First Trust Advisors L.P. (“FTA”) announces the declaration of

distributions for 85 of 94 exchange-traded funds advised by

FTA.

The following dates apply to today’s distribution

declarations:

Expected Ex-Dividend Date: June 24,

2015 Record Date: June 26, 2015 Payable Date: June 30, 2015

Ticker

Exchange

Fund Name

Frequency

Ordinary

Income

Per Share

Amount

ACTIVELY MANAGED EXCHANGE-TRADED

FUNDS

First Trust Exchange-Traded Fund III FPE NYSE Arca

First Trust Preferred Securities and Income ETF Monthly $0.1032 FMB

NASDAQ First Trust Managed Municipal ETF Monthly $0.1150 FEMB

NASDAQ First Trust Emerging Markets Local Currency Bond ETF Monthly

$0.1740 FTLS NYSE Arca First Trust Long/Short Equity ETF Quarterly

$0.0449

First Trust Exchange-Traded Fund IV HYLS

NASDAQ First Trust Tactical High Yield ETF Monthly $0.2400 FTSL

NASDAQ First Trust Senior Loan Fund Monthly $0.1500 FDIV NASDAQ

First Trust Strategic Income ETF Monthly $0.1600 FTSM NASDAQ First

Trust Enhanced Short Maturity ETF Monthly $0.0200 LMBS NASDAQ First

Trust Low Duration Mortgage Opportunities ETF Monthly $0.1275 EMLP

NYSE Arca First Trust North American Energy Infrastructure Fund

Quarterly $0.2317

First Trust Exchange-Traded Fund VI

FTHI NASDAQ First Trust High Income ETF Monthly $0.0850 FTLB NASDAQ

First Trust Low Beta Income ETF Monthly $0.0600

INDEX

EXCHANGE-TRADED FUNDS First Trust Exchange-Traded

Fund FDM NYSE Arca First Trust Dow Jones Select MicroCap Index

Fund Quarterly $0.0579 FDL NYSE Arca First Trust Morningstar

Dividend Leaders Index Fund Quarterly $0.2189 FPX NYSE Arca First

Trust US IPO Index Fund Quarterly $0.0684 FTCS NASDAQ First Trust

Capital Strength ETF Quarterly $0.1434 TUSA NASDAQ First Trust

Total US Market AlphaDEX® ETF Quarterly $0.0558 FVD NYSE Arca First

Trust Value Line® Dividend Index Fund Quarterly $0.1482 FRI NYSE

Arca First Trust S&P REIT Index Fund Quarterly $0.1623 FIW NYSE

Arca First Trust ISE Water Index Fund Quarterly $0.0658 FCG NYSE

Arca First Trust ISE-Revere Natural Gas Index Fund Quarterly

$0.0716 FVL NYSE Arca First Trust Value Line® 100 Exchange-Traded

Fund Quarterly $0.0255 QQEW NASDAQ First Trust NASDAQ-100 Equal

Weighted Index Fund Quarterly $0.0672 QTEC NASDAQ First Trust

NASDAQ-100-Technology Sector Index Fund Quarterly $0.0966 QCLN

NASDAQ First Trust NASDAQ® Clean Edge® Green Energy Index Fund

Quarterly $0.0247 QABA NASDAQ First Trust NASDAQ® ABA Community

Bank Index Fund Quarterly $0.1451 VIXH NYSE Arca First Trust CBOE®

S&P 500® VIX® Tail Hedge Fund Quarterly $0.0880 QQXT NASDAQ

First Trust NASDAQ-100 Ex-Technology Sector Index Fund Quarterly

$0.0464 FBT NYSE Arca First Trust NYSE Arca Biotechnology Index

Fund Quarterly $0.0649 FNI NYSE Arca First Trust ISE Chindia Index

Fund Quarterly $0.0767

First Trust Exchange-Traded Fund

II FDD NYSE Arca First Trust STOXX® European Select Dividend

Index Fund Quarterly $0.3497 FFR NYSE Arca First Trust FTSE

EPRA/NAREIT Developed Markets Real Estate Index Fund Quarterly

$0.3014 FGD NYSE Arca First Trust Dow Jones Global Select Dividend

Index Fund Quarterly $0.4757 FAN NYSE Arca First Trust ISE Global

Wind Energy Index Fund Quarterly $0.1436 FLM NYSE Arca

