B&G Foods, Inc. (NYSE: BGS) today announced financial

results for the second quarter and first two quarters of 2024.

Financial results for the second quarter and first two quarters of

2024 reflect the impact of the Green Giant U.S. shelf-stable

divestiture during the fourth quarter of 2023.

Summary

Second Quarter of 2024

First Two Quarters of

2024

(In millions, except per share

data)

Change vs.

Change vs.

Amount

Q2 2023

Amount

First 2Q 2023

Net Sales

$

444.6

(5.3

)%

$

919.8

(6.3

)%

Base Business Net Sales 1

$

444.6

(2.5

)%

$

919.9

(3.5

)%

Diluted EPS

$

0.05

(66.7

)%

$

(0.46

)

(342.1

)%

Adj. Diluted EPS 1

$

0.08

(46.7

)%

$

0.27

(34.1

)%

Net Income (Loss)

$

3.9

(62.7

)%

$

(36.3

)

(359.9

)%

Adj. Net Income 1

$

6.6

(38.7

)%

$

21.0

(29.7

)%

Adj. EBITDA 1

$

63.9

(6.6

)%

$

139.0

(7.9

)%

Guidance for Full Year Fiscal 2024

- Net sales revised to a range of $1.945 billion to $1.970

billion.

- Adjusted EBITDA revised to a range of $300 million to $315

million.

- Adjusted diluted earnings per share revised to a range of $0.70

to $0.90.

Commenting on the results, Casey Keller, President and Chief

Executive Officer of B&G Foods, stated, “B&G Foods remains

committed to execute against our long-term strategy to improve

organic growth and focus the portfolio, despite short-term weakness

in consumer packaged food demand. Second quarter results were

largely in line with expectations, showing gradual, sequential

improvement in base business net sales from the first quarter. Net

sales on the highest margin Spices & Flavor Solutions business

increased by 4.9% versus last year. As previously announced, we

recently refinanced a large portion of our long-term debt, pushing

out maturity dates several years into the future to reduce balance

sheet risk. We also continue to review and work possible

divestitures to reduce debt, increase focus on our core businesses,

and position B&G Foods for long-term organic and acquisition

growth.”

Financial Results for the Second Quarter of 2024 Net

sales for the second quarter of 2024 decreased $25.0 million, or

5.3%, to $444.6 million from $469.6 million for the second quarter

of 2023. The decrease was primarily attributable to the Green Giant

U.S. shelf-stable divestiture, a decrease in unit volume, a

decrease in net pricing and the impact of product mix. Net sales of

the Green Giant U.S. shelf-stable product line, which the Company

divested on November 8, 2023, were $13.7 million in the second

quarter of 2023.

Base business net sales for the second quarter of 2024 decreased

$11.3 million, or 2.5%, to $444.6 million from $455.9 million for

the second quarter of 2023. The decrease in base business net sales

was driven by a decrease in unit volume of $9.3 million, or 2.0% of

base business net sales, a decrease in net pricing and the impact

of product mix of $1.8 million, or 0.4%, and the negative impact of

foreign currency of $0.2 million.

Gross profit was $92.0 million for the second quarter of 2024,

or 20.7% of net sales. Adjusted gross profit(1), which excludes the

negative impact of $1.2 million of acquisition/divestiture-related

expenses and non-recurring expenses included in cost of goods sold

during the second quarter of 2024, was $93.2 million, or 21.0% of

net sales. Gross profit was $102.3 million for the second quarter

of 2023, or 21.8% of net sales. Adjusted gross profit, which

excludes the negative impact of $0.4 million of

acquisition/divestiture-related expenses and non-recurring expenses

included in cost of goods sold during the second quarter of 2023,

was $102.7 million, or 21.9% of net sales.

Selling, general and administrative expenses decreased $4.8

million, or 9.9%, to $43.1 million for the second quarter of 2024

from $47.9 million for the second quarter of 2023. The decrease was

composed of decreases in consumer marketing expenses of $3.4

million, selling expenses of $1.9 million, and warehousing expenses

of $0.1 million, partially offset by an increase in general and

administrative expenses of $0.6 million. Expressed as a percentage

of net sales, selling, general and administrative expenses improved

by 0.5 percentage points to 9.7% for the second quarter of 2024, as

compared to 10.2% for the second quarter of 2023.

Net interest expense increased $2.0 million, or 5.6%, to $37.8

million for the second quarter of 2024 from $35.8 million for the

second quarter of 2023. The increase was primarily attributable to

higher interest rates on the Company’s long-term debt during the

second quarter of 2024 compared to the second quarter of 2023, as

well as the accelerated amortization of deferred debt financing

costs of $0.5 million resulting from the Company’s prepayment of

$21.3 million aggregate principal amount of tranche B term loans

and repurchase of $0.7 million aggregate principal amount of 8.00%

senior secured notes due 2028 during the second quarter of 2024,

partially offset by a reduction in average long-term debt

outstanding during the second quarter of 2024 compared to the

second quarter of 2023 and the accelerated amortization of deferred

debt financing costs relating to long-term debt prepayments during

the second quarter of 2023.

The Company’s net income was $3.9 million, or $0.05 per diluted

share, for the second quarter of 2024, compared to net income of

$10.6 million, or $0.15 per diluted share, for the second quarter

of 2023. The decrease in net income and diluted earnings per share

were primarily attributable to the reduction of base business net

sales in the second quarter of 2024, the impact of the Green Giant

U.S. shelf-stable divestiture and the negative impact on income tax

expense of $1.0 million, or $0.01 per share, resulting from return

to provision adjustments in the U.S. and Mexico. The Company’s

adjusted net income for the second quarter of 2024 was $6.6

million, or $0.08 per adjusted diluted share, compared to adjusted

net income of $10.7 million, or $0.15 per adjusted diluted share,

for the second quarter of 2023. The Company’s diluted earnings per

share and adjusted diluted earnings per share for the second

quarter of 2024 was negatively impacted by an increase to the

weighted average shares outstanding in the second quarter of 2024

compared to the second quarter of 2023.

For the second quarter of 2024, adjusted EBITDA was $63.9

million, a decrease of $4.6 million, or 6.6%, compared to $68.5

million for the second quarter of 2023. The decrease in adjusted

EBITDA was primarily attributable to the reduction of base business

net sales in the second quarter of 2024 and the impact of the Green

Giant U.S. shelf-stable divestiture. Adjusted EBITDA as a

percentage of net sales was 14.4% for the second quarter of 2024,

compared to 14.6% for the second quarter of 2023.

