Genco Shipping & Trading Limited (NYSE: GNK) (“Genco” or the

“Company”), the largest U.S. headquartered drybulk shipowner

focused on the global transportation of commodities, today

announced it mailed a letter to shareholders in connection with the

Company’s 2024 Annual Meeting of Shareholders (the “2024 Annual

Meeting”), scheduled to be held on May 23, 2024. Shareholders of

record as of March 28, 2024, will be entitled to vote at the

meeting.

Highlights from the letter include:

- Genco’s Comprehensive Value Strategy is

working: Genco’s Board of Directors and management team

are positioning the Company to drive returns through volatile

drybulk market cycles through compelling dividends, reducing debt

and investing in its fleet. The Company is continuing to outperform

its peers while maintaining its best-in-class governance.

- The Genco Board has engaged extensively with

Economou: The Board and management team, with external

financial advisors, thoroughly reviewed Economou’s suggestions,

including implementing a repurchase plan, selling ships and

commencing a tender offer and determined they are NOT in the best

interest of all Genco shareholders.

- Setting the Record Straight: Economou’s public

disclosures mischaracterize our interactions and make misstatements

about our Board and directors.

Genco’s Board of Directors and management team are executing a

clear strategy that is delivering value to shareholders today,

positioning Genco to drive returns through volatile drybulk market

cycles and generating outperforming results. George Economou, a

drybulk competitor of Genco,1 has initiated a proxy fight to add

his director nominee to our Board and advance an agenda, which our

Board has thoroughly reviewed and believes is NOT in the best

interest of all Genco shareholders. We need your VOTE on

the WHITE proxy card for Genco’s shareholders. Here’s

why….

Genco’s Comprehensive Value Strategy Is

Working

Genco’s Board and management team introduced the Comprehensive

Value Strategy to investors in 2021 to position Genco to generate

sustained value in the volatile drybulk sector.

Our strategy is clear:

- Low leverage + high dividend payouts + investments in vessels

to drive growth and increase efficiency = the ability to generate

significant shareholder returns through market cycles.

The key pillars of our strategy include:

- Compelling dividends: We have paid 18

consecutive quarterly dividends – the longest series in

our peer group – and returned $5.155 per share to shareholders, or

~25% of the current share price;2

- Lowering debt: We have reduced Genco’s debt by

55% since 2021 and lowered our cash flow breakeven rate to the

lowest in our peer group; and

- Investing in our fleet: We have invested $520

million in fleet expansion and modernization since 2019, increasing

our earnings capacity, while reducing costs and improving fuel

efficiency.

As a result of this strategy, Genco is outperforming:

- 1-, 3- and 5-year total shareholder returns (TSR), are

37.7%, 146.9% and 237.6%,

respectively, significantly higher than the median

TSR of our proxy statement shipping performance peers which were

16.4%, 134.4% and 148.3% for the past 1-, 3- and 5-year periods,

respectively, and also significantly higher than the TSR of the

S&P 500 which were 27.2%, 30.1% and 91.6% for the past 1-, 3-

and 5-year periods, respectively.3

We are doing it with best-in-class governance:

- Our well-planned and well-executed corporate governance and

sustainability initiatives have us ranked #1 in the annual

Webber Research ESG Scorecard three years in a row.4

Our directors regularly engage with our shareholders and

are open-minded with respect to value-creation

opportunities. We remain committed to maintaining our

strong corporate governance and are taking actions that we believe

will create the most value and are in the best interest of our

shareholders.

Vote WITHHOLD ON George

Economou’s Nominee and Reject His

Agenda

Our Board and management team have engaged with Economou since

he invested in Genco and gave Economou’s suggestions their full

attention and deep consideration.

The Board reviewed and duly rejected Economou’s first

suggestion, which was a share repurchase plan potentially coupled

with the sale of vessels, and then his later recommendation that

Genco commence a tender offer for $100 million of its own shares at

a significant premium to the trading price. Following extensive

analysis of the suggestions with the management team and external

financial advisors, the Board determined that Economou’s

suggestions would not create sustainable value and instead

would:

- Significantly increase Genco’s debt;

- Decrease Genco’s earnings potential;

- Reduce Genco’s market capitalization and trading float;

- Reduce our liquidity for opportunistic fleet growth;

- Increase our cash flow breakeven rate;

- Impact our ability to pay dividends; and

- Diminish real earnings in this strong current market.

