FALSE000146602600014660262024-07-252024-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 25, 2024

Midland States Bancorp, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Illinois | | 001-35272 | | 37-1233196 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | |

1201 Network Centre Drive |

Effingham, Illinois 62401 |

| (Address of Principal Executive Offices) (Zip Code) |

(217) 342-7321

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | MSBI | The Nasdaq Market LLC |

| Depositary Shares, each representing a 1/40th interest in a share of 7.75% fixed rate reset non-cumulative perpetual preferred stock, Series A, $2.00 par value | MSBIP | The Nasdaq Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On July 25, 2024, Midland States Bancorp, Inc. (the “Company”) issued a press release announcing its financial results for the second quarter of 2024. The press release is attached as Exhibit 99.1.

Item 7.01. Regulation FD Disclosure.

On July 25, 2024, the Company made available on its website a slide presentation regarding the Company's second quarter 2024 financial results. The slide presentation is attached as Exhibit 99.2.

The information set forth under Items 2.02 and 7.01 in this Form 8-K and the attached exhibits shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in any such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | |

| Exhibit No. | | Description | |

| | Press Release of Midland States Bancorp, Inc., dated July 25, 2024 | |

| | Slide Presentation of Midland States Bancorp, Inc. regarding second quarter 2024 financial results | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

Date: July 25, 2024 | By: | /s/ Eric T. Lemke |

| | | Eric T. Lemke |

| | | Chief Financial Officer |

EXHIBIT 99.1

Midland States Bancorp, Inc. Announces 2024 Second Quarter Results

Second Quarter 2024 Highlights:

•Net income available to common shareholders of $4.5 million, or $0.20 per diluted share

•Adjusted pre-tax, pre-provision earnings of $25.2 million

•Tangible book value per share decreased to $23.36, compared to $23.44 at March 31, 2024

•Common equity tier 1 capital ratio improved to 8.63% from 8.60%

•Net interest margin of 3.12%, compared to 3.18% in prior quarter

•Efficiency ratio of 65.2%, compared to 58.0% in prior quarter

Effingham, IL, July 25, 2024 (GLOBE NEWSWIRE) -- Midland States Bancorp, Inc. (Nasdaq: MSBI) (the “Company”) today reported net income available to common shareholders of $4.5 million, or $0.20 per diluted share, for the second quarter of 2024, compared to $11.7 million, or $0.53 per diluted share, for the first quarter of 2024. This also compares to net income available to common shareholders of $19.3 million, or $0.86 per diluted share, for the second quarter of 2023.

Provision expense was $16.8 million in the second quarter of 2024 compared to $14.0 million and $5.9 million in the first quarter of 2024 and the second quarter of 2023, respectively. The provision expense in the second quarter of 2024 included provision for credit losses on loans of $17.0 million, offset by a $0.2 million benefit related to unfunded commitments. The elevated loan provision in the second quarter of 2024 was primarily due to credit deterioration and servicing issues involving one of our fintech partners, LendingPoint, subsequent to their system conversion in late 2023. The provision expense for the first quarter of 2024 included a specific reserve of $8.0 million on a multi-family construction project.

Jeffrey G. Ludwig, President and Chief Executive Officer of the Company, said, “We continued to execute well on our strategic priorities during the second quarter and our balance sheet management strategies resulted in further increases in our capital ratios. We are continuing to address credit risk in our loan portfolios, including the relationship with Lending Point, by prudently increasing our loan loss reserves with a focus on reducing problem assets. Our emphasis on our community bank and local markets has led to another good quarter of generating high quality, in-market loans with full banking relationships, which are partially funded by the continued intentional reduction of our equipment finance and consumer portfolios. In particular, we are seeing good results from the investments we have made to increase our presence and business development efforts in the St. Louis market, where our loan balances increased at an annualized rate of 31% during the second quarter.

“We continue to benefit from the strength of the franchise we have built to attract high quality banking talent across the organization. We recently added a new market president for our Northern Illinois region and a new Chief Deposit Officer, who we expect to positively impact our treasury management services and our ability to add new commercial deposit relationships. We are also continuing to invest in our Wealth Management business to improve our ability to cross-sell this service to our community bank clients. We believe the banking talent we are adding will further enhance our efforts to expand our market

share within our community bank. Our successful efforts in this area are resulting in a favorable shift in the mix of our loan portfolio; moving towards a higher quality portfolio and expanded banking relationships with both loans and deposits. We expect to make continued progress on this strategic priority over the remainder of the year, which we believe will further enhance the value of our franchise,” said Mr. Ludwig.

Balance Sheet Highlights

Total assets were $7.76 billion at June 30, 2024, compared to $7.83 billion at March 31, 2024, and $8.03 billion at June 30, 2023. At June 30, 2024, portfolio loans were $5.85 billion, compared to $5.96 billion at March 31, 2024, and $6.37 billion at June 30, 2023.

Loans

During the second quarter of 2024, outstanding loans declined by $106.5 million, or 1.8%, from March 31, 2024, as the Company continued to shrink its equipment financing and consumer loan portfolios, and focus on commercial loan opportunities in our community bank footprint. Increases in commercial, commercial real estate, and construction and land development loans of $25.9 million, $24.4 million and $2.4 million, respectively, were offset by decreases in all other loan categories.

Equipment finance loan and lease balances decreased $59.9 million during the second quarter of 2024 as the Company continued to reduce its concentration of this product within the overall loan portfolio. Consumer loans decreased $91.1 million due to loan payoffs and a cessation in loans originated through GreenSky. Our Greensky-originated loan balances decreased $67.7 million during the second quarter to $538.3 million at June 30, 2024. In addition, as previously disclosed, during the fourth quarter of 2023, the Company ceased originating loans through LendingPoint. As of June 30, 2024, the Company had $114.2 million in loans that were originated through and serviced by LendingPoint. Equipment financing and consumer loans comprised 15.2% and 12.7%, respectively, of the loan portfolio at June 30, 2024, compared to 15.9% and 14.0%, respectively, at March 31, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of |

| | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| (in thousands) | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| Loan Portfolio | | | | | | | | | | |

| Commercial loans | | $ | 939,458 | | | $ | 913,564 | | | $ | 951,387 | | | $ | 943,761 | | | $ | 962,756 | |

| Equipment finance loans | | 461,409 | | | 494,068 | | | 531,143 | | | 578,931 | | | 614,633 | |

| Equipment finance leases | | 428,659 | | | 455,879 | | | 473,350 | | | 485,460 | | | 500,485 | |

| Commercial FHA warehouse lines | | — | | | 8,035 | | | — | | | 48,547 | | | 30,522 | |

| Total commercial loans and leases | | 1,829,526 | | | 1,871,546 | | | 1,955,880 | | | 2,056,699 | | | 2,108,396 | |

| Commercial real estate | | 2,421,505 | | | 2,397,113 | | | 2,406,845 | | | 2,412,164 | | | 2,443,995 | |

| Construction and land development | | 476,528 | | | 474,128 | | | 452,593 | | | 416,801 | | | 366,631 | |

| Residential real estate | | 378,393 | | | 378,583 | | | 380,583 | | | 375,211 | | | 371,486 | |

| Consumer | | 746,042 | | | 837,092 | | | 935,178 | | | 1,020,008 | | | 1,076,836 | |

| Total loans | | $ | 5,851,994 | | | $ | 5,958,462 | | | $ | 6,131,079 | | | $ | 6,280,883 | | | $ | 6,367,344 | |

Loan Quality

Overall, credit quality metrics declined this quarter compared to the first quarter of 2024. Non-performing loans increased $7.1 million to $112.1 million at June 30, 2024, compared to $105.0 million as of March

31, 2024. A $3.6 million commercial loan and $4.7 million of equipment financing loans account for the increase.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of and for the Three Months Ended |

| (in thousands) | | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| Asset Quality | | | | | | | | | | |

| Loans 30-89 days past due | | $ | 54,045 | | | $ | 58,854 | | | $ | 82,778 | | | $ | 46,608 | | | $ | 44,161 | |

| Nonperforming loans | | 112,124 | | | 104,979 | | | 56,351 | | | 55,981 | | | 54,844 | |

| Nonperforming assets | | 123,774 | | | 116,721 | | | 67,701 | | | 58,677 | | | 57,688 | |

| Substandard loans | | 135,555 | | | 149,049 | | | 184,224 | | | 143,793 | | | 130,707 | |

| Net charge-offs | | 2,874 | | | 4,445 | | | 5,117 | | | 3,449 | | | 2,996 | |

| Loans 30-89 days past due to total loans | | 0.92 | % | | 0.99 | % | | 1.35 | % | | 0.74 | % | | 0.69 | % |

| Nonperforming loans to total loans | | 1.92 | % | | 1.76 | % | | 0.92 | % | | 0.89 | % | | 0.86 | % |

| Nonperforming assets to total assets | | 1.60 | % | | 1.49 | % | | 0.86 | % | | 0.74 | % | | 0.72 | % |

| Allowance for credit losses to total loans | | 1.58 | % | | 1.31 | % | | 1.12 | % | | 1.06 | % | | 1.02 | % |

| Allowance for credit losses to nonperforming loans | | 82.22 | % | | 74.35 | % | | 121.56 | % | | 119.09 | % | | 118.43 | % |

| Net charge-offs to average loans | | 0.20 | % | | 0.30 | % | | 0.33 | % | | 0.22 | % | | 0.19 | % |

The Company continued to increase its allowance for credit losses on loans during the second quarter of 2024. Notably, the Company recognized provision expense of $14.0 million this quarter related to the loans originated and serviced by LendingPoint, increasing the allowance to $14.6 million on this portfolio. Credit deterioration and servicing issues following their system conversion have resulted in increased losses within this portfolio. At June 30, 2024, loans serviced by LendingPoint totaled $114.2 million.

