- Record Q2 Revenue of $303 Million

(9% increase over prior year)

- Q2 Earnings Per Diluted Share

- GAAP EPS of $1.03

- Non-GAAP EPS of $1.19 (23% increase

over prior year)

- Backlog of $998 Million (20%

year-over-year increase)

- Company Raises FY 2019

Guidance

OSI Systems, Inc. (the “Company” or “OSI Systems”) (NASDAQ:

OSIS) today announced financial results for the three and six

months ended December 31, 2018.

Deepak Chopra, OSI Systems’ Chairman and Chief Executive

Officer, stated, “We are pleased to report excellent second quarter

financial performance. We achieved record revenues leading to

strong profits and solid cash flow. With a substantial backlog, we

continue to see the Company well positioned for the remainder of

fiscal 2019.”

The Company reported revenues of $303.2 million for the second

quarter of fiscal 2019, an increase of 9% from the $277.5 million

reported for the second quarter of fiscal 2018. Net income for the

second quarter of fiscal 2019 was $19.1 million, or $1.03 per

diluted share, compared to net loss of $47.0 million, or ($2.47)

per diluted share, for the second quarter of fiscal 2018. Non-GAAP

net income for the second quarter of fiscal 2019 was $22.1 million,

or $1.19 per diluted share, compared to non-GAAP net income for the

second quarter of fiscal 2018 of $19.1 million, or $0.97 per

diluted share.

For the six months ended December 31, 2018, revenues increased

7% to $569.5 million, compared with the same period a year ago. Net

income for this period was $28.5 million, or $1.53 per diluted

share, compared with net loss of $36.8 million, or ($1.95) per

diluted share, for the same period a year ago. Non-GAAP net income

for the six months ended December 31, 2018 was $37.3 million, or

$2.00 per diluted share, compared with non-GAAP net income of $34.6

million, or $1.76 per diluted share, for the comparable prior-year

period.

During the quarter ended December 31, 2018, the Company’s

book-to-bill ratio for equipment and related services was 0.9. As

of December 31, 2018, the Company’s backlog was approximately $998

million representing a 20% year-over-year increase. Operating cash

flow during the quarter ended December 31, 2018 was $43.7 million,

and capital expenditures were $4.8 million.

Mr. Chopra commented, “Our Security division delivered record

second fiscal quarter revenues of $189 million, or a 10% increase

compared with the prior-year period and delivered strong operating

profit during the quarter. We were also pleased with our sales

activity in the key markets of aviation, port and border

security.”

Mr. Chopra continued, “The performance in our Healthcare

division improved significantly from the first quarter. Bookings

accelerated leading to stronger sales. With an enhanced focus on

profitable product lines and channels coupled with a reduced cost

structure, the division returned to double digit operating margins

excluding restructuring and other charges.”

Mr. Chopra concluded, “Our Optoelectronics and Manufacturing

division continued to perform well in the quarter delivering

year-over-year sales growth of 13%, operating margin expansion, and

strong cash flow.”

The Company’s effective tax rate for the three and six months

ended December 31, 2018 was 26.8% and 23.0%, respectively.

Excluding the benefit of certain discrete tax items, the Company’s

tax rate for the three and six months ended December 31, 2018 was

28.3% and 28.2%, respectively. As a result of the enactment of the

Tax Cuts and Jobs Act (the “Tax Act”) in December 2017, the Company

recognized a charge of $56 million, or $2.96 per share, in the

second quarter of fiscal 2018. The Company’s reported tax rate,

which included the charge, was 465.0% for the second quarter of

fiscal 2018, and 231.4% for the first half of fiscal 2018. The

Company’s tax rate, excluding the charge related to the Tax Act and

certain discrete tax items, was 28.0% and 28.2% for the three and

six months ended December 31, 2017.