The analysis showed that purchasing new vessels for fleet

optimization can create more long-term value for shareholders than

a self-tender offer. The Board also noted, to its knowledge, that

Economou himself is not selling ships at his own companies,

allowing him to capture opportunities in the current market.

To advance his agenda, Economou has nominated Robert Pons as a

director candidate. In our view, as established in our interview of

him, Pons brings no experience in shipping,

commodities, cyclical businesses or other industries relevant to

Genco’s business. On that basis, our Board firmly believes

he would not be additive to our already strong, focused and

experienced Board.

Setting the Record Straight

Economou has mischaracterized our interactions and made

misstatements about our Board and directors in his public

disclosures.

Here are the points we believe shareholders should know:

- We have engaged with Economou since his initial investment,

including by offering an in-person meeting, which he declined. As

we’ve detailed in this letter, upon receiving his suggestions for

the Company, our Board and management team afforded them their full

attention and conducted comprehensive reviews with the management

team and external financial advisors. From these reviews, the Board

determined that his repurchase plan and self-tender offer were NOT

in the best interest of shareholders.

- Our Board focuses closely on capital allocation. While Economou

baselessly references the Company’s “excess cash” in his materials,

the fact is that our Board prudently manages our cash position with

the goal of paying sustainable dividends. At the same time, our

Board consistently reviews its capital allocation priorities for

the benefit of the Company and all shareholders.

- Each of Genco’s directors is highly qualified, active and

engaged. Our proxy statement provides details of their

qualifications and achievements. We welcome the robust sharing of

perspectives, and each director has an equal and full voice in the

Board room.

- We believe Jim Dolphin’s record of shareholder value-creation

in the shipping industry and his role in helping develop Genco’s

value-creating strategies stands in stark contrast to the

aforementioned lack of any relevant experience brought by

Economou’s nominee, Robert Pons.

- We believe Mr. Dolphin’s interests are aligned with

shareholders including through our equity incentive plan and his

117,556.9 restricted stock units which are currently worth more

than $2 million.

- The Board’s independent-led director search process resulted in

the appointment of Paramita Das, who was identified by a leading

executive search firm as part of a comprehensive process, which

began months before Economou invested in Genco. As part of the

process, the Board considered more than 20 candidates and

interviewed multiple candidates, in addition to Economou’s nominee,

who the Board interviewed in the same time frame.

- From this process, the Board determined that Ms. Das was the

right director to add to the Genco Board. Her significant relevant

experience in markets that are critical to Genco’s business set her

apart. We strongly believe our Board and all of our shareholders

will benefit from her perspectives.

VOTE TODAY

The Genco Board of Directors unanimously recommends that Genco

shareholders vote “FOR” the re-election of each of

Genco’s seven nominees currently serving on the Genco Board,

“WITHHOLD” on Economou's nominee and

“AGAINST” Economou’s shareholder proposal on the

WHITE proxy card.

We appreciate the support of ALL Genco shareholders, as we

continue delivering on our Comprehensive Value Strategy to drive

long-term sustainable value.

We thank you for your continued support.

Sincerely on behalf of the entire Board and management team,

| James G. DolphinChairman of the

Board |

John C. WobensmithChief Executive

Officer |

Vote Today

By Phone / Online / By Signing and Returning your Proxy

Learn more at www.VoteForGenco.com

|

If you have any questions or require any assistance with voting

your shares, please call or email Genco’s proxy solicitor:MacKenzie

Partners, Inc.Toll Free: 800-322-2885Email:

proxy@mackenziepartners.com |

About Genco Shipping & Trading Limited

Genco Shipping & Trading Limited is a U.S. based drybulk

ship owning company focused on the seaborne transportation of

commodities globally. We provide a full-service logistics solution

to our customers utilizing our in-house commercial operating

platform, as we transport key cargoes such as iron ore, grain,

steel products, bauxite, cement, nickel ore among other commodities

along worldwide shipping routes. Our wholly owned high quality,

modern fleet of dry cargo vessels consists of the larger Capesize

(major bulk) and the medium-sized Ultramax and Supramax vessels

(minor bulk) enabling us to carry a wide range of cargoes. We make

capital expenditures from time to time in connection with vessel

acquisitions. As of April 24, 2024, Genco Shipping & Trading

Limited’s fleet consists of 17 Capesize, 15 Ultramax and 12

Supramax vessels with an aggregate capacity of approximately

4,659,000 dwt and an average age of 11.8 years.

