Bally’s Corporation (NYSE: BALY) today reported financial

results for the fourth quarter and full year ended December 31,

2023.

Fourth Quarter 2023 Results and Operating Highlights

- Consolidated revenues of $611.7 million, up 6.1% year-over-year

and up 8.6% for the full year

- Casinos & Resorts revenues of $342.3 million, up 7.2%

year-over-year

- International Interactive revenues of $236.0 million, up 2.1%

year-over-year

- North America Interactive revenues of $33.4 million, up 26.9%

year-over-year year

- Commenced 24/7 operations at the Chicago Temporary Casino on

December 27th; property reached record $10 million GGR for first

full month of 24/7 operations in January

- Repurchased 5.8 million shares of common stock for $68.6

million

- Subsequent to year-end, announced the April 2nd official

closure of Tropicana Las Vegas to prepare for the welcoming of the

Las Vegas A’s to the Tropicana site and potential future

development

Summary of Financial Results

Quarter Ended December

31,

Year Ended December

31,

(in thousands)

2023

2022

2023

2022

Consolidated Revenue

$

611,670

$

576,689

$

2,449,073

$

2,255,705

Casinos & Resorts Revenue

342,317

319,178

1,363,291

$

1,227,563

International Interactive Revenue

235,980

231,218

973,210

946,442

North America Interactive Revenue

33,373

26,293

112,572

81,700

Net loss

(263,492

)

(487,529

)

(172,609

)

(425,546

)

Adjusted EBITDAR(1)

160,936

653,104

(1) Refer to tables in this press release

for a reconciliation of this non-GAAP financial measure to the most

directly comparable measure calculated in accordance with GAAP.

Robeson Reeves, Bally’s Chief Executive Officer, commented,

“Bally’s completed a successful 2023 with healthy results across

all our business segments. Revenues in the fourth quarter grew 6.1%

year-over-year to $611.7 million reflecting continued growth in our

Casinos & Resorts, International Interactive and North America

Interactive segments. For the full year, revenues grew 8.6% versus

2022.”

“In the fourth quarter, Casinos & Resorts revenues rose 7.2%

year-over-year and Adjusted EBITDAR, excluding $31.6 million of

rent expense, was $94.7 million, resulting in solid quarterly

Adjusted EBITDAR margins of 27.7%. For the full year, Casinos &

Resorts revenues grew 11.1%. We saw strong performance across much

of the portfolio, as our properties exceeded the market GGR comp

for revenue performance in 7 of our 10 markets, demonstrating the

underlying health of our properties and our disciplined operating

strategies. Atlantic City delivered its first full year of

profitable Adjusted EBITDAR under our ownership. In Chicago, we

continue to incorporate customer feedback to improve the guest

experience. Further, we remain optimistic about the robustness of

the market and the long-term potential for both the Temporary

Casino and our Permanent Casino. We believe our Casinos &

Resorts assets are well positioned to continue to increase market

share and we will responsibly invest in growing our database to

drive top-line results.”

“International Interactive delivered another strong quarter,

with revenues increasing 2.1% year-over-year to $236.0 million,

including a 10% year-over-year improvement in our UK business on a

U.S. dollar basis and a 5% increase in constant currency. Fourth

quarter Adjusted EBITDAR was up 4.3% year-over-year to an all-time

quarterly record $93.2 million, as our initiatives to optimize

marketing and streamline costs are driving solid overall

profitability improvements. For the full year, International

Interactive revenues grew 2.8%.”

“North America Interactive generated fourth quarter revenues of

$33.4 million, up 26.9% year-over-year, and an Adjusted EBITDAR

loss of $9.8 million. In 2024, we anticipate this segment will

deliver an Adjusted EBITDAR loss of approximately $30 million,

compared to an Adjusted EBITDAR loss of $55.7 million in 2023. We

expect a non-linear quarterly cadence over the course of the year

given various upcoming state launches and market entries, including

our forthcoming iGaming launch in Rhode Island and our own live

dealer online experience. For the full year, North America

Interactive revenues grew 37.8%.”

