0001786352FALSE00017863522025-02-062025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________

FORM 8-K

____________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2025

____________________________________

BILL Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

____________________________________

| | | | | | | | |

| Delaware | 001-39149 | 83-2661725 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | |

6220 America Center Drive, Suite 100 San Jose, California | | 95002 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (650) 621-7700

(Former Name or Former Address, if Changed Since Last Report)

____________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.00001 par value | | BILL | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 6, 2025, BILL Holdings, Inc. (the “Company”) issued a press release and will hold a conference call regarding its financial results for the second fiscal quarter ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information furnished with this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such a filing.

The Company makes reference to certain non-GAAP financial information in both the press release and the conference call. A reconciliation of GAAP to non-GAAP results is provided in the press release attached as Exhibit 99.1 hereto.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | BILL HOLDINGS, INC. |

| | | |

| Date: | February 6, 2025 | By: | /s/ John Rettig |

| | | John Rettig President and Chief Financial Officer |

BILL Reports Second Quarter Fiscal Year 2025 Financial Results

•Q2 Core Revenue Increased 16% Year-Over-Year

•Q2 Total Revenue Increased 14% Year-Over-Year

SAN JOSE, Calif.--(BUSINESS WIRE) – February 6, 2025 – BILL (NYSE: BILL), a leading financial operations platform for small and midsize businesses (SMBs), today announced financial results for the second fiscal quarter ended December 31, 2024.

“We delivered strong financial results and innovated at a rapid pace as we executed on our vision to be the de facto intelligent financial operations platform for SMBs,” said René Lacerte, BILL CEO and Founder. “We are leveraging our leadership position to empower small and mid-sized businesses and the partners that we serve, and we are extending our lead by expanding the depth and breadth of our platform and diverse distribution ecosystem. Today, more than 480,000 businesses rely on BILL to manage their day-to-day financial workflow. We are moving fast to address a vast market opportunity to transform the financial operations for millions of SMBs.”

“In Q2, we delivered strong financial results, expanded our non-GAAP operating margin, and continued our track record of execution across the company,” said John Rettig, BILL President and CFO. “We are executing on our strategic priorities and are confident that our strong business model will allow us to drive years of durable growth, an attractive long-term profitability profile, and sustained value generation for shareholders.”

Financial Highlights for the Second Quarter of Fiscal 2025:

•Total revenue was $362.6 million, an increase of 14% year-over-year.

•Core revenue, which consists of subscription and transaction fees, was $319.6 million, an increase of 16% year-over-year. Subscription fees were $67.7 million, up 7% year-over-year. Transaction fees were $251.9 million, up 19% year-over-year.

•Float revenue, which consists of interest on funds held for customers, was $42.9 million.

•Gross profit was $295.9 million, representing an 81.6% gross margin, compared to $260.1 million, or an 81.7% gross margin, in the second quarter of fiscal 2024. Non-GAAP gross profit was $308.9 million, representing an 85.2% non-GAAP gross margin, compared to $273.7 million, or an 85.9% non-GAAP gross margin, in the second quarter of fiscal 2024.

•Operating loss was $21.7 million, compared to an operating loss of $67.7 million in the second quarter of fiscal 2024. Non-GAAP operating income was $62.8 million, compared to $44.3 million in the second quarter of fiscal 2024, an increase of 41.8% year-over-year.

•Net income was $33.5 million, or $0.33 and $(0.06) per share, basic and diluted, respectively, compared to net loss of $40.4 million, or $(0.38) per basic and diluted share, in the second quarter of fiscal 2024. Non-GAAP net income was $62.9 million, or $0.56 per diluted share, compared to non-GAAP net income of $60.0 million, or $0.51 per diluted share, in the second quarter of fiscal 2024.

Business Highlights and Recent Developments:

•Served 481,300 businesses using our solutions as of the end of the second quarter.1

•Processed $84 billion in total payment volume in the second quarter, an increase of 13% year-over-year.

•Processed 30 million transactions during the second quarter, an increase of 17% year-over-year.

•Completed an offering of $1.4 billion of 0% convertible senior notes due 2030, including full exercise of initial purchasers’ $150 million option to purchase additional notes.

•Repurchased approximately $134 million aggregate principal amount of our outstanding 0% Convertible Senior Notes due 2025 and approximately $451 million aggregate principal amount of our outstanding 0% Convertible Senior Notes due 2027.

•Repurchased approximately 2.3 million shares of BILL common stock in the second quarter for a total cost of approximately $200 million.

1 Businesses using more than one of our solutions are included separately in the total for each solution utilized.

•Added seasoned executives, Keri Gohman and Dan Wernikoff, to our board of directors.

