0000917273false00009172732025-02-032025-02-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

FEBRUARY 3, 2025

Rambus Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 000-22339 | | 94-3112828 |

(State or other jurisdiction of

incorporation) | | (Commission File Number) | | (I. R. S. Employer

Identification No.) |

4453 North First Street, Suite 100

San Jose, California 95134

(Address of principal executive offices)

(408) 462-8000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, $.001 Par Value | RMBS | The NASDAQ Stock Market LLC |

| | (The NASDAQ Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 – Results of Operations and Financial Condition.

On February 3, 2025, Rambus Inc. (“Rambus,” or the “Company”) issued a press release announcing results for the quarter ended December 31, 2024. A copy of the press release is attached as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference herein.

The information under Item 2.02 in this current report on Form 8-K and the related information in the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 – Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| 99.1 | |

| 104 | Cover Page Interactive Date File (formatted as inline XBRL and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | | |

| Date: February 3, 2025 | | | | Rambus Inc. |

| | | |

| | | | | /s/ Desmond Lynch |

| | | | | Desmond Lynch, Senior Vice President, Finance and

Chief Financial Officer |

Exhibit 99.1

News Release

RAMBUS REPORTS FOURTH QUARTER AND FISCAL YEAR 2024 FINANCIAL RESULTS

•Delivered record quarterly product revenue of $73.4 million, up 11% sequentially and 37% year over year

•Generated record annual cash from operations of $230.6 million for 2024, up 18% year over year

•Extended patent license agreement with Micron through 2029

SAN JOSE, Calif. - February 3, 2025 - Rambus Inc. (NASDAQ:RMBS), a provider of industry-leading chips and IP making data faster and safer, today reported financial results for the fourth quarter ended December 31, 2024. GAAP revenue for the fourth quarter was $161.1 million; licensing billings were $63.6 million, product revenue was $73.4 million, and contract and other revenue was $29.5 million. The Company also generated $59.0 million in cash provided by operating activities in the fourth quarter.

“We finished 2024 strongly with sequential and year-over-year growth, delivering record annual product revenue and cash from operations,” said Luc Seraphin, chief executive officer of Rambus. “We expanded our addressable market with a record number of new product introductions throughout the year and gained share through continued product leadership. As AI continues to accelerate performance demands across the computing landscape, we are well positioned to deliver long-term growth and continued stockholder return.”

| | | | | | | | | | | | | | |

| Quarterly Financial Review - GAAP | | Three Months Ended December 31, |

| (In millions, except for percentages and per share amounts) | | 2024 | | 2023 |

| Revenue | | | | |

| Product revenue | | $ | 73.4 | | | $ | 53.7 | |

| Royalties | | 58.2 | | | 52.4 | |

| Contract and other revenue | | 29.5 | | | 16.1 | |

| Total revenue | | 161.1 | | | 122.2 | |

| Cost of product revenue | | 28.5 | | | 19.9 | |

| Cost of contract and other revenue | | 0.7 | | | 1.1 | |

| Amortization of acquired intangible assets (included in total cost of revenue) | | 2.3 | | | 3.1 | |

Total operating expenses (1) | | 71.7 | | | 63.0 | |

| Operating income | | $ | 57.9 | | | $ | 35.1 | |

| Operating margin | | 36 | % | | 29 | % |

| Net income | | $ | 62.2 | | | $ | 58.5 | |

| Diluted net income per share | | $ | 0.58 | | | $ | 0.53 | |

| | | | |

| Net cash provided by operating activities | | $ | 59.0 | | | $ | 54.8 | |

____________________________

(1) Includes amortization of acquired intangibles of approximately $0.2 million for the three months ended December 31, 2023. Amortization of acquired intangibles was immaterial for the three months ended December 31, 2024.

| | | | | | | | | | | | | | | |

Quarterly Financial Review - Supplemental Information(1) | | Three Months Ended December 31, | |

| (In millions) | | 2024 | | 2023 | |

Licensing billings (operational metric) (2) | | $ | 63.6 | | | $ | 66.2 | | |

| Product revenue (GAAP) | | $ | 73.4 | | | $ | 53.7 | | |

| Contract and other revenue (GAAP) | | $ | 29.5 | | | $ | 16.1 | | |

| Non-GAAP cost of product revenue | | $ | 28.3 | | | $ | 19.8 | | |

| Cost of contract and other revenue (GAAP) | | $ | 0.7 | | | $ | 1.1 | | |

| Non-GAAP total operating expenses | | $ | 60.1 | | | $ | 51.0 | | |

| Non-GAAP interest and other income (expense), net | | $ | 4.4 | | | $ | 3.8 | | |

| Diluted share count (GAAP) | | 108 | | | 110 | | |

____________________________

(1) See “Supplemental Reconciliation of GAAP to Non-GAAP Results” table included below.