The allowance for credit losses on loans totaled $92.2 million at June 30, 2024, compared to $78.1 million at March 31, 2024, and $65.0 million at June 30, 2023. The allowance as a percentage of portfolio loans was 1.58% at June 30, 2024, compared to 1.31% at March 31, 2024, and 1.02% at June 30, 2023.

Deposits

Total deposits were $6.12 billion at June 30, 2024, compared with $6.32 billion at March 31, 2024. Noninterest-bearing deposits decreased $103.9 million to $1.11 billion at June 30, 2024, while interest-bearing deposits decreased $102.1 million to $5.01 billion at June 30, 2024. Brokered time deposits decreased $56.8 million to $131.4 million, and represented 2.15% of total deposits at June 30, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of |

| | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| (in thousands) | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| Deposit Portfolio | | | | | | | | | | |

| Noninterest-bearing demand | | $ | 1,108,521 | | | $ | 1,212,382 | | | $ | 1,145,395 | | | $ | 1,154,515 | | | $ | 1,162,909 | |

| Interest-bearing: | | | | | | | | | | |

| Checking | | 2,343,533 | | | 2,394,163 | | | 2,511,840 | | | 2,572,224 | | | 2,499,693 | |

| Money market | | 1,143,668 | | | 1,128,463 | | | 1,135,629 | | | 1,090,962 | | | 1,226,470 | |

| Savings | | 538,462 | | | 555,552 | | | 559,267 | | | 582,359 | | | 624,005 | |

| Time | | 852,415 | | | 845,190 | | | 862,865 | | | 885,858 | | | 840,734 | |

| Brokered time | | 131,424 | | | 188,234 | | | 94,533 | | | 119,084 | | | 72,737 | |

| Total deposits | | $ | 6,118,023 | | | $ | 6,323,984 | | | $ | 6,309,529 | | | $ | 6,405,002 | | | $ | 6,426,548 | |

Results of Operations Highlights

Net Interest Income and Margin

During the second quarter of 2024, net interest income, on a tax-equivalent basis, totaled $55.2 million, a decrease of $0.9 million, or 1.6%, compared to $56.1 million for the first quarter of 2024. The tax-equivalent net interest margin for the second quarter of 2024 was 3.12%, compared with 3.18% in the first quarter of 2024. Net interest income and net interest margin, on a tax-equivalent basis, were $59.0 million and 3.23%, respectively, in the second quarter of 2023. The decline in both the net interest income and margin were largely attributable to increased market interest rates resulting in a faster increase in the cost of funding liabilities than the yield on earning assets, as well as the impact of interest reversals on loans placed on non-accrual.

Average interest-earning assets for the second quarter of 2024 were $7.13 billion, compared to $7.11 billion for the first quarter of 2024. The yield increased 8 basis points to 5.84% compared to the first quarter of 2024. Interest-earning assets averaged $7.33 billion for the second quarter of 2023.

Average loans were $5.92 billion for the second quarter of 2024, compared to $6.01 billion for the first quarter of 2024 and $6.36 billion for the second quarter of 2023. The yield on loans was 6.03% for the second quarter of 2024, up from 5.99% for the first quarter of 2024 and 5.80% for the second quarter of 2023.

Investment securities averaged $1.10 billion for the second quarter of 2024, and yielded 4.69%, compared to an average balance and yield of $988.7 million and 4.36%, respectively, for the first quarter of 2024. The Company purchased additional higher-yielding investments resulting in the increased average balance and yield. Investment securities averaged $861.4 million for the second quarter of 2023.

Average interest-bearing deposits were $5.10 billion for the second quarter of 2024, compared to $5.20 billion for the first quarter of 2024, and $5.26 billion for the second quarter of 2023. Cost of interest-bearing deposits was 3.11% in the second quarter of 2024, which represented a 7 basis point increase from the first quarter of 2024. A competitive market, driven by rising interest rates and increased competition, contributed to the increase in deposit costs.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended |

| (dollars in thousands) | | June 30, 2024 | | March 31, 2024 | | June 30, 2023 |

| Interest-earning assets | | Average Balance | | Interest & Fees | | Yield/Rate | | Average Balance | | Interest & Fees | | Yield/Rate | | Average Balance | | Interest & Fees | | Yield/Rate |

| Cash and cash equivalents | | $ | 65,250 | | | $ | 875 | | | 5.40 | % | | $ | 69,316 | | | $ | 951 | | | 5.52 | % | | $ | 67,377 | | | $ | 852 | | | 5.07 | % |

Investment securities(1) | | 1,098,452 | | | 12,805 | | | 4.69 | | | 988,716 | | | 10,708 | | | 4.36 | | | 861,409 | | | 7,286 | | | 3.39 | |

Loans(1)(2) | | 5,915,523 | | | 88,738 | | | 6.03 | | | 6,012,032 | | | 89,489 | | | 5.99 | | | 6,356,012 | | | 91,890 | | | 5.80 | |

| Loans held for sale | | 4,910 | | | 84 | | | 6.84 | | | 3,405 | | | 55 | | | 6.56 | | | 4,067 | | | 59 | | | 5.79 | |

| Nonmarketable equity securities | | 44,216 | | | 963 | | | 8.76 | | | 35,927 | | | 687 | | | 7.69 | | | 45,028 | | | 599 | | | 5.33 | |

| Total interest-earning assets | | 7,128,351 | | | 103,465 | | | 5.84 | | | 7,109,396 | | | 101,890 | | | 5.76 | | | 7,333,893 | | | 100,686 | | | 5.51 | |

| Noninterest-earning assets | | 669,370 | | | | | | | 671,671 | | | | | | | 612,238 | | | | | |

| Total assets | | $ | 7,797,721 | | | | | | | $ | 7,781,067 | | | | | | | $ | 7,946,131 | | | | | |

| | | | | | | | | | | | | | | | | | |

| Interest-Bearing Liabilities | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits | | $ | 5,101,365 | | | $ | 39,476 | | | 3.11 | % | | $ | 5,195,118 | | | $ | 39,214 | | | 3.04 | % | | $ | 5,259,188 | | | $ | 33,617 | | | 2.56 | % |

| Short-term borrowings | | 30,449 | | | 308 | | | 4.07 | | | 65,182 | | | 836 | | | 5.16 | | | 22,018 | | | 14 | | | 0.26 | |

| FHLB advances & other borrowings | | 500,758 | | | 5,836 | | | 4.69 | | | 313,121 | | | 3,036 | | | 3.90 | | | 471,989 | | | 5,396 | | | 4.59 | |

| Subordinated debt | | 93,090 | | | 1,265 | | | 5.47 | | | 93,583 | | | 1,280 | | | 5.50 | | | 97,278 | | | 1,335 | | | 5.51 | |

| Trust preferred debentures | | 50,921 | | | 1,358 | | | 10.73 | | | 50,707 | | | 1,389 | | | 11.02 | | | 50,218 | | | 1,289 | | | 10.29 | |

| Total interest-bearing liabilities | | 5,776,583 | | | 48,243 | | | 3.36 | | | 5,717,711 | | | 45,755 | | | 3.22 | | | 5,900,691 | | | 41,651 | | | 2.83 | |

| Noninterest-bearing deposits | | 1,132,451 | | | | | | | 1,151,542 | | | | | | | 1,187,584 | | | | | |

| Other noninterest-bearing liabilities | | 104,841 | | | | | | | 121,908 | | | | | | | 81,065 | | | | | |

| Shareholders’ equity | | 783,846 | | | | | | | 789,906 | | | | | | | 776,791 | | | | | |

| Total liabilities and shareholder’s equity | | $ | 7,797,721 | | | | | | | $ | 7,781,067 | | | | | | | $ | 7,946,131 | | | | | |

| | | | | | | | | | | | | | | | | | |

| Net Interest Margin | | | | $ | 55,222 | | | 3.12 | % | | | | $ | 56,135 | | | 3.18 | % | | | | $ | 59,035 | | | 3.23 | % |

| | | | | | | | | | | | | | | | | | |

| Cost of Deposits | | | | | | 2.55 | % | | | | | | 2.49 | % | | | | | | 2.09 | % |

(1)Interest income and average rates for tax-exempt loans and investment securities are presented on a tax-equivalent basis, assuming a federal income tax rate of 21%. Tax-equivalent adjustments totaled $0.2 million for each of the three months ended June 30, 2024, March 31, 2024 and June 30, 2023, respectively.

(2)Average loan balances include nonaccrual loans. Interest income on loans includes amortization of deferred loan fees, net of deferred loan costs.

For the six months ended June 30, 2024, net interest income, on a tax-equivalent basis, decreased to $111.4 million, with a tax-equivalent net interest margin of 3.15%, compared to net interest income, on a tax-equivalent basis, of $119.8 million, and a tax-equivalent net interest margin of 3.31% for the six months ended June 30, 2023.

