false000170275000017027502024-10-242024-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 24, 2024

BYLINE BANCORP, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction

of Incorporation)

|

|

|

|

|

|

001-38139 |

|

36-3012593 |

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

180 North LaSalle Street, Suite 300 |

|

|

Chicago, Illinois |

|

60601 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(773) 244-7000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock |

BY |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 2.02. |

Results of Operations and Financial Condition. |

|

|

On October 24, 2024, Byline Bancorp, Inc., (“Byline" or the "Company”) issued a press release announcing its financial results for the third quarter ended September 30, 2024. A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference.

On October 24, 2024, the Company made available on its website a slide presentation regarding the Company’s third quarter 2024 financial results, which will be used as part of a publicly accessible conference call on October 25, 2024. A copy of the slide presentation is attached as Exhibit 99.2 and is incorporated herein by reference.

The information included in Item 2.02 this Current Report on Form 8-K (including the information in the attached exhibits 99.1 and 99.2) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in any such filing.

|

|

Item 9.01. |

Financial Statements and Exhibits. |

|

|

(d) Exhibits.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated future performance of the Company. These statements are often, but not always, made through the use of words or phrases such as ‘‘may’’, ‘‘might’’, ‘‘should’’, ‘‘could’’, ‘‘predict’’, ‘‘potential’’, ‘‘believe’’, ‘‘expect’’, ‘‘continue’’, ‘‘will’’, ‘‘anticipate’’, ‘‘seek’’, ‘‘estimate’’, ‘‘intend’’, ‘‘plan’’, ‘‘projection’’, ‘‘would’’, ‘‘annualized’’, “target” and ‘‘outlook’’, or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. Forward-looking statements involve estimates and known and unknown risks, and reflect various assumptions and involve elements of subjective judgment and analysis, which may or may not prove to be correct, and which are subject to uncertainties and contingencies outside the control of Byline and its respective affiliates, directors, employees and other representatives, which could cause actual results to differ materially from those presented in this communication.

No representations, warranties or guarantees are or will be made by Byline as to the reliability, accuracy or completeness of any forward-looking statements contained in this communication or that such forward-looking statements are or will remain based on reasonable assumptions. You should not place undue reliance on any forward-looking statements contained in this communication.

Certain risks and important factors that could affect Byline’s future results are identified in our Annual Report on Form 10-K and other reports we file with the Securities and Exchange Commission, including among other things under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023. Any forward-looking statement speaks only as of the date on which it is made, and Byline undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise unless required under the federal securities laws.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BYLINE BANCORP, INC. |

|

|

|

|

Date: October 24, 2024 |

|

|

|

By: |

/s/ Roberto R. Herencia |

|

|

|

|

Name: |

Roberto R. Herencia |

|

|

|

|

Title: |

Executive Chairman and Chief Executive Officer |

Exhibit 99.1

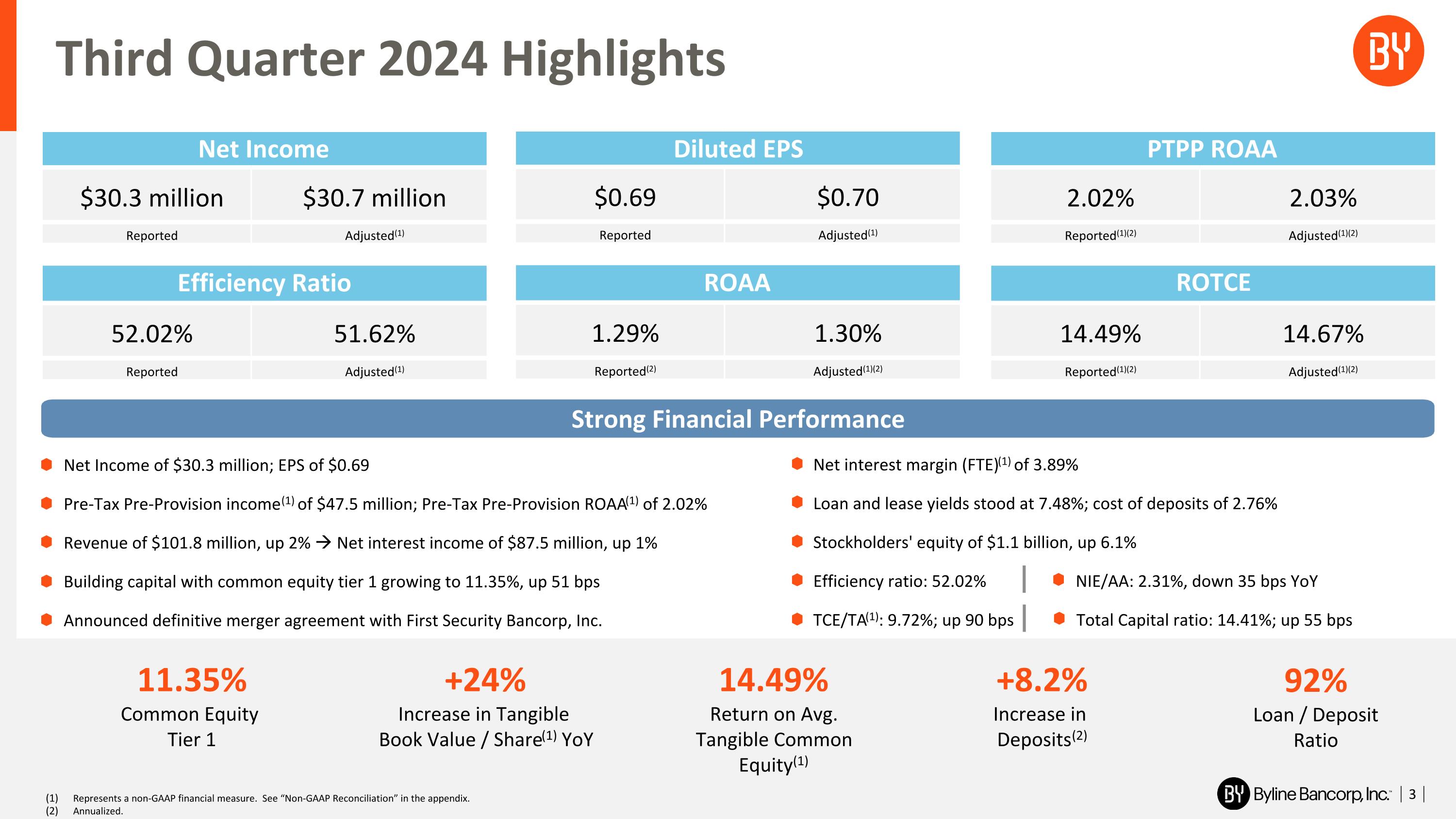

Byline Bancorp, Inc. Reports Third Quarter 2024 Financial Results

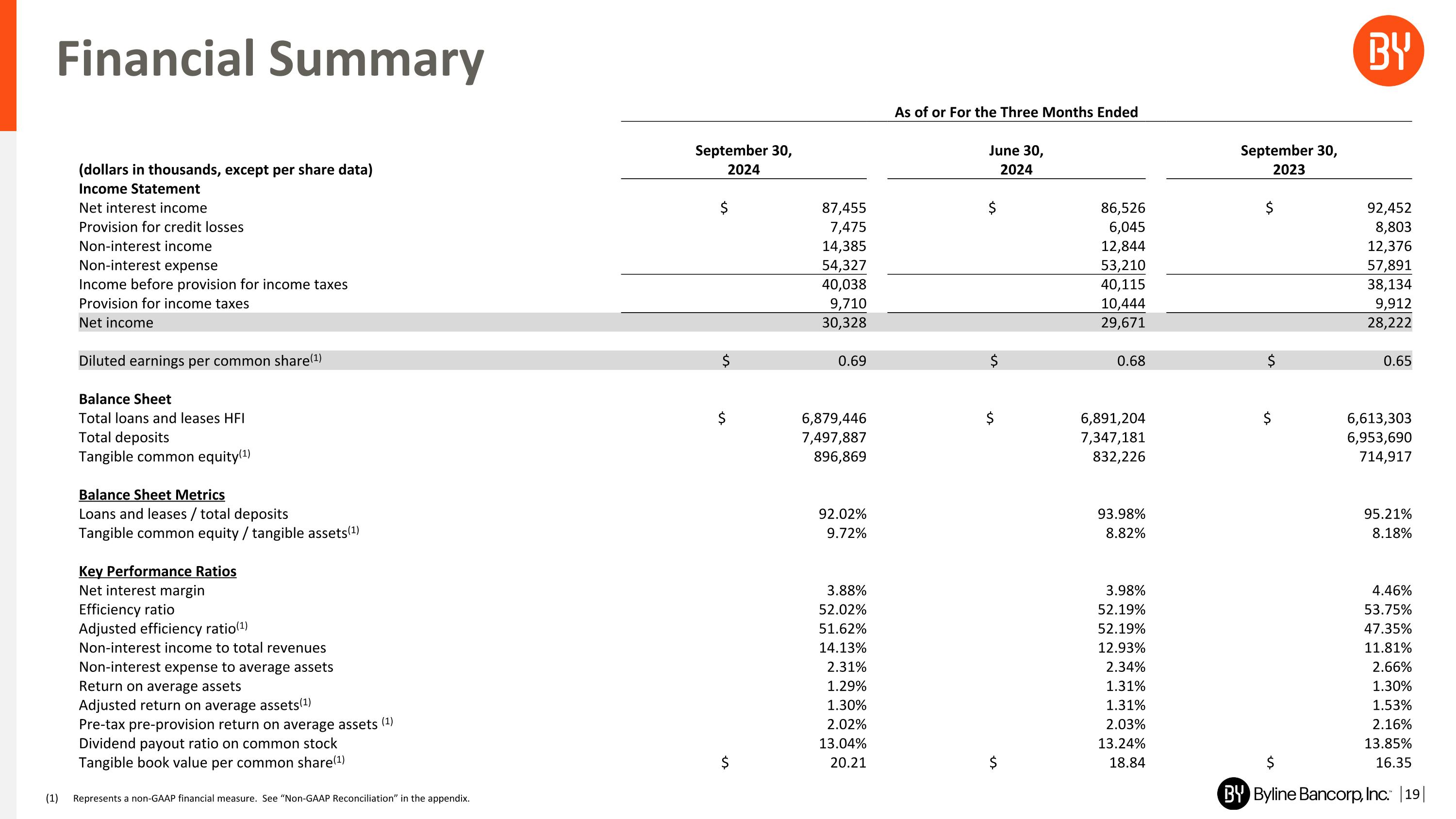

Net income of $30.3 million, $0.69 diluted earnings per share

Chicago, IL, October 24, 2024 – Byline Bancorp, Inc. (NYSE: BY), today reported:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or For the quarter |