(2) Licensing billings is an operational metric that reflects amounts invoiced to our licensing customers during the period, as adjusted for certain differences relating to advanced payments for variable licensing agreements.

GAAP revenue for the quarter was $161.1 million. The Company also had licensing billings of $63.6 million, product revenue of $73.4 million, and contract and other revenue of $29.5 million. The Company had total GAAP cost of revenue of $31.5 million and operating expenses of $71.7 million. The Company also had total non-GAAP operating expenses of $89.1 million (including non-GAAP cost of revenue of $29 million). The Company had GAAP diluted net income per share of $0.58. The Company’s basic share count was 107 million shares and its diluted share count was 108 million shares.

Cash, cash equivalents, and marketable securities as of December 31, 2024 were $481.8 million, an increase of $49.1 million as compared to September 30, 2024, mainly due to cash provided by operating activities of approximately $59 million. Cash provided by operating activities for the year ended December 31, 2024 was $230.6 million.

2025 First Quarter Outlook

The Company will discuss its full revenue guidance for the first quarter of 2025 during its upcoming conference call. The following table sets forth first quarter outlook for other measures.

| | | | | | | | | | | | | | |

| | | | |

| (In millions) | | GAAP | | Non-GAAP (1) |

Licensing billings (operational metric) (2) | | $59 - $65 | | $59 - $65 |

| Product revenue | | $72 - $78 | | $72 - $78 |

| Contract and other revenue | | $22 - $28 | | $22 - $28 |

| Total operating costs and expenses | | $105 - $101 | | $91- $87 |

| Interest and other income (expense), net | | $4 | | $4 |

| Diluted share count | | 108 | | 108 |

| | | | |

____________________________

(1) See “Reconciliation of GAAP Forward-Looking Estimates to Non-GAAP Forward-Looking Estimates” table included below.

(2) Licensing billings is an operational metric that reflects amounts invoiced to our licensing customers during the period, as adjusted for certain differences relating to advanced payments for variable licensing agreements.

For the first quarter of 2025, the Company expects licensing billings to be between $59 million and $65 million. The Company also expects royalty revenue to be between $56 million and $62 million, product revenue to be between $72 million and $78 million and contract and other revenue to be between $22 million and $28 million. Revenue is not without risk and achieving revenue in this range will require that the Company sign customer agreements for various product sales and solutions licensing, among other matters.

The Company also expects operating costs and expenses to be between $105 million and $101 million. Additionally, the Company expects non-GAAP operating costs and expenses to be between $91 million and $87 million. These expectations also

assume a tax rate of 20% and diluted share count of 108 million, and exclude stock-based compensation expense of $12 million and amortization of acquired intangible assets of $2 million.

Conference Call

The Company’s management will discuss the results of the quarter during a conference call scheduled for 2:00 p.m. PT today. The call will be audio and slides will be available online at investor.rambus.com and a replay will be available for the next week at the following numbers: (866) 813-9403 (domestic) or (+1) 929-458-6194 (international) with ID# 691793.

Non-GAAP Financial Information

In the commentary set forth above and in the financial statements included in this earnings release, the Company presents the following non-GAAP financial measures: cost of product revenue, operating expenses and interest and other income (expense), net. In computing each of these non-GAAP financial measures, the following items were considered as discussed below: stock-based compensation expense, acquisition/divestiture-related costs and retention bonus expense, amortization of acquired intangible assets, restructuring and other charges (recoveries), (gain) loss on divestiture, expense on abandoned operating leases, change in fair value of earn-out liability, gain on sale of non-marketable equity security, and certain other one-time adjustments. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations from these results should be carefully evaluated. Management believes the non-GAAP financial measures are appropriate for both its own assessment of, and to show investors, how the Company’s performance compares to other periods. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. A reconciliation from GAAP to non-GAAP results is included in the financial statements contained in this release.

