With the addition of the Las Chispas mine – one

of the world’s lowest-cost and highest-grade silver/gold operations

– the combined company is expected to produce 21 million ounces of

silver annually1 with peer leading EBITDA and free cash flow

Coeur Mining, Inc. (“Coeur”) (NYSE: CDE) and SilverCrest Metals

Inc. (“SilverCrest”) (TSX: SIL; NYSE American: SILV) announce that

they have entered into a definitive agreement (the “Agreement”)

whereby, a wholly-owned subsidiary of Coeur will acquire all of the

issued and outstanding shares of SilverCrest pursuant to a

court-approved plan of arrangement (the “Transaction”).

Under the terms of the Agreement, SilverCrest shareholders will

receive 1.6022 Coeur common shares for each SilverCrest common

share (the “Exchange Ratio”). The Exchange Ratio implies

consideration of $11.34 per SilverCrest common share, based on the

closing price of Coeur common shares on the New York Stock Exchange

(“NYSE”) on October 3, 2024. This represents an 18% premium based

on 20-day volume-weighted average prices of Coeur and SilverCrest

each as at October 3, 2024 on the NYSE and NYSE American,

respectively, and a 22% premium to the October 3, 2024 closing

price of SilverCrest on the NYSE American. This implies a total

equity value of approximately $1.7 billion based on SilverCrest’s

common shares outstanding. Upon completion of the Transaction,

existing Coeur stockholders and SilverCrest shareholders will own

approximately 63% and 37% of the outstanding common stock of the

combined company, respectively.

Transaction Highlights

- Creates a Leading Global Silver Company – Together with

Coeur’s growing silver production from its recently expanded

Rochester mine in Nevada and its Palmarejo underground mine in

northern Mexico, the addition of Las Chispas is expected to

generate peer-leading 2025 silver production of approximately 21

million ounces from five North American operations, with

approximately 56% of revenue generated from U.S.-based mines and

approximately 40% of revenue from silver. In addition to the

peer-leading silver production, the combined company is expected to

produce approximately 432,000 ounces of gold next year1.

- Adds World-Class Las Chispas Operation to Coeur’s

Portfolio – SilverCrest’s Las Chispas underground mine in

Sonora, Mexico is one of the world’s highest-grade, lowest cost,

and highest-margin silver and gold operations. Las Chispas

commenced production in late 2022 and has delivered strong

operational and financial results in 2023, selling approximately

10.25 million silver equivalent ounces at average cash costs of

$7.73 per ounce.

- Significant and Immediate Addition to Coeur’s Rising Free

Cash Flow – The combined company is expected to generate

approximately $700 million of EBITDA1 and $350 million of free cash

flow1 in 2025 at lower overall costs and higher overall

margins.

- Dramatically Accelerates Coeur’s Deleveraging

Initiatives – The combination of SilverCrest’s strong balance

sheet consisting of total treasury assets of $122 million (cash and

equivalents position of $98 million and $24 million of bullion) and

no debt and its strong cash flow profile are expected to accelerate

Coeur’s debt reduction initiative and result in an immediate 40%

expected reduction in Coeur’s leverage ratio upon closing.

- Bolsters Coeur Board by Adding Two SilverCrest Directors

– Upon closing, current SilverCrest Chief Executive Officer and

Director, N. Eric Fier and one other current SilverCrest Director

will join Coeur’s board of directors, adding extensive and relevant

experience to an already distinguished board of directors.

- Continued Commitment to ESG Leadership – A shared

commitment to ESG with a specific focus on water usage, emissions,

community and workforce development, and leading governance

practices.

"The acquisition of SilverCrest creates a leading global silver

company by adding low-cost silver and gold production and

significant free cash flow to our rapidly growing production and

cash flow driven by the recent expansion of our Rochester silver

and gold mine in Nevada,” said Mitchell J. Krebs, Chairman,

President and Chief Executive Officer of Coeur. “Together with

SilverCrest’s large and growing cash balance and no debt, our

balance sheet is expected to be materially strengthened on day one.