Financial Outlook

We are providing the following guidance for the fiscal third quarter ending March 31, 2025 and the full fiscal year ending June 30, 2025.

| | | | | | | | | | | |

| Q3 FY25 Guidance | | FY25 Guidance |

| Total revenue (millions) | $352.5 - $357.5 | | $1,454.0 - $1,469.0 |

| Year-over-year total revenue growth | 9% - 11% | | 13% - 14% |

Core revenue (millions) | $317.5 - $322.5 | | $1,297.0 - $1,312.0 |

Year-over-year core revenue growth | 13% - 15% | | 16% - 17% |

| Non-GAAP operating income (millions) | $38.0 - $43.0 | | $207.5 - $222.5 |

Non-GAAP net income (millions) | $42.0 - $46.0 | | $216.0 - $228.0 |

Non-GAAP net income per diluted share | $0.35 - $0.38 | | $1.87 - $1.97 |

The outlook for non-GAAP net income and non-GAAP net income per diluted share includes a non-GAAP provision for income taxes of 20%. The outlook for non-GAAP net income takes into account the use of corporate cash for investment and other strategic capital allocation, including but not limited to the share repurchase program announced in August 2024. The outlook for non-GAAP net income per diluted share does not take any future repurchases of BILL shares into account, as its impact on a per diluted share basis is not reasonably estimable.

These statements are forward-looking and actual results may differ materially. Refer to the Forward-Looking Statements safe harbor below for information on the factors that could cause our actual results to differ materially from these forward-looking statements.

BILL has not provided a reconciliation of its non-GAAP operating income, non-GAAP net income or non-GAAP net income per share guidance to the most directly comparable GAAP measures because certain items excluded from GAAP cannot be reasonably calculated or predicted at this time. Accordingly, a reconciliation is not available without unreasonable effort.

Conference Call and Webcast Information

In conjunction with this announcement, BILL will host a conference call for investors at 1:30 p.m. PT (4:30 p.m. ET) today to discuss fiscal second quarter 2025 results and our outlook for the fiscal third quarter ending March 31, 2025 and fiscal year ending June 30, 2025. The live webcast and a replay of the webcast will be available at the Investor Relations section of BILL’s website: https://investor.bill.com/events-and-presentations/default.aspx.

About BILL

BILL (NYSE: BILL) is a leading financial operations platform for small and midsize businesses (SMBs). As a champion of SMBs, we are automating the future of finance so businesses can thrive. Our integrated platform helps businesses to more efficiently control their payables, receivables and spend and expense management. Hundreds of thousands of businesses rely on BILL’s proprietary network of millions of members to pay or get paid faster. Headquartered in San Jose, California, BILL is a trusted partner of leading U.S. financial institutions, accounting firms, and accounting software providers. For more information, visit bill.com.

Note on Forward-Looking Statements

This press release and the accompanying conference call contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are statements other than statements of historical facts, and statements in the future tense. Forward-looking statements are based on our expectations as of the date of this press release and are subject to a number of risks, uncertainties and assumptions, many of which involve factors or circumstances that are beyond our control. These statements include, but are not limited to, statements regarding our expectations of future performance, including guidance for our total revenue, core revenue, non-GAAP operating income, non-GAAP net income, and non-GAAP net income per share for the fiscal third quarter ending March 31, 2025 and full fiscal year ending June 30, 2025, our planned investments in fiscal year 2025, our revenue growth profitability profile, activity under our previously-announced share repurchase program, our expectations for the growth of demand on our platform and the expansion of our customers’ utilization of our services. These risks and uncertainties include, but are not limited to macroeconomic factors, including changes in interest rates, tariffs and other trade barriers, inflation and volatile market

environments, as well as fluctuations in foreign exchange rates, our history of operating losses, our recent rapid growth, the large sums of customer funds that we transfer daily, the risk of loss, errors and fraudulent activity, credit risk related to our BILL Divvy Corporate Cards, our ability to attract new customers and convert trial customers into paying customers, our ability to invest in our business and develop new products and services, increased competition or new entrants in the marketplace, potential impacts of acquisitions and investments, our relationships with accounting firms and financial institutions, the global impacts of ongoing geopolitical conflicts, and other risks detailed in the registration statements and periodic reports we file with the SEC, including our quarterly and annual reports, which may be obtained on the Investor Relations section of BILL’s website (https://investor.bill.com/financials/sec-filings/default.aspx) and on the SEC website at www.sec.gov. You should not rely on these forward-looking statements, as actual results may differ materially from those contemplated by these forward-looking statements as a result of such risks and uncertainties. All forward-looking statements in this press release are based on information available to us as of the date hereof. We assume no obligation to update or revise the forward-looking statements contained in this press release or the accompanying conference call because of new information, future events, or otherwise.