Financial Results for First Two Quarters of 2024 Net

sales for the first two quarters of 2024 decreased $61.7 million,

or 6.3%, to $919.8 million from $981.5 million for the first two

quarters of 2023. The decrease was primarily attributable to the

Green Giant U.S. shelf-stable divestiture, a decrease in unit

volume, and a decrease in net pricing and the impact of product

mix. Net sales of the Green Giant U.S. shelf-stable product line,

which the Company divested on November 8, 2023, were $28.2 million

in the first two quarters of 2023.

Base business net sales for the first two quarters of 2024

decreased $33.3 million, or 3.5%, to $919.9 million from $953.2

million for the first two quarters of 2023. The decrease in base

business net sales was driven by a decrease in net pricing and the

impact of product mix of $17.2 million, or 1.8% of base business

net sales and a decrease in unit volume of $16.1 million, or

1.7%.

Gross profit was $200.9 million for the first two quarters of

2024, or 21.8% of net sales. Adjusted gross profit, which excludes

the negative impact of $2.2 million of

acquisition/divestiture-related expenses and non-recurring expenses

included in cost of goods sold during the first two quarters of

2024, was $203.1 million, or 22.1% of net sales. Gross profit was

$216.5 million for the first two quarters of 2023, or 22.1% of net

sales. Adjusted gross profit, which excludes the negative impact of

$1.1 million of acquisition/divestiture-related expenses and

non-recurring expenses included in cost of goods sold during the

first two quarters of 2023, was $217.6 million, or 22.2% of net

sales.

Selling, general and administrative expenses decreased $2.9

million, or 3.0%, to $91.7 million for the first two quarters of

2024 from $94.6 million for the first two quarters of 2023. The

decrease was composed of decreases in selling expenses of $3.0

million, consumer marketing expenses of $1.8 million, and

warehousing expenses of $0.7 million, partially offset by increases

in general and administrative expenses of $2.5 million and

acquisition/divestiture-related and non-recurring expenses of $0.1

million. Expressed as a percentage of net sales, selling, general

and administrative expenses increased by 0.4 percentage points to

10.0% for the first two quarters of 2024, as compared to 9.6% for

the first two quarters of 2023.

In connection with the Company’s transition from one reporting

segment to four reporting segments during the first quarter of

2024, the Company reassigned assets and liabilities, including

goodwill, between the reporting segments and completed a goodwill

impairment test both prior to and subsequent to the change. The

goodwill impairment test resulted in the Company recognizing

pre-tax, non-cash goodwill impairment charges of $70.6 million

within its Frozen & Vegetables reporting segment during the

first quarter of 2024.

Net interest expense increased $0.4 million, or 0.5%, to $75.6

million for the first two quarters of 2024 from $75.2 million for

the first two quarters of 2023. The increase was primarily

attributable to higher interest rates on the Company’s long-term

debt during the first two quarters of 2024 compared to the first

two quarters of 2023, as well as the accelerated amortization of

deferred debt financing costs of $0.5 million resulting from the

Company’s prepayment of $21.3 million aggregate principal amount of

tranche B term loans and repurchase of $0.7 million aggregate

principal amount of 8.00% senior secured notes due 2028 during the

second quarter of 2024, partially offset by a reduction in average

long-term debt outstanding during the first two quarters of 2024

compared to the first two quarters of 2023 and the accelerated

amortization of deferred debt financing costs relating to long-term

debt prepayments during the first two quarters of 2023.

The Company had a net loss of $36.3 million, or $0.46 per

diluted share, for the first two quarters of 2024, compared to net

income of $14.0 million, or $0.19 per diluted share, for the first

two quarters of 2023. The Company’s net loss for the first two

quarters of 2024 was primarily attributable to pre-tax, non-cash

impairment charges of $70.6 million for the impairment of goodwill

within the Company’s Frozen & Vegetables reporting segment, the

reduction of base business net sales in the first two quarters of

2024, the impact of the Green Giant U.S. shelf-stable divestiture

and the negative impact on income tax expense of $1.0 million, or

$0.01 per share, resulting from return to provision adjustments in

the U.S. and Mexico. The Company’s adjusted net income for the

first two quarters of 2024 was $21.0 million, or $0.27 per adjusted

diluted share, compared to adjusted net income of $29.8 million, or

$0.41 per adjusted diluted share, for the first two quarters of

2023. The Company’s adjusted diluted earnings per share for the

first two quarters of 2024 was negatively impacted by an increase

to the weighted average shares outstanding in the first two

quarters of 2024 compared to the first two quarters of 2023.

For the first two quarters of 2024, adjusted EBITDA was $139.0

million, a decrease of $11.8 million, or 7.9%, compared to $150.8

million for the first two quarters of 2023. The decrease in

adjusted EBITDA was primarily attributable to the reduction of base

business net sales in the first two quarters of 2024 and the impact

of the Green Giant U.S. shelf-stable divestiture. Adjusted EBITDA

as a percentage of net sales was 15.1% for the first two quarters

of 2024, compared to 15.4% for the first two quarters of 2023.

Tack-on Offering of Senior Secured Notes and Credit Agreement

Refinancing Tack-on Offering of 8.00% Senior Secured Notes Due

2028. On July 12, 2024, the Company completed its offering of an

additional $250.0 million aggregate principal amount of 8.00%

senior secured notes due 2028. The new senior secured notes were

issued at a price of 100.5% of their face value plus accrued and

unpaid interest from March 15, 2024 to, but excluding, the closing

date. The new senior secured notes constitute an additional

issuance of senior secured notes under the indenture, dated as of

September 26, 2023, governing the Company’s previously issued 8.00%

senior secured notes due 2028. Following completion of the tack-on

offering, as of August 6, 2024, approximately $799.3 million

aggregate principal amount of 8.00% senior secured notes due 2028

are outstanding.

The Company used the net proceeds of the new senior secured

notes offering to repay a portion of its tranche B term loans and

revolving credit loans under its senior secured credit agreement

and to pay related fees and expenses.

Credit Agreement Refinancing. Also on July 12, 2024, the Company

completed the refinancing and amendment of its senior secured

credit agreement. As part of the refinancing and together with a

portion of the net proceeds of the tack-on offering, the Company

reduced the aggregate principal amount of tranche B term loans

outstanding from $507.3 million to $450.0 million by replacing

$507.3 million of outstanding tranche B term loans with $450.0

million of new tranche B term loans. The Company also extended the

maturity date for the tranche B term loans from October 10, 2026 to

October 10, 2029.