This immediate deleveraging, along with the significant combined

expected free cash flow, will allow for rapid debt repayment and

investment in other organic growth opportunities while offering

shareholders an unparalleled re-rating opportunity. With over 15

years of experience operating our Palmarejo underground silver and

gold operation next door in Chihuahua, we look forward to adding

the high-quality Las Chispas mine to create a leading global silver

company at a time when the demand for silver in renewable energy

and a wide range of electrification end uses is rapidly

rising.”

N. Eric Fier, Chief Executive Officer, and Director of

SilverCrest said, “I’m exceptionally proud of what the SilverCrest

team has accomplished over the past nine years taking Las Chispas

from discovery to production and creating one of the world’s

premier silver operations. Our operational consistency since

declaring commercial production in late 2022 is a testament not

only to the asset quality, but also our outstanding team and strong

stakeholder relationships. I feel confident that the Coeur team

will extend this track record of success at Las Chispas and believe

this transaction is the best opportunity for shareholders to not

only receive an immediate premium, but also have the opportunity to

become meaningful owners of a growing, multi-asset, U.S.-based,

NYSE-listed silver and gold company with tremendous upside

potential. I am excited to continue to be involved as an ongoing

Director of Coeur.”

Benefits to Coeur Stockholders

- Pro forma Coeur is positioned to be a leading global silver

company, with expected 2025 production of approximately 21 million

ounces of silver, accounting for approximately 40% of pro forma

Coeur’s expected total 2025 revenue. In addition, combined 2025

gold production is expected to reach approximately 432,000 ounces,

equal to approximately 55 million silver equivalent ounces2 in

total

- Exposure to a high-grade, low-cost, underground primary silver

mine with strong operational track record and compelling

exploration potential

- Las Chispas is expected to significantly improve Coeur’s cost

and margin profile and materially increase its annual free cash

flow given its high grades while maintaining 100% exposure to

precious metals

- SilverCrest’s robust balance sheet combined with Las Chispas’

strong cash flow generation positions Coeur to significantly

accelerate deleveraging

- Strong potential to add to Las Chispas’ current mine life based

on near-mine exploration opportunities on over 20 kilometers of

underexplored potential vein strike length. Current resources are

estimated on only approximately 55% of the over 100 known

silver-gold veins located at the project

- Leverages Coeur’s long track record of successfully operating

the Palmarejo underground silver and gold mine in Chihuahua,

Mexico

- Significant revaluation opportunity given positioning of the

combined company as a leading silver mining company based on its

pro forma production and cash flow profile and the expected

near-term impacts from the recently completed expansion of the

Rochester silver and gold operation in Nevada

Benefits to SilverCrest Shareholders

- Immediate and significant premium of approximately 18% based on

the 20-day volume-weighted average prices of both companies (22%

premium to the October 3, 2024 closing price)

- Substantial equity participation in Coeur’s balanced portfolio

of producing mines located in North America while retaining

meaningful exposure to future upside at Las Chispas

- Pro forma entity uniquely positioned to unlock the full

potential of Las Chispas given Coeur’s extensive underground mining

experience including the past 15 years of experience operating the

Palmarejo underground silver and gold mine

- Combined entity’s robust financial strength and flexibility is

expected to allow for continued future investments in Las

Chispas

- Significantly improved trading liquidity and capital markets

exposure

- Significant re-rate opportunity for the pro forma entity,

providing additional potential value for SilverCrest

shareholders

Transaction Summary

The proposed Transaction will be effected pursuant to a plan of

arrangement under the Business Corporations Act (British Columbia),

which is required to be approved by a British Columbia court. The

Transaction will require approval by 66 2/3 percent of the votes

cast by the shareholders of SilverCrest and 66 2/3 percent of the

votes cast by the shareholders and option holders of SilverCrest,

voting together as a single class, at a special meeting of

SilverCrest shareholders expected to be held around year-end. The

Transaction will also require approval of a simple majority of

votes cast by the shareholders of SilverCrest, excluding those

votes attached to SilverCrest common shares held by persons

required to be excluded pursuant to Multilateral Instrument 61-101

– Protection of Minority Security Holder in Special Transaction.