Non-GAAP Financial Measures

In addition to financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), this press release and the accompanying tables contain, and the conference call will contain, non-GAAP financial measures, including non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income, non-GAAP net income and non-GAAP net income per share, basic and diluted. The non-GAAP financial information is presented for supplemental informational purposes only and is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP.

Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool.

We exclude the following items from non-GAAP gross profit and non-GAAP gross margin:

•stock-based compensation and related payroll taxes

•depreciation and amortization

We exclude the following items from non-GAAP operating expenses and non-GAAP operating income:

•stock-based compensation and related payroll taxes

•depreciation and amortization

•acquisition and integration-related expenses

•restructuring

We exclude the following items from non-GAAP net income and non-GAAP net income per share:

•stock-based compensation expense and related payroll taxes

•depreciation and amortization

•acquisition and integration-related expenses

•restructuring

•gain on debt extinguishment

•amortization of debt issuance costs

•non-GAAP provision for income taxes

It is important to note that the particular items we exclude from, or include in, our non-GAAP financial measures may differ from the items excluded from, or included in, similar non-GAAP financial measures used by other companies in the same industry. We also periodically review our non-GAAP financial measures and may revise these measures to reflect changes in our business or otherwise, including our blended U.S. statutory tax rate.

We believe that these non-GAAP financial measures provide useful information about our financial performance, enhance the overall understanding of our past performance and future prospects, and allow for greater transparency with respect to important metrics used by our management for financial and operational decision-making. We believe that these measures provide an additional tool for investors to use in comparing our core financial performance over multiple periods with other companies in our industry.

We adjust the following items from one or more of our non-GAAP financial measures:

Stock-based compensation and related payroll taxes charged to cost of revenue and operating expenses. We exclude stock-based compensation, which is a non-cash expense, and related payroll taxes from certain of our non-GAAP financial measures because we

believe that excluding these items provide meaningful supplemental information regarding operational performance. In particular, companies calculate stock-based compensation expenses using a variety of valuation methodologies and subjective assumptions while the related payroll taxes are dependent on the price of our common stock and other factors that are beyond our control and do not correlate to the operation of our business.

Depreciation and amortization. We exclude depreciation and amortization from certain of our non-GAAP financial measures because we believe that excluding this non-cash charge provides meaningful supplemental information regarding operational performance. Depreciation and amortization do not include amortization of capitalized internal-use software costs paid in cash.

Acquisition and integration-related expenses. We exclude acquisition and integration-related expenses from certain of our non-GAAP financial measures because these costs would have not otherwise been incurred in the normal course of our business operations. In addition, we believe that acquisition and integration-related expenses are non-recurring charges unique to a specific acquisition. Although we may engage in future acquisitions, such acquisitions and the associated acquisition and integration-related expenses are considered unique and not comparable to other acquisitions.

Restructuring. We exclude costs incurred in connection with formal restructuring plans from certain of our non-GAAP financial measures because these costs are exceptional and would have not otherwise been incurred in the normal course of our business operations.

Gain on debt extinguishment. We exclude gain on debt extinguishment associated with our repurchases of certain of our outstanding convertible senior notes because we believe that excluding this non-cash gain provides better insight regarding our operational performance.

Amortization of debt issuance costs. We exclude amortization of debt issuance costs associated with our issuance of our convertible senior notes and credit arrangement from certain of our non-GAAP financial measures because we believe that excluding this non-cash interest expense provides meaningful supplemental information regarding our operational performance.

Non-GAAP provision for income taxes. Consists of assumed provision for income taxes based on the statutory tax rate taking into consideration the nature of the taxed item and the relevant taxing jurisdiction.

There are material limitations associated with the use of non-GAAP financial measures since they exclude significant expenses and income that are required by GAAP to be recorded in our financial statements. Please see the reconciliation tables at the end of this release for the reconciliation of GAAP and non-GAAP results.

Free Cash Flow

Free cash flow is a non-GAAP measure defined as net cash provided by operating activities, adjusted by purchases of property and equipment and capitalization of internal-use software costs. We believe free cash flow is an important liquidity measure of the cash that is generated, after incurring operating expenses, purchases of property and equipment and capitalization of internal-use software costs, for future operational expenses and investment in our business. Free cash flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash in the ordinary course of business. One limitation of free cash flow is that it does not reflect our future contractual commitments. Additionally, free cash flow does not represent the total increase or decrease in our cash balance for a given period. Once our business needs and obligations are met, cash can be used to maintain strong balance sheets and invest in future growth.