As part of the refinancing, the Company also prepaid $175.0

million aggregate principal amount of revolving credit loans with a

portion of the proceeds of the tack-on offering, decreased the

revolver capacity under the senior secured credit agreement from

$800.0 million to $475.0 million aggregate principal amount, and

extended the maturity date of its revolving credit facility from

December 16, 2025 to December 16, 2028. As of August 6, 2024, $30.0

million aggregate principal amount of revolving credit loans remain

outstanding.

Segment Results(2) Historically, the Company operated in

a single industry segment. However, beginning with the first

quarter of 2024, the Company now operates in, and has begun

reporting results by, four business segments. This change stemmed

from the Company’s recent formation and the evolution of the

Company’s four business units: Specialty, Meals, Frozen &

Vegetables and Spices & Flavor Solutions, which are further

described below. Prior period segment results in this earnings

press release have been recast to reflect the change from one

single operating segment to four operating segments.

Specialty — includes, among others, the

Crisco, Clabber Girl, Bear Creek, Polaner, Underwood, B&G,

Grandma’s, New York Style, B&M, TrueNorth, Don Pepino,

Sclafani, Baker’s Joy, Regina, SugarTwin and Brer Rabbit

brands.

Meals — includes, among others, the Ortega,

Maple Grove Farms, Cream of Wheat, Victoria, Las Palmas, Mama

Mary’s, Spring Tree, McCann’s, Carey’s and Vermont Maid brands.

Frozen & Vegetables — includes the Green

Giant and Le Sueur brands.

Spices & Flavor Solutions — includes,

among others, the Dash, Weber, Spice Islands, Tone’s, Ac’cent,

Trappey’s, Durkee and Wright’s brands.

Specialty Segment Results

Specialty segment results were as follows (dollars in

thousands):

Second Quarter

First Two Quarters

Ended

Ended

June 29,

July 1,

June 29,

July 1,

2024

2023

$ Change

% Change

2024

2023

$ Change

% Change

Specialty segment net sales

$

146,624

$

153,837

$

(7,213

)

(4.7

)%

$

301,353

$

316,460

$

(15,107

)

(4.8

)%

Specialty segment adjusted EBITDA

$

31,688

$

32,706

$

(1,018

)

(3.1

)%

$

68,880

$

69,190

$

(310

)

(0.4

)%

For the second quarter of 2024, the decrease in Specialty

segment net sales was primarily due to a decrease in Crisco net

pricing driven by a decrease in commodity costs coupled with a

decrease in volumes across the rest of the Specialty portfolio in

the aggregate, partially offset by an increase in Crisco volumes.

For the first two quarters of 2024, the decrease in Specialty

segment net sales was primarily due to a decrease in Crisco pricing

driven by a decrease in commodity costs coupled with a decrease in

volumes for Crisco and a decrease in volumes for the rest of the

Specialty portfolio in the aggregate. The decrease in Specialty

segment adjusted EBITDA for the second quarter and first two

quarters of 2024 was primarily due to lower volumes, partially

offset by rate improvements across key materials and freight

costs.

Meals Segment Results

Meals segment results were as follows (dollars in

thousands):

Second Quarter

First Two Quarters

Ended

Ended

June 29,

July 1,

June 29,

July 1,

2024

2023

$ Change

% Change

2024

2023

$ Change

% Change

Meals segment net sales

$

107,889

$

114,143

$

(6,254

)

(5.5

)%

$

227,920

$

236,092

$

(8,172

)

(3.5

)%

Meals segment adjusted EBITDA

$

23,911

$

23,024

$

887

3.9

%

$

49,540

$

49,262

$

278

0.6

%

For the second quarter and first two quarters of 2024, the

decrease in Meals segment net sales was primarily due to a decrease

in volumes across the Meals portfolio in the aggregate, partially

offset by an increase in net pricing. The increase in Meals segment

adjusted EBITDA was primarily due to improvements in freight costs,

partially offset by a decrease in net sales, and rate increases in

other key materials.

Frozen & Vegetables Segment Results

Frozen & Vegetables segment results were as follows (dollars

in thousands):

Second Quarter

First Two Quarters

Ended

Ended

June 29,

July 1,

June 29,

July 1,

2024

2023

$ Change

% Change

2024

2023

$ Change

% Change

Frozen & Vegetables segment net

sales

$

91,580

$

107,762

$

(16,182

)

(15.0

)%

$

196,467

$

233,968

$

(37,501

)

(16.0

)%

Frozen & Vegetables segment adjusted

EBITDA

$

3,808

$

10,775

$

(6,967

)

(64.7

)%

$

11,638

$

21,229

$

(9,591

)

(45.2

)%

For the second quarter and first two quarters of 2024, the

decrease in Frozen & Vegetables segment net sales was primarily

due to the Green Giant U.S. shelf-stable divestiture (which

negatively impacted net sales versus the prior year period by $13.8

million and $28.3 million, respectively), a decrease in volumes,

increased promotional trade spending, and the impact of product mix

in frozen. The decrease in Frozen & Vegetables segment adjusted

EBITDA was primarily due to the Green Giant U.S. shelf-stable

divestiture, a decrease in net sales, increases in material costs

and the negative impact of foreign currency, partially offset by

improvements in freight costs.

Spices & Flavor Solutions Segment Results

Spices & Flavor Solutions segment results were as follows

(dollars in thousands):

Second Quarter

First Two Quarters

Ended

Ended

June 29,

July 1,

June 29,

July 1,

2024

2023

$ Change

% Change

2024

2023

$ Change

% Change

Spices & Flavor Solutions segment net

sales

$

98,497

$

93,895

$

4,602

4.9

%

$

194,073

$

194,931

$

(858

)

(0.4

)%

Spices & Flavor Solutions segment

adjusted EBITDA

$

27,647

$

26,113

$

1,534

5.9

%

$

56,316

$

56,793

$

(477

)

(0.8

)%

For the second quarter of 2024, the increase in Spices &

Flavor Solutions segment net sales was primarily due to increased

volumes across the Spices & Flavor Solutions portfolio in the

aggregate. The increase in Spices & Flavor Solutions segment

adjusted EBITDA was primarily due to an increase in net sales and

improvements in freight costs, partially offset by increases in

material costs. For the first two quarters of 2024, Spices &

Flavor Solutions segment net sales and segment adjusted EBITDA were

essentially flat.

Full Year Fiscal 2024 Guidance B&G Foods revised its

net sales guidance for fiscal 2024 to a range of $1.945 billion to

$1.970 billion, revised its adjusted EBITDA guidance to a range of

$300 million to $315 million, and revised its adjusted diluted

earnings per share guidance to a range of $0.70 to $0.90.

