UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For

the month of February 2025

Commission

File Number: 001-37643

PURPLE

BIOTECH LTD.

(Translation

of registrant’s name into English)

4

Oppenheimer Street, Science Park, Rehovot 7670104, Israel

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Purple

Biotech Ltd. (the “Company” or the “Registrant”) is announcing that an Annual General Meeting of Shareholders

of the Company will be held on Tuesday, April 15, 2025, at 4:30 p.m. Israel time, at the offices of the Company at 4 Oppenheimer Street,

Science Park, Rehovot, Israel. The Notice of Annual General Meeting of Shareholders and the Proxy Statement in connection with the Annual

General Meeting of Shareholders, including the Voting Slip for holders of ordinary shares of the Company, are attached to this Form 6-K

as Exhibit 99.1.

BNY

Mellon, the Depositary of the Company’s American Depositary Shares (“ADSs”) program, will distribute a Voting Instruction

Form for holders of the Company’s ADSs. A copy of the Voting Instruction Form is attached hereto as Exhibit 99.2.

This

report on Form 6-K of the Registrant consists of the following documents, which are attached hereto and incorporated by reference herein:

Incorporation

by Reference

This

Report on Form 6-K, including all exhibits attached hereto, is hereby incorporated by reference into each of the Registrant’s Registration

Statement on Form S-8 filed

with the Securities and Exchange Commission on May 20, 2016 (Registration file number 333-211478), the Registrant’s Registration

Statement on Form S-8 filed

with the Securities and Exchange Commission on June 6, 2017 (Registration file number 333-218538), the Registrant’s Registration

Statement on Form F-3, as

amended, originally filed with the Securities and Exchange Commission on July 16, 2018 (Registration file number 333-226195), the Registrant’s

Registration Statement on Form

S-8 filed with the Securities and Exchange Commission on March 28, 2019 (Registration file number 333-230584), the Registrant’s

Registration Statement on Form

F-3 filed with the Securities and Exchange Commission on September 16, 2019 (Registration file number 333-233795), the Registrant’s

Registration Statement on Form

F-1 filed with the Securities and Exchange Commission on December 27, 2019 (Registration file number 333-235729), the Registrant’s

Registration Statement on Form

F-3 filed with the Securities and Exchange Commission on May 13, 2020 (Registration file number 333-238229), the Registrant’s

Registration Statement on Form

S-8 filed with the Securities and Exchange Commission on May 18, 2020 (Registration file number 333-238481), each of the Registrant’s

Registration Statements on Form

F-3 filed with the Securities and Exchange Commission on July 10, 2020 (Registration file numbers 333-239807 and 333-233793),

the Registrant’s Registration Statement on Form

S-8 filed with the Securities and Exchange Commission on April 4, 2022 (Registration file number 333-264107) and the Registrant’s

Registration Statement on Form

F-3 filed with the Securities and Exchange Commission on March 23, 2023 (Registration file number 333-270769), the Registrant’s

Registration Statement on Form

F-3, as amended, originally filed with the Securities and Exchange Commission on December 8, 2022 (Registration file number 333-268710),

the Registrant’s Registration Statement on Form

F-1, as amended, originally filed with the Securities and Exchange Commission on October 30, 2023 (Registration file

number 333-275216) and the Registrant’s Registration Statement on Form

F-1, filed with the Securities and Exchange Commission on July 22, 2024 (Registration file number 333-280947), to be

a part thereof from the date on which this report is submitted, to the extent not superseded by documents or reports subsequently filed

or furnished.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| February 28, 2025 |

PURPLE BIOTECH

LTD. |

| |

|

| |

By: |

/s/

Gil Efron |

| |

|

Gil Efron |

| |

|

Chief Executive Officer |

2

Exhibit 99.1

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

Notice is hereby given that

an Annual General Meeting of Shareholders (the “Meeting”) of Purple Biotech Ltd. (the “Company”)

will be held on Tuesday, April 15, 2025, at 4:30 p.m. Israel time at the Company’s executive offices at 4 Oppenheimer Street, Science

Park, Rehovot, Israel, for the following purposes:

| 1. | To re-elect each of Dr. Eric Rowinsky, Mr. Robert Gagnon and Mr. Ido Agmon as members of the first class

of directors of the Board of Directors, to serve until the Company’s annual general meeting of shareholders to be held in 2028,

and until their respective successors have been duly elected and qualified; |

| 2. | To approve the grant of equity-based awards to (a) Mr. Gil Efron, our Chief Executive Officer; and (b)

each of our directors who shall serve in such capacity as of immediately following the Meeting; and |

| 3. | To approve an increase in the Company’s authorized ordinary share capital and to amend the Company’s

Articles of Association accordingly. |

In addition, at the Meeting,

representatives of the Company’s management will be available to review and discuss with shareholders the consolidated financial

statements of the Company for the year ended December 31, 2024.

Shareholders and holders of

the Company’s American Depositary Shares (“ADSs”) of record at the close of business in New York on March 6,

2025 (the “Record Date”), are entitled to receive notice of, and vote at, the Meeting and any adjournments or postponements

thereof. You are also entitled to notice of, and to vote at the Meeting, and any adjournments or postponements thereof if you are a beneficial

owner who holds ordinary shares or ADSs through a broker, bank or other nominee as of the Record Date. All shareholders are cordially

invited to attend the Meeting in person.

Whether or not you plan to

attend the Meeting, it is important that your ordinary shares be represented. Holders of ADSs (whether registered in their name or in

“street name”) will receive voting instruction forms from the Bank of New York Mellon (which acts as the Depositary for the

ADSs) in order to instruct their banks, brokers or other nominees on how to vote, and they are kindly requested to complete, date, sign

and mail the voting instruction form in the envelope provided at the earliest convenience so that it will be received no later than the

date and time indicated on the voting instruction form.

Shareholders

who hold ordinary shares through members of the Tel Aviv Stock Exchange (the “TASE”), may vote at the Meeting

in person or through a voting slip, by completing, dating, signing and delivering or mailing (by registered mail) the voting slip to the

Company’s offices so that it is received by the Company no later than four hours prior to the designated time of the Meeting, namely

by no later than Tuesday, April 15, 2025, 12:30 p.m. Israel time. Shareholders who hold ordinary

shares through members of the TASE (whether attending the Meeting in person or voting through a voting slip) must provide the Company

with an ownership certificate confirming their ownership of our ordinary shares as of the Record Date from the applicable TASE member,

as required by the Israeli Companies Regulations (Proof of Ownership of Shares for Voting at General Meeting) of 2000, as amended. Alternatively,

a shareholder whose shares are registered with a TASE member may also vote electronically via the electronic voting system of the Israel

Securities Authority (the “ISA”). You should receive instructions about electronic voting from the TASE member through

which you hold your shares. Voting via the electronic voting system will be permitted until four hours prior to the Meeting commencement,

namely by no later than Tuesday, April 15, 2025, 12:30 p.m. Israel time.

