Albertsons Companies, Inc. (NYSE: ACI) (the "Company") today

reported results for the third quarter of fiscal 2024, which ended

November 30, 2024.

Third Quarter of Fiscal 2024

Highlights

- Identical sales increased 2.0%

- Digital sales increased 23%

- Loyalty members increased 15% to 44.3 million

- Net income of $401 million, or $0.69 per share

- Adjusted net income of $420 million, or $0.71 per share

- Adjusted EBITDA of $1,065 million

- Increased quarterly common stock dividend by 25% to $0.15 per

share

"We delivered solid operating and financial performance in the

third quarter of fiscal 2024 in an environment where the consumer

remains cautious," said Vivek Sankaran, CEO. "Investments in our

Customers for Life strategy drove increased digital engagement

across our platforms, evidenced by strong growth in our digital

sales, pharmacy operations, and membership in our loyalty program.

We want to thank our teams for their ongoing commitment to serving

our customers and supporting the communities in which we operate,

especially during the holiday season."

Sankaran added, "As we look ahead to the balance of fiscal 2024

and beyond, we are energized about our plans to accelerate growth

through our Customers for Life strategy, leveraging investments to

enhance digital engagement and omnichannel revenue growth, improve

our value proposition with customers, and drive digital media

growth. At the same time, we expect our robust productivity agenda

to provide fuel to invest in the business. We look forward to

driving growth and providing value to our customers and returns to

our stockholders."

Third Quarter of Fiscal 2024

Results

Net sales and other revenue increased 1.2% to $18,774.5 million

for the 12 weeks ended November 30, 2024 ("third quarter of fiscal

2024") from $18,557.3 million during the 12 weeks ended December 2,

2023 ("third quarter of fiscal 2023"). The increase was driven by

our 2.0% increase in identical sales, with strong growth in

pharmacy sales being the primary driver of the identical sales

increase. We also continued to grow our digital sales with a 23%

increase during the third quarter of fiscal 2024. The increase in

Net sales and other revenue was partially offset by lower fuel

sales.

Gross margin rate decreased to 27.9% during the third quarter of

fiscal 2024 compared to 28.0% during the third quarter of fiscal

2023. Excluding the impact of fuel and LIFO expense, gross margin

rate decreased 27 basis points compared to the third quarter of

fiscal 2023. The strong growth in pharmacy sales, which carries an

overall lower gross margin rate, and increases in picking and

delivery costs related to the continued growth in our digital sales

were the primary drivers of the decrease, partially offset by the

benefits from our productivity initiatives.

Selling and administrative expenses increased to 25.1% of Net

sales and other revenue during the third quarter of fiscal 2024

compared to 24.8% during the third quarter of fiscal 2023.

Excluding the impact of fuel, Selling and administrative expenses

as a percentage of Net sales and other revenue increased six basis

points. The increase in Selling and administrative expenses as a

percentage of Net sales and other revenue was primarily

attributable to Merger-related costs and an increase in occupancy

costs including third-party store security services, partially

offset by the leveraging of employee costs and benefits from our

productivity initiatives.

Net loss on property dispositions and impairment losses was

$10.2 million during the third quarter of fiscal 2024 compared to

net loss of $23.9 million during the third quarter of fiscal

2023.

Interest expense, net was $109.0 million during the third

quarter of fiscal 2024 compared to $116.3 million during the third

quarter of fiscal 2023. The decrease in interest expense, net was

primarily attributable to lower average outstanding borrowings.

Other income, net was $5.6 million during the third quarter of

fiscal 2024 compared to $6.7 million during the third quarter of

fiscal 2023.

Income tax expense was $14.5 million, representing a 3.5%

effective tax rate, during the third quarter of fiscal 2024

compared to $95.1 million, representing a 20.8% effective tax rate,

during the third quarter of fiscal 2023. The decrease in the

effective rate was primarily driven by the recognition of $81.0

million of discrete state income tax benefits related to the

settlement of audits.

Net income was $400.6 million, or $0.69 per share, during the

third quarter of fiscal 2024, compared to $361.4 million, or $0.62

per share, during the third quarter of fiscal 2023. The third

quarter of fiscal 2024 included the $81.0 million or $0.14 per

share benefit related to certain discrete state income tax benefits

related to the settlement of audits.

