false

0001001316

0001001316

2024-08-02

2024-08-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 2, 2024

TG Therapeutics, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

001-32639

|

36-3898269

|

|

(State or Other Jurisdiction

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

of Incorporation)

|

|

|

3020 Carrington Mill Blvd, Suite 475

Morrisville, North Carolina 27560

(Address of Principal Executive Offices)

(212) 554-4484

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2b under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities filed pursuant to Section 12(b) of the Act:

|

Title of Class

|

Trading Symbol(s)

|

Exchange Name

|

|

Common Stock

|

TGTX

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into Material Definitive Agreement

On August 2, 2024 (the “Closing Date”), TG Therapeutics, Inc. (the "Company" or the “Borrower”) entered into a term loan facility of $250 million (the “Initial Term Loan”) with Blue Owl Capital Corporation, as administrative agent (the “Administrative Agent”), HealthCare Royalty and Blue Owl Capital under the Financing Agreement (as defined below). The Initial Term Loan is governed by a financing agreement, dated as of the Closing Date (the “Financing Agreement”), which provides for (i) a single draw of the Initial Term Loan on the Closing Date and (ii) an uncommitted additional facility in an aggregate principal amount of up to $100 million.

The Initial Term Loan will mature on August 2, 2029 (the “Term Loan Maturity Date”). The Initial Term Loan accrues interest at a per annum rate of interest equal to an applicable margin plus, at the Borrower’s option, either (a) at a base rate determined by reference to the highest of (1) the prime rate published by the Wall Street Journal, (2) the federal funds effective rate plus 0.50% and (3) Term SOFR, plus 1.00% or (b) Term SOFR, which, shall be no less than 1.00%. The applicable margin for borrowings of the Initial Term Loan is determined on a quarterly basis by reference to a pricing grid based on the achievement of US Net Sales (as defined in the Financing Agreement) for the most recently completed four consecutive fiscal quarters of the Borrower and its Subsidiaries (as defined in the Financing Agreement). The pricing grid commences at 5.50% for SOFR borrowings and 4.50% for base rate borrowings and is subject to a 25 basis point step-down upon achievement of a specified US Net Sales threshold. The Initial Term Loan requires scheduled quarterly amortization payments, commencing with the fiscal quarter ending June 30, 2028, in an amount equal to $12.5 million, with the balance due and payable on the Term Loan Maturity Date; provided that such amortization payments may be deferred to the Term Loan Maturity Date upon the achievement of a Total Net Leverage Ratio (as defined in the Financing Agreement) that is less than or equal to an agreed threshold.

The Initial Term Loan is secured by a lien on substantially all of the assets of the Borrower and certain subsidiaries of the Borrower as guarantors (collectively, the “Loan Parties”) and contains customary covenants and representations.

The events of default under the Financing Agreement are customary for financings of this type. If an event of default occurs, the Administrative Agent is entitled to take enforcement action, including acceleration of amounts due under the Financing Agreement.

The description of the Financing Agreement contained herein does not purport to be complete and is qualified in its entirety by reference to the complete text of Financing Agreement, which will be filed as an exhibit to a subsequent periodic report of the Company

Item 1.02. Termination of a Material Definitive Agreement

On the Closing Date, the Company repaid all outstanding principal and accrued interest and fees under the Amended Loan and Security Agreement, dated as of March 31, 2023 (as amended to date, the “Existing Loan Agreement”), by and among the Company and TG Biologics Inc., as borrowers, and Hercules Capital, Inc. (“Hercules”) (such repayment, the “Refinancing”), which Refinancing was funded with the proceeds from the Initial Term Loan. The Existing Loan Agreement was effectively terminated and all guarantees and liens granted thereunder were released on the Closing Date upon the consummation of the Refinancing.

Item 2.2. Results of Operations and Financial Condition.

On August 6, 2024, the Company issued a press release announcing results of operations for the three and six months ended June 30, 2024. A copy of such press release is being furnished as Exhibit 99.1.

In accordance with General Instruction B.2 of Form 8-K, the information included in Item 2.02 of this Current Report on Form 8-K (including Exhibit 99.1 hereto), shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made by the Company under the Exchange Act or Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01. Other Events

Share Repurchase Plan

On August 6, 2024, the Company announced that the Board of Directors (the “Board”) of the Company had authorized and approved a share repurchase program for up to $100 million of the currently outstanding shares of the Company’s common stock. Under the share repurchase program, the Company intends to repurchase shares through open market purchases, privately-negotiated transactions, block purchases or otherwise in accordance with applicable federal securities laws, including Rule 10b-18 of the Exchange Act.