The yield on earning assets increased 37 basis points to 5.80% for the six months ended June 30, 2024 compared to the prior year. However, the cost of interest-bearing liabilities increased at a faster rate during this period, increasing 64 basis points to 3.29% for the six months ended June 30, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Six Months Ended |

| (dollars in thousands) | | June 30, 2024 | | June 30, 2023 |

| Interest-earning assets | | Average Balance | | Interest & Fees | | Yield/Rate | | Average Balance | | Interest & Fees | | Yield/Rate |

| Cash and cash equivalents | | $ | 67,283 | | | $ | 1,826 | | | 5.46 | % | | $ | 76,201 | | | $ | 1,832 | | | 4.85 | % |

Investment securities(1) | | 1,043,585 | | | 23,513 | | | 4.53 | | | 835,771 | | | 13,281 | | | 3.18 | |

Loans(1)(2) | | 5,963,777 | | | 178,226 | | | 6.01 | | | 6,338,305 | | | 179,887 | | | 5.72 | |

| Loans held for sale | | 4,157 | | | 139 | | | 6.72 | | | 2,794 | | | 75 | | | 5.42 | |

| Nonmarketable equity securities | | 40,072 | | | 1,650 | | | 8.28 | | | 46,416 | | | 1,394 | | | 6.05 | |

| Total interest-earning assets | | 7,118,874 | | | 205,354 | | | 5.80 | | | 7,299,487 | | | 196,469 | | | 5.43 | |

| Noninterest-earning assets | | 669,370 | | | | | | | 611,528 | | | | | |

| Total assets | | $ | 7,788,244 | | | | | | | $ | 7,911,015 | | | | | |

| | | | | | | | | | | | |

| Interest-Bearing Liabilities | | | | | | | | | | | | |

| Interest-bearing deposits | | $ | 5,148,242 | | | $ | 78,690 | | | 3.07 | % | | $ | 5,157,148 | | | $ | 60,022 | | | 2.35 | % |

| Short-term borrowings | | 47,815 | | | 1,144 | | | 4.81 | | | 30,291 | | | 39 | | | 0.26 | |

| FHLB advances & other borrowings | | 406,940 | | | 8,872 | | | 4.38 | | | 505,945 | | | 11,402 | | | 4.54 | |

| Subordinated debt | | 93,337 | | | 2,545 | | | 5.45 | | | 98,538 | | | 2,705 | | | 5.54 | |

| Trust preferred debentures | | 50,814 | | | 2,747 | | | 10.87 | | | 50,133 | | | 2,518 | | | 10.13 | |

| Total interest-bearing liabilities | | 5,747,148 | | | 93,998 | | | 3.29 | | | 5,842,055 | | | 76,686 | | | 2.65 | |

| Noninterest-bearing deposits | | 1,141,996 | | | | | | | 1,219,050 | | | | | |

| Other noninterest-bearing liabilities | | 112,223 | | | | | | | 77,895 | | | | | |

| Shareholders’ equity | | 786,877 | | | | | | | 772,015 | | | | | |

| Total liabilities and shareholders’ equity | | $ | 7,788,244 | | | | | | | $ | 7,911,015 | | | | | |

| | | | | | | | | | | | |

| Net Interest Margin | | | | $ | 111,356 | | | 3.15 | % | | | | $ | 119,783 | | | 3.31 | % |

| | | | | | | | | | | | |

| Cost of Deposits | | | | | | 2.52 | % | | | | | | 1.90 | % |

(1)Interest income and average rates for tax-exempt loans and investment securities are presented on a tax-equivalent basis, assuming a federal income tax rate of 21%. Tax-equivalent adjustments totaled $0.4 million for each of the six months ended June 30, 2024 and 2023, respectively.

(2)Average loan balances include nonaccrual loans. Interest income on loans includes amortization of deferred loan fees, net of deferred loan costs.

Noninterest Income

Noninterest income was $17.7 million for the second quarter of 2024, compared to $21.2 million for the first quarter of 2024. Noninterest income for the second quarter of 2024 included a $0.2 million gain on the repurchase of subordinated debt, offset by $0.2 million of net losses on the sale of investment securities. Noninterest income for the first quarter of 2024 included incremental servicing revenues of $3.7 million related to the Greensky portfolio. The second quarter of 2023 included an $0.8 million gain on the sale of OREO and a $0.7 million gain on the repurchase of subordinated debt, partially offset by $0.9 million of net losses on the sale of investment securities. Excluding these transactions, noninterest

income for the second quarter of 2024, the first quarter of 2024, and the second quarter of 2023 was $17.6 million, $17.5 million, and $18.1 million, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended | | For the Six Months Ended |

| | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| (in thousands) | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Noninterest income | | | | | | | | | | |

| Wealth management revenue | | $ | 6,801 | | | $ | 7,132 | | | $ | 6,269 | | | $ | 13,933 | | | $ | 12,680 | |

| Service charges on deposit accounts | | 3,121 | | | 3,116 | | | 2,677 | | | 6,237 | | | 5,245 | |

| Interchange revenue | | 3,563 | | | 3,358 | | | 3,696 | | | 6,921 | | | 7,108 | |

| Residential mortgage banking revenue | | 557 | | | 527 | | | 540 | | | 1,084 | | | 945 | |

| Income on company-owned life insurance | | 1,925 | | | 1,801 | | | 891 | | | 3,726 | | | 1,767 | |

| | | | | | | | | | |

| Loss on sales of investment securities, net | | (152) | | | — | | | (869) | | | (152) | | | (1,517) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other income | | 1,841 | | | 5,253 | | | 5,549 | | | 7,094 | | | 8,304 | |

| Total noninterest income | | $ | 17,656 | | | $ | 21,187 | | | $ | 18,753 | | | $ | 38,843 | | | $ | 34,532 | |

Wealth management revenue totaled $6.8 million in the second quarter of 2024, a decrease of $0.3 million, or 4.6%, as compared to the first quarter of 2024, due to the seasonal impact of tax planning fees in the first quarter. Assets under administration increased to $4.00 billion at June 30, 2024 from $3.89 billion at March 31, 2024, primarily due to improved sales activity. Assets under administration totaled $3.59 billion at June 30, 2023.

Noninterest Expense

Noninterest expense was $47.5 million in the second quarter of 2024, compared to $44.9 million in the first quarter of 2024 and $42.9 million in the second quarter of 2023. Noninterest expense for the second quarter of 2024 included $4.1 million of aggregate expenses related to OREO impairment and property taxes, and accruals related to various legal actions. Excluding these transactions, noninterest expense for the second quarter of 2024, the first quarter of 2024, and the second quarter of 2023 was $43.4 million, $44.9 million, and $42.9 million, respectively. The efficiency ratio increased to 65.16% for the quarter ended June 30, 2024, compared to 58.03% for the quarter ended March 31, 2024, and 55.01% for the quarter ended June 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended | | For the Six Months Ended |

| | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| (in thousands) | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Noninterest expense | | | | | | | | | | |

| Salaries and employee benefits | | $ | 22,872 | | | $ | 24,102 | | | $ | 22,857 | | | $ | 46,974 | | | $ | 47,100 | |

| Occupancy and equipment | | 3,964 | | | 4,142 | | | 3,879 | | | 8,106 | | | 8,322 | |

| Data processing | | 7,205 | | | 6,722 | | | 6,544 | | | 13,927 | | | 12,855 | |

| Professional services | | 2,243 | | | 2,255 | | | 1,663 | | | 4,498 | | | 3,423 | |

| Amortization of intangible assets | | 1,016 | | | 1,089 | | | 1,208 | | | 2,105 | | | 2,499 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| FDIC insurance | | 1,219 | | | 1,274 | | | 1,196 | | | 2,493 | | | 2,525 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other expense | | 8,960 | | | 5,283 | | | 5,547 | | | 14,243 | | | 10,652 | |

| Total noninterest expense | | $ | 47,479 | | | $ | 44,867 | | | $ | 42,894 | | | $ | 92,346 | | | $ | 87,376 | |

Income Tax Expense

Income tax expense was $1.7 million for the second quarter of 2024, compared to $4.4 million for the first quarter of 2024 and $7.2 million for the second quarter of 2023. The resulting effective tax rates were 19.9%, 23.9% and 25.1%, respectively.

Capital

At June 30, 2024, Midland States Bank and the Company exceeded all regulatory capital requirements under Basel III, and Midland States Bank met the qualifications to be a ‘‘well-capitalized’’ financial institution, as summarized in the following table:

| | | | | | | | | | | | | | | | | |

| As of June 30, 2024 |

| Midland States Bank | | Midland States Bancorp, Inc. | | Minimum Regulatory Requirements (2) |

| Total capital to risk-weighted assets | 13.06% | | 13.94% | | 10.50% |

| Tier 1 capital to risk-weighted assets | 11.69% | | 11.21% | | 8.50% |

| Tier 1 leverage ratio | 10.26% | | 9.84% | | 4.00% |

| Common equity Tier 1 capital | 11.69% | | 8.63% | | 7.00% |

Tangible common equity to tangible assets (1) | N/A | | 6.59% | | N/A |

(1) A non-GAAP financial measure. Refer to page 15 for a reconciliation to the comparable GAAP financial measure.

(2) Includes the capital conservation buffer of 2.5%, as applicable.

The impact of rising interest rates on the Company’s investment portfolio and cash flow hedges resulted in an $82.6 million accumulated other comprehensive loss at June 30, 2024, which reduced tangible book value by $3.86 per share.

Stock Repurchase Program

As previously disclosed, on December 5, 2023, the Company’s board of directors authorized a new share repurchase program, pursuant to which the Company is authorized to repurchase up to $25.0 million of common stock through December 31, 2024. During the second quarter of 2024, the Company repurchased 131,372 shares of its common stock at a weighted average price of $22.84 under its stock repurchase program.

About Midland States Bancorp, Inc.

