

| | |

| Chief Executive Officer and President | |

| 1,000,000 | | |

| 4,970,000 | (1)(2) |

| (1) |

Calculated

based on the closing market price of $4.97 at the end of the last completed fiscal year on December 29, 2023. |

| |

|

| (2) |

Mr.

Ran may not sell, convey, transfer, pledge, encumber or otherwise dispose of the Restricted Shares until the earliest to occur of

the following: (i) September 9, 2026, with respect to 1/3 of the Restricted Shares, September 9, 2027 with respect to an additional

1/3 of the Restricted Shares and September 9, 2028 with respect to the final 1/3 of the Restricted Shares; (ii) the date on which

Mr. Ran’s employment is terminated by us for any reason other than for “Cause;” or (iii) on a Risk Termination

Date. If at any time prior to a Risk Termination Date Mr. Ran’s employment is terminated by us for Cause or Mr. Ran voluntarily

terminates his employment for any reason other than death or disability, Mr. Ran will forfeit that portion of the Restricted Shares

which have not previously vested. |

Pay

Versus Performance Table

As

required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and Item 402(v) of Regulation S-K, we are

providing the following information about the relationship between executive compensation actually paid to our Chief Executive Officer

and our other Named Executive Officer and certain financial performance of the Company for each of the fiscal years ended December 31,

2023,2022, and 2021.

| Fiscal Year | |

Summary Compensation Table Total for CEO | | |

Compensation Actually Paid to CEO (1) | | |

Summary Compensation Table Total for Other NEOs | | |

Compensation Actually Paid to Other NEOs (1) | | |

Value of

Initial Fixed $100 Investment Based on Total Shareholder Return | | |

Net Income | |

| 2023 | |

$ | 528,751 | | |

$ | 528,751 | | |

$ | 247,090 | | |

$ | 247,090 | | |

$ | 102 | | |

$ | 5,476,171 | |

| 2022 | |

$ | 375,421 | | |

$ | 375,421 | | |

$ | 172,959 | | |

$ | 172,959 | | |

$ | 106 | | |

$ | 5,211,738 | |

| 2021 | |

$ | 280,973 | | |

$ | 280,973 | | |

$ | 191,968 | | |

$ | 191,968 | | |

$ | 115 | | |

$ | 4,423,325 | |

| (1) | Amounts

represent compensation actually paid to Mr. Assaf Ran, our Chief Executive Officer, and to

Ms. Vanessa Kao, our Chief Financial Officer. No awards were granted to our Chief Executive

Officers and our Chief Financial Officer during each of the fiscal years ended December 31,

2023, 2022 and 2021. See “Executive Compensation – Summary Compensation Table”

for certain other compensation of our Chief Executive Officer and our Chief Financial Officer

for each applicable fiscal year. |

Compensation

actually paid to our Chief Executive Officer represents the total compensation reported in the Summary Compensation Table for the applicable

fiscal year, as adjusted as follows:

| Adjustments to Determine Compensation “Actually Paid” to our Chief Executive Officer | |

2023 | | |

2022 | | |

2021 | |

| Total Compensation in the Summary Compensation Table | |

$ | 528,751 | | |

$ | 375,421 | | |

$ | 280,973 | |

| Deduction for Amounts Reported under the “Stock Awards” Column in the Summary Compensation Table | |

| 0 | | |

| 0 | | |

| 0 | |

| Deduction for Amounts Reported under “Option Awards” Column in the Summary Compensation Table | |

| 0 | | |

| 0 | | |

| 0 | |

| Increase for Fair Value of Awards Granted During Fiscal Year that Remain Unvested as of Year End, Determined as of Applicable Fiscal Year End(1) | |

| 0 | | |

| 0 | | |

| 0 | |

| Increase for Fair Value of Awards Granted During Fiscal Year that Vested during Applicable Fiscal Year, Determined as of Vesting Date(1) | |

| 0 | | |

| 0 | | |

| 0 | |

| Increase/deduction for Awards Granted During Prior Fiscal Year that were Outstanding and Unvested as of Applicable Fiscal Year End | |

| 0 | | |

| 0 | | |

| 0 | |

| Increase/deduction for Awards Granted During Prior Fiscal Year that Vested During Applicable Fiscal Year | |

| 0 | | |

| 0 | | |

| 0 | |

| Total Adjustments | |

| 0 | | |

| 0 | | |

| 0 | |

| Compensation Actually Paid to the CEO | |

$ | 528,751 | | |

$ | 375,421 | | |

$ | 280,973 | |

| (1) | No

awards were granted to our Chief Executive Officers during each of the fiscal years ended