The Board also authorized the Company to enter into written trading plans under Rule 10b5-1 of the Exchange Act. Adopting a trading plan that satisfies the conditions of Rule 10b5-1 allows a company to repurchase its shares at times when it might otherwise be prevented from doing so due to self-imposed trading blackout periods or pursuant to insider trading laws. Under any Rule 10b5-1 trading plan, the Company’s third-party broker, subject to U.S. Securities and Exchange Commission (“SEC”) regulations regarding certain price, market, volume and timing constraints, would have authority to purchase the Company’s common stock in accordance with the terms of the plan. The Company may from time to time enter into Rule 10b5-1 trading plans to facilitate the repurchase of its common stock pursuant to its share repurchase program.

The Company cannot predict when or if it will repurchase any shares of common stock as such stock repurchase program will depend on a number of factors, including constraints specified in any Rule 10b5-1 trading plans, price, general business and market conditions and alternative investment opportunities. Information regarding share repurchases will be available in the Company’s periodic reports on Form 10-Q and 10-K filed with the SEC as required by the applicable rules of the Exchange Act.

10-K/A Filing

In July of 2024, the Company identified an error related to the expense recognition of a single restricted stock grant in 2021 leading to an understatement of non-cash compensation expense for the years ended December 31, 2021 and 2022. The error was determined to be immaterial to all impacted periods.

Although the error was deemed to be immaterial to the consolidated financial statements for the impacted periods, on August 2, 2024, the Audit Committee of the Board of Directors (the “Audit Committee”) of the Company, after discussion with Company management and KPMG LLP (“KPMG”), the Company’s independent registered public accounting firm, concluded that the error was the result of a material weakness in the Company’s internal control over financial reporting (the “Material Weakness”) as of December 31, 2023 as it related to controls over non-routine share based payment awards.

Therefore, the Company’s report regarding the effectiveness of its internal control over financial reporting contained in its Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Annual Report”) filed with the SEC on February 29, 2024 and the statements within the Evaluation of Disclosure Controls and Procedures regarding their effectiveness included in Item 9A, will be updated to reflect this determination and should not be relied upon until updated.

Similarly, KPMG’s opinion relating to the effectiveness of the Company’s internal control over financial reporting as of December 31, 2023 included in the 2023 Annual Report will be updated and should not be relied upon until updated.

Importantly, KPMG has not withdrawn its audit report on the consolidated financial statements included in the 2023 Annual Report, which can still be relied upon.

In summary, there will be no financial changes to the 2023 Annual Report. The Company will submit a 10-K/A to its 2023 Annual Report to reflect the foregoing updated reports and will describe the Company’s plans to remediate the deficiencies in its internal control over financial reporting that led to the error.

Cautionary Statement Regarding Forward-Looking Statements

This filing contains forward looking statements that involve a number of risks and uncertainties. For those statements, we claim protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this filing include information regarding purchases by the Company of its common stock pursuant to any share repurchase program or Rule 10b5-1 trading plan and the Company’s expectations as to the anticipated timing of the filing of the Company’s amended Form 10-K for the year ended December 31, 2023 as well as the filing of the Company’s Form 10-Q for the quarter ended June 30, 2024. Factors that may cause future results to differ materially from management’s current expectations include, among other things, changes in price and volume and the volatility of the Company’s common stock; adverse developments affecting prices and trading of exchange-traded securities, including securities listed on Nasdaq; unexpected or otherwise unplanned or alternative requirements with respect to the capital investments of the Company; that the filing of the amended Form 10-K and the Form 10-Q for the quarter ended June 30, 2024 may take longer than expected; and remediation of the material weakness may not be effected in a timely manner. Any forward-looking statements set forth in this filing speak only as of the date of this filing. We do not undertake to update any of these forward-looking statements to reflect events or circumstances that occur after the date hereof.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

|

Description

|

| |

|

|

|

99.1

|

|

|

| |

|

|

|

|

|

|

|

Exhibit 104

|

|

The cover page from this Current Report on Form 8-K formatted in Inline XBRL.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