The Company’s non-GAAP financial measures reflect adjustments based on the following items:

Stock-based compensation expense. These expenses primarily relate to employee stock options, employee stock purchase plans, and employee non-vested equity stock and non-vested stock units. The Company excludes stock-based compensation expense from its non-GAAP measures primarily because such expenses are non-cash expenses that the Company does not believe are reflective of ongoing operating results. Additionally, given the fact that other companies may grant different amounts and types of equity awards and may use different option valuation assumptions, excluding stock-based compensation expense permits more accurate comparisons of the Company’s results with peer companies.

Acquisition/divestiture-related costs and retention bonus expense. These expenses include all direct costs of certain acquisitions, divestitures and the current periods’ portion of any retention bonus expense associated with the acquisitions. The Company excludes these expenses in order to provide better comparability between periods as they are related to acquisitions and divestitures and have no direct correlation to the Company’s operations.

Amortization of acquired intangible assets. The Company incurs expenses for the amortization of intangible assets acquired in acquisitions. The Company excludes these items because these expenses are not reflective of ongoing operating results in the period incurred. These amounts arise from the Company’s prior acquisitions and have no direct correlation to the operation of the Company’s core business.

Restructuring and other charges (recoveries). These charges (recoveries) may consist of severance, contractual retention payments, exit costs and other charges and are excluded because such charges (recoveries) are not directly related to ongoing business results and do not reflect expected future operating expenses.

(Gain) loss on divestiture. Reflects the (gain) loss on the sale of the Company's PHY IP business. The Company excludes these charges (benefits) because such charges (benefits) are not directly related to ongoing business results and do not reflect expected future operating expenses (benefits).

Expense on abandoned operating leases. Reflects the expense on building leases that were abandoned. The Company excludes these charges because such charges are not directly related to ongoing business results and do not reflect expected future operating expenses.

Change in fair value of earn-out liability. This change is due to adjustments to acquisition purchase consideration. The Company excludes these adjustments because such adjustments are not directly related to ongoing business results and do not reflect expected future operating expenses.

Gain on sale of non-marketable equity security. The Company has excluded gain on sale of non-marketable equity security as this is not a reflection of the Company’s ongoing operations.

Income tax adjustments. For purposes of internal forecasting, planning and analyzing future periods that assume net income from operations, the Company estimates a fixed, long-term projected tax rate of approximately 22 percent and 24 percent for 2024 and 2023, respectively, which consists of estimated U.S. federal and state tax rates, and excludes tax rates associated with certain items such as withholding tax, tax credits, deferred tax asset valuation allowance and the release of any deferred tax asset valuation allowance. Accordingly, the Company has applied these tax rates to its non-GAAP financial results for all periods in the relevant years to assist the Company’s planning.

On occasion in the future, there may be other items, such as significant gains or losses from contingencies, that the Company may exclude in deriving its non-GAAP financial measures if it believes that doing so is consistent with the goal of providing useful information to investors and management.

About Rambus Inc.

Rambus is a global semiconductor company dedicated to enabling the future of the data center and artificial intelligence (“AI”) by delivering innovative memory and security solutions that address the evolving needs of the industry. As a pioneer with approximately 35 years of advanced semiconductor design experience, Rambus is at the forefront of enabling the next era of AI-driven computing, addressing the critical challenges of accelerating and securing data movement in the data center, edge, and client markets. Rambus is a leader in high-performance memory subsystems, offering a balanced and diverse portfolio of products encompassing chips and silicon intellectual property (IP). Focusing primarily on the data center, our innovative solutions maximize performance and security in computationally intensive systems. For more information, visit rambus.com.

Forward-Looking Statements

This release contains forward-looking statements under the Private Securities Litigation Reform Act of 1995, including those relating to Rambus’ expectations regarding business opportunities, the Company’s ability to deliver long-term, profitable growth, product and investment strategies, and the Company’s outlook and financial guidance for the first quarter of 2025 and related drivers, and the Company’s ability to effectively manage market challenges. Such forward-looking statements are based on current expectations, estimates and projections, management’s beliefs and certain assumptions made by the Company’s management. Actual results may differ materially. The Company’s business generally is subject to a number of risks which are described more fully in Rambus’ periodic reports filed with the Securities and Exchange Commission. The Company undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date hereof.

Contact

Desmond Lynch

Senior Vice President, Finance and Chief Financial Officer

(408) 462-8000

dlynch@rambus.com

Source: Rambus Inc.

