Option Care Health, Inc. (the “Company” or “Option Care Health”)

(Nasdaq: OPCH), the nation’s largest independent provider of home

and alternate site infusion services, announced today preliminary

unaudited financial results for the fourth quarter and full year

ended December 31, 2024.

For the fourth quarter 2024, Option Care

Health expects to report:

- Net revenue of approximately $1.34 billion to $1.35 billion,

representing approximately 19.2% to 20.1% growth over the fourth

quarter of 2023

- Net income of approximately $56.8 to $60.9 million, or diluted

earnings per share of $0.33 to $0.36

- Adjusted net income of approximately $71.0 million to $76.8

million, or adjusted diluted earnings per share of $0.42 to

$0.45

- Adjusted EBITDA of approximately $118.7 million to $121.7

million, representing approximately a 6.4% to 9.1% increase over

the fourth quarter of 2023

For full year 2024, Option Care Health

expects to report:

- Net revenue of approximately $4.99 billion to $5.00 billion,

representing approximately 16.0% to 16.2% growth over the prior

year

- Net income of approximately $208.5 million to $212.6 million,

or diluted earnings per share of $1.21 to $1.23

- Adjusted net income of approximately $268.3 million to $274.1

million, or adjusted diluted earnings per share of $1.55 to

$1.59

- Adjusted EBITDA of approximately $441.0 million to $444.0

million, representing approximately a 3.7% to 4.4% increase over

the prior year

- Cash flow from operations of at least $300 million

- Cash and cash equivalents of approximately $412.6 million

Preliminary Full Year 2025

GuidanceFor the full year 2025, Option Care Health expects

to deliver the following financial results:

- Net revenue of $5.2 billion to $5.4 billion

- Adjusted EBITDA of $445 million to $465 million

- Adjusted EPS of $1.59 to $1.69

This preliminary guidance incorporates a negative

gross profit impact of approximately $60 million to $70 million

dollars related to the Stelara pricing adjustments discussed on the

Company’s third quarter earnings call. The Company expects to

provide further information regarding its full year 2025 financial

guidance on its fourth quarter earnings call in February.

New Share Repurchase Program

AuthorizationIn the fourth quarter of 2024, the Company

completed the remaining $90 million of share repurchases under its

prior share repurchase program. On January 10, 2025, the

Company’s Board of Directors approved a new $500 million stock

repurchase program. This program has no specified expiration date.

Shares may be repurchased under the program through open market

purchases, privately negotiated transactions, block trades, or

accelerated or other structured share repurchase programs. The

extent to which the Company repurchases shares, and the timing of

such repurchases, will depend upon a variety of factors, including

market conditions, regulatory requirements and other corporate

considerations, as determined by the Company’s management.

Investor Conference

PresentationThe Company will be participating in the 43rd

Annual J.P. Morgan Healthcare Conference, including a Company

presentation at 1:30 p.m. P.T. on Monday, January 13, 2025.

The presentation, including the presentation materials, can be

accessed via live audio webcast that will be available online at

investors.optioncarehealth.com.

Conference CallThe Company expects

to release its full fourth quarter and full year results on

Wednesday, February 26, 2025 before the market opens and host a

conference call to review the results at 8:30 a.m. E.T. on the same

day.

The conference call can be accessed via a live

audio webcast that will be available online at

investors.optioncarehealth.com. A replay of the call will be

available via webcast for on-demand listening shortly after the

completion of the call, at the same web link, and will remain

available for approximately 90 days.

About Option Care HealthOption

Care Health is the nation’s largest independent provider of home

and alternate site infusion services. With over 8,000 team

members, including more than 5,000 clinicians, we work

compassionately to elevate standards of care for patients with

acute and chronic conditions in all 50 states. Through our

clinical leadership, expertise and national scale, Option Care

Health is reimagining the infusion care experience for patients,

customers and teammates. To learn more, please visit our website at

optioncarehealth.com.

Investor Contacts

Mike ShapiroChief Financial OfficerT: (312)

940-2538mike.shapiro@optioncare.com

Forward-Looking Statements - Safe

Harbor This press release contains “forward-looking

statements” within the meaning of the safe harbor provisions of the

U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by words such as:

“anticipate,” “intend,” “plan,” “believe,” “project,” “estimate,”

“expect,” “may,” “should,” “will” and similar references to future

periods. Examples of forward-looking statements include, among

others, statements the Company may make regarding future revenues,

future earnings, other future financial results, regulatory

developments, market developments, new products and growth

strategies and the effects of any of the foregoing on its future

results of operations or financial condition.