TG Therapeutics, Inc.

|

|

|

(Registrant)

|

|

Date: August 6, 2024

|

By:

|

/s/ Sean A. Power

|

|

|

|

Sean A. Power

|

|

|

|

Chief Financial Officer

|

Exhibit 99.1

TG Therapeutics Reports Second Quarter 2024 Financial Results and Raises BRIUMVI® (ublituximab-xiiy) Full Year Revenue Guidance

Second quarter 2024 U.S. BRIUMVI net revenue of $72.6 million

Raising full year 2024 U.S. BRIUMVI net revenue target to approximately $290 - $300 million

Cash flow positive for second quarter 2024

Establishes $250 million credit facility to repay existing debt and to buy back up to $100 million of common stock under a share repurchase program

Initiated phase 1 study in RMS patients for subcutaneous ublituximab and received FDA IND clearance to study azer-cel (allogeneic CD19 CAR-T) in patients with progressive MS

Conference call to be held today, August 6, 2024, at 8:30 AM ET

New York, NY, (August 6, 2024) – TG Therapeutics, Inc. (NASDAQ: TGTX) (the Company or TG Therapeutics) today announced its financial results for the second quarter of 2024, along with recent company developments and provided an update on 2024 revenue guidance.

Michael S. Weiss, the Company’s Chairman and Chief Executive Officer stated, “We are pleased to report another quarter of outperformance across all aspects of our business. From a financial standpoint, our second quarter U.S. BRIUMVI net revenues exceeded expectations, leading us to raise our full year guidance. On the R&D side, we also had an exciting quarter with the first patients now treated with subcutaneous ublituximab in a newly launched Phase 1 study and clearance of our IND for azer-cel, our allogeneic “off-the-shelf” CD19 CAR-T, for patients with progressive MS.” Mr. Weiss continued, “We are also excited to announce our new $250 million credit facility with HealthCare Royalty and Blue Owl Capital that enables us to accelerate the initiation of a share repurchase program and pay down our current debt, while preserving our current cash to continue building our commercial infrastructure, ramping up our marketing efforts, and investing in our R&D programs. We look forward to continuing the positive momentum into the second half of 2024.”

Recent Highlights & Developments

United States (U.S.) Commercialization of BRIUMVI® (ublituximab-xiiy)

|

●

|

BRIUMVI U.S. net product revenue of $72.6 million for the second quarter of 2024, representing >350% growth over the second quarter of 2023

|

|

●

|

Approximately 5,850 BRIUMVI new patient prescriptions received by the TG Therapeutics hub since launch, from approximately 950 healthcare providers at approximately 525 centers, including more than 1,400 prescriptions received in the second quarter of 2024

|

|

●

|

Awarded a national contract with the Department of Veterans Affairs (VA) for BRIUMVI to be the preferred anti-CD20 agent listed on the VA National Formulary for patients with relapsing forms of multiple sclerosis (RMS)

|

Development Updates & General Business

|

●

|

Initiated a phase 1 clinical trial evaluating subcutaneous ublituximab in RMS, with the first patients now dosed

|

|

●

|

Received clearance by the U.S. Food and Drug Administration (FDA) of an Investigational New Drug (IND) application for azer-cel in progressive forms of multiple sclerosis (MS)

|

|

●

|

Obtained three additional patents from the United States Patent and Trademark Office (USPTO) for BRIUMVI, extending patent protection through 2042

|

Corporate Finance Updates

|

●

|

Established a new 5-year, $250 million credit facility with HealthCare Royalty and Blue Owl Capital, set to mature in 2029, primarily to repay $107 million in outstanding debt and accrued interest, which was set to mature in multiple tranches from mid-2025 to January 2026, and to fund the buyback of up to $100 million of currently outstanding shares of the Company’s common stock. The remainder will be available for working capital purposes, providing the Company with additional operational flexibility.

