0000746210

Oblong, Inc.

false

--12-31

Q2

2024

0.0001

0.0001

0.0001

0.0001

545,000

545,000

42,000

42,000

545

545

1,930

1,930

0.0001

0.0001

150,000,000

150,000,000

28,249,971

28,242,418

16,692,124

16,684,571

7,553

7,553

0

28,250

28,242

545

1,930

1,648

1,648

1,648

1,607,000

1,478,000

3

1,648

1,607,000

1,478,000

963,745

3

31,000

62,000

0

0

0

0

42

0

177,564

177,564

177,564

380,000

false

false

false

false

Calculation does not include the 963,745 Common Warrants issued during the three and six months ended June 30, 2024, as they were not exercisable as of June 30, 2024.

Calculation assumes conversion of the stated value, and accrued dividends, of the Series F Preferred Stock into Common Stock at the Floor Price as of June 30, 2024, and at the initial conversion price of $1.71 as of June 30, 2023.

Calculation assumes exercise of the Series F Preferred Warrants for cash into Series F Preferred Stock and subsequent conversion of the Series F Preferred Stock into Common Stock at the Floor Price as of June 30, 2024 and at the initial conversion price of $1.71 as of June 30, 2023.

00007462102024-01-012024-06-30

xbrli:shares

00007462102024-08-06

thunderdome:item

iso4217:USDxbrli:shares

00007462102024-06-30

00007462102023-12-31

iso4217:USD

00007462102024-04-012024-06-30

00007462102023-04-012023-06-30

00007462102023-01-012023-06-30

0000746210us-gaap:PreferredStockMember2023-12-31

0000746210us-gaap:CommonStockMember2023-12-31

0000746210us-gaap:TreasuryStockCommonMember2023-12-31

0000746210us-gaap:AdditionalPaidInCapitalMember2023-12-31

0000746210us-gaap:RetainedEarningsMember2023-12-31

0000746210us-gaap:PreferredStockMember2024-01-012024-03-31

0000746210us-gaap:CommonStockMember2024-01-012024-03-31

0000746210us-gaap:TreasuryStockCommonMember2024-01-012024-03-31

0000746210us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-31

0000746210us-gaap:RetainedEarningsMember2024-01-012024-03-31

00007462102024-01-012024-03-31

0000746210us-gaap:PreferredStockMember2024-03-31

0000746210us-gaap:CommonStockMember2024-03-31

0000746210us-gaap:TreasuryStockCommonMember2024-03-31

0000746210us-gaap:AdditionalPaidInCapitalMember2024-03-31

0000746210us-gaap:RetainedEarningsMember2024-03-31

00007462102024-03-31

0000746210us-gaap:PreferredStockMember2024-04-012024-06-30

0000746210us-gaap:CommonStockMember2024-04-012024-06-30

0000746210us-gaap:TreasuryStockCommonMember2024-04-012024-06-30

0000746210us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-30

0000746210us-gaap:RetainedEarningsMember2024-04-012024-06-30

0000746210us-gaap:PreferredStockMember2024-06-30

0000746210us-gaap:CommonStockMember2024-06-30

0000746210us-gaap:TreasuryStockCommonMember2024-06-30

0000746210us-gaap:AdditionalPaidInCapitalMember2024-06-30

0000746210us-gaap:RetainedEarningsMember2024-06-30

0000746210us-gaap:PreferredStockMember2022-12-31

0000746210us-gaap:CommonStockMember2022-12-31

0000746210us-gaap:TreasuryStockCommonMember2022-12-31

0000746210us-gaap:AdditionalPaidInCapitalMember2022-12-31

0000746210us-gaap:RetainedEarningsMember2022-12-31

00007462102022-12-31

0000746210us-gaap:PreferredStockMember2023-01-012023-03-31

0000746210us-gaap:CommonStockMember2023-01-012023-03-31

0000746210us-gaap:TreasuryStockCommonMember2023-01-012023-03-31

0000746210us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0000746210us-gaap:RetainedEarningsMember2023-01-012023-03-31

00007462102023-01-012023-03-31

0000746210us-gaap:PreferredStockMember2023-03-31

0000746210us-gaap:CommonStockMember2023-03-31

0000746210us-gaap:TreasuryStockCommonMember2023-03-31

0000746210us-gaap:AdditionalPaidInCapitalMember2023-03-31

0000746210us-gaap:RetainedEarningsMember2023-03-31

00007462102023-03-31

0000746210us-gaap:PreferredStockMember2023-04-012023-06-30

0000746210us-gaap:CommonStockMember2023-04-012023-06-30

0000746210us-gaap:TreasuryStockCommonMember2023-04-012023-06-30

0000746210us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-30

0000746210us-gaap:RetainedEarningsMember2023-04-012023-06-30

0000746210us-gaap:PreferredStockMember2023-06-30

0000746210us-gaap:CommonStockMember2023-06-30

0000746210us-gaap:TreasuryStockCommonMember2023-06-30

0000746210us-gaap:AdditionalPaidInCapitalMember2023-06-30

0000746210us-gaap:RetainedEarningsMember2023-06-30

00007462102023-06-30

0000746210oblg:CommonStockWarrantsMember2024-01-012024-06-30

0000746210oblg:CommonStockWarrantsMember2023-01-012023-06-30

0000746210oblg:PreferredWarrantsMember2024-01-012024-06-30

0000746210oblg:PreferredWarrantsMember2023-01-012023-06-30

xbrli:pure

0000746210oblg:GPCommunicationsMember2024-06-30

00007462102024-06-012024-06-30

0000746210oblg:ConversionOfSeriesFPreferredStockToCommonStockMember2024-04-012024-06-30

0000746210oblg:ConversionOfSeriesFPreferredStockToCommonStockMember2024-01-012024-06-30

0000746210us-gaap:CommonStockMember2023-01-012023-12-31

0000746210us-gaap:CommonStockMember2024-01-012024-06-30

0000746210oblg:WarrantsIssuedOnJune282021Member2024-06-30

0000746210oblg:WarrantsIssuedOnMarch312023Member2024-06-30

0000746210oblg:WarrantsIssuedInQ22024Member2024-06-30

0000746210oblg:CommonWarrantsMember2022-12-31

0000746210oblg:CommonWarrantsMember2023-01-012023-12-31

0000746210oblg:CommonWarrantsMember2023-12-31

0000746210oblg:CommonWarrantsMember2024-01-012024-06-30

0000746210oblg:CommonWarrantsMember2024-06-30

0000746210srt:MaximumMember2024-06-30

0000746210us-gaap:SeriesFPreferredStockMemberus-gaap:PrivatePlacementMember2023-03-302023-03-30

0000746210us-gaap:SeriesFPreferredStockMemberus-gaap:PrivatePlacementMember2023-03-30