December 31, 2023, 2022 and 2021. |

| Adjustments to Determine Compensation “Actually Paid” to our Other Named Executive Officers | |

2023 | | |

2022 | | |

2021 | |

| Total Compensation in the Summary Compensation Table | |

$ | 247,090 | | |

$ | 172,959 | | |

$ | 191,968 | |

| Deduction for Amounts Reported under the “Stock Awards” Column in the Summary Compensation Table | |

| 0 | | |

| 0 | | |

| 0 | |

| Deduction for Amounts Reported under “Option Awards” Column in the Summary Compensation Table | |

| 0 | | |

| 0 | | |

| 0 | |

| Increase for Fair Value of Awards Granted During Fiscal Year that Remain Unvested as of Year End, Determined as of Applicable Fiscal Year End(2) | |

| 0 | | |

| 0 | | |

| 0 | |

| Increase for Fair Value of Awards Granted During Fiscal Year that Vested during Applicable Fiscal Year, Determined as of Vesting Date(2) | |

| 0 | | |

| 0 | | |

| 0 | |

| Increase/deduction for Awards Granted During Prior Fiscal Year that were Outstanding and Unvested as of Applicable Fiscal Year End | |

| 0 | | |

| 0 | | |

| 0 | |

| Increase/deduction for Awards Granted During Prior Fiscal Year that Vested During Applicable Fiscal Year | |

| 0 | | |

| 0 | | |

| 0 | |

| Total Adjustments | |

| 0 | | |

| 0 | | |

| 0 | |

| Compensation Actually Paid to our other Named Executive Officers | |

$ | 247,090 | | |

$ | 172,959 | | |

$ | 191,968 | |

| (2) | No

awards were granted to our other Named Executive Officers during each of the fiscal years

ended December 31, 2023, 2022 and 2021. |

Relationship

Between Financial Performance Measures

The

relationships between the compensation actually paid to our Chief Executive Officer and the compensation actually paid to our other NEOs,

with (i) our cumulative total shareholder return (“TSR”), and (ii) our net income (loss), in each case, for the fiscal years

ended December 31, 2023, 2022 and 2021 are described as follows:

From

2022 to 2023, the compensation actually paid to our Chief Executive Officer increased by approximately 40.8%, from $375,421 to $528,751,

and the compensation actually paid to our Chief Financial Officer increased by approximately 42.9%, from $172,959 to $247,090. In June

2022, the Compensation Committee approved an increase of Mr. Ran’s annual base salary from $305,000 to $350,000, and an increase

of Ms. Kao’s annual base salary from $150,000 to $170,000. In addition, in 2023, the Compensation Committee approved a special

bonus of $60,000 and an annual bonus of $70,000 to Mr. Ran, as well as a special bonus of $30,000 and an annual bonus of $35,000 to Ms.

Kao. Over this same period, the Company’s TSR decreased from 6.0% to 1.7%. Our cumulative TSR for the two-years period ended December

31, 2023 was 7.6%. Our net income increased by 5.1%, from approximately $5,212,000 to $5,476,000, due largely to the increase in interest

income from loans, partially offset by the increases in interest expense and in general and administrative expenses.

From

2021 to 2022, the compensation actually paid to our Chief Executive Officer increased by approximately 33.6%, from $280,973 to $375,421.

In June 2022, the Compensation Committee approved an increase of Mr. Ran’s annual base salary from $305,000 to $350,000. In September

2021, Mr. Ran voluntarily agreed to forgo his base salary for the months of October, November and December 2021 in an aggregate amount

of $76,250 to provide the Company with temporary additional liquidity which was necessary as a result of the dividend payment of $0.125

per share that was paid to all shareholders of record on July 9, 2021. Had this amount of salary actually been paid, the compensation

paid to our Chief Executive Officer would have been $357,223, and the increase from 2021 to 2022 would have been 5.1%. From 2021 to 2022,

the compensation actually paid to our Chief Financial Officer decreased by approximately 9.9%, from $191,968 to $172,959. Over this same

period, the Company’s TSR decreased from 14.9% to 6.0%. Our cumulative TSR for the two-years period ended December 31, 2022 was

21.2%. Our net income increased by 17.8%, from approximately $4,423,000 to $5,212,000, due largely to the increase in revenue, partially

offset by the increases in interest expense and in general and administrative expenses.

Certain

Relationships and Related Transactions

In

February 2023, we sold a mortgage note from our loan portfolio to a third-party investor at its face value of $485,000. Mr. Assaf Ran

participated in such acquisition in the amount of $152,000.