|

2024 Updated Target U.S. BRIUMVI Guidance

|

●

|

Updating BRIUMVI U.S. net product revenue target to approximately $290 to $300 million for the full year 2024 (prior guidance of $270 to $290 million for full year 2024)

|

Remaining 2024 Development Pipeline Anticipated Milestones

|

●

|

Study BRIUMVI in an additional autoimmune disease outside of MS

|

|

●

|

Commence a clinical trial evaluating azer-cel in autoimmune diseases, starting with progressive MS

|

|

●

|

Present additional data from the ENHANCE Phase 3b CD20 switch trial

|

Financial Results for Second Quarter 2024

|

●

|

Product Revenue, net: Product revenue, net was approximately $72.6 million and $123.1 million for the three and six months ended June 30, 2024, respectively, compared to $16.0 million and $23.8 million for the three and six months ended June 30, 2023, respectively. Product revenue, net for both the three and six months ended June 30, 2024 and 2023, consisted of net product sales of BRIUMVI in the United States.

|

|

●

|

License, milestone, royalty and other revenue: License, milestone, royalty and other revenue was approximately $0.9 million and $13.9 million for the three and six months ended June 30, 2024, respectively, compared to less than $0.1 million for both the three and six months ended June 30, 2023, respectively. License, milestone, royalty and other revenue for the six months ended June 30, 2024 is predominantly comprised of a $12.5 million milestone payment under the Neuraxpharm Commercialization Agreement for the first key market commercial launch of BRIUMVI in the European Union (EU) which occurred in the first quarter of 2024.

|

|

●

|

R&D Expenses: Total research and development (R&D) expense was approximately $17.6 million and $50.3 million for the three and six months ended June 30, 2024, respectively, compared to $28.1 million and $44.0 million for the three and six months ended June 30, 2023, respectively. The decrease in R&D expense during the three months ended June 30, 2024 was primarily attributable to reduced clinical trial related expense and license milestones incurred during the period ended June 30, 2024. The increase in R&D expense during the six months ended June 30, 2024 was primarily attributable to license and milestone expense related to the license agreement with Precision BioSciences, Inc., as well as additional manufacturing and development costs incurred in connection with our ublituximab subcutaneous development work during the period.

|

|

●

|

SG&A Expenses: Total selling, general and administrative (SG&A) expense was approximately $38.8 million and $73.4 million for the three and six months ended June 30, 2024, respectively, compared to $30.7 million and $58.8 million for the three and six months ended June 30, 2023, respectively. The increase in both periods was primarily due to the scale-up of the BRIUMVI commercial launch, including personnel.

|

|

●

|

Net Income (Loss): Net income (loss) was $6.9 million and $(3.8) million for the three and six months ended June 30, 2024, respectively, compared to a net loss of $(47.6) million and $(86.8) million for the three and six months ended June 30, 2023, respectively.

|

|

●

|

Cash Position and Financial Guidance: Cash, cash equivalents and investment securities were $217.3 million as of June 30, 2024, which excludes any increase in cash associated with the new $250 million credit facility. We anticipate that our cash, cash equivalents and investment securities as of June 30, 2024, combined with the projected revenues from BRIUMVI, will be sufficient to fund our business based on our current operating plan.

|

CONFERENCE CALL INFORMATION

The Company will host a conference call today, August 6, 2024 at 8:30 AM ET to discuss the Company’s financial results from the second quarter ended June 30, 2024.

To participate in the conference call, please call 1-877-407-8029 (U.S.), 1-201-689-8029 (outside the U.S.), Conference Title: TG Therapeutics. A live audio webcast will be available on the Events page, located within the Investors & Media section, of the Company's website at http://ir.tgtherapeutics.com/events. An audio recording of the conference call will also be available for a period of 30 days after the call.

ABOUT BRIUMVI® (ublituximab-xiiy) 150 mg/6 mL Injection for IV

BRIUMVI is a novel monoclonal antibody that targets a unique epitope on CD20-expressing B-cells. Targeting CD20 using monoclonal antibodies has proven to be an important therapeutic approach for the management of autoimmune disorders, such as RMS. BRIUMVI is uniquely designed to lack certain sugar molecules normally expressed on the antibody. Removal of these sugar molecules, a process called glycoengineering, allows for efficient B-cell depletion at low doses.

BRIUMVI is indicated in the U.S. for the treatment of adults with RMS, including clinically isolated syndrome, relapsing-remitting disease, and active secondary progressive disease and in the EU and UK for the treatment of adult patients with RMS with active disease defined by clinical or imaging features.

A list of authorized specialty distributors can be found at www.briumvi.com.