The issuance of shares by Coeur pursuant to the Transaction and an

amendment to the Coeur certificate of incorporation to increase the

number of authorized shares of Coeur stock is also subject to

approval by the Coeur stockholders at a special meeting also

expected to be held around year-end. The directors and senior

officers of SilverCrest and Coeur have entered into customary

voting support agreements, pursuant to which they have committed to

vote their common shares held in favor of the Transaction. Upon

completion of the Transaction, existing Coeur stockholders and

SilverCrest shareholders will own approximately 63% and 37% of the

issued and outstanding shares of common stock of the combined

company, respectively. Additionally, upon closing of the

Transaction, N. Eric Fier and one other current SilverCrest

director are expected to join Coeur’s board of directors.

In addition to shareholder and court approvals, the Transaction

is subject to applicable regulatory approvals, including Mexican

antitrust approval, approval of the listing of the Coeur common

shares to be issued under the Transaction on the NYSE, and the

satisfaction of certain other closing conditions customary for a

transaction of this nature. Subject to the satisfaction of such

conditions, the Transaction is expected to close in late Q1 2025.

The Agreement includes customary deal protections, including

reciprocal fiduciary-out provisions, non-solicitation covenants,

and the right to match any superior proposals. Additionally, break

fees in the amount of $60 million and $100 million are payable by

SilverCrest and Coeur, respectively, and a reciprocal expense

reimbursement fee is payable by one party to the other party in

certain circumstances if the Transaction is not completed.

Full details of the Transaction will be included in the Coeur

proxy statement and SilverCrest information circular.

Board of Directors’ Recommendations

After consultation with its outside financial and legal

advisors, the Board of Directors of Coeur have unanimously approved

the Transaction. The Board of Directors of Coeur recommends that

Coeur shareholders vote in favor of the Transaction.

SilverCrest appointed a special committee of independent

directors to consider and make a recommendation with respect to the

Transaction. Based on the unanimous recommendation of the

SilverCrest special committee of independent directors, and after

consultation with its outside financial and legal advisors, the

Board of Directors of SilverCrest has unanimously approved the

Transaction. The Board of Directors of SilverCrest recommends that

SilverCrest shareholders vote in favor of the Transaction.

Cormark Securities Inc. and Raymond James Ltd. have each

provided fairness opinions to the SilverCrest Board of Directors,

and Scotiabank has provided a fairness opinion to the SilverCrest

special committee, to the effect that, as of the date thereof, and

based upon and subject to the assumptions, limitations and

qualifications stated in each such opinion, the consideration

received is fair, from a financial point of view, to the

shareholders of SilverCrest.

Advisors and Counsel

BMO Capital Markets is acting as financial advisor to Coeur.

Goldman Sachs & Co. LLC is also acting as a financial advisor

to Coeur. Goodmans LLP and Gibson, Dunn & Crutcher LLP are

acting as Coeur's legal advisors.

Cormark Securities Inc. and Raymond James Ltd. are acting as

financial advisors to SilverCrest and Scotiabank acted as financial

advisor to the special committee. Cassels Brock & Blackwell LLP

and Paul, Weiss, Rifkind, Wharton & Garrison LLP are acting as

SilverCrest’s legal advisors.

Conference Call

Coeur will conduct a conference call to discuss the Transaction

on October 4, 2024 at 8:00 a.m. Eastern Time. An accompanying

presentation will be made available on the Company’s website at

www.coeur.com.

Dial-In Numbers:

(855) 560-2581 (U.S.)

(855) 669-9657 (Canada)

(412) 542-4166 (International)

Conference ID:

Coeur Mining

Hosting this call will be Mitchell J. Krebs, Chairman, President

and Chief Executive Officer of Coeur, who will be joined by N. Eric

Fier, Chief Executive Officer and Director of SilverCrest. A replay

of the call will be available through October 11, 2024.

Replay numbers:

(877) 344-7529 (U.S.)

(855) 669-9658 (Canada)

(412) 317-0088 (International)

Conference ID:

521 50 06

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing

precious metals producer with four wholly-owned operations: the

Palmarejo gold-silver complex in Mexico, the Rochester silver-gold

mine in Nevada, the Kensington gold mine in Alaska and the Wharf

gold mine in South Dakota. In addition, Coeur wholly-owns the

Silvertip polymetallic critical minerals exploration project in

British Columbia.

