0000915389false00009153892025-01-302025-01-300000915389us-gaap:CommonStockMember2025-01-302025-01-300000915389emn:A1.875notesdueNovember2026Member2025-01-302025-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

January 30, 2025

EASTMAN CHEMICAL COMPANY

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-12626 | | 62-1539359 |

(State or Other Jurisdiction

of Incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | |

| | | | | | | | |

| 200 South Wilcox Drive | |

| Kingsport | Tennessee | 37662 |

| (Address of Principal Executive Offices) | (Zip Code) |

(423) 229-2000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | | | | |

| | ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | |

| | ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | |

| | ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | |

| | ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | EMN | | New York Stock Exchange |

| 1.875% Notes Due 2026 | | EMN26 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | | | | |

| EASTMAN CHEMICAL COMPANY - EMN | | |

Item 2.02 Results of Operations and Financial Condition

On January 30, 2025, the registrant publicly released its financial results for fourth quarter and full year 2024. The full text of the release is furnished as Exhibit 99.01 to this Current Report on Form 8-K, and is incorporated herein by reference. This information shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits:

(d) Exhibits

The following exhibits are furnished pursuant to Item 9.01:

99.01 Public release by Eastman on January 30, 2025 of fourth quarter and full year 2024 financial results

104 Cover Page Interactive Data File

| | | | | | | | |

| EASTMAN CHEMICAL COMPANY - EMN | | |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | | Eastman Chemical Company |

| | By: | /s/ Michelle R. Stewart |

| | Michelle R. Stewart |

| | Vice President, Chief Accounting Officer and Corporate Controller |

| | | Date: January 30, 2025 |

Exhibit 99.01

Eastman Announces Fourth-Quarter and Full-Year 2024 Financial Results

KINGSPORT, Tenn., January 30, 2025 – Eastman Chemical Company (NYSE:EMN) announced its fourth-quarter and full-year 2024 financial results.

•Delivered strong specialty volume/mix growth in Advanced Materials and Additives & Functional Products in the fourth quarter and full year.

•Delivered adjusted EBIT margin improvement of both 350 basis points in the fourth quarter and 190 basis points in 2024 through volume/mix growth, operating leverage, and commercial excellence.

•Continued to operate the Kingsport methanolysis facility well in the fourth quarter, positioning the facility to deliver strong earnings growth in 2025.

•Generated approximately $1.3 billion of cash from operating activities in 2024, demonstrating the strength of our cash flow and our resolve to deliver on our commitments.

•Returned approximately $700 million to shareholders in 2024 through dividends and share repurchases.

| | | | | | | | | | | | | | |

| (In millions, except per share amounts; unaudited) | 4Q2024 | 4Q2023 | FY24 | FY23 |

| Sales revenue | $2,245 | $2,207 | $9,382 | $9,210 |

| Earnings before interest and taxes ("EBIT") | 349 | 477 | 1,278 | 1,302 |

| Adjusted EBIT* | 305 | 222 | 1,298 | 1,097 |

| Earnings per diluted share | 2.82 | 2.61 | 7.67 | 7.49 |

| Adjusted earnings per diluted share* | 1.87 | 1.31 | 7.89 | 6.40 |

| Net cash provided by operating activities | 540 | 452 | 1,287 | 1,374 |

| | | | |

*For non-core and unusual items excluded from adjusted earnings and for adjusted provision for income taxes, segment adjusted EBIT margins, and net debt, reconciliations to reported company and segment earnings and total borrowings for all periods presented in this release, see Tables 3A, 3B, 4, and 6.

“The fourth quarter capped off a tremendous year for Eastman, with adjusted earnings per share growing 23 percent in 2024,” said Mark Costa, Board Chair and CEO. “As we ended the year, demand was consistent with our expectations, and we saw seasonal declines across our key end markets. Adjusted EBIT margin increased 350 basis points compared to last year and was supported by higher sales volume/mix, strong operating leverage, and commercial excellence. Throughout 2024, the Eastman team found ways to deliver earnings in line with our commitments despite facing significant macroeconomic uncertainty and persistently weak end-market demand. We also added to our track record of strong cash generation by delivering $1.3 billion of cash from operations in 2024. Consistent with our capital allocation strategy, we continued our investment in growth and returned a meaningful amount of cash to shareholders. In addition to driving strong financial results, we also successfully started up the world’s largest molecular recycling facility, significantly advancing our leadership position in the circular economy. We operated the Kingsport methanolysis facility well in the fourth quarter and made good progress building our Renew sales funnel. As we head into 2025, we are positioned to leverage our innovation-driven growth model to drive growth above underlying market trends. I am confident in our winning team and their ability to drive resilient earnings and cash flow going forward.”

Corporate Results 4Q 2024 versus 4Q 2023

Sales revenue increased 2 percent due to 1 percent higher sales volume/mix and 1 percent higher selling prices.

Higher sales volume/mix in Additives & Functional Products and Advanced Materials was mostly offset by lower sales volume/mix in Fibers and Chemical Intermediates. Higher selling prices across Additives & Functional Products, Chemical Intermediates, and Fibers were partially offset by lower selling prices in Advanced Materials.

Reported EBIT includes the gain on the sale of Texas City Operations in fourth-quarter 2023. Adjusted EBIT increased due to higher sales volume/mix, improved capacity utilization, and favorable price-cost.

Segment Results 4Q 2024 versus 4Q 2023

Advanced Materials – Sales revenue increased 2 percent due to 5 percent higher sales volume/mix partially offset by 3 percent lower selling prices.