IMPORTANT SAFETY INFORMATION

Contraindications: BRIUMVI is contraindicated in patients with:

|

●

|

Active Hepatitis B Virus infection

|

|

●

|

A history of life-threatening infusion reaction to BRIUMVI

|

WARNINGS AND PRECAUTIONS

Infusion Reactions: BRIUMVI can cause infusion reactions, which can include pyrexia, chills, headache, influenza-like illness, tachycardia, nausea, throat irritation, erythema, and an anaphylactic reaction. In MS clinical trials, the incidence of infusion reactions in BRIUMVI-treated patients who received infusion reaction-limiting premedication prior to each infusion was 48%, with the highest incidence within 24 hours of the first infusion. 0.6% of BRIUMVI-treated patients experienced infusion reactions that were serious, some requiring hospitalization.

Observe treated patients for infusion reactions during the infusion and for at least one hour after the completion of the first two infusions unless infusion reaction and/or hypersensitivity has been observed in association with the current or any prior infusion. Inform patients that infusion reactions can occur up to 24 hours after the infusion. Administer the recommended pre-medication to reduce the frequency and severity of infusion reactions. If life-threatening, stop the infusion immediately, permanently discontinue BRIUMVI, and administer appropriate supportive treatment. Less severe infusion reactions may involve temporarily stopping the infusion, reducing the infusion rate, and/or administering symptomatic treatment.

Infections: Serious, life-threatening or fatal, bacterial and viral infections have been reported in BRIUMVI-treated patients. In MS clinical trials, the overall rate of infections in BRIUMVI-treated patients was 56%, compared to 54% in teriflunomide-treated patients. The rate of serious infections was 5% compared to 3%, respectively. There were 3 infection-related deaths in BRIUMVI-treated patients. The most common infections in BRIUMVI-treated patients included upper respiratory tract infection (45%) and urinary tract infection (10%). Delay BRIUMVI administration in patients with an active infection until the infection is resolved.

Consider the potential for increased immunosuppressive effects when initiating BRIUMVI after immunosuppressive therapy or initiating an immunosuppressive therapy after BRIUMVI.

Hepatitis B Virus (HBV) Reactivation: HBV reactivation occurred in an MS patient treated with BRIUMVI in clinical trials. Fulminant hepatitis, hepatic failure, and death caused by HBV reactivation have occurred in patients treated with anti-CD20 antibodies. Perform HBV screening in all patients before initiation of treatment with BRIUMVI. Do not start treatment with BRIUMVI in patients with active HBV confirmed by positive results for HBsAg and anti-HB tests. For patients who are negative for surface antigen [HBsAg] and positive for HB core antibody [HBcAb+] or are carriers of HBV [HBsAg+], consult a liver disease expert before starting and during treatment.

Progressive Multifocal Leukoencephalopathy (PML): Although no cases of PML have occurred in BRIUMVI-treated MS patients, JC virus infection resulting in PML has been observed in patients treated with other anti-CD20 antibodies and other MS therapies.

If PML is suspected, withhold BRIUMVI and perform an appropriate diagnostic evaluation. Typical symptoms associated with PML are diverse, progress over days to weeks, and include progressive weakness on one side of the body or clumsiness of limbs, disturbance of vision, and changes in thinking, memory, and orientation leading to confusion and personality changes.

MRI findings may be apparent before clinical signs or symptoms; monitoring for signs consistent with PML may be useful. Further investigate suspicious findings to allow for an early diagnosis of PML, if present. Following discontinuation of another MS medication associated with PML, lower PML-related mortality and morbidity have been reported in patients who were initially asymptomatic at diagnosis compared to patients who had characteristic clinical signs and symptoms at diagnosis.

If PML is confirmed, treatment with BRIUMVI should be discontinued.

Vaccinations: Administer all immunizations according to immunization guidelines: for live or live-attenuated vaccines, at least 4 weeks and, whenever possible, at least 2 weeks prior to initiation of BRIUMVI for non-live vaccines. BRIUMVI may interfere with the effectiveness of non-live vaccines. The safety of immunization with live or live-attenuated vaccines during or following administration of BRIUMVI has not been studied. Vaccination with live virus vaccines is not recommended during treatment and until B-cell repletion.