About SilverCrest

SilverCrest is a Canadian precious metals producer headquartered

in Vancouver, British Columbia. SilverCrest’s principal focus is

its Las Chispas Operation in Sonora, Mexico. SilverCrest has an

ongoing initiative to increase its asset base by expanding current

resources and reserves, acquiring, discovering, and developing high

value precious metals projects and ultimately operating multiple

silver-gold mines in the Americas. SilverCrest is led by a proven

management team in all aspects of the precious metal mining sector,

including taking projects through discovery, finance, on time and

on budget construction, and production.

Notes All figures are in U.S. dollars unless denoted

otherwise. 1. Source: FactSet, street research, public disclosure.

2. Silver equivalent production based on Street consensus pricing

of US$2,340/oz Au and US$29.66/oz Ag.

No Offer or Solicitation

Communications in the news release do not constitute an offer to

sell or the solicitation of an offer to subscribe for or buy any

securities or a solicitation of any vote or approval with respect

to the proposed Transaction or otherwise, nor shall there be any

sale, issuance or transfer of securities in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction.

Important Additional Information

In connection with the Transaction, Coeur and SilverCrest intend

to file materials with the Securities and Exchange Commission (the

“SEC”) and on SEDAR+, as applicable. Coeur intends to file a

definitive proxy statement on Schedule 14A (the “Proxy Statement”)

with the SEC in connection with the solicitation of proxies to

obtain Coeur stockholder approval of (A) the issuance of shares of

common stock of Coeur in connection with the Transaction (the

“Stock Issuance”) and (B) the amendment of the Coeur certificate of

incorporation to increase the number of authorized shares of Coeur

common stock (the “Charter Amendment”), and SilverCrest intends to

file a notice of the SilverCrest shareholder meeting and

accompanying management information circular (the “Circular”) with

the Toronto Stock Exchange and on SEDAR+ and with the SEC in

connection with the solicitation of proxies to obtain SilverCrest

shareholder approval of the Transaction. After the Proxy Statement

is cleared by the SEC, Coeur intends to mail a definitive Proxy

Statement to the stockholders of Coeur. This communication is not a

substitute for the Proxy Statement, the Circular or for any other

document that Coeur or SilverCrest may file with the SEC or on

SEDAR+ and/or send to Coeur stockholders and/or SilverCrest’s

shareholders in connection with the Transaction. INVESTORS AND

SECURITY HOLDERS OF COEUR AND SILVERCREST ARE URGED TO CAREFULLY

AND THOROUGHLY READ THE PROXY STATEMENT AND THE CIRCULAR,

RESPECTIVELY, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO

TIME, AND OTHER RELEVANT DOCUMENTS FILED BY COEUR AND/OR

SILVERCREST WITH THE SEC OR ON SEDAR+, WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT COEUR,

SILVERCREST, THE TRANSACTION, THE RISKS RELATED THERETO AND RELATED

MATTERS.

Stockholders of Coeur and shareholders of SilverCrest will be

able to obtain free copies of the Proxy Statement and the Circular,

as each may be amended from time to time, and other relevant

documents filed by Coeur and/or SilverCrest with the SEC or on

SEDAR+ (when they become available) through the website maintained

by the SEC at www.sec.gov or on SEDAR+ at www.sedarplus.ca, as

applicable. Copies of documents filed with the SEC by Coeur will be

available free of charge from Coeur’s website at www.coeur.com

under the “Investors” tab or by contacting Coeur’s Investor

Relations Department at (312) 489-5800 or investors@coeur.com.

Copies of documents filed with the SEC or on SEDAR+ by SilverCrest

will be available free of charge from SilverCrest’s website at

www.silvercrestmetals.com under the “Investors” tab or by

contacting SilverCrest’s Investor Relations Department at

604-694-1730 ext. 104.