Higher sales volume/mix was due to the lack of customer inventory destocking across key end markets and continued momentum from our innovation initiatives creating growth above underlying markets. These factors were partially offset by lower selling prices.

EBIT increased due to favorable price-cost, higher sales volume/mix, and improved capacity utilization. These factors were partially offset by operating costs associated with Kingsport methanolysis and continued investment in growth.

Additives & Functional Products – Sales revenue increased 9 percent due to 7 percent higher sales volume/mix and 2 percent higher selling prices.

Higher sales volume/mix was due to the end of destocking in the agriculture end market and stronger demand for aviation fluids.

EBIT increased due to higher sales volume/mix, favorable price-cost, improved capacity utilization, and lower planned maintenance costs.

Fibers – Sales revenue decreased 7 percent due to 9 percent lower sales volume/mix partially offset by 2 percent higher selling prices.

Lower sales volume/mix for acetate tow was driven by year-end customer inventory management. Higher selling prices were primarily for acetate tow.

EBIT decreased due to lower sales volume/mix partially offset by favorable price-cost.

Chemical Intermediates – Sales revenue decreased 2 percent due to 4 percent lower sales volume/mix partially offset by 2 percent higher selling prices.

Lower sales volume/mix was driven by weak end-market demand and year-end customer inventory destocking.

Reported EBIT includes the gain on the sale of Texas City Operations in fourth-quarter 2023. Excluding this unusual item, adjusted EBIT was slightly down compared to the prior year period as lower spreads were partially offset by improved capacity utilization.

Corporate Results 2024 versus 2023

Sales revenue increased 2 percent due to 4 percent higher sales volume/mix partially offset by 2 percent lower selling prices.

Higher sales volume/mix was driven by the end of destocking in most end markets and innovation-driven growth above end-market demand, particularly in the Advanced Materials segment. Lower selling prices were primarily due to lower raw material and energy prices.

Reported EBIT includes the gain on the sale of Texas City Operations in fourth-quarter 2023. Adjusted EBIT increased primarily due to higher sales volume/mix and associated capacity utilization as well as favorable price-cost, partially offset by operating costs from new facilities and continued investment in growth.

Segment Results 2024 versus 2023

Advanced Materials – Sales revenue increased 4 percent due to 8 percent higher sales volume/mix partially offset by 4 percent lower selling prices.

Higher specialty plastics sales volume/mix was driven by the end of customer inventory destocking across key end markets and by continued momentum from our innovation initiatives. Growth above underlying end-market demand in automotive was driven by innovation in premium interlayers products. Lower selling prices were driven by lower raw material and energy prices.

EBIT increased due to higher sales volume/mix and improved capacity utilization partially offset by operating costs associated with Kingsport methanolysis and continued investment in growth.

Additives & Functional Products – Sales revenue increased 1 percent due to 4 percent higher sales volume/mix mostly offset by 3 percent lower selling prices.

Higher sales volume/mix was due to the end of destocking in the agriculture end market as well as growth in stable end markets, including personal care, aviation, and water treatment. Lower selling prices were in part driven by cost-pass-through contracts.

EBIT increased due to higher sales volume/mix and favorable price-cost.

Fibers – Sales revenue increased 2 percent due to 2 percent higher selling prices.

Higher selling prices were due to higher acetate tow contract prices. Sales volume/mix was unchanged as strong growth in Naia™ was offset by a modest decline in acetate tow.

EBIT increased due to favorable price-cost.

Chemical Intermediates – Sales revenue was flat, as 3 percent higher sales volume/mix was offset by 3 percent lower selling prices.

Higher sales volume/mix was primarily driven by reduced customer inventory destocking across most end markets. Lower selling prices were driven by lower raw material and energy prices.

Reported EBIT includes the gain on the sale of Texas City Operations in fourth-quarter 2023. Adjusted EBIT decreased as lower spreads were partially offset by lower operating costs.

Cash Flow

In 2024, cash provided by operating activities was approximately $1.3 billion compared to approximately $1.4 billion in 2023. The modest decrease compared to the prior year period was primarily driven by an increase in working capital in 2024 compared to a decrease in 2023. In 2024, the company returned $679 million to stockholders through dividends and share repurchases. See Table 5. Priorities for uses of available cash for 2025 include organic growth investments, payment of the quarterly dividend, bolt-on acquisitions, and share repurchases.

2025 Outlook

Commenting on the outlook for full-year 2025, Costa said: “As we begin 2025, the global economic and geopolitical environment remains highly uncertain. Despite this uncertainty, we are confident in our ability to generate growth across our portfolio as we build upon a strong year in 2024. First, we expect modest volume growth in our specialty businesses, and we will continue to leverage our innovation-driven growth model to deliver growth above underlying challenged market trends. Across our consumer discretionary end markets, we are not projecting any underlying demand improvement in 2025. Across our more stable markets, we are projecting modest demand growth. A key driver of our innovative growth will be our circular platform as we remain on track with our 2025 commitments of $75 million-$100 million EBITDA growth shared recently at our Circular Deep Dive event. And finally, we will reduce structural costs to more than offset inflation while continuing to invest in growth and capabilities for long-term value creation. Partially offsetting these factors include headwinds related to higher energy costs, a stronger U.S. dollar, and customer inventory management in the Fibers business. Taking this together, we expect 2025 EPS to be between $8.00-$8.75 and for 2025 cash from operations to be approximately $1.3 billion.”