Midland States Bancorp, Inc. is a community-based financial holding company headquartered in Effingham, Illinois, and is the sole shareholder of Midland States Bank. As of June 30, 2024, the Company had total assets of approximately $7.76 billion, and its Wealth Management Group had assets under administration of approximately $4.00 billion. The Company provides a full range of commercial and consumer banking products and services and business equipment financing, merchant credit card services, trust and investment management, insurance and financial planning services. For additional information, visit https://www.midlandsb.com/ or https://www.linkedin.com/company/midland-states-bank.

Non-GAAP Financial Measures

Some of the financial measures included in this press release are not measures of financial performance recognized in accordance with GAAP.

These non-GAAP financial measures include “Adjusted Earnings,” “Adjusted Earnings Available to Common Shareholders,” “Adjusted Diluted Earnings Per Common Share,” “Adjusted Return on Average Assets,” “Adjusted Return on Average Shareholders’ Equity,” “Adjusted Return on Average Tangible Common Equity,” “Adjusted Pre-Tax, Pre-Provision Earnings,” “Adjusted Pre-Tax, Pre-Provision Return on Average Assets,” “Efficiency Ratio,” “Tangible Common Equity to Tangible Assets,” “Tangible Book Value Per Share,” “Tangible Book Value Per Share excluding Accumulated Other Comprehensive

Income,” and “Return on Average Tangible Common Equity.” The Company believes these non-GAAP financial measures provide both management and investors a more complete understanding of the Company’s funding profile and profitability. These non-GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP financial measures. Not all companies use the same calculation of these measures; therefore, the measures in this press release may not be comparable to other similarly titled measures as presented by other companies.

Forward-Looking Statements

Readers should note that in addition to the historical information contained herein, this press release includes "forward-looking statements" within the meanings of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including but not limited to statements about the Company’s plans, objectives, future performance, goals and future earnings levels. These statements are subject to many risks and uncertainties, including changes in interest rates and other general economic, business and political conditions, the impact of inflation, increased deposit volatility and potential regulatory developments; changes in the financial markets; changes in business plans as circumstances warrant; risks relating to acquisitions; changes to U.S. tax laws, regulations and guidance; and other risks detailed from time to time in filings made by the Company with the Securities and Exchange Commission. Readers should note that the forward-looking statements included in this press release are not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking statements. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "will," "propose," "may," "plan," "seek," "expect," "intend," "estimate," "anticipate," "believe," "continue," or similar terminology. Any forward-looking statements presented herein are made only as of the date of this press release, and the Company does not undertake any obligation to update or revise any forward-looking statements to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise.

CONTACTS:

Jeffrey G. Ludwig, President and CEO, at jludwig@midlandsb.com or (217) 342-7321

Eric T. Lemke, Chief Financial Officer, at elemke@midlandsb.com or (217) 342-7321

Douglas J. Tucker, SVP and Corporate Counsel, at dtucker@midlandsb.com or (217) 342-7321

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| MIDLAND STATES BANCORP, INC. |

| CONSOLIDATED FINANCIAL SUMMARY (unaudited) |

| | | | | | | | | | |

| | As of and for the Three Months Ended | | As of and for the Six Months Ended |

| | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| (dollars in thousands, except per share data) | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Earnings Summary | | | | | | | | | | |

| Net interest income | | $ | 55,052 | | | $ | 55,920 | | | $ | 58,840 | | | $ | 110,972 | | | $ | 119,344 | |

| Provision for credit losses | | 16,800 | | | 14,000 | | | 5,879 | | | 30,800 | | | 9,014 | |

| Noninterest income | | 17,656 | | | 21,187 | | | 18,753 | | | 38,843 | | | 34,532 | |

| Noninterest expense | | 47,479 | | | 44,867 | | | 42,894 | | | 92,346 | | | 87,376 | |

| Income before income taxes | | 8,429 | | | 18,240 | | | 28,820 | | | 26,669 | | | 57,486 | |

| Income taxes | | 1,679 | | | 4,355 | | | 7,245 | | | 6,034 | | | 14,139 | |

| Net income | | 6,750 | | | 13,885 | | | 21,575 | | | 20,635 | | | 43,347 | |

| Preferred dividends | | 2,228 | | | 2,228 | | | 2,228 | | | 4,456 | | | 4,456 | |

| Net income available to common shareholders | | $ | 4,522 | | | $ | 11,657 | | | $ | 19,347 | | | $ | 16,179 | | | $ | 38,891 | |

| | | | | | | | | | |

| Diluted earnings per common share | | $ | 0.20 | | | $ | 0.53 | | | $ | 0.86 | | | $ | 0.73 | | | $ | 1.72 | |

| Weighted average common shares outstanding - diluted | | 21,734,849 | | | 21,787,691 | | | 22,205,079 | | | 21,761,492 | | | 22,348,981 | |

| Return on average assets | | 0.35 | % | | 0.72 | % | | 1.09 | % | | 0.53 | % | | 1.10 | % |

| Return on average shareholders' equity | | 3.46 | % | | 7.07 | % | | 11.14 | % | | 5.27 | % | | 11.32 | % |

Return on average tangible common equity (1) | | 3.66 | % | | 9.34 | % | | 15.99 | % | | 6.51 | % | | 16.34 | % |

| Net interest margin | | 3.12 | % | | 3.18 | % | | 3.23 | % | | 3.15 | % | | 3.31 | % |

Efficiency ratio (1) | | 65.16 | % | | 58.03 | % | | 55.01 | % | | 61.49 | % | | 56.31 | % |

| | | | | | | | | | |

Adjusted Earnings Performance Summary (1) | | | | | | | | | | |

| Adjusted earnings available to common shareholders | | $ | 4,511 | | | $ | 11,657 | | | $ | 19,488 | | | $ | 16,168 | | | $ | 39,505 | |

| Adjusted diluted earnings per common share | | $ | 0.20 | | | $ | 0.53 | | | $ | 0.87 | | | $ | 0.73 | | | $ | 1.75 | |

| Adjusted return on average assets | | 0.35 | % | | 0.72 | % | | 1.10 | % | | 0.53 | % | | 1.12 | % |

| Adjusted return on average shareholders' equity | | 3.46 | % | | 7.07 | % | | 11.21 | % | | 5.27 | % | | 11.48 | % |

| Adjusted return on average tangible common equity | | 3.65 | % | | 9.34 | % | | 16.10 | % | | 6.51 | % | | 16.60 | % |

| Adjusted pre-tax, pre-provision earnings | | $ | 25,214 | | | $ | 32,240 | | | $ | 34,892 | | | $ | 57,454 | | | $ | 67,341 | |

| Adjusted pre-tax, pre-provision return on average assets | | 1.30 | % | | 1.67 | % | | 1.76 | % | | 1.48 | % | | 1.72 | % |

| | | | | | | | | | |

| Market Data | | | | | | | | | | |

| Book value per share at period end | | $ | 31.59 | | | $ | 31.67 | | | $ | 30.49 | | | | | |

Tangible book value per share at period end (1) | | $ | 23.36 | | | $ | 23.44 | | | $ | 22.24 | | | | | |

Tangible book value per share excluding accumulated other comprehensive income at period end (1) | | $ | 27.22 | | | $ | 27.23 | | | $ | 26.11 | | | | | |

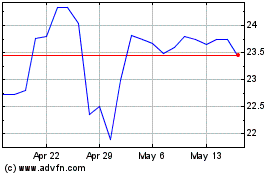

| Market price at period end | | $ | 22.65 | | | $ | 25.13 | | | $ | 19.91 | | | | | |

| Common shares outstanding at period end | | 21,377,215 | | | 21,485,231 | | | 21,854,800 | | | | | |

| | | | | | | | | | |

| Capital | | | | | | | | | | |

| Total capital to risk-weighted assets | | 13.94 | % | | 13.68 | % | | 12.65 | % | | | | |

| Tier 1 capital to risk-weighted assets | | 11.21 | % | | 11.16 | % | | 10.47 | % | | | | |

| Tier 1 common capital to risk-weighted assets | | 8.63 | % | | 8.60 | % | | 8.03 | % | | | | |

| Tier 1 leverage ratio | | 9.84 | % | | 9.92 | % | | 9.57 | % | | | | |

Tangible common equity to tangible assets (1) | | 6.59 | % | | 6.58 | % | | 6.19 | % | | | | |

| | | | | | | | | | |

| Wealth Management | | | | | | | | | | |

| Trust assets under administration | | $ | 3,996,175 | | | $ | 3,888,219 | | | $ | 3,594,727 | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

