Yoshiharu Global Co. (NASDAQ: YOSH) (“Yoshiharu” or the

“Company”), a restaurant operator specializing in

authentic Japanese ramen & rolls, today announced that it has

entered into a securities purchase agreement (the “Securities

Purchase Agreement”), under which the Company has sold and issued a

senior unsecured convertible promissory note in an original

principal amount of $1.1 million (the “Note”) to Crom Structured

Opportunities Fund I, LP (the “Investor”). The Company also

announced that it has entered into an equity purchase agreement

(the “Purchase Agreement”) establishing an equity line of credit

with Crom Structured Opportunities Fund I, LP, under which the

Company will have the right, but not the obligation, to issue and

sell to the Investor up to $10.0 million in shares of the Company’s

common stock from time to time, subject to certain conditions set

forth therein (the “ELOC”).

The Company entered into a Securities Purchase

Agreement with the Investor pursuant to which the Company issued

and sold to the Investor a 10% Original Issue Discount (“OID”)

promissory note in the aggregate principal amount of $1,100,000

(the “Note”) for a purchase price of $1,000,000. The Company will

pay a one-time interest charge on the principal amount of the Note

at a rate of 5% when such amounts become due and payable. The

maturity date of the Note is January 6, 2026, unless repurchased or

converted in accordance with its terms prior to such date.

The Investor has the right at any time (subject

to certain ownership limitations) to convert all or any portion of

the then outstanding and unpaid principal amount of the Note into

shares of Class A Common Stock (the “Conversion Shares”). The

conversion price will be equal to the lesser of: (i) $5.00 or (ii)

90% of the lowest dollar volume weighted average price on any

trading day during the five trading days immediately preceding the

conversion date (the “Conversion Price”).

Under the terms of the ELOC, Yoshiharu has the

right, but not the obligation, to issue and sell to the Investor up

to $10.0 million in shares of the Company’s common stock subject to

customary conditions. The Company may request that the Investor

purchase the ELOC Shares at any time during the commitment period

commencing on January 6, 2025 (the “Effective Date”) and

terminating on January 6, 2027, subject to a registration statement

being effective for an advance notice to be delivered. Each

issuance and sale by the Company to the Investor under the Purchase

Agreement (an “Advance”) is to be effectuated by means of a written

notice setting forth the ELOC Shares which the Company intends to

require the Investor to purchase (the “Advance Notice”). The

purchase price under the ELOC is 93% of the lowest VWAP during the

5 trading days following the clearing date of the respective

advance shares.

The Company has also agreed to pay the Investor

a commitment fee equal to 31,948 shares of Class A Common Stock

(the “Commitment Shares”) in consideration for the Investor’s entry

into the Purchase Agreement.

In accordance with the terms of the Securities

Purchase Agreement, the Company agreed to file with the U.S.

Securities and Exchange Commission (the “SEC”) a registration

statement covering the resale of all of Class A Common Stock which

the Investor may acquire pursuant to the Securities Purchase

Agreement and Purchase Agreement.

Yoshiharu intends to use the net proceeds from

the Note and ELOC for working capital and general corporate

purposes to support its future growth.

Further details on the Securities Purchase

Agreement will be disclosed in a Current Report on Form 8-K that

the Company intends to file with the SEC on January 13, 2025.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of the securities referred to in this press release in any

state or other jurisdiction in which such offer, solicitation or

sale would be unlawful prior to the registration or qualification

under the securities laws of any such state or jurisdiction. Any

offering of Yoshiharu’s common stock under the registration

statements referred to in this press release will be made only by

means of a prospectus.

About Yoshiharu Global Co.

Yoshiharu is a fast-growing restaurant operator

and was born out of the idea of introducing the modernized Japanese

dining experience to customers all over the world. Specializing in

Japanese ramen, Yoshiharu gained recognition as a leading ramen

restaurant in Southern California within six months of its 2016

debut and has continued to expand its top-notch restaurant service

across Southern California and Las Vegas, currently owning and

operating 14 restaurants.

For more information, please visit

www.yoshiharuramen.com.

Forward-Looking Statements

This press release includes certain

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995, including without

limitation, statements regarding our position to execute on our

growth strategy, and our ability to expand our leadership position.

These forward-looking statements include, but are not limited to,

the Company's beliefs, plans, goals, objectives, expectations,

assumptions, estimates, intentions, future performance, other

statements that are not historical facts and statements identified

by words such as "expects", "anticipates", "intends", "plans",

"believes", "seeks", "estimates" or words of similar meaning. These

forward-looking statements reflect our current views about our

plans, intentions, expectations, strategies and prospects, which

are based on the information currently available to us and on

assumptions we have made. Although we believe that our plans,

intentions, expectations, strategies and prospects as reflected in,

or suggested by, these forward-looking statements are reasonable,

we can give no assurance that the plans, intentions, expectations

or strategies will be attained or achieved. Forward-looking

statements involve inherent risks and uncertainties which could

cause actual results to differ materially from those in the

forward-looking statements, as a result of various factors

including those risks and uncertainties described in the Risk

Factors and Management's Discussion and Analysis of Financial

Condition and Results of Operations sections of our filings with

the SEC including our Form 10-K for the year ended December 31,

2023, and subsequent reports we file with the SEC from time to

time, which can be found on the SEC's website at www.sec.gov. Such

risks, uncertainties, and other factors include, but are not

limited to: the risk that our plans to maintain and increase

liquidity may not be successful to remediate our past operating

losses; the risk that we may not be able to successfully implement

our growth strategy if we are unable to identify appropriate sites

for restaurant locations, expand in existing and new markets,

obtain favorable lease terms, attract guests to our restaurants or

hire and retain personnel; that our operating results and growth

strategies will be closely tied to the success of our future

franchise partners and we will have limited control with respect to

their operations; the risk that we may face negative publicity or

damage to our reputation, which could arise from concerns regarding

food safety and foodborne illness or other matters; the risk that

that minimum wage increases and mandated employee benefits could

cause a significant increase in our labor costs; and the risk that

our marketing programs may not be successful, and our new menu

items, advertising campaigns and restaurant designs and remodels

may not generate increased sales or profits. We urge you to

consider those risks and uncertainties in evaluating our

forward-looking statements. We caution readers not to place undue

reliance upon any such forward-looking statements, which speak only

as of the date made. The Company undertakes no obligation to update

these statements for revisions or changes after the date of this

release, except as required by law.

Investor Relations

Contact:Larry W HolubDirectorMZ North

AmericaYOSH@mzgroup.us312-261-6412

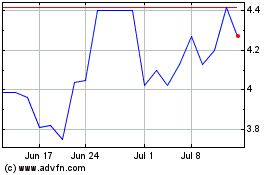

Yoshiharu Global (NASDAQ:YOSH)

Historical Stock Chart

From Dec 2024 to Jan 2025

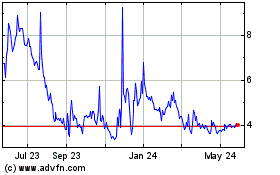

Yoshiharu Global (NASDAQ:YOSH)

Historical Stock Chart

From Jan 2024 to Jan 2025