A holder of ordinary shares

at the close of business on the Record Date shall also be entitled to participate in the Meeting by proxy, which shall be in writing and

signed by the appointing party or its authorized attorney, and if the appointing party is a corporation, the appointment shall be in writing

signed by authorized corporate signatories together with the company stamp or by an authorized attorney. The proxy, or a copy satisfactory

to the Company Secretary, must be deposited at the Company’s offices no later than 72 hours prior to the time scheduled for the

Meeting. However, the Meeting chairman is entitled to waive this requirement with respect to all participants at the Meeting, and to accept

all proxies at the commencement of the Meeting, subject to the presentation of proof of share ownership. A proxy held by a participant

at the Meeting that is dated more than 12 months from the date of the signature shall be considered invalid.

Our Board of Directors

recommends that you vote FOR the above proposals, which are described in the proxy statement.

The quorum required for the

Meeting consists of at least two shareholders who are present at the Meeting, in person, by proxy, voting instruction form or voting slip

(paper or electronic) (“Valid Meeting Participants”), and who hold in the aggregate twenty-five percent (25%) or more

of the voting rights of the Company. In the event that there is no quorum present thirty minutes after the scheduled time, the Meeting

will be adjourned for one week, to the same time and place, i.e., on Tuesday, April 22, 2025, at 4:30 p.m. (Israel time) at the Company’s

offices (the “Adjourned Meeting”). If there is no quorum present thirty minutes after the time set for the Adjourned

Meeting, any two shareholders present as Valid Meeting Participants will then constitute a legal quorum at the Adjourned Meeting. This

notice will serve as notice of the Adjourned Meeting if no quorum is present at the original date and time, and no further notice of the

Adjourned Meeting will be given to shareholders.

The affirmative vote of the

holders of a majority of the Company’s ordinary shares, including those represented by ADSs, participating and voting on the matter

at the Meeting as Valid Meeting Participants (excluding abstentions), is required to approve each of the proposals.

In addition, the approval

of Proposal 2(a) is also subject to the fulfillment of one of the following additional voting requirements: (i) at least a majority of

the shares (including those represented by ADSs) held by shareholders (including ADS holders) who are non-controlling shareholders and

shareholders (including ADS holders) who do not have a personal interest in the matter voted in favor of the proposal (excluding abstentions);

or (ii) the total number of shares (including those represented by ADSs) voted against the proposal by shareholders and ADS holders (as

applicable) referred to in clause (i) does not exceed two-percent (2%) of the outstanding voting power in the Company.

We are not aware of any shareholder

or ADS holder that would be deemed to be a controlling shareholder of our Company as of the current time for purposes of Proposal 2(a).

The Israeli Companies Law, 1999 (the “Companies Law”) requires that each shareholder and ADS holder voting on Proposal

2(a) inform the Company, prior to voting on Proposal 2(a) at the Meeting, if the shareholder or ADS holder has a personal interest in

the proposal; otherwise, a shareholder of ADS holder’s vote will not be counted for the purposes of the proposal. In accordance

with regulations promulgated under the Companies Law, a shareholder who votes via voting slip, and an ADS holder who signs and returns

a voting instruction form, will be deemed to have confirmed that such shareholder or ADS holder (as applicable), and any related party

thereof, does not have a personal interest in Proposal 2(a), unless such shareholder or ADS holder has delivered a written notice to the

Company notifying of the existence of a personal interest no later than 10:00 a.m. (Israel time) on Tuesday, April 15, 2025. Any such

written notice must be sent to the Company via registered mail at the Company’s offices; Attention: Gil Efron, Chief Executive Officer.

All other shareholders voting on Proposal 2(a) are required to indicate via the ISA’s electronic voting system, or, if voting in

person at the Meeting, inform us prior to voting on the matter at the Meeting, whether or not the shareholder has a personal interest

in the proposal; otherwise, any such shareholder’s vote will not be counted for the purposes of such proposal.

Under the Companies Law, a

“personal interest” of a shareholder (including ADS holder) in an act or transaction of a company (i) includes a personal

interest of (a) any relative (i.e., spouse, sibling, parent, grandparent or descendant of the shareholder (including ADS holder), any

descendant, sibling or parent of a spouse of the shareholder (including ADS holder) and the spouse of any of the foregoing); and (b) a

company with respect to which the shareholder (including ADS holder) or any of the foregoing relatives of the shareholder or ADS holder)

owns at least 5% of the outstanding shares or voting rights, serves as a director or chief executive officer or has the right to appoint

one or more directors or the chief executive officer; and (ii) excludes a personal interest arising solely from the ownership of shares.

Under the Companies Law, in the case of a person voting by proxy, “personal interest” includes the personal interest of either

the proxy holder or the shareholder granting the proxy, whether or not the proxy holder has discretion how to vote.

The last date for submitting

a request to include a proposal in accordance with Section 66(b) of the Companies Law and the regulations thereunder, is March 7, 2025.

The full version of the proposed resolutions may be viewed in the proxy statement, which, together with the accompanying voting instruction

form and voting slip (collectively, the “Proxy Materials”), will be furnished to the U.S. Securities and Exchange Commission

under cover of Form 6-K and will be publicly available via its website at http://www.sec.gov. This Notice of Annual General Meeting of

Shareholders and the Proxy Materials will also be submitted to the ISA and TASE and will be available on their respective websites for

listed company reports http://www.tase.co.il/tase/ and http://www.magna.isa.gov.il. The Proxy Materials will also be made available at

the “Investor” portion of our website, which can be found at https://purple-biotech.com/investors, and may also be

viewed at our offices, upon prior coordination and during regular business hours, at 4 Oppenheimer Street, Science Park, Rehovot, Israel

(Tel: +972-3-9333121), until the date of the Meeting. Detailed voting instructions are provided in the proxy statement, the voting instruction

form and the voting slip.

| |

Sincerely, |

| |

|

| |

/s/ Dr. Eric Rowinsky |

| |

Dr. Eric Rowinsky, |

| |

Chairman of the Board of Directors |

February 28, 2025

PROXY STATEMENT

ANNUAL GENERAL MEETING OF SHAREHOLDERS

This Proxy Statement is being

furnished to the holders of ordinary shares, no par value, and to holders of American Depositary Shares (“ADSs”), each

representing ten ordinary shares, issued by the Bank of New York Mellon (“BNY Mellon”), in connection with the solicitation

of proxies on behalf of the Board of Directors of Purple Biotech Ltd. (“we,” “us,” “our,”

“Purple” or the “Company”) to be voted at an Annual General Meeting of Shareholders (the “Meeting”)

and at any adjournment thereof, pursuant to the accompanying Notice of Annual General Meeting of Shareholders. The Meeting will be held

on Tuesday, April 15, 2025, at 4:30 p.m. Israel time at our executive offices at 4 Oppenheimer Street, Science Park, Rehovot, Israel (the

“Company Offices”).

Purpose of the Meeting

At the Meeting, shareholders

will be asked to consider and vote upon the following: (i) the re-election of each of Dr. Eric Rowinsky, Mr. Robert Gagnon and Mr. Ido

Agmon as members of the first class of directors of the Board of Directors, to serve until the Company’s annual general meeting

of shareholders to be held in 2028, and until their respective successors have been duly elected and qualified; (ii) the approval of the

grant of equity-based awards to (a) Mr. Gil Efron, our Chief Executive Officer; and (b) each of our directors who shall serve in such

capacity as of immediately following the Meeting; and (iii) the approval of an increase in the Company’s authorized ordinary share

capital and to amend the Company’s Articles of Association accordingly. In addition, at the Meeting, representatives of our management

will be available to review and discuss our consolidated financial statements for the year ended December 31, 2024.