(1) Non-GAAP financial measures. Refer to pages 13 - 15 for a reconciliation to the comparable GAAP financial measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| MIDLAND STATES BANCORP, INC. | | | | |

| CONSOLIDATED FINANCIAL SUMMARY (unaudited) (continued) | | | | |

| | | | | | | | | | | | | | |

| | As of | | | | |

| | June 30, | | March 31, | | December 31, | | September 30, | | June 30, | | | | |

| (in thousands) | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 | | | | |

| Assets | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 124,646 | | | $ | 167,316 | | | $ | 135,061 | | | $ | 132,132 | | | $ | 160,695 | | | | | |

| Investment securities | | 1,099,654 | | | 1,044,900 | | | 920,396 | | | 839,344 | | | 887,003 | | | | | |

| Loans | | 5,851,994 | | | 5,958,462 | | | 6,131,079 | | | 6,280,883 | | | 6,367,344 | | | | | |

| Allowance for credit losses on loans | | (92,183) | | | (78,057) | | | (68,502) | | | (66,669) | | | (64,950) | | | | | |

| Total loans, net | | 5,759,811 | | | 5,880,405 | | | 6,062,577 | | | 6,214,214 | | | 6,302,394 | | | | | |

| Loans held for sale | | 5,555 | | | 5,043 | | | 3,811 | | | 6,089 | | | 5,632 | | | | | |

| Premises and equipment, net | | 83,040 | | | 81,831 | | | 82,814 | | | 82,741 | | | 81,006 | | | | | |

| Other real estate owned | | 8,304 | | | 8,920 | | | 9,112 | | | 480 | | | 202 | | | | | |

| Loan servicing rights, at lower of cost or fair value | | 18,902 | | | 19,577 | | | 20,253 | | | 20,933 | | | 21,611 | | | | | |

| | | | | | | | | | | | | | |

| Goodwill | | 161,904 | | | 161,904 | | | 161,904 | | | 161,904 | | | 161,904 | | | | | |

| Other intangible assets, net | | 14,003 | | | 15,019 | | | 16,108 | | | 17,238 | | | 18,367 | | | | | |

| Company-owned life insurance | | 207,211 | | | 205,286 | | | 203,485 | | | 201,750 | | | 152,210 | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Other assets | | 274,244 | | | 241,608 | | | 251,347 | | | 292,460 | | | 243,697 | | | | | |

| Total assets | | $ | 7,757,274 | | | $ | 7,831,809 | | | $ | 7,866,868 | | | $ | 7,969,285 | | | $ | 8,034,721 | | | | | |

| | | | | | | | | | | | | | |

| Liabilities and Shareholders' Equity | | | | | | | | | | | | | | |

| Noninterest-bearing demand deposits | | $ | 1,108,521 | | | $ | 1,212,382 | | | $ | 1,145,395 | | | $ | 1,154,515 | | | $ | 1,162,909 | | | | | |

| Interest-bearing deposits | | 5,009,502 | | | 5,111,602 | | | 5,164,134 | | | 5,250,487 | | | 5,263,639 | | | | | |

| Total deposits | | 6,118,023 | | | 6,323,984 | | | 6,309,529 | | | 6,405,002 | | | 6,426,548 | | | | | |

| Short-term borrowings | | 7,208 | | | 214,446 | | | 34,865 | | | 17,998 | | | 21,783 | | | | | |

| FHLB advances and other borrowings | | 600,000 | | | 255,000 | | | 476,000 | | | 538,000 | | | 575,000 | | | | | |

| Subordinated debt | | 91,656 | | | 93,617 | | | 93,546 | | | 93,475 | | | 93,404 | | | | | |

| Trust preferred debentures | | 50,921 | | | 50,790 | | | 50,616 | | | 50,457 | | | 50,296 | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Other liabilities | | 103,694 | | | 102,966 | | | 110,459 | | | 106,743 | | | 90,869 | | | | | |

| Total liabilities | | 6,971,502 | | | 7,040,803 | | | 7,075,015 | | | 7,211,675 | | | 7,257,900 | | | | | |

| Total shareholders’ equity | | 785,772 | | | 791,006 | | | 791,853 | | | 757,610 | | | 776,821 | | | | | |

| Total liabilities and shareholders’ equity | | $ | 7,757,274 | | | $ | 7,831,809 | | | $ | 7,866,868 | | | $ | 7,969,285 | | | $ | 8,034,721 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| MIDLAND STATES BANCORP, INC. |

| CONSOLIDATED FINANCIAL SUMMARY (unaudited) (continued) |

| | | | | | | | | | |

| | For the Three Months Ended | | For the Six Months Ended |

| | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| (in thousands, except per share data) | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Net interest income: | | | | | | | | | | |

| Interest income | | $ | 103,295 | | | $ | 101,675 | | | $ | 100,491 | | | $ | 204,970 | | | $ | 196,030 | |

| Interest expense | | 48,243 | | | 45,755 | | | 41,651 | | | 93,998 | | | 76,686 | |

| Net interest income | | 55,052 | | | 55,920 | | | 58,840 | | | 110,972 | | | 119,344 | |

| | | | | | | | | | |

| Provision for credit losses on loans | | 17,000 | | | 14,000 | | | 5,879 | | | 31,000 | | | 9,014 | |

| Provision for credit losses on unfunded commitments | | (200) | | | — | | | — | | | (200) | | | — | |

| | | | | | | | | | |

| Total provision for credit losses | | 16,800 | | | 14,000 | | | 5,879 | | | 30,800 | | | 9,014 | |

| Net interest income after provision for credit losses | | 38,252 | | | 41,920 | | | 52,961 | | | 80,172 | | | 110,330 | |

| Noninterest income: | | | | | | | | | | |

| Wealth management revenue | | 6,801 | | | 7,132 | | | 6,269 | | | 13,933 | | | 12,680 | |

| Service charges on deposit accounts | | 3,121 | | | 3,116 | | | 2,677 | | | 6,237 | | | 5,245 | |

| Interchange revenue | | 3,563 | | | 3,358 | | | 3,696 | | | 6,921 | | | 7,108 | |

| Residential mortgage banking revenue | | 557 | | | 527 | | | 540 | | | 1,084 | | | 945 | |

| Income on company-owned life insurance | | 1,925 | | | 1,801 | | | 891 | | | 3,726 | | | 1,767 | |

| | | | | | | | | | |

| Loss on sales of investment securities, net | | (152) | | | — | | | (869) | | | (152) | | | (1,517) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other income | | 1,841 | | | 5,253 | | | 5,549 | | | 7,094 | | | 8,304 | |

| Total noninterest income | | 17,656 | | | 21,187 | | | 18,753 | | | 38,843 | | | 34,532 | |

| Noninterest expense: | | | | | | | | | | |

| Salaries and employee benefits | | 22,872 | | | 24,102 | | | 22,857 | | | 46,974 | | | 47,100 | |

| Occupancy and equipment | | 3,964 | | | 4,142 | | | 3,879 | | | 8,106 | | | 8,322 | |

| Data processing | | 7,205 | | | 6,722 | | | 6,544 | | | 13,927 | | | 12,855 | |

| Professional services | | 2,243 | | | 2,255 | | | 1,663 | | | 4,498 | | | 3,423 | |

| Amortization of intangible assets | | 1,016 | | | 1,089 | | | 1,208 | | | 2,105 | | | 2,499 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| FDIC insurance | | 1,219 | | | 1,274 | | | 1,196 | | | 2,493 | | | 2,525 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other expense | | 8,960 | | | 5,283 | | | 5,547 | | | 14,243 | | | 10,652 | |

| Total noninterest expense | | 47,479 | | | 44,867 | | | 42,894 | | | 92,346 | | | 87,376 | |

| Income before income taxes | | 8,429 | | | 18,240 | | | 28,820 | | | 26,669 | | | 57,486 | |

| Income taxes | | 1,679 | | | 4,355 | | | 7,245 | | | 6,034 | | | 14,139 | |

| Net income | | 6,750 | | | 13,885 | | | 21,575 | | | 20,635 | | | 43,347 | |

| Preferred stock dividends | | 2,228 | | | 2,228 | | | 2,228 | | | 4,456 | | | 4,456 | |

| Net income available to common shareholders | | $ | 4,522 | | | $ | 11,657 | | | $ | 19,347 | | | $ | 16,179 | | | $ | 38,891 | |

| | | | | | | | | | |

| Basic earnings per common share | | $ | 0.20 | | | $ | 0.53 | | | $ | 0.86 | | | $ | 0.73 | | | $ | 1.72 | |

| Diluted earnings per common share | | $ | 0.20 | | | $ | 0.53 | | | $ | 0.86 | | | $ | 0.73 | | | $ | 1.72 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| MIDLAND STATES BANCORP, INC. |

| RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (unaudited) |

| | | | | | | | | | |

| Adjusted Earnings Reconciliation |

| | | | | | | | | | |

| | For the Three Months Ended | | For the Six Months Ended |

| | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| (dollars in thousands, except per share data) | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Income before income taxes - GAAP | | $ | 8,429 | | | $ | 18,240 | | | $ | 28,820 | | | $ | 26,669 | | | $ | 57,486 | |

| Adjustments to noninterest income: | | | | | | | | | | |

| Loss on sales of investment securities, net | | 152 | | | — | | | 869 | | | 152 | | | 1,517 | |

| | | | | | | | | | |

| | | | | | | | | | |

| (Gain) on repurchase of subordinated debt | | (167) | | | — | | | (676) | | | (167) | | | (676) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total adjustments to noninterest income | | (15) | | | — | | | 193 | | | (15) | | | 841 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Adjusted earnings pre tax - non-GAAP | | 8,414 | | | 18,240 | | | 29,013 | | | 26,654 | | | 58,327 | |

| Adjusted earnings tax | | 1,675 | | | 4,355 | | | 7,297 | | | 6,030 | | | 14,366 | |

| Adjusted earnings - non-GAAP | | 6,739 | | | 13,885 | | | 21,716 | | | 20,624 | | | 43,961 | |

| Preferred stock dividends | | 2,228 | | | 2,228 | | | 2,228 | | | 4,456 | | | 4,456 | |

| Adjusted earnings available to common shareholders | | $ | 4,511 | | | $ | 11,657 | | | $ | 19,488 | | | $ | 16,168 | | | $ | 39,505 | |

| Adjusted diluted earnings per common share | | $ | 0.20 | | | $ | 0.53 | | | $ | 0.87 | | | $ | 0.73 | | | $ | 1.75 | |

| Adjusted return on average assets | | 0.35 | % | | 0.72 | % | | 1.10 | % | | 0.53 | % | | 1.12 | % |

| Adjusted return on average shareholders' equity | | 3.46 | % | | 7.07 | % | | 11.21 | % | | 5.27 | % | | 11.48 | % |