B&G Foods provides earnings guidance only on a non-GAAP

basis and does not provide a reconciliation of the Company’s

forward-looking adjusted EBITDA and adjusted diluted earnings per

share guidance to the most directly comparable GAAP financial

measures because of the inherent difficulty in forecasting and

quantifying certain amounts that are necessary for such

reconciliations, including adjustments that could be made for

deferred taxes; acquisition/divestiture-related expenses, gains and

losses (which may include third-party fees and expenses,

integration, restructuring and consolidation expenses, amortization

of acquired inventory fair value step-up and gains and losses on

the sale of certain assets); gains and losses on extinguishment of

debt; impairment of assets held for sale; impairment of intangible

assets; non-recurring expenses, gains and losses; and other charges

reflected in the Company’s reconciliation of historic non-GAAP

financial measures, the amounts of which, based on past experience,

could be material. For additional information regarding B&G

Foods’ non-GAAP financial measures, see “About Non-GAAP Financial

Measures and Items Affecting Comparability” below.

Conference Call B&G Foods will hold a conference call

at 4:30 p.m. ET today, August 6, 2024 to discuss second quarter

2024 financial results. The live audio webcast of the conference

call can be accessed at www.bgfoods.com/investor-relations. A

replay of the webcast will be available following the conference

call through the same link.

About Non-GAAP Financial Measures and Items Affecting

Comparability “Adjusted net income” (net income (loss) adjusted

for certain items that affect comparability), “adjusted diluted

earnings per share” (diluted earnings (loss) per share adjusted for

certain items that affect comparability), “base business net sales”

(net sales without the impact of acquisitions until the

acquisitions are included in both comparable periods and without

the impact of discontinued or divested brands), “EBITDA” (net

income (loss) before net interest expense, income taxes, and

depreciation and amortization), “adjusted EBITDA” (EBITDA as

adjusted for cash and non-cash acquisition/divestiture-related

expenses, gains and losses (which may include third-party fees and

expenses, integration, restructuring and consolidation expenses,

amortization of acquired inventory fair value step-up and gains and

losses on the sale of certain assets), gains and losses on

extinguishment of debt, impairment of assets held for sale,

impairment of intangible assets, and non-recurring expenses, gains

and losses), “segment adjusted EBITDA” (adjusted EBITDA for

operating segments), “adjusted gross profit” (gross profit adjusted

for acquisition/divestiture-related expenses and non-recurring

expenses included in cost of goods sold) and “adjusted gross profit

percentage” (gross profit as a percentage of net sales adjusted for

acquisition/divestiture-related expenses and non-recurring expenses

included in cost of goods sold) are “non-GAAP financial measures.”

A non-GAAP financial measure is a numerical measure of financial

performance that excludes or includes amounts so as to be different

than the most directly comparable measure calculated and presented

in accordance with generally accepted accounting principles in the

United States (GAAP) in B&G Foods’ consolidated balance sheets

and related consolidated statements of operations, comprehensive

(loss) income, changes in stockholders’ equity and cash flows.

Non-GAAP financial measures should not be considered in isolation

or as a substitute for the most directly comparable GAAP measures.

The Company’s non-GAAP financial measures may be different from

non-GAAP financial measures used by other companies.

The Company uses non-GAAP financial measures to adjust for

certain items that affect comparability. This information is

provided in order to allow investors to make meaningful comparisons

of the Company’s operating performance between periods and to view

the Company’s business from the same perspective as the Company’s

management. Because the Company cannot predict the timing and

amount of these items that affect comparability, management does

not consider these items when evaluating the Company’s performance

or when making decisions regarding allocation of resources.

Additional information regarding EBITDA, adjusted EBITDA,

segment adjusted EBITDA and reconciliations of EBITDA, adjusted

EBITDA and segment adjusted EBITDA to net income (loss) and, in the

case of EBITDA and adjusted EBITDA, to net cash provided by

operating activities, is included below for the second quarter and

first two quarters of 2024 and 2023, along with the components of

EBITDA, adjusted EBITDA and segment adjusted EBITDA. Also included

below are reconciliations of the non-GAAP terms adjusted net

income, adjusted diluted earnings per share and base business net

sales to the most directly comparable measure calculated and

presented in accordance with GAAP in the Company’s consolidated

balance sheets and related consolidated statements of operations,

comprehensive (loss) income, changes in stockholders’ equity and

cash flows.

End Notes

(1)

Please see “About Non-GAAP Financial

Measures and Items Affecting Comparability” above for the

definition of the non-GAAP financial measures “base business net

sales,” “adjusted diluted earnings per share,” “adjusted net

income,” “EBITDA,” “adjusted EBITDA,” “segment adjusted EBITDA,”

“adjusted gross profit” and “adjusted gross profit percentage,” as

well as information concerning certain items affecting

comparability and reconciliations of the non-GAAP terms to the most

comparable GAAP financial measures.

(2)

Segment net sales and segment adjusted

EBITDA are the primary measures used by the Company’s chief

operating decision maker (CODM) to evaluate segment operating

performance and to decide how to allocate resources to segments.

The Company’s CODM is the Company’s chief executive officer.

Segment adjusted EBITDA excludes unallocated corporate items,

depreciation and amortization, acquisition/divestiture-related and

non-recurring expenses, impairment of intangible assets, gains and

losses on sales of assets, interest expense, and income tax expense

or benefit. Unallocated corporate items consist of centrally

managed corporate functions, including selling, marketing,

procurement, centralized administrative functions, insurance, and

other similar expenses not directly tied to segment operating

performance. Depreciation and amortization expenses are neither

maintained nor available by operating segment, as the Company’s

manufacturing, warehouse, and distribution activities are centrally

managed. These items that are centrally managed at the corporate

level, and therefore excluded from the measure of segment adjusted

EBITDA, are reviewed by the CODM. Expenses that are managed

centrally but can be attributed to a segment, such as warehousing

and transportation expenses, are generally allocated based on

sales.

NM – Not meaningful.

About B&G Foods, Inc. Based in Parsippany, New

Jersey, B&G Foods and its subsidiaries manufacture, sell and

distribute high-quality, branded shelf-stable and frozen foods

across the United States, Canada and Puerto Rico. With B&G

Foods’ diverse portfolio of more than 50 brands you know and love,

including B&G, B&M, Bear Creek, Cream of Wheat, Crisco,

Dash, Green Giant, Las Palmas, Le Sueur, Mama Mary’s, Maple Grove

Farms, New York Style, Ortega, Polaner, Spice Islands and Victoria,

there’s a little something for everyone. For more information about

B&G Foods and its brands, please visit www.bgfoods.com.