|

Third Quarter Highlights (compared to 2Q24, unless otherwise specified) |

|

|

|

3Q24 |

|

2Q24 |

|

3Q23 |

|

|

Financial Results ($ in thousands) |

|

|

|

|

|

|

|

|

|

|

• Announced definitive merger agreement |

|

Net interest income |

|

$ |

87,455 |

|

$ |

86,526 |

|

$ |

92,452 |

|

with First Security Bancorp, Inc. |

|

Non-interest income |

|

|

14,385 |

|

|

12,844 |

|

|

12,376 |

|

|

|

Total revenue(1) |

|

|

101,840 |

|

|

99,370 |

|

|

104,828 |

|

• ROAA of 1.29%; PTPP ROAA of 2.02%(1) |

|

Non-interest expense (NIE) |

|

|

54,327 |

|

|

53,210 |

|

|

57,891 |

|

|

|

Pre-tax pre-provision net income(1) |

|

|

47,513 |

|

|

46,160 |

|

|

46,937 |

|

• TBV per share of $20.21(1); up 7.3% LQ, |

|

Provision for credit losses |

|

|

7,475 |

|

|

6,045 |

|

|

8,803 |

|

and 23.6% YoY |

|

Provision for income taxes |

|

|

9,710 |

|

|

10,444 |

|

|

9,912 |

|

|

|

Net Income |

|

$ |

30,328 |

|

$ |

29,671 |

|

$ |

28,222 |

|

• Common equity tier 1 of 11.35%, an increase |

|

|

|

|

|

|

|

|

|

|

|

|

of 51 bps |

Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share (EPS) |

|

$ |

0.69 |

|

$ |

0.68 |

|

$ |

0.65 |

|

Income Statement |

|

Dividends declared per common share |

|

|

0.09 |

|

|

0.09 |

|

|

0.09 |

|

• Net interest income of $87.5 million, an |

|

Book value per share |

|

|

24.70 |

|

|

23.38 |

|

|

21.04 |

|

increase of $929,000, or 1.1% |

|

Tangible book value (TBV) per share(1) |

|

|

20.21 |

|

|

18.84 |

|

|

16.35 |

|

|

|

|

• Non-interest income of $14.4 million, an |

Balance Sheet & Credit Quality ($ in thousands) |

|

|

|

|

|

|

|

|

|

|

increase of $1.5 million, or 12.0% |

|

Total deposits |

|

$ |

7,497,887 |

|

$ |

7,347,181 |

|

$ |

6,953,690 |

|

|

|

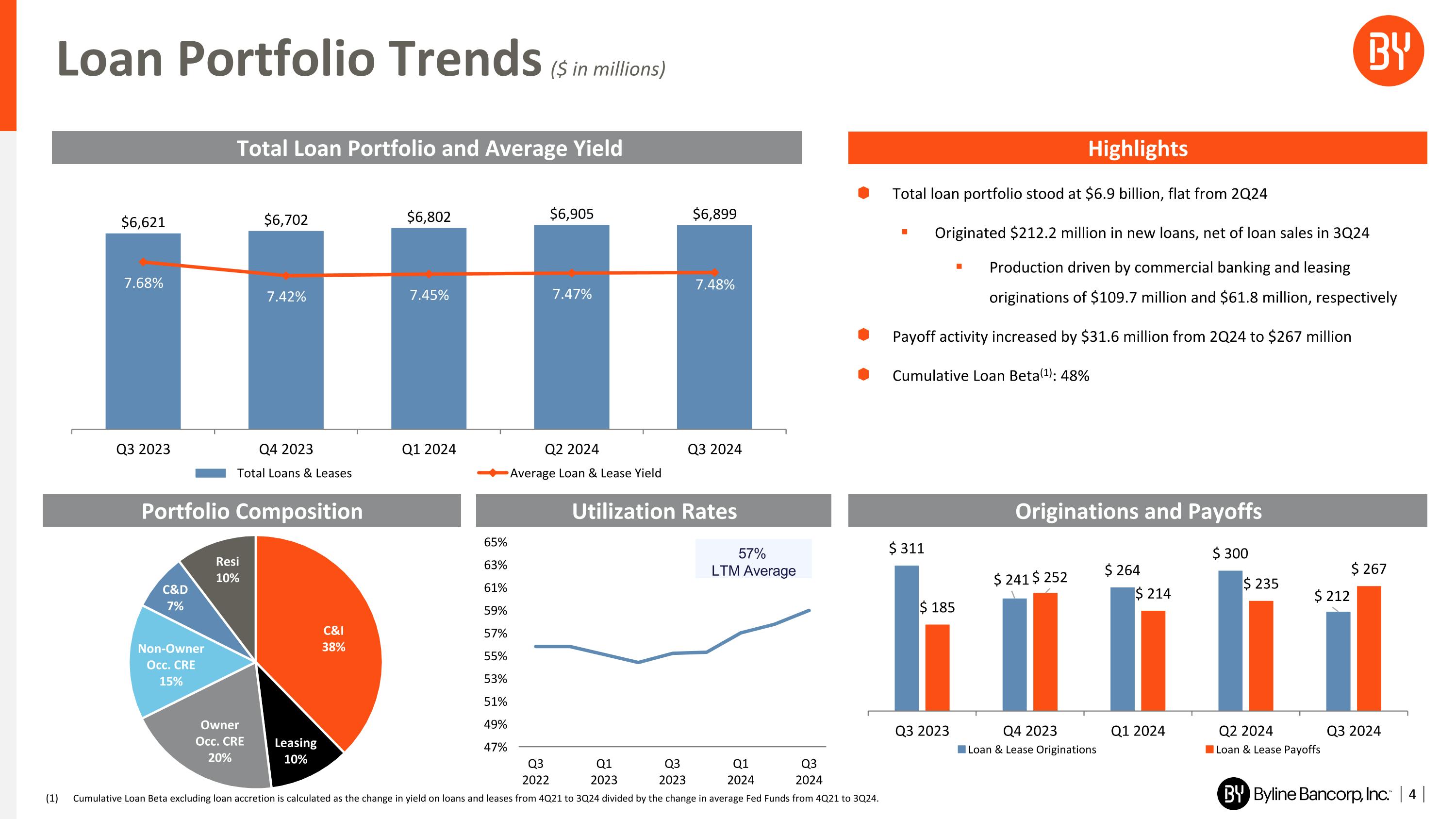

Total loans and leases |

|

|

6,899,401 |

|

|

6,904,564 |

|

|

6,620,602 |

|

• NIE/AA 2.31%, down three bps |

|

Net charge-offs |

|

|

8,467 |

|

|

9,514 |

|

|

5,430 |

|

|

|

Allowance for credit losses (ACL) |

|

|

98,860 |

|

|

99,730 |

|

|

105,696 |

|

• Adjusted efficiency ratio of 51.62%(1), |

|

ACL to total loans and leases held for investment |

|

|

1.44% |

|

|

1.45% |

|

|

1.60% |

|

down by 57 bps |

|

|

|

|

|

|

|

|

|

|

|

|

|

Select Ratios (annualized where applicable) |

|

|

|

|

|

|

|

|

|

|

Balance Sheet |

|

Efficiency ratio(1) |

|

|

52.02% |

|

|

52.19% |

|

|

53.75% |

|

• Total deposits grew $150.7 million, or 2.1% |

|

Return on average assets (ROAA) |

|

|

1.29% |

|

|

1.31% |

|

|

1.30% |

|

|

|

Return on average stockholders' equity |

|

|

11.39% |

|

|

11.83% |

|

|

12.11% |

|

• Loan/deposits down 196 bps to 92.02% |

|

Return on average tangible common equity(1) |

|

|

14.49% |

|

|

15.27% |

|

|

16.15% |

|

|

|

Net interest margin (NIM) |

|

|

3.88% |

|

|

3.98% |

|

|

4.46% |

|

• Reduced other borrowings by $400.0 million |

|

Common equity to total assets |

|

|

11.63% |

|

|

10.72% |

|

|

10.29% |

|

|

|

Tangible common equity to tangible assets(1) |

|

|

9.72% |

|

|

8.82% |

|

|

8.18% |

|

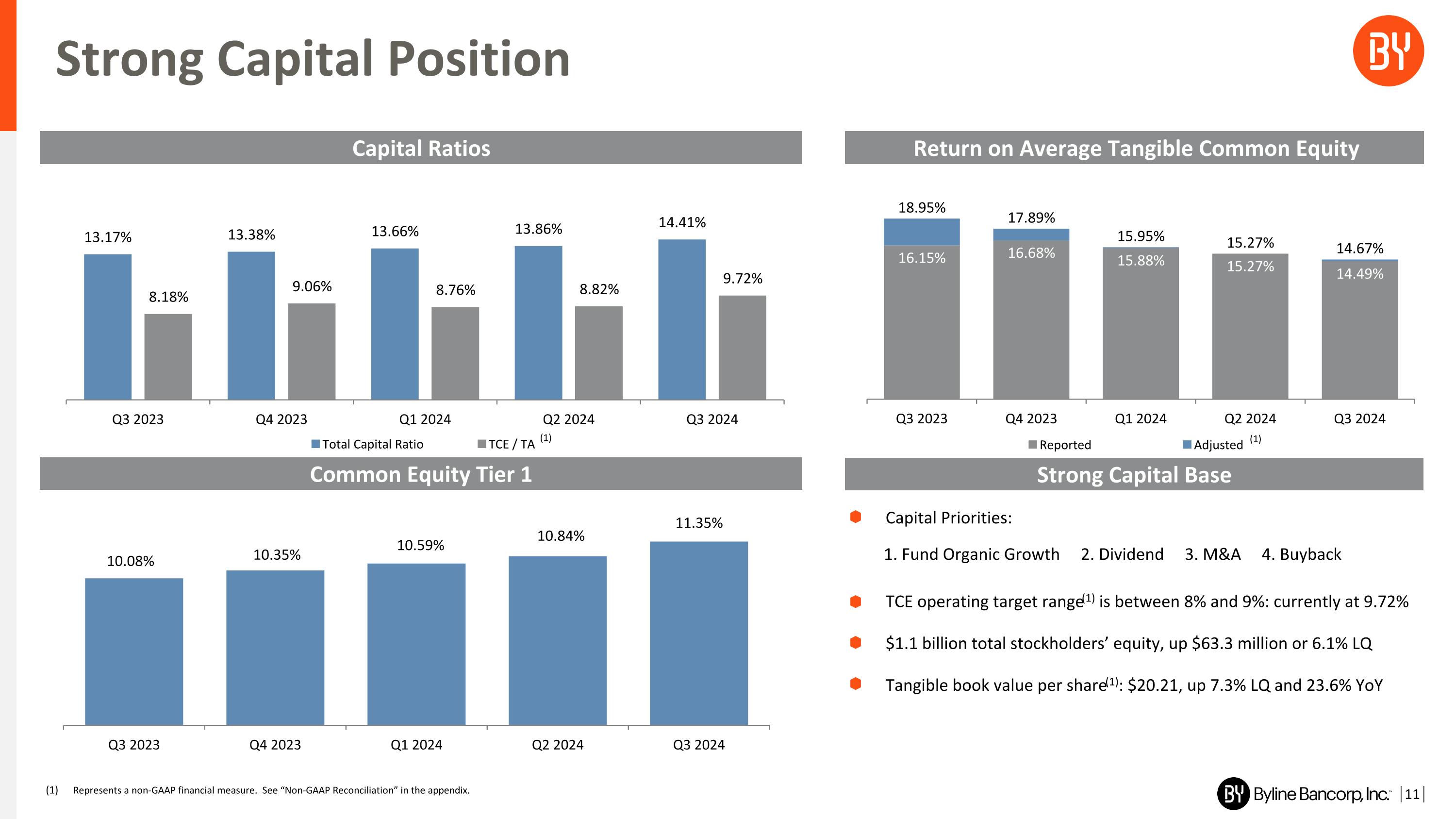

• Tangible common equity to tangible assets |

|

Common equity tier 1 |

|

|

11.35% |

|

|

10.84% |

|

|

10.08% |

|

of 9.72%(1), an increase of 90 bps |

|

CEO/President Commentary |

|

Roberto R. Herencia, Executive Chairman and CEO of Byline Bancorp, commented, "Our third quarter performance reflects Byline’s continued strong momentum across the franchise as we posted strong results. We are excited about our pending First Security Bancorp, Inc. transaction, which aligns with our long-term M&A strategy. We believe this merger strengthens our position in the market by adding a high-quality franchise with a strong core deposit base. We look forward to welcoming First Security Bank and Trust customers to Byline in 2025." Alberto J. Paracchini, President of Byline Bancorp, added, "Third quarter results were highlighted by robust earnings, strong profitability, net interest income expansion, solid deposit and fee revenue growth, and controlled non-interest expense. Importantly, we increased tangible book value and continue to maintain excellent balance sheet strength. We remain focused on executing our strategy of becoming the preeminent commercial bank in Chicago while continuing to increase the value of the franchise." |

(1)Represents non-GAAP financial measures. See “Reconciliation of non-GAAP Financial Measures” for a reconciliation to the most directly comparable GAAP financial measure.

Byline Bancorp, Inc.

Page 2 of 13

Board Declares Cash Dividend of $0.09 per Share

On October 22, 2024, the Company's Board of Directors declared a cash dividend of $0.09 per share, payable on November 19, 2024, to stockholders of record of the Company's common stock as of November 5, 2024.

STATEMENTS OF OPERATIONS HIGHLIGHTS

Net Interest Income

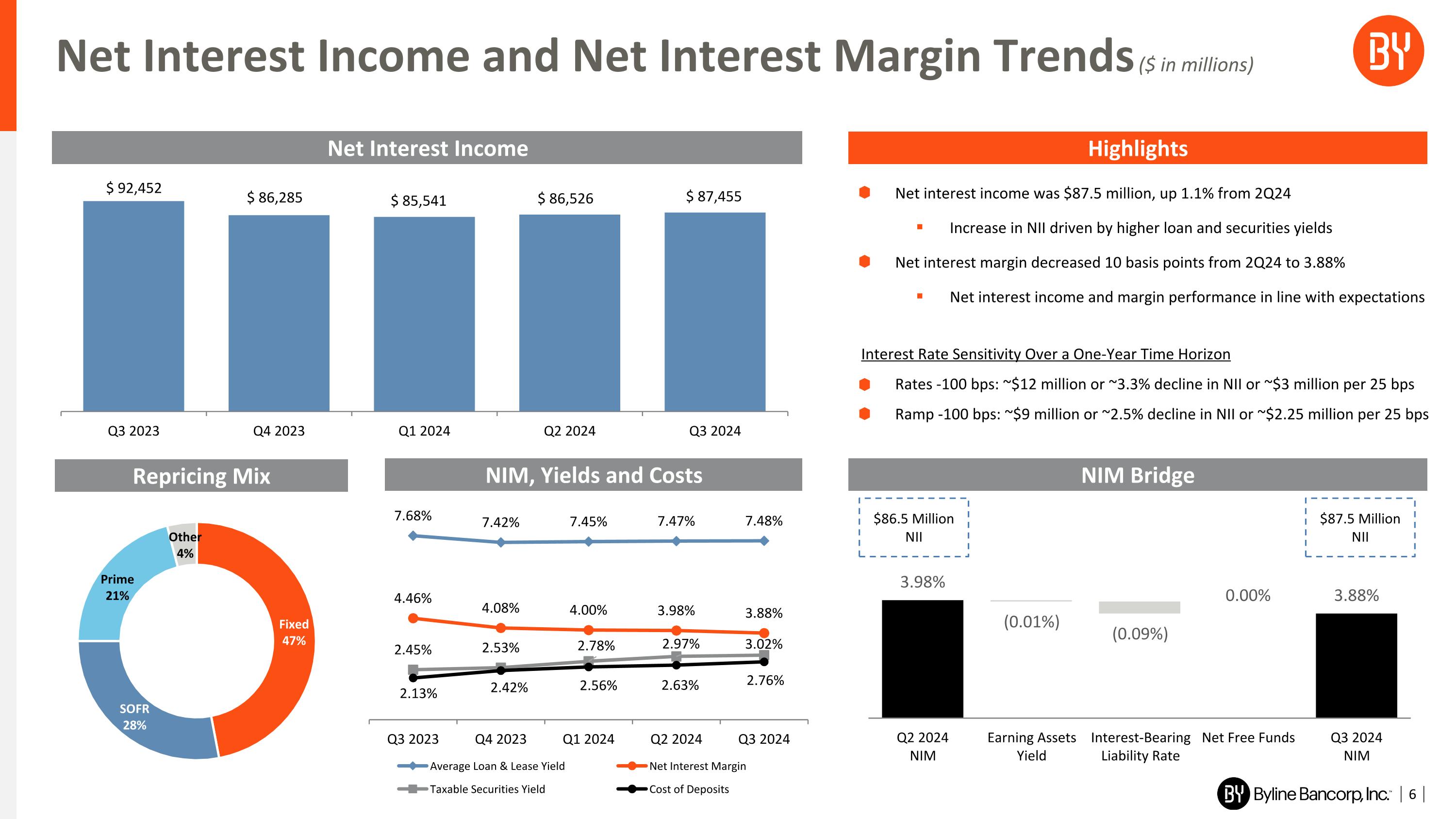

Net interest income for the third quarter of 2024 was $87.5 million, an increase of $929,000, or 1.1%, from the second quarter of 2024. The increase in net interest income was primarily due to increases in other interest and dividend income driven by increased interest income on funds held with the Federal Reserve Bank, and increases in interest and fees on loans and leases mainly due to day count. These were offset by increases in interest expense on deposits primarily due to increased average balances in time deposits and money market accounts from our deposit promotion campaigns.

