SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1) OR

13(E)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 2)

CVR ENERGY, INC.

(Name of Subject Company (Issuer))

Icahn

Enterprises Holdings L.P.

Icahn Enterprises L.P.

Icahn Enterprises G.P. Inc.

IEP Energy Holding LLC

American Entertainment Properties Corp.

Beckton Corp.

Carl C. Icahn

(Name of Filing Persons (Offerors))

Common Stock, par value $0.01 per share

(Title of Class of Securities)

12662P108

(CUSIP Number of Class of Securities)

Andrew Teno

President and Chief Executive Officer

Icahn Enterprises L.P.

16690 Collins Avenue, PH-1

Sunny Isles Beach, FL 33160

(305) 422-4100

(Name, address, and telephone numbers of person

authorized to receive notices and communications on behalf of filing persons)

Copies to:

Jesse A. Lynn, Esq.

General Counsel

Icahn Enterprises L.P.

16690 Collins Avenue, PH-1

Sunny Isles Beach, FL 33160

(305) 422-4100

and

Joshua A. Apfelroth, Esq.

Louis E. Rambo, Esq.

Proskauer Rose LLP

Eleven Times Square

New York, NY 10036-8299

(212) 969-3438

| ¨ | Check the box if the filing relates solely to preliminary communications

made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to

which the statement relates:

| x | third-party tender offer subject to Rule 14d-1. |

| ¨ | issuer tender offer subject to Rule 13e-4. |

| ¨ | going-private transaction subject to Rule 13e-3. |

| x | amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting

the results of the tender offer: ¨

If applicable, check the appropriate box(es) below to designate the

appropriate rule provision(s) relied upon:

| ¨ | Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ | Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

Neither the Securities and Exchange Commission

(the “SEC”) nor any state securities commission has approved or disapproved of this transaction, passed upon the merits or

fairness of this transaction, or passed upon the adequacy or accuracy of the disclosure herein. Any representation to the contrary is

a criminal offense.

| CUSIP No. 12662P108 |

|

| 1 |

NAME OF REPORTING PERSON |

|

| |

IEP Energy Holding LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨ |

| |

|

(b) ¨ |

| 3 |

SEC USE ONLY |

|

| 4 |

SOURCE OF FUNDS |

|

| |

Not applicable |

|

| 5 |

CHECK BOX IF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

Delaware |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

|

| 7 |

SOLE VOTING POWER |

|

| |

51,192,381 |

|

| 8 |

SHARED VOTING POWER |

|

| |

0 |

|

| 9 |

SOLE DISPOSITIVE POWER |

|

| |

51,192,381 |

|

| 10 |

SHARED DISPOSITIVE POWER |

|

| |

0 |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

51,192,381 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUSED CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

50.9% |

|

| 14 |

TYPE OF REPORTING PERSON |

|

| |

OO |

|

| CUSIP No. 12662P108 |

|

| 1 |

NAME OF REPORTING PERSON |

|

| |

American Entertainment Properties Corp. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨ |

| |

|

(b) ¨ |

| 3 |

SEC USE ONLY |

|

| 4 |

SOURCE OF FUNDS |

|

| |

Not applicable |

|

| 5 |

CHECK BOX IF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

Delaware |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

|

| 7 |

SOLE VOTING POWER |

|

| |

0 |

|

| 8 |

SHARED VOTING POWER |

|

| |

51,192,381 |

|

| 9 |

SOLE DISPOSITIVE POWER |

|

| |

0 |

|

| 10 |

SHARED DISPOSITIVE POWER |

|

| |

51,192,381 |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

51,192,381 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUSED CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