We are currently not aware

of any other matters that may be raised at the Meeting. If any other matters are properly raised at the Meeting or any adjournment or

postponement thereof, the proxy and voting instruments confer discretionary authority with respect to acting thereon, and the persons

named in the proxy or other voting instrument will vote on such matters in accordance with their best judgment.

Board Recommendation

The Board of Directors

recommends that you vote “FOR” each of the proposals on the agenda.

Record Date; Shareholders and ADS Holders Entitled

to Vote

Shareholders and

holders of our ADSs of record at the close of business in New York on March 6, 2025 (the “Record Date”) are entitled

to receive notice of, and vote at, the Meeting and any adjournments or postponements thereof. You are also entitled to notice of, and

to vote at the Meeting, and any adjournments or postponements thereof if you are a beneficial owner who holds ordinary shares or ADSs

through a broker, bank or other nominee as of the Record Date. All shareholders are cordially invited to attend the Meeting in person.

As of February 23, 2025, 529,447,717 ordinary shares were issued and outstanding (excluding one dormant ordinary share held in treasury).

How to Vote

| |

● |

Holders of ADSs. Holders of ADSs (whether registered in their name or in “street name”) will receive from BNY Mellon (which acts as the Depositary for the ADSs) a voting instruction form in order to instruct their banks, brokers or other nominees on how to vote. Under the terms of the Deposit Agreement between the Company, BNY Mellon and the holders of the Company’s ADSs, BNY Mellon shall endeavor (insofar as is practicable) to vote or cause to be voted the number of ordinary shares represented by ADSs in accordance with the instructions provided by the holders of ADSs to BNY Mellon. For ADSs that are held in “street name” through a bank, broker or other nominee, the voting process will be based on the underlying beneficial holder of the ADSs directing the bank, broker or other nominee to arrange for BNY Mellon to vote the ordinary shares represented by the ADSs in accordance with the beneficial holder’s voting instructions. If no instructions are received by the Depositary from an owner of ADSs with respect to a matter and a number of ADSs of that owner on or before the instruction cutoff date set forth on the BNY Mellon voting instruction form, the Depositary shall deem that owner to have instructed the Depositary to give a discretionary proxy to a person designated by us with respect to that matter and the number of ordinary shares represented by that number of ADSs, and the Depositary shall give a discretionary proxy to the person designated by us to vote that number of ordinary shares as to that matter, except that no instruction of that kind shall be deemed given and no discretionary proxy shall be given with respect to any matter as to which we inform the Depositary (and we agree to provide such information as promptly as practicable in writing, if applicable) that (x) we do not wish a proxy to be given, (y) substantial shareholder opposition exists, or (z) the matter materially and adversely affects the rights of holders of shares. ADS holders should return their BNY Mellon voting instruction form by no later than the date and time set forth on such voting instruction form. |

| |

● |

Holders of Ordinary Shares Traded on TASE. Shareholders who hold ordinary shares through a member of the Tel Aviv Stock Exchange (“TASE”) may vote the Meeting by (i) attending the meeting and voting in person at the Meeting. All such shareholders must present a form of government-issued photograph identification (e.g., passport or certificate of incorporation (as the case may be))) and an ownership certificate (as of the Record Date) from the applicable TASE member, as required by the Israeli Companies Regulations (Proof of Ownership of Shares for Voting at General Meeting) of 2000, as amended (an “Ownership Certificate”); (ii) by voting slip, by sending the duly executed voting slip together with an Ownership Certificate to the Company Offices no later than four hours prior to the designated time of the Meeting, namely by no later than Tuesday, April 15, 2025, 12:30 p.m. Israel time. A shareholder whose shares are registered with a TASE member is entitled to receive from the TASE member that holds the shares on the shareholder’s behalf by e-mail (for no charge) a link to the text of the voting slip posted on the website of the Israel Securities Authority (the “ISA”), unless the shareholder notified such TASE member that he or she or it is not interested in receiving such link, provided that such notification was provided by the shareholder with respect to a particular securities account prior to the Record Date; (iii) by voting electronically via the electronic voting system of the ISA. You should receive instructions about electronic voting from the TASE member through which you hold your shares. Voting via the ISA electronic voting system will be permitted until four hours prior to the Meeting commencement, namely by no later than Tuesday, April 15, 2025, 12:30 p.m. Israel time; and (iv) by proxy, by sending the duly executed proxy together with an Ownership Certificate to the Company Offices no later than 72 hours prior to the time scheduled for the Meeting. However, the Meeting chairman is entitled to waive this requirement with respect to all participants at the Meeting, and to accept all proxies (and accompanying Ownership Certificates) at the commencement of the Meeting, subject to the presentation of proof of share ownership. The proxy must be signed by the appointing party or its authorized attorney, and if the appointing party is a corporation, by authorized corporate signatories together with the Company stamp or by an authorized attorney. A proxy dated more than 12 months from the date of the signature shall be considered invalid. |

Change or Revocation of Vote

Holders of ADSs:

A holder of ADS who has executed and returned a voting instruction form may revoke its voting instructions at any time before the applicable

deadline by filing with BNY Mellon (in the case of holders of ADSs) a written notice of revocation or a duly executed voting instruction

form bearing a later date. If your ADSs are held in “street name,” you may change your vote by submitting new voting instructions

to your broker, bank, trustee, or nominee or, if you have obtained a legal proxy from your broker, bank, trustee or nominee giving you

the right to vote your shares, by attending the Meeting and voting in person.

Holder of Ordinary Shares:

If you are a beneficial owner of ordinary shares registered in the name of a member of the TASE, you may change your vote (i) by attending

the Meeting and voting in person, by presenting a valid Ownership Certificate (as of the Record Date); (ii) by delivering a later-dated

duly executed voting slip, together with a valid Ownership Certificate (as of the Record Date), to the Company Offices no later than four

hours prior to the designated time of the Meeting, (iii) by following the relevant instructions for changing your vote via the ISA electronic

voting system by no later than four hours before the time set for the Meeting; or (iv) by delivering a later-dated duly executed proxy,

together with a valid Ownership Certificate (as of the Record Date), to the Company Offices no later than 72 hour prior to the designated

time of the Meeting.

Quorum

The quorum required for the

Meeting consists of at least two shareholders who are present at the Meeting, in person, by proxy, voting instruction form or voting slip,

or voting via the ISA electronic system, or otherwise represented at the Meeting by their authorized persons (“Valid Meeting

Participants”), and who hold in the aggregate twenty-five percent (25%) or more of the voting rights of the Company. In the

event that there is no quorum present thirty minutes after the scheduled time, the Meeting will be adjourned for one week, to the same

time and place, i.e., to Tuesday, April 22, 2025, at 4:30 p.m. (Israel time) at the Company Offices (each such adjourned meeting is referred

to as an “Adjourned Meeting”). If there is no quorum present thirty minutes after the time set for the Adjourned Meeting,

any two shareholders present as Valid Meeting Participants will then constitute a legal quorum at the Adjourned Meeting. This notice will

serve as notice of an Adjourned Meeting if no quorum is present at the original date and time, and no further notice of the Adjourned

Meeting will be given to shareholders.