Tax-equivalent net interest margin(1) for the third quarter of 2024 was 3.89%, a decrease of ten basis points compared to the second quarter of 2024. Net loan accretion income positively contributed 13 basis points to the net interest margin for the current quarter compared to 17 basis points for the prior quarter.

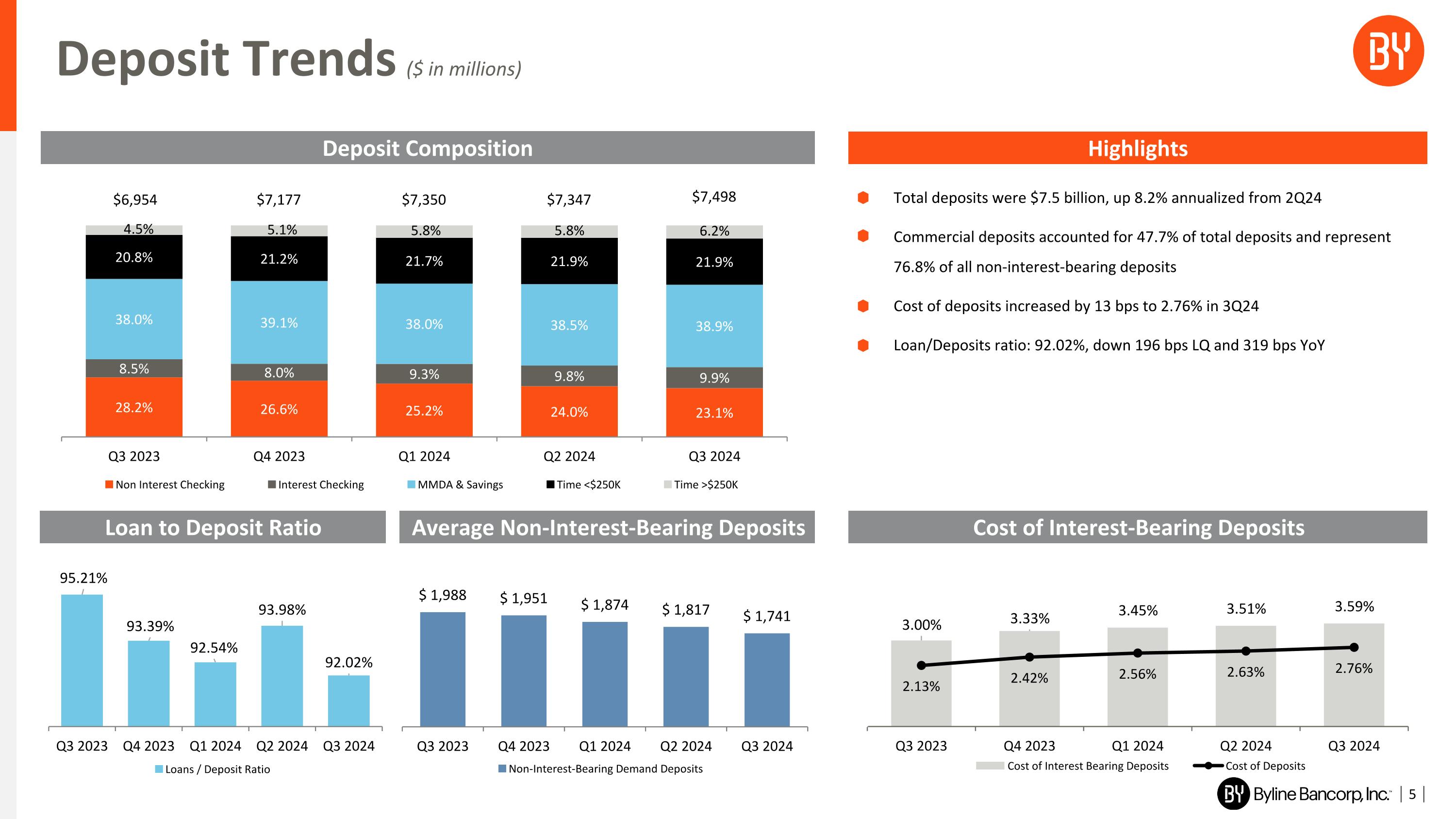

The average cost of total deposits was 2.76% for the third quarter of 2024, an increase of 13 basis points compared to the second quarter of 2024, as a result of higher rates paid on time deposits. Average non-interest-bearing demand deposits were 23.2% of average total deposits for the current quarter compared to 25.0% during the prior quarter.

Provision for Credit Losses

The provision for credit losses was $7.5 million for the third quarter of 2024, an increase of $1.4 million compared to $6.0 million for the second quarter of 2024, mainly attributed to increases related to individually assessed loans in the government guaranteed loan portfolio. The provision for credit losses for the quarter is comprised of a provision for loan and lease losses of $7.6 million compared to $6.9 million in the second quarter of 2024, and a recapture of the provision for unfunded commitments of $122,000 compared to $833,000 in the second quarter of 2024.

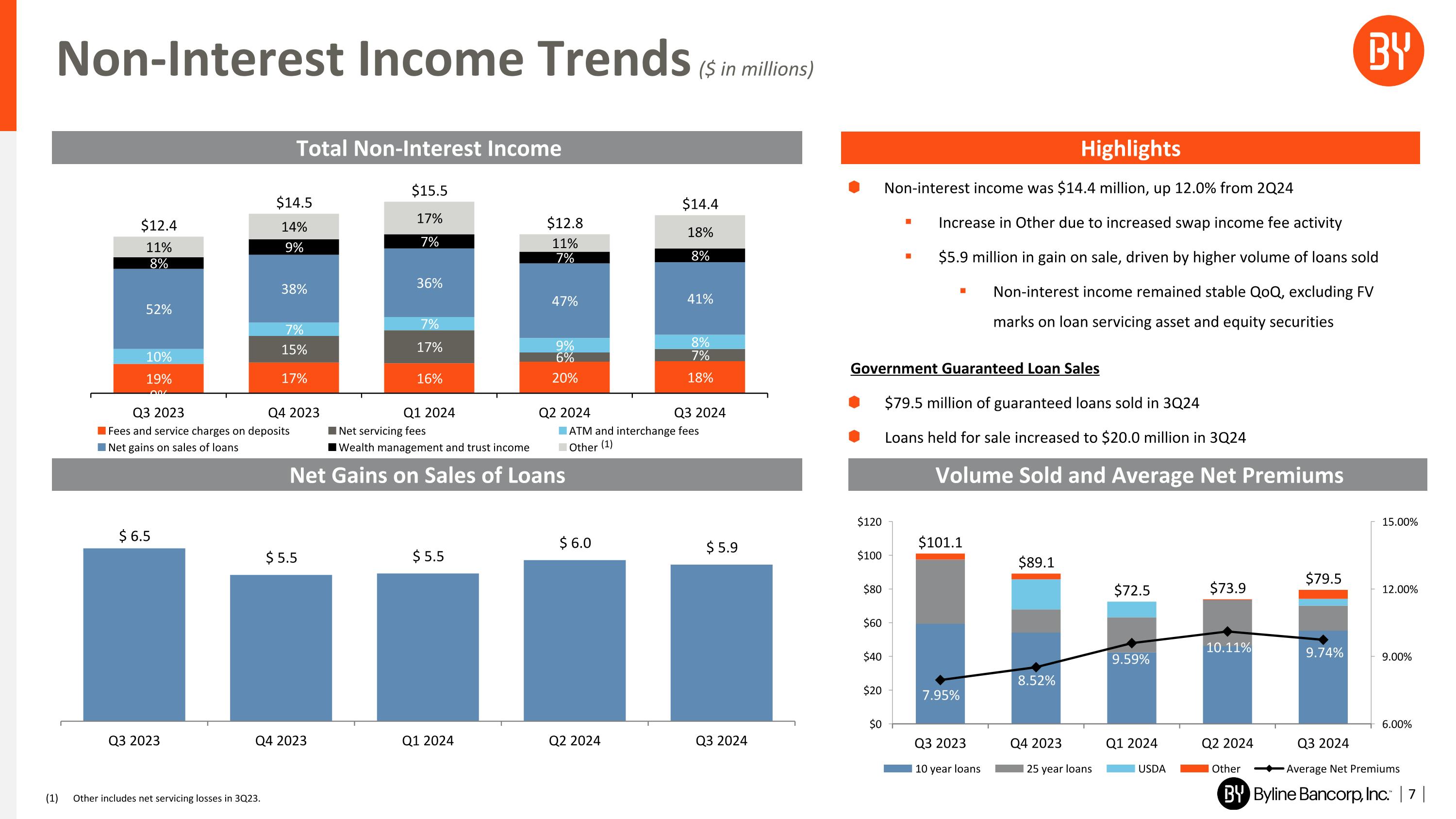

Non-interest Income

Non-interest income for the third quarter of 2024 was $14.4 million, an increase of $1.5 million, or 12.0%, compared to $12.8 million for the second quarter of 2024. The increase in total non-interest income was primarily due to the change in the fair value of equity securities, net, and an increase in other non-interest income due to increased swap fee activity.

Net gains on sales of loans were $5.9 million for the current quarter, a decrease of $172,000, or 2.8% compared to the prior quarter. During the third quarter of 2024, we sold $79.5 million of U.S. government guaranteed loans compared to $73.9 million during the second quarter of 2024.

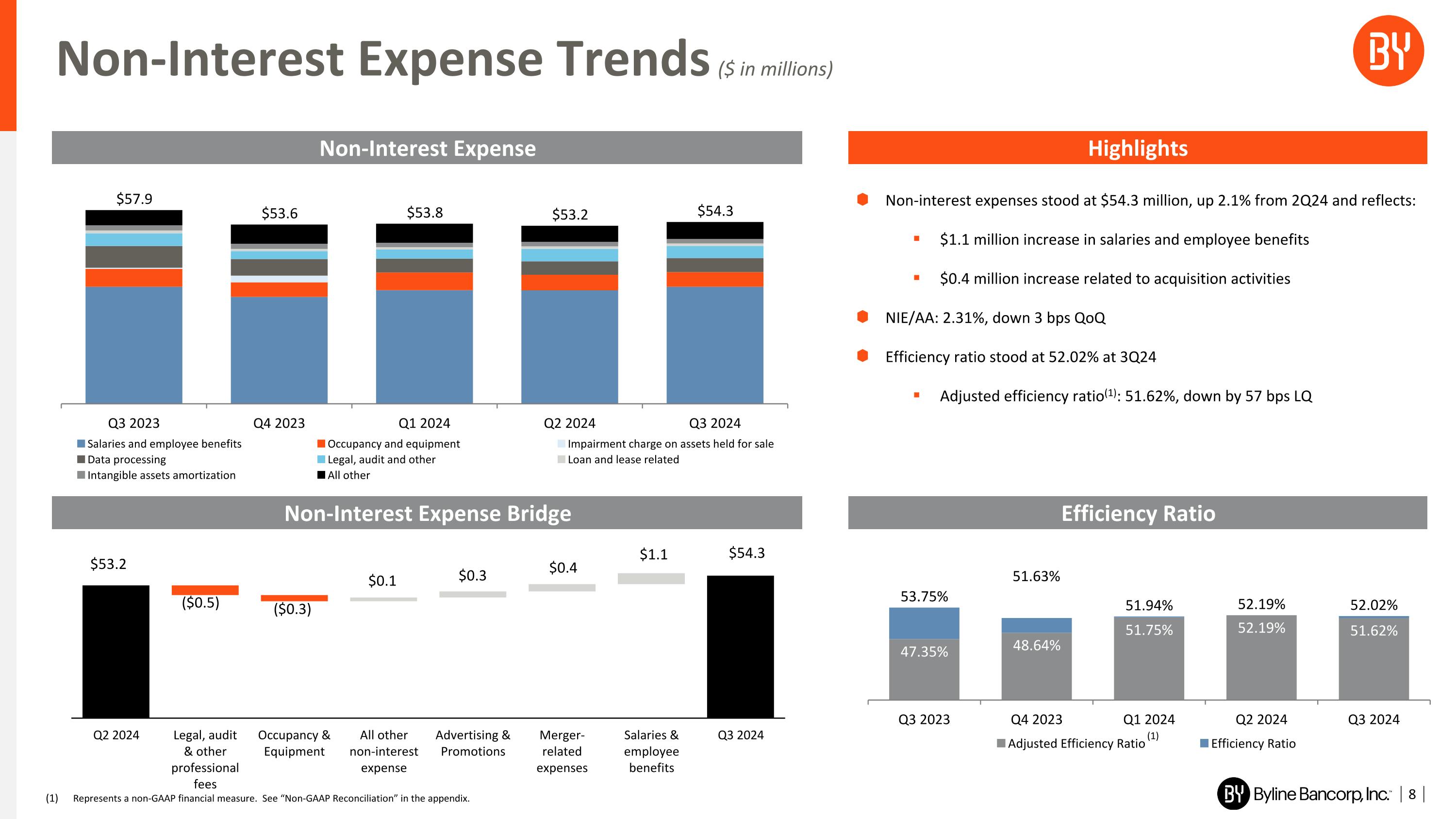

Non-interest Expense

Non-interest expense for the third quarter of 2024 was $54.3 million, an increase of $1.1 million, or 2.1%, compared to $53.2 million for the second quarter of 2024. The increase in non-interest expense was mainly due to increased salaries and employee benefits as a result of one additional payroll day, higher commissions, and lower deferred salaries related to loan and lease originations. Included in legal, audit and other professionals fees are $408,000 in merger-related expenses, and $3,000 merger-related expenses in data processing.