Forward-Looking Statements Statements in this press

release that are not statements of historical or current fact

constitute “forward-looking statements.” The forward-looking

statements contained in this press release include, without

limitation, statements related to B&G Foods’ expectations

regarding net sales, adjusted EBITDA and adjusted diluted earnings

per share, and B&G Foods’ long-term strategy, including

possible divestitures to reduce debt, increase focus on core

businesses and position B&G Foods for long-term organic and

acquisition growth. Such forward-looking statements involve known

and unknown risks, uncertainties and other unknown factors that

could cause the actual results of B&G Foods to be materially

different from the historical results or from any future results

expressed or implied by such forward-looking statements. In

addition to statements that explicitly describe such risks and

uncertainties, readers are urged to consider statements labeled

with the terms “believes,” “belief,” “expects,” “projects,”

“intends,” “anticipates,” “assumes,” “could,” “should,”

“estimates,” “potential,” “seek,” “predict,” “may,” “will” or

“plans” and similar references to future periods to be uncertain

and forward-looking. Factors that may affect actual results

include, without limitation: the Company’s substantial leverage;

the effects of rising costs for and/or decreases in supply of the

Company’s commodities, ingredients, packaging, other raw materials,

distribution and labor; crude oil prices and their impact on

distribution, packaging and energy costs; the Company’s ability to

successfully implement sales price increases and cost saving

measures to offset any cost increases; intense competition, changes

in consumer preferences, demand for the Company’s products and

local economic and market conditions; the Company’s continued

ability to promote brand equity successfully, to anticipate and

respond to new consumer trends, to develop new products and

markets, to broaden brand portfolios in order to compete

effectively with lower priced products and in markets that are

consolidating at the retail and manufacturing levels and to improve

productivity; the ability of the Company and its supply chain

partners to continue to operate manufacturing facilities,

distribution centers and other work locations without material

disruption, and to procure ingredients, packaging and other raw

materials when needed despite disruptions in the supply chain or

labor shortages; the impact pandemics or disease outbreaks, such as

the COVID-19 pandemic, may have on the Company’s business,

including among other things, the Company’s supply chain,

manufacturing operations or workforce and customer and consumer

demand for the Company’s products; the Company’s ability to recruit

and retain senior management and a highly skilled and diverse

workforce at the Company’s corporate offices, manufacturing

facilities and other locations despite a very tight labor market

and changing employee expectations as to fair compensation, an

inclusive and diverse workplace, flexible working and other

matters; the risks associated with the expansion of the Company’s

business; the Company’s possible inability to identify new

acquisitions or to integrate recent or future acquisitions or the

Company’s failure to realize anticipated revenue enhancements, cost

savings or other synergies from recent or future acquisitions; the

Company’s ability to successfully complete the integration of

recent or future acquisitions into the Company’s enterprise

resource planning (ERP) system; tax reform and legislation,

including the effects of the Infrastructure Investment and Jobs

Act, U.S. Tax Cuts and Jobs Act and the U.S. CARES Act, and future

tax reform or legislation; the Company’s ability to access the

credit markets and the Company’s borrowing costs and credit

ratings, which may be influenced by credit markets generally and

the credit ratings of the Company’s competitors; unanticipated

expenses, including, without limitation, litigation or legal

settlement expenses; the effects of currency movements of the

Canadian dollar and the Mexican peso as compared to the U.S.

dollar; the effects of international trade disputes, tariffs,

quotas, and other import or export restrictions on the Company’s

international procurement, sales and operations; future impairments

of the Company’s goodwill and intangible assets; the Company’s

ability to protect information systems against, or effectively

respond to, a cybersecurity incident, other disruption or data

leak; the Company’s ability to successfully implement the Company’s

sustainability initiatives and achieve the Company’s sustainability

goals, and changes to environmental laws and regulations; and other

factors that affect the food industry generally, including: recalls

if products become adulterated or misbranded, liability if product

consumption causes injury, ingredient disclosure and labeling laws

and regulations and the possibility that consumers could lose

confidence in the safety and quality of certain food products;

competitors’ pricing practices and promotional spending levels;

fluctuations in the level of the Company’s customers’ inventories

and credit and other business risks related to the Company’s

customers operating in a challenging economic and competitive

environment; and the risks associated with third-party suppliers

and co-packers, including the risk that any failure by one or more

of the Company’s third-party suppliers or co-packers to comply with

food safety or other laws and regulations may disrupt the Company’s

supply of raw materials or certain finished goods products or

injure the Company’s reputation. The forward-looking statements

contained herein are also subject generally to other risks and

uncertainties that are described from time to time in B&G

Foods’ filings with the Securities and Exchange Commission,

including under Item 1A, “Risk Factors” in the Company’s most

recent Annual Report on Form 10-K and in its subsequent reports on

Forms 10-Q and 8-K. Investors are cautioned not to place undue

reliance on any such forward-looking statements, which speak only

as of the date they are made. B&G Foods undertakes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

B&G Foods, Inc. and

Subsidiaries

Consolidated Balance

Sheets

(In thousands, except share

and per share data)

(Unaudited)

June 29,

December 30,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

40,323

$

41,094

Trade accounts receivable, net

142,252

143,015

Inventories

559,594

568,980

Prepaid expenses and other current

assets

42,803

41,747

Income tax receivable

11,604

7,988

Total current assets

796,576

802,824

Property, plant and equipment, net

287,395

302,288

Operating lease right-of-use assets

64,140

70,046

Finance lease right-of-use assets

1,303

1,832

Goodwill

548,589

619,399

Other intangible assets, net

1,617,047

1,627,836

Other assets

24,768

23,484

Deferred income taxes

11,731

15,581

Total assets

$

3,351,549

$

3,463,290

Liabilities and Stockholders’

Equity

Current liabilities:

Trade accounts payable

$

126,210

$

123,778

Accrued expenses

64,166

83,217

Current portion of operating lease

liabilities

17,841

16,939

Current portion of finance lease

liabilities

1,082

1,070

Current portion of long-term debt

265,392

22,000

Income tax payable

240

475

Dividends payable

15,041

14,939

Total current liabilities

489,972

262,418

Long-term debt, net of current portion

1,779,034

2,023,088

Deferred income taxes

248,909

267,053

Long-term operating lease liabilities, net

of current portion

46,517

53,724

Long-term finance lease liabilities, net

of current portion

183

726

Other liabilities

21,923

20,818

Total liabilities

2,586,538

2,627,827

Stockholders’ equity:

Preferred stock, $0.01 par value per

share. Authorized 1,000,000 shares; no shares issued or

outstanding

—

—

Common stock, $0.01 par value per share.