Fiscal Year 2019 Outlook

The Company is raising its fiscal 2019 sales guidance to a range

of $1.150 billion - $1.185 billion, which would represent growth of

6% to 9% compared to the prior fiscal year. In addition, the

Company is increasing its non-GAAP earnings guidance to $3.93 -

$4.10 per diluted share for fiscal 2019. Actual sales and non-GAAP

diluted earnings per share could vary from this guidance due to

factors discussed under “Forward-Looking Statements” and other

factors.

The Company’s fiscal 2019 diluted earnings per share guidance is

provided on a non-GAAP basis only. The Company does not provide a

reconciliation of non-GAAP diluted EPS guidance to GAAP diluted EPS

(the most directly comparable GAAP measure) on a forward-looking

basis because the Company is unable to provide a meaningful or

accurate compilation of reconciling items and certain information

is not available. This is due to the inherent difficulty and

complexity in accurately forecasting the timing and amounts of

various items that would be excluded from GAAP diluted EPS,

including, for example, acquisition costs and other non-recurring

items that have not yet occurred, are out of the Company’s control,

or cannot be reasonably predicted. For the same reasons, the

Company is unable to address the probable significance of

unavailable information which may be material and therefore could

result in GAAP diluted EPS, the corresponding GAAP financial

measure, being materially less than projected non-GAAP diluted

EPS.

Presentation of Non-GAAP Financial Measures

This earnings release includes a presentation of non-GAAP net

income, non-GAAP diluted earnings per share, non-GAAP operating

income (loss) by segment and non-GAAP operating margin, all of

which are non-GAAP financial measures. The presentation of these

non-GAAP figures for the three and six month periods ended December

31, 2017 and 2018 is provided to allow for the comparison of the

underlying performance of the Company, net of impairment,

restructuring and other charges (including certain legal costs),

amortization of intangible assets acquired through business

acquisitions and non-cash interest expense related to convertible

debt, and their associated tax effects, and the impact of discrete

income tax items including charges resulting from the

implementation of the Tax Act. Management believes that these

non-GAAP financial measures provide (i) additional insight into the

ongoing operations of the Company, (ii) meaningful supplemental

information regarding the Company’s results (excluding amounts

management does not view as reflective of ongoing operating

results) for purposes of planning, forecasting, and assessing the

performance of the Company’s businesses, (iii) a meaningful

comparison of results of the current period against results of past

periods, and (iv) financial results that are comparable to those of

peer companies. Non-GAAP financial measures should not be assessed

in isolation or as a substitute for measures of financial

performance prepared in accordance with GAAP. These non-GAAP

measures may not be the same as similar measures used by other

companies due to possible differences in method and in the items or

events for which adjustments are made.

Reconciliations of GAAP to non-GAAP financial information are

provided in the accompanying tables. The financial results

calculated in accordance with GAAP and reconciliations from those

financial results should be carefully evaluated.

Conference Call Information

The Company will host a conference call and simultaneous webcast

beginning at 1:30 p.m. PT (4:30 p.m. ET) today to discuss its

results for the second quarter of fiscal 2019. To listen, please

visit the Investor Relations section of the OSI Systems website,

http://investors.osi-systems.com/index.cfm and follow the link that

will be posted on the front page. A replay of the webcast will be

available shortly after the conclusion of the conference call until

February 7, 2019. The replay can either be accessed through the

Company’s website, www.osi-systems.com, or by telephonic replay by

calling 1-855-859-2056 and entering the conference call

identification number ’5456605’ when prompted for the replay

code.