Participants in the Solicitation

Coeur, SilverCrest and their respective directors and certain of

their executive officers and other members of management and

employees may be deemed, under SEC rules, to be participants in the

solicitation of proxies from Coeur’s stockholders and SilverCrest’s

shareholders in connection with the Transaction. Information

regarding the executive officers and directors of Coeur is included

in its definitive proxy statement for its 2024 annual meeting under

the headings “Proposal No. 1 – Election of Directors”, “Information

about our Executive Officers”, “Compensation Discussion and

Analysis”, and “Director Compensation”, which was filed with the

SEC on April 4, 2024 and is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/215466/000114036124017966/ny20018623x1_def14a.htm.

Information regarding the directors and certain executive officers

of SilverCrest is included in its information circular and proxy

statement for its 2024 annual meeting under the headings

“Compensation of Executive Officers and Directors” and

“Compensation Discussion and Analysis”, which was filed on SEDAR+

on April 18, 2024 and is available at

https://www.silvercrestmetals.com/_resources/agm/2024-Information-Circular.pdf?v=093009.

Additional information regarding the persons who may be deemed

participants and their direct and indirect interests, by security

holdings or otherwise, will be set forth in the Proxy Statement,

the Circular and other materials when they are filed with the SEC

or on SEDAR+ in connection with the Arrangement. Free copies of

these documents may be obtained as described in the paragraphs

above.

Cautionary Note to U.S. Investors

Coeur’s public disclosures are governed by the U.S. Securities

Exchange Act of 1934, as amended, including Regulation S-K 1300

thereunder, whereas SilverCrest discloses estimates of “measured,”

“indicated,” and “inferred” mineral resources as such terms are

used in Canada’s National Instrument 43-101. Although S-K 1300 and

NI 43-101 have similar goals in terms of conveying an appropriate

level of confidence in the disclosures being reported, they at

times embody different approaches or definitions. Consequently,

investors are cautioned that public disclosures by SilverCrest

prepared in accordance with NI 43-101 may not be comparable to

similar information made public by companies, including Coeur,

subject to S-K 1300 and the other reporting and disclosure

requirements under the U.S. federal securities laws and the rules

and regulations thereunder. The scientific and technical

information concerning Coeur’s mineral projects in this

communication have been reviewed and approved by a “qualified

person” under Item 1300 of SEC Regulation S-K, namely Coeur’s

Senior Director, Technical Services, Christopher Pascoe. The

SilverCrest “qualified person” under NI 43-101 for this

communication is N. Eric Fier, CPG, P.Eng, CEO for SilverCrest, who

has reviewed and approved its contents.

Forward-Looking Statements and Cautionary Statements

Certain statements in this document concerning the proposed

Transaction, including any statements regarding the expected

timetable for completing the Arrangement, the results, effects,

benefits and synergies of the Transaction, future opportunities for

the combined company, future financial performance and condition,

guidance and any other statements regarding Coeur’s or

SilverCrest’s future expectations, beliefs, plans, objectives,

financial conditions, assumptions or future events or performance

that are not historical facts are “forward-looking” statements

based on assumptions currently believed to be valid.

Forward-looking statements are all statements other than statements

of historical facts. The words “anticipate,” “believe,” “ensure,”

“expect,” “if,” “intend,” “estimate,” “probable,” “project,”

“forecasts,” “predict,” “outlook,” “aim,” “will,” “could,”

“should,” “would,” “potential,” “may,” “might,” “anticipate,”

“likely” “plan,” “positioned,” “strategy,” and similar expressions

or other words of similar meaning, and the negatives thereof, are

intended to identify forward-looking statements. Specific

forward-looking statements include, but are not limited to,

statements regarding Coeur’s or SilverCrest’s plans and

expectations with respect to the proposed Transaction and the

anticipated impact of the proposed Transaction on the combined

company’s results of operations, financial position, growth

opportunities and competitive position, including maintaining

current Coeur and SilverCrest management, strategies and plans and

integration. The forward-looking statements are intended to be

subject to the safe harbor provided by Section 27A of the

Securities Act, Section 21E of the Securities Exchange Act of 1934

and the Private Securities Litigation Reform Act of 1995 and

applicable Canadian securities laws.