The full-year 2025 projected adjusted diluted EPS and Earnings Before Interest, Taxes, Depreciation, and Amortization (“EBITDA”) exclude any non-core, unusual, or nonrecurring items. Our financial results forecasts do not include non-core items (such as mark-to-market pension and other postretirement benefit gain or loss, and asset impairments and restructuring charges) or any unusual or non-recurring items because we are unable to predict with reasonable certainty the financial impact of such items. These items are uncertain and depend on various factors, and we are unable to reconcile projected adjusted diluted EPS and EBITDA excluding non-core and any unusual or non-recurring items to reported GAAP diluted EPS or net earnings without unreasonable efforts.

Forward-Looking Statements

This information and other statements by the company may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act with respect to, among other items: projections and estimates of earnings, revenues, volumes, pricing, margins, cost reductions, expenses, taxes, liquidity, capital expenditures, cash flow, dividends, share repurchases or other financial items, statements of management’s plans, strategies and objectives for future operations, and statements regarding future economic, industry or market conditions or performance. Such projections and estimates are based upon certain preliminary information, internal estimates, and management assumptions, expectations, and plans. Forward-looking

statements are subject to a number of risks and uncertainties, and actual performance or results could differ materially from that anticipated by any forward-looking statements. Forward-looking statements speak only as of the date they are made, and the company undertakes no obligation to update or revise any forward-looking statement. Other important assumptions and factors that could cause actual results to differ materially from those in the forward-looking statements are detailed in the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the company's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and as updated in the company’s filings with the Securities and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at www.sec.gov and the company’s website at www.eastman.com.

Conference Call and Webcast Information

Eastman will host a conference call with industry analysts on Jan. 31, 2025, at 8:00 a.m. ET. To listen to the live webcast of the conference call and view the accompanying slides and prepared remarks, go to investors.eastman.com, Events & Presentations. The slides and prepared remarks to be discussed during the call and webcast will be available at investors.eastman.com at approximately 4:30 p.m. ET on Jan. 30, 2025. To listen via telephone, the dial-in number is +1 (833) 470-1428, passcode: 793608. A web replay, a replay in downloadable MP3 format, and the accompanying slides and prepared remarks will be available at investors.eastman.com, Events & Presentations. A telephone replay will be available continuously beginning at approximately 1:00 p.m. ET, Jan. 31, 2025, through 11:59 p.m. ET, Feb. 9, 2025, Toll Free at +1 (866) 813-9403, passcode 540646.

Founded in 1920, Eastman is a global specialty materials company that produces a broad range of products found in items people use every day. With the purpose of enhancing the quality of life in a material way, Eastman works with customers to deliver innovative products and solutions while maintaining a commitment to safety and sustainability. The company’s innovation-driven growth model takes advantage of world-class technology platforms, deep customer engagement, and differentiated application development to grow its leading positions in attractive end markets such as transportation, building and construction, and consumables. As a globally inclusive company, Eastman employs approximately 14,000 people around the world and serves customers in more than 100 countries. The company had 2024 revenue of approximately $9.4 billion and is headquartered in Kingsport, Tennessee, USA. For more information, visit www.eastman.com.

# # #

Contacts:

Media: Tracy Kilgore Addington

423-224-0498 / tracy@eastman.com

Investors: Greg Riddle

212-835-1620 / griddle@eastman.com

FINANCIAL INFORMATION

January 30, 2025

For Eastman Chemical Company Fourth Quarter and Full Year 2024 Financial Results Release

Table 1 – Statements of Earnings | | | | | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter | | Twelve Months |

| (Dollars in millions, except per share amounts; unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Sales | $ | 2,245 | | | $ | 2,207 | | | $ | 9,382 | | | $ | 9,210 | |

Cost of sales (1)(2)(3) | 1,691 | | | 1,743 | | | 7,092 | | | 7,149 | |

| Gross profit | 554 | | | 464 | | | 2,290 | | | 2,061 | |

| Selling, general and administrative expenses | 182 | | | 191 | | | 736 | | | 727 | |

| Research and development expenses | 66 | | | 57 | | | 250 | | | 239 | |

| Asset impairments, restructuring, and other charges, net | 10 | | | 15 | | | 51 | | | 37 | |

| Other components of post-employment (benefit) cost, net | (58) | | | 49 | | | (72) | | | 41 | |

| Other (income) charges, net | 5 | | | (2) | | | 47 | | | 38 | |

Net gain on divested business (4) | — | | | (323) | | | — | | | (323) | |

| Earnings before interest and taxes | 349 | | | 477 | | | 1,278 | | | 1,302 | |

| Net interest expense | 52 | | | 52 | | | 200 | | | 215 | |

| | | | | | | |

| Earnings before income taxes | 297 | | | 425 | | | 1,078 | | | 1,087 | |

(Benefit from) Provision for income taxes | (34) | | | 114 | | | 170 | | | 191 | |

| Net earnings | 331 | | | 311 | | | 908 | | | 896 | |

| Less: Net earnings attributable to noncontrolling interest | 1 | | | 1 | | | 3 | | | 2 | |

| Net earnings attributable to Eastman | $ | 330 | | | $ | 310 | | | $ | 905 | | | $ | 894 | |

| | | | | | | |

| Basic earnings per share attributable to Eastman | $ | 2.85 | | | $ | 2.63 | | | $ | 7.75 | | | $ | 7.54 | |

| Diluted earnings per share attributable to Eastman | $ | 2.82 | | | $ | 2.61 | | | $ | 7.67 | | | $ | 7.49 | |

| | | | | | | |

| Shares (in millions) outstanding at end of period | 115.2 | | | 117.3 | | | 115.2 | | | 117.3 | |

| Shares (in millions) used for earnings per share calculation | | | | | | | |

| Basic | 115.6 | | | 118.0 | | | 116.7 | | | 118.6 | |

| Diluted | 116.9 | | | 118.7 | | | 117.9 | | | 119.4 | |

(1)Twelve months 2024 includes inventory adjustment charges of $7 million related to the planned closure of a solvent-based resins production line at an advanced interlayers facility in North America.