| Adjusted return on average tangible common equity | | 3.65 | % | | 9.34 | % | | 16.10 | % | | 6.51 | % | | 16.60 | % |

|

| | | | | | | | | | |

| | | | | | | | | | |

| Adjusted Pre-Tax, Pre-Provision Earnings Reconciliation |

| | | | | | | | | | |

| | For the Three Months Ended | | For the Six Months Ended |

| | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| (dollars in thousands) | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Adjusted earnings pre tax - non-GAAP | | $ | 8,414 | | | $ | 18,240 | | | $ | 29,013 | | | $ | 26,654 | | | $ | 58,327 | |

| Provision for credit losses | | 16,800 | | | 14,000 | | | 5,879 | | | 30,800 | | | 9,014 | |

| | | | | | | | | | |

| Adjusted pre-tax, pre-provision earnings - non-GAAP | | $ | 25,214 | | | $ | 32,240 | | | $ | 34,892 | | | $ | 57,454 | | | $ | 67,341 | |

| Adjusted pre-tax, pre-provision return on average assets | | 1.30 | % | | 1.67 | % | | 1.76 | % | | 1.48 | % | | 1.72 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| MIDLAND STATES BANCORP, INC. |

| RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (unaudited) (continued) |

| | | | | | | | | | |

| Efficiency Ratio Reconciliation |

| | | | | | | | | | |

| | For the Three Months Ended | | For the Six Months Ended |

| | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| (dollars in thousands) | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Noninterest expense - GAAP | | $ | 47,479 | | | $ | 44,867 | | | $ | 42,894 | | | $ | 92,346 | | | $ | 87,376 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net interest income - GAAP | | $ | 55,052 | | | $ | 55,920 | | | $ | 58,840 | | | $ | 110,972 | | | $ | 119,344 | |

| Effect of tax-exempt income | | 170 | | | 215 | | | 195 | | | 384 | | | 439 | |

| Adjusted net interest income | | 55,222 | | | 56,135 | | | 59,035 | | | 111,356 | | | 119,783 | |

| | | | | | | | | | |

| Noninterest income - GAAP | | 17,656 | | | 21,187 | | | 18,753 | | | 38,843 | | | 34,532 | |

| | | | | | | | | | |

| Loss on sales of investment securities, net | | 152 | | | — | | | 869 | | | 152 | | | 1,517 | |

| | | | | | | | | | |

| (Gain) on repurchase of subordinated debt | | (167) | | | — | | | (676) | | | (167) | | | (676) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Adjusted noninterest income | | 17,641 | | | 21,187 | | | 18,946 | | | 38,828 | | | 35,373 | |

| | | | | | | | | | |

| Adjusted total revenue | | $ | 72,863 | | | $ | 77,322 | | | $ | 77,981 | | | $ | 150,184 | | | $ | 155,156 | |

| | | | | | | | | | |

| Efficiency ratio | | 65.16 | % | | 58.03 | % | | 55.01 | % | | 61.49 | % | | 56.31 | % |

| | | | | | | | | | |

| Return on Average Tangible Common Equity (ROATCE) |

| | | | | | | | | | |

| | For the Three Months Ended | | For the Six Months Ended |

| | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| (dollars in thousands) | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income available to common shareholders | | $ | 4,522 | | | $ | 11,657 | | | $ | 19,347 | | | $ | 16,179 | | | $ | 38,891 | |

| | | | | | | | | | |

| Average total shareholders' equity—GAAP | | $ | 783,846 | | | $ | 789,906 | | | $ | 776,791 | | | $ | 786,877 | | | $ | 772,015 | |

| Adjustments: | | | | | | | | | | |

| Preferred Stock | | (110,548) | | | (110,548) | | | (110,548) | | | (110,548) | | | (110,548) | |

| Goodwill | | (161,904) | | | (161,904) | | | (161,904) | | | (161,904) | | | (161,904) | |

| Other intangible assets, net | | (14,483) | | | (15,525) | | | (18,937) | | | (15,004) | | | (19,557) | |

| Average tangible common equity | | $ | 496,911 | | | $ | 501,929 | | | $ | 485,402 | | | $ | 499,421 | | | $ | 480,006 | |

| ROATCE | | 3.66 | % | | 9.34 | % | | 15.99 | % | | 6.51 | % | | 16.34 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| MIDLAND STATES BANCORP, INC. |

| RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (unaudited) (continued) |

| | | | | | | | | | |

| Tangible Common Equity to Tangible Assets Ratio and Tangible Book Value Per Share |

| | | | | | | | | | |

| | As of |

| | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| (dollars in thousands, except per share data) | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| Shareholders' Equity to Tangible Common Equity | | | | | | | | |

| Total shareholders' equity—GAAP | | $ | 785,772 | | | $ | 791,006 | | | $ | 791,853 | | | $ | 757,610 | | | $ | 776,821 | |

| Adjustments: | | | | | | | | | | |

| Preferred Stock | | (110,548) | | | (110,548) | | | (110,548) | | | (110,548) | | | (110,548) | |

| Goodwill | | (161,904) | | | (161,904) | | | (161,904) | | | (161,904) | | | (161,904) | |

| Other intangible assets, net | | (14,003) | | | (15,019) | | | (16,108) | | | (17,238) | | | (18,367) | |

| Tangible common equity | | 499,317 | | | 503,535 | | | 503,293 | | | 467,920 | | | 486,002 | |

| | | | | | | | | | |

| Less: Accumulated other comprehensive loss (AOCI) | | (82,581) | | | (81,419) | | | (76,753) | | | (101,181) | | | (84,719) | |

| Tangible common equity excluding AOCI | | $ | 581,898 | | | $ | 584,954 | | | $ | 580,046 | | | $ | 569,101 | | | $ | 570,721 | |

| | | | | | | | | | |

| Total Assets to Tangible Assets: | | | | | | | | | | |

| Total assets—GAAP | | $ | 7,757,274 | | | $ | 7,831,809 | | | $ | 7,866,868 | | | $ | 7,969,285 | | | $ | 8,034,721 | |

| Adjustments: | | | | | | | | | | |

| Goodwill | | (161,904) | | | (161,904) | | | (161,904) | | | (161,904) | | | (161,904) | |

| Other intangible assets, net | | (14,003) | | | (15,019) | | | (16,108) | | | (17,238) | | | (18,367) | |

| Tangible assets | | $ | 7,581,367 | | | $ | 7,654,886 | | | $ | 7,688,856 | | | $ | 7,790,143 | | | $ | 7,854,450 | |

| | | | | | | | | | |

| Common Shares Outstanding | | 21,377,215 | | | 21,485,231 | | | 21,551,402 | | | 21,594,546 | | | 21,854,800 | |

| | | | | | | | | | |

| Tangible Common Equity to Tangible Assets | | 6.59 | % | | 6.58 | % | | 6.55 | % | | 6.01 | % | | 6.19 | % |

| Tangible Book Value Per Share | | $ | 23.36 | | | $ | 23.44 | | | $ | 23.35 | | | $ | 21.67 | | | $ | 22.24 | |

| Tangible Book Value Per Share, excluding AOCI | | $ | 27.22 | | | $ | 27.23 | | | $ | 26.91 | | | $ | 26.35 | | | $ | 26.11 | |

1 Midland States Bancorp, Inc. NASDAQ: MSBI Second Quarter 2024 Earnings Presentation

22 Forward-Looking Statements. This presentation may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements expressing management’s current expectations, forecasts of future events or long-term goals may be based upon beliefs, expectations and assumptions of the Company’s management, and are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “intend,” “estimate,” “may,” “will,” “would,” “could,” “should” or other similar expressions. All statements in this presentation speak only as of the date they are made, and the Company undertakes no obligation to update any statement. A number of factors, many of which are beyond the ability of the Company to control or predict, could cause actual results to differ materially from those in its forward-looking statements including changes in interest rates and other general economic, business and political conditions, the impact of inflation, increased deposit volatility and potential regulatory developments. These risks and uncertainties should be considered in evaluating forward-looking statements, and undue reliance should not be placed on such statements. Additional information concerning the Company and its businesses, including additional factors that could materially affect the Company’s financial results, are included in the Company’s filings with the Securities and Exchange Commission. Use of Non-GAAP Financial Measures. This presentation may contain certain financial information determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP financial measures include “Adjusted Earnings,” "Adjusted Earnings Available to Common Shareholders," “Adjusted Diluted Earnings Per Common Share,” “Adjusted Return on Average Assets,” “Adjusted Return on Average Shareholders’ Equity,” “Adjusted Return on Average Tangible Common Equity,” “Adjusted Pre-Tax, Pre-Provision Earnings,” “Adjusted Pre-Tax, Pre-Provision Return on Average Assets,” “Efficiency Ratio,” “Tangible Common Equity to Tangible Assets,” “Tangible Book Value Per Share,” “Tangible Book Value Per Share excluding Accumulated Other Comprehensive Income,”and “Return on Average Tangible Common Equity.” The Company believes that these non-GAAP financial measures provide both management and investors a more complete understanding of the Company’s funding profile and profitability. These non-GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP financial measures. Not all companies use the same calculation of these measures; therefore this presentation may not be comparable to other similarly titled measures as presented by other companies. Reconciliations of these non-GAAP measures are provided in the Appendix section of this presentation.