Adjusted net income was $420.3 million, or $0.71 per share,

during the third quarter of fiscal 2024, compared to $462.3

million, or $0.79 per share, during the third quarter of fiscal

2023.

Adjusted EBITDA was $1,065.1 million, or 5.7% of Net sales and

other revenue, during the third quarter of fiscal 2024 compared to

$1,106.5 million, or 6.0% of Net sales and other revenue, during

the third quarter of fiscal 2023.

Capital Allocation and Common Stock

Repurchase Program

During the first 40 weeks of fiscal 2024, capital expenditures

were $1,446.7 million, which primarily included the completion of

84 remodels, the opening of nine new stores and continued

investment in our digital and technology platforms. During the

third quarter of fiscal 2024, the Company also paid its quarterly

dividend of $0.12 per share on November 8, 2024 to stockholders of

record as of October 28, 2024.

On December 11, 2024, subsequent to the end of the third quarter

of fiscal 2024, the Company announced that the Board of Directors

(the "Board") increased the quarterly cash dividend 25% from $0.12

per common share to $0.15 per common share. On January 8, 2025, the

Company announced the next quarterly dividend payment of $0.15 per

share of Class A common stock to be paid on February 7, 2025 to

stockholders of record as of the close of business on January 24,

2025.

On December 11, 2024, subsequent to the end of the third quarter

of fiscal 2024, the Company announced that the Board has authorized

a share repurchase program of up to $2.0 billion of our common

stock, inclusive of the existing authorization. The share

repurchase program could include open market repurchases,

accelerated share repurchase programs, tender offers, block trades,

potential privately negotiated transactions, or trading plans in

compliance with the federal securities laws.

Termination of the Merger

Agreement

As previously disclosed, on October 13, 2022, the Company, The

Kroger Co. ("Kroger") and Kettle Merger Sub, Inc., a wholly owned

subsidiary of Kroger ("Merger Sub"), entered into an Agreement and

Plan of Merger (the "Merger Agreement"), pursuant to which Merger

Sub would have been merged with and into the Company (the

"Merger"), with the Company surviving the Merger as the surviving

corporation and a direct, wholly owned subsidiary of Kroger. On

December 10, 2024, subsequent to the end of the third quarter of

fiscal 2024, the United States District Court for the District of

Oregon issued a preliminary injunction in the case Federal Trade

Commission et al. v. The Kroger Company and Albertsons Companies,

Inc. (Case No.: 3:24-cv-00347-AN), whereby the court enjoined the

consummation of the Merger. In light of the preliminary injunction,

and in accordance with Section 8.1(e) of the Merger Agreement, the

Company exercised its right to terminate the Merger Agreement and

sent a notice to Kroger on December 10, 2024 terminating the Merger

Agreement. Also on December 10, 2024, the King County Superior

Court for the State of Washington issued a permanent injunction in

the case State of Washington v. Kroger Co. et al (Case No.:

24-2-00977-9 SEA) whereby it enjoined the consummation of the

Merger.

Following the Company's termination of the Merger Agreement, on

December 10, 2024, the Company filed a lawsuit against Kroger in

the Court of Chancery in the State of Delaware seeking damages in

an amount to be determined at trial, in addition to the $600

million termination fee which Kroger is already obligated to pay

the Company under the Merger Agreement. On December 11, 2024,

Kroger delivered a termination notice to the Company, alleging that

the Company's December 10, 2024 termination notice was not

effective and that Kroger had no obligation to pay the $600 million

termination fee. Details regarding the termination of the Merger

Agreement and ensuing litigation are available in our Quarterly

Report on Form 10-Q for the third quarter of fiscal 2024 filed with

the Securities and Exchange Commission ("SEC") on January 8,

2025.

Fiscal 2024 Outlook

The Company is providing an updated fiscal 2024 outlook and

expects its financial results to be as follows:

- Identical sales growth in the range of 1.8% to 2.0% (previously

1.8% to 2.2%)

- Adjusted EBITDA in the range of $3.95 billion to $3.99 billion

(previously $3.90 billion to $3.98 billion)

- Adjusted net income per Class A common share in the range of

$2.25 to $2.31 per share (previously $2.20 to $2.30 per share)

- Effective income tax rate in the range of 15% to 16%

(previously 23%) (1)

- Capital expenditures in the range of $1.8 billion to $1.9

billion (unchanged)

The Company is unable to provide a full reconciliation of the

GAAP and Non-GAAP Measures (as defined below) used in the updated

fiscal 2024 outlook without unreasonable effort because it is not

possible to predict certain of the adjustment items with a

reasonable degree of certainty. This information is dependent upon

future events and may be outside of the Company's control and could

have a significant impact on its GAAP financial results for fiscal

2024. The expected effective tax rate does not reflect potential

future rate adjustments for the resolution of tax audits or

potential changes in tax laws, which cannot be predicted with

reasonable certainty.