(2)Twelve months 2023 includes $8 million insurance proceeds, net of costs, from the previously reported operational incident at the Kingsport site as a result of a steam line failure (the "steam line incident").

(3)Twelve months 2023 includes $23 million accelerated depreciation related to the closure of an acetate yarn manufacturing facility in Europe.

(4)Fourth quarter and twelve months 2023 related to the sale of the Company's operations in Texas City, Texas, excluding the plasticizers operations ("Texas City Operations").

Table 2A – Segment Sales Information | | | | | | | | | | | | | | | | | | | | | | | |

| | Fourth Quarter | | Twelve Months |

| (Dollars in millions, unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Sales by Segment | | | | | | | |

| Advanced Materials | $ | 720 | | | $ | 705 | | | $ | 3,050 | | | $ | 2,932 | |

Additives & Functional Products | 696 | | | 640 | | | 2,862 | | | 2,834 | |

Chemical Intermediates | 503 | | | 513 | | | 2,134 | | | 2,143 | |

| Fibers | 321 | | | 346 | | | 1,318 | | | 1,295 | |

| Total Sales by Segment | 2,240 | | | 2,204 | | | 9,364 | | | 9,204 | |

Other | 5 | | | 3 | | | 18 | | | 6 | |

| Total Eastman Chemical Company | $ | 2,245 | | | $ | 2,207 | | | $ | 9,382 | | | $ | 9,210 | |

| | | | | |

| | Third Quarter |

| (Dollars in millions, unaudited) | 2024 |

| Sales by Segment | |

| Advanced Materials | $ | 787 | |

Additives & Functional Products | 744 | |

Chemical Intermediates | 593 | |

| Fibers | 336 | |

| Total Sales by Segment | 2,460 | |

Other | 4 | |

| Total Eastman Chemical Company | $ | 2,464 | |

Table 2B – Sales Revenue Change | | | | | | | | | | | | | | | |

| | Fourth Quarter 2024 Compared to Fourth Quarter 2023 |

| | Change in Sales Revenue Due To |

| (Unaudited) | Revenue

% Change | Volume / Product Mix Effect | Price Effect | Exchange

Rate

Effect | |

| Advanced Materials | 2 | % | 5 | % | (3) | % | — | % | |

| Additives & Functional Products | 9 | % | 7 | % | 2 | % | — | % | |

| Chemical Intermediates | (2) | % | (4) | % | 2 | % | — | % | |

| Fibers | (7) | % | (9) | % | 2 | % | — | % | |

Total Eastman Chemical Company | 2 | % | 1 | % | 1 | % | — | % | |

| | Twelve Months 2024 Compared to Twelve Months 2023 |

| | Change in Sales Revenue Due To |

| (Unaudited) | Revenue

% Change | Volume / Product Mix Effect | Price Effect | Exchange

Rate

Effect | |

| Advanced Materials | 4 | % | 8 | % | (4) | % | — | % | |

| Additives & Functional Products | 1 | % | 4 | % | (3) | % | — | % | |

| Chemical Intermediates | — | % | 3 | % | (3) | % | — | % | |

| Fibers | 2 | % | — | % | 2 | % | — | % | |

| Total Eastman Chemical Company | 2 | % | 4 | % | (2) | % | — | % | |

| | | | | | | | | | | | | | |

| | Fourth Quarter 2024 Compared to Third Quarter 2024 |

| | Change in Sales Revenue Due To |

| (Unaudited) | Revenue

% Change | Volume / Product Mix Effect | Price Effect | Exchange

Rate

Effect |

| Advanced Materials | (9) | % | (8) | % | (1) | % | — | % |

| Additives & Functional Products | (6) | % | (7) | % | 1 | % | — | % |

| Chemical Intermediates | (15) | % | (13) | % | (2) | % | — | % |

| Fibers | (4) | % | (4) | % | — | % | — | % |

| | | | |

| Total Eastman Chemical Company | (9) | % | (8) | % | (1) | % | — | % |

Table 2C – Sales by Customer Location | | | | | | | | | | | | | | | | | | | | | | | |

| | Fourth Quarter | | Twelve Months |

| (Dollars in millions, unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Sales by Customer Location | | | | | | | |

| United States and Canada | $ | 942 | | | $ | 907 | | | $ | 3,937 | | | $ | 3,938 | |

| Europe, Middle East, and Africa | 622 | | | 612 | | | 2,571 | | | 2,558 | |

| Asia Pacific | 556 | | | 573 | | | 2,363 | | | 2,227 | |

| Latin America | 125 | | | 115 | | | 511 | | | 487 | |

| Total Eastman Chemical Company | $ | 2,245 | | | $ | 2,207 | | | $ | 9,382 | | | $ | 9,210 | |

| | | | | | | |

Table 3A - Segment, Other, and Company

Non-GAAP Earnings (Loss) Before Interest and Taxes Reconciliations (1) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fourth Quarter | | Twelve Months |

| (Dollars in millions, unaudited) | | 2024 | | 2023 | | 2024 | | 2023 |

| Advanced Materials | | | | | | | | |

| Earnings before interest and taxes | | $ | 107 | | | $ | 65 | | | $ | 442 | | | $ | 343 | |

Cost of sales impact from restructuring activities (2) | | — | | | — | | | 4 | | | — | |