“Our corporate and property-level teams delivered on an active

year of building our growth pipeline. This included the opening of

the Chicago Temporary Casino, the approved relocation of the “Las

Vegas” Athletics to our Tropicana site, the opening of our expanded

and re-imagined Bally’s Kansas City casino, partnerships with

leading technology vendors to support our successful relaunch of

Bally Bet OSB in North America, our agreement to operate the

concession at Bally’s Golf Links at Ferry Point in the Bronx, and

the expansion of our flagship property in Rhode Island. Our

development opportunities in Chicago, Las Vegas and New York

include significant optionality and unique long-term growth

prospects, and we expect to begin converting these development

opportunities into value for Bally’s stakeholders, starting in

2024.”

George Papanier, Bally’s President, added, “The soft opening of

the Chicago Temporary Casino on September 9th was a key 2023

milestone. Since opening, the team has worked to ramp up operations

and move us closer to our targeted revenue run rate. Key

improvements have included the expansion to 24/7 operations, the

addition of VIP amenities, increased parking, added transportation

options for guests, and enhancements to the hospitality product.

Our operating team continues to refine all aspects of the Temporary

Casino, while we simultaneously move forward with the financing and

planning for the Permanent Casino.”

“At the end of January, we announced that on April 2nd, the

Tropicana Las Vegas will officially close. While this will bring an

end to this iconic property’s colorful history, closing the

property will allow for preparations to welcome Major League

Baseball and the A’s to Las Vegas which will open the pathway to

the next era of development at the site. We also continue to work

diligently in anticipation of submitting a proposal to build a

world class casino and resort at the Bally’s Golf Links course in

the Bronx, New York.”

Marcus Glover, Bally’s Chief Financial Officer, added, “Bally’s

operating teams have been focused on expense reduction and

operating efficiency. To that end, we are evaluating all areas of

the business and are executing initiatives to centralize certain

functions and streamline others. We continue to make progress with

our plans for the financing of the Chicago Permanent Casino and

hope to provide additional details on those plans in the near term.

In all, 2023 was an active and productive year for Bally’s and we

are extremely excited by what the future holds.”

Capital Return Program

During the fourth quarter, Bally’s repurchased 5.8 million

shares of its common stock for an aggregate purchase price of $68.6

million. During the full year ended December 31, 2023, Bally’s

repurchased 7.6 million shares for an aggregate purchase price of

$99.1 million. Bally’s currently has $95.5 million available for

use under its capital return program, subject to limitations in its

regulatory and debt agreements. On a fully-diluted basis, applying

the treasury method of presentation, there were approximately 52

million shares and share equivalents outstanding as of year-end

2023.

2024 Guidance

Bally’s expects to generate full year 2024 revenues in a range

of $2.5 billion to $2.7 billion and Adjusted EBITDAR in a range of

$655 million to $695 million. The full year guidance includes the

impact of severe winter weather on January results in the Casinos

& Resorts segment followed by stabilization thus far in

February, as well as the impact the closure of the Tropicana Las

Vegas will have on our 2024 year-over-year comparisons. The outlook

also includes continued growth in the International Interactive

business and the launch of iGaming in Rhode Island in our North

America Interactive segment.