0000746210oblg:PreferredWarrantsMemberus-gaap:PrivatePlacementMember2023-03-30

0000746210oblg:InvestorWarrantsMemberus-gaap:PrivatePlacementMember2023-03-30

0000746210us-gaap:PrivatePlacementMember2023-03-302023-03-31

0000746210us-gaap:SeriesFPreferredStockMember2023-03-30

00007462102023-10-06

0000746210us-gaap:SeriesFPreferredStockMember2023-10-06

0000746210us-gaap:SeriesFPreferredStockMember2023-10-062023-10-06

0000746210us-gaap:SeriesFPreferredStockMember2024-01-012024-06-30

0000746210us-gaap:SeriesFPreferredStockMember2024-06-30

0000746210us-gaap:SeriesFPreferredStockMember2024-04-012024-06-30

0000746210oblg:PreferredWarrantsMember2024-04-012024-06-30

0000746210us-gaap:SeriesFPreferredStockMember2023-03-312023-03-31

0000746210us-gaap:SeriesFPreferredStockMember2023-01-012023-12-31

0000746210srt:WeightedAverageMemberus-gaap:SeriesFPreferredStockMember2023-12-31

0000746210oblg:ConversionOfSeriesFPreferredStockToCommonStockMember2023-01-012023-12-31

0000746210us-gaap:SeriesFPreferredStockMember2023-12-31

0000746210srt:WeightedAverageMemberus-gaap:SeriesFPreferredStockMember2024-06-30

0000746210oblg:ConversionOfSeriesFPreferredStockToCommonStockMember2023-01-012024-06-30

0000746210oblg:PreferredWarrantsMember2024-06-30

utr:Y

0000746210oblg:CommonWarrantsMember2024-04-012024-06-30

00007462102023-01-012023-12-31

0000746210us-gaap:EmployeeStockOptionMember2024-04-012024-06-30

0000746210us-gaap:EmployeeStockOptionMember2023-04-012023-06-30

0000746210us-gaap:EmployeeStockOptionMember2024-01-012024-06-30

0000746210us-gaap:EmployeeStockOptionMember2023-01-012023-06-30

0000746210us-gaap:RestrictedStockMember2024-06-30

0000746210us-gaap:RestrictedStockMember2023-12-31

0000746210us-gaap:RestrictedStockUnitsRSUMember2024-06-30

0000746210us-gaap:RestrictedStockUnitsRSUMember2023-12-31

0000746210us-gaap:RestrictedStockMember2024-04-012024-06-30

0000746210us-gaap:RestrictedStockMember2024-01-012024-06-30

0000746210us-gaap:RestrictedStockMember2023-04-012023-06-30

0000746210us-gaap:RestrictedStockMember2023-01-012023-06-30

0000746210us-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-30

0000746210us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-30

0000746210us-gaap:RestrictedStockMember2022-12-31

0000746210us-gaap:RestrictedStockUnitsRSUMember2022-12-31

0000746210us-gaap:RestrictedStockMember2023-01-012023-12-31

0000746210us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-31

0000746210us-gaap:EmployeeStockOptionMember2024-01-012024-06-30

0000746210us-gaap:EmployeeStockOptionMember2023-01-012023-06-30

0000746210oblg:ConvertibleSeriesFPreferredStockMember2024-01-012024-06-30

0000746210oblg:ConvertibleSeriesFPreferredStockMember2023-01-012023-06-30

0000746210oblg:SeriesFPreferredWarrantsMember2024-01-012024-06-30

0000746210oblg:SeriesFPreferredWarrantsMember2023-01-012023-06-30

0000746210oblg:CommonStockWarrantsMember2024-01-012024-06-30

0000746210oblg:CommonStockWarrantsMember2023-01-012023-06-30

0000746210us-gaap:SeriesFPreferredStockMember2023-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:ManagedServicesMember2024-04-012024-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:CollaborationProductsMember2024-04-012024-06-30

0000746210us-gaap:CorporateNonSegmentMember2024-04-012024-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:ManagedServicesMemberus-gaap:ReportableSubsegmentsMember2024-04-012024-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:CollaborationProductsMemberus-gaap:ReportableSubsegmentsMember2024-04-012024-06-30

0000746210us-gaap:CorporateNonSegmentMemberus-gaap:ReportableSubsegmentsMember2024-04-012024-06-30

0000746210us-gaap:ReportableSubsegmentsMember2024-04-012024-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:ManagedServicesMemberus-gaap:IntersubsegmentEliminationsMember2024-04-012024-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:CollaborationProductsMemberus-gaap:IntersubsegmentEliminationsMember2024-04-012024-06-30

0000746210us-gaap:CorporateNonSegmentMemberus-gaap:IntersubsegmentEliminationsMember2024-04-012024-06-30

0000746210us-gaap:IntersubsegmentEliminationsMember2024-04-012024-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:ManagedServicesMember2023-04-012023-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:CollaborationProductsMember2023-04-012023-06-30

0000746210us-gaap:CorporateNonSegmentMember2023-04-012023-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:ManagedServicesMemberus-gaap:ReportableSubsegmentsMember2023-04-012023-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:CollaborationProductsMemberus-gaap:ReportableSubsegmentsMember2023-04-012023-06-30

0000746210us-gaap:CorporateNonSegmentMemberus-gaap:ReportableSubsegmentsMember2023-04-012023-06-30

0000746210us-gaap:ReportableSubsegmentsMember2023-04-012023-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:ManagedServicesMemberus-gaap:IntersubsegmentEliminationsMember2023-04-012023-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:CollaborationProductsMemberus-gaap:IntersubsegmentEliminationsMember2023-04-012023-06-30

0000746210us-gaap:CorporateNonSegmentMemberus-gaap:IntersubsegmentEliminationsMember2023-04-012023-06-30

0000746210us-gaap:IntersubsegmentEliminationsMember2023-04-012023-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:ManagedServicesMember2024-01-012024-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:CollaborationProductsMember2024-01-012024-06-30

0000746210us-gaap:CorporateNonSegmentMember2024-01-012024-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:ManagedServicesMemberus-gaap:ReportableSubsegmentsMember2024-01-012024-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:CollaborationProductsMemberus-gaap:ReportableSubsegmentsMember2024-01-012024-06-30

0000746210us-gaap:CorporateNonSegmentMemberus-gaap:ReportableSubsegmentsMember2024-01-012024-06-30

0000746210us-gaap:ReportableSubsegmentsMember2024-01-012024-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:ManagedServicesMemberus-gaap:IntersubsegmentEliminationsMember2024-01-012024-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:CollaborationProductsMemberus-gaap:IntersubsegmentEliminationsMember2024-01-012024-06-30

0000746210us-gaap:CorporateNonSegmentMemberus-gaap:IntersubsegmentEliminationsMember2024-01-012024-06-30

0000746210us-gaap:IntersubsegmentEliminationsMember2024-01-012024-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:ManagedServicesMember2023-01-012023-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:CollaborationProductsMember2023-01-012023-06-30

0000746210us-gaap:CorporateNonSegmentMember2023-01-012023-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:ManagedServicesMemberus-gaap:ReportableSubsegmentsMember2023-01-012023-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:CollaborationProductsMemberus-gaap:ReportableSubsegmentsMember2023-01-012023-06-30

