BOEING COfalse0000012927929 Long Bridge DriveArlingtonVA703465-350000000129272025-01-232025-01-230000012927us-gaap:CommonStockMember2025-01-232025-01-230000012927us-gaap:ConvertiblePreferredStockSubjectToMandatoryRedemptionMember2025-01-232025-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 23, 2025

| | | | | | | | |

| THE BOEING COMPANY |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 1-442 | | 91-0425694 | |

| (State or other jurisdiction of

incorporation or organization) | | (Commission file number) | | (I.R.S. Employer Identification No.) | |

| | | | | | | | |

929 Long Bridge Drive, Arlington, VA | | 22202 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

(703) 465-3500 |

| (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $5.00 Par Value | | BA | | New York Stock Exchange |

| Depositary Shares, each representing a 1/20th interest in a share of 6.00% Series A Mandatory Convertible Preferred Stock, $1.00 Par Value | | BA-PRA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On January 23, 2025, The Boeing Company issued a press release announcing certain preliminary financial results for the fourth quarter of 2024. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit

Number | | Description |

| | |

| | |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | |

| THE BOEING COMPANY |

| |

| |

| By: | /s/ Michael J. Cleary |

| Michael J. Cleary |

| Senior Vice President and Controller |

| |

| Dated: January 23, 2025 |

Boeing Reports Preliminary Fourth Quarter Results

Results impacted by the International Association of Machinists and Aerospace Workers (IAM) work stoppage and agreement, as well as charges in the defense segment

ARLINGTON, Va., January 23, 2025 - The Boeing Company [NYSE: BA] announced today it will recognize impacts to its financial results related to the IAM work stoppage and agreement, charges for certain Defense, Space & Security programs and costs associated with workforce reductions announced last year when it reports fourth quarter results on January 28. The company expects to report fourth quarter revenue of $15.2 billion, GAAP loss per share of ($5.46), and operating cash flow of ($3.5) billion. Cash and investments in marketable securities totaled $26.3 billion at the end of the quarter.

“Although we face near-term challenges, we took important steps to stabilize our business during the quarter including reaching an agreement with our IAM-represented teammates and conducting a successful capital raise to improve our balance sheet,” said Kelly Ortberg, Boeing president and chief executive officer. “We also restarted 737, 767 and 777/777X production and our team remains focused on the hard work ahead to build a new future for Boeing.”

Commercial Airplanes results will reflect impacts associated with the IAM work stoppage and agreement including lower deliveries and pre-tax earnings charges of $1.1 billion on the 777X and 767 programs. The 777X program pre-tax charge of $0.9 billion reflects higher estimated labor costs associated with finalizing the IAM agreement and will be incurred over the next several years. The company still anticipates first delivery of the 777-9 in 2026. Commercial Airplanes expects to report fourth quarter revenue of $4.8 billion and operating margin of (43.9) percent.

Defense, Space & Security expects to recognize pre-tax earnings charges of $1.7 billion on the KC-46A, T-7A, Commercial Crew, VC-25B, and MQ-25 programs. The KC-46A program pre-tax charge of $0.8 billion reflects higher estimated manufacturing costs, including impacts of the IAM work stoppage and agreement. The T-7A program pre-tax charge of $0.5 billion was primarily driven by higher estimated costs on production lots in 2026 and beyond. Defense, Space & Security expects to report fourth quarter revenue of $5.4 billion and operating margin of (41.9) percent.

Caution Concerning Forward-Looking Statements

The preliminary estimated financial results for the quarter ended December 31, 2024 included in this press release are preliminary, unaudited and subject to completion, and may change as a result of management’s continued review. Such preliminary results are subject to the finalization of quarter-end financial and accounting procedures. The preliminary financial results represent management estimates that constitute forward-looking statements subject to risks and uncertainties. As a result, the preliminary financial results may materially differ from the actual results when they are completed and publicly disclosed. This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “should,” “expects,” “intends,” “projects,” “plans,” “believes,” “estimates,” “targets,” “anticipates,” and other similar words or expressions, or the negative thereof, generally can be used to help identify these forward-looking statements. Examples of forward-looking statements include statements relating to our future financial condition and operating results, as well as any other statement that does not directly relate to any historical or current fact. Forward-looking statements are based on expectations and assumptions that we believe to be reasonable when made, but that may not prove to be accurate.