Revenue and Adjusted EBITDAR ranges by segment:

- Casinos & Resorts: revenues of $1.4 billion to $1.5 billion

and Adjusted EBITDAR of $410 to $440 million

- International Interactive: revenues of $950 million to $1.0

billion and Adjusted EBITDAR of $320 to $350 million

- North America Interactive: revenues of $150 million to $200

million and an Adjusted EBITDAR loss of $25 million to $35

million

- Corporate Expense: $50 million to $60 million

Additional factors considered in the Company’s outlook

include:

- Straight-line GAAP rent expense of approximately $126 million

and cash rent of approximately $121 million

- Total capital expenditures of $165 million (this amount

excludes investments in the Chicago Permanent Casino development

plan and demolition costs for Tropicana Las Vegas)

- FX currency conversion for GBP at 1.27 and Euro at 1.10 based

upon year-end 2023 prevailing rates

The guidance provided is based on current plans and expectations

and contains several assumptions. It is subject to known and

unknown uncertainties and risks, including those discussed under

“Cautionary Note Regarding Forward Looking Statements” set forth

below.

Impairment Charges

In the fourth quarter of 2023, Bally’s recorded total non-cash

impairment charges of $122.1 million which included $54.0 million

in the International Interactive segment related to a long-standing

trademark acquired as part of the Gamesys acquisition, $58.6

million impairment on indefinite-lived gaming licenses in our

Casinos & Resorts segment, $5.7 million of impairment charges

in connection with our interactive restructuring program for

certain technology which will no longer be utilized, and $3.8

million of impairment on intangible assets held for sale.

Diamond Sports Group

Diamond Sports Group agreed in principle to settle its claims

against all defendants, including Bally’s, that Diamond brought

through an adversary proceeding in its bankruptcy case. Through the

proposed settlement, Diamond would receive payments from Sinclair

and would reject the Commercial Agreement, pursuant to which

Bally’s acquired certain naming rights on Diamond’s RSNs. Bally’s

would continue to have naming rights on Diamond’s RSNs through the

2024 major league baseball season at no cost to either party

(unless Diamond agrees with a new counterparty that will pay for

such naming rights). Bally’s, in turn, would receive a release of

all claims Diamond may have against it. The agreement in principle

is subject to the entry into definitive documentation and certain

other conditions, including bankruptcy court approval. Bally’s

obligation to pay for the naming rights would terminate immediately

upon effectiveness of the agreement. Bally’s recorded a $144.9

million non-cash reserve to reflect the termination of naming

rights on its remaining commercial rights intangible asset offset

by the forgiveness of a liability.

Reconciliation of GAAP Measures to Non-GAAP Measures

To supplement the financial information presented on a generally

accepted accounting principles (“GAAP”) basis, Bally’s has included

in this earnings release non-GAAP financial measures for

consolidated Adjusted EBITDA and segment Adjusted EBITDAR, which

exclude certain items described below. The reconciliations of these

non-GAAP financial measures to their comparable GAAP financial

measures are presented in the tables appearing below.

“Adjusted EBITDA” is earnings, or loss, for Bally’s, or where

noted Bally’s reportable segments, before, in each case, interest

expense, net of interest income, provision (benefit) for income

taxes, depreciation and amortization, non-operating (income)

expense, acquisition and other transaction related costs,

share-based compensation, and certain other gains or losses as well

as, when presented for Bally’s reporting segments, an adjustment

related to the allocation of corporate costs among segments.

“Segment Adjusted EBITDAR” is Adjusted EBITDA (as defined above)

for Bally’s reportable segments, plus rent expense associated with

triple net operating leases for the real estate assets used in the

operation of the Bally’s casinos and the assumption of the lease

for real estate and land underlying the operations of the Bally’s

Lake Tahoe property. For the International Interactive, North

America Interactive, and Other segments, Segment Adjusted EBITDAR

and segment Adjusted EBITDA are equivalent due to a lack of triple

net operating lease for real estate assets used in those

segments.