About OSI Systems

OSI Systems is a vertically integrated designer and manufacturer

of specialized electronic systems and components for critical

applications in the homeland security, healthcare, defense and

aerospace industries. The Company combines more than 40 years of

electronics engineering and manufacturing experience with offices

and production facilities in more than a dozen countries to

implement a strategy of expansion into selective end-product

markets. For more information on OSI Systems or its subsidiary

companies, visit www.osi-systems.com. News Filter: OSIS-E

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements relate to the Company’s current

expectations, beliefs, and projections concerning matters that are

not historical facts. Forward-looking statements are not guarantees

of future performance and involve uncertainties, risks,

assumptions, and contingencies, many of which are outside the

Company’s control and which may cause actual results to differ

materially from those described in or implied by any

forward-looking statement. Forward-looking statements include, but

are not limited to, information provided regarding expected

revenues, earnings, growth, and performance in fiscal 2019. In

addition, the Company could be exposed to a variety of negative

consequences as a result of delays related to the award of domestic

and international contracts; failure to secure the renewal of key

customer contracts; delays in customer programs; delays in revenue

recognition related to the timing of customer acceptance;

unanticipated impacts of sequestration and other U.S. Government

budget control provisions; changes in domestic and foreign

government spending and budgetary, procurement and trade policies

adverse to the Company’s businesses; global economic uncertainty;

unfavorable currency exchange rate fluctuations; effect of changes

in tax legislation; market acceptance of the Company’s new and

existing technologies, products, and services; the Company’s

ability to win new business and convert orders received to sales

within the fiscal year; enforcement actions in respect of any

noncompliance with laws and regulations, including export control

and environmental regulations and the matters that are the subject

of some or all of the Company’s ongoing investigations and

compliance reviews; contract and regulatory compliance matters, and

actions, if brought, resulting in judgments, settlements, fines,

injunctions, debarment, or penalties; and other risks and

uncertainties, including, but not limited to, those detailed herein

and from time to time in the Company’s Securities and Exchange

Commission filings, which could have a material and adverse impact

on the Company’s business, financial condition, and results of

operations. For additional information on these and other factors

that could cause the Company’s future results to differ materially

from those in any forward-looking statements, see the section

titled “Risk Factors” in the Company’s most recently filed Annual

Report on Form 10-K and other risks described therein and in

documents subsequently filed by the Company from time to time with

the Securities and Exchange Commission. Undue reliance should not

be placed on forward-looking statements, which are based on

currently available information and speak only as of the date on

which they are made. The Company assumes no obligation to update

any forward-looking statement made in this press release that

becomes untrue because of subsequent events, new information, or

otherwise, except to the extent it is required to do so under

federal securities laws.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (in thousands, except per share data)

Three Months Ended Six Months Ended

December 31, December 31, 2017

2018 2017 2018 Revenue:

Products $ 181,393 $ 225,402 $ 347,046 $ 407,882

Services 96,135 77,803 187,615

161,572 Total revenues 277,528 303,205 534,661

569,454 Cost of goods sold: Products 122,464 150,131 236,644

275,502 Services 53,434 42,730

105,116 87,695 Total cost of goods sold

175,898 192,861 341,760

363,197 Gross profit 101,630 110,344 192,901 206,257

Operating expenses: Selling, general and administrative 60,098

67,097 115,745 128,804 Research and development 15,088 12,805

30,188 26,558 Impairment, restructuring and other charges

8,297 (1,265 ) 9,427 2,931

Total operating expenses 83,483 78,637

155,360 158,293 Income from

operations 18,147 31,707 37,541 47,964 Interest expense and other,

net (5,282 ) (5,620 ) (9,531 ) (10,952

) Income before income taxes 12,865 26,087 28,010 37,012 Provision

for income taxes (59,816 ) (6,980 ) (64,804 )

(8,503 ) Net income (loss) $ (46,951 ) $ 19,107 $

(36,794 ) $ 28,509 Diluted earnings (loss) per share

$ (2.47 ) $ 1.03 $ (1.95 ) $ 1.53 Weighted average

shares outstanding – diluted 18,971 18,624

18,874 18,679

UNAUDITED SEGMENT INFORMATION (in thousands)

Three Months Ended Six Months Ended

December 31, December 31, 2017

2018 2017 2018 Revenues – by

Segment: Security division $ 172,269 $ 188,684 $ 334,514 $

358,644 Healthcare division 52,506 51,559 98,035 89,832

Optoelectronics and Manufacturing division (including intersegment

revenues) 63,886 72,019 122,812 142,973 Intersegment revenues

eliminations (11,133 ) (9,057 ) (20,700 )