IR Contact:

Karen Sansot

ksansot@hq.bill.com

Press Contact:

John Welton

john.welton@hq.bill.com

Source: BILL

BILL HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited, in thousands)

| | | | | | | | | | | | | | |

| | December 31,

2024 | | June 30,

2024 |

| | |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 1,566,271 | | | $ | 985,941 | |

| Short-term investments | | 644,672 | | | 601,535 | |

| Accounts receivable, net | | 28,911 | | | 28,049 | |

| Acquired card receivables, net | | 581,661 | | | 697,216 | |

| Prepaid expenses and other current assets | | 251,877 | | | 297,169 | |

| Funds held for customers | | 3,766,541 | | | 3,704,907 | |

| Total current assets | | 6,839,933 | | | 6,314,817 | |

| Non-current assets: | | | | |

| Operating lease right-of-use assets, net | | 60,144 | | | 59,414 | |

| Property and equipment, net | | 94,467 | | | 88,034 | |

| Intangible assets, net | | 253,134 | | | 281,471 | |

| Goodwill | | 2,396,509 | | | 2,396,509 | |

| Other assets | | 30,019 | | | 38,568 | |

| Total assets | | $ | 9,674,206 | | | $ | 9,178,813 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 5,723 | | | $ | 7,447 | |

| Accrued compensation and benefits | | 29,249 | | | 34,158 | |

| Deferred revenue | | 21,775 | | | 17,006 | |

| Other accruals and current liabilities | | 265,548 | | | 299,506 | |

| Convertible senior notes, net | | 33,373 | | | — | |

| Customer fund deposits | | 3,766,541 | | | 3,704,907 | |

| Total current liabilities | | 4,122,209 | | | 4,063,024 | |

| Non-current liabilities: | | | | |

| Deferred revenue | | 202 | | | 4,167 | |

| Operating lease liabilities | | 63,400 | | | 62,847 | |

| Borrowings from credit facilities, net | | 180,007 | | | 180,009 | |

| Convertible senior notes, net | | 1,498,490 | | | 733,991 | |

| Other long-term liabilities | | 504 | | | 574 | |

| Total liabilities | | 5,864,812 | | | 5,044,612 | |

| Stockholders' equity: | | | | |

| Common stock | | 2 | | | 2 | |

| Additional paid-in capital | | 5,267,182 | | | 5,233,037 | |

| Accumulated other comprehensive loss | | (239) | | | (1,890) | |

| Accumulated deficit | | (1,457,551) | | | (1,096,948) | |

| Total stockholders' equity | | 3,809,394 | | | 4,134,201 | |

| Total liabilities and stockholders' equity | | $ | 9,674,206 | | | $ | 9,178,813 | |

BILL HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in thousands except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Six Months Ended

December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | | | | | | | | |

Subscription and transaction fees (1) | | $ | 319,616 | | | $ | 274,992 | | | $ | 634,559 | | | $ | 540,134 | |

| Interest on funds held for customers | | 42,938 | | | 43,503 | | | 86,445 | | | 83,346 | |

| Total revenue | | 362,554 | | | 318,495 | | | 721,004 | | | 623,480 | |

| Cost of revenue | | | | | | | | |

Service costs (1) | | 56,298 | | | 47,239 | | | 109,900 | | | 92,143 | |

Depreciation and amortization (2) | | 10,310 | | | 11,138 | | | 21,403 | | | 22,260 | |

| Total cost of revenue | | 66,608 | | | 58,377 | | | 131,303 | | | 114,403 | |

| Gross profit | | 295,946 | | | 260,118 | | | 589,701 | | | 509,077 | |

| Operating expenses | | | | | | | | |

Research and development (1) | | 84,784 | | | 86,489 | | | 163,469 | | | 175,552 | |

Sales and marketing (1) | | 132,534 | | | 118,305 | | | 258,856 | | | 236,704 | |

General and administrative (1)(3) | | 71,122 | | | 70,053 | | | 137,893 | | | 143,304 | |

Provision for expected credit losses (3) | | 21,358 | | | 15,530 | | | 42,019 | | | 27,605 | |