Management has historically used consolidated Adjusted EBITDA

and segment Adjusted EBITDAR when evaluating operating performance

because Bally’s believes that these metrics are necessary to

provide a full understanding of Bally’s core operating results and

as a means to evaluate period-to-period performance. Management

also believes that consolidated Adjusted EBITDA and segment

Adjusted EBITDAR are measures that are widely used for evaluating

operating performance of companies in Bally’s industry and a

principal basis for valuing such companies as well. Consolidated

Adjusted EBITDAR is used outside of our financial statements solely

as a valuation metric. Management believes Consolidated Adjusted

EBITDAR is an additional metric traditionally used by analysts in

valuing gaming companies subject to triple net leases since it

eliminates the effects of variability in leasing methods and

capital structures. Consolidated Adjusted EBITDA and segment

Adjusted EBITDAR should not be construed as alternatives to GAAP

net income as an indicator of Bally’s performance. In addition,

consolidated Adjusted EBITDA or segment Adjusted EBITDAR as used by

Bally’s may not be defined in the same manner as other companies in

Bally’s industry, and, as a result, may not be comparable to

similarly titled non-GAAP financial measures of other

companies.

Bally’s does not provide a reconciliation of Adjusted EBITDAR on

a forward-looking basis to net income, its most comparable GAAP

financial measure, because Bally’s is unable to forecast the amount

or significance of certain items required to develop meaningful

comparable GAAP financial measures without unreasonable efforts.

These items include depreciation, impairment charges, gains or

losses on retirement of debt, acquisition, integration and

restructuring expenses, interest expense, share-based compensation

expense, professional and advisory fees associated with Bally’s

capital return program and variations in effective tax rate, which

are difficult to predict and estimate and are primarily dependent

on future events, but which are excluded from Bally’s calculation

of Adjusted EBITDAR. Bally’s believes that the probable

significance of providing this forward-looking valuation metric

without a reconciliation to the most directly comparable GAAP

metric, is that investors and analysts will have certain

information that Bally’s believes is useful and meaningful in

valuing its business. Investors are cautioned that Bally’s cannot

predict the occurrence, timing or amount of all non-GAAP items that

may be excluded from Adjusted EBITDAR in the future. Accordingly,

the actual effect of these items, when determined, could

potentially be significant to the calculation of Adjusted

EBITDAR.

Fourth Quarter Conference Call

Bally’s fourth quarter 2023 earnings conference call and audio

webcast will be held today, Wednesday, February 21, 2024 at 4:30

p.m. EDT. To access the conference call, please dial (800) 343-4136

(U.S. toll-free) and reference conference ID BALYQ423. The webcast

of the call will be available to the public, on a listen-only

basis, via the Internet at the Investors section of the Company’s

website at www.ballys.com. An online archive of the webcast will be

available on the Company’s website for 120 days. Supplemental

materials have also been posted to the Investors section of the

website under Events & Presentations.

About Bally’s Corporation

Bally’s Corporation is a global casino-entertainment company

with a growing omni-channel presence of Online Sports Betting and

iGaming offerings. It currently owns and manages 16 casinos across

10 states, a golf course in New York, a horse racetrack in

Colorado, and has access to OSB licenses in 18 states. It also owns

Bally’s Interactive International, formerly Gamesys Group, a

leading, global, online gaming operator, Bally Bet, a

first-in-class sports betting platform, and Bally Casino, a growing

iCasino platform.

With 10,500 employees, the Company’s casino operations include

approximately 15,000 slot machines, 600 table games and 5,300 hotel

rooms. Upon completing the construction of a permanent casino

facility in Chicago, IL, and a land-based casino near the Nittany

Mall in State College, PA, Bally’s will own and/or manage 17

casinos across 11 states. Its shares trade on the New York Stock

Exchange under the ticker symbol “BALY”.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements may generally be identified by the use of words such as