Asset impairments, restructuring, and other charges, net (2) | | — | | | — | | | 18 | | | — | |

| | | | | | | | |

| Excluding non-core item | | 107 | | | 65 | | | 464 | | | 343 | |

| Additives & Functional Products | | | | | | | | |

| Earnings before interest and taxes | | 128 | | | 67 | | | 487 | | | 436 | |

| | | | | | | | |

Cost of sales impact from restructuring activities (2) | | — | | | — | | | 3 | | | — | |

| | | | | | | | |

| Excluding non-core item | | 128 | | | 67 | | | 490 | | | 436 | |

| Chemical Intermediates | | | | | | | | |

| Earnings before interest and taxes | | 20 | | | 347 | | | 101 | | | 434 | |

| | | | | | | | |

| | | | | | | | |

| Net gain on divested business | | — | | | (323) | | | — | | | (323) | |

Excluding non-core items | | 20 | | | 24 | | | 101 | | | 111 | |

| Fibers | | | | | | | | |

| Earnings before interest and taxes | | 103 | | | 113 | | | 454 | | | 393 | |

Cost of sales impact from restructuring activities | | — | | | — | | | — | | | 23 | |

| Asset impairments, restructuring, and other charges, net | | — | | | — | | | — | | | 6 | |

| Excluding non-core items | | 103 | | | 113 | | | 454 | | | 422 | |

| Other | | | | | | | | |

| Loss before interest and taxes | | (9) | | | (115) | | | (206) | | | (304) | |

Steam line incident (insurance proceeds) costs, net | | — | | | — | | | — | | | (8) | |

Asset impairments, restructuring, and other charges net (3) | | 10 | | | 15 | | | 33 | | | 31 | |

Mark-to-market pension and other postretirement benefit plans (gain) loss, net | | (54) | | | 53 | | | (54) | | | 53 | |

| | | | | | | | |

| | | | | | | | |

Environmental and other costs (4) | | — | | | — | | | 16 | | | 13 | |

| | | | | | | | |

| Excluding non-core and unusual items | | (53) | | | (47) | | | (211) | | | (215) | |

| | | | | | | | |

| Total Eastman Chemical Company | | | | | | | | |

| Earnings before interest and taxes | | 349 | | | 477 | | | 1,278 | | | 1,302 | |

Cost of sales impact from restructuring activities | | — | | | — | | | 7 | | | 23 | |

Steam line incident (insurance proceeds) costs, net | | — | | | — | | | — | | | (8) | |

Asset impairments, restructuring, and other charges, net | | 10 | | | 15 | | | 51 | | | 37 | |

Mark-to-market pension and other postretirement benefit plans (gain) loss, net | | (54) | | | 53 | | | (54) | | | 53 | |

| Environmental and other costs | | — | | | — | | | 16 | | | 13 | |

Net gain on divested business | | — | | | (323) | | | — | | | (323) | |

| | | | | | | | |

| Total earnings before interest and taxes excluding non-core and unusual items | | $ | 305 | | | $ | 222 | | | $ | 1,298 | | | $ | 1,097 | |

(1)See "Management's Discussion and Analysis of Financial Condition and Results of Operations" of the Annual Report on Form 10-K for 2023 for description of 2023 non-core and unusual items. (2)Twelve months 2024 includes asset impairment charges of $5 million, severance charges of $4 million, and site closure costs of $9 million related to the planned closure of a solvent-based resins production line at an advanced interlayers facility in North America. In addition, twelve months 2024 also includes inventory adjustment charges of $4 million and $3 million in the Advanced Materials ("AM") and the Additives and Functional Products ("AFP") segments, respectively, related to this planned closure.

(3)Fourth quarter and twelve months 2024 includes growth and profitability improvement initiatives of $6 million and $12 million, respectively. Additionally, fourth quarter and twelve months 2024 includes severance charges of $4 million and $21 million, respectively, as part of corporate cost reduction initiatives reported in "Other".

(4)Twelve months 2024 includes environmental and other costs from previously divested or non-operational sites and product lines.

Table 3A - Segment, Other, and Company

Non-GAAP Earnings (Loss) Before Interest and Taxes Reconciliations (continued) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fourth Quarter | | Twelve Months |

| (Dollars in millions, unaudited) | | 2024 | | 2023 | | 2024 | | 2023 |

| Company Non-GAAP Earnings Before Interest and Taxes Reconciliations by Line Items | | | | | | | | |

| Earnings before interest and taxes | | $ | 349 | | | $ | 477 | | | $ | 1,278 | | | $ | 1,302 | |

Cost of sales | | — | | | — | | | 7 | | | 15 | |

| | | | | | | | |

| | | | | | | | |

Asset impairments, restructuring, and other charges, net | | 10 | | | 15 | | | 51 | | | 37 | |

| Other components of post-employment (benefit) cost, net | | (54) | | | 53 | | | (54) | | | 53 | |

| Other (income) charges, net | | — | | | — | | | 16 | | | 13 | |

Net gain on divested business | | — | | | (323) | | | — | | | (323) | |

| Total earnings before interest and taxes excluding non-core and unusual items | | $ | 305 | | | $ | 222 | | | $ | 1,298 | | | $ | 1,097 | |