Abstentions and “broker

non-votes”, as well as any abstentions by ADS holders with respect to our ordinary shares held by BNY Mellon, are counted as present

and entitled to vote for purposes of determining a legal quorum.

Vote Required for Approval of the Proposals

The affirmative vote of the

holders of a majority of the Company’s ordinary shares, including those represented by ADSs, participating and voting on the matter

at the Meeting as Valid Meeting Participants (excluding abstentions), is required to approve each of the proposals.

In addition, the approval

of Proposal 2(a) is also subject to the fulfillment of one of the following additional voting requirements (the “Special Majority”):

(i) at least a majority of the shares (including those represented by ADSs) held by shareholders (including ADS holders) who are non-controlling

shareholders and shareholders (including ADS holders) who do not have a personal interest in the matter voted in favor of the proposal

(excluding abstentions); or (ii) the total number of shares (including those represented by ADSs) voted against the proposal by shareholders

and ADS holders (as applicable) referred to in clause (i), does not exceed two-percent (2%) of the outstanding voting power in the Company.

We are not aware of any shareholder

or holder of ADSs that would be deemed to be a controlling shareholder of our Company as of the current time for purposes of Proposal

2(a). The Israeli Companies Law, 1999 (the “Companies Law”) requires that each shareholder and ADS holder voting on Proposal

2(a) inform the Company, prior to voting on the proposal at the Meeting, if the shareholder or ADS holder has a personal interest in the

proposal; otherwise, a shareholder of ADS holder’s vote will not be counted for the purposes of the proposal. In accordance with

regulations promulgated under the Companies Law, a shareholder who votes via voting slip or proxy, and an ADS holder who signs and returns

a voting instruction form, will be deemed to have confirmed that such shareholder or ADS holder (as applicable), and any related party

thereof, does not have a personal interest in Proposal 2(a), unless such shareholder or ADS holder has delivered a written notice to the

Company notifying of the existence of a personal interest no later than 10:00 a.m. (Israel time) on Tuesday, April 15, 2025. Any such

written notice must be sent to the Company via registered mail at the Company’s Offices; Attention: Gil Efron, Chief Executive Officer.

All other shareholders voting on Proposal 2(a) are required to indicate via the ISA’s electronic voting system, or, if voting

in person at the Meeting, inform us prior to voting on the matter at the Meeting, whether or not the shareholder has a personal interest

in the proposal; otherwise, any such shareholder’s vote will not be counted for the purposes of such proposal.

Under the Companies Law, a

“personal interest” of a shareholder (including ADS holder) in an act or transaction of a company (i) includes a personal

interest of (a) any relative (i.e., spouse, sibling, parent, grandparent or descendant of the shareholder (including ADS holder), any

descendant, sibling or parent of a spouse of the shareholder (including ADS holder) and the spouse of any of the foregoing); and (b) a

company with respect to which the shareholder (including ADS holder) or any of the foregoing relatives of the shareholder or ADS holder)

owns at least 5% of the outstanding shares or voting rights, serves as a director or chief executive officer or has the right to appoint

one or more directors or the chief executive officer; and (ii) excludes a personal interest arising solely from the ownership of shares.

Under the Companies Law, in the case of a person voting by proxy, “personal interest” includes the personal interest of either

the proxy holder or the shareholder granting the proxy, whether or not the proxy holder has discretion how to vote.

Solicitation of Proxies

We may bear the reasonable

and actual cost of solicitation of proxies, including preparation, assembly, printing, and mailing of the BNY Mellon voting instruction

form and any additional information furnished to holders of ordinary shares or ADSs. The Notice of Annual General Meeting of the Shareholders,

the Proxy Statement, and the voting slip will not be mailed to beneficial ordinary shareholders in Israel. We may reimburse brokerage

firms and other persons representing beneficial owners of ordinary shares or ADSs only for reasonable expenses incurred by them in forwarding

proxy soliciting materials to such beneficial owners. In addition to solicitation by mail, certain of our directors, officers and employees,

without additional remuneration, may solicit proxies by telephone, facsimile, email or personal contact.

Reporting Requirements

We are subject to the information

reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), applicable to foreign

private issuers. We fulfill these requirements by filing reports with the U.S. Securities and Exchange Commission (the “Commission”).

Our filings with the Commission are available to the public on the Commission’s website at www.sec.gov. We submit copies of our

filings with the Commission to the ISA and the TASE, and such filings can be reviewed on their respective websites for listed company

reports at www.magna.isa.gov.il and www.maya.tase.co.il.

As a foreign private issuer,

we are exempt from the rules under the Exchange Act related to the furnishing and content of proxy statements. The circulation of this

proxy statement and related notice should not be taken as an admission that we are subject to those proxy rules. Furthermore, our officers,

directors and principal shareholders are exempt from the reporting and “short swing” profit recovery provisions contained

in Section 16 of the Exchange Act and the rules thereunder, with respect to their purchases and sales of securities. Additionally, we

are not required to file periodic reports and financial statements with the Commission under the Exchange Act as frequently or as promptly

as United States companies whose securities are registered under the Exchange Act.

Compensation of Executive Officers

Information regarding the

compensation incurred by us in relation to our five most highly compensated office holders (within the meaning of the Companies Law) for

the year ended December 31, 2024, will be available under “Item 6. Directors, Senior Management and Employees — Compensation

— Executive Compensation” of our annual report on Form 20-F for the year ended December 31, 2024, upon its filing with the

Commission.

Security Ownership of Certain Beneficial Owners

and Management

As of February 23, 2025, (i)

no officer or director individually beneficially owned 1% or more of our outstanding ordinary shares, other than Mr. Gil Efron, our Chief

Executive Officer, who beneficially owned 7,003,823 of our ordinary shares, representing 1.31% of our ordinary shares as of such date.

The number of shares beneficially owned by Mr. Efron includes 5,391,123 ordinary shares issuable under outstanding options held by Mr.

Efron currently exercisable or which will be exercisable within 60 days of February 23, 2025; and (ii) all of our current officers and

directors as a group (9 persons) beneficially owned 19,219,041, or 3.55%, of our outstanding ordinary shares. Such number of ordinary

shares includes 12,691,481 ordinary shares issuable under outstanding options and restricted stock units (“RSUs”) which

will be exercisable or shall vest (as applicable) within 60 days of February 23, 2025.

The following table sets forth

information with respect to the beneficial ownership of our ordinary shares by each person or entity known to us to beneficially own 5%

or more of our outstanding ordinary shares as of February 23, 2025.

