- THIRD QUARTER FY 2025 REVENUE INCREASED 17% TO A RECORD

$1.83 BILLION

- THIRD QUARTER FY 2025 DILUTED EPS INCREASED 19% TO A RECORD

$3.00

- FY 2025 REVENUE GROWTH GUIDANCE RAISED TO APPROXIMATELY

15%

- FY 2025 DILUTED EPS GUIDANCE RAISED TO RANGE OF

$5.75-$5.80

Deckers Brands (NYSE: DECK), a global leader in designing,

marketing, and distributing innovative footwear, apparel, and

accessories, today announced financial results for the third fiscal

quarter ended December 31, 2024. The Company also provided an

update to its financial outlook for the full fiscal year ending

March 31, 2025.

“Deckers posted exceptional results in the third quarter,

delivering record quarterly revenue, gross margin, and earnings,”

said Stefano Caroti, President and Chief Executive Officer. “UGG

continued to experience incredible global momentum, with the

brand’s iconic franchises capturing strong full price consumer

demand across all regions. At the same time, HOKA delivered

impressive results consistent with our strategy, remaining focused

on scaling through innovative performance products. Our increased

full-year revenue outlook calls for 15% growth, which would be our

fifth consecutive year growing mid-teens or higher, complemented by

our commitment to maintain top-tier levels of operating

margin.”

Third Quarter Fiscal 2025 Financial Review (Compared to the

Same Period Last Year)

- Net sales increased 17.1% to $1.827 billion compared to

$1.560 billion. On a constant currency basis, net sales increased

16.6%.

- Channel

- Direct-to-Consumer (DTC) net sales increased 17.9% to $1.011

billion compared to $858.1 million. DTC comparable net sales

increased 18.3%.

- Wholesale net sales increased 16.2% to $815.8 million compared

to $702.2 million.

- Geography

- Domestic net sales increased 11.5% to $1.169 billion compared

to $1.048 billion.

- International net sales increased 28.5% to $657.9 million

compared to $511.9 million.

- Gross margin was 60.3% compared to 58.7%.

- Selling, general, and administrative (SG&A) expenses

were $535.3 million compared to $428.7 million.

- Operating income was $567.3 million compared to $487.9

million.

- Diluted earnings per share was $3.00 compared to $2.52.

As previously disclosed, the Company effected a six-for-one forward

stock split of its common stock during the second fiscal quarter.

The share, per share, and resulting financial amounts in this press

release have been adjusted to reflect the effectiveness of the

stock split.

Third Quarter Fiscal 2025 Brand Summary (Compared to the Same

Period Last Year)

- UGG® brand net sales increased 16.1% to $1.244 billion compared

to $1.072 billion.

- HOKA® brand net sales increased 23.7% to $530.9 million

compared to $429.3 million.

- Teva® brand net sales decreased 6.0% to $24.1 million compared

to $25.6 million.

- Other brands net sales decreased 16.6% to $28.0 million

compared to $33.6 million.

Balance Sheet (December 31, 2024 as compared to December 31,

2023)

- Cash and cash equivalents were $2.241 billion compared to

$1.651 billion.

- Inventories were $576.7 million compared to $539.0

million.

- The Company had no outstanding borrowings.

Capital Allocation

During the third fiscal quarter, the Company repurchased

approximately 275 thousand shares of its common stock for a total

of $44.7 million at a weighted average price paid per share of

$162.85. As of December 31, 2024, the Company had approximately

$640.7 million remaining under its stock repurchase

authorization.

Full Fiscal Year 2025 Outlook for the Twelve Month Period

Ending March 31, 2025

The Company’s full fiscal year 2025 outlook is forward-looking

in nature, reflecting our expectations as of January 30, 2025, and

is subject to significant risks and uncertainties that limit our

ability to accurately forecast results. This outlook assumes no

meaningful changes to the Company’s business prospects or risks and

uncertainties identified by management that could impact future

results, which include but are not limited to: foreign currency

fluctuations, changes in economic conditions, including consumer

confidence, discretionary spending, and inflationary pressures;

supply chain disruptions; and geopolitical tensions.