Our efficiency ratio was 52.02% for the third quarter of 2024 compared to 52.19% for the second quarter of 2024, a decrease of 17 basis points. Our adjusted efficiency ratio was 51.62%(1) for the third quarter of 2024 compared to 52.19%(1) for the second quarter of 2024, a decrease of 57 basis points.

Income Taxes

We recorded income tax expense of $9.7 million during the third quarter of 2024, compared to $10.4 million during the second quarter of 2024. The effective tax rates were 24.3% and 26.0% for the third quarter of 2024 and second quarter of 2024, respectively. The decrease in the effective tax rate was due to higher income tax benefits related to share-based compensation recorded in the third quarter.

(1) Represents non-GAAP financial measures. See “Reconciliation of non-GAAP Financial Measures” for a reconciliation of our non-GAAP measures to the most directly comparable GAAP financial measure.

Byline Bancorp, Inc.

Page 3 of 13

STATEMENTS OF FINANCIAL CONDITION HIGHLIGHTS

Assets

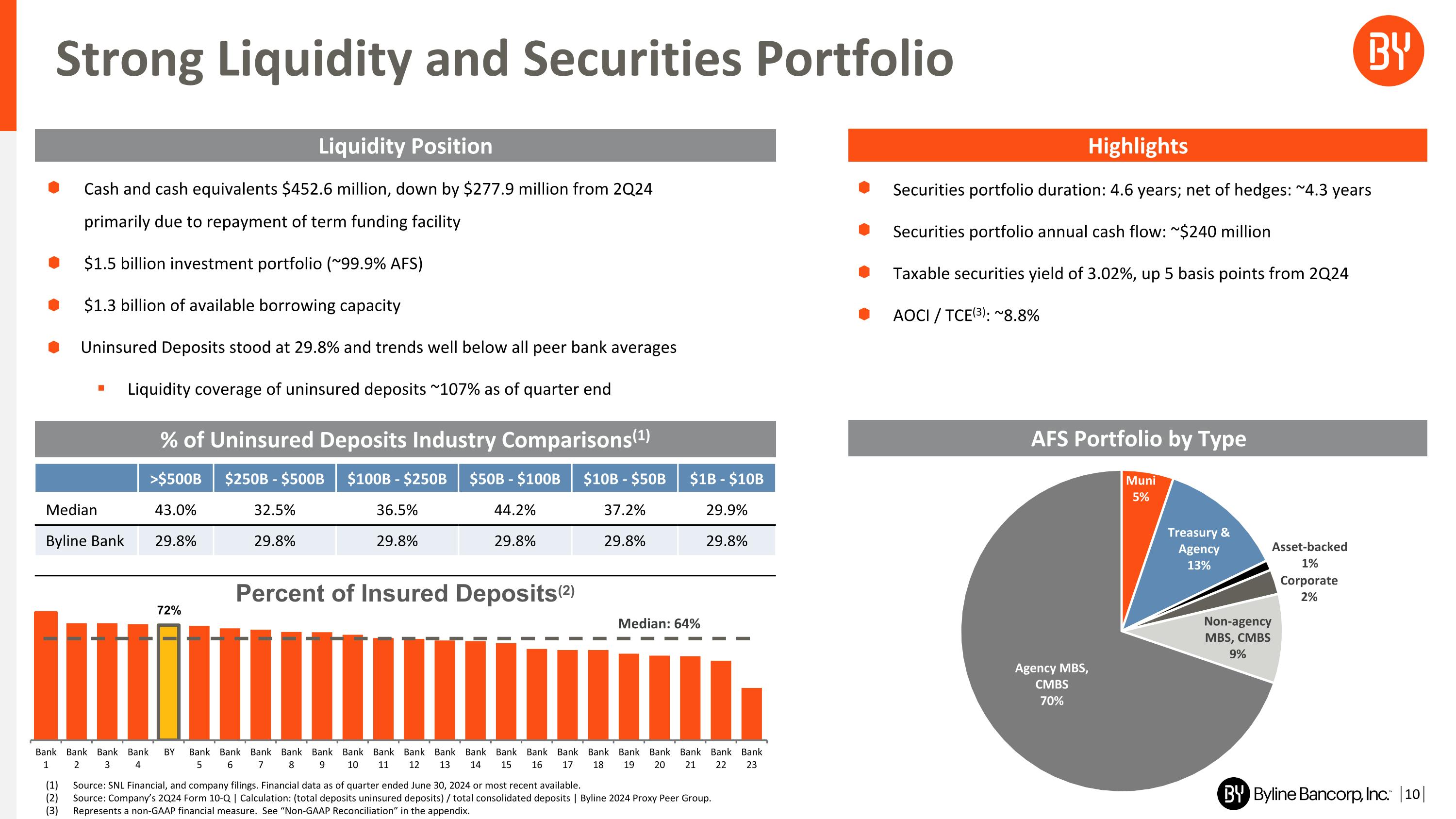

Total assets were $9.4 billion as of September 30, 2024, a decrease of $209.5 million, or 2.2%, compared to $9.6 billion at June 30, 2024. The decrease was mainly due to a decrease in cash and cash equivalents of $277.9 million, primarily due to the repayment during the quarter of the Bank Term Funding Program advance of $200.0 million, offset by an increase to securities available-for-sale, mainly from purchases of commercial and residential mortgage-backed securities.

Asset and Credit Quality

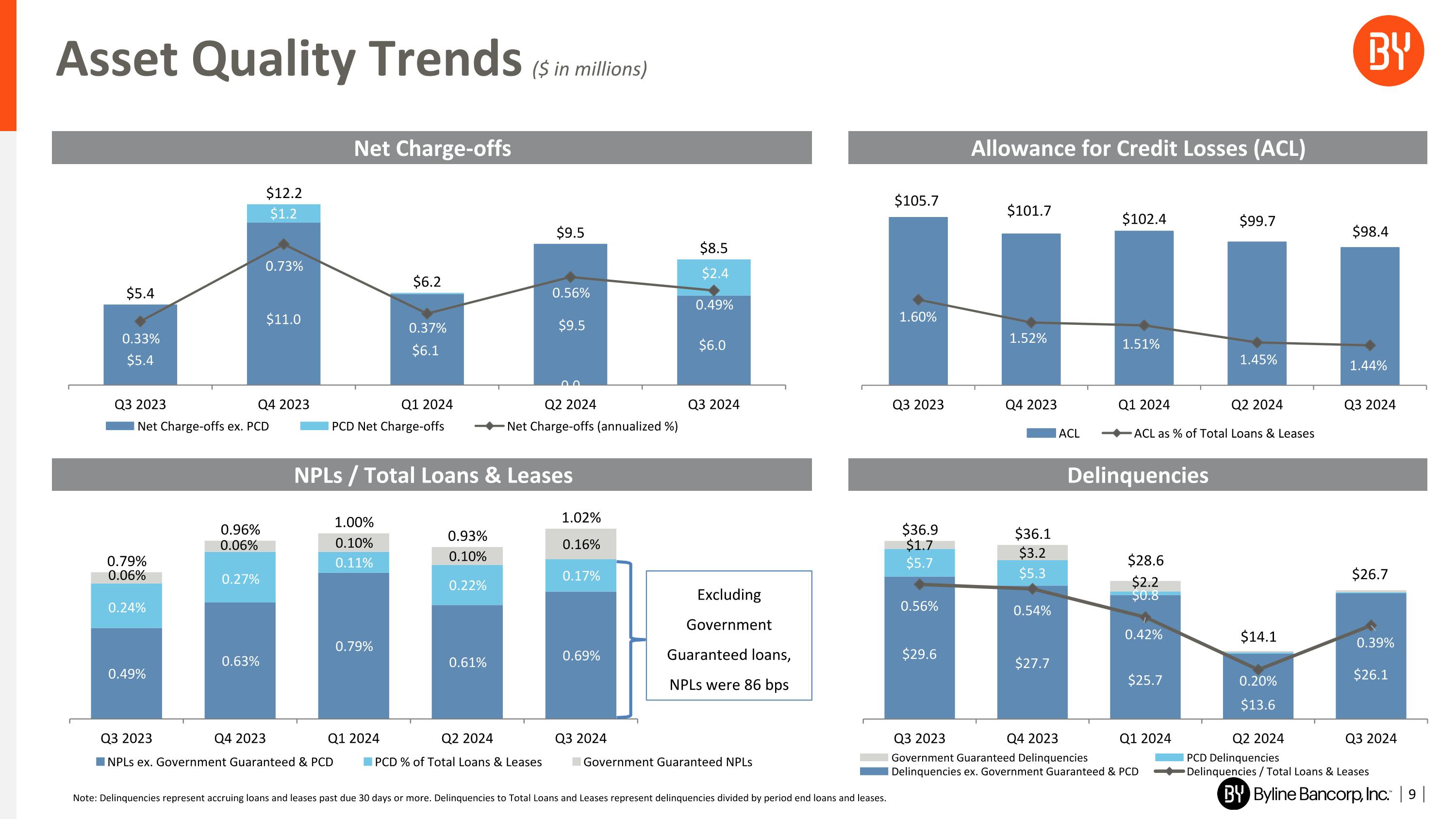

The ACL was $98.9 million as of September 30, 2024, a decrease of $870,000, or 0.9%, from $99.7 million at June 30, 2024. Net charge-offs of loans and leases during the third quarter of 2024 were $8.5 million, or 0.49% of average loans and leases, on an annualized basis. This was a decrease of $1.0 million compared to net charge-offs of $9.5 million, or 0.56% of average loans and leases, during the second quarter of 2024. The decrease is primarily due to lower charge-offs in the conventional portfolio.

Non-performing assets were $71.0 million, or 0.75% of total assets, as of September 30, 2024, an increase of $6.5 million from $64.6 million, or 0.67% of total assets, at June 30, 2024. The increase was primarily in non-accrual government guaranteed loans. The government guaranteed portion of non-performing loans included in non-performing assets was $11.3 million at September 30, 2024 compared to $6.6 million at June 30, 2024, an increase of $4.7 million.

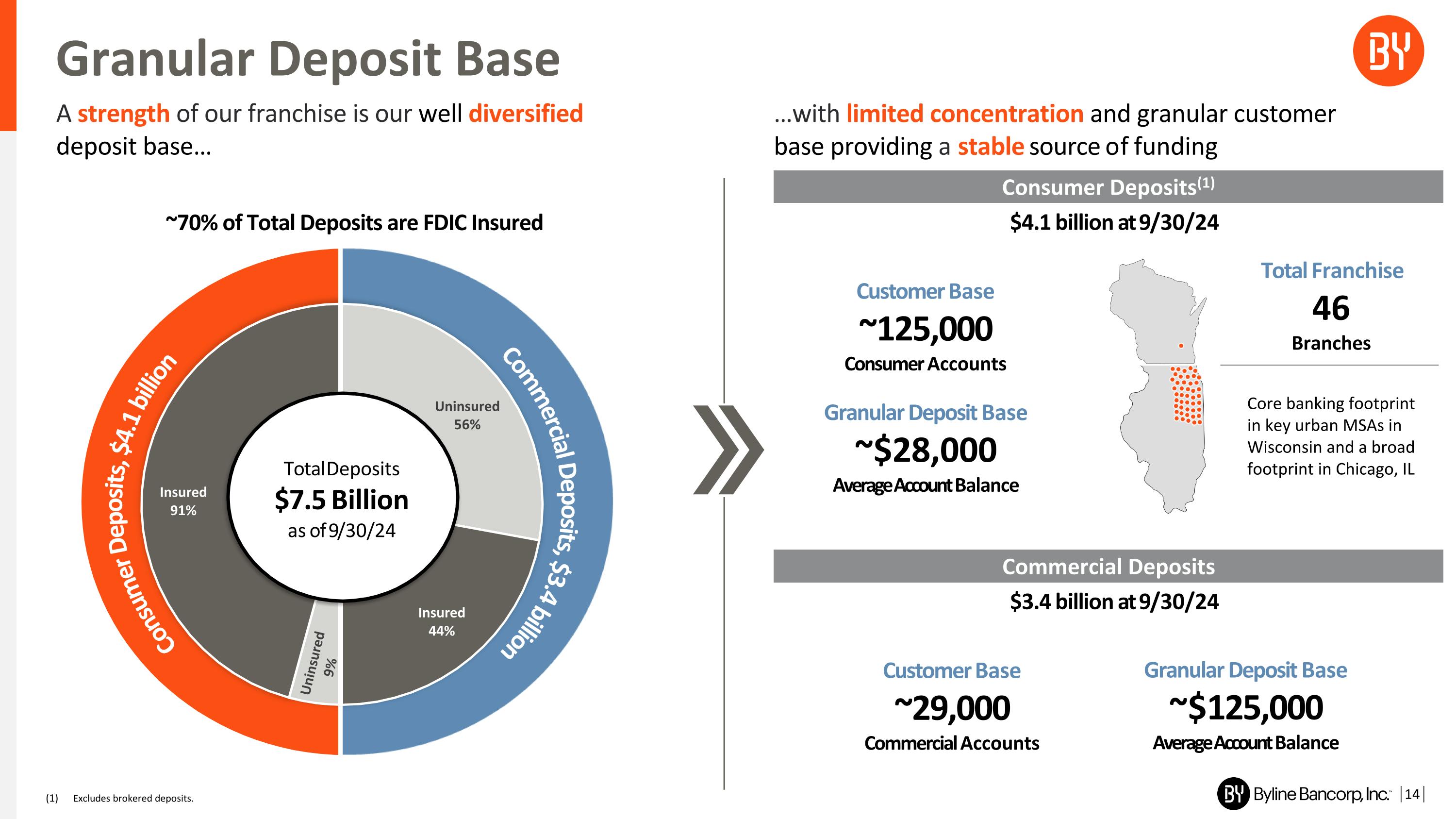

Deposits and Other Liabilities

Total deposits increased $150.7 million to $7.5 billion at September 30, 2024 compared to $7.3 billion at June 30, 2024. The increase in deposits in the current quarter was mainly due to increases in commercial money market accounts and consumer time deposits.