Depreciation and amortization (2) | | 7,858 | | | 12,324 | | | 16,871 | | | 25,141 | |

| Restructuring | | — | | | 25,091 | | | — | | | 25,091 | |

| Total operating expenses | | 317,656 | | | 327,792 | | | 619,108 | | | 633,397 | |

| Operating loss | | (21,710) | | | (67,674) | | | (29,407) | | | (124,320) | |

| Other income, net | | 55,303 | | | 28,919 | | | 73,181 | | | 58,227 | |

| Income (loss) before provision for income taxes | | 33,593 | | | (38,755) | | | 43,774 | | | (66,093) | |

| Provision for income taxes | | 45 | | | 1,666 | | | 1,314 | | | 2,189 | |

| Net income (loss) | | $ | 33,548 | | | $ | (40,421) | | | $ | 42,460 | | | $ | (68,282) | |

| | | | | | | | |

| Net income (loss) per share attributable to common stockholders: | | | | | | | | |

| Basic | | $ | 0.33 | | | $ | (0.38) | | | $ | 0.41 | | | $ | (0.64) | |

| Diluted | | $ | (0.06) | | | $ | (0.38) | | | $ | 0.02 | | | $ | (0.64) | |

| Weighted-average number of common shares used to compute net income (loss) per share attributable to common stockholders: | | | | | | | | |

| Basic | | 103,102 | | | 105,914 | | | 104,394 | | | 106,350 | |

| Diluted | | 104,480 | | | 105,914 | | | 107,718 | | | 106,350 | |

| | |

______________________________________ |

(1) Includes stock-based compensation charged to revenue and expenses as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue - subscription and transaction fees | $ | 608 | | | $ | 486 | | | $ | 1,135 | | | $ | 856 | |

| Cost of revenue - service costs | 2,579 | | | 2,388 | | | 4,732 | | | 4,934 | |

| Research and development | 29,270 | | | 26,160 | | | 52,903 | | | 53,526 | |

| Sales and marketing | 10,480 | | | 12,789 | | | 21,274 | | | 26,674 | |

| General and administrative | 22,943 | | | 20,322 | | | 40,497 | | | 41,302 | |

| Restructuring | — | | | 3,355 | | | — | | | 3,355 | |

Total stock-based compensation | $ | 65,880 | | | $ | 65,500 | | | $ | 120,541 | | | $ | 130,647 | |

(2) Depreciation and amortization do not include amortization of capitalized internal-use software costs paid in cash.

(3) Provision for expected credit losses was included in general and administrative expenses during the three and six months ended December 31, 2023.

BILL HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | | | | |

| Net income (loss) | $ | 33,548 | | | $ | (40,421) | | | $ | 42,460 | | | $ | (68,282) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | | | |

| Stock-based compensation | 65,884 | | | 65,500 | | | 120,541 | | | 130,647 | |

| Amortization of intangible assets | 14,657 | | | 20,222 | | | 31,595 | | | 40,443 | |

| Depreciation of property and equipment | 3,510 | | | 3,240 | | | 6,679 | | | 6,958 | |

| Amortization of capitalized internal-use software costs paid in cash | 3,889 | | | 2,387 | | | 7,833 | | | 3,739 | |

| Amortization of debt issuance costs | 1,001 | | | 1,762 | | | 1,896 | | | 3,523 | |

| Accretion of discount on investments in marketable debt securities | (9,431) | | | (11,078) | | | (21,672) | | | (24,171) | |

| Accretion of discount on loans held for investment | (5,329) | | | (1,926) | | | (9,960) | | | (2,631) | |

| Gain on debt extinguishment | (40,472) | | | — | | | (40,550) | | | — | |

| Provision for expected credit losses on acquired card receivables and other financial assets | 21,358 | | | 16,288 | | | 42,019 | | | 28,689 | |

| Non-cash operating lease expense | 2,062 | | | 2,164 | | | 4,107 | | | 4,552 | |

| Other | 340 | | | (200) | | | 590 | | | (100) | |

| Changes in assets and liabilities: | | | | | | | |

| Accounts receivable | 2,868 | | | (3,317) | | | (1,160) | | | 390 | |

| Prepaid expenses and other current assets | (26,164) | | | 4,553 | | | (27,307) | | | (151) | |

| Other assets | 2,004 | | | (166) | | | 8,914 | | | (1,240) | |

| Accounts payable | (5,878) | | | 2,741 | | | (2,074) | | | 233 | |

| Other accruals and current liabilities | 16,926 | | | 23,230 | | | 7,135 | | | 20,944 | |

| Operating lease liabilities | (2,080) | | | (2,494) | | | (4,428) | | | (4,917) | |

| Other long-term liabilities | (124) | | | (15) | | | (124) | | | (47) | |

| Deferred revenue | 147 | | | (2,788) | | | 804 | | | (5,237) | |

| Net cash provided by operating activities | 78,716 | | | 79,682 | | | 167,298 | | | 133,342 | |

| Cash flows from investing activities: | | | | | | | |

| Purchases of corporate and customer fund short-term investments | (572,575) | | | (590,652) | | | (1,210,567) | | | (990,240) | |

| Proceeds from maturities and sales of corporate and customer fund short-term investments | 539,073 | | | 524,336 | | | 1,102,750 | | | 1,281,505 | |