First Trust ISE Global Engineering and

Construction Index Fund

Quarterly $0.3901 GRID NASDAQ First Trust NASDAQ® Clean Edge® Smart

Grid Infrastructure Index Fund Quarterly $0.2407 BICK NASDAQ First

Trust BICK Index Fund Quarterly $0.0474 FONE NASDAQ First Trust

NASDAQ CEA Smartphone Index Fund Quarterly $0.1636 CARZ NASDAQ

First Trust NASDAQ Global Auto Index Fund Quarterly $0.3231 SKYY

NASDAQ First Trust ISE Cloud Computing Index Fund Quarterly $0.0344

PLTM NASDAQ First Trust ISE Global Platinum Index Fund Quarterly

$0.0157 FPXI NASDAQ First Trust International IPO ETF Quarterly

$0.1735

First Trust Exchange-Traded Fund VI MDIV

NASDAQ Multi-Asset Diversified Income Index Fund Monthly $0.0840

YDIV NASDAQ International Multi-Asset Diversified Income Index Fund

Monthly $0.1650 RDVY NASDAQ First Trust NASDAQ Rising Dividend

Achievers ETF Quarterly $0.1058 TDIV NASDAQ First Trust NASDAQ

Technology Dividend Index Fund Quarterly $0.1656 AIRR NASDAQ First

Trust RBA American Industrial Renaissance® ETF Quarterly $0.0136 FV

NASDAQ First Trust Dorsey Wright Focus 5 ETF Quarterly $0.0090 QINC

NASDAQ First Trust RBA Quality Income ETF Quarterly $0.1828

First Trust Exchange-Traded AlphaDEX® Fund FEX

NYSE Arca First Trust Large Cap Core AlphaDEX® Fund Quarterly

$0.1381 FNX NYSE Arca First Trust Mid Cap Core AlphaDEX® Fund

Quarterly $0.1205 FYX NYSE Arca First Trust Small Cap Core

AlphaDEX® Fund Quarterly $0.0821 FTA NYSE Arca First Trust Large

Cap Value AlphaDEX® Fund Quarterly $0.2012 FTC NYSE Arca First

Trust Large Cap Growth AlphaDEX® Fund Quarterly $0.0556 FAB NYSE

Arca First Trust Multi Cap Value AlphaDEX® Fund Quarterly $0.1575

FAD NYSE Arca First Trust Multi Cap Growth AlphaDEX® Fund Quarterly

$0.0337 FXD NYSE Arca First Trust Consumer Discretionary AlphaDEX®

Fund Quarterly $0.0975 FXG NYSE Arca First Trust Consumer Staples

AlphaDEX® Fund Quarterly $0.0936 FXN NYSE Arca First Trust Energy

AlphaDEX® Fund Quarterly $0.0936 FXO NYSE Arca First Trust

Financials AlphaDEX® Fund Quarterly $0.0719 FXZ NYSE Arca First

Trust Materials AlphaDEX® Fund Quarterly $0.0741 FXU NYSE Arca

First Trust Utilities AlphaDEX® Fund Quarterly $0.1814 FNY NYSE

Arca First Trust Mid Cap Growth AlphaDEX® Fund Quarterly $0.0153

FNK NYSE Arca First Trust Mid Cap Value AlphaDEX® Fund Quarterly

$0.1037 FYT NYSE Arca First Trust Small Cap Value AlphaDEX® Fund

Quarterly $0.0532 FMK NYSE Arca First Trust Mega Cap AlphaDEX® Fund

Quarterly $0.0818 FYC NYSE Arca First Trust Small Cap Growth

AlphaDEX® Fund Quarterly $0.0047

First Trust

Exchange-Traded AlphaDEX® Fund II FBZ NYSE Arca

First Trust Brazil AlphaDEX® Fund Quarterly $0.2145 FDT NYSE Arca

First Trust Developed Markets Ex-US AlphaDEX® Fund Quarterly

$0.3638 FEM NYSE Arca First Trust Emerging Markets AlphaDEX® Fund

Quarterly $0.2225 FEP NYSE Arca First Trust Europe AlphaDEX® Fund

Quarterly $0.5150 FLN NYSE Arca First Trust Latin America AlphaDEX®

Fund Quarterly $0.1554 FPA NYSE Arca First Trust Asia Pacific

Ex-Japan AlphaDEX® Fund Quarterly $0.0097 FCAN NYSE Arca First

Trust Canada AlphaDEX® Fund Quarterly $0.0457 FAUS NYSE Arca First

Trust Australia AlphaDEX® Fund Quarterly $0.1124 FKU NYSE Arca

