Franklin Universal Trust (“FT” or the “Fund”) Announces Notification of Sources of Distributions

31 July 2024 - 1:28AM

Business Wire

Franklin Universal Trust [NYSE: FT]:

Notification of Sources of

Distributions

Pursuant to Section 19(a) of the

Investment Company Act of 1940

The Fund’s estimated sources of the distribution to be paid on

July 31, 2024 and for the fiscal year 2024 year-to-date are as

follows:

Estimated Allocations for July Monthly Distribution as of June

30, 2024:

Distribution

Per Share

Net Investment

Income

Net Realized

Short-Term Capital

Gains

Net Realized

Long-Term Capital Gains

Return of Capital

$0.0425

$0.0211 (50%)

$0.0053 (13%)

$0.00 (0%)

$0.0161 (37%)

Cumulative Estimated Allocations fiscal year-to-date as of June

30, 2024, for the fiscal year ending August 31, 2024:

Distribution

Per Share

Net Investment

Income

Net Realized

Short-Term Capital

Gains

Net Realized

Long-Term Capital

Gains

Return of Capital

$0.4250

$0.2418 (57%)

$0.0817 (19%)

$0.00 (0%)

$0.1015 (24%)

Shareholders should not draw any conclusions about the Fund’s

investment performance from the amount of the current distribution

or from the terms of the Fund’s Distribution Policy. FT estimates

that it has distributed more than its income and net realized

capital gains; therefore, a portion of the FT distribution to

shareholders may be a return of capital. A return of capital may

occur, for example, when some or all of the money that a

shareholder invested in a Fund is paid back to them. A return of

capital distribution does not necessarily reflect FT’s investment

performance and should not be confused with ‘yield’ or ‘income’.

The amounts and sources of distributions reported herein are only

estimates and are not being provided for tax reporting purposes.

The actual amounts and sources of the amounts for tax reporting

purposes will depend upon the Fund’s investment experience during

the remainder of its fiscal year and may be subject to changes

based on tax regulations. The Fund will send a Form 1099-DIV to

shareholders for the calendar year that will describe how to report

the Fund’s distributions for federal income tax purposes.

Average Annual Total Return (in relation

to the change in net asset value (NAV) for the 5-year period ended

on 6/30/2024)1

Annualized Distribution Rate (as a

percentage of NAV for the current fiscal period through

6/30/2024)2

Cumulative Total Return (in relation to

the change in NAV for the fiscal period through 6/30/2024)3

Cumulative Fiscal Year-To-Date

Distribution Rate (as a percentage of NAV as of 6/30/2024)4

4.29%

6.61%

11.04%

5.51%

Fund Performance and Distribution Rate Information:

- Average Annual Total Return in relation to NAV represents

the compound average of the Annual NAV Total Returns of the Fund

for the five-year period ended through June 30, 2024. Annual NAV

Total Return is the percentage change in the Fund’s NAV over a

year, assuming reinvestment of distributions paid.

- The Annualized Distribution Rate is the current fiscal

period’s distribution rate annualized as a percentage of the Fund’s

NAV through June 30, 2024.

- Cumulative Total Return is the percentage change in the

Fund’s NAV from August 31, 2023 through June 30, 2024, assuming

reinvestment of distributions paid.

- The Cumulative Fiscal Year-To-Date Distribution Rate is the

dollar value of distributions for the fiscal period August 31, 2023

through June 30, 2024, as a percentage of the Fund’s NAV as of June

30, 2024.

The Fund’s primary investment objective is to provide high,

current income consistent with preservation of capital. Its

secondary objective is growth of income through dividend increases

and capital appreciation. Distributions may vary based on the

Fund’s net investment income. Past distributions are not indicative

of future trends.

For further information on Franklin

Universal Trust, please visit our web site at:

www.franklintempleton.com

Franklin Resources, Inc. is a global investment management

organization with subsidiaries operating as Franklin Templeton and

serving clients in over 150 countries. Franklin Templeton’s mission

is to help clients achieve better outcomes through investment

management expertise, wealth management and technology solutions.

Through its specialist investment managers, the company offers

specialization on a global scale, bringing extensive capabilities

in fixed income, equity, alternatives and multi-asset solutions.

With more than 1,500 investment professionals, and offices in major

financial markets around the world, the California-based company

has over 75 years of investment experience and over $1.6 trillion

in assets under management as of June 30, 2024. For more

information, please visit franklintempleton.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730735477/en/

For more information, please contact Franklin Templeton at

1-800-342-5236

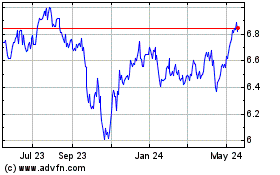

Franklin Universal (NYSE:FT)

Historical Stock Chart

From Nov 2024 to Dec 2024

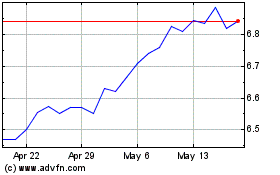

Franklin Universal (NYSE:FT)

Historical Stock Chart

From Dec 2023 to Dec 2024