Rambus Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | | | | |

| (In thousands) | | December 31, 2024 | | December 31, 2023 |

| ASSETS | | | | |

Current assets: | | | | |

Cash and cash equivalents | | $ | 99,775 | | | $ | 94,767 | |

Marketable securities | | 382,023 | | | 331,077 | |

Accounts receivable | | 122,813 | | | 82,925 | |

Unbilled receivables | | 25,070 | | | 50,872 | |

Inventories | | 44,634 | | | 36,154 | |

Prepaids and other current assets | | 15,942 | | | 34,850 | |

| | | | |

Total current assets | | 690,257 | | | 630,645 | |

Intangible assets, net | | 17,059 | | | 28,769 | |

Goodwill | | 286,812 | | | 286,812 | |

Property, plant and equipment, net | | 75,509 | | | 67,808 | |

Operating lease right-of-use assets | | 21,454 | | | 21,497 | |

| | | | |

| | | | |

Deferred tax assets | | 136,466 | | | 127,892 | |

| Income taxes receivable | | 109,947 | | | 88,768 | |

Other assets | | 5,632 | | | 6,036 | |

Total assets | | $ | 1,343,136 | | | $ | 1,258,227 | |

| | | | |

| LIABILITIES & STOCKHOLDERS’ EQUITY | | | | |

Current liabilities: | | | | |

Accounts payable | | $ | 18,522 | | | $ | 18,074 | |

Accrued salaries and benefits | | 19,193 | | | 17,504 | |

| | | | |

Deferred revenue | | 19,903 | | | 17,393 | |

Income taxes payable | | 1,264 | | | 5,099 | |

Operating lease liabilities | | 5,617 | | | 4,453 | |

Other current liabilities | | 17,313 | | | 26,598 | |

Total current liabilities | | 81,812 | | | 89,121 | |

| | | | |

| | | | |

| | | | |

Long-term operating lease liabilities | | 24,534 | | | 26,255 | |

Long-term income taxes payable | | 109,383 | | | 78,947 | |

| | | | |

Other long-term liabilities | | 6,715 | | | 25,803 | |

Total long-term liabilities | | 140,632 | | | 131,005 | |

Total stockholders’ equity | | 1,120,692 | | | 1,038,101 | |

Total liabilities and stockholders’ equity | | $ | 1,343,136 | | | $ | 1,258,227 | |

Rambus Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Years Ended

December 31, | | |

| (In thousands, except per share amounts) | | 2024 | | 2023 | | 2024 | | 2023 | | |

Revenue: | | | | | | | | | | |

Product revenue | | $ | 73,369 | | | $ | 53,698 | | | $ | 246,815 | | | $ | 224,632 | | | |

Royalties | | 58,211 | | | 52,412 | | | 226,172 | | | 150,110 | | | |

Contract and other revenue | | 29,522 | | | 16,115 | | | 83,637 | | | 86,375 | | | |

Total revenue | | 161,102 | | | 122,225 | | | 556,624 | | | 461,117 | | | |

Cost of revenue: | | | | | | | | | | |

Cost of product revenue | | 28,494 | | | 19,941 | | | 95,875 | | | 84,495 | | | |

Cost of contract and other revenue | | 721 | | | 1,123 | | | 3,028 | | | 5,403 | | | |

| Amortization of acquired intangible assets | | 2,300 | | | 3,052 | | | 11,204 | | | 13,524 | | | |

Total cost of revenue | | 31,515 | | | 24,116 | | | 110,107 | | | 103,422 | | | |

| Gross profit | | 129,587 | | | 98,109 | | | 446,517 | | | 357,695 | | | |

| Operating expenses: | | | | | | | | | | |

Research and development | | 43,698 | | | 35,985 | | | 162,881 | | | 156,827 | | | |

Sales, general and administrative | | 27,998 | | | 25,665 | | | 104,094 | | | 108,149 | | | |

| Amortization of acquired intangible assets | | 30 | | | 195 | | | 506 | | | 1,217 | | | |

Restructuring and other charges (recoveries) | | — | | | (26) | | | — | | | 9,368 | | | |

| (Gain) loss on divestiture | | — | | | 59 | | | — | | | (90,784) | | | |

| Impairment of assets | | — | | | — | | | 1,071 | | | 10,045 | | | |

Change in fair value of earn-out liability | | — | | | 1,100 | | | (5,044) | | | 9,234 | | | |

Total operating expenses | | 71,726 | | | 62,978 | | | 263,508 | | | 204,056 | | | |