Authorized 125,000,000 shares; 79,163,886 and 78,624,419 shares

issued and outstanding as of June 29, 2024 and December 30, 2023,

respectively

792

786

Additional paid-in capital

21,288

46,990

Accumulated other comprehensive (loss)

income

(5,858

)

2,597

Retained earnings

748,789

785,090

Total stockholders’ equity

765,011

835,463

Total liabilities and stockholders’

equity

$

3,351,549

$

3,463,290

B&G Foods, Inc. and

Subsidiaries

Consolidated Statements of

Operations

(In thousands, except per

share data)

(Unaudited)

Second Quarter Ended

First Two Quarters

Ended

June 29,

July 1,

June 29,

July 1,

2024

2023

2024

2023

Net sales

$

444,590

$

469,637

$

919,813

$

981,451

Cost of goods sold

352,553

367,361

718,895

764,939

Gross profit

92,037

102,276

200,918

216,512

Operating expenses:

Selling, general and administrative

expenses

43,128

47,872

91,740

94,601

Amortization expense

5,111

5,211

10,223

10,452

Impairment of goodwill

—

—

70,580

—

Loss on sales of assets

—

—

135

85

Operating income

43,798

49,193

28,240

111,374

Other (income) and expenses:

Interest expense, net

37,808

35,814

75,633

75,249

Other income

(1,046

)

(936

)

(2,088

)

(1,857

)

Income (loss) before income tax expense

(benefit)

7,036

14,315

(45,305

)

37,982

Income tax expense (benefit)

3,098

3,762

(9,004

)

24,014

Net income (loss)

$

3,938

$

10,553

$

(36,301

)

$

13,968

Weighted average shares outstanding:

Basic

79,083

72,237

78,865

72,008

Diluted

79,389

72,380

78,865

72,087

Earnings (loss) per share:

Basic

$

0.05

$

0.15

$

(0.46

)

$

0.19

Diluted

$

0.05

$

0.15

$

(0.46

)

$

0.19

Cash dividends declared per share

$

0.19

$

0.19

$

0.38

$

0.38

B&G Foods, Inc. and

Subsidiaries

Net Sales and Adjusted EBITDA

by Segment and

Reconciliation of Segment

Adjusted EBITDA to Net Income (Loss)

(In thousands)

(Unaudited)

Second Quarter Ended

First Two Quarters

Ended

June 29,

July 1,

June 29,

July 1,

2024

2023

2024

2023

Net sales:

Specialty

$

146,624

$

153,837

$

301,353

$

316,460

Meals

107,889

114,143

227,920

236,092

Frozen & Vegetables

91,580

107,762

196,467

233,968

Spices & Flavor Solutions

98,497

93,895

194,073

194,931

Total net sales

444,590

469,637

919,813

981,451

Segment adjusted EBITDA:

Specialty

31,688

32,706

68,880

69,190

Meals

23,911

23,024

49,540

49,262

Frozen & Vegetables

3,808

10,775

11,638

21,229

Spices & Flavor Solutions

27,647

26,113

56,316

56,793

Total segment adjusted EBITDA

87,054

92,618

186,374

196,474

Unallocated corporate expenses

23,134

24,167

47,409

45,658

Adjusted EBITDA

$

63,920

$

68,451

$

138,965

$

150,816

Depreciation and amortization

$

17,343

$

17,286

$

34,552

$

35,304

Acquisition/divestiture-related and

non-recurring expenses

1,733

1,036

3,370

2,196

Impairment of goodwill

—

—

70,580

—

Loss on sales of assets, net of facility

closure costs

—

—

135

85

Interest expense, net

37,808

35,814

75,633

75,249

Income tax expense (benefit)

3,098

3,762

(9,004

)

24,014

Net income (loss)

$

3,938

$

10,553

$

(36,301

)

$

13,968

B&G Foods, Inc. and

Subsidiaries

Items Affecting

Comparability

Reconciliation of Net Income

(Loss) to EBITDA(1) and Adjusted EBITDA(1)

(In thousands)

(Unaudited)

Second Quarter Ended

First Two Quarters

Ended

June 29,

July 1,

June 29,

July 1,

2024

2023

2024

2023

Net income (loss)

$

3,938

$

10,553

$

(36,301

)

$

13,968

Income tax expense (benefit)

3,098

3,762

(9,004

)

24,014

Interest expense, net(2)

37,808

35,814

75,633

75,249

Depreciation and amortization

17,343

17,286

34,552

35,304

EBITDA(1)

62,187

67,415

64,880

148,535

Acquisition/divestiture-related and

non-recurring expenses(3)

1,733

1,036

3,370

2,196

Impairment of goodwill(4)

—

—

70,580

—

Loss on sales of assets, net of facility

closure costs

—

—

135

85

Adjusted EBITDA(1)

$

63,920

$

68,451

$

138,965

$

150,816

B&G Foods, Inc. and

Subsidiaries

Items Affecting

Comparability

Reconciliation of Net Cash

Provided by Operating Activities to EBITDA(1) and Adjusted

EBITDA(1)

(In thousands)

(Unaudited)

Second Quarter Ended

First Two Quarters

Ended

June 29,

July 1,

June 29,

July 1,

2024

2023

2024

2023

Net cash provided by operating

activities

$

11,288

$

62,850

$

46,410

$

132,377

Income tax expense (benefit)

3,098

3,762

(9,004

)

24,014

Interest expense, net(2)

37,808

35,814

75,633

75,249

Impairment of goodwill(4)

—

—

(70,580

)

—

Gain on extinguishment of debt(2)

—

786

—

786

Loss on sales of assets

(123

)

(84

)

(258

)

(177

)

Deferred income taxes

(2,716

)

(78

)

15,158

(15,097

)

Amortization of deferred debt financing

costs and bond discount/premium

(1,910

)

(1,036

)

(3,208

)

(4,684

)

Share-based compensation expense

(2,612

)

(2,374

)

(4,395

)

(3,301

)

Changes in assets and liabilities, net of

effects of business combinations

17,354

(32,225

)

15,124

(60,632

)

EBITDA(1)

62,187

67,415

64,880

148,535

Acquisition/divestiture-related and

non-recurring expenses(3)

1,733

1,036

3,370

2,196

Impairment of goodwill(4)