The beneficial ownership of

our ordinary shares is determined in accordance with the rules of the Commission. Under these rules, a person is deemed to be a beneficial

owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of the security,

or investment power, which includes the power to dispose of or to direct the disposition of the security. For purposes of the table below,

we deem ordinary shares issuable pursuant to options or warrants that are currently exercisable or exercisable within 60 days of February

23, 2025 and ordinary shares underlying RSUs that vest within 60 days of February 23, 2025, if any, to be outstanding and to be beneficially

owned by the person holding the options, warrants or RSUs for the purposes of computing the percentage ownership of that person, but we

do not treat them as outstanding for the purpose of computing the percentage ownership of any other person. The calculation of beneficial

ownership is based on 529,447,717 ordinary shares (not including 1 share held in treasury) outstanding as of February 23, 2025. Each one

(1) ADS held represents two hundred (200) ordinary shares. The information in the table below with respect to the beneficial ownership

of shareholders is based on the public filings of such shareholders with the Commission through February 23, 2025.

| Name | |

Share

Number | | |

Percentage | |

| Armistice Capital, LLC (1) | |

| 44,600,000 | | |

| 8.42 | % |

| | |

| | | |

| | |

| (1) |

Based solely on, and qualified in its entirety with reference to, a Schedule 13G/A filed by Armistice Capital, LLC (“Armistice Capital”) with the SEC on November 14, 2024. According to the Schedule 13G/A, Armistice Capital is the investment manager of Armistice Capital Master Fund Ltd. (the “Master Fund”), the direct holder of the 223,000 ADS (equivalent to 44,600,000 ordinary shares), and pursuant to an investment management agreement, Armistice Capital exercises voting and investment power over the ordinary shares held by the Master Fund and thus, may be deemed to beneficially own the ordinary shares held by the Master Fund. Mr. Boyd, as the managing member of Armistice Capital, may be deemed to beneficially own the ordinary shares held by the Master Fund. The Master Fund disclaims beneficial ownership of the ordinary shares directly held by it by virtue of its inability to vote or dispose of such securities as a result of its investment management agreement with Armistice Capital. In addition, Armistice Capital holds warrants to purchase 497,938 additional ADSs (equivalent to 99,587,600 ordinary shares) that include a 4.99% beneficial ownership limitation. |

PROPOSAL

1

RE-ELECTION

OF DIRECTORs TO SERVE AS First CLASS DIRECTORS

Background

Under our Articles of Association,

the number of directors on our Board of Directors will be no less than four and no more than nine and our directors are divided into three

classes with staggered three-year terms. Each class consists, as nearly equal in number as practicable, of one-third of the total number

of directors constituting the entire Board of Directors. The term of one class of directors expires at each annual general meeting of

shareholders, at which the election (or re-election) of directors of the class whose term expired at such annual general meeting shall

be for a term that expires on the date of the third annual general meeting following such election (or re-election) and until his or her

respective successor has been elected and qualified, unless the tenure of such director expires earlier pursuant to the Companies Law

or unless removed from office. Under our Articles of Association, the majority of the members of our Board of Directors shall be residents

of Israel, unless our center of management is transferred to another country in accordance with a resolution of our Board of Directors

by a majority including at least 75% of the participating director votes.

Our Board of Directors is

currently comprised of seven directors and is divided into three classes with staggered three-year terms, as follows:

| Name |

|

Age |

|

Position |

| First Class of Directors Serving until 2025 Annual General Meeting |

| Eric Rowinsky, M.D.(1) |

|

69 |

|

Independent Director and Chairman of the Board of Directors |

| Ido Agmon(2)(3) |

|

48 |

|

Independent Director |

| Robert Gagnon (2)(4) |

|

51 |

|

Independent Director |

| |

|

|

|

|

| Second Class of Directors Serving until 2026 Annual General Meeting |

| Simcha Rock (2)(3) |

|

76 |

|

Independent Director |

| Yael Margolin |

|

72 |

|

Independent Director |

| |

|

|

|

|

| Third Class of Directors Serving until 2027 Annual General Meeting |

| Isaac Israel(1)(4) |

|

47 |

|

Director |

| Suzana Nahum-Zilberberg(1)(3) |

|

54 |

|

Independent Director |

| (1) |

Member of our nominations committee |

| (2) |

Member of our audit committee |

| (3) |

Member of our compensation committee |

| (4) |

Member of our pricing committee for the Company’s “at the market” facility |

We rely on the exemption available

to foreign private issuers under the Nasdaq Listing Rules and follow Israeli law and practice with regard to the process of nominating

directors, in accordance with which our Board of Directors (or a committee thereof) is authorized to recommend to our shareholders director

nominees for election. Our Board of Directors has established a Nominations Committee, which is not required to be comprised only of independent

directors, whose role is to (among other things) identify and recommend to the Board of Directors for selection, director nominees for

election by the shareholders, while considering the appropriate size and composition of the Board of Directors, the requirements applicable

to all members of the Board of Directors, the diversity of our directors, and the criteria for the selection of new members of the Board

of Directors.

At the Meeting, the term of

the members of our first class of directors, Eric Rowinsky, Robert Gagnon and Ido Agmon expire. Our Nominations Committee recommended,

and our Board of Directors approved, that each of Eric Rowinsky, Robert Gagnon and Ido Agmon be nominated for re-election at the Meeting

as a first class director to serve until the Company’s 2028 annual general meeting of shareholders, and until his successor has

been duly elected and qualified or until his office is vacated in accordance with our Articles of Association and the Companies Law. Subject

to shareholder approval of the re-election of the above director nominees, our Board of Directors will consist of seven members, six of

whom satisfy the independence requirements of the Nasdaq Listing Rules.

Suitability of Director Nominees

Our Nominating Committee and

Board of Directors have reviewed the qualifications and suitability of the director nominees and our Board of Directors as a whole. We

believe that our Board of Directors contains highly qualified and talented directors, including directors with global pharmaceutical and

financial experience. In accordance with the Companies Law, each of the director nominees has certified to us that he meets all the requirements

of the Companies Law for election as a director of a public company and that he possesses the necessary qualifications and is able to

dedicate sufficient time to fulfill his duties as a director of our Company, taking into consideration our Company’s size and special

needs. Accordingly, upon the recommendation of our Nominating Committee, our Board of Directors has nominated each of Eric Rowinsky, Robert

Gagnon and Ido Agmon for re-election as a first class director, to hold office until our 2028 annual general meeting of shareholders,

and until their respective successors have been duly elected and qualified, or until their respective office is vacated in accordance

with our Articles of Association and the Companies Law.

We are not aware of any reason

why any of the nominees, if elected, would be unable or unwilling to serve as director. Should any of the nominees be unavailable for

election, the proxies will be voted for substitute nominee(s) designated by our Board of Directors.