Forward-looking statements are not guarantees and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict. Many factors could cause actual results to differ materially and adversely from these forward-looking statements. Among these factors are risks related to: (1) general conditions in the economy and our industry, including those due to regulatory changes; (2) our reliance on our commercial airline customers; (3) the overall health of our aircraft production system, production quality issues, commercial airplane production rates, our ability to successfully develop and certify new aircraft or new derivative aircraft, and the ability of our aircraft to meet stringent performance and reliability standards; (4) changing budget and appropriation levels and acquisition priorities of the U.S. government, as well as significant delays in U.S. government appropriations; (5) our dependence on our subcontractors and suppliers, as well as the availability of highly skilled labor and raw materials; (6) work stoppages or other labor disruptions; (7) competition within our markets; (8) our non-U.S. operations and sales to non-U.S. customers; (9) changes in accounting estimates; (10) our pending acquisition of Spirit AeroSystems Holdings, Inc. (Spirit), including the satisfaction of closing conditions in the expected timeframe or at all; (11) realizing the anticipated benefits of mergers, acquisitions, joint ventures/strategic alliances or divestitures, including anticipated synergies and quality improvements related to our pending acquisition of Spirit; (12) our dependence on U.S. government contracts; (13) our reliance on fixed-price contracts; (14) our reliance on cost-type contracts; (15) contracts that include in-orbit incentive payments; (16) management of a complex, global IT infrastructure; (17) compromise or unauthorized access to our, our customers’ and/or our suppliers' information and systems; (18) potential business disruptions, including threats to physical security or our information technology systems, extreme weather (including effects of climate change) or other acts of nature, and pandemics or other public health crises; (19) potential adverse developments in new or pending litigation and/or government inquiries or investigations; (20) potential environmental liabilities; (21) effects of climate change and legal, regulatory or market responses to such change; (22) credit rating agency actions and our ability to effectively manage our liquidity; (23) substantial pension and other postretirement benefit obligations; (24) the adequacy of our insurance coverage; and (25) customer and aircraft concentration in our customer financing portfolio.

Additional information concerning these and other factors can be found in our filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Any forward-looking statement speaks only as of the date on which it is made, and we assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law.

# # #

Contact: Investor Relations: BoeingInvestorRelations@boeing.com

Communications: media@boeing.com

v3.24.4

Cover

|

Jan. 23, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 23, 2025

|

| Entity Registrant Name |

BOEING CO

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-442

|

| Entity Tax Identification Number |

91-0425694

|

| Entity Address, Address Line One |

929 Long Bridge Drive

|

| Entity Address, City or Town |

Arlington

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22202

|

| City Area Code |

703

|

| Local Phone Number |

465-3500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000012927

|

| Document Information [Line Items] |

|

| Document Period End Date |

Jan. 23, 2025

|

| Convertible Preferred Stock Subject to Mandatory Redemption [Member] |

|

| Cover [Abstract] |

|

| Title of 12(b) Security |

Depositary Shares, each representing a 1/20th interest in a share of 6.00% Series A Mandatory Convertible Preferred Stock, $1.00 Par Value

|

| Trading Symbol |

BA-PRA

|

| Security Exchange Name |

NYSE

|

| Document Information [Line Items] |

|

| Trading Symbol |

BA-PRA

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Depositary Shares, each representing a 1/20th interest in a share of 6.00% Series A Mandatory Convertible Preferred Stock, $1.00 Par Value

|

| Common Stock [Member] |

|

| Cover [Abstract] |

|

| Title of 12(b) Security |

Common Stock, $5.00 Par Value

|

| Trading Symbol |

BA

|

| Security Exchange Name |

NYSE

|

| Document Information [Line Items] |

|

| Trading Symbol |

BA

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Common Stock, $5.00 Par Value

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_ConvertiblePreferredStockSubjectToMandatoryRedemptionMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

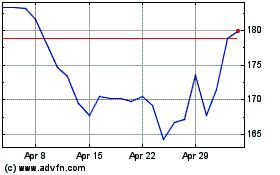

Boeing (NYSE:BA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Boeing (NYSE:BA)

Historical Stock Chart

From Jan 2024 to Jan 2025