(1)

Expected effective tax rate of

15% to 16% reflects the $81.0 million of discrete state income tax

benefits recognized in the third quarter of fiscal 2024

Conference Call

The Company will hold a conference call today at 8:30 a.m.

Eastern Time, which will be hosted by Vivek Sankaran, CEO, and

Sharon McCollam, President & CFO. The call will be webcast and

can be accessed at

https://albertsonscompanies.com/investors/events-and-presentations.

A replay of the webcast will be available for at least two weeks

following the completion of the call.

About Albertsons

Companies

Albertsons Companies is a leading food and drug retailer in the

United States. As of November 30, 2024, the Company operated 2,273

retail food and drug stores with 1,732 pharmacies, 405 associated

fuel centers, 22 dedicated distribution centers and 19

manufacturing facilities. The Company operates stores across 34

states and the District of Columbia under more than 20 well known

banners including Albertsons, Safeway, Vons, Jewel-Osco, Shaw's,

Acme, Tom Thumb, Randalls, United Supermarkets, Pavilions, Star

Market, Haggen, Carrs, Kings Food Markets and Balducci's Food

Lovers Market. The Company is committed to helping people across

the country live better lives by making a meaningful difference,

neighborhood by neighborhood. In 2023, along with the Albertsons

Companies Foundation, the Company contributed more than $350

million in food and financial support, including more than $35

million through our Nourishing Neighbors Program to ensure those

living in our communities and those impacted by disasters have

enough to eat.

Forward-Looking Statements and Factors

That Impact Our Operating Results and Trends

This press release includes "forward-looking statements" within

the meaning of the federal securities laws. The "forward-looking

statements" include our current expectations, assumptions,

estimates and projections about our business and our industry. They

include statements relating to our future operating or financial

performance which the Company believes to be reasonable at this

time. You can identify forward-looking statements by the use of

words such as "outlook," "may," "should," "could," "estimates,"

"predicts," "potential," "continue," "anticipates," "believes,"

"plans," "expects," "future" and "intends" and similar expressions

which are intended to identify forward-looking statements.

These statements are not guarantees of future performance and

are subject to numerous risks and uncertainties which are beyond

our control and difficult to predict and could cause actual results

to differ materially from the results expressed or implied by the

statements. Risks and uncertainties that could cause actual results

to differ materially from such statements and may adversely impact

our financial condition and results of operations include:

- the termination of the Merger Agreement and our inability to

successfully optimize our value-creating initiatives following the

termination of the Merger Agreement;

- litigation in connection with the previously pending Merger and

the termination of the Merger Agreement, resulting in:

- ongoing costs, including damages that we may be required to pay

in connection with the lawsuit against Kroger or our inability to

collect the $600 million termination fee from Kroger, all of which

could be substantial; and

- negative reactions from the financial markets and our

suppliers, customers, and associates;

- significant transaction costs related to the previously pending

Merger;

- our inability to execute on our standalone business strategies

following the termination of the Merger Agreement due to prolonged

uncertainties and restrictions on our business during the pendency

of the Merger;

- our ability to recruit and retain qualified associates who are

critical to the success of our Customers for Life strategy;

- changes in macroeconomic conditions such as rates of food price

inflation or deflation, fuel and commodity prices and expiration of

student loan payment deferments;

- changes in price of goods sold in our stores and cost of goods

used in our food products due to change in government regulations

such as tariffs;

- changes in consumer behavior and spending due to the impact of

macroeconomic factors;

- failure to achieve productivity initiatives, unexpected changes

in our objectives and plans, inability to implement our strategies,

plans, programs and initiatives, or enter into strategic

transactions, investments or partnerships in the future on terms

acceptable to us, or at all;

- changes in wage rates and ability to negotiate acceptable

contracts with labor unions;

- challenges with our supply chain;

- operational and financial effects resulting from cyber

incidents at the Company or at a third party, including outages in

the cloud environment and the effectiveness of business continuity

plans during a ransomware or other cyber incident; and

- changes in tax rates, tax laws, and regulations that directly

impact our business or our customers.