Forward-looking statements are neither historical

facts nor assurances of future performance. Instead, they are based

only on the Company’s current beliefs, expectations and assumptions

regarding the future of its business, future plans and strategies,

projections, anticipated events and trends, the economy and other

future conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and many of

which are outside of the Company’s control. The Company’s actual

results and financial condition may differ materially from those

indicated in the forward-looking statements. Important factors that

could cause the Company’s actual results and financial condition to

differ materially from those indicated in the forward-looking

statements include, among others, the following: changes in laws

and regulations applicable to its business model; changes in market

conditions and receptivity to its services and offerings; pending

and future litigation; potential liability for claims not covered

by insurance; and loss of relationships with managed care

organizations and other non-governmental third party payers. For a

detailed discussion of the risk factors that could affect its

actual results, please refer to the risk factors identified in the

Company’s SEC reports as filed with the SEC.

Any forward-looking statement made by the Company

in this press release is based only on information currently

available to it and speaks only as of the date on which it is made.

The Company undertakes no obligation to publicly update any

forward-looking statement, whether written or oral, that may be

made from time to time, whether as a result of new information,

future developments or otherwise.

Preliminary Unaudited Financial

DataThe preliminary financial information included in this

press release is subject to completion of the Company’s year-end

close procedures and further financial review. The Company has

provided ranges, rather than specific amounts, because these

results are preliminary and subject to change. Actual results may

differ from these estimates as a result of the completion of the

Company’s year-end closing procedures, review adjustments and other

developments that may arise between now and the time such financial

information for the period is finalized. As a result, these

estimates are preliminary, may change and constitute

forward-looking information and, as a result, are subject to risks

and uncertainties. These preliminary estimates should not be viewed

as a substitute for full financial statements prepared in

accordance with United States generally accepted accounting

principles (“GAAP”), and they should not be viewed as indicative of

the Company’s results for any future period. The Company’s

independent registered public accounting firm has not audited,

reviewed, compiled, or performed any procedures with respect to

these estimated financial results and, accordingly, does not

express an opinion or any other form of assurance with respect to

these preliminary estimates.

Note Regarding Use of Non-GAAP Financial

MeasuresIn addition to reporting financial information in

accordance with generally accepted accounting principles (GAAP),

the Company is also reporting Adjusted net income, Adjusted EBITDA

and Adjusted earnings per share ("Adjusted EPS"), which are

non-GAAP financial measures. These adjusted measures are not

measurements of financial performance under GAAP and should not be

used in isolation or as a substitute or alternative to net income,

earnings per share, or any other performance measure derived in

accordance with GAAP, or as a substitute or alternative to cash

flow from operating activities or a measure of the Company’s

liquidity. In addition, the Company’s definitions of Adjusted net

income, Adjusted EBITDA, and Adjusted EPS may not be comparable to

similarly titled non-GAAP financial measures reported by other

companies. As defined by the Company: (i) Adjusted net income

represents net income before intangible asset amortization expense,

stock-based compensation expense, and restructuring, acquisition,

integration and other expenses, net of tax adjustments, (ii)

Adjusted EBITDA represents net income before net interest expense,

income tax expense, depreciation and amortization, stock-based

compensation expense, loss on extinguishment of debt, and

restructuring, acquisition, integration and other expenses, and

(iii) Adjusted earnings per share represents Adjusted net income

divided by weighted average common shares outstanding, diluted. As

part of restructuring, acquisition, integration and other expenses,

the Company may incur significant charges such as the write down of

certain long‑lived assets, temporary redundant expenses,

professional fees, certain litigation expenses and reserves related

to acquired businesses, potential retention and severance costs and

potential accelerated payments or termination costs for certain of

its contractual obligations. Management believes that these

adjusted measures provide useful supplemental information regarding

the performance of Option Care Health’s business operations and

facilitate comparisons to the Company’s historical operating

results. The Company has not reconciled Adjusted EBITDA guidance to

net income, nor Adjusted EPS guidance to GAAP earnings per share,

as management believes creation of this reconciliation would not be

practicable due to the uncertainty regarding, and potential

variability of, material reconciling items. Full reconciliations of

each adjusted measure to the most comparable GAAP financial measure

are set forth below.