Table 3A - Segment, Other, and Company

Non-GAAP Earnings (Loss) Before Interest and Taxes Reconciliations (continued) (1)

| | | | | | | | |

| | Third Quarter |

| (Dollars in millions, unaudited) | | 2024 |

| Advanced Materials | | |

| Earnings before interest and taxes | | $ | 100 | |

Cost of sales impact from restructuring activities | | 4 | |

| Asset impairments, restructuring, and other charges, net | | 18 | |

| Excluding non-core item | | 122 | |

| Additives & Functional Products | | |

| Earnings before interest and taxes | | 127 | |

| Cost of sales impact from restructuring activities | | 3 | |

| Excluding non-core item | | 130 | |

| Chemical Intermediates | | |

| Earnings before interest and taxes | | 43 | |

| Fibers | | |

| Earnings before interest and taxes | | 112 | |

| Other | | |

| Loss before interest and taxes | | (53) | |

| Asset impairments, restructuring, and other charges, net | | 12 | |

| Excluding non-core and unusual items | | (41) | |

| | |

| Total Eastman Chemical Company | | |

| Earnings before interest and taxes | | 329 | |

| Cost of sales impact from restructuring activities | | 7 | |

| Asset impairments, restructuring, and other charges, net | | 30 | |

| Total earnings before interest and taxes excluding non-core and unusual items | | $ | 366 | |

| | | | | | | | |

| Company Non-GAAP Earnings Before Interest and Taxes Reconciliations by Line Items | | |

| Earnings before interest and taxes | | 329 | |

Cost of sales | | 7 | |

| | |

| | |

Asset impairments, restructuring, and other charges, net | | 30 | |

| | |

| | |

| | |

| Total earnings before interest and taxes excluding non-core and unusual items | | $ | 366 | |

(1)See "Management's Discussion and Analysis of Financial Condition and Results of Operations" of the Quarterly Report on Form 10-Q for third quarter 2024 for description of third quarter 2024 non-core and unusual items.

Table 3B - Segment Non-GAAP Earnings (Loss) Before Interest and Taxes Margins(1)(2)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fourth Quarter | | Twelve Months |

| (Dollars in millions, unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Adjusted EBIT | Adjusted EBIT Margin | | Adjusted EBIT | Adjusted EBIT Margin | | Adjusted EBIT | Adjusted EBIT Margin | | Adjusted EBIT | Adjusted EBIT Margin |

| Advanced Materials | $ | 107 | | 14.9 | % | | $ | 65 | | 9.2 | % | | $ | 464 | | 15.2 | % | | $ | 343 | | 11.7 | % |

Additives & Functional Products | 128 | | 18.4 | % | | 67 | | 10.5 | % | | 490 | | 17.1 | % | | 436 | | 15.4 | % |

Chemical Intermediates | 20 | | 4.0 | % | | 24 | | 4.7 | % | | 101 | | 4.7 | % | | 111 | | 5.2 | % |

| Fibers | 103 | | 32.1 | % | | 113 | | 32.7 | % | | 454 | | 34.4 | % | | 422 | | 32.6 | % |

| Total segment EBIT excluding non-core and unusual items | 358 | | 16.0 | % | | 269 | | 12.2 | % | | 1,509 | | 16.1 | % | | 1,312 | | 14.3 | % |

Other | (53) | | | | (47) | | | | (211) | | | | (215) | | |

| Total EBIT excluding non-core and unusual items | $ | 305 | | 13.6 | % | | $ | 222 | | 10.1 | % | | $ | 1,298 | | 13.8 | % | | $ | 1,097 | | 11.9 | % |

| | | | | | | | |

| | Third Quarter |

| (Dollars in millions, unaudited) | 2024 |

| Adjusted EBIT | Adjusted EBIT Margin |

| Advanced Materials | $ | 122 | | 15.5 | % |

Additives & Functional Products | 130 | | 17.5 | % |

Chemical Intermediates | 43 | | 7.3 | % |

| Fibers | 112 | | 33.3 | % |

| Total segment EBIT excluding non-core and unusual items | 407 | | 16.5 | % |

Other | (41) | | |

| Total EBIT excluding non-core and unusual items | $ | 366 | | 14.9 | % |

(1)For identification of excluded non-core and unusual items and reconciliations to GAAP EBIT, see Table 3A. (2)Adjusted EBIT margin is non-GAAP EBIT divided by GAAP sales. See Table 2A for sales.

Table 4 – Non-GAAP Earnings Before Interest and Taxes, Net Earnings,

and Earnings Per Share Reconciliations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fourth Quarter 2024 |

| | Earnings Before Interest and Taxes | | Earnings Before Income Taxes | | (Benefit from) Provision for Income Taxes | | Effective Income Tax Rate | | Net Earnings

Attributable to Eastman |

| (Dollars in millions, except per share amounts, unaudited) | | After Tax | | Per Diluted Share |

| As reported (GAAP) | | $ | 349 | | | $ | 297 | | | $ | (34) | | | (11) | % | | $ | 330 | | | $ | 2.82 | |

Non-Core and Unusual Items: (1) | | | | | | | | | | | | |

Asset impairments, restructuring, and other charges, net | | 10 | | | 10 | | | (1) | | | | | 11 | | | 0.09 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Mark-to-market pension and other postretirement benefit plans (gain) loss, net | | (54) | | | (54) | | | (14) | | | | | (40) | | | (0.34) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Tax expense associated with previously divested business | | — | | | — | | | (7) | | | | | 7 | | | 0.06 | |

| | | | | | | | | | | | |

Interim adjustment to tax provision (2) | | — | | | — | | | 89 | | | | | (89) | | | (0.76) | |

| Non-GAAP (Excluding non-core and unusual items and with adjusted provision for income taxes) | | $ | 305 | | | $ | 253 | | | $ | 33 | | | 14 | % | | $ | 219 | | | $ | 1.87 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fourth Quarter 2023 |

| | | Earnings Before Interest and Taxes | | Earnings Before Income Taxes | | Provision for Income Taxes | | Effective Income Tax Rate | | Net Earnings