(21,995 ) Total $ 277,528 $ 303,205 $ 534,661

$ 569,454

Operating income (loss) – by

Segment: Security division $ 22,471 $ 26,063 $ 45,164 $ 49,113

Healthcare division 603 2,209 1,450 334 Optoelectronics and

Manufacturing division 4,502 8,067 9,677 14,892 Corporate (9,118 )

(4,560 ) (17,871 ) (15,911 ) Eliminations (311 ) (72

) (879 ) (464 ) Total $ 18,147 $ 31,707

$ 37,541 $ 47,964

OSI SYSTEMS, INC.

AND SUBSIDIARIES UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS (in thousands) June 30, 2018

December 31, 2018 Assets Cash and cash

equivalents $ 84,814 $ 95,967 Accounts receivable, net 210,744

226,086 Inventories 313,552 315,200 Other current assets

41,587 43,949 Total current assets 650,697 681,202 Property

and equipment, net 115,524 121,270 Goodwill 292,213 305,164

Intangible assets, net 142,001 140,202 Other non-current assets

55,256 49,839 Total Assets $ 1,255,691 $ 1,297,677

Liabilities and Stockholders' Equity Bank

lines of credit $ 113,000 $ 149,000 Current portion of long-term

debt 2,262 2,107 Accounts payable and accrued expenses 194,815

180,392 Other current liabilities 133,245 138,415

Total current liabilities 443,322 469,914 Long-term debt 248,980

253,184 Other long-term liabilities 73,953 78,383

Total liabilities 766,255 801,481 Total stockholders’ equity

489,436 496,196 Total Liabilities and Stockholders’ Equity $

1,255,691 $ 1,297,677

RECONCILIATION OF GAAP TO

NON-GAAP NET INCOME (LOSS) AND EARNINGS (LOSS) PER SHARE

(in thousands, except share and earnings per share data)

Three Months Ended December 31, Six

Months Ended December 31, 2017 2018

2017 2018 Net Net

income Net income Net

(loss) EPS income EPS (loss)

EPS income EPS GAAP basis $ (46,951 ) $ (2.47

) $ 19,107 $ 1.03 $ (36,794 ) $ (1.95 ) $ 28,509 $ 1.53 Impairment,

restructuring and other charges 8,297 0.44 (1,265 ) (0.07 ) 9,427

0.50 2,931 0.16 Amortization of acquired intangible assets 3,533

0.19 4,022 0.22 7,076 0.37 8,190 0.44 Non-cash interest 1,870 0.10

1,955 0.10 3,674 0.19 3,881 0.21 Tax benefit of above adjustments

(3,838 ) (0.20 ) (1,331 ) (0.07 ) (5,680 ) (0.30 ) (4,231 ) (0.23 )

Discrete tax items 56,212 2.96 (392 ) (0.02 ) 56,919 3.02 (1,934 )

(0.11 ) Impact of diluted shares 1 -- (0.05 )

-- -- -- (0.07 )

-- -- Non-GAAP basis $ 19,123 $

0.97 $ 22,096 $ 1.19 $ 34,622 $ 1.76

$ 37,346 $ 2.00

1

For the three and six months ended

December 31, 2017, the weighted average diluted shares used to

calculate EPS on a GAAP basis exclude potential common shares

(stock options and restricted stock units) due to their

antidilutive effect resulting from the Company’s reported net loss.

For the three and six months ended December 31, 2017, the weighted

average diluted shares used to calculate EPS on a non-GAAP basis

were approximately 19,655,000 shares and 19,628,000 shares,

respectively.