If elected at the Meeting,

Robert Gagnon and Ido Agmon will be entitled to the same cash compensation that we have paid to each of our non-executive directors since

our extraordinary general meeting in July 2017, of an annual fee in the amount of US$40,000 for service on our Board of Directors, an

additional US$3,500 annual fee for service on each permanent committee of the Board of Directors, and an additional US$7,000 annual fee

for service on the Board of Directors of a subsidiary (if applicable), provided, however, that the maximum annual fee for services on

our Board of Directors, its committees and/or on the Board of Directors of any subsidiaries, shall not exceed US$47,000. Dr. Rowinsky,

the chairman of our Board of Directors, is entitled to an annual fee of US$60,000 for services as a member of our Board of Directors,

as Chairman of the Board of Directors, for service on any permanent committee of the Board of Directors, and for service on the board

of directors of a subsidiary. In addition, we pay Dr. Rowinsky a monthly fee for his service as the chairman of our medical and clinical

committee in the amount of US$5,000 for the period commencing on April 1, 2023, and for such additional period at the discretion of the

Board (as approved by our shareholders at our annual general meeting held in June 2023). Since August 2024, the members of the Board of

Directors agreed to voluntarily and irrevocably waive, until further notice, an amount equal to 20% of their respective director service

fees for participation as members of the Board of Directors, each permanent committee of the Board of Directors, and on the board of directors

of a Subsidiary (if applicable). Such annual fees shall be paid pro-rata for service during any part of the year. The above dollar denominated

fees, and all other dollar denominated payments that we pay our directors based in Israel, are paid in NIS based on the NIS/US$ exchange

rate at the beginning of the month in which such amounts are paid, but not lower than the exchange rate in effect on January 1, 2017.

Such director fees are consistent with our current compensation policy for executive officers and directors, as approved by our shareholders

on June 15, 2023 (the “Compensation Policy”). If re-elected as directors at the Meeting, the approval of the re-election

of the director nominees will be deemed to be an approval of the foregoing cash compensation. We may also subsidize ongoing corporate

governance or other professional training for directors in amounts up to US$5,000 per director per annum, and we reimburse directors for

any direct expenses incurred during the performance of their duties (such as travel expenses). If elected at the Meeting, the director

nominees will continue to benefit from our directors’ and officers’ liability insurance policy, as in effect from time to

time, and the indemnification and exemption letter agreements that we previously entered into with each of them. In addition, at the Meeting,

shareholders are being asked to approve the grant of equity-based awards to each of our directors who shall serve in such capacity as

of immediately following the Meeting, including the director nominees if elected at the Meeting (see Proposal 2).

Nominees for Director

Biographical information concerning

the nominees for election as first class directors at the Meeting is set forth below.

Eric Rowinsky, M.D.,

has served as the Chairman of Purple Biotech’s Board since October 2019. Dr. Eric Rowinsky’s principal expertise is in the

development and registration of novel therapeutics to treat cancer and related disorders. Dr. Rowinsky currently serves as consulting

chief medical officer and/or advisor for drug development and registrational strategies to several biopharma companies worldwide. From

July 2021 to March 2023, Dr. Rowinsky served as the Chief Medical Officer of Hummingbird Biotherapeutics, a life-science company. From

2015 to 2021, Dr. Rowinsky served as Executive Chairman of the Board of Directors and President of Inspira, Inc. (formerly Rgenix, Inc)

and is currently serving as its President, Chairman of the Scientific Advisory Board, and Director. Dr. Rowinsky also served as the Chief

Scientific Officer of Clearpath Development Inc., from 2015-2021, and has served or serves as a scientific advisor, consultant, or consulting

Chief Medical Officer of a wide variety of biotech companies providing expertise in developing and registering a wide range of novel cancer

therapeutics. Dr. Rowinsky served as Executive Vice President, Chief Medical Officer and Head of Research and Development of Stemline

Therapeutics, Inc., a clinical-stage biopharmaceutical company, from November 2011 until October 2015. Prior to joining Stemline, Dr.

Rowinsky was co-founder and Chief Executive Officer of Primrose Therapeutics, Inc., a start-up biotechnology company, from June 2010 until

its acquisition in September 2011. Dr. Rowinsky also served as a drug development and regulatory strategy consultant to the ImClone-Lilly

Oncology Business Unit and several other biopharmaceutical and life sciences companies from 2010 to 2011. From 2005 to 2009, Dr. Rowinsky

was Executive Vice President and Chief Medical Officer of ImClone Systems Inc., where he led the FDA approval of Erbitux for head and

neck and colorectal cancers and advanced eight other monoclonal antibodies through clinical development. From 1996 to 2004, Dr. Rowinsky

held several positions at the Cancer Therapy and Research Center, including Director of the Institute of Drug Development, or IDD, and

the SBC Endowed Chair for Early Drug Development at the IDD. From 1996 to 2006, Dr. Rowinsky was a Clinical Professor of Medicine at the

University of Texas Health Science Center at San Antonio. From 1988 to 1996, Dr. Rowinsky was an Associate Professor of Oncology at The

Johns Hopkins University School of Medicine. Dr. Rowinsky was a longstanding National Cancer Institute principal and co-principal investigator

from 1990 to 2004, and was integrally involved in pivotal clinical and preclinical investigations that led to the development of numerous

cancer therapeutics, including paclitaxel, docetaxel, topotecan, irinotecan, erlotinib, gefitinib, ramucirumab, tagraxofusp and temsirolimus

among others. Dr. Rowinsky was also an Adjunct Professor of Medicine at New York University School of Medicine (2008-2018). Dr. Rowinsky

presently serves on the boards of directors of the public companies Biogen Idec, Inc. and Verastem Inc. Dr. Rowinsky formerly served on

the boards of directors of the public companies Fortress Biotech Inc., (2010-2024), Navidea Biopharmaceuticals Inc. (2010-2018), BIND

Therapeutics (2014-2016), and Biophytis S.A. (2018-2019), as well as at a number of privately held companies. Dr. Rowinsky received a

B.A. degree from New York University (1977) and an M.D. degree from Vanderbilt University School of Medicine (1981). Dr. Rowinsky completed

his residency in internal medicine at the University of California, San Diego (1984) and completed his fellowship in medical oncology

at The Johns Hopkins Oncology Center (1987).

Robert Gagnon, MBA,

has served as a member of Purple Biotech’s Board since March 2021. Mr. Gagnon currently serves as Chief Financial Officer of Remix

Therapeutics. Prior to that, Mr. Gagnon was Operating Partner of Gurnet Point Capital, a healthcare venture capital and private equity

fund. Prior to joining Gurnet Point Capital in 2022, Mr. Gagnon was Chief Financial Officer of Verastem Oncology. Before joining Verastem

in 2018, Mr. Gagnon served as the Chief Financial Officer at Harvard Bioscience, Inc. Prior to that, Mr. Gagnon served as Executive Vice

President, Chief Financial Officer and Treasurer at Clean Harbors, Inc., as well as Chief Accounting Officer and Controller at Biogen

Idec, Inc. Earlier in his career, Mr. Gagnon worked in a variety of senior positions at Deloitte & Touche, LLP and PricewaterhouseCoopers,

LLP. Mr. Gagnon holds an M.B.A. degree from the MIT Sloan School of Management and a B.A. degree in accounting from Bentley College.

Ido Agmon, MBA, has

served as a member of Purple Biotech’s Board since June 2016. Since 2012, Mr. Agmon has been acting as an independent consultant

and investment manager, providing start-ups, investment funds and technology-based ventures with advice in strategic and financial planning,

fund-raising and related business development activities. From 2014 until the end of 2016, Mr. Agmon was a manager of Aviv New-Tech (formerly

Aviv Bio-Invest), a private investment fund which manages a portfolio of public Israeli and global biomed and technology companies, of

which he was a co-founder, and where he was responsible for analysis and evaluation of investments in Israeli and global biomed companies.