—

—

70,580

—

Loss on sales of assets, net of facility

closure costs

—

—

135

85

Adjusted EBITDA(1)

$

63,920

$

68,451

$

138,965

$

150,816

B&G Foods, Inc. and

Subsidiaries

Items Affecting

Comparability

Reconciliation of Net Income

(Loss) to Adjusted Net Income(5) and Adjusted Diluted Earnings per

Share(5)

(In thousands, except per

share data)

(Unaudited)

Second Quarter Ended

First Two Quarters

Ended

June 29,

July 1,

June 29,

July 1,

2024

2023

2024

2023

Net income (loss)

$

3,938

$

10,553

$

(36,301

)

$

13,968

Gain on extinguishment of debt(2)

—

(786

)

—

(786

)

Acquisition/divestiture-related and

non-recurring expenses(3)

1,733

1,036

3,370

2,196

Impairment of goodwill(4)

—

—

70,580

—

Loss on sales of assets, net of facility

closure costs

—

—

135

85

Accelerated amortization of deferred debt

financing costs(6)

456

—

456

—

Tax adjustment related to Back to Nature

divestiture(7)

—

—

—

14,736

Tax true-up(8)

997

—

997

—

Tax effects of non-GAAP adjustments(9)

(537

)

(61

)

(18,261

)

(366

)

Adjusted net income(5)

$

6,587

$

10,742

$

20,976

$

29,833

Adjusted diluted earnings per share(5)

$

0.08

$

0.15

$

0.27

$

0.41

_____________________________

(1)

EBITDA and adjusted EBITDA are non-GAAP

financial measures used by management to measure operating

performance. A non-GAAP financial measure is defined as a numerical

measure of the Company’s financial performance that excludes or

includes amounts so as to be different from the most directly

comparable measure calculated and presented in accordance with GAAP

in the Company’s consolidated balance sheets and related

consolidated statements of operations, comprehensive (loss) income,

changes in stockholders’ equity and cash flows. The Company defines

EBITDA as net income (loss) before net interest expense, income

taxes, and depreciation and amortization. The Company defines

adjusted EBITDA as EBITDA adjusted for cash and non-cash

acquisition/divestiture-related expenses, gains and losses (which

may include third-party fees and expenses, integration,

restructuring and consolidation expenses, amortization of acquired

inventory fair value step-up, and gains and losses on the sale of

certain assets); gains and losses on extinguishment of debt;

impairment of assets held for sale; impairment of intangible

assets; and non-recurring expenses, gains and losses.

Management believes that it is useful to

eliminate these items because it allows management to focus on what

it deems to be a more reliable indicator of ongoing operating

performance and the Company’s ability to generate cash flow from

operations. The Company uses EBITDA and adjusted EBITDA in the

Company’s business operations to, among other things, evaluate the

Company’s operating performance, develop budgets and measure the

Company’s performance against those budgets, determine employee

bonuses and evaluate the Company’s cash flows in terms of cash

needs. The Company also presents EBITDA and adjusted EBITDA because

the Company believes they are useful indicators of the Company’s

historical debt capacity and ability to service debt and because

covenants in the Company’s credit agreement and the Company’s

senior notes indentures contain ratios based on these measures. As

a result, reports used by internal management during monthly

operating reviews feature the EBITDA and adjusted EBITDA metrics.

However, management uses these metrics in conjunction with

traditional GAAP operating performance and liquidity measures as

part of its overall assessment of company performance and

liquidity, and therefore does not place undue reliance on these

measures as its only measures of operating performance and

liquidity.

EBITDA and adjusted EBITDA are not

recognized terms under GAAP and do not purport to be alternatives

to operating income (loss), net income (loss) or any other GAAP

measure as an indicator of operating performance. EBITDA and

adjusted EBITDA are not complete net cash flow measures because

EBITDA and adjusted EBITDA are measures of liquidity that do not

include reductions for cash payments for an entity’s obligation to

service its debt, fund its working capital, capital expenditures

and acquisitions and pay its income taxes and dividends. Rather,

EBITDA and adjusted EBITDA are potential indicators of an entity’s

ability to fund these cash requirements. EBITDA and adjusted EBITDA

are not complete measures of an entity’s profitability because they

do not include certain costs and expenses and gains and losses

described above. Because not all companies use identical

calculations, this presentation of EBITDA and adjusted EBITDA may

not be comparable to other similarly titled measures of other

companies. However, EBITDA and adjusted EBITDA can still be useful

in evaluating the Company’s performance against the Company’s peer

companies because management believes these measures provide users

with valuable insight into key components of GAAP amounts.

(2)

Net interest expense for the second

quarter and first two quarters of 2023 was reduced by $0.8 million

as a result of a gain on extinguishment of debt related to the

Company’s repurchase of $24.4 million aggregate principal amount of

its 5.25% senior notes due 2025 in open market purchases at an

average discounted repurchase price of 95.74% of such principal

amount plus accrued and unpaid interest, which results in a pre-tax

gain of $0.8 million, net of the accelerated amortization of

deferred debt financing costs of $0.2 million.

(3)

Acquisition/divestiture-related and

non-recurring expenses for the second quarter and first two

quarters of 2024 of $1.7 million (or $1.3 million, net of tax) and

$3.4 million (or $2.5 million, net of tax), respectively, primarily

includes non-recurring expenses related to Crisco,

divestiture-related expenses for the Green Giant U.S. shelf-stable

and Back to Nature divestitures, and other non-recurring expenses.

Acquisition/divestiture-related and non-recurring expenses for the

second quarter and first two quarters of 2023 of $1.0 million (or

$0.8 million, net of tax) and $2.2 million (or $1.7 million, net of

tax), respectively, primarily includes acquisition and integration

expenses for the Crisco acquisition and the acquisition of the

frozen vegetable manufacturing operations of Growers Express, LLC,

which was completed on May 5, 2022, and divestiture-related

expenses for the Back to Nature divestiture.

(4)

In connection with the Company’s

transition from one reporting segment to four reporting segments

during the first quarter of 2024, the Company reassigned assets and

liabilities, including goodwill, between the reporting segments and

completed a goodwill impairment test both prior to and subsequent

to the change. The goodwill impairment test resulted in the Company

recognizing pre-tax, non-cash goodwill impairment charges of $70.6

million (or $53.4 million, net of tax) within its Frozen &

Vegetables reporting segment during the first quarter of 2024.