|

|

|

|

|

|

OPTION CARE HEALTH, INC. RECONCILIATION

BETWEEN GAAP AND NON-GAAP MEASURES(IN MILLIONS,

EXCEPT PER SHARE AMOUNTS)(UNAUDITED) |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months EndedDecember 31,

2024 |

|

Full Year EndedDecember 31,

2024 |

|

|

Low |

|

High |

|

Low |

|

High |

|

Net income |

$ |

56.8 |

|

|

$ |

60.9 |

|

|

$ |

208.5 |

|

|

$ |

212.6 |

|

|

Interest expense, net |

|

10.9 |

|

|

|

10.9 |

|

|

|

49.0 |

|

|

|

49.0 |

|

|

Income tax expense |

|

22.3 |

|

|

|

20.0 |

|

|

|

73.2 |

|

|

|

70.9 |

|

|

Depreciation and amortization expense |

|

17.5 |

|

|

|

17.5 |

|

|

|

63.5 |

|

|

|

63.5 |

|

|

EBITDA |

|

107.5 |

|

|

|

109.3 |

|

|

|

394.2 |

|

|

|

396.0 |

|

|

|

|

|

|

|

|

|

|

|

EBITDA adjustments |

|

|

|

|

|

|

|

|

Stock-based incentive compensation |

|

8.5 |

|

|

|

8.5 |

|

|

|

36.1 |

|

|

|

36.1 |

|

|

Loss on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

0.4 |

|

|

|

0.4 |

|

|

Restructuring, acquisition, integration and other |

|

2.8 |

|

|

|

4.0 |

|

|

|

10.3 |

|

|

|

11.5 |

|

|

Adjusted EBITDA |

$ |

118.7 |

|

|

$ |

121.7 |

|

|

$ |

441.0 |

|

|

$ |

444.0 |

|

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

56.8 |

|

|

$ |

60.9 |

|

|

$ |

208.5 |

|

|

$ |

212.6 |

|

|

Intangible asset amortization expense |

|

8.6 |

|

|

|

8.6 |

|

|

|

34.4 |

|

|

|

34.4 |

|

|

Stock-based incentive compensation |

|

8.5 |

|

|

|

8.5 |

|

|

|

36.1 |

|

|

|

36.1 |

|

|

Restructuring, acquisition, integration and other |

|

2.8 |

|

|

|

4.0 |

|

|

|

10.3 |

|

|

|

11.5 |

|

|

Total pre-tax adjustments |

|

19.9 |

|

|

|

21.1 |

|

|

|

80.8 |

|

|

|

82.0 |

|

|

Tax adjustments (1) |

|

(5.7 |

) |

|

|

(5.2 |

) |

|

|

(21.0 |

) |

|

|

(20.5 |

) |

|

Adjusted net income |

$ |

71.0 |

|

|

$ |

76.8 |

|

|

$ |

268.3 |

|

|

$ |

274.1 |

|

|

|

|

|

|

|

|

|

|

|

Earnings per share, diluted |

$ |

0.33 |

|

|

$ |

0.36 |

|

|

$ |

1.21 |

|

|

$ |

1.23 |

|

|

Adjusted earnings per share, diluted |

$ |

0.42 |

|

|

$ |

0.45 |

|

|

$ |

1.55 |

|

|

$ |

1.59 |

|

|

Weighted average common shares outstanding, diluted |

|

169,980 |

|

|

|

169,980 |

|

|

|

172,845 |

|

|

|

172,845 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Tax adjustments for fourth quarter and full

year 2024 includes the estimated income tax effect on non-GAAP

adjustments based on the expected effective tax rate

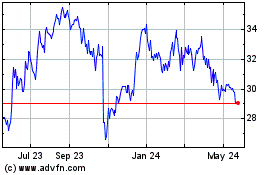

Option Care Health (NASDAQ:OPCH)

Historical Stock Chart

From Dec 2024 to Jan 2025

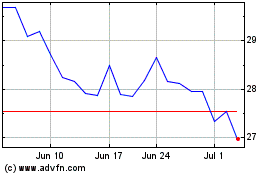

Option Care Health (NASDAQ:OPCH)

Historical Stock Chart

From Jan 2024 to Jan 2025