0000746210us-gaap:CorporateNonSegmentMemberus-gaap:ReportableSubsegmentsMember2023-01-012023-06-30

0000746210us-gaap:ReportableSubsegmentsMember2023-01-012023-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:ManagedServicesMemberus-gaap:IntersubsegmentEliminationsMember2023-01-012023-06-30

0000746210us-gaap:OperatingSegmentsMemberoblg:CollaborationProductsMemberus-gaap:IntersubsegmentEliminationsMember2023-01-012023-06-30

0000746210us-gaap:CorporateNonSegmentMemberus-gaap:IntersubsegmentEliminationsMember2023-01-012023-06-30

0000746210us-gaap:IntersubsegmentEliminationsMember2023-01-012023-06-30

0000746210country:US2024-04-012024-06-30

0000746210country:US2023-04-012023-06-30

0000746210country:US2024-01-012024-06-30

0000746210country:US2023-01-012023-06-30

0000746210us-gaap:NonUsMember2024-04-012024-06-30

0000746210us-gaap:NonUsMember2023-04-012023-06-30

0000746210us-gaap:NonUsMember2024-01-012024-06-30

0000746210us-gaap:NonUsMember2023-01-012023-06-30

0000746210oblg:VideoCollaborationServiceMemberoblg:ManagedServicesMember2024-04-012024-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:VideoCollaborationServiceMemberoblg:ManagedServicesMember2024-04-012024-06-30

0000746210oblg:VideoCollaborationServiceMemberoblg:ManagedServicesMember2023-04-012023-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:VideoCollaborationServiceMemberoblg:ManagedServicesMember2023-04-012023-06-30

0000746210oblg:NetworkServicesMemberoblg:ManagedServicesMember2024-04-012024-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:NetworkServicesMemberoblg:ManagedServicesMember2024-04-012024-06-30

0000746210oblg:NetworkServicesMemberoblg:ManagedServicesMember2023-04-012023-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:NetworkServicesMemberoblg:ManagedServicesMember2023-04-012023-06-30

0000746210oblg:ProfessionalAndOtherServicesMemberoblg:ManagedServicesMember2024-04-012024-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:ProfessionalAndOtherServicesMemberoblg:ManagedServicesMember2024-04-012024-06-30

0000746210oblg:ProfessionalAndOtherServicesMemberoblg:ManagedServicesMember2023-04-012023-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:ProfessionalAndOtherServicesMemberoblg:ManagedServicesMember2023-04-012023-06-30

0000746210oblg:ManagedServicesMember2024-04-012024-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:ManagedServicesMember2024-04-012024-06-30

0000746210oblg:ManagedServicesMember2023-04-012023-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:ManagedServicesMember2023-04-012023-06-30

0000746210oblg:VideoCollaborationServiceMemberoblg:CollaborationProductsMember2024-04-012024-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:VideoCollaborationServiceMemberoblg:CollaborationProductsMember2024-04-012024-06-30

0000746210oblg:VideoCollaborationServiceMemberoblg:CollaborationProductsMember2023-04-012023-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:VideoCollaborationServiceMemberoblg:CollaborationProductsMember2023-04-012023-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:AllProductsMember2024-04-012024-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:AllProductsMember2023-04-012023-06-30

0000746210oblg:VideoCollaborationServiceMemberoblg:ManagedServicesMember2024-01-012024-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:VideoCollaborationServiceMemberoblg:ManagedServicesMember2024-01-012024-06-30

0000746210oblg:VideoCollaborationServiceMemberoblg:ManagedServicesMember2023-01-012023-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:VideoCollaborationServiceMemberoblg:ManagedServicesMember2023-01-012023-06-30

0000746210oblg:NetworkServicesMemberoblg:ManagedServicesMember2024-01-012024-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:NetworkServicesMemberoblg:ManagedServicesMember2024-01-012024-06-30

0000746210oblg:NetworkServicesMemberoblg:ManagedServicesMember2023-01-012023-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:NetworkServicesMemberoblg:ManagedServicesMember2023-01-012023-06-30

0000746210oblg:ProfessionalAndOtherServicesMemberoblg:ManagedServicesMember2024-01-012024-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:ProfessionalAndOtherServicesMemberoblg:ManagedServicesMember2024-01-012024-06-30

0000746210oblg:ProfessionalAndOtherServicesMemberoblg:ManagedServicesMember2023-01-012023-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:ProfessionalAndOtherServicesMemberoblg:ManagedServicesMember2023-01-012023-06-30

0000746210oblg:ManagedServicesMember2024-01-012024-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:ManagedServicesMember2024-01-012024-06-30

0000746210oblg:ManagedServicesMember2023-01-012023-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:ManagedServicesMember2023-01-012023-06-30

0000746210oblg:VideoCollaborationServiceMemberoblg:CollaborationProductsMember2024-01-012024-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:VideoCollaborationServiceMemberoblg:CollaborationProductsMember2024-01-012024-06-30

0000746210oblg:VideoCollaborationServiceMemberoblg:CollaborationProductsMember2023-01-012023-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:VideoCollaborationServiceMemberoblg:CollaborationProductsMember2023-01-012023-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:AllProductsMember2024-01-012024-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberoblg:AllProductsMember2023-01-012023-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerAMemberoblg:ManagedServicesMember2024-04-012024-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerAMemberoblg:ManagedServicesMember2023-04-012023-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerAMemberoblg:ManagedServicesMember2024-01-012024-06-30

0000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerAMemberoblg:ManagedServicesMember2023-01-012023-06-30

0000746210us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerAMemberoblg:ManagedServicesMember2024-01-012024-06-30

0000746210us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerAMemberoblg:ManagedServicesMember2023-01-012023-06-30

0000746210us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerBMemberoblg:CollaborationProductsMember2024-01-012024-06-30

0000746210us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerBMemberoblg:CollaborationProductsMember2023-01-012023-06-30

0000746210us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerCMemberoblg:CollaborationProductsMember2024-01-012024-06-30

0000746210us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerCMemberoblg:CollaborationProductsMember2023-01-012023-06-30

0000746210us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerDMemberoblg:ManagedServicesMember2024-01-012024-06-30

0000746210us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerDMemberoblg:ManagedServicesMember2023-01-012023-06-30

0000746210us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerEMemberoblg:CollaborationProductsMember2024-01-012024-06-30

0000746210us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerEMemberoblg:CollaborationProductsMember2023-01-012023-06-30

0000746210us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerFMemberoblg:ManagedServicesMember2024-01-012024-06-30

0000746210us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberoblg:CustomerFMemberoblg:ManagedServicesMember2023-01-012023-06-30

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the quarterly period ended June 30, 2024.

or

☐ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Commission file number: 001-35376

OBLONG, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 77-0312442 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

110 16th Street, Suite 1400-1024, Denver, CO 80202

(Address of Principal Executive Offices, including Zip Code)

(213) 683-8863 ext. 5

(Registrant’s Telephone Number, including Area Code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

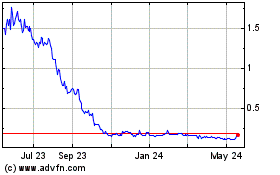

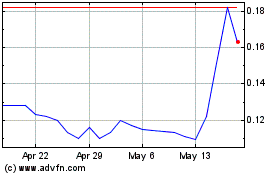

| Common Stock, par value $0.0001 per share | | OBLG | | Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| | |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | |

| | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.)