From 2009 until 2011, Mr. Agmon served as the chief executive officer of Meytav Technology Incubator, an Israeli-based accelerator for

biotech, pharma and medtech ventures with over 20 portfolio companies. Mr. Agmon has served as a board member at several biomed ventures.

From 2007 until 2009, Mr. Agmon served as the Director of Business Development at ATI incubator, a technology incubator specializing in

biomed and cleantech projects, responsible for deal-flow and project evaluation. Mr. Agmon holds a B.A. degree in Business Administration

and Life Sciences from Tel Aviv University, Tel Aviv, Israel, and an MBA degree from the Hebrew University of Jerusalem, Israel.

Approval Required

See “Vote Required

for Approval of the Proposals” above. Each director nominee shall be voted on separately.

Board Recommendation

Our Board of Directors

recommends a vote “FOR” the re-election of each director nominee named above as a first class director, to serve until the

Company’s 2028 annual general meeting of shareholders, on the terms described in Proposal 1.

PROPOSAL

2

APPROVAL OF THE GRANT OF EQUITY-BASED

AWARDS TO Our Chief executive officer and OUR DIRECTORS

Background

Under the Companies Law, the

payment of compensation, including equity-based compensation, to a chief executive officer or director that is consistent with a company’s

compensation policy must be approved by the compensation committee, board of directors and shareholders, in the case of a chief executive

officer, by the Special Majority (for definition, see “Vote Required for Approval of the Proposals” above), and in the case

of a director, by an ordinary majority.

Our Compensation Committee

and Board of Directors conducted a review of the equity-based compensation of our directors, executives and employees. Based on such review,

our Compensation Committee and Board of Directors approved, subject to shareholder approval, the grant to our Chief Executive Officer

and to each of our currently serving directors of the following equity-based awards: (i) to Mr. Gil Efron, our Chief Executive Officer,

options to purchase up to 3,500,000 ordinary shares (equivalent to 17,500 ADSs) and 3,500,000 RSUs (equivalent to 17,500 ADSs); (ii) to

Dr. Eric Rowinsky, the Chairman of our Board of Directors, options to purchase up to 1,750,000 ordinary shares (equivalent to 8,750 ADSs)

and 1,750,000 RSUs (equivalent to 8,750 ADSs); and (iii) to each of our other directors who shall serve in such capacity immediately following

the Meeting, options to purchase up to 875,000 ordinary shares (equivalent to 4,375ADSs) and 875,000 RSUs (equivalent to 4,375ADSs), in

each case on the terms described below, provided that non-Israeli resident directors (namely, Dr. Rowinsky and Mr. Gagnon, if re-elected

at the Meeting), may elect, at their sole discretion, to receive all of the equity award in the form of stock options.

Each of the proposed option

awards will have an exercise price of US$0.017, which is equal to the quotient of the average closing price of our ADSs on the Nasdaq

Capital Market during the 30 days prior to the date of the approval of the grant of the equity awards by our Board of Directors (i.e.,

$3.40), divided by two hundred (200). Each of the proposed equity awards will vest over a period of three years, with one-third of each

of the awards vesting on the first anniversary of the date of the approval of the awards by our Board of Directors on February 11, 2025,

and an additional 8.33% of each of the awards vesting at the end of each subsequent three-month period thereafter, subject to such individual’s

continued engagement by the Company on each applicable vesting date. Any outstanding unexercised options shall expire five years following

the date of the approval of the awards by our Board of Directors. The vesting of any of outstanding equity awards shall accelerate in

full upon a “Merger/Sale,” as defined in the Company’s 2016 Equity-Based Incentive Plan (the “2016 Plan”).

The equity awards, if approved at the Meeting, will be granted under and shall be subject to the 2016 Plan and the applicable award agreements

to be entered into with each of them. The equity awards to Israeli resident directors (namely, Isaac Israel, Ido Agmon (if re-elected

at the Meeting), Simcha Rock, Suzana Nahum-Zilberberg, and Yael Margolin), if approved at the Meeting, will be granted pursuant to the

capital gains track of Section 102 of the Israel Income Tax Ordinance [New Version] 5721-1961. The estimated fair market value of the

equity award proposed to be granted to (i) Mr. Efron is approximately US$94,000, (ii) Dr. Rowinsky is approximately US$47,000, and (iii)

each of the other directors is approximately US$23,000, in each case estimated using the average closing price of our ADSs on the Nasdaq

Capital Market during the 30 days prior to February 11, 2025, and calculated using the Black & Scholes valuation method.

Each of our Compensation Committee

and Board of Directors determined that the grant of the equity awards and their terms are in accordance with our Compensation Policy.

In conducting their review,

the Compensation Committee and Board of Directors considered our compensation philosophies and the provisions of our Compensation Policy,

as well as internal consistency and market trends. Our compensation philosophy encourages the grant of equity-based compensation to our

directors and executive officers in order to further align their compensation with the long-term interests of our shareholders.

Proposed Resolutions

It is proposed that the following

resolutions be adopted at the Meeting:

2(a). “RESOLVED, to approve the

grant of equity-based awards to Gil Efron, the Chief Executive Officer of the Company, in such amounts and with such terms and conditions

as described in Proposal 2 of the Proxy Statement for the Meeting.”

2(b). “RESOLVED, to approve the

grant of equity-based awards to each of the members of our Board of Directors who shall serve in such capacity as of immediately following

the Meeting, in such amounts and with such terms and conditions as described in Proposal 2 of the Proxy Statement for the Meeting.”

Approvals Required

See “Vote Required for

Approval of the Proposals” above.

Board Recommendation

Our Board of Directors

recommends a vote “FOR” the approval of the grant of equity-based awards to our Chief Executive Officer and each of our directors

who shall serve in such capacity as of immediately following the Meeting, as described in Proposal 2.

PROPOSAL

3

APPROVAL OF AN INCREASE IN THE COMPANY’S

AUTHORIZED ORDINARY SHARE CAPITAL

AND TO AMEND THE ARTICLES OF ASSOCIATION ACCORDINGLY

Background

The Company’s authorized

share capital is currently 1,000,000,000 ordinary shares, with no par value, and 50,000,000 non-voting senior preferred shares, with no

par value, divided into five classes of 10,000,000 preferred shares in each class. As of February 23, 2025, 529,447,717 ordinary shares

(or 2,647,238 ADSs representing ordinary shares) were issued and outstanding. In addition, as of such date, an additional 27,255,200 ordinary

shares (equivalent to 136,276 ADSs) were reserved for issuance under the 2016 Plan (including shares underlying outstanding options and

RSUs) and 146,257,800 ordinary shares (equivalent to 731,289 ADSs) were reserved for issuance upon exercise of outstanding warrants. Consequently,

as of such date, 297,039,283 ordinary shares (equivalent to 1,485,196 ADSs) remain unissued and unreserved and available for future issuances.

No preferred shares are issued or reserved for issuance as of such date.