(5)

Adjusted net income and adjusted diluted

earnings per share are non-GAAP financial measures used by

management to measure operating performance. The Company defines

adjusted net income and adjusted diluted earnings per share as net

income (loss) and diluted earnings (loss) per share adjusted for

certain items that affect comparability. These non-GAAP financial

measures reflect adjustments to net income (loss) and diluted

earnings (loss) per share to eliminate the items identified in the

reconciliation above. This information is provided in order to

allow investors to make meaningful comparisons of the Company’s

operating performance between periods and to view the Company’s

business from the same perspective as the Company’s management.

Because the Company cannot predict the timing and amount of these

items, management does not consider these items when evaluating the

Company’s performance or when making decisions regarding allocation

of resources.

(6)

Interest expense for the second quarter

and first two quarters of 2024 includes the accelerated

amortization of deferred debt financing costs of $0.5 million (or

$0.3 million, net of tax), resulting from the Company’s prepayment

of $21.3 million aggregate principal amount of tranche B term loans

and repurchase of $0.7 million aggregate principal amount of 8.00%

senior secured notes due 2028 during the second quarter of

2024.

(7)

As a result of the Back to Nature

divestiture, the Company incurred a capital loss for tax purposes,

for which the Company recorded a deferred tax asset during the

first quarter of 2023. A valuation allowance has been recorded

against this deferred tax asset, which negatively impacted the

Company’s first quarter of 2023 income taxes by $14.7 million, or

$0.21 per share.

(8)

Tax true-up for the second quarter of 2024

of approximately $1.0 million related to return to provision

adjustments in the U.S. and Mexico.

(9)

Represents the tax effects of the non-GAAP

adjustments listed above, assuming a tax rate of 24.5%.

B&G Foods, Inc. and

Subsidiaries

Items Affecting

Comparability

Reconciliation of Net Sales to

Base Business Net Sales(1)

(In thousands)

(Unaudited)

Second Quarter Ended

First Two Quarters

Ended

June 29,

July 1,

June 29,

July 1,

2024

2023

2024

2023

Net sales

$

444,590

$

469,637

$

919,813

$

981,451

Net sales from discontinued or divested

brands(2)

41

(13,726

)

106

(28,208

)

Base business net sales(1)

$

444,631

$

455,911

$

919,919

$

953,243

_____________________________

(1)

Base business net sales is a non-GAAP

financial measure used by management to measure operating

performance. The Company defines base business net sales as the

Company’s net sales excluding (1) the net sales of acquisitions

until the net sales from such acquisitions are included in both

comparable periods and (2) net sales of discontinued or divested

brands. The portion of current period net sales attributable to

recent acquisitions for which there is no corresponding period in

the comparable period of the prior year is excluded. For each

acquisition, the excluded period starts at the beginning of the

most recent fiscal period being compared and ends on the first

anniversary of the acquisition date. For discontinued or divested

brands, the entire amount of net sales is excluded from each fiscal

period being compared. The Company has included this financial

measure because management believes it provides useful and

comparable trend information regarding the results of the Company’s

business without the effect of the timing of acquisitions and the

effect of discontinued or divested brands.

(2)

For the second quarter and first two

quarters of 2023, reflects net sales of the Green Giant U.S.

shelf-stable product line, which was sold on November 8, 2023,

partially offset by a net credit paid to customers relating to

discontinued brands. For the second quarter and first two quarters

of 2024, reflects a net credit paid to customers relating to

discontinued and divested brands.

B&G Foods, Inc. and

Subsidiaries

Items Affecting

Comparability

Reconciliation of Gross Profit

to Adjusted Gross Profit(1) and

Gross Profit Percentage to

Adjusted Gross Profit Percentage(1)

(In thousands, except

percentages)

(Unaudited)

Second Quarter Ended

First Two Quarters

Ended

June 29,

July 1,

June 29,

July 1,

2024

2023

2024

2023

Gross profit

$

92,037

$

102,276

$

200,918

$

216,512

Acquisition/divestiture-related expenses

and non-recurring expenses included in cost of goods sold(2)

1,186

407

2,191

1,056

Adjusted gross profit(1)

$

93,223

$

102,683

$

203,109

$

217,568

Gross profit percentage

20.7

%

21.8

%

21.8

%

22.1

%

Acquisition/divestiture-related expenses

and non-recurring expenses included in cost of goods sold as a

percentage of net sales

0.3

%

0.1

%

0.2

%

0.1

%

Adjusted gross profit percentage(1)

21.0

%

21.9

%

22.1

%

22.2

%

_____________________________

(1)

Adjusted gross profit and adjusted gross

profit percentage are non-GAAP financial measures used by

management to measure operating performance. The Company defines

adjusted gross profit as gross profit adjusted for

acquisition/divestiture-related expenses and non-recurring expenses

included in cost of goods sold and adjusted gross profit percentage

as gross profit percentage (i.e., gross profit as a percentage of

net sales) adjusted for acquisition/divestiture-related expenses

and non-recurring expenses included in cost of goods sold. These

non-GAAP financial measures reflect adjustments to gross profit and

gross profit percentage to eliminate the items identified in the

reconciliation above. This information is provided in order to

allow investors to make meaningful comparisons of the Company’s

operating performance between periods and to view the Company’s

business from the same perspective as the Company’s management.

Because the Company cannot predict the timing and amount of these

items, management does not consider these items when evaluating the

Company’s performance or when making decisions regarding allocation

of resources.

(2)

Acquisition/divestiture related expenses

and non-recurring expenses included in cost of goods sold for the

second quarter and first two quarters of 2024 of $1.2 million and

$2.2 million, respectively, primarily includes non-recurring

expenses related to Crisco, divestiture-related expenses for the

Green Giant U.S. shelf-stable and Back to Nature divestitures, and

other non-recurring expenses. Acquisition/divestiture related

expenses and non-recurring expenses included in cost of goods sold

for the second quarter and first two quarters of 2023 of $0.4

million and $1.1 million, respectively, primarily includes

acquisition and integration expenses for the Crisco acquisition and

divestiture-related expenses for the Back to Nature

divestiture.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806067653/en/

Investor Relations: ICR, Inc. Anna Kate Heller

bgfoodsIR@icrinc.com

Media Relations: ICR, Inc. Matt Lindberg 203.682.8214

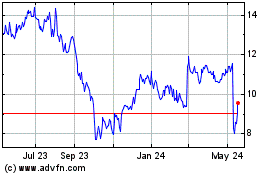

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Oct 2024 to Nov 2024

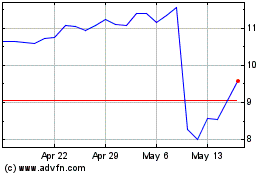

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Nov 2023 to Nov 2024