Yes ☐ No ☒

The number of shares outstanding of the registrant’s common stock as of August 6, 2024 was 28,242,418.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report on Form 10-Q (this “Report”) contains statements that are considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and its rules and regulations (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended, and its rules and regulations (the “Exchange Act”). These forward-looking statements include, but are not limited to, statements about the plans, objectives, expectations and intentions of Oblong, Inc. (“Oblong” or “we” or “us” or the “Company”). All statements other than statements of current or historical fact contained in this Report, including statements regarding Oblong’s future financial position, business strategy, budgets, projected costs and plans and objectives of management for future operations, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” and similar expressions, as they relate to Oblong, are intended to identify forward-looking statements. These statements are based on Oblong’s current plans, and Oblong’s actual future activities and results of operations may be materially different from those set forth in the forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the statements made. Any or all of the forward-looking statements in this Report may turn out to be inaccurate. Oblong has based these forward-looking statements largely on its current expectations and projections about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy and financial needs. The forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and assumptions. There are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements, including our plans, objectives, expectations and intentions and other factors that are discussed under the section entitled “Part I. Item 1A. Risk Factors” and in our consolidated financial statements and the footnotes thereto for the fiscal year ended December 31, 2023, each included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the Securities and Exchange Commission (the “SEC”) on March 19, 2024, as well as under “Part II. Item 1A. Risk Factors” in this report. Oblong undertakes no obligation to publicly revise these forward-looking statements to reflect events occurring after the date hereof. All subsequent written and oral forward-looking statements attributable to Oblong or persons acting on its behalf are expressly qualified in their entirety by the cautionary statements contained in this Report. Forward-looking statements in this Report include, among other things: opportunities for and benefits of potential strategic alternatives; our expectations and estimates relating to customer attrition, demand for our product offerings, sales cycles, future revenues, expenses, capital expenditures and cash flows; evolution of our customer solutions and our service platforms; our ability to fund operations and continue as a going concern; our liquidity projection; expectations regarding adjustments to our cost of revenue and other operating expenses; our ability to finance investments in product development and sales and marketing; the future exercise of warrants; our ability to raise capital through sales of additional equity or debt securities and/or loans from financial institutions; our beliefs about the ongoing performance and success of our Managed Service business; statements relating to market need and evolution of the industry, our solutions and our service platforms; and the adequacy of our internal controls. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, those summarized below:

| • |

our ability to raise capital in one or more debt and/or equity offerings in order to fund operations or any growth initiatives and our ability to continue as a going concern; |

| • |

the impact of the issuance of our Series F Preferred Stock in the March 2023 private placements, conversions of our Series F Preferred Stock, exercises of the Series F Preferred Stock warrants, and sales of the underlying conversion shares. |

| • |

customer acceptance and demand for our video collaboration services and network applications; |

| • |

our ability to launch new products and offerings and to sell our solutions; |

| • |

our ability to compete effectively in the video collaboration services and network services businesses; |

| • |

the ongoing performance and success of our Managed Services business; |

| • |

our ability to maintain and protect our proprietary rights; |

| • |

our ability to withstand industry consolidation; |

| • |

our ability to adapt to changes in industry structure and market conditions; |

| • |

actions by our competitors, including price reductions for their competitive services; |

| • |

the quality and reliability of our products and services; |

| • |

the prices for our products and services and changes to our pricing model; |

| • |

the success of our sales and marketing approach and efforts, and our ability to grow revenue; |

| • |

customer renewal and retention rates; |

| • |

the continued impact from the aftermath of the coronavirus pandemic on our revenue and results of operations; |

| • |

risks related to the concentration of our customers and the degree to which our sales, now or in the future, depend on certain large client relationships; |

| • |

increases in material, labor or other manufacturing-related costs; |

| • |

changes in our go-to-market cost structure; |

| • |

inventory management and our reliance on our supply chain; |

| • |

our ability to attract and retain highly skilled personnel; |

| • |

our reliance on open-source software and technology; |

| • |

potential federal and state regulatory actions; |

| • |

our ability to innovate technologically, and, in particular, our ability to develop next generation Oblong technology; |

| • |

our ability to satisfy the standards for continued listing of our common stock on the Nasdaq Capital Market; |

| • |

changes in our capital structure and/or stockholder mix; |

| • |

the costs, disruption, and diversion of management’s attention associated with campaigns commenced by activist investors; and |

| • |

our management’s ability to execute its plans, strategies and objectives for future operations. |

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

OBLONG, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except par value and stated value)

| | | June 30, 2024 | | | December 31, 2023 | |

| | | (Unaudited) | | | | | |

| ASSETS | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 5,858 | | | $ | 5,990 | |

| Accounts receivable, net | | | 31 | | | | 424 | |

| Inventory, net | | | 88 | | | | 239 | |

| Prepaid expenses and other current assets | | | 317 | | | | 243 | |

| Total current assets | | | 6,294 | | | | 6,896 | |

| Operating lease - right of use asset, net | | | — | | | | 17 | |

| Other assets | | | 11 | | | | 12 | |

| Total assets | | $ | 6,305 | | | $ | 6,925 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 111 | | | $ | 211 | |

| Accrued expenses and other current liabilities | | | 1,059 | | | | 1,038 | |

| Current portion of deferred revenue | | | 77 | | | | 132 | |

| Operating lease liabilities | | | — | | | | 17 | |

| Total current liabilities | | | 1,247 | | | | 1,398 | |

| Long-term liabilities: | | | | | | | | |

| Deferred revenue, net of current portion | | | 6 | | | | 26 | |

| Total liabilities | | | 1,253 | | | | 1,424 | |

| Commitments and contingencies (see Note 9) | | | | | | | | |

| Stockholders’ equity: | | | | | | | | |

| Preferred stock Series F, convertible; $0.0001 par value; $545,000 stated value; 42,000 shares authorized, 545 and 1,930 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | | | — | | | | — | |

| Common stock, $0.0001 par value; 150,000,000 shares authorized; 28,249,971 shares issued and 28,242,418 shares outstanding at June 30, 2024 and 16,692,124 shares issued and 16,684,571 outstanding at December 31, 2023 | | | 3 | | | | 2 | |

| Treasury Stock, 7,553 common shares | | | (181 | ) | | | (181 | ) |

| Additional paid-in capital | | | 235,580 | | | | 233,911 | |

| Accumulated deficit | | | (230,350 | ) | | | (228,231 | ) |

| Total stockholders' equity | | | 5,052 | | | | 5,501 | |

| Total liabilities and stockholders’ equity | | $ | 6,305 | | | $ | 6,925 | |

See accompanying notes to condensed consolidated financial statements.