“anticipate,” “believe,” “expect,” “intend,” “plan” and “will” or,

in each case, their negative, or other variations or comparable

terminology. These forward-looking statements include all matters

that are not historical facts. By their nature, forward-looking

statements involve risks and uncertainties because they relate to

events and depend on circumstances that may or may not occur in the

future. As a result, these statements are not guarantees of future

performance and actual events may differ materially from those

expressed in or suggested by the forward-looking statements. Any

forward-looking statement made by Bally’s in this press release,

its reports filed with the Securities and Exchange Commission

(“SEC”) and other public statements made from time-to-time speak

only as of the date made. New risks and uncertainties come up from

time to time, and it is impossible for Bally’s to predict or

identify all such events or how they may affect it. Bally’s has no

obligation, and does not intend, to update any forward-looking

statements after the date hereof, except as required by federal

securities laws. Factors that could cause these differences include

those included in Bally’s Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q and other reports filed by Bally’s with the

SEC. These statements constitute Bally’s cautionary statements

under the Private Securities Litigation Reform Act of 1995.

BALLY'S CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited)

(In thousands, except per share

data)

Quarter Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

Revenue:

Gaming

$

502,955

$

461,601

$

1,992,041

$

1,846,124

Non-gaming

108,715

115,088

457,032

409,581

Total revenue

611,670

576,689

2,449,073

2,255,705

Operating (income) costs and

expenses:

Gaming

223,206

192,459

888,937

812,918

Non-gaming

53,578

55,803

216,239

196,318

General and administrative

391,482

245,906

1,113,976

825,706

Gain from sale-leaseback, net

—

—

(374,321

)

(50,766

)

Impairment charges

122,072

463,978

131,725

463,978

Depreciation and amortization

119,173

73,052

350,408

300,559

Total operating costs and expenses

909,511

1,031,198

2,326,964

2,548,713

(Loss) income from operations

(297,841

)

(454,509

)

122,109

(293,008

)

Other income (expense):

Interest expense, net

(76,574

)

(63,068

)

(277,561

)

(208,153

)

Other non-operating income (expense),

net

(37,135

)

129

(12,186

)

46,692

Total other expense, net

(113,709

)

(62,939

)

(289,747

)

(161,461

)

Loss before income taxes

(411,550

)

(517,448

)

(167,638

)

(454,469

)

(Benefit) provision for income taxes

(148,058

)

(29,919

)

4,971

(28,923

)

Net loss

$

(263,492

)

$

(487,529

)

$

(172,609

)

$

(425,546

)

Basic loss per share

$

(5.11

)

$

(8.87

)

$

(3.24

)

$

(7.32

)

Weighted average common shares

outstanding, basic

51,582,156

54,969,976

53,350,817

58,111,699

Diluted loss per share

$

(5.11

)

$

(8.87

)

$

(3.24

)

$

(7.32

)

Weighted average common shares

outstanding, diluted

51,582,156

54,969,976

53,350,817

58,111,699

BALLY'S CORPORATION

Revenue and Reconciliation of

Net Loss and Net Loss Margin to

Adjusted EBITDA and Adjusted

EBITDA Margin (unaudited)

(in thousands, except

percentages)

Quarter Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

Revenue

$

611,670

$

576,689

$

2,449,073

$

2,255,705

Net loss

$

(263,492

)

$

(487,529

)

$

(172,609

)

$

(425,546

)

Interest expense, net of interest

income

76,574

63,068

277,561

208,153

(Benefit) provision for income taxes

(148,058

)

(29,919

)

4,971

(28,923

)

Depreciation and amortization

119,173

73,052

350,408

300,559

Non-operating (income) expense(1)

26,216

(1,861

)

12,688

(46,176

)

Foreign exchange loss (gain)

13,531

1,732

11,019

(516

)

Transaction costs(2)

20,971

46,009

80,376

85,604

Restructuring charges(3)

10,341

—

31,014

—

Decommissioning costs(4)

240

—

2,583

—

Share-based compensation

5,487

9,780

24,074

27,912

Gain on sale-leaseback, net

—

—

(374,321

)

(50,766

)

Planned business divestiture(5)

—

5,585

2,089

5,585

Impairment charges(6)

122,072

463,978

131,725

463,978

Diamond Sports Group reserve(7)

144,883

—

144,883

—

Other(8)