| Purchase of intangible assets | (2,868) | | | — | | | (2,868) | | | — | |

| Purchases of loans held for investment | (198,987) | | | (77,357) | | | (380,673) | | | (110,113) | |

| Principal repayments of loans held for investment | 197,462 | | | 68,970 | | | 369,449 | | | 94,300 | |

| Acquired card receivables, net | 54,918 | | | 29,991 | | | 6,950 | | | (12,342) | |

| Capitalization of internal-use software costs | (6,720) | | | (5,117) | | | (13,759) | | | (10,762) | |

| Other | (461) | | | (352) | | | (978) | | | (755) | |

| Net cash provided by (used in) investing activities | 9,842 | | | (50,181) | | | (129,696) | | | 251,593 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Cash flows from financing activities: | | | | | | | |

| Proceeds from issuance of convertible senior notes | 1,400,000 | | | — | | | 1,400,000 | | | — | |

| Cash paid for convertible senior notes issuance costs | (23,100) | | | — | | | (23,100) | | | — | |

| Payments for repurchase of convertible senior notes | (539,403) | | | — | | | (539,403) | | | — | |

| Purchase of capped calls | (92,960) | | | — | | | (92,960) | | | — | |

| Customer fund deposits liability and other | (25,781) | | | 390,960 | | | 52,731 | | | 299,770 | |

| Prepaid card deposits | 21,049 | | | (2,505) | | | 32,371 | | | (16,484) | |

| Repurchase of common stock | (199,999) | | | (199,841) | | | (400,001) | | | (211,902) | |

| Proceeds from exercise of stock options | 1,235 | | | 2,106 | | | 2,252 | | | 5,052 | |

| Tax withholdings related to net share settlements of equity awards | (3,410) | | | — | | | (4,714) | | | — | |

| Proceeds from issuance of common stock under the employee stock purchase plan | — | | | — | | | 5,302 | | | 7,846 | |

| Contingent consideration payout | — | | | — | | | — | | | (5,471) | |

| Net cash provided by financing activities | 537,631 | | | 190,720 | | | 432,478 | | | 78,811 | |

| Effect of exchange rate changes on cash, cash equivalents, restricted cash and restricted cash equivalents | (645) | | | 173 | | | (772) | | | (7) | |

| Net increase in cash, cash equivalents, restricted cash, and restricted cash equivalents | 625,544 | | | 220,394 | | | 469,308 | | | 463,739 | |

| Cash, cash equivalents, restricted cash, and restricted cash equivalents, beginning of period | 3,195,163 | | | 4,468,186 | | | 3,351,399 | | | 4,224,841 | |

| Cash, cash equivalents, restricted cash, and restricted cash equivalents, end of period | $ | 3,820,707 | | | $ | 4,688,580 | | | $ | 3,820,707 | | | $ | 4,688,580 | |

| Reconciliation of cash, cash equivalents, restricted cash, and restricted cash equivalents within the condensed consolidated balance sheets to the amounts shown in the condensed consolidated statements of cash flows above: | | | | | | | |

| Cash and cash equivalents | $ | 1,566,271 | | | $ | 1,579,633 | | | $ | 1,566,271 | | | $ | 1,579,633 | |

| Restricted cash included in other current assets | 92,613 | | | 103,462 | | | 92,613 | | | 103,462 | |

| Restricted cash included in other assets | 5,297 | | | 7,116 | | | 5,297 | | | 7,116 | |

| Restricted cash and restricted cash equivalents included in funds held for customers | 2,156,526 | | | 2,998,369 | | | 2,156,526 | | | 2,998,369 | |

| Total cash, cash equivalents, restricted cash, and restricted cash equivalents, end of period | $ | 3,820,707 | | | $ | 4,688,580 | | | $ | 3,820,707 | | | $ | 4,688,580 | |

BILL HOLDINGS, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(Unaudited, in thousands except percentages and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of gross profit: | | | | | | | |

| GAAP gross profit | $ | 295,946 | | $ | 260,118 | | $ | 589,701 | | $ | 509,077 |

| Add: | | | | | | | |

Depreciation and amortization (1) | 10,310 | | 11,138 | | 21,403 | | 22,260 |

| Stock-based compensation and related payroll taxes charged to cost of revenue | 2,654 | | 2,446 | | 4,837 | | 5,074 |

| Non-GAAP gross profit | $ | 308,910 | | $ | 273,702 | | $ | 615,941 | | $ | 536,411 |

| GAAP gross margin | 81.6 | % | | 81.7 | % | | 81.8 | % | | 81.7 | % |

| Non-GAAP gross margin | 85.2 | % | | 85.9 | % | | 85.4 | % | | 86.0 | % |

___________________ (1) Consists of depreciation of property and equipment and amortization of developed technology, excluding amortization of capitalized internal-use software costs paid in cash. |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of operating expenses: | | | | | | | |