"Safe Harbor" Statement under the Private Securities

Litigation Reform Act of 1995

This release contains certain forward-looking statements

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements use

words such as “expect,” “intend,” “plan,” “believe,” and other

words and terms of similar meaning in connection with a discussion

of potential future events, circumstances or future operating or

financial performance. These forward-looking statements are based

on management’s current expectations and observations. For a

discussion of factors that could cause results to differ, please

see the Company's filings with the Securities and Exchange

Commission, including, without limitation, the Company’s Annual

Report on form 10-K for the year ended December 31, 2023, and the

Company's reports on Form 10-Q and Form 8-K subsequently filed with

the SEC. We do not undertake any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Additional Information and Where to Find It

On April 16, 2024, Genco filed with the SEC a definitive proxy

statement on Schedule 14A (the “Definitive Proxy Statement”),

containing a form of WHITE proxy card, with respect to its

solicitation of proxies for Genco’s 2024 Annual Meeting of

Shareholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE

PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO)

FILED BY GENCO AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL

CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and

security holders may obtain copies of these documents and other

documents filed with the SEC by Genco free of charge through the

website maintained by the SEC at www.sec.gov. Copies of the

documents filed by Genco are also available free of charge by

accessing Genco’s website at www.gencoshipping.com.

Participants

Genco, its directors and certain of its executive officers will

be participants in the solicitation of proxies from shareholders in

respect of the 2024 Annual Meeting of Shareholders, including John

C. Wobensmith (Chief Executive Officer and President), Peter Allen

(Chief Financial Officer), Joseph Adamo (Chief Accounting Officer),

Jesper Christensen (Chief Commercial Officer), and Genco’s

directors other than Mr. Wobensmith, namely James G. Dolphin,

Paramita Das, Kathleen C. Haines, Basil G. Mavroleon, Karin Y.

Orsel, and Arthur L. Regan. Investors and security holders may

obtain more detailed information regarding the Company’s directors

and executive officers, including a description of their direct or

indirect interests, by security holdings or otherwise, under the

captions “Management,” “Executive Compensation,” and “Security

Ownership of Certain Beneficial Owners and Management” in Genco’s

Definitive Proxy Statement. To the extent holdings of such

participants in Genco’s securities changed since the amounts

described in the Definitive Proxy Statement, such changes will be

reflected on Initial Statements of Beneficial Ownership on Form 3

or Statements of Change in Ownership on Form 4 filed with the SEC.

These documents are available free of charge as described

above.

MEDIA/INVESTOR CONTACT:

Peter AllenChief Financial OfficerGenco Shipping & Trading

Limited(646) 443-8550

Aaron Palash / Carleigh Roesler / Jenna Shinderman Joele Frank,

Wilkinson Brimmer Katcher (212) 355-4449

1 Based on conversations between George Economou and members of

our Board. See also, “Economou strikes again to lift newbuilding

tally to 40,” TradeWinds, December 13, 2023 at

https://www.tradewindsnews.com/tankers/economou-strikes-again-to-lift-newbuilding-tally-to-40/2-1-1570434

(“He is said to have ordered . . . four Kamsarmax bulk carriers.”);

“Economou’s TMS Dry stacks orderbook with midsize bulk carrier

newbuildings,” TradeWinds, July 28, 2023 at

https://www.tradewindsnews.com/bulkers/economou-s-tms-dry-stacks-orderbook-with-midsize-bulk-carrier-newbuildings/2-1-1492558.2

As of April 4, 2024.3 Represents the total shareholder returns of

Genco, the Company's peers as listed in its proxy statement and the

S&P 500 total return index, as of the closing price on April

12, 2024, for the past 1-, 3- and 5-year periods.4 Based on the

Webber Research 2023, 2022 and 2021 ESG scorecard.

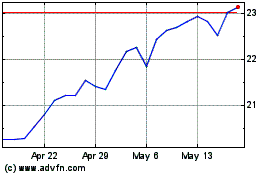

Genco Shipping and Trading (NYSE:GNK)

Historical Stock Chart

From Oct 2024 to Nov 2024

Genco Shipping and Trading (NYSE:GNK)

Historical Stock Chart

From Nov 2023 to Nov 2024