50.9% |

|

| 14 |

TYPE OF REPORTING PERSON |

|

| |

CO |

|

| CUSIP No. 12662P108 |

|

| 1 |

NAME OF REPORTING PERSON |

|

| |

Icahn Enterprises Holdings L.P. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨ |

| |

|

(b) ¨ |

| 3 |

SEC USE ONLY |

|

| 4 |

SOURCE OF FUNDS |

|

| |

Not applicable |

|

| 5 |

CHECK BOX IF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

Delaware |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

|

| 7 |

SOLE VOTING POWER |

|

| |

15,500,000 |

|

| 8 |

SHARED VOTING POWER |

|

| |

51,192,381 |

|

| 9 |

SOLE DISPOSITIVE POWER |

|

| |

15,500,000 |

|

| 10 |

SHARED DISPOSITIVE POWER |

|

| |

51,192,381 |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

66,692,381 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUSED CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

66.3% |

|

| 14 |

TYPE OF REPORTING PERSON |

|

| |

PN |

|

| CUSIP No. 12662P108 |

|

| 1 |

NAME OF REPORTING PERSON |

|

| |

Icahn Enterprises G.P. Inc. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨ |

| |

|

(b) ¨ |

| 3 |

SEC USE ONLY |

|

| 4 |

SOURCE OF FUNDS |

|

| |

Not applicable |

|

| 5 |

CHECK BOX IF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

Delaware |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

|

| 7 |

SOLE VOTING POWER |

|

| |

0 |

|

| 8 |

SHARED VOTING POWER |

|

| |

66,692,381 |

|

| 9 |

SOLE DISPOSITIVE POWER |

|

| |

0 |

|

| 10 |

SHARED DISPOSITIVE POWER |

|

| |

66,692,381 |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

66,692,381 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUSED CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

66.3% |

|

| 14 |

TYPE OF REPORTING PERSON |

|

| |

CO |

|

| CUSIP No. 12662P108 |

|

| 1 |

NAME OF REPORTING PERSON |

|

| |

Beckton Corp. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨ |

| |

|

(b) ¨ |

| 3 |

SEC USE ONLY |

|

| 4 |

SOURCE OF FUNDS |

|

| |

Not applicable |

|

| 5 |

CHECK BOX IF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

Delaware |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

|

| 7 |

SOLE VOTING POWER |

|

| |

0 |

|

| 8 |

SHARED VOTING POWER |

|

| |

66,692,381 |

|

| 9 |

SOLE DISPOSITIVE POWER |

|

| |

0 |

|

| 10 |

SHARED DISPOSITIVE POWER |

|

| |

66,692,381 |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

66,692,381 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUSED CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

66.3% |

|

| 14 |

TYPE OF REPORTING PERSON |

|

| |

CO |

|

| CUSIP No. 12662P108 |

|

| 1 |

NAME OF REPORTING PERSON |

|

| |

Carl C. Icahn |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨ |

| |

|

(b) ¨ |

| 3 |

SEC USE ONLY |

|

| 4 |

SOURCE OF FUNDS |

|

| |

Not applicable |

|

| 5 |

CHECK BOX IF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

United States of America |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

|

| 7 |

SOLE VOTING POWER |

|

| |

0 |

|

| 8 |

SHARED VOTING POWER |

|

| |

66,692,381 |

|

| 9 |

SOLE DISPOSITIVE POWER |

|

| |

0 |

|

| 10 |

SHARED DISPOSITIVE POWER |

|

| |

66,692,381 |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

66,692,381 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUSED CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

66.3% |

|

| 14 |

TYPE OF REPORTING PERSON |

|

| |

IN |

|

This Amendment No. 2 to the Tender Offer Statement on Schedule TO (this

“Amendment No. 2”) amends and supplements the Tender Offer Statement on Schedule TO filed by Icahn Enterprises Holdings L.P.

a Delaware limited partnership (together with its direct and indirect subsidiaries, “Icahn Enterprises,” “we,”

or “us”), Icahn Enterprises L.P., Icahn Enterprises G.P. Inc., IEP Energy Holding LLC, American Entertainment Properties Corp.,

Beckton Corp., and Carl C. Icahn (collectively, the “Filing Persons”) with the U.S. Securities and Exchange Commission

(the “SEC”) on December 6, 2024, as amended and supplemented by Amendment No. 1 to the Tender Offer Statement on Schedule

TO filed with the Commission on December 18, 2024 (together with any subsequent amendments and supplements thereto, the “Schedule