| GAAP research and development expenses | $ | 84,784 | | | $ | 86,489 | | | $ | 163,469 | | | $ | 175,552 | |

| Less - stock-based compensation and related payroll taxes | (29,774) | | | (26,550) | | | (53,750) | | | (54,437) | |

| Non-GAAP research and development expenses | $ | 55,010 | | | $ | 59,939 | | | $ | 109,719 | | | $ | 121,115 | |

| | | | | | | |

| GAAP sales and marketing expenses | $ | 132,534 | | | $ | 118,305 | | | $ | 258,856 | | | $ | 236,704 | |

| Less - stock-based compensation and related payroll taxes | (10,656) | | | (13,009) | | | (21,550) | | | (27,091) | |

| Non-GAAP sales and marketing expenses | $ | 121,878 | | | $ | 105,296 | | | $ | 237,306 | | | $ | 209,613 | |

| | | | | | | |

GAAP general and administrative expenses (1) | $ | 71,122 | | | $ | 70,053 | | | $ | 137,893 | | | $ | 143,304 | |

| Less: | | | | | | | |

| Stock-based compensation and related payroll taxes | (23,264) | | | (20,547) | | | (40,982) | | | (41,934) | |

| Acquisition and integration-related expenses | — | | | (872) | | | — | | | (969) | |

| Restructuring | — | | | — | | | 92 | | | — | |

| Non-GAAP general and administrative expenses | $ | 47,858 | | | $ | 48,634 | | | $ | 97,003 | | | $ | 100,401 | |

___________________ (1) Provision for expected credit losses was included in general and administrative expenses during the three and six months ended December 31, 2023. |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of operating loss: | | | | | | | |

| GAAP operating loss | $ | (21,710) | | | $ | (67,674) | | | $ | (29,407) | | | $ | (124,320) | |

| Add: | | | | | | | |

Depreciation and amortization (1) | 18,168 | | | 23,462 | | | 38,274 | | | 47,401 | |

| Stock-based compensation and related payroll taxes charged to cost of revenue and operating expenses | 66,348 | | | 62,552 | | | 121,119 | | | 128,536 | |

| Acquisition and integration-related expenses | — | | | 872 | | | — | | | 969 | |

| Restructuring | — | | | 25,091 | | | (92) | | | 25,091 | |

| Non-GAAP operating income | $ | 62,806 | | | $ | 44,303 | | | $ | 129,894 | | | $ | 77,677 | |

___________________ (1) Excludes amortization of capitalized internal-use software costs paid in cash. |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of net income (loss): | | | | | | | |

| GAAP net income (loss) | $ | 33,548 | | | $ | (40,421) | | | $ | 42,460 | | | $ | (68,282) | |

| Add - GAAP provision for income taxes | 45 | | | 1,666 | | | 1,314 | | | 2,189 | |

| Income (loss) before taxes | 33,593 | | | (38,755) | | | 43,774 | | | (66,093) | |

| Add (less): | | | | | | | |

Depreciation and amortization (1) | 18,168 | | | 23,462 | | | 38,274 | | | 47,401 | |

| Stock-based compensation and related payroll taxes charged to cost of revenue and operating expenses | 66,348 | | | 62,552 | | | 121,119 | | | 128,536 | |

| Acquisition and integration-related expenses | — | | | 872 | | | — | | | 969 | |

| Restructuring | — | | | 25,091 | | | (92) | | | 25,091 | |

| Gain on debt extinguishment | (40,472) | | | — | | | (40,550) | | | — | |

| Amortization of debt issuance costs | 1,001 | | | 1,762 | | | 1,896 | | | 3,523 | |

| Non-GAAP net income before non-GAAP tax adjustments | 78,638 | | | 74,984 | | | 164,421 | | | 139,427 | |

Non-GAAP provision for income taxes (2) | (15,728) | | | (14,997) | | | (32,884) | | | (27,885) | |

| Non-GAAP net income | $ | 62,910 | | | $ | 59,987 | | | $ | 131,537 | | | $ | 111,542 | |