All forward-looking statements attributable to us or persons

acting on our behalf are expressly qualified in their entirety by

these cautionary statements and risk factors. Forward-looking

statements contained in this press release reflect our view only as

of the date of this press release. We undertake no obligation,

other than as required by law, to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

In evaluating our financial results and forward-looking

statements, you should carefully consider the risks and

uncertainties more fully described in the "Risk Factors" section or

other sections in our reports filed with the SEC including the most

recent annual report on Form 10-K and any subsequent periodic

reports on Form 10-Q and current reports on Form 8-K.

Non-GAAP Measures and Identical

Sales

Non-GAAP Measures. EBITDA, Adjusted EBITDA, Adjusted net income,

Adjusted net income per Class A common share and Net debt ratio

(collectively, the "Non-GAAP Measures") are performance measures

that provide supplemental information the Company believes is

useful to analysts and investors to evaluate its ongoing results of

operations, when considered alongside other GAAP measures such as

net income, operating income, gross margin, and net income per

Class A common share. These Non-GAAP Measures exclude the financial

impact of items management does not consider in assessing the

Company's ongoing core operating performance, and thereby provide

useful measures to analysts and investors of its operating

performance on a period-to-period basis. Other companies may have

different definitions of Non-GAAP Measures and provide for

different adjustments, and comparability to the Company's results

of operations may be impacted by such differences. The Company also

uses Adjusted EBITDA and Net debt ratio for board of director and

bank compliance reporting. The Company's presentation of Non-GAAP

Measures should not be construed as an inference that its future

results will be unaffected by unusual or non-recurring items.

Identical Sales. As used in this earnings release, the term

"identical sales" includes stores operating during the same period

in both the current fiscal year and the prior fiscal year,

comparing sales on a daily basis. Direct to consumer digital sales

are included in identical sales, and fuel sales are excluded from

identical sales.

Albertsons Companies, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Operations

(dollars in millions, except

per share data)

(unaudited)

12 weeks ended

40 weeks ended

November 30,

2024

December 2,

2023

November 30,

2024

December 2,

2023

Net sales and other revenue

$

18,774.5

$

18,557.3

$

61,591.4

$

60,898.2

Cost of sales

13,528.1

13,360.0

44,484.8

43,996.7

Gross margin

5,246.4

5,197.3

17,106.6

16,901.5

Selling and administrative

expenses

4,717.7

4,607.3

15,777.1

15,215.7

Loss on property dispositions and

impairment losses, net

10.2

23.9

59.4

43.1

Operating income

518.5

566.1

1,270.1

1,642.7

Interest expense, net

109.0

116.3

358.3

383.1

Other (income) expense, net

(5.6

)

(6.7

)

0.3

(14.6

)

Income before income taxes

415.1

456.5

911.5

1,274.2

Income tax expense

14.5

95.1

124.7

228.7

Net income

$

400.6

$

361.4

$

786.8

$

1,045.5

Net income per Class A common

share

Basic net income per Class A common

share

$

0.69

$

0.63

$

1.36

$

1.82

Diluted net income per Class A common

share

0.69

0.62

1.35

1.80

Weighted average Class A common shares

outstanding (in millions)

Basic

580.2

576.2

579.7

575.2

Diluted

584.1

581.1

582.9

580.5

% of net sales and other

revenue

Gross margin

27.9

%

28.0

%

27.8

%

27.8

%

Selling and administrative expenses

25.1

%

24.8

%

25.6

%

25.0

%

Store data

Number of stores at end of quarter

2,273

2,271

Albertsons Companies, Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

(in millions)

(unaudited)