TO”) relating to an offer by Icahn Enterprises to purchase up to 17,753,322 shares of common stock, par value $0.01 per share (the

“common stock”) of the Company at a price of $18.25 per share, net to the seller in cash, without interest, less any applicable

tax withholding, upon the terms and subject to the conditions set forth in the Offer to Purchase, dated December 6, 2024 (the “Offer

to Purchase”), and in the related Letter of Transmittal (the “Letter of Transmittal” which, together with the Offer

to Purchase, as each may be amended or supplemented from time to time, collectively constitute the “Offer”), copies of which

were filed with the Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively.

Except to the extent specifically provided in this Amendment No. 2,

the information set forth in the Schedule TO remains unchanged. This Amendment No. 2 is being filed to extend the expiration time of the

Offer.

Items 1 through 9 and Item 11.

The Offer to Purchase and Items 1 through 9 and Item

11 of the Schedule TO, to the extent such Items incorporate by reference the information contained in the Offer to Purchase, are hereby

amended and supplemented as follows:

“Icahn Enterprises is extending the Expiration

Time to 5:00 p.m., New York City time, on January 8, 2025. The Offer had been previously scheduled to expire at one minute after 11:59

p.m., New York City time, on January 6, 2025.”

Throughout the Schedule TO, the Offer to Purchase,

the related Letter of Transmittal and other materials relating to the Offer, all references to the expiration of the Offer or to the Expiration

Time are hereby amended to extend the Expiration Time of the Offer to 5:00 p.m., New York City time, on January 8, 2025.

The press release announcing the extension of the Offer

is attached hereto as Exhibit (a)(5)(B) and is incorporated herein by reference.

Item 12. Exhibits.

| Exhibit |

|

Description

|

| (a)(1)(A)*

|

|

Offer

to Purchase, dated December 6, 2024. |

| (a)(1)(B)*

|

|

Form of

Letter of Transmittal (including Guidelines for Certification of Taxpayer Identification Number on Substitute Form W-9). |

| (a)(1)(C)*

|

|

Form of

Notice of Guaranteed Delivery. |

| (a)(1)(D)*

|

|

Form of

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

| (a)(1)(E)*

|

|

Form of

Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

| (a)(1)(F)*

|

|

Press

release issued by Icahn Enterprises L.P., dated December 6, 2024. |

| (a)(1)(G)* |

|

Summary

Advertisement published in the New York Times on December 6, 2024. |

(a)(5)(A)* |

|

Letter

dated November 8, 2024 to the Board of Directors of the Company. |

| (a)(5)(B) |

|

Press

release issued by Icahn Enterprises L.P., dated January 6, 2025. |

| (b) |

|

Not

applicable. |

| (d)(1)*

|

|

Tender

Offer Agreement (the “Tender Offer Agreement”) by and between Icahn Enterprises Holdings and the Company, dated December 6,

2024. |

| (d)(2)*

|

|

Form of

Tax Allocation Agreement by and among American Entertainment Properties Corp., the Company and certain subsidiaries of the Company

(included as Exhibit B to the Tender Offer Agreement, filed herewith as Exhibit (d)(1)). |

| (g) |

|

Not

applicable. |

| (h) |

|

Not

applicable. |

| 107*

|

|

Filing

Fee Table |

* Filed previously

Item 13. Information Required by Schedule

13E-3.

Not applicable.

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I

certify that the information set forth in this statement is true, complete and correct.

