- Record Fiscal Q1 Revenues of $344 Million (23% growth

year-over-year)

- Q1 Earnings Per Diluted Share

- GAAP EPS of $1.05

- Record Q1 Non-GAAP Adjusted EPS of $1.25

- Q1 Operating Income Growth of 34% Year-Over-Year

- Q1-Ended Backlog of Approximately $1.8 Billion

- Company Increases Fiscal 2025 Revenues and Non-GAAP Adjusted

Diluted EPS Guidance

OSI Systems, Inc. (the “Company” or “OSI Systems”) (NASDAQ:

OSIS) today announced its financial results for the first quarter

of fiscal 2025.

Deepak Chopra, OSI Systems’ Chairman and Chief Executive

Officer, stated “We are pleased to kick off fiscal 2025 with a

strong first quarter in which we posted record Q1 revenues and

non-GAAP earnings per share led again by outstanding growth in the

Security division. Given our robust backlog and high visibility

into the opportunity pipeline, we anticipate a strong fiscal

year.”

For Q1 FY25, the Company reported revenues of $344.0 million, a

23% increase over the $279.2 million reported for the same quarter

of the prior year. Net income for Q1 FY25 was $17.9 million, or

$1.05 per diluted share, compared to net income of $12.9 million,

or $0.75 per diluted share, for the same quarter of the prior year.

Non-GAAP net income for Q1 FY25 was $21.3 million, or $1.25 per

diluted share, compared to non-GAAP net income for the same quarter

of the prior year of $15.6 million, or $0.91 per diluted share.

The Company's backlog was approximately $1.8 billion as of

September 30, 2024, compared to approximately $1.7 billion as of

June 30, 2024. For Q1 FY25, net cash used in operating activities

was $37.2 million, driven primarily by increases in working capital

to support planned future growth. Capital expenditures were $7.7

million and depreciation and amortization was $11.5 million for Q1

FY25. The Company repurchased 531,314 shares during Q1 FY25 for an

aggregate cost of approximately $80 million.

Mr. Chopra commented, “The Security division results reflect

continuing strong momentum with heightened demand for our product

and service offerings, as well as our superior competitive

position. The Security division’s revenues in the first quarter of

fiscal 2025 increased 36% year-over-year, leading to significant

operating income growth and year-over-year adjusted operating

margin expansion. During the quarter, we acquired a business that

provides critical military, space and surveillance solutions, which

is expected to be complementary to our sales channel. Security

bookings were solid and we ended the quarter with near-record

backlog in this division. This provides us significant confidence

that the Security division is well-positioned for the future.”

Mr. Chopra continued, “Our Optoelectronics and Manufacturing

division delivered solid quarterly results, reporting

year-over-year revenue growth despite certain customers continuing

to adjust inventory levels and purchasing patterns. The division

continues to benefit from our global manufacturing footprint with

exposure across multiple end markets.”

Mr. Chopra concluded, “During the first quarter of fiscal 2025,

we saw improved margins in the Healthcare division on a comparable

level of revenues with the same quarter of the prior year. We

continue to focus on new product development, principally in our

patient monitoring portfolio.”

In July 2024 the Company issued $350 million of convertible

senior notes due in fiscal 2030 at an interest rate of 2.25%. The

net proceeds of the issuance were partially used to reduce the

outstanding balance under the Company’s revolving credit facility

and to repurchase shares of common stock.

Fiscal Year 2025 Outlook

Current Updated

Guidance

Previous Guidance

Revenues

$1.670 billion - $1.695

billion

$1.620 billion - $1.650

billion

Growth Rate

8.5% - 10.2%

5.3% - 7.2%

Non-GAAP Adjusted Diluted Earnings Per

Share

$9.00 - $9.30

$8.80 - $9.15

Growth Rate

10.7% - 14.4%

8.2% - 12.5%

The Company is increasing its fiscal 2025 revenues and non-GAAP

adjusted diluted earnings per share guidance. Actual revenues and

adjusted diluted earnings per share could vary from this guidance

due to factors discussed under “Forward-Looking Statements” or

other factors.