OBLONG, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Revenue |

|

$ |

611 |

|

|

$ |

956 |

|

|

$ |

1,237 |

|

|

$ |

1,994 |

|

| Cost of revenue (exclusive of amortization) |

|

|

491 |

|

|

|

834 |

|

|

|

1,120 |

|

|

|

1,596 |

|

| Gross profit |

|

|

120 |

|

|

|

122 |

|

|

|

117 |

|

|

|

398 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

65 |

|

|

|

5 |

|

|

|

115 |

|

|

|

11 |

|

| Sales and marketing |

|

|

57 |

|

|

|

(58 |

) |

|

|

111 |

|

|

|

160 |

|

| General and administrative |

|

|

1,016 |

|

|

|

1,577 |

|

|

|

2,093 |

|

|

|

2,746 |

|

| Amortization |

|

|

— |

|

|

|

87 |

|

|

|

— |

|

|

|

173 |

|

| Impairment charges |

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

2 |

|

| Casualty gain (insurance proceeds) |

|

|

— |

|

|

|

(400 |

) |

|

|

— |

|

|

|

(400 |

) |

| Total operating expenses |

|

|

1,138 |

|

|

|

1,213 |

|

|

|

2,319 |

|

|

|

2,692 |

|

| Operating loss |

|

|

(1,018 |

) |

|

|

(1,091 |

) |

|

|

(2,202 |

) |

|

|

(2,294 |

) |

| Interest income, net |

|

|

(44 |

) |

|

|

(42 |

) |

|

|

(92 |

) |

|

|

(64 |

) |

| Loss before income taxes |

|

|

(974 |

) |

|

|

(1,049 |

) |

|

|

(2,110 |

) |

|

|

(2,230 |

) |

| Income tax expense |

|

|

9 |

|

|

|

— |

|

|

|

9 |

|

|

|

38 |

|

| Net loss |

|

|

(983 |

) |

|

|

(1,049 |

) |

|

|

(2,119 |

) |

|

|

(2,268 |

) |

| Preferred stock dividends |

|

|

20 |

|

|

|

149 |

|

|

|

64 |

|

|

|

149 |

|

| Warrant modification |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

25 |

|

| Induced conversion of warrants |

|

|

— |

|

|

|

751 |

|

|

|

— |

|

|

|

751 |

|

| Net loss attributable to common share holders |

|

$ |

(1,003 |

) |

|

$ |

(1,949 |

) |

|

$ |

(2,183 |

) |

|

$ |

(3,193 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to common stockholders per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net loss per share |

|

$ |

(0.04 |

) |

|

$ |

(0.78 |

) |

|

$ |

(0.11 |

) |

|

$ |

(1.40 |

) |

| Weighted-average number of shares of common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

22,882 |

|

|

|

2,487 |

|

|

|

20,003 |

|

|

|

2,277 |

|

See accompanying notes to condensed consolidated financial statements.

OBLONG, INC.

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

Three and Six Months Ended June 30, 2024

(In thousands, except shares of Series F Preferred Stock)

(Unaudited)

| |

|

Series F Preferred Stock |

|

|

Common Stock |

|

|

Treasury Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

|

Accumulated |

|

|

|

|

|

| |

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Paid-In Capital |

|

|

Deficit |

|

|

Total |

|

| Balance at December 31, 2023 |

|

|

1,930 |

|

|

$ |

— |

|

|

|

16,692 |

|

|

$ |

2 |

|

|

|

8 |

|

|

$ |

(181 |

) |

|

$ |

233,911 |

|

|

$ |

(228,231 |

) |

|

$ |

5,501 |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,136 |

) |

|

|

(1,136 |

) |

| Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

31 |

|

|

|

— |

|

|

|

31 |

|

| Series F Preferred Stock conversions |

|

|

(922 |

) |

|

|

— |

|

|

|

3,602 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

82 |

|

|

|

— |

|

|

|

82 |

|

| Series F Preferred Stock dividends |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(44 |

) |

|

|

— |

|

|

|

(44 |

) |

| Balance at March 31, 2024 |

|

|

1,008 |

|

|

|

— |

|

|

|

20,294 |

|

|

|

2 |

|

|

|

8 |

|

|

|

(181 |

) |

|

|

233,980 |

|

|

|

(229,367 |

) |

|

|

4,434 |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(983 |

) |

|

|

(983 |

) |

| Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

31 |

|

|

|

— |

|

|

|

31 |

|

| Warrant exercise, net of fees |

|

|

1,648 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,478 |

|

|

|

— |

|

|

|

1,478 |

|

| Series F Preferred Stock conversions |

|

|

(2,111 |

) |

|

|

— |

|

|

|

7,956 |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

111 |

|

|

|

— |

|

|

|

112 |

|

| Series F Preferred Stock dividends |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(20 |

) |

|

|

— |

|

|

|

(20 |

) |

| Balance at June 30, 2024 |

|

|

545 |

|

|

$ |

— |

|

|

|

28,250 |

|

|

$ |

3 |

|

|

|

8 |

|

|

$ |

(181 |

) |

|

$ |

235,580 |

|

|

$ |

(230,350 |

) |

|

$ |

5,052 |

|

See accompanying notes to condensed consolidated financial statements.

OBLONG, INC.

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

Three and Six Months Ended June 30, 2023

(In thousands, except shares of Series F Preferred Stock)

(Unaudited)

| |

|

Series F Preferred Stock |

|

|

Common Stock |

|

|

Treasury Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

|

Accumulated |

|

|

|

|

|

| |

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Paid-In Capital |

|

|

Deficit |

|

|

Total |

|

| Balance at December 31, 2022 |

|

|

— |

|

|

$ |

— |

|

|

|

2,071 |

|

|

$ |

— |

|

|

|

8 |

|

|

$ |

(181 |

) |

|

$ |

227,645 |

|

|

$ |

(223,847 |

) |

|

$ |

3,617 |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,219 |

) |

|

|

(1,219 |

) |

| Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

31 |

|

|

|

— |

|

|

|

31 |

|

| Proceeds from private placement, net of fees and amounts held in escrow |

|

|

6,550 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,473 |

|

|

|

— |

|

|

|

1,473 |

|

| Balance at March 31, 2023 |

|

|

6,550 |

|

|

|

— |

|

|

|

2,071 |

|

|

|

— |

|

|

|

8 |

|

|

|

(181 |

) |

|

|

229,149 |

|

|

|

(225,066 |

) |

|

|

3,902 |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,049 |

) |

|

|

(1,049 |

) |

| Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

180 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

411 |

|

|

|

— |

|

|

|

411 |

|

| Warrant exercise, net of fees |

|

|

— |

|

|

|

— |

|

|

|

339 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

534 |

|

|

|

— |

|

|

|

534 |

|

| Release of escrow from March 31, 2023 private placement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,000 |

|

|

|

— |

|

|

|

4,000 |

|

| Fees associated with Series F Preferred Stock issuance |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(38 |

) |

|

|

— |

|

|

|

(38 |

) |

| Series F Preferred Stock conversions |

|

|

(175 |

) |

|

|

— |

|

|

|

147 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4 |

|

|

|

— |

|

|

|

4 |

|

| Series F Preferred Stock dividends |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(149 |

) |

|

|

— |

|

|

|

(149 |

) |

| Balance at June 30, 2023 |

|

|

6,375 |

|

|

$ |

— |

|

|

|

2,737 |

|

|

$ |

— |

|

|

|

8 |

|

|

$ |

(181 |

) |

|

$ |

233,911 |

|

|

$ |

(226,115 |

) |

|

$ |

7,615 |

|

See accompanying notes to condensed consolidated financial statements.