___________________ (1) Excludes amortization of capitalized internal-use software costs paid in cash. (2) The non-GAAP provision for income taxes is calculated using a blended tax rate of 20%, taking into consideration the nature of the taxed item and the applicable statutory tax rate in each relevant taxing jurisdiction. |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of net income (loss) per share attributable to common stockholders, basic and diluted: | | | | | | | |

| GAAP net income (loss) per share attributable to common stockholders, basic and diluted | $ | 0.33 | | | $ | (0.38) | | | $ | 0.41 | | | $ | (0.64) | |

| Add - GAAP provision for income taxes | 0.00 | | | 0.02 | | | 0.01 | | | 0.02 | |

| Income (loss) before taxes | 0.33 | | | (0.36) | | | 0.42 | | | (0.62) | |

| Add: | | | | | | | |

Depreciation and amortization (1) | 0.18 | | | 0.21 | | | 0.37 | | | 0.45 | |

| Stock-based compensation and related payroll taxes charged to cost of revenue and operating expenses | 0.63 | | | 0.59 | | | 1.16 | | | 1.20 | |

| Acquisition and integration-related expenses | — | | | 0.01 | | | — | | | 0.01 | |

| Restructuring | — | | | 0.24 | | | — | | | 0.24 | |

| Gain on debt extinguishment | (0.39) | | | — | | | (0.39) | | | — | |

| Amortization of debt issuance costs | 0.01 | | | 0.02 | | | 0.02 | | | 0.03 | |

| Non-GAAP net income before non-GAAP tax adjustments per share attributable to common stockholders, basic | $ | 0.76 | | | $ | 0.71 | | | $ | 1.58 | | | $ | 1.31 | |

| Non-GAAP net income before non-GAAP tax adjustments per share attributable to common stockholders, diluted | $ | 0.70 | | | $ | 0.64 | | | $ | 1.48 | | | $ | 1.19 | |

| Less - Non-GAAP provision for income taxes | (0.15) | | | (0.14) | | | (0.32) | | | (0.26) | |

| Non-GAAP net income per share attributable to common stockholders, basic | $ | 0.61 | | | $ | 0.57 | | | $ | 1.26 | | | $ | 1.05 | |

| Non-GAAP net income per share attributable to common stockholders, diluted | $ | 0.56 | | | $ | 0.51 | | | $ | 1.19 | | | $ | 0.95 | |

___________________ (1) Excludes amortization of capitalized internal-use software costs paid in cash. |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Shares used to compute GAAP and non-GAAP net income (loss) per share attributable to common stockholders, basic | 103,102 | | | 105,914 | | | 104,394 | | | 106,350 | |

| Shares used to compute GAAP net income (loss) per share attributable to common stockholders, diluted | 104,480 | | | 105,914 | | | 107,718 | | | 106,350 | |

| Shares used to compute non-GAAP net income per share attributable to common stockholders, diluted | 111,919 | | | 116,712 | | | 110,840 | | | 117,471 | |

BILL HOLDINGS, INC.

FREE CASH FLOW

(Unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by operating activities | $ | 78,716 | | | $ | 79,682 | | | $ | 167,298 | | | $ | 133,342 | |

| Purchases of property and equipment | (382) | | | (352) | | | (399) | | | (755) | |

| Capitalization of internal-use software costs | (6,720) | | | (5,117) | | | (13,759) | | | (10,762) | |

| Free cash flow | $ | 71,614 | | | $ | 74,213 | | | $ | 153,140 | | | $ | 121,825 | |

BILL HOLDINGS, INC.

REMAINING PERFORMANCE OBLIGATIONS

(Unaudited, in thousands)

| | | | | | | | | | | |

| December 31,

2024 | | June 30,

2024 |

| Remaining performance obligations to be recognized as revenue: | | | |

| Over the next 1 year | $ | 30,464 | | | $ | 30,225 | |

| Between 1 to 2 years | 16,700 | | | 16,887 | |

| Thereafter | 30,882 | | | 39,733 | |

| Total | $ | 78,046 | | | $ | 86,845 | |

v3.25.0.1

Cover

|

Feb. 06, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 06, 2025

|

| Entity Registrant Name |

BILL Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39149

|

| Entity Tax Identification Number |

83-2661725

|

| Entity Address, Address Line One |

6220 America Center Drive, Suite 100

|

| Entity Address, State or Province |

CA

|

| Entity Address, City or Town |

San Jose

|

| Entity Address, Postal Zip Code |

95002

|

| City Area Code |

650

|

| Local Phone Number |

621-7700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.00001 par value

|

| Trading Symbol |

BILL

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001786352

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

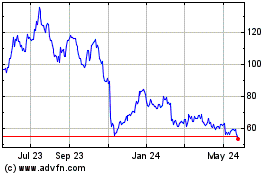

BILL (NYSE:BILL)

Historical Stock Chart

From Jan 2025 to Feb 2025

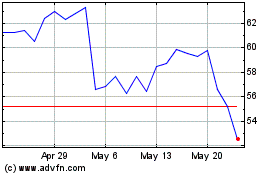

BILL (NYSE:BILL)

Historical Stock Chart

From Feb 2024 to Feb 2025