Total borrowings and other liabilities were $830.1 million at September 30, 2024, a decrease of $423.5 million from $1.3 billion at June 30, 2024, primarily driven by a $200.0 million decrease in Federal Home Loan Bank advances and the repayment of the $200.0 million advance under the Bank Term Funding Program.

Stockholders’ Equity

Total stockholders’ equity was $1.1 billion at September 30, 2024, an increase of $63.3 million, or 6.1%, from June 30, 2024, primarily due to a decrease in unrealized losses on securities available-for-sale and an increase in retained earnings from net income.

(1) Represents non-GAAP financial measures. See “Reconciliation of non-GAAP Financial Measures” for a reconciliation of our non-GAAP measures to the most directly comparable GAAP financial measure.

Byline Bancorp, Inc.

Page 4 of 13

Conference Call, Webcast and Slide Presentation

We will host a conference call and webcast at 9:00 a.m. Central Time on Friday, October 25, 2024, to discuss our quarterly financial results. Analysts and investors may participate in the question-and-answer session. The call can be accessed via telephone at (833) 470-1428; passcode 097541. A recorded replay can be accessed through November 8, 2024, by dialing (866) 813-9403; passcode: 402924.

A slide presentation relating to our third quarter 2024 results will be accessible prior to the conference call. The slide presentation and webcast of the conference call can be accessed on our investor relations website at www.bylinebancorp.com.

About Byline Bancorp, Inc.

Headquartered in Chicago, Byline Bancorp, Inc. is the parent company of Byline Bank, a full service commercial bank serving small- and medium-sized businesses, financial sponsors, and consumers. Byline Bank has approximately $9.4 billion in assets and operates 46 branch locations throughout the Chicago and Milwaukee metropolitan areas. Byline Bank offers a broad range of commercial and community banking products and services including small ticket equipment leasing solutions and is one of the top Small Business Administration lenders in the United States.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated future performance of the Company. These statements are often, but not always, made through the use of words or phrases such as ‘‘may’’, ‘‘might’’, ‘‘should’’, ‘‘could’’, ‘‘predict’’, ‘‘potential’’, ‘‘believe’’, ‘‘expect’’, ‘‘continue’’, ‘‘will’’, ‘‘anticipate’’, ‘‘seek’’, ‘‘estimate’’, ‘‘intend’’, ‘‘plan’’, ‘‘projection’’, ‘‘would’’, ‘‘annualized’’, “target” and ‘‘outlook’’, or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. Forward-looking statements involve estimates and known and unknown risks, and reflect various assumptions and involve elements of subjective judgment and analysis, which may or may not prove to be correct, and which are subject to uncertainties and contingencies outside the control of Byline and its respective affiliates, directors, employees and other representatives, which could cause actual results to differ materially from those presented in this communication.

No representations, warranties or guarantees are or will be made by Byline as to the reliability, accuracy or completeness of any forward-looking statements contained in this communication or that such forward-looking statements are or will remain based on reasonable assumptions. You should not place undue reliance on any forward-looking statements contained in this communication.

Certain risks and important factors that could affect Byline’s future results are identified in our Annual Report on Form 10-K and other reports we file with the Securities and Exchange Commission, including among other things under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023. Any forward-looking statement speaks only as of the date on which it is made, and Byline undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise unless required under the federal securities laws.

Contacts:

|

Investors / Media: |

Brooks Rennie |

Investor Relations Director |

312-660-5805 |

brennie@bylinebank.com |

|

Byline Bancorp, Inc.

Page 5 of 13

BYLINE BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

(dollars in thousands) |

|

2024 |

|

|

2024 |

|

|

2023 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

$ |

77,047 |

|

|

$ |

68,251 |

|

|

$ |

71,248 |

|

Interest bearing deposits with other banks |

|

|

375,549 |

|

|

|

662,206 |

|

|

|

357,640 |

|

Cash and cash equivalents |

|

|

452,596 |

|

|

|

730,457 |

|

|

|

428,888 |

|

Equity and other securities, at fair value |

|

|

9,132 |

|

|

|

8,745 |

|

|

|

7,902 |

|

Securities available-for-sale, at fair value |

|

|

1,502,108 |

|

|

|

1,386,827 |

|

|

|

1,239,929 |

|

Securities held-to-maturity, at amortized cost |

|

|

605 |

|

|

|

606 |

|

|

|

1,157 |

|

Restricted stock, at cost |

|

|

22,743 |

|

|

|

31,775 |

|

|

|

30,505 |

|

Loans held for sale |

|

|

19,955 |

|

|

|

13,360 |

|

|

|

7,299 |

|

Loans and leases: |

|

|

|

|

|

|

|

|

|

Loans and leases |

|

|

6,879,446 |

|

|

|

6,891,204 |

|

|

|

6,613,303 |

|

Allowance for credit losses - loans and leases |

|

|

(98,860 |

) |

|

|

(99,730 |

) |

|

|

(105,696 |

) |

Net loans and leases |

|

|

6,780,586 |

|

|

|

6,791,474 |

|

|

|

6,507,607 |

|

Servicing assets, at fair value |

|

|

18,945 |

|

|

|

19,617 |

|

|

|

19,743 |

|

Premises and equipment, net |

|

|

63,135 |

|

|

|

63,919 |

|

|

|

67,121 |

|

Goodwill and other intangible assets, net |

|

|

199,443 |

|

|

|

200,788 |

|

|

|

205,028 |

|

Bank-owned life insurance |

|

|

99,295 |

|

|

|

98,519 |

|

|

|

96,268 |

|

Deferred tax assets, net |

|

|

37,737 |

|

|

|

48,888 |

|

|

|

89,841 |

|

Accrued interest receivable and other assets |

|

|

218,036 |

|

|

|

238,840 |

|

|

|

242,080 |

|

Total assets |

|

$ |

9,424,316 |

|

|

$ |

9,633,815 |

|

|

$ |

8,943,368 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

Non-interest-bearing demand deposits |

|

$ |

1,729,908 |

|

|

$ |

1,762,891 |

|

|

$ |

1,959,855 |

|

Interest-bearing deposits |

|

|

5,767,979 |

|

|

|

5,584,290 |

|

|

|

4,993,835 |

|

Total deposits |

|

|

7,497,887 |

|

|

|

7,347,181 |

|

|

|

6,953,690 |

|

Other borrowings |

|

|

518,786 |

|

|

|

918,738 |

|

|

|

713,233 |

|

Subordinated notes, net |

|

|

73,997 |

|

|

|

73,953 |

|

|

|

73,822 |

|

Junior subordinated debentures issued to

capital trusts, net |

|

|

70,783 |

|

|

|

70,675 |

|

|

|

70,336 |

|

Accrued interest payable and other liabilities |

|

|

166,551 |

|

|

|

190,254 |

|

|

|

212,342 |

|

Total liabilities |

|

|

8,328,004 |

|

|

|

8,600,801 |

|

|

|

8,023,423 |

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Common stock |

|

|

454 |

|

|

|

452 |

|

|

|

450 |

|

Additional paid-in capital |

|

|

714,864 |

|

|

|

710,792 |

|

|

|

708,615 |

|

Retained earnings |

|

|

507,576 |

|

|

|

481,232 |

|

|

|

403,368 |

|

Treasury stock |

|

|

(47,904 |

) |

|

|

(47,993 |

) |

|

|

(50,329 |

) |

Accumulated other comprehensive loss, net of tax |

|

|

(78,678 |

) |

|

|

(111,469 |

) |

|

|

(142,159 |

) |

Total stockholders’ equity |

|

|

1,096,312 |

|

|

|

1,033,014 |

|

|

|

919,945 |

|

Total liabilities and stockholders’ equity |

|

$ |

9,424,316 |

|

|

$ |

9,633,815 |

|

|

$ |

8,943,368 |

|

Byline Bancorp, Inc.

Page 6 of 13

BYLINE BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

(dollars in thousands, except per share data) |

|

2024 |

|

|

2024 |

|

|

2023 |

|

INTEREST AND DIVIDEND INCOME |

|

|

|

|

|

|

|

|

|

Interest and fees on loans and leases |

|

$ |

128,336 |

|

|

$ |

126,523 |

|

|

$ |

125,465 |

|

Interest on securities |

|

|

11,260 |

|

|

|

10,514 |

|

|

|

8,415 |

|

Other interest and dividend income |

|

|

6,840 |

|

|

|

4,532 |

|

|

|

2,710 |

|

Total interest and dividend income |

|

|

146,436 |

|

|

|

141,569 |

|

|

|

136,590 |

|

INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

Deposits |

|

|

52,076 |

|

|

|

47,603 |

|

|

|

37,163 |

|

Other borrowings |

|

|

3,919 |

|

|

|

4,460 |

|

|

|

3,981 |

|

Subordinated notes and debentures |

|

|

2,986 |

|

|

|

2,980 |

|

|

|

2,994 |

|

Total interest expense |

|

|

58,981 |

|

|

|

55,043 |

|

|

|

44,138 |

|

Net interest income |

|

|

87,455 |

|

|

|

86,526 |

|

|

|

92,452 |

|

PROVISION FOR CREDIT LOSSES |

|

|

7,475 |

|

|

|

6,045 |

|

|

|

8,803 |

|

Net interest income after provision for

credit losses |

|

|

79,980 |

|

|

|

80,481 |

|

|

|

83,649 |

|

NON-INTEREST INCOME |

|

|

|

|

|

|

|

|

|

Fees and service charges on deposits |

|

|

2,591 |

|

|

|

2,548 |

|

|

|

2,372 |

|

Loan servicing revenue |

|

|

3,174 |

|

|

|

3,216 |

|

|

|

3,369 |

|

Loan servicing asset revaluation |

|

|

(2,183 |

) |

|

|

(2,468 |

) |

|

|

(3,646 |

) |

ATM and interchange fees |

|

|

1,143 |

|

|

|

1,163 |

|

|

|

1,205 |

|

Change in fair value of equity securities, net |

|

|

388 |

|

|

|

(390 |

) |

|

|

(313 |

) |

Net gains on sales of loans |

|

|

5,864 |

|

|

|

6,036 |

|

|

|

6,473 |

|

Wealth management and trust income |

|

|

1,101 |

|

|

|

942 |

|

|

|

939 |

|

Other non-interest income |

|

|

2,307 |

|

|

|

1,797 |

|

|

|

1,977 |

|

Total non-interest income |

|

|

14,385 |

|

|

|

12,844 |

|

|

|

12,376 |

|

NON-INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

34,974 |

|

|

|

33,911 |

|

|

|

34,969 |

|

Occupancy and equipment expense, net |

|

|

4,373 |

|

|

|

4,639 |

|

|

|

5,314 |

|

Loan and lease related expenses |

|

|

703 |

|

|

|

741 |

|

|

|

836 |

|

Legal, audit, and other professional fees |

|

|

3,643 |

|

|

|

3,708 |

|

|

|

3,805 |

|

Data processing |

|

|

4,215 |

|

|

|

4,036 |

|

|

|

6,472 |

|

Net (gain) loss recognized on other real estate

owned and other related expenses |

|

|

74 |

|

|

|

(62 |

) |

|

|

111 |

|

Other intangible assets amortization expense |

|

|

1,345 |

|

|

|

1,345 |

|

|

|

1,551 |

|

Other non-interest expense |

|

|

5,000 |

|

|

|

4,892 |

|

|

|

4,833 |

|

Total non-interest expense |

|

|

54,327 |

|

|

|

53,210 |

|

|

|

57,891 |

|

INCOME BEFORE PROVISION FOR INCOME TAXES |

|

|

40,038 |

|

|

|

40,115 |

|

|

|

38,134 |

|

PROVISION FOR INCOME TAXES |

|

|

9,710 |

|

|

|

10,444 |

|

|

|

9,912 |

|

NET INCOME |

|

$ |

30,328 |

|

|

$ |

29,671 |

|

|

$ |

28,222 |

|

EARNINGS PER COMMON SHARE |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.70 |

|

|

$ |

0.68 |

|

|

$ |

0.66 |

|

Diluted |

|

$ |

0.69 |

|

|

$ |

0.68 |

|

|

$ |

0.65 |

|

Byline Bancorp, Inc.