Operating income | | 57,861 | | | 35,131 | | | 183,009 | | | 153,639 | | | |

Interest income and other income (expense), net | | 4,796 | | | 4,215 | | | 18,450 | | | 11,327 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Loss on fair value adjustment of derivatives, net | | — | | | — | | | — | | | (240) | | | |

| Gain on sale of non-marketable equity security | | — | | | 23,924 | | | — | | | 23,924 | | | |

Interest expense | | (352) | | | (377) | | | (1,416) | | | (1,490) | | | |

Interest and other income (expense), net | | 4,444 | | | 27,762 | | | 17,034 | | | 33,521 | | | |

Income before income taxes | | 62,305 | | | 62,893 | | | 200,043 | | | 187,160 | | | |

Provision for (benefit from) income taxes | | 103 | | | 4,348 | | | 20,222 | | | (146,744) | | | |

Net income | | $ | 62,202 | | | $ | 58,545 | | | $ | 179,821 | | | $ | 333,904 | | | |

Net income per share: | | | | | | | | | | |

Basic | | $ | 0.58 | | | $ | 0.54 | | | $ | 1.67 | | | $ | 3.09 | | | |

Diluted | | $ | 0.58 | | | $ | 0.53 | | | $ | 1.65 | | | $ | 3.01 | | | |

Weighted average shares used in per share calculation: | | | | | | | | | | |

Basic | | 106,716 | | | 107,703 | | | 107,438 | | | 108,183 | | | |

Diluted | | 108,082 | | | 110,065 | | | 109,041 | | | 110,889 | | | |

| | | | | | | | | | |

Rambus Inc.

Supplemental Reconciliation of GAAP to Non-GAAP Results

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | December 31, | | | | | | |

| (In thousands) | | 2024 | | 2023 | | | | | | |

| Cost of product revenue | | $ | 28,494 | | | $ | 19,941 | | | | | | | |

| Adjustment: | | | | | | | | | | |

| Stock-based compensation expense | | (172) | | | (145) | | | | | | | |

| Non-GAAP cost of product revenue | | $ | 28,322 | | | $ | 19,796 | | | | | | | |

| | | | | | | | | | |

| Total operating expenses | | $ | 71,726 | | | $ | 62,978 | | | | | | | |

| Adjustments: | | | | | | | | | | |

| Stock-based compensation expense | | (11,563) | | | (10,389) | | | | | | | |

| Acquisition/divestiture-related costs and retention bonus expense | | (22) | | | (285) | | | | | | | |

| Amortization of acquired intangible assets | | (30) | | | (195) | | | | | | | |

| Restructuring and other recoveries | | — | | | 26 | | | | | | | |

| Loss on divestiture | | — | | | (59) | | | | | | | |

| Expense on abandoned operating leases | | — | | | (3) | | | | | | | |

| | | | | | | | | | |

| Change in fair value of earn-out liability | | — | | | (1,100) | | | | | | | |

| Non-GAAP total operating expenses | | $ | 60,111 | | | $ | 50,973 | | | | | | | |

| | | | | | | | | | |

| Interest and other income (expense), net | | $ | 4,444 | | | $ | 27,762 | | | | | | | |

| Adjustment: | | | | | | | | | | |

| Gain on sale of non-marketable equity security | | — | | | (23,924) | | | | | | | |

| Non-GAAP interest and other income (expense), net | | $ | 4,444 | | | $ | 3,838 | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Rambus Inc.

Reconciliation of GAAP Forward-Looking Estimates to Non-GAAP Forward-Looking Estimates

(Unaudited)

| | | | | | | | | | | | | | | | | | |

2025 First Quarter Outlook | | Three Months Ended March 31, 2025 | | |

| (In millions) | | Low | | High | | | | |

| Forward-looking operating costs and expenses | | $ | 105 | | | $ | 101 | | | | | |

| Adjustments: | | | | | | | | |

| Stock-based compensation expense | | (12) | | | (12) | | | | | |

| Amortization of acquired intangible assets | | (2) | | | (2) | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Forward-looking Non-GAAP operating costs and expenses | | $ | 91 | | | $ | 87 | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

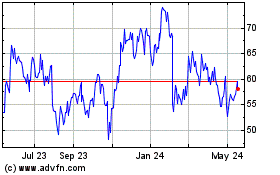

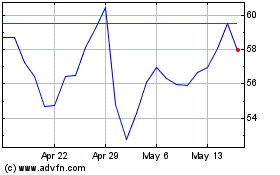

Rambus (NASDAQ:RMBS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Rambus (NASDAQ:RMBS)

Historical Stock Chart

From Feb 2024 to Feb 2025