Vaccination of Infants Born to Mothers Treated with BRIUMVI During Pregnancy: In infants of mothers exposed to BRIUMVI during pregnancy, assess B-cell counts prior to administration of live or live-attenuated vaccines as measured by CD19+ B-cells. Depletion of B-cells in these infants may increase the risks from live or live-attenuated vaccines. Inactivated or non-live vaccines may be administered prior to B-cell recovery. Assessment of vaccine immune responses, including consultation with a qualified specialist, should be considered to determine whether a protective immune response was mounted.

Fetal Risk: Based on data from animal studies, BRIUMVI may cause fetal harm when administered to a pregnant woman. Transient peripheral B-cell depletion and lymphocytopenia have been reported in infants born to mothers exposed to other anti-CD20 B-cell depleting antibodies during pregnancy. A pregnancy test is recommended in females of reproductive potential prior to each infusion. Advise females of reproductive potential to use effective contraception during BRIUMVI treatment and for 6 months after the last dose.

Reduction in Immunoglobulins: As expected with any B-cell depleting therapy, decreased immunoglobulin levels were observed. Decrease in immunoglobulin M (IgM) was reported in 0.6% of BRIUMVI-treated patients, compared to none of the patients treated with teriflunomide in RMS clinical trials. Monitor the levels of quantitative serum immunoglobulins during treatment, especially in patients with opportunistic or recurrent infections, and after discontinuation of therapy, until B-cell repletion. Consider discontinuing BRIUMVI therapy if a patient with low immunoglobulins develops a serious opportunistic infection or recurrent infections, or if prolonged hypogammaglobulinemia requires treatment with intravenous immunoglobulins.

Most Common Adverse Reactions: The most common adverse reactions in RMS trials (incidence of at least 10%) were infusion reactions and upper respiratory tract infections.

Physicians, pharmacists, or other healthcare professionals with questions about BRIUMVI should visit www.briumvi.com.

The full Summary of Product Characteristics approved in the European Union (EU) for BRIUMVI can be found here Briumvi | European Medicines Agency (europa.eu).

ABOUT BRIUMVI PATIENT SUPPORT in the U.S.

BRIUMVI Patient Support is a flexible program designed by TG Therapeutics to support U.S. patients through their treatment journey in a way that works best for them. More information about the BRIUMVI Patient Support program can be accessed at www.briumvipatientsupport.com.

ABOUT MULTIPLE SCLEROSIS

Relapsing multiple sclerosis (RMS) is a chronic demyelinating disease of the central nervous system (CNS) and includes people with relapsing-remitting multiple sclerosis (RRMS) and people with secondary progressive multiple sclerosis (SPMS) who continue to experience relapses. RRMS is the most common form of multiple sclerosis (MS) and is characterized by episodes of new or worsening signs or symptoms (relapses) followed by periods of recovery. It is estimated that nearly 1 million people are living with MS in the United States and approximately 85% are initially diagnosed with RRMS.1,2 The majority of people who are diagnosed with RRMS will eventually transition to SPMS, in which they experience steadily worsening disability over time. Worldwide, more than 2.3 million people have a diagnosis of MS.1

ABOUT TG THERAPEUTICS

TG Therapeutics is a fully integrated, commercial stage, biopharmaceutical company focused on the acquisition, development, and commercialization of novel treatments for B-cell diseases. In addition to a research pipeline including several investigational medicines, TG Therapeutics has received approval from the U.S. Food and Drug Administration (FDA) for BRIUMVI® (ublituximab-xiiy) for the treatment of adult patients with relapsing forms of multiple sclerosis, including clinically isolated syndrome, relapsing-remitting disease, and active secondary progressive disease, as well as approval by the European Commission (EC) and the Medicines and Healthcare Products Regulatory Agency (MHRA) for BRIUMVI to treat adult patients with RMS who have active disease defined by clinical or imaging features in Europe and the United Kingdom, respectively. For more information, visit www.tgtherapeutics.com, and follow us on X (formerly Twitter) @TGTherapeutics and on LinkedIn.

BRIUMVI® is a registered trademark of TG Therapeutics, Inc.

Cautionary Statement

This press release contains forward-looking statements that involve a number of risks and uncertainties. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Any forward-looking statements in this press release are based on management's current expectations and beliefs and are subject to a number of risks, uncertainties and important factors that may cause actual events or results to differ materially from those expressed or implied by any forward-looking statements contained in this press release. In addition to the risk factors identified from time to time in our reports filed with the U.S. Securities and Exchange Commission (SEC), factors that could cause our actual results to differ materially include the below.