OBLONG, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| |

|

Six Months Ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(2,119 |

) |

|

$ |

(2,268 |

) |

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Amortization |

|

|

— |

|

|

|

173 |

|

| Bad debt (recovery) expense |

|

|

— |

|

|

|

(32 |

) |

| Non-cash lease expense from right-of-use asset |

|

|

17 |

|

|

|

77 |

|

| Stock-based compensation |

|

|

62 |

|

|

|

442 |

|

| Casualty gain (insurance proceeds) |

|

|

— |

|

|

|

(400 |

) |

| Impairment charges - property and equipment |

|

|

— |

|

|

|

2 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

393 |

|

|

|

203 |

|

| Inventory |

|

|

151 |

|

|

|

321 |

|

| Prepaid expenses and other current assets |

|

|

(74 |

) |

|

|

213 |

|

| Other assets |

|

|

1 |

|

|

|

18 |

|

| Accounts payable |

|

|

(100 |

) |

|

|

(48 |

) |

| Accrued expenses and other current liabilities |

|

|

151 |

|

|

|

(456 |

) |

| Deferred revenue |

|

|

(75 |

) |

|

|

(259 |

) |

| Lease liabilities |

|

|

(17 |

) |

|

|

(168 |

) |

| Net cash used in operating activities |

|

|

(1,610 |

) |

|

|

(2,182 |

) |

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Proceeds from private placement, net of issuance costs and amounts in escrow |

|

|

— |

|

|

|

5,435 |

|

| Net proceeds from exercise of common stock warrants |

|

|

— |

|

|

|

534 |

|

| Net proceeds from exercise of preferred stock warrants |

|

|

1,478 |

|

|

|

— |

|

| Net cash provided by financing activities |

|

|

1,478 |

|

|

|

5,969 |

|

| (Decrease) increase in cash |

|

|

(132 |

) |

|

|

3,787 |

|

| Cash and cash equivalents at beginning of period |

|

|

5,990 |

|

|

|

3,085 |

|

| Cash and cash equivalents at end of period |

|

$ |

5,858 |

|

|

$ |

6,872 |

|

| Supplemental disclosures of cash flow information: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Reconciliation of cash and cash equivalents |

|

|

|

|

|

|

|

|

| Cash |

|

$ |

5,358 |

|

|

$ |

6,872 |

|

| Current certificates of deposit |

|

$ |

500 |

|

|

$ |

— |

|

| Total cash and cash equivalents |

|

$ |

5,858 |

|

|

$ |

6,872 |

|

| |

|

|

|

|

|

|

|

|

| Cash paid during the period for interest |

|

$ |

5 |

|

|

$ |

9 |

|

| Cash paid for income taxes |

|

$ |

— |

|

|

$ |

31 |

|

| |

|

|

|

|

|

|

|

|

| Non-cash investing and financing activities: |

|

|

|

|

|

|

|

|

| Preferred stock dividends |

|

$ |

64 |

|

|

$ |

149 |

|

| Common stock issued for conversion of Preferred Stock and accrued dividends |

|

$ |

194 |

|

|

$ |

4 |

|

| Warrant modification |

|

$ |

— |

|

|

$ |

25 |

|

| Induced exercise of common stock warrants |

|

$ |

— |

|

|

$ |

751 |

|

See accompanying notes to condensed consolidated financial statements.

OBLONG, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2024

(Unaudited)

Note 1 - Business Description and Significant Accounting Policies

Business Description

Oblong, Inc. (“Oblong” or “we” or “us” or the “Company”) was formed as a Delaware corporation in May 2000 and is a provider of patented multi-stream collaboration technologies and managed services for video collaboration and network applications.

Basis of Presentation

The Company's fiscal year ends on December 31 of each calendar year. The accompanying interim Condensed Consolidated Financial Statements are unaudited and have been prepared on substantially the same basis as our annual Consolidated Financial Statements for the fiscal year ended December 31, 2023. In the opinion of the Company's management, these interim Condensed Consolidated Financial Statements reflect all adjustments (consisting only of normal recurring adjustments) considered necessary for a fair statement of our financial position, results of operations and cash flows for the periods presented. The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Condensed Consolidated Financial Statements and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from these estimates.

The December 31, 2023 Condensed Consolidated Balance Sheet data in this document was derived from audited consolidated financial statements. The Condensed Consolidated Financial Statements and notes included in this quarterly report on Form 10-Q do not include all disclosures required by U.S. generally accepted accounting principles and should be read in conjunction with the Company's audited consolidated financial statements as of and for the year ended December 31, 2023 and notes thereto included in the Company's fiscal 2023 Annual Report on Form 10-K, filed with the Securities and Exchange Commission (“SEC”) on March 19, 2024 (the “2023 Annual Report”).

The results of operations and cash flows for the interim periods included in these Condensed Consolidated Financial Statements are not necessarily indicative of the results to be expected for any future period or the entire fiscal year.

Principles of Consolidation

The Condensed Consolidated Financial Statements include the accounts of Oblong and our 100%-owned subsidiaries (i) GP Communications, LLC (“GP Communications”), whose business function is to provide interstate telecommunications services for regulatory purposes, and (ii) Oblong Industries, Inc. All inter-company balances and transactions have been eliminated in consolidation. The U.S. Dollar is the functional currency for all subsidiaries.

Cash and Cash Equivalents

As of June 30, 2024, our total cash balance of $5,858,000 is available. Of this balance $500,000 was held in short-term certificates of deposit with MidFirst Bank. As of December 31, 2023, our total cash balance of $5,990,000 was available with $500,000 held in short-term certificates of deposit with MidFirst Bank. The Company considers highly liquid investments with original maturities of three months or less to be cash equivalents.

Segments

The Company currently operates in two segments: (1) “Collaboration Products” which represents the business surrounding our Mezzanine™ product offerings, and (2) “Managed Services” which represents the business surrounding managed services for video collaboration and network solutions. See Note 8 - Segment Reporting for further discussion.

Use of Estimates

Preparation of the Condensed Consolidated Financial Statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual amounts could differ from the estimates made. We continually evaluate estimates used in the preparation of our consolidated financial statements for reasonableness. Appropriate adjustments, if any, to the estimates used are made prospectively based upon such periodic evaluation. The significant areas of estimation include determining the allowances for inventory obsolescence and estimated credit losses and the inputs used in the fair value of equity-based awards.

Amortization Expense

As of June 30, 2024 and December 31, 2023, we had no intangible assets. Amortization expense related to intangible assets for the three and six months ended June 30, 2023 was $87,000 and $173,000, respectively.