November 30,

2024

February 24,

2024

ASSETS

Current assets

Cash and cash equivalents

$

202.3

$

188.7

Receivables, net

929.0

724.4

Inventories, net

5,137.2

4,945.2

Other current assets

397.0

429.2

Total current assets

6,665.5

6,287.5

Property and equipment, net

9,632.9

9,570.3

Operating lease right-of-use assets

6,094.9

5,981.6

Intangible assets, net

2,349.3

2,434.5

Goodwill

1,201.0

1,201.0

Other assets

721.7

746.2

TOTAL ASSETS

$

26,665.3

$

26,221.1

LIABILITIES

Current liabilities

Accounts payable

$

4,026.1

$

4,218.2

Accrued salaries and wages

1,352.0

1,302.6

Current maturities of long-term debt and

finance lease obligations

61.3

285.2

Current maturities of operating lease

obligations

686.3

677.6

Other current liabilities

1,029.4

974.1

Total current liabilities

7,155.1

7,457.7

Long-term debt and finance lease

obligations

7,777.1

7,783.4

Long-term operating lease obligations

5,685.5

5,493.2

Deferred income taxes

729.3

807.6

Other long-term liabilities

1,952.6

1,931.7

Commitments and contingencies

STOCKHOLDERS' EQUITY

Class A common stock

6.0

5.9

Additional paid-in capital

2,169.2

2,129.6

Treasury stock, at cost

(304.2

)

(304.2

)

Accumulated other comprehensive income

90.9

88.0

Retained earnings

1,403.8

828.2

Total stockholders' equity

3,365.7

2,747.5

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

26,665.3

$

26,221.1

Albertsons Companies, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Cash Flows

(in millions)

(unaudited)

40 weeks ended

November 30,

2024

December 2,

2023

Cash flows from operating

activities:

Net income

$

786.8

$

1,045.5

Adjustments to reconcile net income to net

cash provided by operating activities:

Loss on property dispositions and

impairment losses, net

59.4

43.1

Depreciation and amortization

1,396.9

1,359.9

Operating lease right-of-use assets

amortization

522.0

510.7

LIFO expense

22.9

87.8

Deferred income tax

(182.9

)

(116.5

)

Contributions to pension and

post-retirement benefit plans, net of expense (income)

(70.7

)

(17.0

)

Deferred financing costs

12.4

12.0

Equity-based compensation expense

87.9

80.5

Other operating activities

12.8

(14.7

)

Changes in operating assets and

liabilities:

Receivables, net

(205.1

)

(139.4

)

Inventories, net

(214.9

)

(481.6

)

Accounts payable, accrued salaries and

wages and other accrued liabilities

(77.6

)

54.1

Operating lease liabilities

(435.1

)

(424.3

)

Self-insurance assets and liabilities

35.4

31.3

Other operating assets and liabilities

171.9

(300.6

)

Net cash provided by operating

activities

1,922.1

1,730.8

Cash flows from investing

activities:

Payments for property, equipment and

intangibles, including lease buyouts

(1,446.7

)

(1,535.0

)

Proceeds from sale of assets

24.1

201.3

Other investing activities

6.1

4.9

Net cash used in investing

activities

(1,416.5

)

(1,328.8

)

Cash flows from financing

activities:

Proceeds from issuance of long-term debt,

including ABL facility

50.0

150.0

Payments on long-term borrowings,

including ABL facility

(250.7

)

(500.7

)

Payments of obligations under finance

leases

(41.1

)

(45.4

)

Dividends paid on common stock

(208.5

)

(207.1

)

Dividends paid on convertible preferred

stock

—

(0.8

)

Employee tax withholding on vesting of

restricted stock units

(42.0

)

(37.1

)

Other financing activities

—

2.5

Net cash used in financing

activities

(492.3

)

(638.6

)

Net increase (decrease) in cash and

cash equivalents and restricted cash

13.3

(236.6

)

Cash and cash equivalents and

restricted cash at beginning of period

193.2

463.8

Cash and cash equivalents and

restricted cash at end of period

$

206.5

$

227.2

Albertsons Companies, Inc. and

Subsidiaries

Reconciliation of Non-GAAP

Measures

(in millions, except per share

data)

The following table reconciles Net income

to Adjusted net income and Adjusted EBITDA (in millions):

12 weeks ended

40 weeks ended

November 30,

2024

December 2,

2023

November 30,

2024

December 2,

2023

Net income

$

400.6

$

361.4

$

786.8

$

1,045.5

Adjustments:

(Gain) loss on energy hedges, net (d)

(0.5

)

(0.7

)

1.1

(6.1

)

Business transformation (1)(b)

15.0

12.3

52.8

37.9

Equity-based compensation expense (b)

21.7

23.3

87.9

80.5

Loss on property dispositions and

impairment losses, net

10.2

23.9

59.4

43.1

LIFO expense (a)