Date: January 6, 2025

| |

ICAHN ENTERPRISES HOLDINGS L.P. |

| |

|

| |

BY: |

Icahn Enterprises G.P. Inc., its general partner |

| |

|

| |

By: |

/s/ Ted Papapostolou |

| |

|

Name: |

Ted Papapostolou |

| |

|

Title: |

Chief Financial Officer and Secretary |

| |

|

| |

ICAHN ENTERPRISES L.P. |

| |

|

| |

BY: |

Icahn Enterprises G.P. Inc., its general partner |

| |

|

| |

By: |

/s/ Ted Papapostolou |

| |

|

Name: |

Ted Papapostolou |

| |

|

Title: |

Chief Financial Officer and Secretary |

| |

|

| |

ICAHN ENTERPRISES G.P. INC. |

| |

|

| |

By: |

/s/ Ted Papapostolou |

| |

|

Name: |

Ted Papapostolou |

| |

|

Title: |

Chief Financial Officer and Secretary |

| |

|

| |

IEP ENERGY HOLDING LLC |

| |

|

| |

By: |

/s/ Ted Papapostolou |

| |

|

Name: |

Ted Papapostolou |

| |

|

Title: |

Chief Financial Officer and Secretary |

| |

|

| |

AMERICAN ENTERTAINMENT PROPERTIES CORP. |

| |

|

| |

By: |

/s/ Ted Papapostolou |

| |

|

Name: |

Ted Papapostolou |

| |

|

Title: |

Chief Financial Officer, Treasurer and Secretary |

| |

|

| |

BECKTON CORP. |

| |

|

| |

By: |

/s/ Ted Papapostolou |

| |

|

Name: |

Ted Papapostolou |

| |

|

Title: |

Vice President |

| |

|

| |

|

| |

/s/ CARL C. ICAHN |

| |

Name: Carl C. Icahn |

Exhibit (a)(5)(B)

ICAHN ENTERPRISES L.P. AND ICAHN ENTERPRISES HOLDINGS

L.P. ANNOUNCE EXTENSION OF TENDER OFFER FOR UP TO 17,753,322 SHARES OF COMMON STOCK OF CVR ENERGY

SUNNY ISLES BEACH, Fla., January 6, 2025 —

Icahn Enterprises L.P. (NASDAQ: IEP) (“IEP”), and Icahn Enterprises Holdings L.P. (“IEH”), today announced that

the expiration time of its cash tender offer for up to 17,753,322 shares of CVR Energy, Inc.’s (NYSE: CVI) (“CVR Energy”)

common stock, par value $0.01 per share, at a price per share of $18.25 (the “Offer”), has been extended from one minute after

11:59 p.m., New York City time, on January 6, 2025 to 5:00 p.m., New York City time, on January 8, 2025. All other terms and conditions

of the Offer remain unchanged, and IEP and IEH do not intend to further extend the Offer, increase the price of the Offer or otherwise

change any of the terms or conditions with respect to the Offer.

The full terms and conditions of the Offer are

discussed in the Offer to Purchase, dated December 6, 2024 (the “Offer to Purchase”), and the associated Letter of Transmittal

and other materials relating to the Offer that were filed with the Securities and Exchange Commission (the “SEC”) and

distributed to CVR Energy’s stockholders.

Broadridge Corporate Issuer Solutions, LLC, the

depositary and paying agent for the Offer, has informed IEP that as of 6:00 p.m., New York City time, on January 6, 2025, approximately

960,479 shares have been tendered in the Offer, including 700,244 shares tendered by guaranteed delivery. The number of shares tendered may change significantly prior to the expiration time.

None of CVR Energy, the Special Committee -

Strategic of its Board, IEP or IEH or their affiliates, the information agent nor the depositary and paying agent, are making any

recommendation to stockholders as to whether to tender or refrain from tendering their shares in the Offer. Stockholders

must decide how many shares they will tender. In doing so, stockholders should read carefully the information in the Offer to

Purchase and the other offer documents.

D.F. King & Co., Inc. is serving as Information

Agent for the Offer. Copies of the Offer to Purchase, Letter of Transmittal and other related materials are available free of charge

from D.F. King & Co., Inc., toll free at (866) 207-3626 or via email at CVREnergy@dfking.com, or on the SEC’s website, at www.sec.gov.

CVR Energy’s other public filings with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current

reports on Form 8-K, are also available for free on the SEC’s website at www.sec.gov.

THIS PRESS RELEASE DOES NOT CONSTITUTE

AN OFFER TO PURCHASE, OR A SOLICITATION OF AN OFFER TO SELL, ANY SECURITIES. THIS PRESS RELEASE IS FOR INFORMATIONAL PURPOSES ONLY.