Page 7 of 13

BYLINE BANCORP, INC. AND SUBSIDIARIES

SELECTED FINANCIAL DATA (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

As of or For the Three Months Ended |

|

(dollars in thousands, except share |

September 30, |

|

|

June 30, |

|

|

September 30, |

|

and per share data) |

2024 |

|

|

2024 |

|

|

2023 |

|

Earnings per Common Share |

|

|

|

|

|

|

|

|

Basic earnings per common share |

$ |

0.70 |

|

|

$ |

0.68 |

|

|

$ |

0.66 |

|

Diluted earnings per common share |

$ |

0.69 |

|

|

$ |

0.68 |

|

|

$ |

0.65 |

|

Adjusted diluted earnings per common share(1)(3) |

$ |

0.70 |

|

|

$ |

0.68 |

|

|

$ |

0.77 |

|

Weighted average common shares outstanding (basic) |

|

43,516,006 |

|

|

|

43,361,516 |

|

|

|

43,025,927 |

|

Weighted average common shares outstanding (diluted) |

|

43,966,189 |

|

|

|

43,741,840 |

|

|

|

43,458,110 |

|

Common shares outstanding |

|

44,384,706 |

|

|

|

44,180,829 |

|

|

|

43,719,203 |

|

Cash dividends per common share |

$ |

0.09 |

|

|

$ |

0.09 |

|

|

$ |

0.09 |

|

Dividend payout ratio on common stock |

|

13.04 |

% |

|

|

13.24 |

% |

|

|

13.85 |

% |

Book value per common share |

$ |

24.70 |

|

|

$ |

23.38 |

|

|

$ |

21.04 |

|

Tangible book value per common share(1) |

$ |

20.21 |

|

|

$ |

18.84 |

|

|

$ |

16.35 |

|

Key Ratios and Performance Metrics

(annualized where applicable) |

|

|

|

|

|

|

|

|

Net interest margin |

|

3.88 |

% |

|

|

3.98 |

% |

|

|

4.46 |

% |

Net interest margin, fully taxable equivalent (1)(4) |

|

3.89 |

% |

|

|

3.99 |

% |

|

|

4.47 |

% |

Average cost of deposits |

|

2.76 |

% |

|

|

2.63 |

% |

|

|

2.13 |

% |

Efficiency ratio(1)(2) |

|

52.02 |

% |

|

|

52.19 |

% |

|

|

53.75 |

% |

Adjusted efficiency ratio(1)(2)(3) |

|

51.62 |

% |

|

|

52.19 |

% |

|

|

47.35 |

% |

Non-interest income to total revenues(1) |

|

14.13 |

% |

|

|

12.93 |

% |

|

|

11.81 |

% |

Non-interest expense to average assets |

|

2.31 |

% |

|

|

2.34 |

% |

|

|

2.66 |

% |

Adjusted non-interest expense to average assets(1)(3) |

|

2.29 |

% |

|

|

2.34 |

% |

|

|

2.35 |

% |

Return on average stockholders' equity |

|

11.39 |

% |

|

|

11.83 |

% |

|

|

12.11 |

% |

Adjusted return on average stockholders' equity(1)(3) |

|

11.53 |

% |

|

|

11.83 |

% |

|

|

14.30 |

% |

Return on average assets |

|

1.29 |

% |

|

|

1.31 |

% |

|

|

1.30 |

% |

Adjusted return on average assets(1)(3) |

|

1.30 |

% |

|

|

1.31 |

% |

|

|

1.53 |

% |

Pre-tax pre-provision return on average assets(1) |

|

2.02 |

% |

|

|

2.03 |

% |

|

|

2.16 |

% |

Adjusted pre-tax pre-provision return on average assets(1)(3) |

|

2.03 |

% |

|

|

2.03 |

% |

|

|

2.46 |

% |

Return on average tangible common stockholders' equity(1) |

|

14.49 |

% |

|

|

15.27 |

% |

|

|

16.15 |

% |

Adjusted return on average tangible common

stockholders' equity(1)(3) |

|

14.67 |

% |

|

|

15.27 |

% |

|

|

18.95 |

% |

Non-interest-bearing deposits to total deposits |

|

23.07 |

% |

|

|

23.99 |

% |

|

|

28.18 |

% |

Loans and leases held for sale and loans and lease

held for investment to total deposits |

|

92.02 |

% |

|

|

93.98 |

% |

|

|

95.21 |

% |

Deposits to total liabilities |

|

90.03 |

% |

|

|

85.42 |

% |

|

|

86.67 |

% |

Deposits per branch |

$ |

162,998 |

|

|

$ |

159,721 |

|

|

$ |

144,869 |

|

Asset Quality Ratios |

|

|

|

|

|

|

|

|

Non-performing loans and leases to total loans and leases

held for investment, net before ACL |

|

1.02 |

% |

|

|

0.93 |

% |

|

|

0.79 |

% |

Total non-performing assets as a percentage

of total assets |

|

0.75 |

% |

|

|

0.67 |

% |

|

|

0.60 |

% |

ACL to total loans and leases held for investment, net before ACL |

|

1.44 |

% |

|

|

1.45 |

% |

|

|

1.60 |

% |

Net charge-offs (annualized) to average total loans and leases held for

investment, net before ACL - loans and leases |

|

0.49 |

% |

|

|

0.56 |

% |

|

|

0.33 |

% |

Capital Ratios |

|

|

|

|

|

|

|

|

Common equity to total assets |

|

11.63 |

% |

|

|

10.72 |

% |

|

|

10.29 |

% |

Tangible common equity to tangible assets(1) |

|

9.72 |

% |

|

|

8.82 |

% |

|

|

8.18 |

% |

Leverage ratio |

|

11.18 |

% |

|

|

11.08 |

% |

|

|

10.75 |

% |

Common equity tier 1 capital ratio |

|

11.35 |

% |

|

|

10.84 |

% |

|

|

10.08 |

% |

Tier 1 capital ratio |

|

12.39 |

% |

|

|

11.86 |

% |

|

|

11.12 |

% |

Total capital ratio |

|

14.41 |

% |

|

|

13.86 |

% |

|

|

13.17 |

% |

(1) Represents a non-GAAP financial measure. See “Reconciliation of non-GAAP Financial Measures” for a reconciliation of our non-GAAP measures to the most directly comparable GAAP financial measure.

(2) Represents non-interest expense less amortization of intangible assets divided by net interest income and non-interest income.

(3) Calculation excludes merger-related expenses and impairment charges on ROU assets.

(4) Interest income and rates include the effects of a tax equivalent adjustment to adjust tax exempt investment income on tax exempt investment securities to a fully taxable basis, assuming a federal income tax rate of 21%.

Byline Bancorp, Inc.

Page 8 of 13

BYLINE BANCORP, INC. AND SUBSIDIARIES

QUARTER-TO-DATE STATEMENT OF AVERAGE INTEREST-EARNING ASSETS AND AVERAGE INTEREST-BEARING LIABILITIES (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

September 30, 2023 |

|

(dollars in thousands) |

Average

Balance(5) |

|

|

Interest

Inc / Exp |

|

|

Avg.

Yield /

Rate |

|

|

Average

Balance(5) |

|

|

Interest

Inc / Exp |

|

|

Avg.

Yield /

Rate |

|

|

Average

Balance(5) |

|

|

Interest

Inc / Exp |

|

|

Avg.

Yield /

Rate |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

468,852 |

|

|

$ |

5,771 |

|

|

|

4.90 |

% |

|

$ |

305,873 |

|

|

$ |

3,315 |

|

|

|

4.36 |

% |

|

$ |

195,019 |

|

|

$ |

1,724 |

|

|

|

3.51 |

% |

Loans and leases(1) |

|

6,827,726 |

|

|

|

128,336 |

|

|

|

7.48 |

% |

|

|

6,807,934 |

|

|

|

126,523 |

|

|

|

7.47 |

% |

|

|

6,484,875 |

|

|

|

125,465 |

|

|

|

7.68 |

% |

Taxable securities |

|

1,508,987 |

|

|

|

11,467 |

|

|

|

3.02 |

% |

|

|

1,473,000 |

|

|

|

10,869 |

|

|

|

2.97 |

% |

|

|

1,371,979 |

|

|

|

8,465 |

|

|

|

2.45 |

% |

Tax-exempt securities(2) |

|

156,085 |

|

|

|

1,091 |

|

|

|

2.78 |

% |

|

|

156,655 |

|

|

|

1,091 |

|

|

|

2.80 |

% |

|

|

168,805 |

|

|

|

1,184 |

|

|

|

2.78 |

% |

Total interest-earning assets |

$ |

8,961,650 |

|

|

$ |

146,665 |

|

|

|

6.51 |

% |

|

$ |

8,743,462 |

|

|

$ |

141,798 |

|

|

|

6.52 |

% |

|

$ |

8,220,678 |

|

|

$ |

136,838 |

|

|

|

6.60 |

% |

Allowance for credit losses -

loans and leases |

|

(101,001 |

) |

|

|

|

|

|

|

|

|

(103,266 |

) |

|

|

|

|

|

|

|

|

(108,315 |

) |

|

|

|

|

|

|

All other assets |

|

513,200 |

|

|

|

|

|

|

|

|

|

500,540 |

|

|

|

|

|

|

|

|

|

521,982 |

|

|

|

|

|

|

|

TOTAL ASSETS |

$ |

9,373,849 |

|

|

|

|

|

|

|

|

$ |

9,140,736 |

|

|

|

|

|

|

|

|

$ |

8,634,345 |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest checking |

$ |

754,586 |

|

|

$ |

4,439 |

|

|

|

2.34 |

% |

|

$ |

717,513 |

|

|

$ |

4,096 |

|

|

|

2.30 |

% |

|

$ |

579,917 |

|

|

$ |

2,208 |

|

|

|

1.51 |

% |

Money market accounts |

|

2,386,909 |

|

|

|

21,371 |

|

|

|

3.56 |

% |

|

|

2,270,231 |

|

|

|

19,978 |

|

|

|

3.54 |

% |

|

|

2,040,476 |

|

|

|

16,676 |

|

|

|

3.24 |

% |

Savings |

|

495,541 |

|

|

|

190 |

|

|

|

0.15 |

% |

|

|

514,192 |

|

|

|

194 |

|

|

|

0.15 |

% |

|

|

594,555 |

|

|

|

228 |

|

|

|

0.15 |

% |

Time deposits |

|

2,134,587 |

|

|

|

26,076 |

|

|

|

4.86 |

% |

|

|

1,951,448 |

|

|

|

23,335 |

|

|

|

4.81 |

% |

|

|

1,706,531 |

|

|

|

18,051 |

|

|

|

4.20 |

% |

Total interest-bearing

deposits |

|

5,771,623 |

|

|

|

52,076 |

|

|

|

3.59 |

% |

|

|

5,453,384 |

|

|

|

47,603 |

|

|

|

3.51 |

% |

|

|

4,921,479 |

|

|

|

37,163 |

|

|

|

3.00 |

% |

Other borrowings |

|

474,498 |

|

|

|

3,919 |

|

|

|

3.29 |

% |

|

|

521,545 |

|

|

|

4,439 |

|

|

|

3.42 |

% |

|

|

463,561 |

|

|

|

3,981 |

|

|

|

3.41 |

% |

Federal funds purchased |

|

— |

|

|

|

— |

|

|

|

0.00 |

% |

|

|

1,401 |

|

|

|

21 |

|

|

|

6.05 |

% |

|

|

— |

|

|

|

— |

|

|

|

0.00 |

% |

Subordinated notes and

debentures |

|

144,702 |

|

|

|

2,986 |

|

|

|

8.21 |

% |

|

|

144,548 |

|

|

|

2,980 |

|

|

|

8.29 |

% |

|

|

144,171 |

|

|

|

2,994 |

|

|

|

8.24 |

% |

Total borrowings |

|

619,200 |

|

|

|

6,905 |

|

|

|

4.44 |

% |

|

|

667,494 |

|

|

|

7,440 |

|

|

|

4.48 |

% |

|

|

607,732 |

|

|

|

6,975 |

|

|

|

4.55 |

% |

Total interest-bearing liabilities |

$ |

6,390,823 |

|

|

$ |

58,981 |

|

|

|

3.67 |

% |

|

$ |

6,120,878 |

|

|

$ |

55,043 |

|

|

|

3.62 |

% |

|

$ |

5,529,211 |

|

|

$ |

44,138 |

|

|

|

3.17 |

% |

Non-interest-bearing

demand deposits |

|

1,741,250 |

|

|

|

|

|

|

|

|

|

1,817,133 |

|

|

|

|

|

|

|

|

|

1,987,996 |

|

|

|

|

|

|

|

Other liabilities |

|

182,148 |

|

|

|

|

|

|

|

|

|

193,923 |

|

|

|

|

|

|

|

|

|

192,860 |

|

|

|

|

|

|

|

Total stockholders’ equity |

|

1,059,628 |

|

|

|

|

|

|

|

|

|

1,008,802 |

|

|

|

|

|

|

|

|

|

924,278 |

|

|

|

|

|

|

|

TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

$ |

9,373,849 |

|

|

|

|

|

|

|

|

$ |

9,140,736 |

|

|

|

|

|

|

|

|

$ |

8,634,345 |

|

|

|

|

|

|

|

Net interest spread(3) |

|

|

|

|

|

|

|

2.84 |

% |

|

|

|

|

|

|

|

|

2.90 |

% |

|

|

|

|

|

|

|

|

3.43 |

% |

Net interest income, fully

taxable equivalent |

|

|

|

$ |

87,684 |

|

|

|

|

|

|

|

|

$ |

86,755 |

|

|

|

|

|

|

|

|

$ |

92,700 |

|

|

|

|

Net interest margin, fully

taxable equivalent(2)(4) |

|

|

|

|

|

|

|

3.89 |

% |

|

|

|

|

|

|

|

|

3.99 |

% |

|

|

|

|

|

|

|

|

4.47 |

% |

Less: Tax-equivalent adjustment |

|

|

|

|

229 |

|

|

|

0.01 |

% |

|

|

|

|

|

229 |

|

|

|

0.01 |

% |

|

|

|

|

|

248 |

|

|

|

0.01 |

% |

Net interest income |

|

|

|

$ |

87,455 |

|

|

|

|

|

|

|

|

$ |

86,526 |

|

|

|

|

|

|

|

|

$ |

92,452 |

|

|

|

|

Net interest margin(4) |

|

|

|

|

|

|

|

3.88 |

% |

|

|

|

|

|

|

|

|

3.98 |

% |

|

|

|

|

|

|

|

|

4.46 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loan accretion impact

on margin |

|

|

|

$ |

2,982 |

|

|

|

0.13 |

% |

|

|

|

|

$ |

3,656 |

|

|

|

0.17 |

% |

|

|

|

|

$ |

10,276 |

|

|

|

0.50 |

% |

(1) Loan and lease balances are net of deferred origination fees and costs and initial direct costs. Non-accrual loans and leases are included in total loan and lease balances.