Operating Lease Right-of-use-Assets and Liabilities

In February 2024, we exited our warehouse lease in City of Industry, California, and are no longer a party to any long-term operating leases. Right-of-use assets, net totaled $17,000 as of December 31, 2023, consisting of the warehouse lease discussed above. As of June 30, 2024, the Company had no right-of-use assets remaining. The remaining operating lease liability as of December 31, 2023 was $17,000, consisting of the warehouse lease discussed above. As of June 30, 2024, the Company had no lease liability remaining. During the six months ended June 30, 2024, we recorded $17,000 in lease expenses. During the three and six months ended June 30, 2023, we recorded $36,000 and $82,000 in lease expenses, respectively. These expenses are net of common charges, and sublease proceeds of $11,000 and $27,000, respectively.

Significant Accounting Policies

The significant accounting policies used in preparation of these Condensed Consolidated Financial Statements are disclosed in our 2023 Annual Report, and there have been no changes to the Company’s significant accounting policies during the six months ended June 30, 2024.

Recently Issued Accounting Pronouncements

In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic280): Improvements to Reportable Segment Disclosures. The new guidance is intended to improve reportable segment disclosure requirements primarily through enhanced disclosures about significant segment expenses. The amendments are effective retrospectively for fiscal years beginning after December 15, 2023 and interim periods within fiscal years beginning after December 15, 2024. The Company is in the process of evaluating the impact that the adoption of this ASU will have on the financial statements and related disclosures, which is not expected to be material.

In December 2023, the FASB issued ASU No. 2023-09, Improvements to Tax Disclosures (Topic 740), to enhance the transparency and decision usefulness of income tax disclosures through changes to the rate reconciliation and income taxes paid information. This guidance is effective for fiscal years beginning after December 15, 2024, with early adoption permitted. The Company is evaluating the impact of adopting this new accounting guidance on its Consolidated Financial Statements.

Note 2 - Liquidity

As of June 30, 2024, we had $5,858,000 in cash and working capital of $5,047,000. For the six months ended June 30, 2024 we incurred a net loss of $2,119,000, financing activities provided $1,478,000 in net cash, and we used net cash of $1,610,000 in operating activities.

We believe that our existing cash and cash equivalents will be sufficient to fund our operations and meet our working capital requirements through 2025.

Note 3 - Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following (in thousands):

| | | June 30, | | | December 31, | |

| | | 2024 | | | 2023 | |

| | | | | | | | | |

| Compensation costs | | $ | 675 | | | $ | 448 | |

| Customer deposits | | | 86 | | | | 118 | |

| Professional fees | | | 93 | | | | 104 | |

| Taxes and regulatory fees | | | 20 | | | | 22 | |

| Accrued rent | | | 170 | | | | 202 | |

| Accrued dividends on Series F Preferred Stock | | | 4 | | | | 136 | |

| Other accrued expenses and liabilities | | | 11 | | | | 8 | |

| Accrued expenses and other liabilities | | $ | 1,059 | | | $ | 1,038 | |

Note 4 - Capital Stock

Common Stock

The Company’s common stock, par value $0.0001 per share (the “Common Stock”), is listed on the Nasdaq Capital Market (“Nasdaq”), under the ticker symbol “OBLG”. As of June 30, 2024, we had 150,000,000 shares of our Common Stock authorized, with 28,250,000 and 28,242,000 shares issued and outstanding, respectively.

During the three months ended June 30, 2024, 2,111 shares of Series F Preferred Stock, plus $110,000 of accrued dividends, were converted to 7,955,743 shares of the Company’s Common Stock. During the six months ended June 30, 2024, 3,033 shares of Series F Preferred Stock, plus $194,000 of accrued dividends, were converted into 11,558,000 shares of the Company's Common Stock. See Note 5 - Preferred Stock for further detail.

Common Stock activity for the year ended December 31, 2023 and six months ended June 30, 2024 is presented below (in thousands).

| Issued Shares as of December 31, 2022 | | | 2,071 | |

| Issuances from Preferred Stock conversions | | | 14,102 | |

| Issuances related to warrant exercises | | | 746 | |

| Issuances related to stock compensation | | | 180 | |

| Common shares exchanged for prepaid warrants | | | (407 | ) |

| Issued Shares as of December 31, 2023 | | | 16,692 | |

| Issuances from Preferred Stock conversions | | | 11,558 | |

| Issued Shares as of June 30, 2024 | | | 28,250 | |

| Less Treasury Shares: | | | (8 | ) |

| Outstanding Shares as of June 30, 2024 | | | 28,242 | |

Common Stock Warrants

During the three and six months ended June 30, 2024, Common Warrants were issued in accordance with the exercise provisions of the Preferred Warrants. See Note 5 - Preferred Stock for additional detail on the exercises of the Preferred Warrants. These Common Warrants are exercisable on the six-month anniversary of issuance, at an initial exercise price of $1.71, and have a term of five years.

Common Warrants outstanding as of June 30, 2024 are as follows:

| Issue Date | | Warrants Outstanding | | | Exercise Price | | Expiration Date |

| | | | | | | | | | |

| | | | | | | | | | |

| Q2 2021 | | | 750 | | | $ | 66.00 | | Q4 2024 |

| Q1 2023 | | | 4,136,850 | | | $ | 1.71 | | Q3 2028 |

| Q2 2024 | | | 963,745 | | | $ | 1.71 | | Q4 2029 |

| | | | 5,101,345 | | | | | | |

Common Warrant activity for the year ended December 31, 2023 and six months ended June 30, 2024 is presented below.

| | | Outstanding | |

| | | Number of Warrants | | | Weighted Average Exercise Price | |

| Warrants outstanding as of December 31, 2022 | | | 343,099 | | | $ | — | |

| Granted | | | 4,543,626 | | | | 1.56 | |

| Exercised | | | (746,027 | ) | | | 0.78 | |

| Expired | | | (2,848 | ) | | | 70.25 | |

| Warrants outstanding as of December 31, 2023 | | | 4,137,850 | | | | 1.73 | |

| Granted | | | 963,745 | | | | 1.71 | |

| Expired | | | (250 | ) | | | 60.00 | |

| Warrants outstanding as of June 30, 2024 (1) | | | 5,101,345 | | | $ | 1.71 | |

| | | | | | | | | |

| (1) Of the outstanding shares at June 30, 2024, 4,137,600 were exercisable. | | | | | | | | |

Treasury Shares

The Company maintains treasury stock for the Common Stock shares bought back by the Company when withholding shares to cover taxes on transactions related to equity awards. There were no treasury stock transactions during the six months ended June 30, 2024 or the year ended December 31, 2023.

Note 5 - Preferred Stock

Our Certificate of Incorporation authorizes the issuance of up to 5,000,000 shares of preferred stock. As of June 30, 2024, we had 1,983,250 designated shares of preferred stock and 545 shares of preferred stock issued and outstanding. As of December 31, 2023, we had 1,930 shares of preferred stock issued and outstanding.