Except

for the compensation arrangements and the transaction described above, no director, executive officer, principal stockholder holding

at least 5% of our Common Shares, or any family member thereof, had or will have any material interest, direct or indirect, in any transaction,

or proposed transaction, during fiscal year 2023 in which the amount involved in the transaction exceeded or exceeds the lesser of $120,000

or one percent of our total assets at the end of fiscal year 2023.

Security

Ownership of Certain Beneficial Owners

The

following table, together with the accompanying footnotes, sets forth information, as of the Record Date, regarding the beneficial ownership

of our common shares by all persons known by us to beneficially own more than 5% of our outstanding common shares, each Named Executive,

each director, and all of our directors and executive officers as a group:

| Name of Beneficial Owner | |

Amount of Beneficial Ownership (1) | | |

Percentage of Class | |

| | |

| | |

| |

| Executive Officers and Directors | |

| | | |

| | |

| Assaf Ran (2) | |

| 2,606,000 | | |

| 22.8 | % |

| Vanessa Kao | |

| 8,236 | | |

| * | |

| Michael Jackson | |

| 41,344 | | |

| * | |

| Eran Goldshmit | |

| 10,978 | | |

| * | |

| Lyron Bentovim | |

| 39,287 | | |

| * | |

| Phillip Michals | |

| 101,058 | | |

| * | |

| All executive officers and directors as a group (6 persons) | |

| 2,806,903 | | |

| 24.5 | % |

*

Less than 1%

| (1) |

A

person is deemed to be a beneficial owner of securities that can be acquired by such person within 60 days from the Record Date upon

the exercise of options and warrants or conversion of convertible securities. Each beneficial owner’s percentage ownership

is determined by assuming that options, warrants and convertible securities that are held by such person (but not held by any other

person) and that are exercisable or convertible within 60 days from the Record Date have been exercised or converted. Except as otherwise

indicated, and subject to applicable community property and similar laws, each of the persons named has sole voting and investment

power with respect to the shares shown as beneficially owned. All percentages are determined based on 11,438,651 shares outstanding

on the Record Date. |

| |

|

| (2) |

Includes

1,000,000 Restricted Shares granted to Mr. Ran on September 9, 2011, which was approved by shareholders at our 2011 annual meeting

of shareholders. Mr. Ran may not sell, convey, transfer, pledge, encumber or otherwise dispose of the Restricted Shares until the

earliest to occur of the following: (i) September 9, 2026, with respect to 1/3 of the Restricted Shares, September 9, 2027 with respect

to an additional 1/3 of the Restricted Shares and September 9, 2028 with respect to the final 1/3 of the Restricted Shares; (ii)

the date on which Mr. Ran’s employment is terminated by us for any reason other than for “Cause;” or (iii) on a

Risk Termination Date. If at any time prior to a Risk Termination Date Mr. Ran’s employment is terminated by us for Cause or

Mr. Ran voluntarily terminates his employment for any reason other than death or disability, Mr. Ran will forfeit that portion of

the Restricted Shares which have not previously vested. Mr. Ran’s address is c/o Manhattan Bridge Capital, Inc., 60 Cutter

Mill Road, Suite 205, Great Neck, New York 11021. |

Independent

Registered Public Accounting Firm Fees and Other Matters

The

aggregate fees billed by our principal accounting firm, H&L, for the fiscal years ended December 31, 2023 and 2022 are as follows:

(a)

Audit Fees

2023

The

aggregate fees incurred during 2023 for our principal accountant were $71,000, covering the audit of our annual financial statements

and the review of our financial statements for the first, second and third quarters of 2023.

2022

The

aggregate fees incurred during 2022 for our principal accountant were $69,500, covering the audit of our annual financial statements

and the review of our financial statements for the first, second and third quarters of 2022.

(b)

Audit-Related Fees

There

were no audit-related fees billed by our principal accountant during 2023 or 2022.

(c)

Tax Fees

There

were no tax fees billed by our principal accountant during 2023 or 2022.

(d)

All Other Fees

No

other fees, beyond those disclosed above, were billed during 2023 or 2022.

Audit

Committee Pre-Approval, Policies and Procedures

Our

Audit Committee approved the engagement with Hoberman & Lesser CPAs, LLP. These services were pre-approved by our Audit Committee

to assure that such services do not impair the auditor’s independence from us.

MISCELLANEOUS

Other

Matters

Management

knows of no matter other than the foregoing to be brought before the Annual Meeting, but if such other matters properly come before the

meeting, or any adjournment thereof, the persons named in the accompanying form of proxy will vote such proxy on such matters in accordance

with their best judgment.