33 Company Snapshot Financial Highlights as of June 30, 2024 $7.8 Billion Total Assets $5.9 Billion Total Loans $6.1 Billion Total Deposits $4.0 Billion Assets Under Administration YTD Adjusted ROAA(1): 0.53% YTD Adjusted Return on TCE(1): 6.51% TCE/TA: 6.59% YTD PTPP(1) ROAA: 1.48% Dividend Yield: 5.47% Price/Tangible Book: 0.97x Price/LTM EPS: 11.4x Notes: (1) Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. Founded in 1881, this Illinois state- chartered community bank focuses on in-market relationships while having national diversification through equipment finance. • 53 Branches in Illinois and Missouri • 16 successful acquisitions since 2008

4 Overview of 2Q24 Financial Performance Continued Success in Balance Sheet Management Strategies Successfully Growing Community Bank Continued Investments in Talent and Technology 4 • Net income available to common shareholders of $4.5 million, or $0.20 diluted EPS • Pre-tax, pre-provision earnings(1) of $25.2 million • Strong noninterest income of $17.7 million • Strengthened ACL to 1.58% of total loans • Increases in capital ratios • CET1 ratio increased 3 bps to 8.63% • Runoff in non-core loan portfolios being used to fund new loan production and purchase of higher-yielding investment securities • Another good quarter of business development in community bank with full banking relationships added with high quality in-market clients • Community bank loans increased by $91 million during 2Q24, offset by intentional reduction of equipment finance and consumer portfolios • Loan portfolio continues to shift towards core in-market C&I and CRE loans resulting in higher quality loan portfolio • Strength of franchise allowing Midland to continue attracting high quality banking talent including new market president for Northern Illinois region and new Chief Deposit Officer • New technology platform in Wealth Management will enhance ability to cross-sell to community bank clients • New talent and technology investments expected to drive profitable growth and further enhance the value of Midland franchise Notes: (1) Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix.

5 Loan Portfolio 5 • Total loans decreased $106.5 million from prior quarter to $5.85 billion • Decrease primarily driven by decline in equipment finance portfolio of $59.9 million and continued runoff of GreenSky portfolio of $67.7 million • Decrease in non-core portfolios partially offset by new loan production from high quality commercial clients that provide full banking relationships • Investments made to increase business development efforts in St. Louis resulted in total loans increasing at an annualized rate of 31% during 2Q24 in this market • Runoff from GreenSky portfolio rotated into investment portfolio Loan Portfolio Mix (in millions, as of quarter-end) 2Q 2024 1Q 2024 2Q 2023 Commercial loans and leases $ 1,829 $ 1,872 $ 2,108 Commercial real estate 2,422 2,397 2,444 Construction and land development 477 474 367 Residential real estate 378 378 371 Consumer 746 837 1,077 Total Loans $ 5,852 $ 5,958 $ 6,367 Total Loans ex. Commercial FHA Lines $ 5,852 $ 5,950 $ 6,337 $6,367 $6,281 $6,131 $5,958 $5,852 5.80% 5.93% 6.00% 5.99% 6.03% Total Loans Average Loan Yield 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 Total Loans and Average Loan Yield (in millions, as of quarter-end)

6 Loan Segments 6 • Total loans in our Community Bank increased $91 million from prior quarter to $3.13 billion • Loans in St. Louis region increased $59 million or 31% annualized in 2Q24 • Focused on core, in-market loan relationships • Continuing to add talent in faster growing markets to drive quality loan relationships and commercial deposits Loan Portfolio Segments (in millions, as of quarter-end) 2Q 2024 1Q 2024 2Q 2023 Regions: Eastern $ 884 $ 897 $ 860 Northern 725 692 721 Southern 700 688 696 St. Louis 825 766 687 Community Bank $ 3,134 $ 3,043 $ 2,964 Other: Specialty Finance $ 1,093 $ 1,142 $ 1,216 Equipment Finance 890 950 1,115 BaaS(1) 735 823 1,072 Total Loans $ 5,852 $ 5,958 $ 6,367 Loan Segment Mix Community Bank, 53.6% Specialty Finance, 18.7% Equipment Finance, 15.2% BaaS, 12.6% Notes: (1) includes loans originated through Greensky and LendingPoint relationships

7 Total Deposits 7 • Total deposits decreased $206.0 million from end of prior quarter, primarily due to decreases in noninterest-bearing demand and brokered time • Deposit outflows primarily related to some larger commercial depositors moving funds into higher interest account including Midland's Wealth Management business and declines in brokered time • Average balances of non-interest bearing demand deposits declined $19 million compared to prior quarter • Brokered time deposits decreased $57 million from prior quarter as maturities were not replaced Deposit Mix (in millions, as of quarter-end) 2Q 2024 1Q 2024 2Q 2023 Noninterest-bearing demand $ 1,109 $ 1,212 $ 1,163 Interest-bearing: Checking 2,344 2,394 2,500 Money market 1,144 1,128 1,226 Savings 538 556 624 Time 852 845 841 Brokered time 131 188 73 Total Deposits $ 6,118 $ 6,324 $ 6,427 $6,427 $6,405 $6,310 $6,324 $6,118 2.09% 2.32% 2.41% 2.49% 2.55% Total Deposits Cost of Deposits 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 Total Deposits and Cost of Deposits (in millions, as of quarter-end)

8 Deposit Summary as of June 30, 2024 8 Deposits by Channel (in millions, as of quarter-end) 2Q 2024 1Q 2024 2Q 2023 Retail $ 2,742 $ 2,768 $ 2,780 Commercial 1,217 1,388 1,298 Public Funds 569 516 578 Wealth & Trust 299 324 329 Servicing 932 901 1,018 Brokered Deposits 239 309 270 Other 120 118 154 Total Deposits $ 6,118 $ 6,324 $ 6,427 $6,427 $6,405 $6,310 $6,324 $6,118 Retail Commercial Public Funds Wealth & Trust Servicing Brokered Deposits Other 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 • Commercial deposits decreased $171 million over prior quarter • Four large commercial customers decreased deposit balances by $120 million in 2Q24 with approximately $88 million moving to our Wealth business line • Retail deposit balances decreased $26 million in 2Q24 primarily due to decreased in average balances in interest bearing checking accounts • Total brokered deposits including money market accounts and time decreased $70 million in 2Q24 Trend of Deposit Channel Mix (in millions, as of quarter-end)

9 0.3% 4.6% 64.3% 7.9% 6.0% 7.8% 9.1% Treasuries US GSE & US Agency MBS - agency MBS - non agency State & Muni Corporate Other Investment Portfolio As of June 30, 2024 9 Fair Value of Investments by Type • All Investments are classified as Available for Sale • Average T/E Yield is 4.69% for 2Q24 • Average Duration is 4.76 years • Purchased $151 million with T/E Yield of 5.96% and sold $48 million with T/E Yield of 4.50% in 2Q24 Investments by Yield and DurationInvestment Mix & Unrealized Gain (Loss) (in millions) Fair Value Book Value Unrealized Gain (Loss) Treasuries $ 3 $ 3 $ — US GSE & US Agency 51 52 (1) MBS - agency 704 790 (86) MBS - non agency 86 89 (3) State & Municipal 66 73 (7) Corporate 85 93 (8) Other 100 100 — Total Investments $ 1,095 $ 1,202 $ (107) Duration Y ie ld -1 0 1 2 3 4 5 6 7 8 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% $1.10 billion

10 Liquidity Overview 10 Liquidity Sources (in millions) June 30, 2024 March 31, 2024 Cash and Cash Equivalents $ 124.6 $ 167.3 Unpledged Securities 527.3 506.2 FHLB Committed Liquidity 797.1 1,167.4 FRB Discount Window Availability 610.3 613.3 Total Estimated Liquidity $ 2,059.4 $ 2,454.1 Conditional Funding Based on Market Conditions Additional Credit Facility $ 409.0 $ 431.0 Brokered CDs (additional capacity) $ 450.0 $ 400.0

11 3.23% 3.20% 3.21% 3.18% 3.12% 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 $58.8 $58.6 $58.1 $55.9 $55.1 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 Net Interest Income/Margin 11 • Net interest income down slightly from prior quarter due to higher average FHLB borrowings • Net interest margin decreased 6bp to 3.12% as the increase in the cost of deposits exceeded the increase in the average yield on earning assets, as well as the impact of interest reversals on loans placed on non-accrual • Average rate on new and renewed loan originations was 7.67% in 2Q24 and higher than average rates on loan payoffs making them accretive to net interest margin Net Interest Income (in millions) Net Interest Margin

12 Loans & Securities - Repricing and Maturity 12 Total Loans and Leases (net of unearned income)(1) (in millions) As of June 30, 2024 Repricing Term Rate Structure 3 mos or less 3-12 mos 1-3 years 3-5 years 5-10 years 10-15 years Over 15 years Total Floating Rate Adjustable Rate Fixed Rate Commercial loans and leases $ 725 $ 272 $ 542 $ 217 $ 39 $ 4 $ 30 $ 1,829 $ 585 $ 74 $ 1,170 Commercial real estate 733 371 686 409 156 18 49 2,422 542 232 1,648 Construction and land development 237 94 101 18 — — 27 477 272 29 176 Residential real estate 73 54 78 63 83 20 7 378 54 114 210 Consumer 167 168 393 12 6 — — 746 97 — 649 Total $ 1,935 $ 959 $ 1,800 $ 719 $ 284 $ 42 $ 113 $ 5,852 $ 1,550 $ 449 $ 3,853 % of Total 33 % 16 % 31 % 12 % 5 % 1 % 2 % 100 % 26 % 8 % 66 % Weighted Average Rate 7.69 % 5.75 % 5.24 % 5.61 % 4.63 % 3.83 % 0.19 % (2) 6.04 % 8.17 % 4.82 % 5.33 % Investment Securities Available for Sale(3) (in millions) As of June 30, 2024 Maturity & Projected Cash Flow Distribution 1 year or less 1-3 years 3-5 years 5-10 years Over 10 years Total Amortized Cost $ 182 $ 170 $ 188 $ 337 $ 325 $ 1,202 % of Total 15 % 14 % 16 % 28 % 27 % 100 % Notes: (1) Based on projected principal payments for all loans plus the next reset for floating and adjustable rate loans and the maturity date of fixed rate loans. (2) Over 15 years category includes all nonaccrual loans and leases. (3) Projected principal cash flows for securities. Differences between amortized cost and total principal are included in Over 10 years.