3.5

27.6

22.9

87.8

Merger-related costs (2)(b)

61.1

35.9

220.8

124.2

Certain legal and regulatory accruals and

settlements, net (b)

2.2

(6.7

)

2.0

(6.7

)

Amortization of debt discount and deferred

financing costs (c)

3.8

3.6

12.3

11.9

Amortization of intangible assets

resulting from acquisitions (b)

11.1

11.0

36.9

37.5

Miscellaneous adjustments (3)(f)

4.8

3.4

36.0

24.0

State income tax benefits related to the

settlement of audits

(81.0

)

—

(81.0

)

—

Tax impact of adjustments to Adjusted net

income

(32.2

)

(32.7

)

(125.0

)

(103.9

)

Adjusted net income

$

420.3

$

462.3

$

1,112.9

$

1,375.7

Tax impact of adjustments to Adjusted net

income

32.2

32.7

125.0

103.9

State income tax benefits related to the

settlement of audits

81.0

—

81.0

—

Income tax expense

14.5

95.1

124.7

228.7

Amortization of debt discount and deferred

financing costs (c)

(3.8

)

(3.6

)

(12.3

)

(11.9

)

Interest expense, net

109.0

116.3

358.3

383.1

Amortization of intangible assets

resulting from acquisitions (b)

(11.1

)

(11.0

)

(36.9

)

(37.5

)

Depreciation and amortization (e)

423.0

414.7

1,396.9

1,359.9

Adjusted EBITDA

$

1,065.1

$

1,106.5

$

3,149.6

$

3,401.9

Albertsons Companies, Inc. and

Subsidiaries

Reconciliation of Non-GAAP

Measures

(in millions, except per share

data)

The following tables reconcile diluted net

income per Class A common share to Adjusted net income per Class A

common share (in millions, except per share data):

12 weeks ended

40 weeks ended

November 30,

2024

December 2,

2023

November 30,

2024

December 2,

2023

Numerator:

Adjusted net income (4)

$

420.3

$

462.3

$

1,112.9

$

1,375.7

Denominator:

Weighted average Class A common shares

outstanding - diluted

584.1

581.1

582.9

580.5

Adjustments:

Convertible Preferred Stock (5)

—

—

—

0.4

Restricted stock units and awards (6)

7.4

6.9

8.0

6.4

Adjusted weighted average Class A common

shares outstanding - diluted

591.5

588.0

590.9

587.3

Adjusted net income per Class A common

share - diluted

$

0.71

$

0.79

$

1.88

$

2.34

12 weeks ended

40 weeks ended

November 30,

2024

December 2,

2023

November 30,

2024

December 2,

2023

Net income per Class A common share -

diluted

$

0.69

$

0.62

$

1.35

$

1.80

Non-GAAP adjustments (7)

0.03

0.18

0.56

0.57

Restricted stock units and awards (6)

(0.01

)

(0.01

)

(0.03

)

(0.03

)

Adjusted net income per Class A common

share - diluted

$

0.71

$

0.79

$

1.88

$

2.34

(1)

Includes costs associated with

third-party consulting fees related to our Customers for Life

strategy and associated business transformation initiatives.

(2)

Primarily relates to third-party

legal and advisor fees and retention program expense related to the

Merger.

(3)

Primarily includes net realized

and unrealized gains and losses related to non-operating

investments, lease adjustments related to non-cash rent expense and

costs incurred on leased surplus properties, pension settlement

loss, adjustments for unconsolidated equity investments and other

costs not considered in our core performance.

(4)

See the reconciliation of Net

income to Adjusted net income above for further details.

(5)

Represents the conversion of

convertible preferred stock to the fully outstanding as-converted

Class A common shares as of the end of each respective period, for

periods in which the convertible preferred stock is antidilutive

under GAAP.

(6)

Represents incremental unvested

restricted stock units ("RSUs") and unvested restricted stock

awards ("RSAs") to adjust the diluted weighted average Class A

common shares outstanding during each respective period to the

fully outstanding RSUs and RSAs as of the end of each respective

period.

(7)

Reflects the per share impact of

Non-GAAP adjustments for each period. See the reconciliation of Net

income to Adjusted net income above for further details.