Solicitation

of Proxies

The

accompanying proxy is solicited by and on behalf of our Board, whose notice of meeting is attached to this Proxy Statement, and the entire

cost of the solicitation of proxies will be borne by us. Proxies may be solicited by directors, officers and regular employees of ours,

without extra compensation, by telephone, telegraph, mail or personal interview. Solicitation is not to be made by specifically engaged

employees or paid solicitors. We will also request that brokers, nominees, custodians and other fiduciaries forward soliciting materials

to the beneficial owners of shares held of record by such brokers, nominees, custodians and other fiduciaries. We will also reimburse

brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses for sending proxies and proxy material

to the beneficial owners of our Common Shares.

Shareholder

Proposals for the 2025 Annual Meeting of Shareholders

Shareholders

who intend to have a proposal considered for inclusion in our proxy materials for presentation at our 2025 annual meeting of shareholders

(the “2025 Annual Meeting”), must comply with Rule 14a-8 under the Exchange Act and any other applicable rules. Rule 14a-8

requires that shareholder proposals be delivered to our principal executive offices no later than 120 days before the one-year anniversary

of the release date of the previous year’s annual meeting proxy statement. Accordingly, if you wish to submit a proposal to be

considered for inclusion in the proxy statement for our 2025 Annual Meeting, you must submit the proposal to our Secretary at our offices

at 60 Cutter Mill Road, Suite 205, Great Neck, NY 11021, in writing not later than January 9, 2025. Shareholders who wish to present

a proposal at our next annual meeting of stockholders without the inclusion of such proposal in our proxy materials must advise our Secretary

of such proposals in writing by March 31, 2025. In addition to satisfying the foregoing requirements, to comply with the universal proxy

rules, shareholders who intend to solicit proxies in support of director nominees other than management’s nominees must provide

notice that sets forth the information required by Rule 14a-19 under the Exchange Act.

Householding

of Annual Meeting Materials

Some

banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and

annual reports. This means that only one copy of our proxy statement or annual report may have been sent to multiple shareholders in

your household. We will promptly deliver a separate copy of either document to you if you call or write us at the following address or

phone number: 60 Cutter Mill Road, Suite 205, Great Neck, NY 11021, (516) 444-3400. If you want to receive separate copies of the annual

report and proxy statement in the future or if you are receiving multiple copies and would like to receive only one copy for your household,

you should contact your bank, broker, or other nominee record holders, or you may contact us at the above address and phone number.

Certain

information contained in this Proxy Statement relating to the occupations and security holdings of our directors and officers is based

upon information received from the individual directors and officers.

WE

WILL FURNISH, WITHOUT CHARGE, A COPY OF OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2023, INCLUDING FINANCIAL STATEMENTS

AND SCHEDULES THERETO, BUT NOT INCLUDING EXHIBITS, TO EACH OF OUR SHAREHOLDERS OF RECORD ON THE RECORD DATE AND TO EACH BENEFICIAL SHAREHOLDER

ON THAT DATE UPON WRITTEN REQUEST MADE TO OUR SECRETARY. A REASONABLE FEE WILL BE CHARGED FOR COPIES OF REQUESTED EXHIBITS.

PLEASE

DATE, SIGN AND RETURN THE PROXY CARD AT YOUR EARLIEST CONVENIENCE IN THE ENCLOSED RETURN ENVELOPE. A PROMPT RETURN OF YOUR PROXY CARD

WILL BE APPRECIATED AS IT WILL SAVE THE EXPENSE OF FURTHER MAILINGS.

EVERY

SHAREHOLDER, WHETHER OR NOT HE OR SHE EXPECTS TO ATTEND THE ANNUAL MEETING IN PERSON, IS URGED TO EXECUTE THE PROXY AND RETURN IT PROMPTLY

IN THE ENCLOSED BUSINESS REPLY ENVELOPE.

| |

By

order of the Board of Directors |

| |

|

| |

|

| |

Vanessa

Kao |

| |

Secretary |

Great

Neck, New York

May

9, 2024

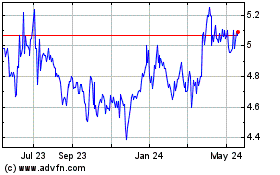

Manhattan Bridge Capital (NASDAQ:LOAN)

Historical Stock Chart

From Nov 2024 to Dec 2024

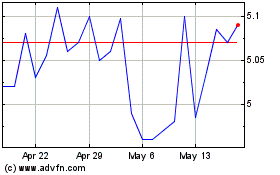

Manhattan Bridge Capital (NASDAQ:LOAN)

Historical Stock Chart

From Dec 2023 to Dec 2024