Such forward looking statements include but are not limited to statements regarding expectations for the timing and success of the ongoing commercialization and availability of BRIUMVI® (ublituximab-xiiy) for RMS in the United States and Europe; anticipated healthcare professional (HCP) and patient acceptance and use of BRIUMVI for the approved indications; expectations of future revenue for BRIUMVI, expenses, or profits; expectations for our pipeline products; our ability to initiate and execute the proposed share repurchase program; and the results of the ENHANCE or ULTIMATE I & II Phase 3 studies.

Additional factors that could cause our actual results to differ materially include the following: the Company’s ability to maintain and continue to maintain a commercial infrastructure for BRIUMVI, and to successfully, or in the timeframe projected, market and sell BRIUMVI; the risk that trends in prescriptions are not maintained or that prescriptions are not filled; the failure to obtain and maintain payor coverage; the risk that HCP interest in BRIUMVI will not be sustained; the risk that momentum in sales for BRIUMVI will not build during the course of the year; the risk that the commercialization of BRIUMVI does not continue to exceed expectations; the risk that our current or future BRIUMVI revenue targets will not be achieved; the failure to obtain and maintain requisite regulatory approvals, including the risk that the Company fails to satisfy post-approval regulatory requirements, the potential for variation from the Company’s projections and estimates about the potential market for BRIUMVI due to a number of factors, including, further limitations that regulators may impose on the required labeling for BRIUMVI (such as modifications, resulting from safety signals that arise in the post-marketing setting or in the long-term extension study from the ULTIMATE I and II clinical trials); the Company’s ability to meet post-approval compliance obligations (on topics, including but not limited to product quality, product distribution and supply chain, pharmacovigilance, and sales and marketing); the Company’s reliance on third parties for manufacturing, distribution and supply, and other support functions for our clinical and commercial products, including BRIUMVI, and the ability of the Company and its manufacturers and suppliers to produce and deliver BRIUMVI to meet the market demand for BRIUMVI; potential regulatory challenges to the Company’s plans to seek marketing approval for the product in jurisdictions outside of the U.S.; the uncertainties inherent in research and development; the risk that any individual patient’s clinical experience in the post-marketing setting, or the aggregate patient experience in the post-marketing setting, may differ from that demonstrated in controlled clinical trials such as ULTIMATE I and II; the risk that the Company does not achieve its 2024 development pipeline anticipated milestones in the timeframe projected or at all, including the development of subcutaneous BRIUMVI, commencing a trial evaluating BRIUMVI in an autoimmune disease outside of MS, or commencing a trial evaluating azer-cel; our ability to initiate and execute the proposed share repurchase program; and general political, economic, and business conditions. Further discussion about these and other risks and uncertainties can be found in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and in our other filings with the SEC.

Any forward-looking statements set forth in this press release speak only as of the date of this press release. We do not undertake to update any of these forward-looking statements to reflect events or circumstances that occur after the date hereof. This press release and prior releases are available at www.tgtherapeutics.com. The information found on our website is not incorporated by reference into this press release and is included for reference purposes only.

CONTACT:

Investor Relations

Email: ir@tgtxinc.com

Telephone: 1.877.575.TGTX (8489), Option 4

Media Relations:

Email: media@tgtxinc.com

Telephone: 1.877.575.TGTX (8489), Option 6

1. MS Prevalence. National Multiple Sclerosis Society website. https://www.nationalmssociety.org/About-the-Society/MS-Prevalence. Accessed October 26, 2020. 2. Multiple Sclerosis International Federation, 2013 via Datamonitor p. 236.

TG Therapeutics, Inc.