1,375

1,923

868

8,651

Adjusted EBITDA

$

129,313

$

145,818

$

527,329

$

548,515

Rent expense associated with triple net

operating leases (9)

31,623

125,775

Adjusted EBITDAR

$

160,936

$

653,104

Net loss margin

(43.1

)%

(84.5

)%

(7.0

)%

(18.9

)%

Adjusted EBITDA margin

21.1

%

25.3

%

21.5

%

24.3

%

________________________________

(1)

Non-operating (income) expense includes:

(i) change in value of naming rights liabilities, (ii) gain on

extinguishment of debt, (iii) non-operating items of equity method

investments including our share of net income or loss on an

investment and depreciation expense related to our Rhode Island

joint venture, (iv) adjustment on bargain purchase, and (v) other

(income) expense, net.

(2)

Includes acquisition, integration and

other transaction related costs, financing costs incurred in

connection with the Hard Rock Biloxi and Tiverton sale lease-back

transactions, the prior year tender offer process, and costs

incurred to address the Standard General takeover bid.

(3)

Restructuring charges representing the

severance and employee related benefits related to the announced

Interactive business restructuring initiatives.

(4)

Costs related to the decommissioning of

the Company’s sports betting platform in favor of outsourcing the

platform solution to third parties.

(5)

Losses related to a North America

Interactive business that Bally’s is marketing as held-for-sale as

of December 31, 2023.

(6)

Non-cash impairment charges for 2023

included $54.0 million in the International Interactive segment

related to a long-standing indefinite lived trademark acquired as

part of the Gamesys acquisition, $58.6 million impairment on

indefinite-lived gaming licenses in our Casinos & Resorts

segment, $5.7 million of impairment charges related to our

interactive restructuring program representing the impairment of

certain technology which will no longer be utilized, and $3.8

million of impairment on intangible assets held for sale. Non-cash

impairment charges for 2022 included $390.7 million related to our

North America Interactive segment as part of our annual goodwill

and asset impairment analysis and $73.3 million in the

International Interactive segment related to a long-standing

indefinite lived trademark acquired as part of the Gamesys

acquisition.

(7)

Non-cash reserve to reflect the remaining

Diamond commercial rights intangible asset offset by forgiveness of

the liability.

(8)

Other includes the following items: (i)

non-routine legal expenses and settlement charges for matters

outside the normal course of business, (ii) storm related insurance

and business interruption recoveries, and (iii) other individually

de minimis expenses.

(9)

Consists of the operating lease components

contained within our triple net master lease dated June 4, 2021

with GLPI for the real estate assets used in the operation of

Bally’s Evansville, Bally’s Dover, Bally’s Quad Cities, Bally’s

Black Hawk, Hard Rock Biloxi and Bally’s Tiverton, the individual

triple net lease with GLPI for the land underlying the operations

of Tropicana Las Vegas, and the triple net lease assumed in

connection with the acquisition of Bally’s Lake Tahoe for real

estate and land underlying the operations of the Bally’s Lake Tahoe

facility.

BALLY'S CORPORATION Revenue and

Segment Adjusted EBITDAR (unaudited)

Quarter Ended December

31,

Year Ended December

31,

(in thousands)

2023

2022

2023

2022

Revenue

Casinos & Resorts

$

342,317

$

319,178

$

1,363,291

$

1,227,563

International Interactive

235,980

231,218

973,210

946,442

North America Interactive

33,373

26,293

112,572

81,700

Total

$

611,670

$

576,689

$

2,449,073

$

2,255,705

Adjusted EBITDAR(1)

Casinos & Resorts

$

94,656

$

95,517

$

428,968

$

398,930

International Interactive

93,207

89,399

343,559

321,651

North America Interactive

(9,844

)

(5,858

)

(55,653

)

(65,729

)

Other

(17,083

)

(14,644

)

(63,770

)

(53,024

)

Total

$

160,936

$

653,104

________________________________

(1)

