0000010795false00000107952024-10-022024-10-020000010795exch:XNYSus-gaap:CommonStockMember2024-10-022024-10-020000010795exch:XNYSbdx:Notes1.900dueDecember152026Member2024-10-022024-10-020000010795exch:XNYSbdx:Notes3.020dueMay242025Member2024-10-022024-10-020000010795exch:XNYSbdx:Notes1.208dueJune42026Member2024-10-022024-10-020000010795exch:XNYSbdx:Notes1213DueFebruary122036Member2024-10-022024-10-020000010795exch:XNYSbdx:Notes0034DueAugust132025Member2024-10-022024-10-020000010795exch:XNYSbdx:Notes3.519DueFebruary82031Member2024-10-022024-10-020000010795exch:XNYSbdx:Notes3.828DueJune72032Member2024-10-022024-10-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) October 2, 2024

| | | | | | | | | | | | | | |

BECTON, DICKINSON AND COMPANY |

| (Exact Name of Registrant as Specified in Its Charter) |

| | | | |

New Jersey |

| (State or Other Jurisdiction of Incorporation) |

| | | | | | | | | | | | | | |

| 001-4802 | | 22-0760120 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

| 1 Becton Drive, | Franklin Lakes, | New Jersey | | 07417-1880 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | | | | | | | | | | | | | | | | |

| | (201) | 847-6800 | | |

(Registrant’s Telephone Number, Including Area Code) |

| | | | | |

N/A |

(Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K Filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, par value $1.00 | | BDX | | New York Stock Exchange |

| 1.900% Notes due December 15, 2026 | | BDX26 | | New York Stock Exchange |

| 3.020% Notes due May 24, 2025 | | BDX25 | | New York Stock Exchange |

| 1.208% Notes due June 4, 2026 | | BDX/26A | | New York Stock Exchange |

| 1.213% Notes due February 12, 2036 | | BDX/36 | | New York Stock Exchange |

| 0.034% Notes due August 13, 2025 | | BDX25A | | New York Stock Exchange |

| 3.519% Notes due February 8, 2031 | | BDX31 | | New York Stock Exchange |

| 3.828% Notes due June 7, 2032 | | BDX32A | | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

ITEM 7.01. Regulation FD Disclosure.

On October 2, 2024, Becton, Dickinson and Company (“BD”) issued a press release related to its agreement to resolve the vast majority of its existing hernia litigation (the “Settlement”), including cases in both the Rhode Island consolidated litigation and the federal multidistrict litigation in Ohio. The aggregate amount payable pursuant to the Settlement (the “Settlement Amount”) is within BD’s current product litigation reserve for this matter and will be paid out over a multi-year period. As a result, the Settlement Amount is already recorded as a liability within BD’s consolidated balance sheet and the Settlement will not result in an incremental charge to BD's consolidated income statement. The multi-year payment structure was contemplated as part of BD’s cash flow planning process and was included in BD’s previously communicated free cash flow goals and capital allocation strategy.

The Settlement does not include any admission of liability or wrongdoing, and BD continues to dispute the allegations in these matters. BD will continue to vigorously defend itself in cases not resolved through this agreement.

A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated into this Item 7.01 by reference. The information in this Item 7.01 shall neither be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Forward Looking Statements

This report contains forward-looking statements (as defined under Federal securities laws) regarding the hernia mass tort litigation settlement, including statements regarding the potential impact of the settlement on the existing litigation relating to the products that are the subject of the settlement. These statements may be identified by words such as “believes”, “will” and other similar expressions. Forward-looking statements are based on management’s current expectations, estimates, assumptions, and projections, and are subject to significant uncertainties and other factors, many of which are beyond BD’s control. Factors that could cause actual results to differ materially include, but are not limited to, whether the anticipated level of participation by plaintiffs in the settlement will be achieved or will fall below the level that would permit BD to terminate the settlement, the number of claims made by plaintiffs that decline to participate in the settlement, whether the settlement is appealed or challenged, and the filing of future claims by plaintiffs that are not covered by the settlement, and the outcome of any pending or future litigation relating to the products that are the subject of the settlement. BD is subject to additional risks and uncertainties as described in BD’s latest Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. BD does not intend to update any forward-looking statements to reflect events or circumstances after the date hereof except as required by applicable laws or regulations.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

Exhibit 99.1 Press release dated October 2, 2024, which is furnished pursuant to Item 7.01.