The Company’s fiscal 2025 adjusted diluted earnings per share

guidance is provided on a non-GAAP basis only. The Company does not

provide a reconciliation of guidance for non-GAAP adjusted diluted

EPS to GAAP diluted EPS (the most directly comparable GAAP measure)

on a forward-looking basis because the Company is unable to provide

a meaningful or accurate compilation of reconciling items and

certain information is not available. This is due to the inherent

difficulty and complexity in accurately forecasting the timing and

amounts of various items included in the calculation of GAAP

diluted EPS but excluded in the calculation of non-GAAP adjusted

diluted EPS, such as acquisition costs and other non-recurring

items that have not yet occurred, are out of the Company’s control

or cannot otherwise reasonably be predicted. For the same reasons,

the Company is unable to address the significance of unavailable

information which may be material and therefore could result in

GAAP diluted EPS, the most directly comparable GAAP financial

measure, being materially different from projected non-GAAP

adjusted diluted EPS.

Presentation of Non-GAAP Financial Measures

This earnings release includes a presentation of non-GAAP net

income, non-GAAP adjusted diluted earnings per share, non-GAAP

operating income (loss) by segment and non-GAAP operating margin,

all of which are non-GAAP financial measures. The presentation of

these non-GAAP figures for all fiscal periods is provided to allow

for the comparison of the underlying performance of the Company,

net of impairment, restructuring and other charges (including

certain legal costs), amortization of intangible assets acquired

through business acquisitions, and their associated tax effects,

and the impact of discrete income tax items. Although we exclude

amortization of acquired intangible assets from our non-GAAP

figures, revenue generated from such intangibles is included within

revenue in determining non-GAAP financial performance of the

Company. Management believes that the non-GAAP financial measures

presented in this earnings release provide (i) enhanced insight

into the ongoing operations of the Company, (ii) meaningful

information regarding the Company’s financial results (excluding

amounts management does not view as reflective of ongoing operating

results) for purposes of planning, forecasting and assessing the

performance of the Company’s businesses, (iii) a meaningful

comparison of financial results of the current period against

results of past periods and (iv) financial results that are

generally more comparable to financial results of peer companies

than are GAAP figures. Non-GAAP financial measures should not be

assessed in isolation or as a substitute for measures of financial

performance prepared in accordance with GAAP. These non-GAAP

measures may not be the same as measures used by other companies

due to possible differences in methods and in the items or events

for which adjustments are made.

Reconciliations of GAAP financial information to non-GAAP

financial information are provided in the accompanying tables. The

financial results calculated in accordance with GAAP and

reconciliations from those financial results should be carefully

evaluated.

Conference Call Information

The Company will host a conference call and simultaneous webcast

beginning at 9:00am PT (12:00pm ET) today to discuss its results

for Q1 FY25. To listen, please visit the Investor Relations section

of the OSI Systems website at

http://investors.osi-systems.com/index.cfm and follow the link that

will be posted on the front page. A replay of the webcast will be

available beginning shortly after the conclusion of the conference

call until November 10, 2024. The replay can be accessed through

the Company’s website at www.osi-systems.com.

About OSI Systems

OSI Systems is a vertically integrated designer and manufacturer

of specialized electronic systems and components for critical

applications in the homeland security, healthcare, defense and

aerospace industries. The Company combines more than 40 years of

electronics engineering and manufacturing experience with offices

and production facilities in more than a dozen countries to

implement a strategy of expansion into selective end-product

markets. For more information on OSI Systems and its subsidiary

companies, visit www.osi-systems.com. News Filter: OSIS-E

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements relate to the Company's current