Attributable to Eastman |

| (Dollars in millions, except per share amounts, unaudited) | | After Tax | | Per Diluted Share |

| As reported (GAAP) | | $ | 477 | | | $ | 425 | | | $ | 114 | | | 27 | % | | $ | 310 | | | $ | 2.61 | |

Non-Core and Unusual Items: (1) | | | | | | | | | | | | |

Asset impairments, restructuring, and other charges, net | | 15 | | | 15 | | | 1 | | | | | 14 | | | 0.12 | |

| | | | | | | | | | | | |

Mark-to-market pension and other postretirement benefit plans (gain) loss, net | | 53 | | | 53 | | | 14 | | | | | 39 | | | 0.33 | |

Net gain on divested business | | (323) | | | (323) | | | (98) | | | | | (225) | | | (1.89) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Interim adjustment to tax provision (2) | | — | | | — | | | (17) | | | | | 17 | | | 0.14 | |

| Non-GAAP (Excluding non-core and unusual items and with adjusted provision for income taxes) | | $ | 222 | | | $ | 170 | | | $ | 14 | | | 8 | % | | $ | 155 | | | $ | 1.31 | |

(1)See Table 3A for description of fourth quarter 2024 and 2023 non-core and unusual items excluded from non-GAAP EBIT. Provision for income taxes for non-core and unusual items is calculated using the tax rate for the jurisdiction where the gains are taxable and the expenses are deductible. (2)Fourth quarter 2024 and 2023 is a reconciliation of the adjustments made in interim quarters to reflect the previously forecasted full year effective tax rate.

Table 4 – Non-GAAP Earnings Before Interest and Taxes, Net Earnings,

and Earnings Per Share Reconciliations (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Twelve Months 2024 |

| | | Earnings Before Interest and Taxes | | Earnings Before Income Taxes | | Provision for Income Taxes | | Effective Income Tax Rate | | Net Earnings

Attributable to Eastman |

| (Dollars in millions, except per share amounts, unaudited) | | After Tax | | Per Diluted Share |

| As reported (GAAP) | | $ | 1,278 | | | $ | 1,078 | | | $ | 170 | | | 16 | % | | $ | 905 | | | $ | 7.67 | |

Non-Core or Unusual Items: (1) | | | | | | | | | | | | |

| | | | | | | | | | | | |

Cost of sales impact from restructuring activities | | 7 | | | 7 | | | 2 | | | | | 5 | | | 0.04 | |

Asset impairments, restructuring, and other charges, net | | 51 | | | 51 | | | 10 | | | | | 41 | | | 0.36 | |

| | | | | | | | | | | | |

Mark-to-market pension and other postretirement benefit plans (gain) loss, net | | (54) | | | (54) | | | (14) | | | | | (40) | | | (0.34) | |

| Environmental and other costs | | 16 | | | 16 | | | 3 | | | | | 13 | | | 0.10 | |

| | | | | | | | | | | | |

| Tax expense associated with previously divested business | | — | | | — | | | (7) | | | | | 7 | | | 0.06 | |

| | | | | | | | | | | | |

Non-GAAP (Excluding non-core and unusual items) | | $ | 1,298 | | | $ | 1,098 | | | $ | 164 | | | 15 | % | | $ | 931 | | | $ | 7.89 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Twelve Months 2023 |

| | | Earnings Before Interest and Taxes | | Earnings Before Income Taxes | | Provision for Income Taxes | | Effective Income Tax Rate | | Net Earnings

Attributable to Eastman |

| (Dollars in millions, except per share amounts, unaudited) | | After Tax | | Per Diluted Share |

| As reported (GAAP) | | $ | 1,302 | | | $ | 1,087 | | | $ | 191 | | | 18 | % | | $ | 894 | | | $ | 7.49 | |

Non-Core or Unusual Items: (1) | | | | | | | | | | | | |

Cost of sales impact from restructuring activities | | 23 | | | 23 | | | 3 | | | | | 20 | | | 0.17 | |

| Steam line incident costs (insurance proceeds), net | | (8) | | | (8) | | | (2) | | | | | (6) | | | (0.05) | |

Asset impairments, restructuring, and other charges, net | | 37 | | | 37 | | | 5 | | | | | 32 | | | 0.26 | |

Mark-to-market pension and other postretirement benefit plans (gain) loss, net | | 53 | | | 53 | | | 14 | | | | | 39 | | | 0.33 | |

| Environmental and other costs | | 13 | | | 13 | | | 4 | | | | | 9 | | | 0.08 | |

Net gain on divested business | | (323) | | | (323) | | | (98) | | | | | (225) | | | (1.88) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Non-GAAP (Excluding non-core and unusual items) | | $ | 1,097 | | | $ | 882 | | | $ | 117 | | | 13 | % | | $ | 763 | | | $ | 6.40 | |

(1)See Table 3A for description of 2024 and 2023 non-core and unusual items excluded from non-GAAP EBIT. Provision for income taxes for non-core and unusual items is calculated using the tax rate for the jurisdiction where the gains are taxable and the expenses are deductible.