13 Wealth Management 13 • Assets under administration increased $212 million mainly due to new accounts • New accounts include commercial customers moving funds of approximately $88 million to Wealth for higher rate and other options • Wealth Management fees decreased from prior quarter due to seasonal impact of tax planning fees in 1Q24 • New technology launched in 2Q24 that integrates Wealth Management data into mobile banking app that is expected to positively impact cross-selling to community bank clients • Continual hiring of wealth advisors positively impacting new business development Assets Under Administration (in millions) $3,595 $3,501 $3,733 $3,888 $3,996 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 $6.27 $6.29 $6.60 $7.13 $6.80 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 Wealth Management Revenue (in millions)

14 $18.8 $11.5 $20.5 $21.2 $17.7 Wealth Management Interchange Service Charges on Deposits Residential Mortgage All Other 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 Noninterest Income 14 • Noninterest income decreased from prior quarter primarily due to 1Q24 incremental servicing revenues of $3.7 million related to the Greensky portfolio • 2Q24 noninterest income included a $0.2 million gain on the repurchase of subordinated debt, offset by $0.2 million of losses on the sale of investment securities • Other income negatively impacted by losses on sale of repossessed and other equipment of $0.6 million in the current quarter • Fee income expected to be $18.0 - $18.5 million in the near-term quarters Noninterest Income (in millions)

15 $42.9 $42.0 $44.5 $44.9 $47.5 55.0% 55.8% 55.2% 58.0% 65.2% Total Noninterest Expense Efficiency Ratio 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 Noninterest Expense and Operating Efficiency 15 Noninterest Expense and Efficiency Ratio (1) (Noninterest expense in millions) • Efficiency Ratio (1) was 65.2% in 2Q 2024 vs. 58.0% in 1Q 2024 • Increase in noninterest expense from prior quarter primarily attributable to $4.1 million related to OREO expense and various legal actions • Compensation and benefits decreased $1.2 million compared to prior quarter due to reduced incentive compensation accruals • Near-term operating expense run- rate expected to be approximately $45.5 - $46.5 million Notes: (1) Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix.

16 Asset Quality 16 • Nonperforming loans increased due to equipment financing loans and one $3.5 million commercial loan placed on non-accrual • Past due loans and substandard loans declined during the second quarter • Net charge-offs to average loans was 0.20% primarily driven by equipment finance with provision for credit losses on loans of $17.0 million, primarily related to reserves added to the LendingPoint portfolio resulting from credit deterioration and servicing issues • Net charge offs include $2.2 million recovery on previously charged off CRE loan Nonperforming Loans / Total Loans (Total Loans as of quarter-end) NCO / Average Loans 0.75% 0.69% 0.68% 1.49% 1.58%0.11% 0.20% 0.24% 0.27% 0.34% 0.86% 0.89% 0.92% 1.76% 1.92% All other Equipment Finance 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 0.10% 0.08% 0.07% 0.05% (0.06)% 0.09% 0.14% 0.26% 0.25% 0.26% 0.19% 0.22% 0.33% 0.30% 0.20% All other Equipment Finance 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024

17 $78,057 $193 $15,264 $(1,331) $92,183 ACL March 31, 2024 Specific Reserves Portfolio Changes Economic Factors ACL June 30, 2024 Changes in Allowance for Credit Losses 17 ($ in thousands) ▪ Changes to specific reserves ▪ Changes in Loans ▪ Changes in Credit quality including risk rating ▪ Changes in portfolio mix ▪ Aging of existing portfolio ▪ Other charge-offs and recoveries ▪ Reserves added to the LendingPoint portfolio resulting from credit deterioration and servicing issues ▪ Change to macro- economic variables and forecasts ▪ Changes to other economic qualitative factors

18 ACL by Portfolio 18 ($ in thousands) June 30, 2024 March 31, 2024 Portfolio Loans ACL % of Total Loans Loans ACL % of Total Loans Commercial $ 829,888 $ 8,821 1.06 % $ 813,963 $ 9,135 1.12 % Commercial Other 570,979 15,426 2.70 % 601,704 12,194 2.03 % Equipment Finance Loans 461,409 11,839 2.57 % 494,068 11,806 2.39 % Equipment Finance Leases 428,659 13,288 3.10 % 455,879 13,466 2.95 % CRE non-owner occupied 1,621,102 13,949 0.86 % 1,591,455 13,353 0.84 % CRE owner occupied 438,117 5,286 1.21 % 450,149 4,858 1.08 % Multi-family 293,863 2,636 0.90 % 287,586 2,871 1.00 % Farmland 68,423 326 0.48 % 67,923 285 0.42 % Construction and Land Development 476,528 12,966 2.72 % 474,128 12,629 2.66 % Residential RE First Lien 315,039 4,616 1.47 % 316,310 4,986 1.58 % Other Residential 63,354 577 0.91 % 62,273 669 1.07 % Consumer 94,763 499 0.53 % 99,157 520 0.52 % Consumer Other(1) 651,279 13,793 2.12 % 737,935 3,091 0.42 % Total Loans $ 5,851,994 $ 92,183 1.58 % $ 5,958,462 $ 78,057 1.31 % Loans (excluding BaaS portfolio(1) and warehouse lines) 5,125,723 74,815 1.46 % 5,136,557 74,587 1.45 % Notes: (1) Primarily consists of loans originated through GreenSky and LendingPoint relationships

19 2024 Outlook and Priorities 19 • Well positioned with increased levels of capital, liquidity, and reserves • Prudent risk management will remain top priority while economic uncertainty remains with business development efforts focused on adding new commercial and retail deposit relationships throughout our markets • Capitalizing on market disruption resulting from M&A to add new clients and banking talent • Strong financial performance and prudent balance sheet management should lead to further increases in capital ratios • Loan pipeline remains steady and new loan production within the community bank will continue to partially offset the runoff from the GreenSky portfolio and continued intentional reduction of the equipment finance portfolio • Neutral interest rate sensitivity positions Midland well for managing future changes in interest rates • Maintain disciplined expense management while also investing in areas that will enhance the long- term value of the franchise * Improvements in technology platform and additional advisors positively impacting business development in Wealth Management * Expanded presence in higher growth St. Louis market including the addition of a new market president resulting in new commercial, retail and wealth management clients * Banking-as-a-Service initiative expected to start making a contribution to deposit gathering and fee income during 2024

20 APPENDIX 20

2121 Industries as a percentage of Commercial, CRE and Equipment Finance Loans and Leases with outstanding balances of $4.73 billion as of 6/30/2024 ($s in millions) RE/Rental & Leasing $1,692.4 35.8% All Others $568.2 12.0% Skilled Nursing $403.1 8.5% Construction - General $303.1 6.4% Manufacturing $225.1 4.8% Finance and Insurance $259.0 5.5% Accommodation & Food Svcs $263.6 5.6% Trans./Ground Passenger $179.2 3.8% Assisted Living $103.9 2.2% Ag., Forestry, & Fishing $140.7 3.0% General Freight Trucking $180.6 3.8% Retail Trade $178.9 3.8% Wholesale Trade $59.2 1.3% Other Services $102.9 2.2% Commercial Loans and Leases by Industry Health Care $67.8 1.4%

22 Commercial Real Estate Portfolio by Collateral Type 22 CRE Concentration (as of June 30, 2024) CRE as a % of Total Loans 49.5% CRE as a % of Total Risk-Based Capital (1) 264.4% Notes: (1) Represents non-owner occupied CRE loans only Collateral type as a percentage of the Commercial Real Estate and Construction Portfolio with outstanding balances of $2.90 billion as of June 30, 2024 ($s in millions) Skilled Nursing $408.7 14.1% Retail $470.7 16.2% Multi-Family $547.8 18.9% Industrial/Warehouse $219.9 7.6% Assisted Living $124.7 4.3% Hotel/Motel $201.3 6.9% All Other $150.9 5.2% Office $152.6 5.3% Farmland $68.3 2.4% Residential 1-4 Family $89.9 3.1% Raw Land $21.9 0.8% Restaurant $30.9 1.1% Mixed Use/Other $112.8 3.9% Medical Building $95.6 3.3% Special Purpose $122.8 4.2% C-Store/Gas Station $79.2 2.7%

23 Capital Ratios and Strategy 23 • Capital initiatives increased CET1 to 8.63% from 7.77% at December 31, 2022 with limited buybacks below TBV • Internal capital generated from strong profitability and slower balance sheet growth expected to raise TCE ratio to 7.00%-7.75% by the end of 2024 • Capital actions and strong profitability expected to enable MSBI to raise capital ratios while maintaining current dividend payout Capital Strategy Capital Ratios (as of June 30, 2024) 6.59% 8.63% 9.84% 11.21% 13.94% 11.69% 10.26% 11.69% 13.06% Consolidated Bank Level TCE/TA Common Eq. Tier 1 Tier 1 Leverage Tier 1 RBC Total RBC