THE OFFER IS MADE ONLY PURSUANT TO THE OFFER TO PURCHASE, LETTER OF TRANSMITTAL AND RELATED MATERIALS THAT IEH HAS DISTRIBUTED TO CVR

ENERGY’S STOCKHOLDERS. IEH HAS FILED A TENDER OFFER STATEMENT ON SCHEDULE TO WITH THE SEC. CVR ENERGY’S STOCKHOLDERS

SHOULD READ THESE MATERIALS AND THE DOCUMENTS INCORPORATED THEREIN BY REFERENCE CAREFULLY AND IN THEIR ENTIRETY BEFORE MAKING ANY

DECISION WITH RESPECT TO THE OFFER AS THEY CONTAIN IMPORTANT INFORMATION ABOUT THE OFFER.

About CVR Energy

Headquartered in Sugar Land, Texas, CVR Energy

is a diversified holding company primarily engaged in the renewables, petroleum refining and marketing businesses as well as in the nitrogen

fertilizer manufacturing business through its interest in CVR Partners, LP. CVR Energy subsidiaries serve as the general partner and own

approximately 37% of the common units of CVR Partners, LP.

About IEP and IEH

Icahn Enterprises L.P. (NASDAQ: IEP), a master

limited partnership, is a diversified holding company owning subsidiaries currently engaged in the following continuing operating businesses:

Investment, Energy, Automotive, Food Packaging, Real Estate, Home Fashion and Pharma.

Icahn Enterprises Holdings L.P. (“IEH”)

is a Delaware limited partnership. IEP owns a 99% limited partner interest in IEH, and each of IEP and IEH are indirectly controlled by

Carl C. Icahn.

Cautionary Statement Regarding Forward-Looking

Statements

This press release may contain

“forward-looking statements” within the meaning of the federal securities laws. In this context, forward-looking

statements often address expected future business and financial performance and financial condition, and often contain words such as

“expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,”

“see,” “will,” “would,” “target,” and similar expressions, and variations or

negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such

as statements about the consummation of the Offer and the anticipated benefits thereof, and the terms of the related tender

offer agreement. Such statements involve risks, uncertainties and assumptions. If such risks or uncertainties materialize or such

assumptions prove incorrect, the results of the Offer or the business of CVR Energy could differ materially from those

expressed or implied by such forward-looking statements and assumptions. All statements other than statements of historical fact are

statements that could be deemed forward-looking statements, including any statements regarding the expected benefits and costs of

the Offer; the expected timing of the completion of the Offer; the ability of IEP to complete the Offer

considering the various conditions to the Offer, some of which are outside the parties control; any statements of expectation

or belief; and any statements of assumptions underlying any of the foregoing. Risks, uncertainties and assumptions include the

possibility that expected benefits may not materialize as expected; that the Offer may not be timely completed, if at all;

that, prior to the completion of the transaction, CVR Energy’s business may not perform as expected due to transaction-related

uncertainty or other factors; and other risks that are described in CVR Energy’s latest Annual Report on Form 10-K and its

other filings with the SEC. IEP does not intend to update you concerning any future revisions to any forward-looking statements to

reflect events or circumstances occurring after the date of this press release, except to the extent necessary to amend and promptly

disseminate revised information in the event that our existing disclosure regarding the Offer materially changes or as otherwise

required by law or applicable rule or regulation.

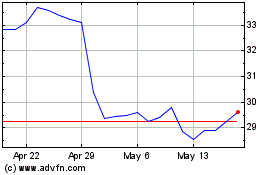

CVR Energy (NYSE:CVI)

Historical Stock Chart

From Dec 2024 to Jan 2025

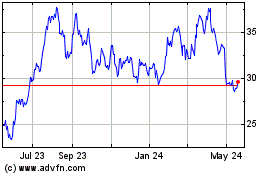

CVR Energy (NYSE:CVI)

Historical Stock Chart

From Jan 2024 to Jan 2025