Table 4 – Non-GAAP Earnings Before Interest and Taxes, Net Earnings,

and Earnings Per Share Reconciliations (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Third Quarter 2024 |

| | Earnings Before Interest and Taxes | | Earnings Before Income Taxes | | Provision for Income Taxes | | Effective Income Tax Rate | | Net Earnings

Attributable to Eastman |

| (Dollars in millions, except per share amounts, unaudited) | | After Tax | | Per Diluted Share |

| As reported (GAAP) | | $ | 329 | | | $ | 280 | | | $ | 99 | | | 35 | % | | $ | 180 | | | $ | 1.53 | |

Non-Core and Unusual Items: (1) | | | | | | | | | | | | |

| | | | | | | | | | | | |

Cost of sales impact from restructuring activities | | 7 | | | 7 | | | 2 | | | | | 5 | | | 0.04 | |

| | | | | | | | | | | | |

| Asset impairments, restructuring, and other charges, net | | 30 | | | 30 | | | 8 | | | | | 22 | | | 0.19 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Interim adjustment to tax provision (2) | | — | | | — | | | (59) | | | | | 59 | | | 0.50 | |

| Non-GAAP (Excluding non-core and unusual items and with adjusted provision for income taxes) | | $ | 366 | | | $ | 317 | | | $ | 50 | | | 16 | % | | $ | 266 | | | $ | 2.26 | |

(1)See Table 3A for description of third quarter 2024 non-core and unusual items excluded from non-GAAP EBIT. Provision for income taxes for non-core and unusual items is calculated using the tax rate for the jurisdiction where the gains are taxable and the expenses are deductible. (2)The adjusted provision for income taxes for third quarter 2024 was calculated applying the then forecasted full year effective tax rate.

Table 5 – Statements of Cash Flows

| | | | | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter | | Twelve Months |

| (Dollars in millions, unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Operating activities | | | | | | | |

| Net earnings | $ | 331 | | | $ | 311 | | | $ | 908 | | | $ | 896 | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | 129 | | | 118 | | | 509 | | | 498 | |

Mark-to-market pension and other postretirement benefit plans (gain) loss, net | (54) | | | 53 | | | (54) | | | 53 | |

| Asset impairment charges | — | | | — | | | 5 | | | — | |

| | | | | | | |

Gain on sale of assets | — | | | (15) | | | — | | | (15) | |

| | | | | | | |

Gain on divested business | — | | | (323) | | | — | | | (323) | |

Provision for (benefit from) deferred income taxes | 24 | | | 54 | | | (52) | | | (102) | |

| Changes in operating assets and liabilities, net of effect of acquisitions and divestitures: | | | | | | | |

| (Increase) decrease in trade receivables | 182 | | | 58 | | | 28 | | | 126 | |

| (Increase) decrease in inventories | (122) | | | 54 | | | (344) | | | 201 | |

| Increase (decrease) in trade payables | 152 | | | 173 | | | 188 | | | (190) | |

| Pension and other postretirement contributions (in excess of) less than expenses | (12) | | | (27) | | | (51) | | | (66) | |

| Variable compensation payments (in excess of) less than expenses | 55 | | | 69 | | | 99 | | | 142 | |

| Other items, net | (145) | | | (73) | | | 51 | | | 154 | |

| Net cash provided by operating activities | 540 | | | 452 | | | 1,287 | | | 1,374 | |

| Investing activities | | | | | | | |

| Additions to properties and equipment | (179) | | | (179) | | | (599) | | | (828) | |

Government incentives | 9 | | | — | | | 9 | | | — | |

| | | | | | | |

| Proceeds from sale of businesses | 38 | | | 418 | | | 38 | | | 456 | |

| Acquisition, net of cash acquired | — | | | (3) | | | — | | | (77) | |

| | | | | | | |

| | | | | | | |

| Other items, net | — | | | 12 | | | 18 | | | 17 | |

Net cash used in investing activities | (132) | | | 248 | | | (534) | | | (432) | |

| Financing activities | | | | | | | |

Net decrease in commercial paper and other borrowings | — | | | (399) | | | — | | | (326) | |

| Proceeds from borrowings | — | | | — | | | 1,237 | | | 796 | |

| Repayment of borrowings | — | | | — | | | (1,039) | | | (808) | |

| Dividends paid to stockholders | (94) | | | (94) | | | (379) | | | (376) | |

| Treasury stock purchases | (100) | | | (100) | | | (300) | | | (150) | |

| | | | | | | |

| Other items, net | 13 | | | — | | | 27 | | | (24) | |

| Net cash used in financing activities | (181) | | | (593) | | | (454) | | | (888) | |

| Effect of exchange rate changes on cash and cash equivalents | (12) | | | 2 | | | (10) | | | 1 | |

| Net change in cash and cash equivalents | 215 | | | 109 | | | 289 | | | 55 | |

| Cash and cash equivalents at beginning of period | 622 | | | 439 | | | 548 | | | 493 | |

| Cash and cash equivalents at end of period | $ | 837 | | | $ | 548 | | | $ | 837 | | | $ | 548 | |

Table 6 – Total Borrowings to Net Debt Reconciliations | | | | | | | | | | | | | | | | |

| | | December 31, | | | | December 31, |

| (Dollars in millions, unaudited) | | 2024 | | | | 2023 |

| Total borrowings | | $ | 5,017 | | | | | $ | 4,846 | |

| Less: Cash and cash equivalents | | 837 | | | | | 548 | |

Net debt (1) | | $ | 4,180 | | | | | $ | 4,298 | |

(1)Includes non-cash decrease of $32 million in 2024 and non-cash increase of $20 million in 2023 resulting from foreign currency exchange rates.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=emn_A1.875notesdueNovember2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

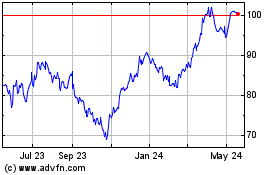

Eastman Chemical (NYSE:EMN)

Historical Stock Chart

From Jan 2025 to Feb 2025

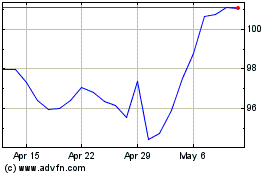

Eastman Chemical (NYSE:EMN)

Historical Stock Chart

From Feb 2024 to Feb 2025