Segment Adjusted EBITDAR is Bally’s

reportable segment GAAP measure and its primary measure for profit

or loss for its reportable segments. “Segment Adjusted EBITDAR” is

Adjusted EBITDA (as defined above) for Bally’s reportable segments,

plus rent expense associated with triple net operating leases for

the real estate assets used in the operation of the Bally’s casinos

and the assumption of the lease for real estate and land underlying

the operations of the Bally’s Lake Tahoe property. For the

International Interactive, North America Interactive, and Other

segments, segment Adjusted EBITDAR and segment Adjusted EBITDA are

equivalent due to a lack of triple net operating lease for real

estate assets used in those segments.

BALLY'S CORPORATION Selected

Financial Information (unaudited)

Balance Sheet Data

(in thousands)

December 31,

2023

December 31,

2022

Cash and cash equivalents

$

163,194

$

212,515

Restricted cash

$

139,191

$

52,669

Term Loan Facility(1)

$

1,906,100

$

1,925,550

Revolving Credit Facility

335,000

137,000

5.625% Senior Notes due 2029

750,000

750,000

5.875% Senior Notes due 2031

735,000

750,000

Less: Unamortized original issue

discount

(23,756

)

(27,729

)

Less: Unamortized deferred financing

fees

(39,709

)

(46,266

)

Long-term debt, including current

portion

$

3,662,635

$

3,488,555

Less: Current portion of Term Loan and

Revolving Credit Facility

$

(19,450

)

$

(19,450

)

Long-term debt, net of discount and

deferred financing fees; excluding current portion

$

3,643,185

$

3,469,105

Cash Flow Data

Quarter Ended December

31,

Year Ended December

31,

(in thousands)

2023

2022

2021

2023

2022

2021

Capital expenditures

$

45,252

$

44,893

$

32,393

$

311,483

$

212,256

$

97,525

Cash paid for capitalized software

9,297

3,704

13,865

45,200

37,121

15,891

Acquisition of gaming licenses

135,335

2,087

25,750

145,485

55,117

30,159

Cash payments associated with triple net

operating leases(2)

29,935

17,446

11,353

118,416

58,029

26,720

________________________________

(1)

During the year ending December 31, 2023,

the Company entered certain currency swaps to synthetically convert

$500 million of its Term Loan Facility to €461.6 million fixed-rate

Euro-denominated instrument due October 2028 paying a

weighted-average fixed-rate coupon of approximately 6.69% per

annum. The Company also entered certain currency swaps to

synthetically convert $200 million notional amount of its floating

rate Term Loan Facility to an equivalent £159.2 million

GBP-denominated floating rate instrument with tenor of the swap

instrument due October 2026. As part of the Company’s risk

management program, managing our overall interest rate exposure,

the Company entered into $500 million notional in interest rate

collar arrangements maturing in 2028 where our SOFR floating rate

interest is capped at 4.25%, with a weighted average SOFR floor

rate of 3.22%, pursuant to the interest rate collar

arrangements.

(2)

Consists of payments made in connection

with Bally’s triple net operating leases, as defined above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240221389554/en/

Investor Marcus Glover Chief Financial Officer (401)

475-8564 IR@ballys.com

James Leahy, Joseph Jaffoni, Richard Land JCIR (212) 835-8500

baly@jcir.com

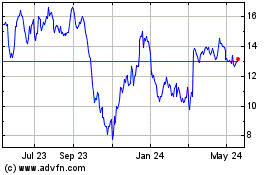

Ballys (NYSE:BALY)

Historical Stock Chart

From Dec 2024 to Jan 2025

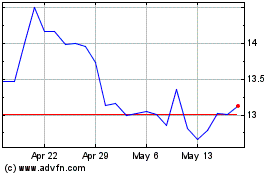

Ballys (NYSE:BALY)

Historical Stock Chart

From Jan 2024 to Jan 2025