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

BECTON, DICKINSON AND COMPANY

(Registrant)

| | | | | |

| By: | /s/ Stephanie M. Kelly |

| | Stephanie M. Kelly |

| | Associate General Counsel, Securities and Governance and Assistant Secretary |

Date: October 2, 2024

NEWS RELEASE

NEWS RELEASE

BD Reaches Agreement to Resolve Vast Majority of Hernia Litigation

•No admission of liability or wrongdoing; settlement structured to eliminate uncertainty for all stakeholders related to settled cases.

•Settlement amount within current product litigation reserve and will be paid out over a multi-year period.

•Settlement will not change BD’s cash flow goals or capital allocation strategy.

FRANKLIN LAKES, N.J. (Oct. 2, 2024) – BD (Becton, Dickinson and Company) (NYSE: BDX), a leading global medical technology company, today announced it has reached an agreement to resolve the vast majority of its existing hernia litigation.

Terms of the settlement agreement, which are confidential, include cases in both the Rhode Island consolidated litigation and the federal multidistrict litigation in Ohio. The aggregate amount payable pursuant to this settlement is within the company’s current product litigation reserve for this matter and will be paid out over a multi-year period. As a result, the settlement amount is already recorded as a liability within BD’s consolidated balance sheet and the agreement will not result in an incremental charge to the company’s consolidated income statement. BD believes this agreement is in the best interest of all parties and is structured to eliminate uncertainty for all stakeholders related to the settled cases. The hernia mass tort litigation represents a large majority of BD’s total product litigation reserve.

The multi-year payment structure was contemplated as part of the company’s cash flow planning process and was included in its previously communicated free cash flow goals and capital allocation strategy.

The settlement does not include any admission of liability or wrongdoing, and BD continues to dispute the allegations in these matters. The company will continue to vigorously defend itself in cases not resolved through this agreement.

Patient safety and product quality are top priorities at BD. All implantable medical devices carry inherent risks and provide significant clinical benefits. BD is confident in both the design of its products and fulfilling its obligation to provide information about both the risks and the benefits of its products, enabling physicians, in consultation with their patients, to determine whether those benefits outweigh the potential risks in a particular instance.

# # #

About BD

BD is one of the largest global medical technology companies in the world and is advancing the world of health by improving medical discovery, diagnostics and the delivery of care. The company supports the heroes on the frontlines of health care by developing innovative technology, services and solutions that help advance both clinical therapy for patients and clinical process for health care providers. BD and its more than 70,000 employees have a passion and commitment to help enhance the safety and efficiency of clinicians' care delivery process, enable laboratory scientists to accurately detect disease and advance researchers' capabilities to develop the next generation of diagnostics and therapeutics. BD has a presence in virtually every country and partners with organizations around the world to address some of the most challenging global health issues. By working in close collaboration with customers, BD can help enhance outcomes, lower costs, increase efficiencies, improve safety and expand access to health care. For more information on BD, please visit bd.com or connect with us on LinkedIn at www.linkedin.com/company/bd1/, X (formerly Twitter) @BDandCo or Instagram @becton_dickinson.