First Trust United Kingdom AlphaDEX® Fund Quarterly $0.3220 FHK

NYSE Arca First Trust Hong Kong AlphaDEX® Fund Quarterly $0.2905

FDTS NYSE Arca

First Trust Developed Markets ex-US Small

Cap AlphaDEX® Fund

Quarterly $0.2687 FEMS NYSE Arca First Trust Emerging Markets Small

Cap AlphaDEX® Fund Quarterly $0.2931 FJP NYSE Arca First Trust

Japan AlphaDEX® Fund Quarterly $0.2459 FEUZ NASDAQ First Trust

Eurozone AlphaDEX® ETF Quarterly $0.3156 FCA NYSE Arca First Trust

China AlphaDEX® Fund Quarterly $0.3018 FGM NYSE Arca First Trust

Germany AlphaDEX® Fund Quarterly $0.3660 FKO NYSE Arca First Trust

South Korea AlphaDEX® Fund Quarterly $0.0259 FSZ NYSE Arca First

Trust Switzerland AlphaDEX® Fund Quarterly $0.3880

First Trust Advisors L.P., the Fund’s investment advisor, along

with its affiliate, First Trust Portfolios L.P., are privately-held

companies which provide a variety of investment services, including

asset management and financial advisory services, with collective

assets under management or supervision of approximately $119

billion as of May 31, 2015, through unit investment trusts,

exchange-traded funds, closed-end funds, mutual funds and separate

managed accounts.

You should consider the investment objectives, risks, charges

and expenses of a Fund before investing. Prospectuses for the Funds

contain this and other important information and are available free

of charge by calling toll-free at 1-800-621-1675 or visiting

www.ftportfolios.com. A prospectus should be read

carefully before investing.

Past performance is no assurance of future results. Principal

Risk Factors: A Fund’s shares will change in value, and you could

lose money by investing in a Fund. An investment in a Fund involves

risk similar to those of investing in any fund of equity securities

traded on exchanges. The risks of investing in each Fund are

spelled out in its prospectus, shareholder report, and other

regulatory filings.

A Fund that is concentrated in securities of companies in a

certain sector or industry involves additional risks, including

limited diversification. A Fund that invests in companies that are

domiciled in a certain country or region may be subject to

additional risks due to political, economic and social conditions

in that country or region. A Fund which invests in foreign

securities may be subject to additional risks not associated with

domestic securities. Such risks may be heightened in the case of

securities of emerging markets countries. An Index ETF seeks

investment results that correspond generally to the price and yield

of an index. You should anticipate that the value of an Index

Fund’s shares will decline, more or less, in correlation with any

decline in the value of the index. An Index Fund’s return may not

match the return of the index. Unlike a Fund, the indices do not

actually hold a portfolio of securities and therefore do not incur

the expenses incurred by a Fund.

An actively managed ETF is subject to management risk because it

is an actively managed portfolio. In managing such a Fund’s

investment portfolio, the portfolio managers will apply investment

techniques and risk analyses that may not have the desired result.