expectations, beliefs, and projections concerning matters that are

not historical facts. Forward-looking statements are not guarantees

of future performance and involve uncertainties, risks,

assumptions, and contingencies, many of which are outside the

Company's control and which may cause actual results to differ

materially from those described in or implied by any

forward-looking statement. Forward-looking statements include, but

are not limited to, information provided regarding expected

revenues, earnings, growth, and operational performance in fiscal

2025 and beyond. The Company could be exposed to a variety of

negative consequences as a result of delays related to the award of

domestic and international contracts; failure to secure the renewal

of key customer contracts; delays in customer programs; delays in

revenue recognition related to the timing of customer acceptance;

the impact of potential information technology, cybersecurity or

data security breaches; changes in domestic and foreign government

spending and budgetary, procurement and trade policies adverse to

the Company's businesses; the impact of the Russia-Ukraine conflict

or conflicts in the Middle East, including the potential for broad

economic disruption; global economic uncertainty; material delays

and cancellations of orders or deliveries thereon, supply chain

disruptions, plant closures, or other adverse impacts on the

Company’s ability to execute business plans; unfavorable currency

exchange rate fluctuations; unfavorable interest rate fluctuations;

effect of changes in tax legislation; market acceptance of the

Company's new and existing technologies, products, and services;

the Company's ability to win new business and convert orders

received to sales within the current fiscal year; contract and

regulatory compliance matters, and actions which, if brought, could

result in judgments, settlements, fines, injunctions, debarment, or

penalties; and other risks and uncertainties, including, but not

limited to, those detailed herein and from time to time in the

Company's Securities and Exchange Commission filings, which could

have a material and adverse impact on the Company's business,

financial condition, and results of operations. For additional

information on these and other factors that could cause the

Company's future results to differ materially from those in any

forward-looking statements, see the section titled "Risk Factors"

in the Company's most recently filed Annual Report on Form 10-K and

other risks described therein and in documents subsequently filed

by the Company from time to time with the Securities and Exchange

Commission. Undue reliance should not be placed on forward-looking

statements, which are based on currently available information and

speak only as of the date on which they are made. The Company

assumes no obligation to update any forward-looking statement made

in this press release that becomes untrue because of subsequent

events, new information, or otherwise, except to the extent

required to do so under federal securities laws.

OSI SYSTEMS, INC. AND

SUBSIDIARIES

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per

share data)

Three Months Ended

September 30,

2023

2024

Revenues:

Products

$

199,709

$

255,808

Services

79,501

88,199

Total net revenues

279,210

344,007

Cost of goods sold:

Products

136,983

170,422

Services

43,482

52,083

Total cost of goods sold

180,465

222,505

Gross profit

98,745

121,502

Operating expenses:

Selling, general and administrative

59,798

72,223

Research and development

15,922

17,773

Restructuring and other charges, net

466

1,178

Total operating expenses

76,186

91,174

Income from operations

22,559

30,328

Interest and other expense, net

(5,748)

(7,359)

Income before income taxes

16,811

22,969

Provision for income taxes

(3,932)

(5,033)

Net income

$

12,879

$

17,936

Diluted earnings per share

$

0.75

$

1.05

Weighted average shares outstanding –

diluted

17,175

17,055

UNAUDITED SEGMENT

INFORMATION

(in thousands)

Three Months Ended

September 30,

2023

2024

Revenues – by Segment:

Security division

$

164,629

$

224,314

Optoelectronics and Manufacturing

division, including intersegment revenues

96,128

97,795

Healthcare division

37,787

37,102

Intersegment eliminations

(19,334)

(15,204)

Total

$

279,210

$

344,007

Operating income (loss) – by

Segment:

Security division

$

20,609

$

28,856

Optoelectronics and Manufacturing

division

11,437

10,609

Healthcare division

164

800

Corporate

(9,916)

(9,510)

Intersegment eliminations

265

(427)

Total

$

22,559

$

30,328

OSI SYSTEMS, INC. AND

SUBSIDIARIES

UNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS

(in thousands)

June 30, 2024

September 30, 2024

Assets

Cash and cash equivalents

$

95,353

$

85,053

Accounts receivable, net

648,155

687,610

Inventories

397,939

456,030

Prepaid expenses and other current

assets

74,077

81,310

Total current assets

1,215,524

1,310,003

Property and equipment, net

113,967

124,613

Goodwill

351,480

381,444

Intangible assets, net

139,529

183,222

Other non-current assets

115,508

114,232

Total Assets

$

1,936,008

$

2,113,514

Liabilities and Stockholders'