Selected Condensed Consolidated Financial Data

Statements of Operations Information (in thousands, except share and per share amounts; unaudited):

| |

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue, net

|

|

|

72,596 |

|

|

|

16,036 |

|

|

|

123,084 |

|

|

|

23,801 |

|

|

License, milestone, royalty and other revenue

|

|

|

870 |

|

|

|

38 |

|

|

|

13,855 |

|

|

|

76 |

|

|

Total revenue

|

|

|

73,466 |

|

|

|

16,074 |

|

|

|

136,939 |

|

|

|

23,877 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue

|

|

|

8,304 |

|

|

|

1,911 |

|

|

|

13,745 |

|

|

|

2,768 |

|

|

Research and development:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noncash compensation

|

|

|

2,520 |

|

|

|

5,664 |

|

|

|

4,972 |

|

|

|

7,247 |

|

|

Other research and development

|

|

|

15,036 |

|

|

|

22,458 |

|

|

|

45,306 |

|

|

|

36,744 |

|

|

Total research and development

|

|

|

17,556 |

|

|

|

28,122 |

|

|

|

50,278 |

|

|

|

43,991 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noncash compensation

|

|

|

6,962 |

|

|

|

6,877 |

|

|

|

13,848 |

|

|

|

12,117 |

|

|

Other selling, general and administrative

|

|

|

31,828 |

|

|

|

23,838 |

|

|

|

59,522 |

|

|

|

46,666 |

|

|

Total selling, general and administrative

|

|

|

38,790 |

|

|

|

30,715 |

|

|

|

73,370 |

|

|

|

58,783 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses

|

|

|

64,650 |

|

|

|

60,748 |

|

|

|

137,393 |

|

|

|

105,542 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

|

8,816 |

|

|

|

(44,674 |

) |

|

|

(454 |

) |

|

|

(81,665 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expense (income):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

3,977 |

|

|

|

3,627 |

|

|

|

6,265 |

|

|

|

6,471 |

|

|

Other income

|

|

|

(1,712 |

) |

|

|

(691 |

) |

|

|

(2,592 |

) |

|

|

(1,295 |

) |

|

Total other expense, net

|

|

|

2,265 |

|

|

|

2,936 |

|

|

|

3,673 |

|

|

|

5,176 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) before taxes

|

|

$ |

6,551 |

|

|

$ |

(47,610 |

) |

|

$ |

(4,127 |

) |

|

$ |

(86,841 |

) |

|

Income tax benefit

|

|

|

328 |

|

|

|

- |

|

|

|

299 |

|

|

|

- |

|

|

Net Income (loss)

|

|

$ |

6,879 |

|

|

$ |

(47,610 |

) |

|

$ |

(3,828 |

) |

|

$ |

(86,841 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.05 |

|

|

$ |

(0.34 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.62 |

) |

|

Diluted

|

|

$ |

0.04 |

|

|

$ |

(0.34 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.62 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares of common stock outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

144,727,482 |

|

|

|

141,503,738 |

|

|

|

145,464,255 |

|

|

|

140,911,295 |

|

|

Diluted

|

|

|

159,423,571 |

|

|

|

141,503,738 |

|

|

|

145,464,255 |

|

|

|

140,911,295 |

|

Condensed Balance Sheet Information (in thousands):

| |

|

June 30, 2024

(Unaudited)

|

|

|

December 31, 2023*

|

|

|

Cash, cash equivalents and investment securities

|

|

|

217,252 |

|

|

|

217,508 |

|

|

Total assets

|

|

|

401,207 |

|

|

|

329,587 |

|

|

Total equity

|

|

|

177,568 |

|

|

|

160,502 |

|

* Condensed from audited financial statements

v3.24.2.u1

Document And Entity Information

|

Aug. 02, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

TG Therapeutics, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 02, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-32639

|

| Entity, Tax Identification Number |

36-3898269

|

| Entity, Address, Address Line One |

3020 Carrington Mill Blvd, Suite 475

|

| Entity, Address, City or Town |

Morrisville

|

| Entity, Address, State or Province |

NC

|

| Entity, Address, Postal Zip Code |

27560

|

| City Area Code |

212

|

| Local Phone Number |

554-4484

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

TGTX

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001001316

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

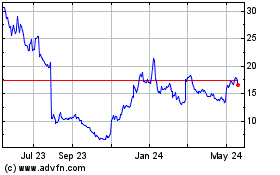

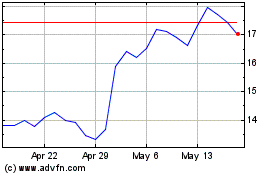

TG Therapeutics (NASDAQ:TGTX)

Historical Stock Chart

From Oct 2024 to Nov 2024

TG Therapeutics (NASDAQ:TGTX)

Historical Stock Chart

From Nov 2023 to Nov 2024