There can be no guarantee that a Fund will meet its investment

objective. Preferred Securities are subject to credit risk,

interest rate risk and income risk. Credit Risk may be heightened

if a Fund invests in “high yield” or “junk” debt. The First Trust

Senior Loan Fund is subject to credit risk, currency risk, high

yield securities risk, interest rate risk, prepayment risk and

senior loans risk. The First Trust Tactical High Yield ETF is

subject to convertible bonds risk, credit risk, distressed

securities risk, high yield securities risk, interest rate risk,

loans risk, prepayment risk and short sale risk. The First Trust

Preferred Securities and Income ETF is subject to financial company

risk, high yield securities risk, income risk, preferred securities

risk and REIT risk. The First Trust High Income ETF is subject to

cash transaction risk, depositary receipts risk, derivatives risk,

market risk, new fund risk, diversification risk, and non-U.S.

securities risk. The First Trust Low Beta Income ETF is subject to

cash transaction risk, depositary receipts risk, derivatives risk,

market risk, new fund risk, non-diversification risk and non-U.S.

securities risk. The First Trust North American Energy

Infrastructure Fund is subject to concentration risk, currency

risk, depositary receipts risk, derivatives risk, energy

infrastructure company risk, geographic risk, interest rate risk,

MLP risk, non-diversification risk, and non-U.S. securities risk.

The First Trust Managed Municipal ETF is subject to alternative

minimum tax risk, call risk, cash transaction risk, credit risk,

high yield securities risk, income risk, municipal lease obligation

risk, non-diversification risk, political and economic risk, tax

risk, and zero coupon bonds risk. The First Trust Enhanced Short

Maturity ETF is subject to risk associated with investing in

mortgage-related and other asset back securities, interest rate

risk, prepayment risk, credit risk, call risk, cash transaction

risk, fixed income securities risk, floating rate loan risk, income

risk, investment company risk, new fund risk, non-U.S. securities

risk, and volatility risk. The First Trust Strategic Income ETF is

subject to covered call risk, credit risk, currency risk,

depositary receipts risk, derivatives risk, energy infrastructure

companies risk, equity securities risk, financial companies risk,

fixed income risk, high yield securities risk, illiquid securities

risk, income risk, interest rate risk, investment companies risk,

MLP risk, mortgage securities risk, emerging markets risk,

preferred securities risk, senior loan risk, and smaller companies

risk. The First Trust Low Duration Mortgage Opportunities ETF is

subject to cash transaction risk, counterparty risk, credit risk,

high yield securities risk, illiquid securities risk, income risk,

interest rate risk, management risk, market risk, mortgage-related

investments risk, new fund risk, non-diversification risk,

prepayment risk, repurchase agreement risk, short sales risk and

U.S. government and agency securities risk. The First Trust

Emerging Markets Local Currency Bond ETF is subject to call risk,

cash transactions risk, credit risk, currency exchange rate risk,

currency risk, derivatives risk, emerging markets risk, global

depositary notes risk, high yield securities risk, illiquid

securities risk, income risk, interest rate risk, management risk,

market risk, new fund risk, non-diversification risk, non-U.S.

securities risk and sovereign debt risk. The First Trust Long/Short

Equity Fund is subject to cash transactions risk, depositary

receipts risk, derivatives risk, equity securities risk, ETF risk,

management risk, mark risk, non-U.S. securities risk, short sales

risk, and small fund risk.

Investors buying or selling Fund shares on the secondary market

may incur brokerage commissions. Investors who sell Fund shares may

receive less than the share’s net asset value. Unlike shares of

open-end mutual funds, investors are generally not able to purchase

Fund shares directly from the Fund and individual shares are not

redeemable. However, specified large blocks of shares called

“creation units” can be purchased from, or redeemed to, the

Fund.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150623006595/en/

First Trust Advisors L.P.Press Inquiries: Ryan Issakainen,

630-765-8689Broker Inquiries: Sales Team, 866-848-9727Analyst

Inquiries: Stan Ueland, 630-517-7633

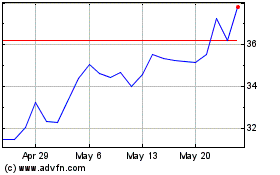

First Trust NASDAQ Clean... (NASDAQ:QCLN)

Historical Stock Chart

From Jan 2025 to Feb 2025

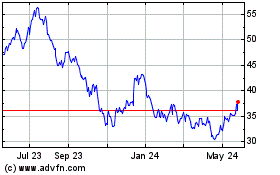

First Trust NASDAQ Clean... (NASDAQ:QCLN)

Historical Stock Chart

From Feb 2024 to Feb 2025