- Net sales are now expected to increase approximately 15% to

$4.9 billion.

- Gross margin is now expected to be at or slightly better than

57%.

- SG&A expenses as a percentage of net sales are still

expected to be approximately 35%.

- Operating margin is now expected to be approximately 22%.

- Effective tax rate is expected to be approximately 23.5%.

- Diluted earnings per share is now expected to be in the range

of $5.75 to $5.80.

- The earnings per share guidance takes into account the

effectiveness of the stock split, but does not take into account

the impact from any potential future share repurchases.

Non-GAAP Financial Measures

In certain instances the Company may present financial measures

that were not prepared in accordance with generally accepted

accounting principles in the United States (non-GAAP financial

measures), including constant currency, to provide information that

may assist investors in understanding its financial results and

assessing its prospects for future performance. The Company

believes these non-GAAP financial measures are important indicators

of its operating performance because they exclude items that are

unrelated to, and may not be indicative of, its core operating

results.

The non-GAAP financial measures presented by the Company may not

necessarily be comparable to similarly titled measures of other

companies and may not be appropriate measures for comparing the

performance of other companies relative to Deckers. For example, in

order to calculate constant currency information, the Company

calculates the current period financial information using the

foreign currency exchange rates that were in effect during the

previous comparable period, excluding the effects of foreign

currency exchange rate hedges and remeasurements in the condensed

consolidated financial statements. Further, the Company reports DTC

comparable net sales on a constant currency basis for DTC

operations that were open throughout the current and prior

reporting periods, and may adjust prior reporting periods to

conform to current year accounting policies. These non-GAAP

financial measures are not intended to represent, and should not be

considered to be more meaningful measures than, or alternatives to,

measures of operating performance as determined in accordance with

GAAP. To the extent the Company utilizes such non-GAAP financial

measures in the future, it expects to calculate them using a

consistent method from period-to-period.

Conference Call Information

The Company’s conference call to review the results for the

third quarter fiscal year 2025 will be broadcast live today,

Thursday, January 30, 2025, at 4:30 pm Eastern Time and hosted at

ir.deckers.com. You can access the broadcast by clicking on the

link within the “Webcast” box at the top of the page. A replay of

the broadcast will be available for at least 30 days following the

conference call and can be accessed under the “Quarterly Earnings”

section of the “Financials” tab at the aforementioned website.

About Deckers Brands

Deckers Brands is a global leader in designing, marketing, and

distributing innovative footwear, apparel, and accessories

developed for both everyday casual lifestyle use and

high-performance activities. The Company’s portfolio of brands

includes UGG®, HOKA®, Teva®, Koolaburra®, and AHNU®. Deckers Brands

products are sold in more than 50 countries and territories through

select department and specialty stores, Company-owned and operated

retail stores, and select online stores, including Company-owned

websites. Deckers Brands has over 50 years of history building

niche footwear brands into lifestyle market leaders attracting

millions of loyal consumers globally. For more information, please

visit www.deckers.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995, which statements are

subject to considerable risks and uncertainties. Forward-looking

statements include all statements other than statements of

historical fact contained in this press release, including

statements regarding our projected financial results, including net

sales, gross margin, SG&A expenses, operating margin,

inventories, effective tax rate, and diluted earnings per share;

consumer confidence and discretionary spending; the strength of our

brands and demand for our products; our ability to drive future

growth and profitability; our ability to execute on our long-term

strategies and objectives; and our capital allocation, including

the potential repurchase of shares. We have attempted to identify

forward-looking statements by using words such as “anticipate,”

“believe,” “estimate,” “intend,” “may,” “plan,” “predict,”

“project,” “should,” “will,” or “would,” and similar expressions or

the negative of these expressions.

Forward-looking statements represent our management’s current

expectations and predictions about trends affecting our business

and industry and are based on information available as of the time

such statements are made. Although we do not make forward-looking

statements unless we believe we have a reasonable basis for doing

so, we cannot guarantee their accuracy or completeness.