(2) Interest income and rates include the effects of a tax equivalent adjustment to adjust tax exempt investment income on tax exempt investment securities to a fully taxable basis, assuming a federal income tax rate of 21%.

(3) Represents the average rate earned on interest-earning assets minus the average rate paid on interest-bearing liabilities.

(4) Represents net interest income (annualized) divided by total average earning assets.

(5) Average balances are average daily balances.

Byline Bancorp, Inc.

Page 9 of 13

BYLINE BANCORP, INC. AND SUBSIDIARIES

SELECTED BALANCE SHEET TABLES AND FINANCIAL RATIOS (unaudited)

The following table presents our allocation of originated, purchased credit deteriorated (PCD), and acquired non-credit-deteriorated loans and leases at the dates indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

September 30, 2023 |

|

(dollars in thousands) |

|

Amount |

|

|

% of Total |

|

|

Amount |

|

|

% of Total |

|

|

Amount |

|

|

% of Total |

|

Originated loans and leases: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial real estate |

|

$ |

2,040,072 |

|

|

|

29.7 |

% |

|

$ |

1,924,797 |

|

|

|

27.9 |

% |

|

$ |

1,837,531 |

|

|

|

27.8 |

% |

Residential real estate |

|

|

497,034 |

|

|

|

7.2 |

% |

|

|

498,578 |

|

|

|

7.2 |

% |

|

|

454,456 |

|

|

|

6.9 |

% |

Construction, land development, and

other land |

|

|

415,636 |

|

|

|

6.0 |

% |

|

|

445,919 |

|

|

|

6.5 |

% |

|

|

406,334 |

|

|

|

6.1 |

% |

Commercial and industrial |

|

|

2,476,177 |

|

|

|

36.0 |

% |

|

|

2,493,229 |

|

|

|

36.2 |

% |

|

|

2,286,058 |

|

|

|

34.6 |

% |

Installment and other |

|

|

3,839 |

|

|

|

0.1 |

% |

|

|

2,576 |

|

|

|

0.0 |

% |

|

|

2,968 |

|

|

|

0.0 |

% |

Leasing financing receivables |

|

|

711,233 |

|

|

|

10.3 |

% |

|

|

710,784 |

|

|

|

10.3 |

% |

|

|

641,032 |

|

|

|

9.7 |

% |

Total originated loans and leases |

|

$ |

6,143,991 |

|

|

|

89.3 |

% |

|

$ |

6,075,883 |

|

|

|

88.1 |

% |

|

$ |

5,628,379 |

|

|

|

85.1 |

% |

Purchased credit deteriorated loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial real estate |

|

$ |

95,240 |

|

|

|

1.4 |

% |

|

$ |

114,053 |

|

|

|

1.7 |

% |

|

$ |

154,573 |

|

|

|

2.3 |

% |

Residential real estate |

|

|

31,362 |

|

|

|

0.5 |

% |

|

|

40,728 |

|

|

|

0.6 |

% |

|

|

47,485 |

|

|

|

0.7 |

% |

Construction, land development, and

other land |

|

|

4 |

|

|

|

0.0 |

% |

|

|

9 |

|

|

|

0.0 |

% |

|

|

29,587 |

|

|

|

0.5 |

% |

Commercial and industrial |

|

|

14,526 |

|

|

|

0.2 |

% |

|

|

17,796 |

|

|

|

0.3 |

% |

|

|

21,014 |

|

|

|

0.3 |

% |

Installment and other |

|

|

110 |

|

|

|

0.0 |

% |

|

|

116 |

|

|

|

0.0 |

% |

|

|

125 |

|

|

|

0.0 |

% |

Total purchased credit deteriorated loans |

|

$ |

141,242 |

|

|

|

2.1 |

% |

|

$ |

172,702 |

|

|

|

2.6 |

% |

|

$ |

252,784 |

|

|

|

3.8 |

% |

Acquired non-credit-deteriorated loans

and leases: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial real estate |

|

$ |

227,035 |

|

|

|

3.3 |

% |

|

$ |

254,858 |

|

|

|

3.7 |

% |

|

$ |

296,656 |

|

|

|

4.5 |

% |

Residential real estate |

|

|

181,976 |

|

|

|

2.6 |

% |

|

|

188,489 |

|

|

|

2.7 |

% |

|

|

220,091 |

|

|

|

3.4 |

% |

Construction, land development, and

other land |

|

|

84,172 |

|

|

|

1.2 |

% |

|

|

84,849 |

|

|

|

1.2 |

% |

|

|

87,087 |

|

|

|

1.3 |

% |

Commercial and industrial |

|

|

100,852 |

|

|

|

1.5 |

% |

|

|

113,997 |

|

|

|

1.7 |

% |

|

|

127,253 |

|

|

|

1.9 |

% |

Installment and other |

|

|

32 |

|

|

|

0.0 |

% |

|

|

153 |

|

|

|

0.0 |

% |

|

|

153 |

|

|

|

0.0 |

% |

Leasing financing receivables |

|

|

146 |

|

|

|

0.0 |

% |

|

|

273 |

|

|

|

0.0 |

% |

|

|

900 |

|

|

|

0.0 |

% |

Total acquired non-credit-deteriorated

loans and leases |

|

$ |

594,213 |

|

|

|

8.6 |

% |

|

$ |

642,619 |

|

|

|

9.3 |

% |

|

$ |

732,140 |

|

|

|

11.1 |

% |

Total loans and leases |

|

$ |

6,879,446 |

|

|

|

100.0 |

% |

|

$ |

6,891,204 |

|

|

|

100.0 |

% |

|

$ |

6,613,303 |

|

|

|

100.0 |

% |

Allowance for credit losses - loans and leases |

|

|

(98,860 |

) |

|

|

|

|

|

(99,730 |

) |

|

|

|

|

|

(105,696 |

) |

|

|

|

Total loans and leases, net of allowance for

credit losses - loans and leases |

|

$ |

6,780,586 |

|

|

|

|

|

$ |

6,791,474 |

|

|

|

|

|

$ |

6,507,607 |

|

|

|

|

The following table presents the balance and activity within the allowance for credit losses - loans and lease for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

(dollars in thousands) |

|

2024 |

|

|

2024 |

|

|

2023 |

|

ACL - loans and leases, beginning of period |

|

$ |

99,730 |

|

|

$ |

102,366 |

|

|

$ |

92,665 |

|

Adjustment for acquired PCD loans |

|

|

— |

|

|

|

— |

|

|

|

10,596 |

|

Provision for credit losses - loans and leases |

|

|

7,597 |

|

|

|

6,878 |

|

|

|

7,865 |

|

Net charge-offs - loans and leases |

|

|

(8,467 |

) |

|

|

(9,514 |

) |

|

|

(5,430 |

) |

ACL - loans and leases, end of period |

|

$ |

98,860 |

|

|

$ |

99,730 |

|

|

$ |

105,696 |

|

Net charge-offs (annualized) to average total loans and leases held for

investment, net before ACL - loans and leases |

|

|

0.49 |

% |

|

|

0.56 |

% |

|

|

0.33 |

% |

Provision for credit losses - loans and leases

to net charge-offs - loans and leases during the period |

|

|

0.90 |

x |

|

|

0.72 |

x |

|

|

1.45 |

x |

Byline Bancorp, Inc.

Page 10 of 13

BYLINE BANCORP, INC. AND SUBSIDIARIES

SELECTED BALANCE SHEET TABLES AND FINANCIAL RATIOS (unaudited)

The following table presents the amounts of non-performing loans and leases and other real estate owned at the date indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

Change from |

|

(dollars in thousands) |

|

September 30,

2024 |

|

|

June 30,

2024 |

|

|

September 30,

2023 |

|

|

June 30,

2024 |

|

|

September 30,

2023 |

|

Non-performing assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-accrual loans and leases |

|

$ |

70,507 |

|

|

$ |

63,808 |

|

|

$ |

52,070 |

|

|

|

10.5 |

% |

|

|

35.4 |

% |

Past due loans and leases 90 days or more

and still accruing interest |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

—% |

|

|

—% |

|

Total non-performing loans and leases |

|

$ |

70,507 |

|

|

$ |

63,808 |

|

|

$ |

52,070 |

|

|

|

10.5 |

% |

|

|

35.4 |

% |

Other real estate owned |

|

|

532 |

|

|

|

780 |

|

|

|

1,671 |

|

|

|

(31.8 |

)% |

|

|

(68.1 |

)% |

Total non-performing assets |

|

$ |

71,039 |

|

|

$ |

64,588 |

|

|

$ |

53,741 |

|

|

|

10.0 |

% |

|

|

32.2 |

% |

Total non-performing loans and leases as a

percentage of total loans and leases |

|

|

1.02 |

% |

|

|

0.93 |

% |

|

|

0.79 |

% |

|

|

|

|

|

|

Total non-performing assets as a percentage

of total assets |

|

|

0.75 |

% |

|

|

0.67 |

% |

|

|

0.60 |

% |

|

|

|

|

|

|

Allowance for credit losses - loans and leases

as a percentage of non-performing

loans and leases |

|

|

140.21 |

% |

|

|

156.30 |

% |

|

|

202.99 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-performing assets guaranteed by

U.S. government: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-accrual loans guaranteed |

|

$ |

11,332 |

|

|

$ |

6,616 |

|

|

$ |

3,588 |

|

|

|

71.3 |

% |

|

|

215.9 |

% |

Past due loans 90 days or more and still

accruing interest guaranteed |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

—% |

|

|

—% |

|

Total non-performing loans guaranteed |

|

$ |

11,332 |

|

|

$ |

6,616 |

|

|

$ |

3,588 |

|

|

|

71.3 |

% |

|

|

215.9 |

% |

Total non-performing loans and leases

not guaranteed as a percentage of total

loans and leases |

|

|

0.86 |

% |

|

|

0.83 |

% |

|

|

0.73 |

% |

|

|

|

|

|

|

Total non-performing assets not guaranteed

as a percentage of total assets |

|

|

0.63 |

% |

|

|

0.60 |

% |

|

|

0.56 |

% |

|

|

|

|

|

|

The following table presents the composition of deposits at the dates indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

Change from |

|

(dollars in thousands) |

|

September 30,

2024 |

|

|

June 30,

2024 |

|

|

September 30,

2023 |

|

|

June 30,

2024 |

|

|

September 30,

2023 |

|

Non-interest-bearing demand deposits |

|

$ |

1,729,908 |

|

|

$ |

1,762,891 |

|

|

$ |

1,959,855 |

|

|

|

(1.9 |

)% |

|

|

(11.7 |

)% |

Interest-bearing checking accounts |

|

|

749,721 |

|

|

|

717,229 |

|

|

|

592,771 |

|

|

|

4.5 |

% |

|

|

26.5 |

% |

Money market demand accounts |

|

|

2,426,522 |

|

|

|

2,323,245 |

|

|

|

2,062,252 |

|

|

|

4.4 |

% |

|

|

17.7 |

% |

Other savings |

|

|

489,618 |

|

|

|

503,935 |

|

|

|

581,073 |

|

|

|

(2.8 |

)% |

|

|

(15.7 |

)% |

Time deposits (below $250,000) |

|

|

1,639,658 |

|

|

|

1,610,308 |

|

|

|

1,447,053 |

|

|

|

1.8 |

% |

|

|

13.3 |

% |

Time deposits ($250,000 and above) |

|

|

462,460 |

|

|

|

429,573 |

|

|

|

310,686 |

|

|

|

7.7 |

% |

|

|

48.9 |

% |

Total deposits |

|

$ |

7,497,887 |

|

|

$ |

7,347,181 |

|

|

$ |

6,953,690 |

|

|

|

2.1 |

% |

|

|

7.8 |

% |

Byline Bancorp, Inc.