RECONCILIATION OF GAAP TO NON-GAAP

OPERATING INCOME (LOSS) AND OPERATING MARGIN BY SEGMENT

(in thousands, except percentages) Three Months

Ended December 31, 2017 Optoelectronics

and Security Healthcare

Manufacturing Corporate / Division

Division Division Elimination Total

% of % of % of % of Sales Sales Sales

Sales GAAP basis – operating income (loss) $ 22,471 13.0 % $ 603

1.1 % $ 4,502 7.0 % $ (9,429 ) $ 18,147 6.5 % Impairment,

restructuring and other charges 1,591 0.9 % 5,022 9.6 % 1,221 1.9 %

463 8,297 3.0 % Amortization of acquired intangible assets

3,152 1.9 % 14 0.0 % 367 0.6 % -

3,533 1.3 % Non-GAAP basis– operating income (loss) $ 27,214 15.8 %

$ 5,639 10.7 % $ 6,090 9.5 % $ (8,966 ) $ 29,977 10.8 %

Three Months Ended December 31,

2018

Optoelectronics and

Security Healthcare Manufacturing Corporate

/ Division Division Division

Elimination Total % of % of % of

% of Sales Sales Sales Sales GAAP basis – operating income

(loss) $ 26,063 13.8 % $ 2,209 4.3 % $ 8,067 11.2 % $ (4,632 ) $

31,707 10.5 % Impairment, restructuring and other charges (46 ) 0.0

% 3,335 6.5 % 46 0.0 % (4,600 ) (1,265 ) (0.4 %) Amortization of

acquired intangible assets 2,818 1.5 % -- --

1,205 1.7 % - - 4,023 1.3

% Non-GAAP basis– operating income (loss) $ 28,835 15.3 % $

5,544 10.8 % $ 9,318 12.9 % $ (9,232 ) $ 34,465 11.4 %

Six Months Ended December 31, 2017

Optoelectronics and

Security Healthcare Manufacturing Corporate

/ Division Division Division

Elimination Total % of % of % of

% of Sales Sales Sales Sales GAAP basis – operating income

(loss) $ 45,164 13.5 % $ 1,450 1.5 % $ 9,677 7.9 % $ (18,750 ) $

37,541 7.0 % Impairment, restructuring and other charges 1,901 0.6

% 5,022 5.1 % 1,221 1.0 % 1,283 9,427 1.8 % Amortization of

acquired intangible assets 6,314 1.9 % 29 0.0 %

733 0.6 % - - 7,076 1.3 % Non-GAAP

basis– operating income (loss) $ 53,379 16.0 % $ 6,501 6.6 % $

11,631 9.5 % $ (17,467 ) $ 54,044 10.1 %

Six Months Ended December 31,

2018

Optoelectronics and

Security Healthcare Manufacturing Corporate

/ Division Division Division

Elimination Total % of % of % of

% of Sales Sales Sales Sales GAAP basis – operating income

(loss) $ 49,113 13.7 % $ 334 0.4 % $ 14,892 10.4 % $ (16,375 ) $

47,964 8.4 % Impairment, restructuring and other charges -- --

3,526 3.9 % 420 0.3 % (1,015 ) 2,931 0.5 % Amortization of acquired

intangible assets 5,916 1.6 % -- --

2,274 1.6 % -- 8,190 1.5 % Non-GAAP basis–

operating income (loss) $ 55,029 15.3 % $ 3,860 4.3 % $ 17,586 12.3

% $ (17,390 ) $ 59,085 10.4 %

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190124005734/en/

OSI Systems, Inc.Ajay VashishatVice President, Business

DevelopmentTel: (310) 349-2237avashishat@osi-systems.com

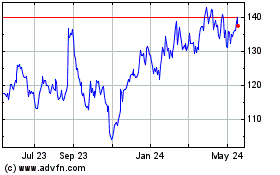

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Oct 2024 to Nov 2024

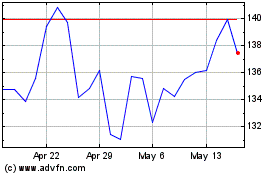

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Nov 2023 to Nov 2024