Forward-looking statements involve numerous known and unknown

risks, uncertainties and other factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements predicted,

assumed or implied by the forward-looking statements. Some of the

risks and uncertainties that may cause our actual results to

materially differ from those expressed or implied by these

forward-looking statements are described in the section entitled

“Risk Factors” in our Annual Report on Form 10-K for the fiscal

year ended March 31, 2024, as well as in our Quarterly Reports on

Form 10-Q and other filings with the Securities and Exchange

Commission.

Any forward-looking statement made by us in this press release

is based only on information currently available to us and speaks

only as of the date on which it is made. Except as required by

applicable law or the listing rules of the New York Stock Exchange,

we expressly disclaim any intent or obligation to update any

forward-looking statements, or to update the reasons actual results

could differ materially from those expressed or implied by these

forward-looking statements, whether to conform such statements to

actual results or changes in our expectations, or as a result of

the availability of new information.

DECKERS OUTDOOR CORPORATION

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS

OF COMPREHENSIVE INCOME (UNAUDITED)

(dollar and share data amounts in

thousands, except per share data)

Three Months Ended December

31,

Nine Months Ended December

31,

2024

2023

2024

2023

Net sales

$

1,827,165

$

1,560,307

$

3,963,832

$

3,328,005

Cost of sales

724,542

643,738

1,657,937

1,481,993

Gross profit

1,102,623

916,569

2,305,895

1,846,012

Selling, general, and administrative

expenses

535,349

428,670

1,300,728

1,062,760

Income from operations

567,274

487,899

1,005,167

783,252

Total other income, net

(16,668

)

(11,154

)

(46,840

)

(31,482

)

Income before income taxes

583,942

499,053

1,052,007

814,734

Income tax expense

127,208

109,134

237,327

182,716

Net income

456,734

389,919

814,680

632,018

Total other comprehensive (loss) income,

net of tax

(11,686

)

7,077

(4,711

)

(3,339

)

Comprehensive income

$

445,048

$

396,996

$

809,969

$

628,679

Net income per share

Basic

$

3.01

$

2.53

$

5.35

$

4.06

Diluted

$

3.00

$

2.52

$

5.33

$

4.03

Weighted-average common shares

outstanding

Basic

151,820

153,985

152,307

155,716

Diluted

152,386

154,865

152,924

156,670

DECKERS OUTDOOR CORPORATION

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

(dollar amounts in thousands)

December 31, 2024

March 31, 2024

ASSETS

(AUDITED)

Current assets

Cash and cash equivalents

$

2,240,923

$

1,502,051

Trade accounts receivable, net

303,079

296,565

Inventories

576,669

474,311

Other current assets

153,441

170,556

Total current assets

3,274,112

2,443,483

Property and equipment, net

323,413

302,122

Operating lease assets

218,876

225,669

Other noncurrent assets

147,952

164,305

Total assets

$

3,964,353

$

3,135,579

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities

Trade accounts payable

$

586,371

$

378,503

Operating lease liabilities

46,014

53,581

Other current liabilities

400,497

287,909

Total current liabilities

1,032,882

719,993

Long-term operating lease liabilities

211,015

213,298

Other long-term liabilities

89,537

94,820

Total long-term liabilities

300,552

308,118

Total stockholders’ equity

2,630,919

2,107,468

Total liabilities and stockholders’

equity

$

3,964,353

$

3,135,579

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130744693/en/

Investor Contact: Erinn Kohler | VP, Investor Relations,

Corporate Planning & Business Analytics | Deckers Brands |

805.967.7611

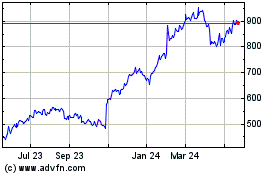

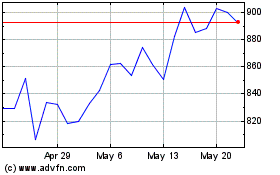

Deckers Outdoor (NYSE:DECK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Deckers Outdoor (NYSE:DECK)

Historical Stock Chart

From Feb 2024 to Feb 2025