Series F Preferred Stock

On March 30, 2023, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain accredited investors (the “Investors”), pursuant to which we issued and sold, in a private placement (the “Private Placement”) (i) 6,550 shares of our newly designated Series F Preferred Stock, $0.0001 par value per share (the “Series F Preferred Stock”), (ii) preferred warrants (the “Preferred Warrants”) to acquire 32,750 shares of Series F Preferred Stock, and (iii) common warrants (“Common Warrants” and with the Preferred Warrants the “Investor Warrants”) to acquire up to 3,830,417 shares of Common Stock. See Note 4 - Capital Stock for additional detail regarding the Common Warrants. The terms of the Series F Preferred Stock are as set forward in the Certificate of Designations of Series F Preferred Stock of Oblong, Inc. (the “Certificate of Designations”), which was filed and became effective with the Secretary of State of the State of Delaware on March 31, 2023. The Private Placement closed on March 31, 2023, in exchange for gross and net proceeds of $6,386,000 and $5,364,000, respectively. The financing fees associated with the Purchase Agreement were $1,022,000.

The Series F Preferred Shares are convertible into fully paid and non-assessable shares of the Company’s Common Stock at the election of the holder at any time at an initial conversion price of $1.71 (the “Conversion Price”). The holders of the Series F Preferred Shares may also elect to convert their shares at an alternative conversion price equal to the lower of (i) 80% of the applicable Conversion Price as in effect on the date of the conversion, (ii) 80% of the closing price on the trading day immediately preceding the delivery of the conversion notice, and (iii) the greater of (a) the Floor Price (as defined in the Certificate of Designations) and (b) the quotient of (x) the sum of the five lowest Closing Bid Prices (as defined in the Certificate of Designations) for trading days in the 30 consecutive trading day period ending and including the trading day immediately preceding the delivery of the applicable Conversion Notice, divided by (y) five. The Conversion Price is subject to customary adjustments for stock splits, stock dividends, stock combination recapitalization, or other similar transactions involving the Common Stock, and subject to price-based adjustment, on a full ratchet basis, in the event of any issuances of our common stock, or securities convertible, exercisable or exchangeable for Common Stock, at a price below the then-applicable Conversion Price (subject to certain exceptions).

On October 6, 2023, the Company and Investors holding a majority of the outstanding shares of the Preferred Stock agreed to waive any and all provisions, terms, covenants and obligations in the Certificate of Designations or Common Warrants to the extent such provisions permit the conversion or exercise of the Preferred Stock and the Common Warrants, respectively, to occur at a price below $0.2792. Notwithstanding anything to the contrary in the Certificate of Designations, each of the “Alternate Conversion Price” and the “Floor Price” as set forth in the Certificate of Designations shall in no event be less than $0.2792 (as adjusted for stock splits, stock dividends, stock combinations, recapitalizations and similar events).

Under the Certificate of Designations, the Series F Preferred Shares have an initial stated value of $1,000 per share (the “Stated Value”). The holders of the Series F Preferred Shares are entitled to dividends of 9% per annum, which will be payable in arrears quarterly. Accrued dividends may be paid, at our option, in cash and if not paid, shall increase the stated value of the Series F Preferred Shares. Upon the occurrence and during the continuance of a Triggering Event (as defined in the Certificate of Designations), the Series F Preferred Shares will accrue dividends at the rate of 20% per annum (the “Default Rate”). The Series F Preferred Shares have no voting rights, other than with respect to certain matters affecting the rights of the Series F Preferred Shares. On matters with respect to which the holders of the Series F Preferred Shares have a right to vote, holders of the Preferred Shares will have voting rights on an as-converted basis.

Our ability to settle conversions is subject to certain limitations set forth in the Certificate of Designations. Further, the Certificate of Designations contains a certain beneficial ownership limitation after giving effect to the issuance of shares of common stock issuable upon conversion of the Series F Preferred Shares.

The Certificate of Designations includes certain Triggering Events (as defined in the Certificate of Designations), including, among other things, (i) the failure to file and maintain an effective registration statement covering the sale of the holder’s securities registrable pursuant to the Registration Rights Agreement, (ii) the failure to pay any amounts due to the holders of the Series F Preferred Shares when due, and (iii) if Peter Holst ceases to be the chief executive officer of the Company other than because of his death, and a qualified replacement, reasonably acceptable to a majority of the holders of the Series F Preferred Shares, is not appointed within thirty (30) business days. In connection with a Triggering Event, the Default Rate is triggered. We are subject to certain affirmative and negative covenants regarding the incurrence of indebtedness, acquisition transactions, the existence of liens, the repayment of indebtedness, the payment of cash in respect of dividends (other than dividends pursuant to the Certificate of Designations), maintenance of properties and the transfer of assets, among other matters.

During the three and six months ended June 30, 2024, 2,111 and 3,033shares of Series F Preferred Stock, plus accrued dividends, were converted to 7,955,743 and 11,558,000 shares of the Company’s common stock, respectively. There were 545 shares of Series F Preferred Stock outstanding and accrued dividends of $4,000 as of June 30, 2024.

During the three and six months ended June 30, 2024, 1,648 Series F Preferred Shares were issued upon exercise of 1,648 Preferred Warrants. The Company received gross and net proceeds of $1,607,000 and $1,478,000, respectively.

One of our directors, Jonathan Schechter, is currently a partner at The Special Equities Group ("SEG"), a division of Dawson James Securities, Inc. In March 2023, prior to Mr. Schechter's appointment to our board in May 2023, SEG acted as placement agent in connection with our March 31, 2023 Purchase Agreement. During the three and six months ended June 30, 2024, pursuant to the terms of our engagement later with Dawson James Securities, Inc., we paid SEG a cash fee equal to 8% of the aggregate gross proceeds raised from the exercise of the 1,648 Series F Preferred Warrants. This fee was approximately $129,000. Mr. Schechter did not receive any of the fees paid.

Series F Preferred Stock transactions are summarized in the table below (in thousands except for shares of Series F Preferred Stock:

| | | Series F Preferred Stock Shares | | | Preferred Stock Dividends | | | Weighted Average Conversion Price | | | Common Shares Issued from Conversions | |

| March 31, 2023 Issuance | | | 6,550 | | | $ | — | | | | | | | | — | |

| 2023 Accrued Dividends | | | — | | | | 345,000 | | | | | | | | — | |

| 2023 Conversions | | | (4,620 | ) | | | (209,000 | ) | | $ | 0.34 | | | | 14,102,000 | |

| December 31, 2023 Balance | | | 1,930 | | | | 136,000 | | | | | | | | 14,102,000 | |

| 2024 Issuances | | | 1,648 | | | | — | | | | | | | | — | |

| 2024 Accrued Dividends | | | — | | | | 63,000 | | | | | | | | — | |

| 2024 Conversions | | | (3,033 | ) | | | (195,000 | ) | | $ | 0.28 | | | | 11,558,000 | |

| June 30, 2024 Balance | | | 545 | | | $ | 4,000 | | | $ | 0.33 | | | | 25,660,000 | |

Series F Preferred Stock Warrants