These forward-looking statements involve significant risks and

uncertainties that could cause actual results to differ materially

from those anticipated, including, but not limited to, the

possibility that shareholders of SilverCrest may not approve the

Transaction or stockholders of Coeur may not approve the Stock

Issuance or the Charter Amendment; the risk that any other

condition to closing of the Transaction may not be satisfied; the

risk that the closing of the Transaction might be delayed or not

occur at all; the anticipated timing of mailing proxy statements

and circulars regarding the Transaction; the risk that the either

Coeur or SilverCrest may terminate the Agreement and either Coeur

or SilverCrest is required to pay a termination fee to the other

party; potential adverse reactions or changes to business or

employee relationships of Coeur or SilverCrest, including those

resulting from the announcement or completion of the Transaction;

the diversion of management time on transaction-related issues; the

ultimate timing, outcome and results of integrating the operations

of Coeur and SilverCrest; the effects of the business combination

of Coeur and SilverCrest, including the combined company’s future

financial condition, results of operations, strategy and plans; the

ability of the combined company to realize anticipated synergies in

the timeframe expected or at all; changes in capital markets and

the ability of the combined company to finance operations in the

manner expected; the risk that Coeur or SilverCrest may not receive

the required stock exchange and regulatory approvals of the

Transaction; the expected listing of shares on the NYSE; the risk

of any litigation relating to the proposed Transaction; the risk of

changes in governmental regulations or enforcement practices; the

effects of commodity prices, life of mine estimates; the timing and

amount of estimated future production; the risks of mining

activities; and the fact that operating costs and business

disruption may be greater than expected following the public

announcement or consummation of the Transaction. Expectations

regarding business outlook, including changes in revenue, pricing,

capital expenditures, cash flow generation, strategies for the

combined company’s operations, gold and silver market conditions,

legal, economic and regulatory conditions, and environmental

matters are only forecasts regarding these matters.

Additional factors that could cause results to differ materially

from those described above can be found in Coeur’s Annual Report on

Form 10-K for the year ended December 31, 2023, and subsequent

Quarterly Reports on Form 10-Q, which are on file with the SEC and

available from Coeur’s website at www. coeur.com under the

“Investors” tab, and in other documents Coeur files with the SEC

and in SilverCrest’s annual information form for the year ended

December 31, 2023, which is on file with the SEC and on SEDAR+ and

available from SilverCrest’s website at www.silvercrestmetals.com

under the “Investors” tab, and in other documents SilverCrest files

with the SEC or on SEDAR+.

All forward-looking statements speak only as of the date they

are made and are based on information available at that time.

Neither Coeur nor SilverCrest assumes any obligation to update

forward-looking statements to reflect circumstances or events that

occur after the date the forward-looking statements were made or to

reflect the occurrence of unanticipated events except as required

by applicable securities laws. As forward-looking statements

involve significant risks and uncertainties, caution should be

exercised against placing undue reliance on such statements.

Non-GAAP and Non-IFRS Financial Measures

This press release contains certain non-GAAP and non-IFRS

financial measures, which management believes may enable investors

to better evaluate the Coeur and SilverCrest performance, liquidity

and ability to generate cash flow. These measures do not have any

standardized definition under U.S. GAAP or IFRS, and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with U.S. GAAP or IFRS, as

applicable. Other companies may calculate these measures

differently.

Free Cash Flow Free cash flow subtracts sustaining capital

expenditures from net cash provided by operating activities,

serving as an indicator of the capacity to generate cash from

operations post-sustaining capital investments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241004279894/en/

Coeur Mining, Inc. Attention: Jeff Wilhoit, Senior Director,

Investor Relations Phone: (312) 489-5800 www.coeur.com SilverCrest

Metals Inc. Attention: Lindsay Bahadir, Manager Investor Relations

& Organizational Effectiveness Phone: +1 (604) 694-1730

www.silvercrestmetals.com

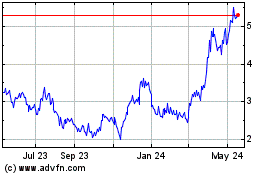

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Dec 2023 to Dec 2024