Equity

Bank lines of credit

$

384,000

$

259,000

Current portion of long-term debt

8,167

8,217

Accounts payable and accrued expenses

248,427

269,067

Other current liabilities

174,043

176,252

Total current liabilities

814,637

712,536

Long-term debt

129,383

468,084

Other long-term liabilities

128,505

146,399

Total liabilities

1,072,525

1,327,019

Total stockholders’ equity

863,483

786,495

Total Liabilities and Stockholders’

Equity

$

1,936,008

$

2,113,514

RECONCILIATION OF GAAP TO

NON-GAAP

NET INCOME AND EARNINGS PER

SHARE

(in thousands, except earnings

per share data)

Three Months Ended September

30,

2023

2024

Net income

Diluted EPS

Net income

Diluted EPS

GAAP basis

$

12,879

$

0.75

$

17,936

$

1.05

Restructuring and other charges, net

466

0.02

1,178

0.07

Amortization of acquired intangible

assets

3,707

0.22

3,867

0.23

Non-cash interest expense

-

-

-

-

Tax effect of above adjustments

(1,079

)

(0.06

)

(1,211

)

(0.07

)

Discrete tax benefit

(413

)

(0.02

)

(482

)

(0.03

)

Non-GAAP basis

$

15,560

$

0.91

$

21,288

$

1.25

RECONCILIATION OF GAAP TO

NON-GAAP

OPERATING INCOME (LOSS) AND

OPERATING MARGIN BY SEGMENT

(in thousands, except

percentages)

Three Months Ended September

30, 2023

Security Division

Optoelectronics and Manufacturing

Division

Healthcare Division

Corporate / Elimination

Total

% of

Sales

% of

Sales

% of

Sales

% of

Sales

GAAP basis – operating income (loss)

$

20,609

12.5%

$

11,437

11.9%

$

164

0.4%

$

(9,651)

$

22,559

8.1%

Restructuring and other charges, net

272

0.2%

51

0.1%

-

0.0%

143

466

0.2%

Amortization of acquired intangible

assets

2,627

1.6%

779

0.8%

301

0.8%

-

3,707

1.3%

Non-GAAP basis– operating income

(loss)

$

23,508

14.3%

$

12,267

12.8%

$

465

1.2%

$

(9,508)

$

26,732

9.6%

Three Months Ended September

30, 2024

Security Division

Optoelectronics and Manufacturing

Division

Healthcare Division

Corporate / Elimination

Total

% of

Sales

% of

Sales

% of

Sales

% of

Sales

GAAP basis – operating income (loss)

$

28,856

12.9%

$

10,609

10.8%

$

800

2.2%

$

(9,937)

$

30,328

8.8%

Restructuring and other charges, net

479

0.2%

547

0.6%

152

0.4%

-

1,178

0.3%

Amortization of acquired intangible

assets

2,986

1.3%

580

0.6%

301

0.8%

-

3,867

1.2%

Non-GAAP basis– operating income

(loss)

$

32,321

14.4%

$

11,736

12.0%

$

1,253

3.4%

$

(9,937)

$

35,373

10.3%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024089255/en/

For Additional Information,

Contact:

OSI Systems, Inc. Ajay Vashishat Vice President, Business

Development Tel: (310) 349-2237 avashishat@osi-systems.com

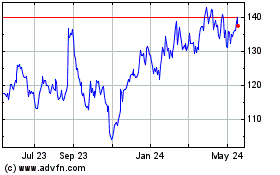

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Oct 2024 to Nov 2024

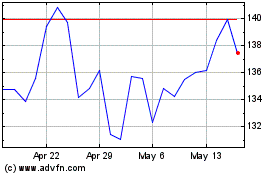

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Nov 2023 to Nov 2024