Albertsons Companies, Inc. and

Subsidiaries

Reconciliation of Non-GAAP

Measures

(in millions, except per share

data)

Non-GAAP adjustment classifications within the Condensed

Consolidated Statements of Operations:

(a)

Cost of sales

(b)

Selling and administrative

expenses

(c)

Interest expense, net

(d)

(Gain) loss on energy hedges,

net:

12 weeks ended

40 weeks ended

November 30,

2024

December 2,

2023

November 30,

2024

December 2,

2023

Cost of sales

$

(0.4

)

$

(0.5

)

$

2.0

$

(4.3

)

Selling and administrative expenses

(0.1

)

(0.2

)

(0.9

)

(1.8

)

Total (Gain) loss on energy hedges,

net

$

(0.5

)

$

(0.7

)

$

1.1

$

(6.1

)

(e) Depreciation and amortization:

12 weeks ended

40 weeks ended

November 30,

2024

December 2,

2023

November 30,

2024

December 2,

2023

Cost of sales

$

41.3

$

40.9

$

136.7

$

125.9

Selling and administrative expenses

381.7

373.8

1,260.2

1,234.0

Total Depreciation and amortization

$

423.0

$

414.7

$

1,396.9

$

1,359.9

(f) Miscellaneous adjustments:

12 weeks ended

40 weeks ended

November 30,

2024

December 2,

2023

November 30,

2024

December 2,

2023

Selling and administrative expenses

$

8.2

$

7.3

$

32.6

$

29.2

Other (income) expense, net

(3.4

)

(3.9

)

3.4

(5.2

)

Total Miscellaneous adjustments

$

4.8

$

3.4

$

36.0

$

24.0

Albertsons Companies, Inc. and

Subsidiaries

Reconciliation of Non-GAAP

Measures

(in millions)

The following table is a reconciliation of

Net Debt Ratio on a rolling four quarter basis:

November 30,

2024

December 2,

2023

Total debt (including finance leases)

$ 7,838.4

$ 8,534.8

Cash and cash equivalents

202.3

222.7

Total debt net of cash and cash

equivalents

7,636.1

8,312.1

Rolling four quarters Adjusted EBITDA

$ 4,065.4

$ 4,452.1

Total Net Debt Ratio

1.88

1.87

The following table is a reconciliation of

Net income to Adjusted EBITDA on a rolling four quarter basis:

Rolling four quarters

ended

November 30,

2024

December 2,

2023

Net income

$

1,037.3

$

1,356.6

Depreciation and amortization

1,816.0

1,786.1

Interest expense, net

467.3

474.7

Income tax expense

189.0

269.1

EBITDA

3,509.6

3,886.5

Loss (gain) on interest rate swaps and

energy hedges, net

4.0

(1.6

)

Business transformation (1)

60.0

51.7

Equity-based compensation expense

111.9

122.2

Loss (gain) on property dispositions and

impairment losses, net

60.2

(18.3

)

LIFO (benefit) expense

(12.9

)

174.4

Merger-related costs (2)

277.2

156.9

Certain legal and regulatory accruals and

settlements, net

2.0

50.3

Miscellaneous adjustments (3)

53.4

30.0

Adjusted EBITDA

$

4,065.4

$

4,452.1

(1)

Includes costs associated with

third-party consulting fees related to our Customers for Life

strategy and associated business transformation initiatives.

(2)

Primarily relates to third-party

legal and advisor fees and retention program expense related to the

Merger and costs in connection with our previously-announced

Board-led review of potential strategic alternatives.

(3)

Primarily includes net realized

and unrealized gains and losses related to non-operating

investments, lease adjustments related to non-cash rent expense and

costs incurred on leased surplus properties, pension settlement

loss, adjustments for unconsolidated equity investments and other

costs not considered in our core performance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250108875556/en/

For Investor Relations, contact

investor-relations@albertsons.com For Media Relations, contact

media@albertsons.com

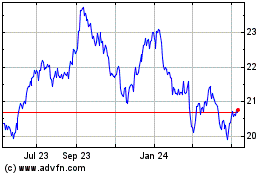

Albertsons Companies (NYSE:ACI)

Historical Stock Chart

From Dec 2024 to Jan 2025

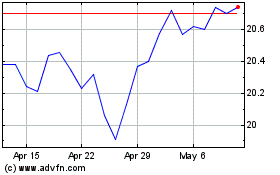

Albertsons Companies (NYSE:ACI)

Historical Stock Chart

From Jan 2024 to Jan 2025