Under the Companies Law, a

company may not issue shares in excess of its authorized share capital. The Company wishes to have sufficient authorized ordinary share

capital available for corporate purposes and to meet its future business needs as they arise including (without limitation) potential

public and private offerings of the Company’s ordinary shares or ADSs in the ordinary course to fund operations, additional grants

of equity-based compensation under the 2016 Plan or any other equity-based incentive plan that may be adopted by the Company in the future,

and for potential future strategic transactions (such as licensing agreements, acquisitions of other companies or assets or other transactions

that may involve issuances of ordinary shares or ADSs).

Accordingly, we are seeking

the approval of the shareholders to increase the Company’s authorized ordinary share capital from 1,000,000,000 ordinary shares,

with no par value, to 100,000,000,000 ordinary shares, with no par value, and to amend Article 11 of our Articles of Association accordingly.

In addition, our authorized share capital includes 50,000,000 non-voting senior preferred shares, with no par value, divided into five

classes of 10,000,000 preferred shares in each class, which will remain unchanged.

Proposal

It is therefore proposed that

the following resolution be adopted at the Meeting:

“RESOLVED, to approve an

increase of the Company’s authorized ordinary share capital from 1,000,000,000 ordinary shares, with no par value, to 100,000,000,000

ordinary shares, with no par value, and to amend Article 11 of the Company’s Articles of Association accordingly.

Approval Required

See “Vote Required for

Approval of the Proposals” above.

Board Recommendation

Our Board of Directors

recommends a vote “FOR” approval of the increase in the Company’s authorized ordinary share capital and to amend our

Articles of Association accordingly.

REVIEW AND DISCUSSION OF FINANCIAL STATEMENTS

In addition to considering

the foregoing agenda item at the Meeting, we will also present for review and discussion at the Meeting, our consolidated audited financial

statements for the year ended December 31, 2024. This item will not involve a shareholder vote.

Our audited consolidated financial

statements for the year ended December 31, 2024, which form part of our annual report on Form 20-F for the year ended December 31, 2024,

will be filed with the Commission and will be available for viewing via the Commission’s website at www.sec.gov as well as under

the Investors section of our website at https://purple-biotech.com. None of the audited consolidated financial statements, the Form 20-F

nor the contents of our website form part of the proxy solicitation material.

OTHER MATTERS

The Board of Directors is

not aware of any other matters to be presented at the Meeting other than those specifically set forth in this Proxy Statement. If any

other matters properly come before the Meeting, it is the intention of the persons named in the accompanying proxy to vote such proxy

in accordance with the judgment and recommendation of the Board of Directors.

| |

By Order of the Board of Directors, |

| |

|

| |

/s/ Dr. Eric Rowinsky |

| |

Dr. Eric Rowinsky, |

| |

Chairman of the Board of Directors |

February 28, 2025

VOTING

SLIP FOR ANNUAL GENERAL MEETING OF SHAREHOLDERS

Company

name: Purple Biotech Ltd., company no. 520031238

Company

address (for submission and delivery of Voting Slips): 4 Oppenheimer Street, Science Park, Rehovot 6701101, Israel, Attn.: Gil Efron,

Chief Executive Officer

Meeting

date: Tuesday, April 15, 2025, at 4:30 p.m. (Israel time).

Meeting

type: Annual General Meeting (the “Meeting").

Record

Date: Thursday, March 6, 2025

Shareholder

details:

| Israeli

identification number: |

|

For

shareholders who do not have an Israeli identification card:

For

shareholders that are corporations:

| Country

of incorporation: |

|

Is

the shareholder a “Principal Shareholder1", “Senior Officer of the Company2” or an “Institutional

Investor3"? Yes/No (circle as appropriate)

| |

1 |

As

defined in Section 1 of the Israel Securities Law, 5728-1968 (the “Securities Law"). |

| |

2 |

As

defined in Section 37(d) of the Securities Law. |

| |

3 |

As

defined in Regulation 1 of the Supervision of Financial Services Regulations (Provident Funds) (Participation of a Management Company

at a General Meeting), 5769-2009 as well as a Manager of Mutual Funds as per the meaning in the Mutual Funds Law, 5754-1999. |

MANNER

OF VOTING

(Check

or mark “X” clearly in each column in accordance with your voting decision.)

| |

Matter |

Manner

of Voting |

| For |

Against |

Abstain |

| 1(a). |

To

approve the re-election of Eric Rowinsky to serve as a first class director, until the annual general meeting to be held in 2028,

and until his successor is duly elected and qualified. |

|

|

|

| 1(b). |

To

approve the re-election of Robert Gagnon to serve as a first class director, until the annual general meeting to be held in 2028,

and until his successor is duly elected and qualified. |

|

|

|

| 1(c) |

To

approve the re-election of Ido Agmon to serve as a first class director, until the annual general meeting to be held in 2028, and

until his successor is duly elected and qualified. |

|

|

|

| 2(a) |

To

approve the grant of equity-based awards to Gil Efron, the Chief Executive Officer of the Company, in such amounts and with such

terms and conditions as described in Proposal 2 of the Proxy Statement for the Meeting. |

|

|

|

| 2(b) |

To

approve the grant of equity-based awards to each of the members of the Board of Directors who shall serve in such capacity as of

immediately following the Meeting, in such amounts and with such terms and conditions as described in Proposal 2 of the Proxy Statement

for the Meeting. |

|

|

|

| 3 |

To

approve an increase of the Company’s authorized ordinary share capital from 1,000,000,000 ordinary shares, with no par value,

to 100,000,000,000 ordinary shares, with no par value, and to amend Article 11 of the Company’s Articles of Association accordingly. |

|

|

|

For

shareholders holding shares through a member of the Tel Aviv Stock Exchange, this Voting Slip is only valid when accompanied by a certification

of ownership, in accordance with the Israeli Companies Regulations (Proof of Ownership of Shares for Voting at General Meeting) of 2000.

For shareholders registered in the Company’s shareholder registry, this Voting Slip will only be valid when accompanied by a photocopy

of a government-issued photograph identification (e.g., passport, identification card or certificate of incorporation (as the case may

be)).

Each

shareholder voting on Proposal 2(a) who votes via voting slip, will be deemed to have confirmed that such shareholder, and any related

party thereof, does not have a personal interest in Proposal 2(a), unless such shareholder or ADS holder has delivered a written notice

to the Company notifying of the existence of a personal interest no later than 10:00 a.m. (Israel time) on Tuesday, April 15, 2025. Any

such written notice must be sent to the Company via registered mail at the Company’s offices; Attention: Gil Efron, Chief Executive

Officer.

16

Exhibit 99.2

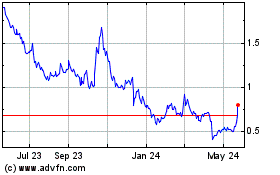

Purple Biotech (NASDAQ:PPBT)

Historical Stock Chart

From Feb 2025 to Mar 2025

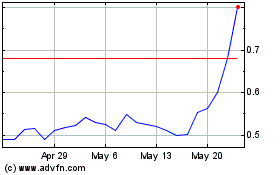

Purple Biotech (NASDAQ:PPBT)

Historical Stock Chart

From Mar 2024 to Mar 2025