Forward Looking Statements

This press release contains forward-looking statements (as defined under Federal securities laws) regarding the hernia mass tort litigation settlement, including statements regarding the potential impact of the settlement on the existing litigation relating to the products that are the subject of the settlement. These statements may be identified by words such as “believes”, “will” and other similar expressions. Forward-looking statements are based on management’s current expectations, estimates, assumptions, and projections, and are subject to significant uncertainties and other factors, many of which are beyond BD’s control. Factors that could cause actual results to differ materially include, but are not limited to, whether the anticipated level of participation by plaintiffs in the settlement will be achieved or will fall below the level that would permit BD to terminate the settlement, the number of claims made by plaintiffs that decline to participate in the settlement, whether the settlement is appealed or challenged, the filing of future claims by plaintiffs that are not covered by the settlement, and the impact or outcome of any pending or future litigation relating to the products that are the subject of the settlement. BD is subject to additional risks and uncertainties as described in BD’s latest Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. BD does not intend to update any forward-looking statements to reflect events or circumstances after the date hereof except as required by applicable laws or regulations.

Contacts:

Media: Investors:

Troy Kirkpatrick Adam Reiffe

VP, Public Relations Sr. Director, Investor Relations

858.617.2361 201.847.6927

troy.kirkpatrick@bd.com adam.reiffe@bd.com

v3.24.3

Cover Page

|

Oct. 02, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 02, 2024

|

| Entity Registrant Name |

BECTON, DICKINSON AND COMPANY

|

| Entity Central Index Key |

0000010795

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

NJ

|

| Entity File Number |

001-4802

|

| Entity Tax Identification Number |

22-0760120

|

| Entity Address, Address Line One |

1 Becton Drive,

|

| Entity Address, City or Town |

Franklin Lakes,

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07417-1880

|

| City Area Code |

(201)

|

| Local Phone Number |

847-6800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock | NEW YORK STOCK EXCHANGE, INC. |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $1.00

|

| Trading Symbol |

BDX

|

| Security Exchange Name |

NYSE

|

| Notes 1.900% due December 15, 2026 | NEW YORK STOCK EXCHANGE, INC. |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.900% Notes due December 15, 2026

|

| Trading Symbol |

BDX26

|

| Security Exchange Name |

NYSE

|

| Notes 3.020% due May 24, 2025 | NEW YORK STOCK EXCHANGE, INC. |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.020% Notes due May 24, 2025

|

| Trading Symbol |

BDX25

|

| Security Exchange Name |

NYSE

|

| Notes 1.208% due June 4, 2026 | NEW YORK STOCK EXCHANGE, INC. |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.208% Notes due June 4, 2026

|

| Trading Symbol |

BDX/26A

|

| Security Exchange Name |

NYSE

|

| Notes 1.213% due February 12, 2036 | NEW YORK STOCK EXCHANGE, INC. |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.213% Notes due February 12, 2036

|

| Trading Symbol |

BDX/36

|

| Security Exchange Name |

NYSE

|

| Notes 0.034% due August 13, 2025 | NEW YORK STOCK EXCHANGE, INC. |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.034% Notes due August 13, 2025

|

| Trading Symbol |

BDX25A

|

| Security Exchange Name |

NYSE

|

| Notes 3.519% due February 8, 2031 | NEW YORK STOCK EXCHANGE, INC. |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.519% Notes due February 8, 2031

|

| Trading Symbol |

BDX31

|

| Security Exchange Name |

NYSE

|

| Notes 3.828% due June 7, 2032 | NEW YORK STOCK EXCHANGE, INC. |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.828% Notes due June 7, 2032

|

| Trading Symbol |

BDX32A

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bdx_Notes1.900dueDecember152026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bdx_Notes3.020dueMay242025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bdx_Notes1.208dueJune42026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bdx_Notes1213DueFebruary122036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bdx_Notes0034DueAugust132025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bdx_Notes3.519DueFebruary82031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bdx_Notes3.828DueJune72032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

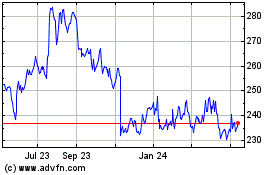

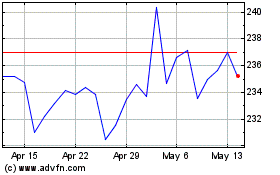

Becton Dickinson (NYSE:BDX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Becton Dickinson (NYSE:BDX)

Historical Stock Chart

From Dec 2023 to Dec 2024