Vessels, undersea cables, and offshore oil installations increasingly becoming “gray zone” targets

10 December 2024 - 11:40PM

The threat to vessels, undersea cables, and offshore oil

installations has increased due to the availability of advanced

weapons and the willingness of certain states – particularly Russia

and Iran – to disregard international maritime laws. This is just

one identified emerging risk from ‘gray zone aggression’, meaning

any action used to weaken a country by means short of war,

according to the latest Political Risk Index from WTW (NASDAQ:

WTW), a leading global advisory, broking, and solutions company.

This edition of the index is developed with input from WTW’s

marine and aerospace teams, sectors notably vulnerable to gray zone

attacks, alongside support from the WTW Research Network and the

crisis management team, both experts in addressing gray zone

aggression and global security risks. The index follows WTW’s

annual political risk survey published earlier this year, which

found that 69 percent of respondents were impacted by

geopolitically-related supply chain disruptions in 2024, including

gray zone attacks on global shipping.

WTW’s research identifies three primary types of gray zone

flashpoints: military conflicts and rivalries (e.g. Ukraine, South

China Sea), fragile states (e.g. Lebanon, Yemen, Syria, Iraq), and

ideological polarisation (e.g. political interference in Latin

American elections). Examples of hybrid warfare include destruction

of critical infrastructure, state cyber-attacks, weaponisation of

migration, sponsorship of violent non-state actors, disinformation

campaigns, and declared or undeclared economic sanctions. The

report also observes an increasing trend in gray zone activities,

partly driven by rising middle powers operating with limited

military budgets.

Other findings include:

- Marine assets: The global shadow fleet, which

has grown exponentially since Russia began using it to export oil,

was identified as another threat in the report. The vessels lack

standard P&I insurance, do not undergo regular maintenance, and

habitually alter their AIS signals.

- Insurance impact: Gray zone attacks causing

exclusions and cancellations of insurance cover lead to disruptions

and rerouting, affecting businesses reliant on timely shipping.

However, trade disruption insurance offers some recourse for

impacted companies.

- Aerospace threat: There is an increasing

possibility for the aerospace sector to become a key gray zone

target, and attacks such as GPS jamming and spoofing are already

happening.

Samuel Wilkin, director of political risk analytics, WTW said:

“Without insurance, many ships will not sail and planes will not

fly, so improving our understanding of gray zone risks is vital for

the protection of people and assets and the health of global

commerce. These attacks appear to have soared in recent years, for

many reasons. One reason is that countries that are deeply

interconnected by globalisation increasingly find themselves in

adversarial relationships, and these deep interconnections offer

many avenues for gray zone action, especially actions directed at

globalised businesses. Another reason is that new technologies have

enabled gray zone actions, including cyber-attacks and remote

attacks by drones. Hybrid warfare is likely to continue to rise and

evolve, so insurers need to be able to understand the implications

of ambiguous gray zone activities to properly assess risk.”

The index can be downloaded here.

About WTW

At WTW (NASDAQ: WTW), we provide data-driven, insight-led

solutions in the areas of people, risk and capital. Leveraging the

global view and local expertise of our colleagues serving 140

countries and markets, we help organizations sharpen their

strategy, enhance organizational resilience, motivate their

workforce and maximize performance.

Working shoulder to shoulder with our clients, we uncover

opportunities for sustainable success—and provide perspective that

moves you.

Learn more at wtwco.com.

Media contact

Sarah Booker: Sarah.Booker@wtwco.com / +44 7917 722040

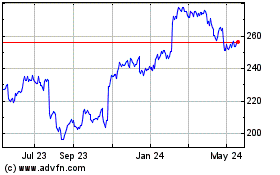

Willis Towers Watson Pub... (NASDAQ:WTW)

Historical Stock Chart

From Dec 2024 to Jan 2025

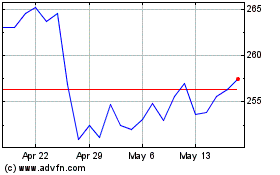

Willis Towers Watson Pub... (NASDAQ:WTW)

Historical Stock Chart

From Jan 2024 to Jan 2025