Page 11 of 13

BYLINE BANCORP, INC. AND SUBSIDIARIES

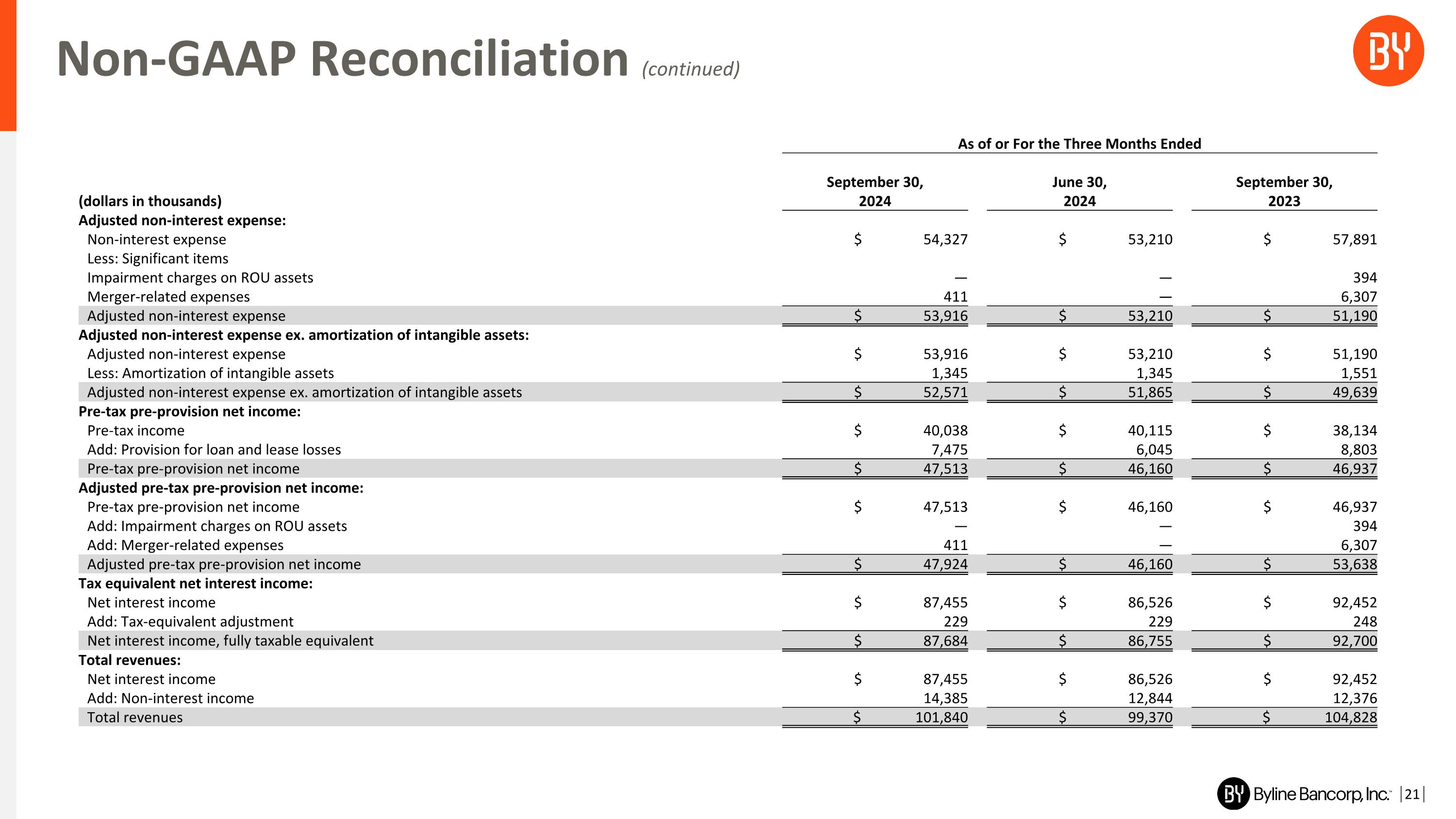

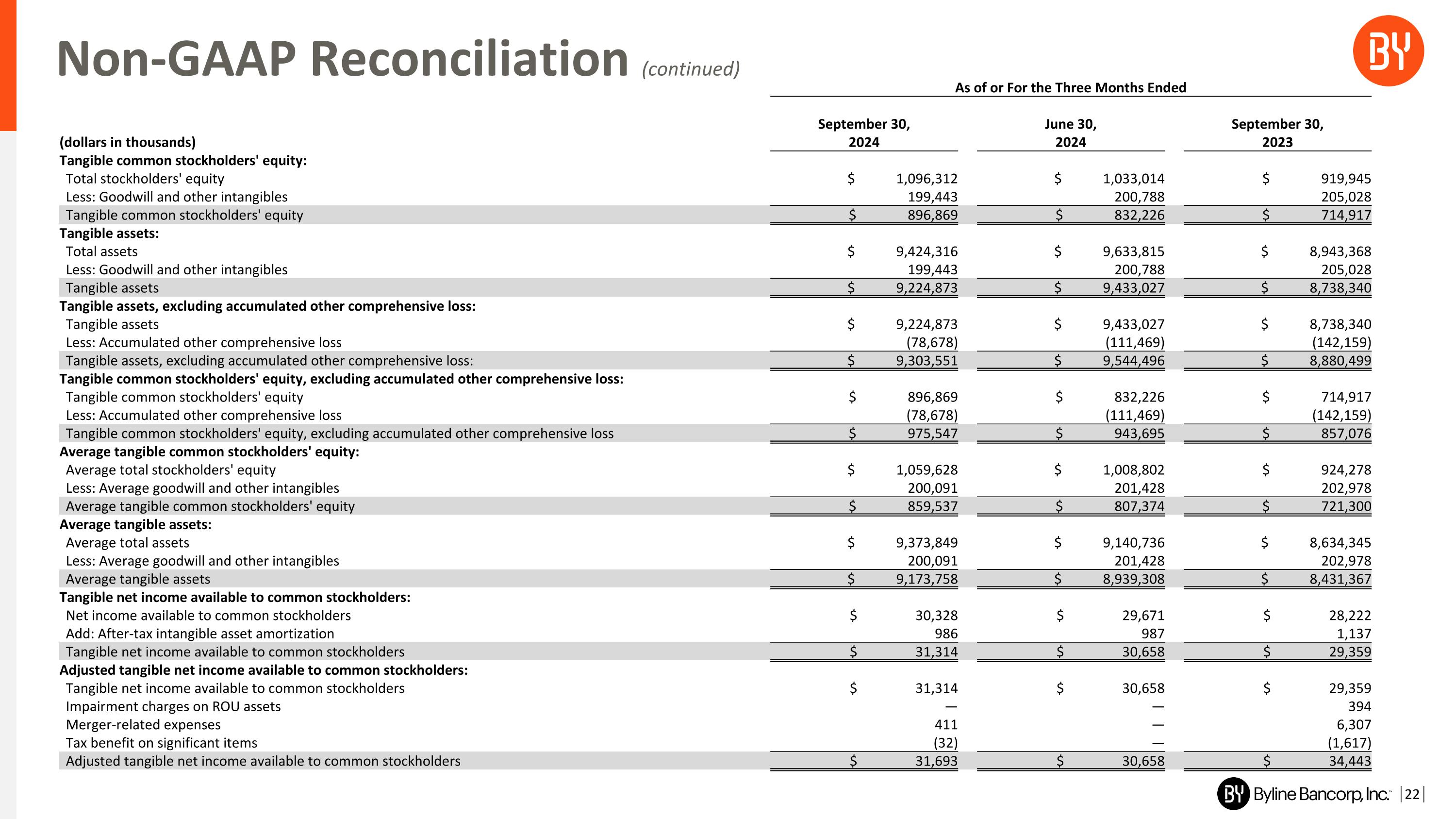

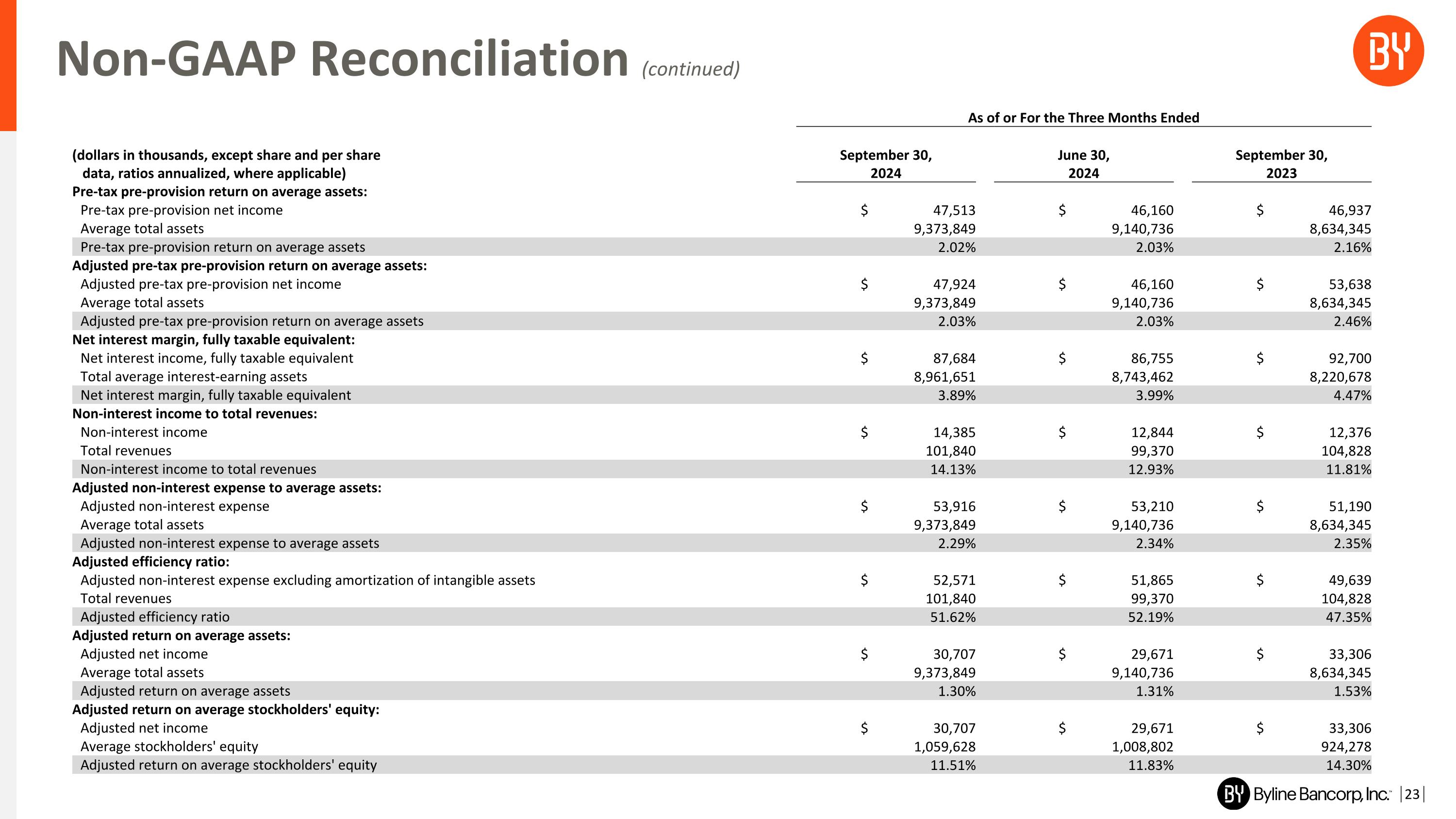

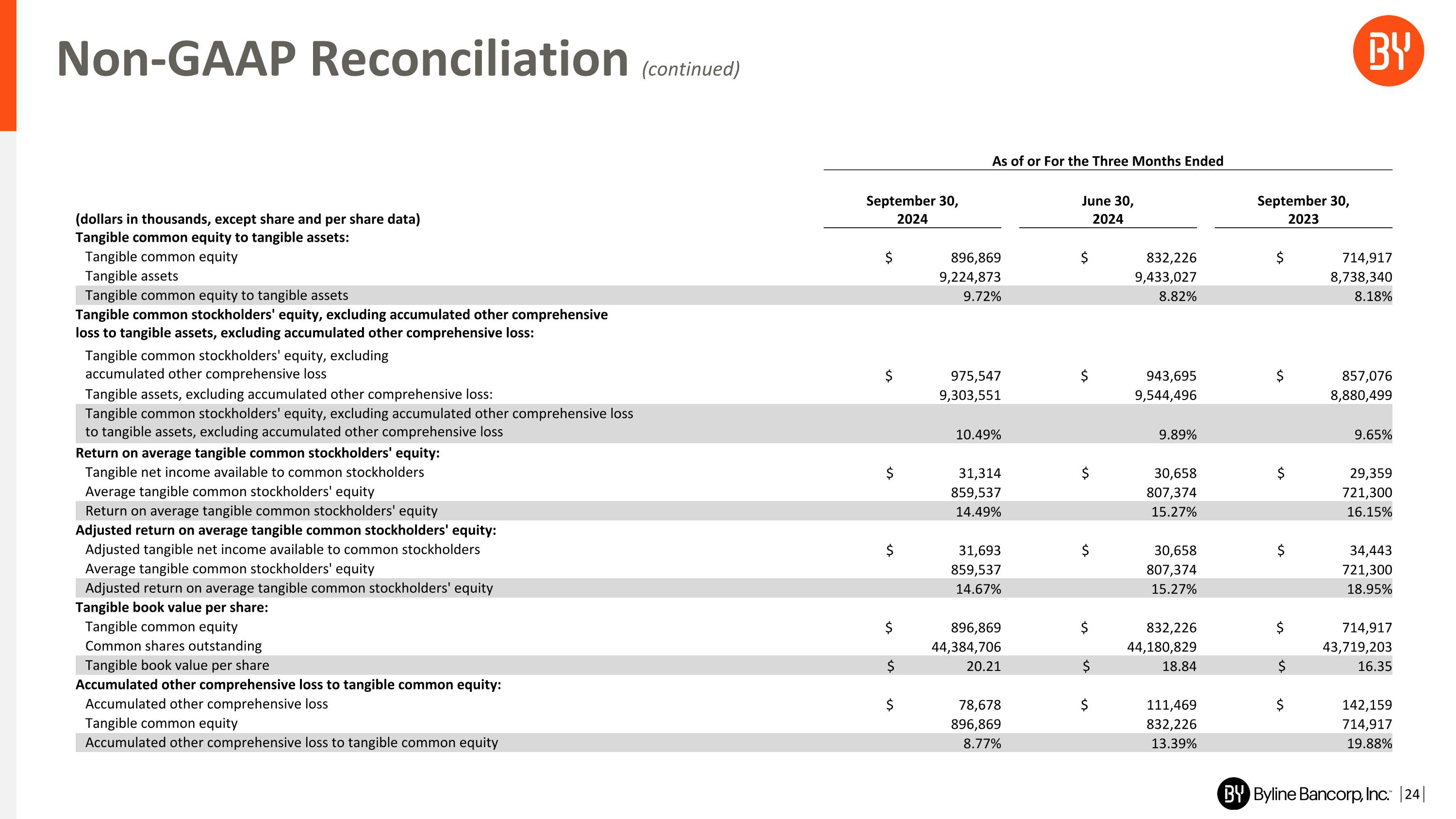

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (unaudited)

Non-GAAP Financial Measures